Multi-Million Dollar Investments Are No Longer Just Available to the Super Rich

Buying a $10 million waterfront property or a museum-quality artwork seems out of reach for most. Typically, this kind of lavish purchase has only been available to the ultra-rich “one percent”…until now.

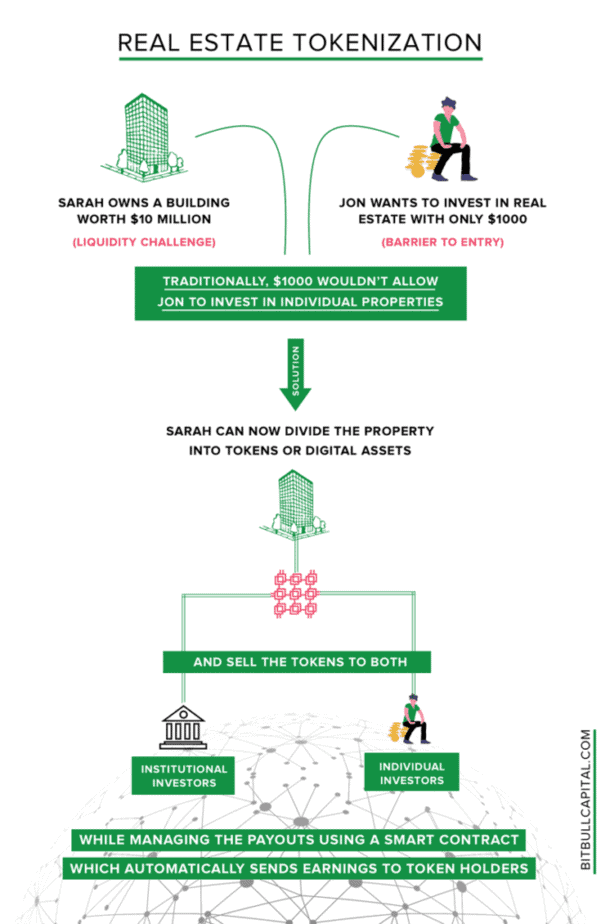

Getting your hands on a piece of real estate or a luxury painting is now achievable thanks to blockchain technology and its ability to facilitate something called “tokenization.”

Tokenization refers to the process of issuing tokens on the blockchain that represent a “real world” asset (house, art, car, watch, etc.). These types of tokens are called “security tokens” and can be divided into smaller amounts, with each one representing only a fraction of the entire asset. This resembles how traditional securities (like stocks) are digitally represented and traded in the markets today.[1]

The unique capabilities of blockchain technology (more on this in the next section), allow previously illiquid assets to be purchased and traded in ways that have never been possible before.

I am confident that tokenization will drastically change how Millennial and Gen Z investors allocate their capital in the coming years.

Don’t believe me? Read on to learn how tokenization is influencing how people invest, what companies are taking advantage of it and why this matters in the first place.

Just as Bitcoin runs on its own blockchain, other types of cryptocurrencies or digital tokens can be issued on a blockchain as well, including security tokens.

There are some specific ways in which the security tokenization process has advantages over typical investment structures, the most notable of which I have highlighted below:

The total value of real estate globally is approximately $228 trillion, which is more than the total global value of stocks and bonds combined.[8] Even considering this massive market, there are countless barriers of entry when it comes to investing in it, including poor liquidity and large initial capital requirements, so tokenization provides enormous value in this industry. [9]

For instance, instead of selling a waterfront development for $10 million to a single entity, you can sell 10 million tokens for $1 each or 1 million tokens for $10 each.[10]

After the tokens are issued, they can be listed on a cryptocurrency exchange for secondary trading, which is where the benefits of property tokenization are really highlighted.[11]

Secondary trading is “instant, nearly free of charge, and, if done properly, without counterparty risk. This is an absolute game-changer for the industry.”[12] The buyer can also benefit from “the token’s price appreciation and any rights that are specified in its smart contract,” which may include dividends from rent and interest payments. [13]

New York based asset manager Elevated Returns was behind one of the first tokenized real estate offerings.

In October 2018, they closed an SEC compliant security token offering (STO) on the Ethereum blockchain representing fractional property ownership of the St. Regis Aspen Resort in Colorado (pictured on the right). [14]

The company raised $18 million by selling 18.9% of the hotel in the form of a security token, called Aspencoin, on the crowdfunding platform Indiegogo. Elevated Returns, owns the remaining 81.1% of the property.[15]

Aspencoin’s were sold for $1 and each participant was required to buy a minimum of 10,000 coins (meaning that the minimum investment was $10,000). [16] The offering was only available to accredited investors and there was a one-year lock up period on the tokens.[17]

This STO (security token offering) provided a more flexible model than an IPO (initial public offering), which was what the company originally planned for. Elevated Returns’ CEO explained that “We went to IPO, but realized halfway through the process that this will not be a scalable business because the cost of a listing on the NYSE is just so prohibitive that it just does not make sense for a single asset.”[18]

It is still unclear if Aspencoin will greatly increase in value, as it is in its early stages of trading. Currently, Aspencoin is only available for trading on an alternative trading system (ATS), which “is a US and Canadian regulatory term for a non-exchange trading venue that matches buyers and sellers to find counterparties for transactions.”[19]

However, Elevated Returns is presently working on getting it listed on popular cryptocurrency exchanges in the coming months.

Since Aspencoin, there have been several other tokenized real estate offerings. Most notably, there was a $3 million sale in Baar, Switzerland representing 20% of the overall property value, as well as a €2 million property sale in Germany, both which took place in the Spring of 2019.[20]

The art market has many of the same issues as real estate, as both deal with extremely costly assets that are often hard to resell.

Maecenas, a Singapore-based company that tokenizes fine art work, wanted to challenge this restrictive model, declaring that their goal is to “democratize fine art.”

Their first offering took place in the summer of 2018 and was a work made in 1980 by American Pop artist Andy Warhol entitled 14 Small Electric Chairs.

Maecenas created “tamper-proof digital certificates” that represented the work in the form of tokens on the Ethereum blockchain, which buyers were able to purchase with cryptocurrency including Bitcoin and Ethereum. Meanwhile, the original work is stored in a high security facility overseen by the company.

Because of the tamper-proof nature of blockchain technology, an investor can trust that the token they own does, in fact, represent part of the Warhol piece.

The auction raised $1.7 million representing 31.5% of the artwork at a valuation of $5.6 million.[21] The sale was run entirely through smart contracts, so each purchase and transfer of ownership took place automatically – no lawyers or brokers were needed.

Tokens are able to be traded on the Atex Exchange, but, similar to Aspencoin, it is difficult to anticipate if this investment will appreciate in the long run, as it is still early on and there are limited trading venues right now.

Owners will never be able to display the piece in their homes, but they do get to leverage its potential price appreciation as well as tell their friends (and post on social media) that they actually own an artwork by a world-famous artist.[22]

There is much made about how tokenization can help to facilitate sales and liquidity for “real world” assets like art and real estate, but this technology also opens up the possibility for intangible assets to be monetized and traded in ways not possible before.

For example, NBA point guard Spencer Dinwiddie officially announced in January 2020 that he will tokenize his 3-year $34.4 million contract with the Brooklyn Nets. He will sell 90 tokens for a cost of $150,000 each (representing about 40% of his contract). The sale of these tokens allows Dinwiddie to claim $13.5M of his contract upfront.

The tokens will represent a three-year bond, “forecasted to pay out 4.95% base interest on a monthly basis, with the entire principal dispensed at the end of the period upon maturity in a bullet payment.”[23]

The tokens can only be purchased by accredited investors and cannot be sold or traded for one year. [24]

$150,000 is not a particularly affordable amount for most people to invest in a single asset, but this model highlights a new way for athletes to leverage their contracts.

As NBA journalist Kevin Arnovitz writes on ESPN.com: “Dinwiddie's token would be a proof of concept for a larger objective: He [Dinwiddie] wants to create a new asset class – athletes – that would allow fans and anyone else to invest in players the way you would the stock market, a treasury bond, a real estate fund or cryptocurrency. Those assets could then be traded on a platform that he is in the process of creating.” [25]

The contract is set to launch in the coming months and I believe it is a sign of what’s ahead, as professional athletes look to engage in more creative ways to take advantage of their massive contracts and connect more deeply with their fans.

Even with the many opportunities that arise from tokenization, it is important to acknowledge that this process also presents major obstacles from both a technical and legal standpoint.

It is no secret that blockchain technology is intimidating to most people. Many find it daunting to use and do not know how to safely store a security token.

A single token may represent a $150,000 stake in an NBA contract or a $1 million stake in a luxury hotel…so it is important that investors don’t lose them! A lack of clarity and confidence in this area can be a major deterrent to participate in buying/trading security tokens.

There are also several difficulties in conducting a fully regulated and compliant STO (security token offering).

There has been some clarity in regards to real estate STOs as they “will virtually always qualify as securities under state and federal law,” meaning they must be registered with the Securities and Exchange Commission (SEC). [26] These regulations impose different requirements, “from limitations on who may invest, to limits on the amounts raised, to resale restrictions on investors.”[27]

However, for assets like artwork or contracts, it is more difficult to get clarity on how to conduct a fully compliant STO, which can ramp up legal costs and delay listings.

Before concluding this article, I thought it important to mention some other start-ups that have emerged in the last couple years that sell fragmented assets without using blockchain technology. I believe this further highlights the growing trend of fractionalized investing.

Rally Rd. and Otis are just two examples of apps that “enable users to make small investments in rare cars, sneakers, and other items these services dub ‘cultural investments.’” [28]

Although both platforms do not run on a blockchain, an executive from Rally Rd. has said they are “looking into” its benefits which would presumably provide tighter security and transparency for its users.[29]

Perhaps the most famous offering on apps of this type was Rally Rd.’s January 2019 sale of a 1980 Lamborghini Countach Turbo (valued at $635,000) for $127 a share.[30] It sold out within a week and 973 investors participated.

This kind of investing, where users put in such small amounts of money, is often referred to as “microinvesting” or “nanoinvesting.”

To help shareholders feel closer to their investment, which presumably, they will never get to drive, the company also sold $30 limited edition t-shirts and a $25 candle that smelled like the car’s interior.[31] Both sold out immediately.

The question you may be asking yourself is why would someone want to own $127 worth of a $635,000 asset?!

Rally Rd. co-founder Rob Petrozzo explained on a podcast last year that the app’s investors, who are predominantly Millennials and Gen Z, don’t necessarily see ownership and possession and utility as directly related.[32]

Petrozzo went on to say that Rally Rd.’s customers “have never really trusted banks” and often “feel alienated” by large institutions, so they feel comfortable investing in “offbeat things and doing the due diligence themselves.”[33]

I believe this mindset represents a seminal shift from how older generations understand investing. Because younger age groups grew up online, they are more comfortable owning something that may only exist in digital form and/or that they will never get to see in person.

The blockchain has ushered in a new way of investing. Some of the most notable features of security tokens, including an immutable record of ownership, programmable smart contracts and ease of trade in the secondary market will change the way that we invest in years to come.

This technology has opened up unique asset classes to be traded, and allows people with smaller amounts of capital to begin investing in assets that, in the past, they would have not had access to.

With such clear benefits and upsides, I wonder if STOs may even threaten the dominance of IPOs as government regulation around them becomes clearer.

I believe this trend will continue to grow as it lines up directly with younger generations’ digital fluency and their evolving understanding of ownership: you may not be able to have it all, but you can at least have a piece!

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://masterthecrypto.com/tokenization-tokens-create-liquid-world/

[2] https://dilendorf.com/resources/tokenization-of-real-estate-what-why-and-how.html

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] https://theblockchainland.com/2019/04/11/property-tokenization-real-estate-future/

[7] https://dilendorf.com/resources/tokenization-of-real-estate-what-why-and-how.html

[8] https://theblockchainland.com/2019/04/11/property-tokenization-real-estate-future/

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12] Ibid.

[13] Ibid.

[14] https://reactcrypto.net/tezos-aspencoin-exciting-developments-with-tokensoft/

[15] https://www.aspentimes.com/trending/in-18-million-deal-nearly-one-fifth-of-st-regis-aspen-sells-through-digital-tokens/

[16] https://vairt.com/learn/18-mln-raised-for-security-token-offering-by-st-regis-aspen-resort/

[17] Ibid.

[18] https://theblockchainland.com/2019/12/13/real-estate-tokenization-where-are-we-at/

[19] https://aspencoin.io/pdfs/AspenCoin-FAQ.pdf

[20] https://theblockchainland.com/2019/04/11/property-tokenization-real-estate-future/

[21] https://blog.maecenas.co/blockchain-art-auction-andy-warhol/

[22] http://www.franknews.us/interviews/340/what-is-crypto-art

[23] https://news.bitcoin.com/nba-star-spencer-dinwiddie-just-tokenized-his-own-contract/?omhide=true&utm_source=ActiveCampaign&utm_medium=email&utm_content=Market+Outlook%3A+Bullish+Trend+Sends+Crypto+Prices+Northwards&utm_campaign=email-January+14%2C+2020+Daily+Newsletter

[24] Ibid.

[25] https://www.espn.com/nba/story/_/id/27853850/how-investing-150k-spencer-dinwiddie-actually-work

[26] https://dilendorf.com/resources/tokenization-of-real-estate-what-why-and-how.html

[27] Ibid.

[28] https://www.businessoffashion.com/articles/intelligence/art-investment-apps-rally-road-otis

[29] https://www.youtube.com/watch?v=IA5RcfUrED4

[30] https://www.cnbc.com/2019/02/10/rally-rd-wants-to-make-owning-expensive-sports-cars-more-accessible.html

[31] https://www.businessoffashion.com/articles/intelligence/art-investment-apps-rally-road-otis

[32] https://www.youtube.com/watch?v=IA5RcfUrED4

[33] https://www.youtube.com/watch?v=Ny2AS3pleHQ