As the U.S.–China intense techno-rivalry moves forward into overdrive, both countries want to protect and promote their national technology champions while still selling to each other and securing their complex multinational supply chains.

This is a tall order that will create both new risks and opportunities for investors. You need to first understand and then navigate the geopolitical landscape carefully.

To begin with, it is important to recognize that America’s rivalry with China is of great consequence.

It will determine whether America’s leading role on the world stage will be confirmed or upended.

This competition will run across many countries and battlegrounds such as trade, finance, technology, freedom of navigation, cyber warfare, space and even obscure rare earths and rare metals — a market that China has cornered while America slept.

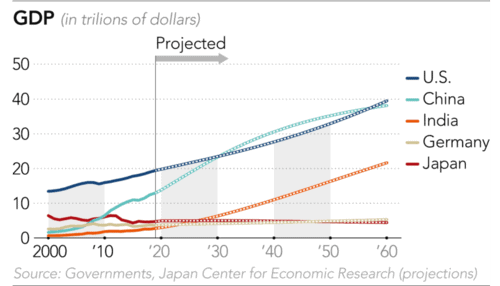

The rivalry is the squaring off of the two largest economies in the world with each country representing strikingly different brands. China seeks to leverage its momentum, scale and authoritarian state-sponsored capitalism against America and its free market capitalism.

Which of these two rivals will be on top by 2030?

It depends which country has the most talent with a people unified and willing to work and sacrifice for the common good. Which country has the leading economy, finances, and technology? Which country musters the most ambition?

China has over the past three decades incrementally, and then quite suddenly, confronted and challenged America’s leadership role in Asia and the world. The unfolding of this great rivalry will be the defining drama of the 2020s.

It is both interesting and helpful to grasp just how America and China see each other and themselves. Based on all the evidence that I could gather and assess, here is my conclusion.

China sees an America divided and in decline. America sees China as deceptive and disruptive.

China sees itself as a rising power destined to be the dominant power in Asia and then the world. America sees itself as the world’s leader but struggling with the responsibilities and commitment that it requires.

The leadership of both countries surely realizes the strengths and weaknesses of their own country as well as a perception of their rival.

Each is scrambling to shore up weaknesses and build on strengths all the while coping with the incessant demands the world throws at them every day.

The rivalry is the squaring off of the two largest economies in the world with each country representing a strikingly different brand. Certainly, China wants its brand to be of a rising power and seeks to frame and shape an image of America as a declining power.

At the heart of this tug-of-war playing out around the world is technology. China has an enviable high-tech manufacturing base and advances in U.S. manufacturing now allow a ton of American steel to be produced with 1/10 the manpower required in the 1980s. Panasonic (TYO: 6752 / OTC US: PCRFY) has a plant in Japan that churns out two million plasma screens each month with only 25 workers.

Technology competition in space, 5G and 6G infrastructure, financial technology, robotics, drones, advanced manufacturing, semiconductors and all the future-oriented industries will be critical to each country’s wealth, power and national security.

If China calls the shots in these key industries, China’s economy will be larger than America’s by a sizable margin by 2030. America would then need to double its defense budget and the U.S. dollar’s reign as the world’s reserve currency would then be in jeopardy.

America would then not be able to guarantee freedom of navigation through the South China Sea at the strategic gateway between the Indian Ocean and the Pacific Ocean.

And though a struggling Boeing (NYSE: BA) is still the king of aerospace, and an estimated one billion Chinese people have yet to even board an airplane, by 2030 the world’s dominant aerospace company could be the Commercial Aircraft Company of China, also known as COMAC (OTC US: CHKIF).

These high stakes make America’s epochal contest with China, fueled by its vaunting ambition and determination, much more challenging than was its Cold War rivalry with the Soviet Union or its economic rivalry with Japan.

Unfortunately, for most Americans, China is still a faraway country making cheap stuff for Walmart (NYSE: WMT) rather than a near peer rival going for America’s jugular in supercomputers.

Intel Corp.’s (NASDAQ: INTC) announcement last month that it had fallen a full year behind schedule in the process technology needed to make its next generation of chips and is considering outsourcing to Asian partners all of its chip fabrication reverberated well beyond Silicon Valley and Washington.

It also hit its stock price hard.

This development has to be seen against the backdrop of the United States and China’s increasingly intense techno-rivalry.

One of the areas that China is still relatively behind in is advanced chip technology which runs across chip design, computer software and equipment.

Semiconductors are crucial and the most strategically important technology because they are the materials and circuitry needed to produce microchips that are at the heart of everything from smart phones to advanced satellites. You might think of these microchips as the brains inside all advanced technology.

Alex Capri of the Hinrich Foundation has zeroed in on a vital techno-rivalry battleground through an excellent report: Semiconductors at the Heart of the US-China Tech War: How a New Era of Techno-Nationalism is Shaking up Semiconductor Value Chains.

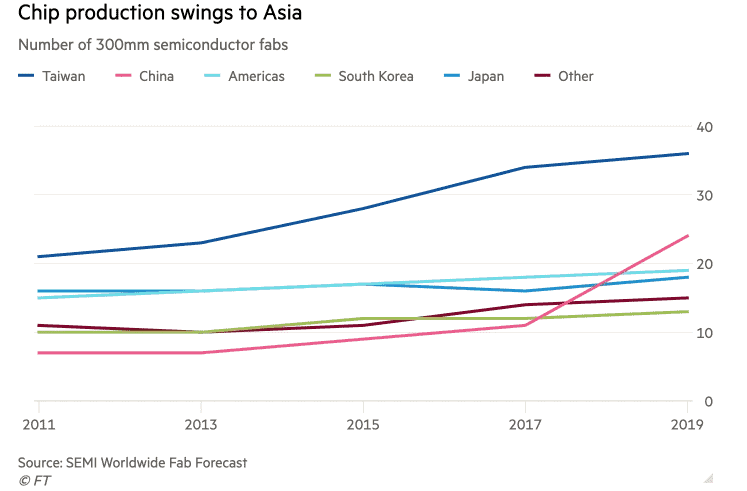

Understanding microchips intricate and fragile supply chains is important for both policymakers and investors. This report outlines a typical manufacturing and assembly scenario for a semiconductor chip: from research and development in America, base silicon ingots are cut into wafers in Taiwan or Korea, and finally the microchips are embedded into end products in China.

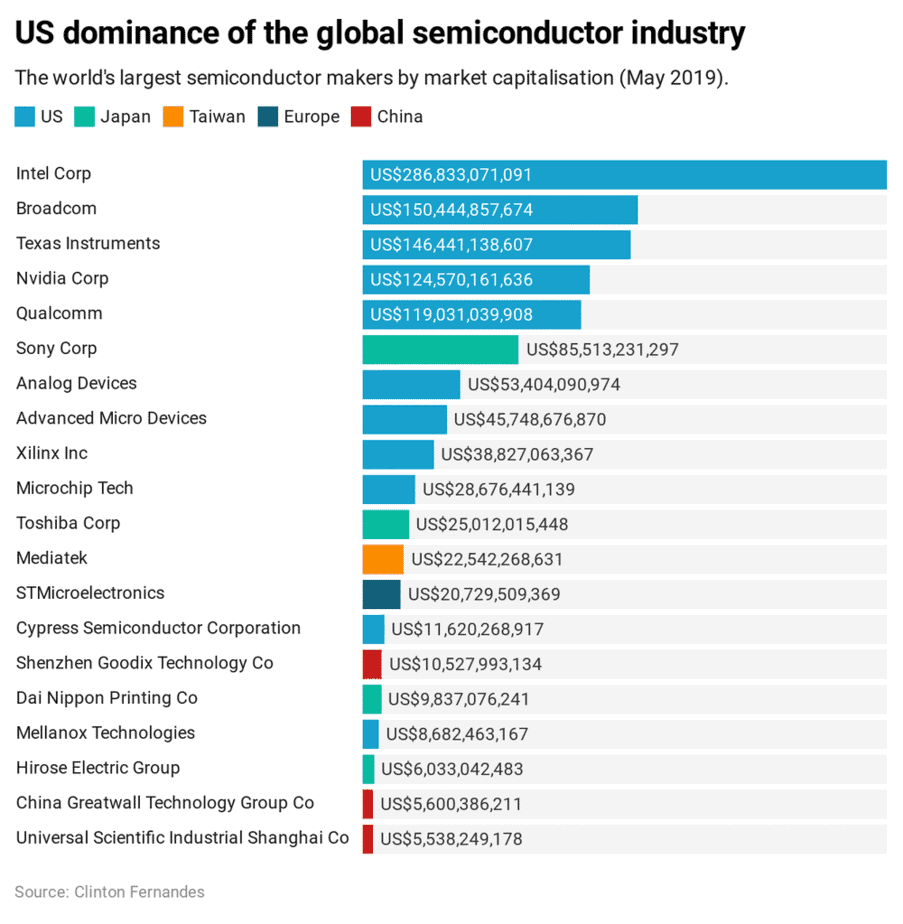

The chief concern is that while many advanced chips are designed in America, only around 12% of all chips are manufactured here and these tend to be the less advanced chips produced in older plants.

According to the Semiconductor Industry Association, between 2000 and 2019, U.S. chip sales almost doubled from $102 billion to $193 billion for more than 40% of the entire global market. Over the same period, domestic employment in the sector rose from 186,000 to 241,000.

America is also a leader in semiconductor equipment used to make and process wafers as well as test and assemble the final chipsets. According to the U.S. International Trade Commission, U.S. chip equipment firms, which have roughly 60,000 domestic employees, account for about half of global production. America is even more dominant in chip design software, controlling about 80% of the global market.

The challenge and dilemma for America is that it wants to protect its lead in semiconductor technology while U.S. companies also want to continue selling advanced chips to China. Day by day, this makes China a more formidable tech rival across the board as it learns more about moving up the food chain.

An estimated 70% of chips are made on older production lines operated by companies like Global Foundries.

Older chip manufacturing technologies also play an important part in national security — a key reason for the U.S. push for more local manufacturing. Many weapons systems rely on chips that come from small production runs and older designs, prompting the Pentagon to search for more local suppliers.

Many American chip designers such as Nvidia (NASDAQ: NVDA), Micron Technology (NASDAQ: MU), Qualcomm (NASDAQ: QCOM), Texas Instruments (NASDAQ: TXN), and Advanced Micro Devices (NASDAQ: AMD) outsource the fabrication of these chips to Taiwan Semiconductor (NYSE: TSM). With the exception of Intel (NASDAQ: INTC), most U.S. chip companies shut or sold their domestic plants years ago.

American semiconductor and related equipment exports to China climbed 22% to a record $9.8 billion in 2019 while chip exports through Hong Kong added an additional $4.7 billion.

Total U.S. technology exports to China are estimated to have been close to $100 billion and companies such as many of the above mentioned semiconductor companies receive 35% or more of annual revenue from China in one form or another.

Meanwhile, China’s total revenue from technology sales incorporating American technology exceeded $1 trillion in 2019. This includes telecom exports to America and around the world. The controversy around Huawei we have all been following is the perfect microcosm of the U.S.–China high-tech war.

U.S. semiconductor firms and their lobbyists in Washington emphasize that they allocate around 20% of revenues to research and development in order to maintain their technological lead over competitors in China, Japan, Taiwan, Korea and Europe. So if sales of U.S. advanced chips to China are curtailed or off limits, then revenue for R&D will be cut back and they will lose ground to competitors. This is America’s semiconductor dilemma.

Washington is listening and acting. Intel’s slip came just as the U.S. Senate and House of Representatives were converging around a bill that would pour taxpayer money into domestic chip production. The final bill lays out a framework for $25 billion worth of direct incentives to stimulate investment in manufacturing capacity, along with advanced research.

One way to reduce America’s chip-making vulnerability would be to get Samsung (KSE: 005930) or Taiwan Semiconductor (NYSE: TSM) to invest in more cutting edge fabrication plants based on the latest process technology that could cost more than $15 billion to build in the United States.

This is exactly what TSMC is considering as the world’s largest fabricator announced it is exploring building a new $12 billion facility in Arizona, adding to an existing and smaller facility in Oregon. Samsung already has an advanced chip plant in Austin, Texas, ensuring local supply of its chips for big customers like Apple.

The scenario is to begin construction of this fabrication facility in 2021 and complete it by 2024 though details, final financial arrangements and TSMC board approval are all pending.

TSMC makes semiconductors for major names like Apple (NASDAQ: AAPL) and Huawei Technologies mainly from its home base in Taiwan, and it also operates plants in Nanjing and Shanghai.

As Asia’s dominating chip fabricator, TSMC must execute a diplomatic balancing act it needs to strike between its sizable list of American, Chinese, Japanese and European clients.

The key reason that Taiwan Semiconductor is successful at smaller transistor sizes is because of its scale in building billions of chips for smart phones — vastly larger than the number of microchips needed for personal computers and data centers.

Taiwan Semiconductor’s chief Chinese rival is SMIC (HKSE: 0981), the largest chip foundry in China. TSMC previously successfully sued SMIC over its alleged theft of trade secrets, and in 2009 this resulted in TSMC gaining an 8% stake in its rival.

TSMC had ten times more revenue than SMIC last year but SMIC receives Chinese government support equivalent to roughly 40% of its annual revenues, according to an Organization for Economic Co-operation and Development (OECD) report last year. In addition, China's state-backed funds also recently increased their stakes in SMIC's Shanghai plant after TSMC cut off to appease U.S. regulators.

Surprisingly, SMIC generated 25% of its revenue from US chipmakers last quarter led by Qualcomm (NASDAQ: QCOM), which owns an equity stake in SMIC through a joint venture. SMIC produces Qualcomm's lower-end Snapdragon chips, while TSMC produces Qualcomm's higher-end chips.

In early August, the U.S. Commerce Department announced that companies would require licenses for sales to Huawei of semiconductors made abroad with U.S. technology. As you can see, this is a complicated game very much impacted by geopolitics.

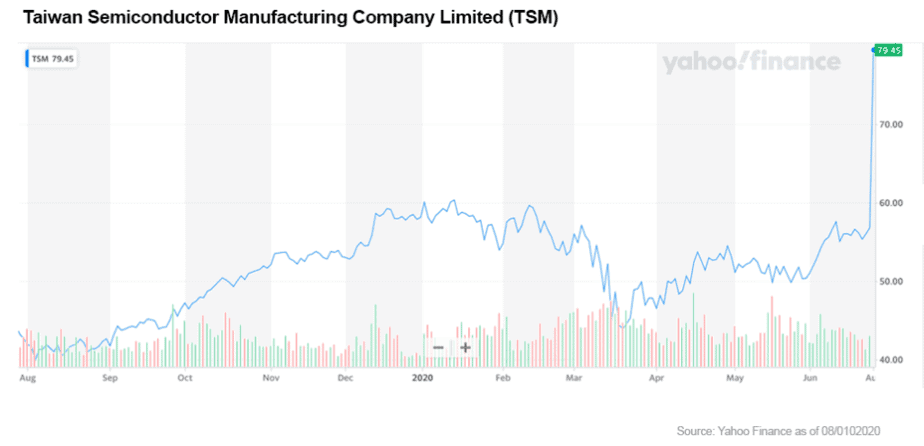

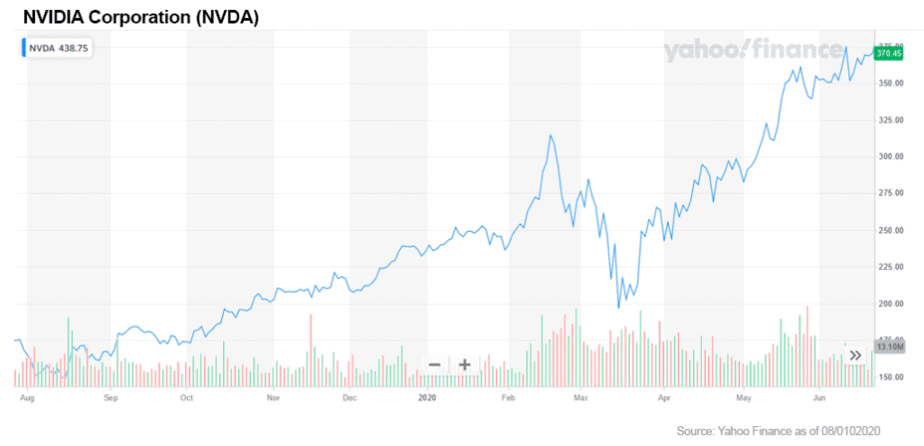

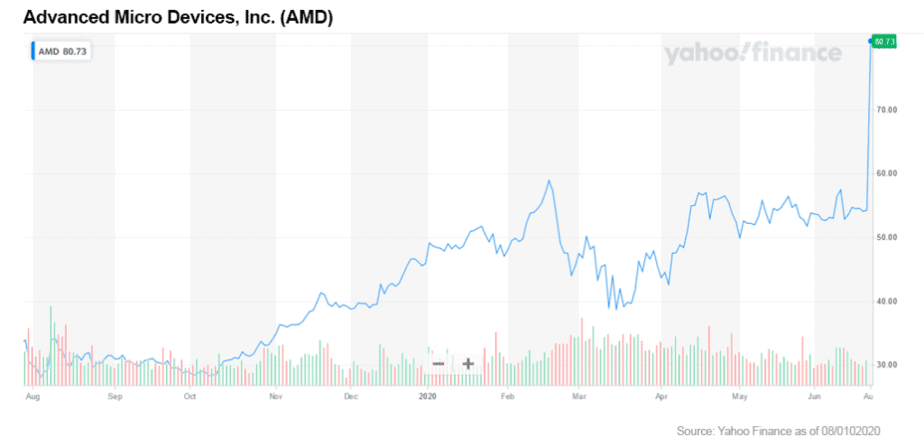

Intel’s announcement of its production stumble may have hit its stock price but the flip side is that the stock of its competitors such as Taiwan Semiconductor (NYSE: TSM), Advanced Micro Devices (NASDAQ: AMD), and Nvidia (NASDAQ: NVDA) surged.

Nvidia (NASDAQ: NVDA) seems to have unbeatable momentum in this critical industry as the company’s market value recently exceeded that of Intel for the first time.

But don’t count out Intel since it might be able to focus its efforts and gain political support and cash to help it get back into this high stakes, strategically important game.

As strategic decoupling accelerates in America, China and around the world, you can expect a bumpy ride in semiconductor stocks.

Perhaps the company best positioned to take advantage of Intel’s stumble is Advanced Micro Devices (NASDAQ: AMD).

AMD has charted a different course than Intel, spinning off its fabrication capabilities into a company that would eventually become closely held Global Foundries and opting to focus on chip designs while contracting the fabrication to the likes of Taiwan Semiconductor.

Putting these three stocks in your portfolio might be the smartest strategy right now.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

US chip industry plots route back to homegrown production, Richard Waters, 3 August, 2020

Semiconductors at the Heart of the US-China Tech War: How a New Era of Techno-Nationalism is Shaking up Semiconductor Value Chains. www.hinrichfoundation.com/research/wp/tech/semiconductors-at-the-heart-of-the-us-china-tech-war/

National Semiconductor Association, https://www.semiconductors.org

Thomas J. Duesterberg, Hudson Institute, Next Steps for US Trade, Manufacturing, and Supply Chains After COVID-19, www.hudson.org/research/16264-next-steps-for-us-trade-manufacturing-and-supply-chains-after-covid-19

Move Over Intel. Nvidia Is Officially the Largest U.S. Chip Maker, Barrons, July 8, 2020. www.barrons.com/articles/nvidia-stock-is-poised-to-be-worth-more-than-intel-51594083051