The world is a magnificent place, full of wonderful nature providing us with all the resources we need and/or the means to develop them.

Unfortunately, over time mankind has taken for granted these resources and as such, we find ourselves in an environmental crisis. Oceans we admire, the air we breathe, the silence we crave have all been hampered by our own ambitions to develop, develop, develop.

Finally, we are waking up. People are starting to really realize that they need not only to invest financially in their future, but they also need to make decisions that will be an investment in their family’s future well-being.

Across the globe, countries are giving into the pressure and implementing measures to try to, at least in some way, repair the damage caused by centuries of human consumption.

Enter the Paris Agreement, a legally binding international treaty on climate change. On December 12, 2015, it was adopted by 196 parties and entered into force on November 4, 2016. The purpose of the agreement is to limit global warming which would require social and economic transformation. To keep track of countries’ progress, the enhanced transparency framework (ETF) was formed. Under the ETF, starting in 2024, countries will report on actions taken, adaptation measures and progress.[1] This was a giant wake-up call for countries to take action. After all, there is nothing like peer pressure to motivate those involved.

One such measure which is becoming increasingly popular is to advocate for the use of Electric Vehicles (EVs) in a bid to reduce the stress on the environment and in doing so, reduce carbon footprints.

There is no denying that EVs, powered by primarily lithium-ion batteries, are definitely better for the environment for a number of reasons.

As such, countries are jumping on the EV bandwagon. In August 2021, it was announced that President Joe Biden had signed an executive order setting a national goal for zero-emissions vehicles to make up half of the new cars and trucks sold by 2030.[3] This is a very aggressive timeline and order!

Canada’s plan for 2030 Emissions Reduction Plan will be unveiled in 2022, with a target to reduce greenhouse gas emissions by 40% from 2005 levels. It is anticipated that it will include an EV mandate.[4]

The European Union has announced that it will end the sale of polluting vehicles by 2035, including hybrids. In addition, the auto industry will be required to slash the average emissions of new cars by 55% by 2030. In fact, with 2050 as a goal, Europe wants to be the first continent to be climate neutral.[5]

Obviously, with all of this movement towards the future of Electric Vehicles (EVs), companies that produce elements, notably lithium and graphite, that are crucial in the manufacturing of lithium batteries are going to become more and more interesting to investors.

And indeed, to quote Elon Musk on the future of the lithium market, “Our goal here is to fundamentally change the way the world uses energy. We're talking terawatt scale. The goal is complete transformation of the entire energy infrastructure of the world.”[6] Given Musk’s heightened background, he probably knows what he is talking about![7]

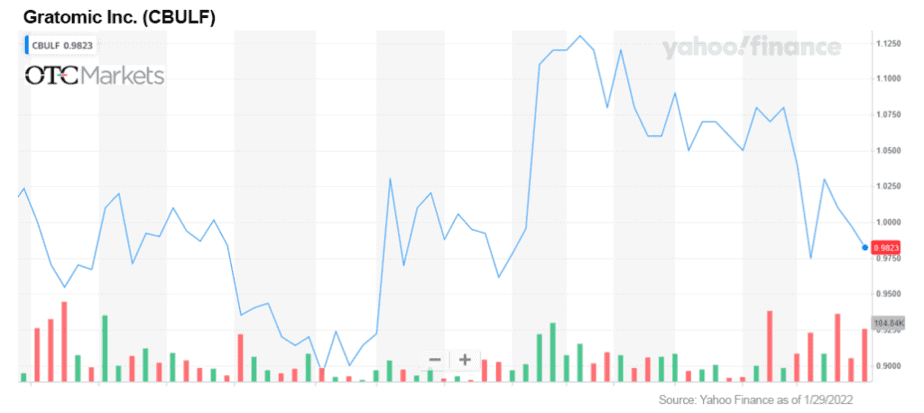

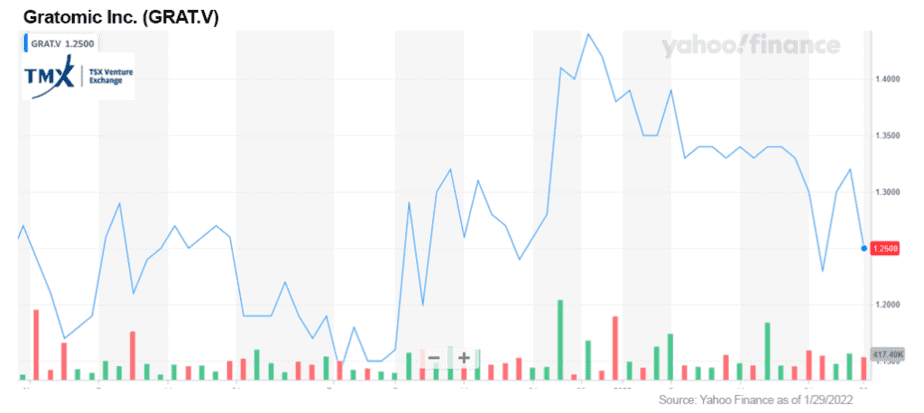

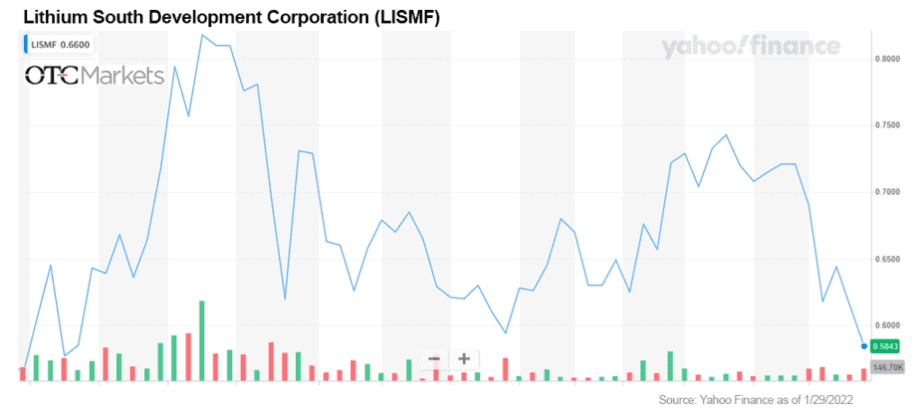

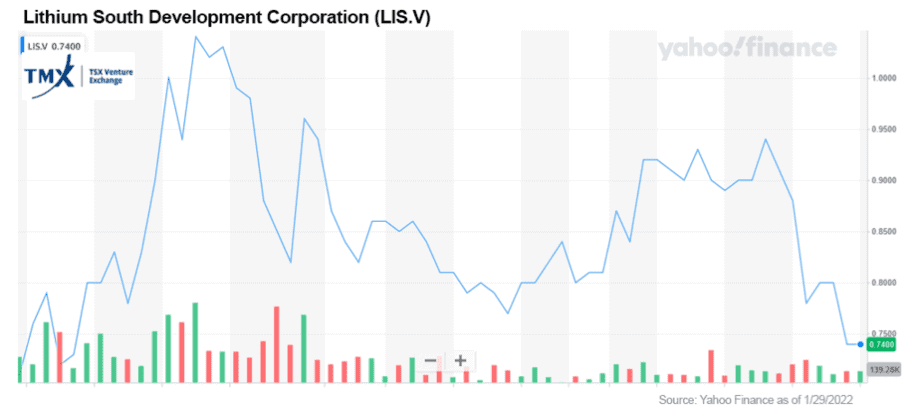

A few companies that are involved in various ways in this market are Gratomic Inc. (OTCQX: CBULF / TSX-V: GRAT / FRANKFURT: CB82), Lithium South (OTCQB: LISMF / TSX-V: LIS / FRANKFURT: OGPQ) and Sony Group Corporation (NYSE: SONY).

It is commonly known that graphite powder is used as an anode material in the majority of lithium-ion batteries.

Gratomic Inc., with a foundation built on being an eco-conscious company, engages in exploration and mining focusing on low-cost mine to carbon-neutral, eco-friendly, naturally high-quality vein graphite. This multinational entity has several projects on the roster in very desirable locales, including in the Karas Region of Namibia (Aukum), the Bahia State of Brazil (Capim Grosso) and Buckingham, Quebec (Buckingham).

So far, the company has been successful in upscaling the naturally pure vein graphite from the Aukam Graphite Project to a battery grade level of 99% + Cg through the addition of air classification, and the commissioning and calibration of its onsite Aukam Vein Graphite Processing Plant remains on schedule as planned.[8][9] From there, it is anticipated that the company will be moving into full operational capabilities within the first quarter of 2022.

I find the Aukam Project very interesting for several reasons. This region, which covers a historical vein graphite mine, is significant. Data obtained over the past 9 years of the project has demonstrated significant potential for expansion. Other variables that contribute to Aukam’s attractiveness are year-round road access as well as nearby power, water, and rail line sources.[10]

At the beginning of 2021, Gratomic provided an update on the commissioning process of several key equipment pieces for the Aukam project in preparation for the final stage of grinding, flotation, and drying circuits. The Product Thickener assembly had been completed, and the vibrating feeder installed in readiness for calibration. This included the process of relocating material from the historical stockpiles to the feed pad.[11]

Clearly, Gratomic is on the move, despite roadblocks faced globally due to the current pandemic.

“Our Aukam construction team has demonstrated resilience in the face of adversity. Even during the holiday period, they never stopped finding ways to push our project forward and keep us ahead of the game.” [12]

— Armando Farhate, COO & Head of Graphite Marketing and Sales

I like to see that determination in a company. I find that it inspires confidence that despite whatever barriers (expected or unexpected) may pop up, determination will supersede difficulties.

With all the positives this unique asset presents, in combination with being one of the only jurisdictions of viable vein graphite outside of Sri Lanka, it may be poised to replace a large part of declining production capacity of vein graphite from Sri Lanka.[13]

In summary, I believe that Gratomic has all the necessary elements to power up success. It is one of my favorite companies.

Based in Salta, Argentina, Lithium South’s focus is the Hombre Muerte North (HMN) Lithium Project, a flagship lithium brine project containing six separate claims and located in the lithium triangle, the nexus for the coveted mineral. In fact, Argentina, Bolivia, and Chile in South America hold more than half of the world’s lithium deposits. It is this huge on a world scale![14]

The company is currently evaluating a Direct Lithium Extraction (DLE) using an absorbent. The exciting part of this is that, if effective, it may have the capability to reduce production time from months to hours and increase recovery from traditional extraction methods of 42% to over 80%. Given how the need for lithium may exponentially increase over the coming years as countries strive to meet their promises, in my opinion, this could be a game changer for the company.

Highlights of the HMN project include:

Two production wells have been drilled and cased, with a 2,000-meter drill program to follow.[16] With everything LIS has in place, in my opinion, this company has strong fundamentals and I am keeping a very close watch on this one.

In my opinion, this is only the tip of the iceberg.

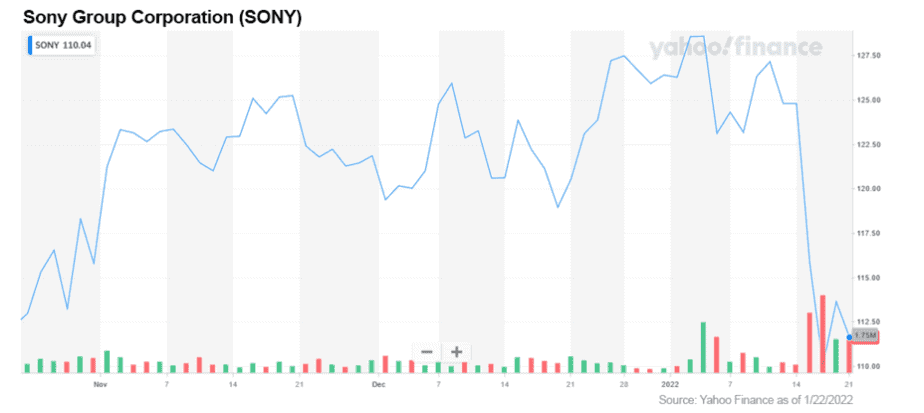

Last but not least, on January 5, 2022, Sony announced that they are launching a new company to explore entry into the electric vehicle market. The company is set to announce the plans to open their subsidiary, to be known as Sony Mobility, at the 2022 Consumer Electronic Show in Las Vegas according to Kenichiro Yoshida, Sony chief executive. The announcement sent Sony’s shares up more than 4.5 percent.[17]

The stock is currently sitting at around $112.50 on the NYSE board.

It will be interesting to see where things go when this tech giant unleashes its’ EV program at full strength.

In summary, I believe that it is an opportune time for investors to look at companies either offering components for the EV market, or the end-products. It is the way the world is heading and more importantly, if we want to help our planet, I feel it is a necessary avenue.

And let’s face it… investing in helping our planet IS investing in our family’s future in the most important way, because if you don’t have a healthy and safe environment, money doesn’t matter so much. We should all be doing our part and, in my opinion, supporting companies that are trying to do theirs is a win-win situation.

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Gratomic Inc. and Lithium South are Kal Kotecha portfolio holdings under his Junior Gold Report. Junior Gold Report (Dr. Kotecha) is currently engaged and paid by Gratomic for marketing/consulting services. His relationship with Gratomic and holdings of Gratomic Inc. and Lithium South should be deemed a potential conflict of interest.

[1] United Nations Climate Change : The Paris Agreement : https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[2] Caroline Fortuna (March 25, 2019) : EVObsession : Why Electric Cars Are Better : https://evobsession.com/why-electric-cars-are-better/

[3] Josh Lederman : August 5, 2021 : Biden Signs Order Aiming for Half of New Vehicles to be Electric by 2030 : https://www.nbcnews.com/politics/politics-news/biden-sign-order-aiming-half-new-vehicles-be-electric-2030-n1275995

[4] Electric Automony (December 8, 2021) : Canada’s emissions plan for 2030 targets to be released in spring 2022 as strategic consultations begin : https://electricautonomy.ca/2021/12/08/canada-emissions-plan-consultations/

[5] Charles Riley, CNN Business : Europe aims to kill gasoline and diesel cars by 2035 : (https://www.cnn.com/2021/07/14/business/eu-emissions-climate-cars/index.html

[6] Tesla’s Powerful Event: The 11 Most Important Facts https://www.bloomberg.com/news/articles/2015-05-01/tesla-s-powerwall-event-the-11-most-important-facts

[7] Energy & Capital : Why Lithium Investments Are Wall Street’s Hottest Stocks : https://www.energyandcapital.com/report/the-coming-lithium-revolution/1450

[8] Gratomic (September 7, 2021) : Gratomic Provides Update on Pre-Feasibility Study, Independent Lab Results, and the Aukum Vein Graphite Project : https://gratomic.ca/2021/09/07/gratomic-provides-update-on-pre-feasibility-study-independent-lab-results-and-the-aukam-veingraphite-project/

[9] Gratomic (January 11, 2022) : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphiteprocessing-plant-in-namibia/

[10] Gratomic : Aukam : https://gratomic.ca/aukam/

[11] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[12] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[13] Gratomic Inc. Profile : https://agoracom.com/ir/Gratomic/profile

[14] Explainer: Latin America's Lithium Triangle https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[15] Lithium South Development Corporation : www.lithiumsouth.com

[16] Lithium South Development Corporation : www.lithiumsouth.com

[17] Christopher Grimes, Leo Lewis (January 5, 2022) : Sony Launches Electric Vehicle Company to ‘Explore’ entering market. https://www.irishtimes.com/business/manufacturing/sony-launches-electric-vehicle-company-to-explore-entering-market-1.4769241