One of the most attractive investment opportunities to cross my desk in a while is the significant transformation of our energy landscape that is now taking place.

Countries around the world are making massive investments to transition away from fossil fuels and put renewable energy technologies and related infrastructure in its place.

By any measure this task ahead is enormous. Estimates to fully transition away from fossil fuels run in the tens of trillions of dollars. The fact is, governments around the world are facing the reality that the transition to green energy is not only necessary but urgent.

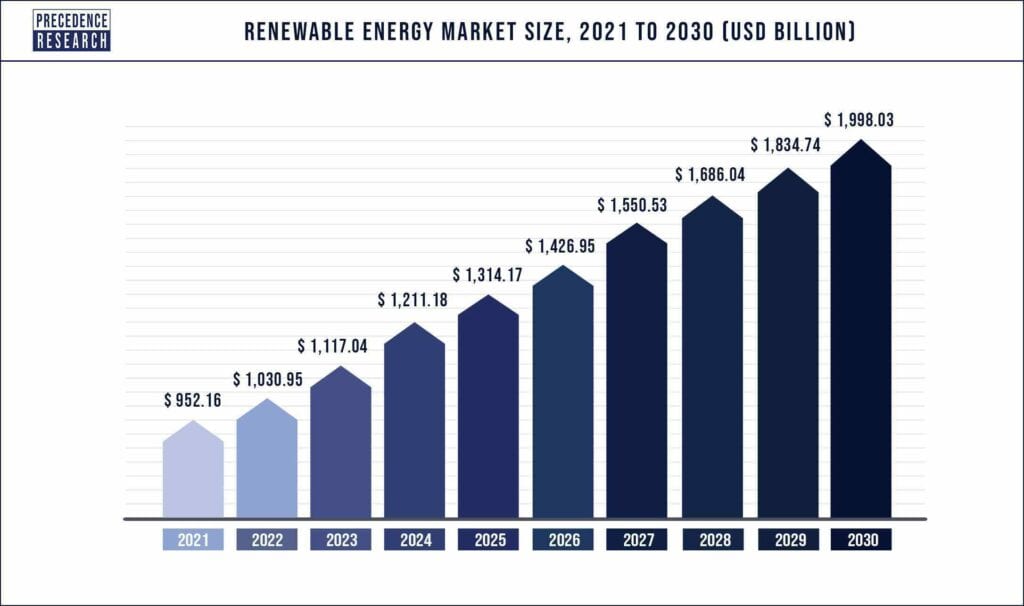

The global renewable energy market size was estimated at just over US$1 trillion in 2022 and is expected to hit about US$2 trillion by 2030, with a registered CAGR of 8.6% from 2022 to 2030.[1]

The decarbonization megatrend is exploding and early investors in the space could very well see their investments skyrocket over the coming years.

Do I have your attention now?

Keep reading and learn why investing in renewable energy stocks is one of the smartest moves an investor could make today.

As a bonus I’ll throw in my 5 top stock picks in the field to kick-start your investment research!

Now let’s get started...

Three key factors have come into play that are forcing governments and corporations alike to reconsider their energy policies and investment strategies.

1. The War in Ukraine

Europe’s dependence almost entirely on Russian oil and gas was laid bare with the invasion of Ukraine by Russia last year. The fact that Russia’s war machine is largely funded by sales of its oil and gas to Europe set off a political and existential crisis.

All across Europe the people raised their voices, “How can we buy Russian oil and gas knowing the money is going directly to buy bullets and bombs being used against Ukraine?

The renewable energy movement has been well underway for many years in Europe and the Ukrainian invasion was the tipping point to put that movement into high gear.

2. Climate Change Has Unleashed Devastating Effects

The second key factor that is driving the renewable energy transition is one we all know about.

Climate change.

Climate change experts have been warning for decades of the effects of rising CO2 levels, rising global temperatures and the extreme weather events that would follow.

We are now beginning to see some of those predictions come true as the weather worldwide begins to change drastically.

Extremes in weather patterns are sending large swaths of the globe into severe drought or devastating 100-year event flooding in certain parts of the world. Rising temperatures are breaking all known records on a regular basis resulting in the rapid melting of huge glaciers not only in the polar regions but also in continental mountain chains that supply the majority of drinking water to to major cities below. Coastal flooding from rising ocean levels is already taking place and displacing populations around the world.[2]

And recently Lufthansa Air experienced extreme turbulence over Tennessee on a flight from Texas to Switzerland. The flight had to be diverted to Washington Dulles International Airport, and seven passengers were taken to the hospital with what were believed to be minor injuries. Scientists are saying this will become more common due to severe wind shear from temperature extremes caused by climate change.[3]

Without a doubt climate change has moved from theory to reality, and governments around the world are now beginning to act with earnest.

3. Socially Responsible Investing

Increasingly, investors are moving their money out of destructive fossil fuel industries and into greater future-focused green renewable energy companies.

This movement is called socially responsible investing, and there has been a dramatic increase in the number of investors participating in this movement over the past few years.

In 2020, approximately $15 trillion of professionally managed assets in the US was considered Environmental, Social, and Governance (popularly known as ESG). That is a huge increase from just ten years prior when less than $2 trillion was invested in ESG equities.[4]

The pros and cons of this type of investment strategy can be discussed at extreme length but suffice to say that there are a significant number of investors that do consider the environmental impact a company makes when choosing where to put their money.

This investment strategy does ultimately encourage companies to establish environmental goals that help in mitigating climate change.

All said and told, these three factors have made the transition away from historical fossil fuels a top priority for governments and corporations around the world. The paradigm shift is just beginning, and early investors in the space have the potential to profit handsomely over the next several years.

By all measures the global renewable energy transition is seeing record growth, and I believe we are still at the very beginning of the adoption curve with plenty of time to re-position your portfolio now for maximum gains.

Double or even triple-digit growth is well within the realm of possibility as more money is invested in renewable energy companies.

Take a look at these estimated annual growth rates that are predicted to last for at least the next 7 years:

Forecasts for the green energy market sees the valuation doubling over the next 7 years to almost US$2 trillion dollars!

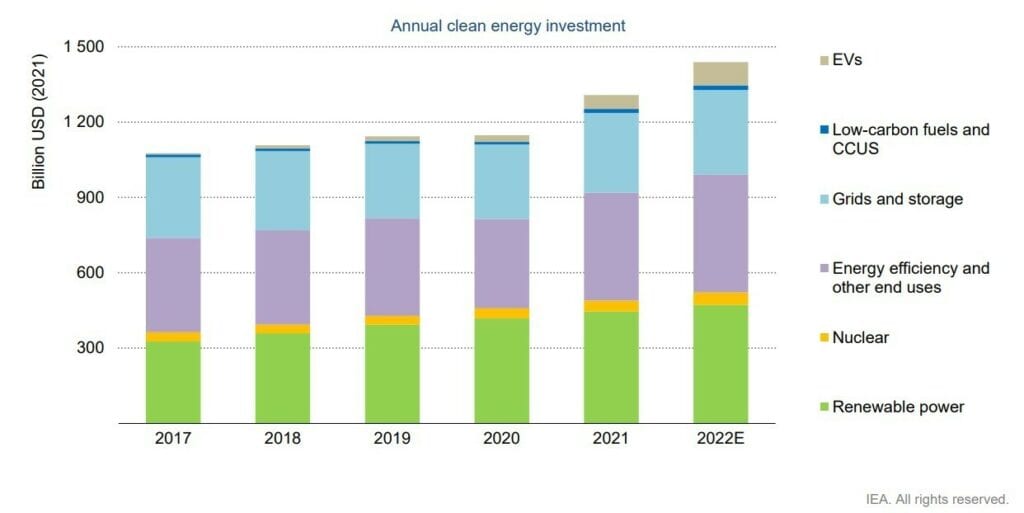

Since 2020, the pace of growth in clean energy investment has accelerated significantly to 12%. This increase has been fueled by government support as well as socially responsible investors.

According to the IEA’s World Energy Investment 2022 report, the fastest growth in energy investment is coming from the power sector — mainly in renewables and grids — and from energy efficiency.

Renewables, grids and storage now account for more than 80% of the total power sector investment.[6]

The decarbonization megatrend is already driving trillions of investment dollars into renewable energy. This trend will not be ending anytime soon.

The global price tag for fully transitioning to renewable energy sources is estimated at around US$62 trillion according to a Stanford University study.[7]

Time magazine recently reported that clean energy investment set a $1.1 trillion record, matching fossil fuels for the first time.[8]

President Biden signed a $1.2 trillion infrastructure package in November 2021 that includes funding to accelerate clean energy investments.[9] Meanwhile, Congress worked through the summer of 2022 to reach an agreement on a $369 billion climate and tax bill to further accelerate the country’s transition away from fossil fuels.[10]

The climate funding would move forward Biden’s proposal to cut US carbon emissions in half by 2030 and achieve net-zero emissions by 2050.

Some of Biden’s spending areas on climate include:

Most see these massive spending bills as merely a down payment on the real cost of decarbonizing the economy. For sure more government spending is in the pipeline to continue to drive the transition to clean energy. Renewable energy companies will be the beneficiaries of these massive public works, and ultimately savvy investors in the right companies could see their portfolio valuations grow exponentially.

There are several investment opportunities that investors should consider when evaluating renewable energy companies.

Here are 5 areas that I believe are the most profitable and where intelligent investors should be focusing their attention:

1. Solar Energy

Solar energy has become one of the most prominent renewable energy sources in recent years. There are opportunities for investment in solar panel manufacturers, installation companies, and solar energy project development firms.

2. Wind Energy

Wind energy is another growing sector in the renewable energy industry. Investment opportunities can be found in wind turbine manufacturing companies, wind farm developers, and companies that provide wind energy storage solutions.

3. Geothermal Energy

Geothermal energy utilizes the natural heat from the earth's core to generate electricity. There are opportunities for investment in geothermal power plant developers and companies that specialize in geothermal drilling and exploration.

4. Energy Storage

As renewable energy sources become more prevalent, energy storage solutions are becoming increasingly important. Investment opportunities can be found in companies that manufacture energy storage systems, such as lithium-ion batteries, and companies that provide energy storage management and optimization solutions.

5. Hydropower

This energy source is the backbone of low-carbon electricity generation, providing almost half of the world’s energy needs today. Hydropower’s contribution is 55% higher than nuclear and larger than that of all other renewables combined, including wind, solar PV, bioenergy and geothermal.

In 2020, hydropower supplied 17% of global electricity generation, the third‑largest source after coal and natural gas. Over the last 20 years, hydropower’s total capacity rose 70% globally, but its share of total generation stayed stable due to the growth of wind, solar PV, coal and natural gas.

While doing my research on renewable energy stocks, I was shocked by the number of quality companies that exist. To be frank, it was actually difficult to narrow down the field to five of my favorites.

From a chart perspective, many of these companies have followed the majority of Wall Street and taken their respective hits over the past year. I’m looking at these as long-term investments — and buying now when their valuations are low could represent a win-win situation — especially for new investors to the space.

We also must consider the fact that this megatrend is just getting started. As more investment dollars pour into the space, companies that are well-positioned now could stand to profit the most.

1. First Solar (NASDAQ: FSLR)

First Solar is one of the largest solar panel manufacturers globally, and develops some of the most advanced solar panels in the world.

They are leaders in what is known as thin-film solar modules that are super-efficient and reliable. Their solar panels generate more energy than competing technologies, making them ideal for utility-scale solar energy projects.

They are also conscious of keeping their manufacturing processes with a low carbon footprint. All of their solar panels are fully recyclable as well.

They have a diversified business model with operations in multiple countries around the world. They also offer a wide range of products and services, including solar modules, project development, and engineering, procurement and construction services.

This diversification helps to mitigate risks associated with changes in market conditions or regulatory environments in any one region.

As one of the world's leading solar panel makers, the company is in an excellent position to capitalize as demand for solar panels accelerates. It’s actively investing to increase its capacity to produce solar panels and meet demand. As of 2022’s second quarter, it had sold out all its capacity through 2024 except for a new plant being built in India. Meanwhile, it has contracts in place to sell panels stretching out into 2026, giving it significant visibility into future revenue.

First Solar has the means to continue expanding because it boasts one of the best balance sheets in the sector. The company has consistently reported strong financial results, with increasing revenues and profits over the years. In its most recent quarter, the company reported net sales of $2.6 billion for 2022. First Solar is also sitting on $2.4 billion in net cash reserves.[12]

First Solar is already up over +43.1% this calendar year. In comparison, Oils-Energy companies have returned an average of -0.5%.[13]

A must add for any investor in renewable energy in my opinion.

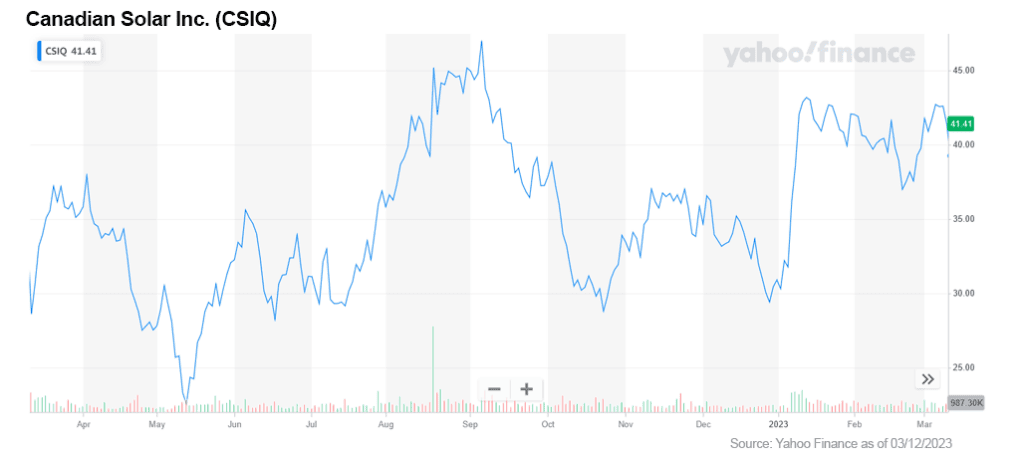

2. Canadian Solar Inc. (NASDAQ: CSIQ)

Canadian Solar is a leading vertically integrated solar energy solutions company that designs, develops, and manufactures solar photovoltaic (PV) modules and systems for both on-grid and off-grid applications.

Canadian Solar has consistently reported strong financial results with increasing revenues and profits over the years. For the third quarter ended September 30, 2022, the company reported +57% year-over-year revenue growth for a total of $1.93 billion.[14]

Canadian Solar will announce its full fourth quarter of 2022 and full year of 2022 results on March 21, 2023.[15]

The company expects shipments for 2023 to grow over 56% year-over-year.

Canadian Solar has a diversified business model with operations in over 20 countries and a wide range of products and services, including solar modules, inverters, and energy storage solutions. This diversification helps to mitigate risks associated with changes in market conditions or regulatory environments in any one region.

Despite its strong financial performance and growth prospects, Canadian Solar's stock is currently undervalued compared to its peers in the solar energy industry. This presents an opportunity for investors to buy into the company at a relatively low price.

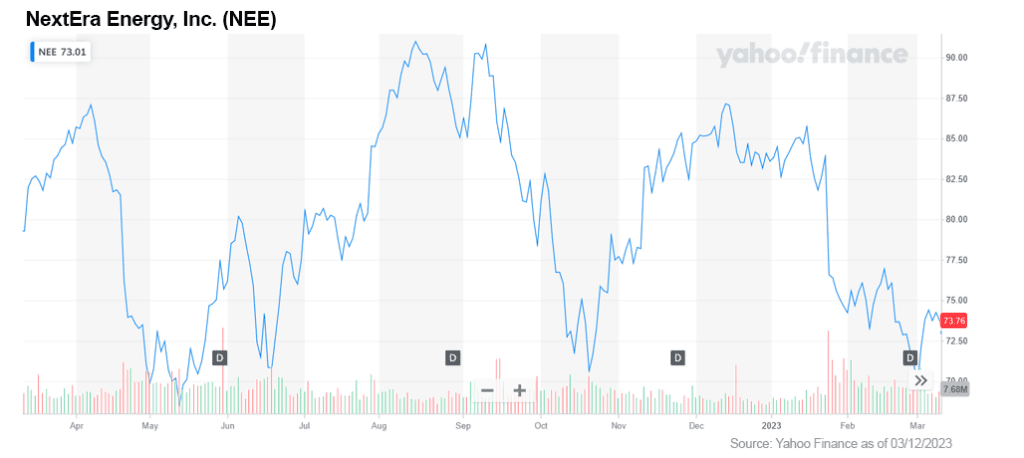

3. NextEra Energy (NYSE: NEE)

NextEra Energy is a Florida-based electric utility holding company that is primarily engaged in the generation, transmission, and distribution of electricity, as well as in the development and construction of renewable energy projects. It is the world's largest producer of wind and solar energy.

NextEra Energy has a strong financial position, with steady revenue growth and high profitability margins. The company has consistently increased its earnings per share (EPS) over the past several years and has a strong balance sheet with manageable debt levels.

The company recently reported a profit of $1.52 billion, or 76 cents a share, compared with a profit of $1.2 billion, or 61 cents a share, a year earlier.[16]

NextEra Energy has a robust growth pipeline, with plans to invest heavily in renewable energy projects over the next several years. The company is also expanding its transmission and distribution networks to support the growth of renewable energy and to enhance the reliability of its services.

NextEra Energy has consistently increased its dividend over the past several years and has a current dividend yield of around 2.54% as of March 8, 2023. NextEra has increased its dividend for more than 25 consecutive years, earning it the S&P Dividend Aristocrat distinction.[17]

The company expects its investments to continue paying dividends for shareholders. It predicts earnings will increase at or near its 6% to 8% annual target range through at least 2025, powered by continued investments in renewable energy.

The company is a solid play in the renewable energy space and one to strongly consider adding to your portfolio.

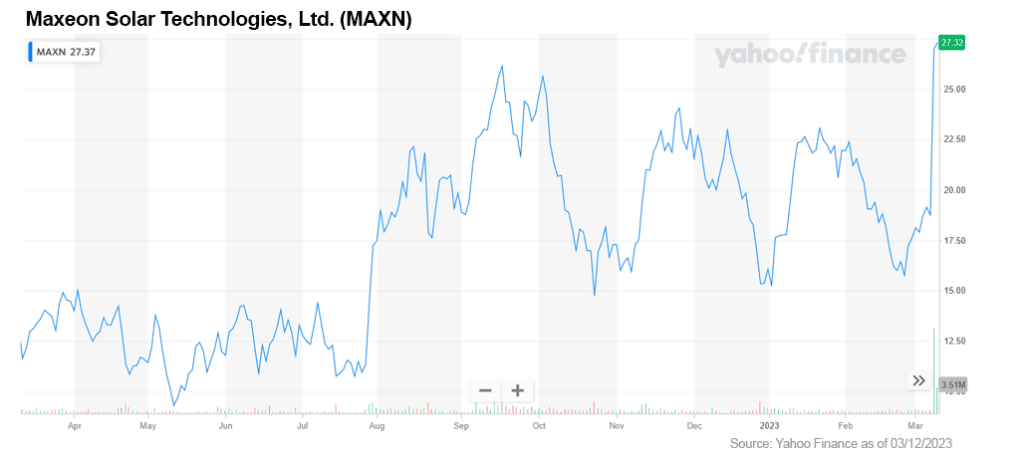

4. Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN)

Maxeon Solar Technologies is a leading global manufacturer of premium solar panels, with a strong focus on innovation, sustainability, and quality.

The company is an innovator in the solar industry with a strong focus on research and development. It has a number of patented technologies, including its Maxeon® solar cell technology, which has been shown to be highly efficient and reliable.

Maxeon Solar Technologies has a strong financial track record, with consistent revenue growth and profitability. In its most recent quarter, the company posted Q4 2022 earnings with strong revenue generation of $324 million, slightly ahead of the market consensus $316 million, and up +46.3% from $221.5 million in revenue generated in Q4 2021.

“The company’s gross profit increased to $20 million in the fourth quarter due to strong operational performance and prudent supply chain management, a record for Maxeon.”[18]

- Bill Mulligan, Chief Executive Officer of Maxeon

A strong choice for any intelligent investor.

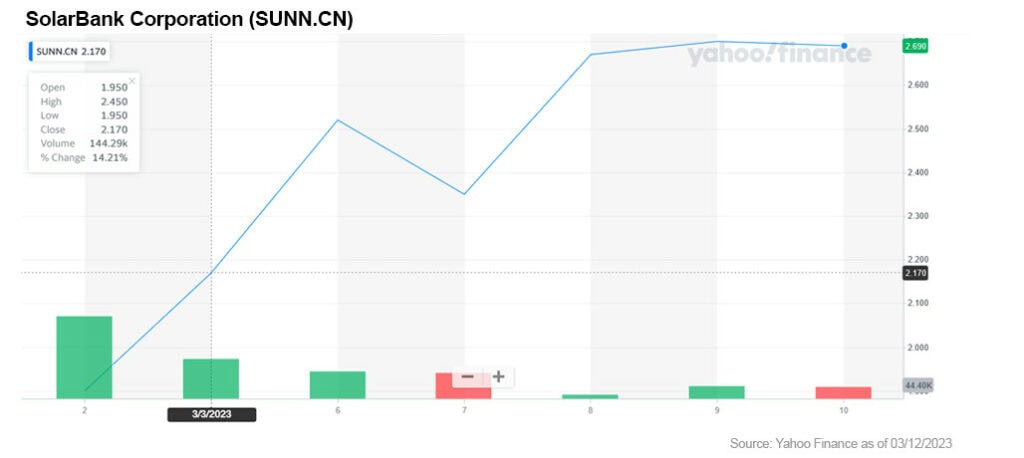

5. SolarBank Corporation (OTCQX: SUUNF / Cboe: SUNN)

SolarBank Corporation is a solar energy solutions company that provides end-to-end services for residential, commercial, and industrial customers.

The company recently IPO’d on the Canadian Securities Exchange (CSE) in Canada and has seen significant investor attention over the past week since it has gone public.

SolarBank reports over 100 solar power plants completed and under management in Canada and the US over the last decade.

The company also touts a strong and loyal customer base with a whopping 100% customer retention rate since inception, 4,000+ community solar subscribers, 90% government contracts, and several Fortune 500 companies as customers.

Future booked projects look very strong for the coming fiscal year; the company has reported 700 megawatts of solar development pipeline.

The company has a strong management team with deep industry experience and a proven track record of success. The team has demonstrated the ability to execute on the company's growth strategy, while creating value for shareholders.

SolarBank has a number of innovative technologies that set it apart from competitors, such as its patented SolarSkin™ technology, which allows solar panels to blend seamlessly into a building's exterior.

This is my wildcard pick which could turn investors an easy 10-bagger over the next couple of years. Get in early and ride the wave.

Intelligent investors should be starting their own research and due diligence in this rapidly developing megatrend today. The adoption curve is still at its beginning stage and there is still time to create your green energy portfolio.

Investing in green energy is just common sense in my opinion. Without a doubt the world will transition to these renewable energy sources and leave fossil fuels in the ground. Governments around the world are pouring money into the space to rapidly develop and deploy green energy projects to lessen their dependence on fossil fuels and fight climate change.

I am providing my top 5 picks of viable and profitable companies that are leading the charge into our clean energy future. You may have noticed four out of five of my picks are in the solar space. I feel very strongly solar represents the very best near-term opportunity right now!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.precedenceresearch.com/renewable-energy-market

[2] https://apnews.com/article/turbulence-lufthansa-dulles-flight-injuries-3c0d7d7839c9bad7ad4e84f86cb8e204

[3] https://apnews.com/article/turbulence-lufthansa-dulles-flight-injuries-3c0d7d7839c9bad7ad4e84f86cb8e204

[4] https://blogs.worldbank.org/allaboutfinance/pace-change-how-quickly-can-socially-responsible-investors-create-impact

[5] https://www.precedenceresearch.com/renewable-energy-market

[6] https://www.iea.org/news/record-clean-energy-spending-is-set-to-help-global-energy-investment-grow-by-8-in-2022

[7] https://unfccc.int/sites/default/files/resource/climate-finance-roadmap-to-us100-billion.pdf

[8] https://time.com/6250469/clean-energy-investment-sets-1-1-trillion-record-matching-fossil-fuels-for-the-first-time/

[9] https://www.cnn.com/2021/11/05/politics/house-votes-infrastructure-build-back-better/index.html

[10] https://www.cnbc.com/2022/08/15/investors-flock-to-green-energy-funds-as-congress-passes-climate-bill.html

[11] https://www.cnbc.com/2023/03/09/bidens-budget-proposal-calls-for-boosting-climate-resilience-funding.html

[12] https://investor.firstsolar.com/news/press-release-details/2023/First-Solar-Inc.-Announces-Fourth-Quarter-and-Full-Year-2022-Financial-Results-and-2023-Guidance/default.aspx

13] https://finance.yahoo.com/news/first-solar-fslr-outperforming-other-144002134.html

[14] https://investors.canadiansolar.com/news-releases/news-release-details/canadian-solar-reports-third-quarter-2022-results

[15] https://finance.yahoo.com/news/canadian-solar-preannounces-selective-q4-120000759.html

[16] https://www.morningstar.com/news/dow-jones/202301254987/nextera-energy-logs-higher-4q-profit-revenue

[17] https://www.marketbeat.com/dividends/aristocrats/

[18] https://pv-magazine-usa.com/2023/03/09/maxeon-posts-q4-2022-revenue-beat-increased-shipments-stock-up-44/