If you are an investor looking for the next red-hot sector, stop what you are doing and read this right now. I promise that the time spent will ultimately lead you to a greater understanding of the metals sector with the potential to make better investment decisions in 2023.

Today we are taking a deeper look into the fast-evolving and high-growth battery market.

Batteries are literally at the core of our modern life and the new electric economy.

Think of all the things that you use on a daily basis that have a battery inside. Now add to this the exploding market share that electric vehicles are seeing and imagine how many batteries they will need in the coming years to keep up with production.

The fast-expanding green energy grid also needs batteries to store the energy they produce from solar and wind.

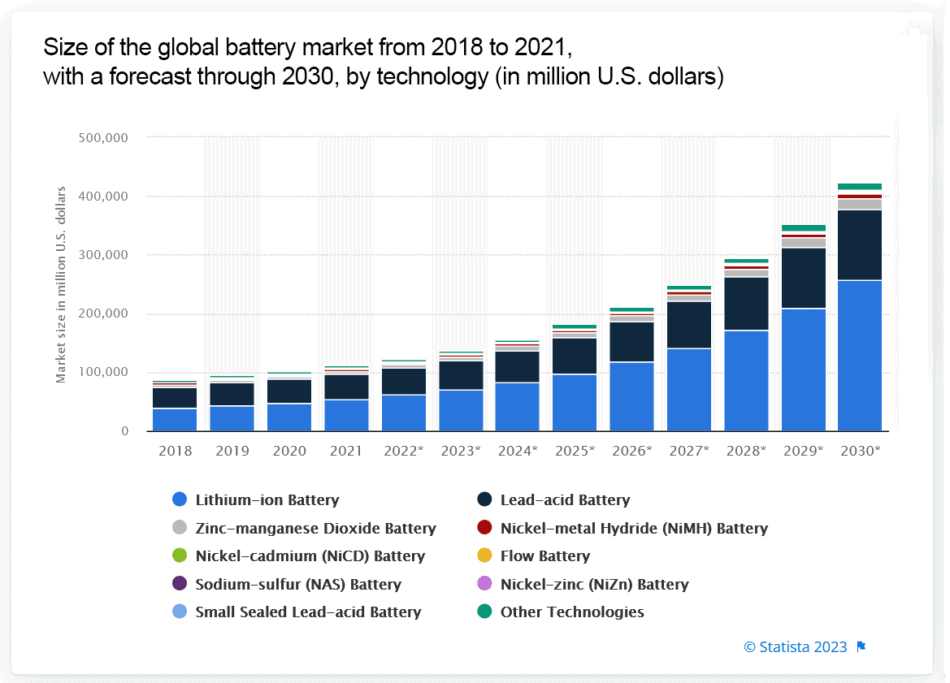

The global batteries market grew from $83.83 billion in 2021 to $93.65 billion in 2022 at a compound annual growth rate (CAGR) of 11.7%. By 2026, the batteries market is expected to grow to $138.76 billion at a CAGR of 10.3%.[1]

In my opinion, the battery market is one of the most secure investment opportunities we will see this year and most likely will be a solid investment play for at least the next 3–5 years ahead.

Follow me as we discuss battery technology, applications and investment opportunities that I uncovered in my research.

Battery technology has lagged behind other technologies due to the incredible complexity of safely and effectively storing large amounts of electricity for later use. The chemistry and physics of this process have largely eluded scientists. Newly emerging tech is reshaping energy storage as we know it.

The king of batteries is the lead-acid battery. It has dominated the battery market for almost one hundred years and it was the only viable battery solution on the market until recently.

Its use is still ubiquitous in the gas-powered auto industry —you use it every time in order to start your car.

These batteries are safe, reliable and relatively cheap. On the downside, they are also very heavy, have a finite limit of charge cycles and a relatively low capacity for energy storage.

It wasn’t until 1991 that the world saw the first lithium-ion (Li-ion) battery used in commercial production. It took over 20 years of research and development to achieve the first commercial model.[2]

Today, the lithium-ion battery has become the go-to solution for energy storage. It has a very high storage capacity and can be recharged thousands of times.

The electric vehicle revolution was made possible in large part to the discovery of the lithium-ion battery platform that has come to dominate the energy storage space over the past couple of years.

While lithium-ion batteries are far superior to lead-acid batteries in their storage capacity, they have one fatal flaw — they have the potential to be chemically unstable and have proven to catch fire or explode without warning. The most notable involved Samsung cell-phones. An investigation found the phone's casing was too small for the batteries causing them to short-circuit and overheat.

The search for a stable lithium-ion battery has had some successes. Researchers have discovered they can stabilize the batteries by using various metals in the anodes, cathodes and barriers between the cells.

Another issue with lithium-ion batteries is the raw resources used in the batteries are sourced from regions of the world that are in some cases geopolitically unstable.

For example, China is a major producer of lithium. Relations between the US and China have not been on the best of terms over the past several years as China flexes its military muscle to become a major player on the world stage.

This reality has some people thinking it is not the best idea to rely on an adversary for a critical raw material used in energy storage that could be shut off at any moment.

Apart from lithium, other battery metals such as cobalt, vanadium, nickel, manganese and graphite have become crucial materials used in current lithium-ion battery configurations. Each also has its own sourcing problems.

These metals are another potential investment opportunity I will discuss later.

While lithium-ion technology has its set of problems, it is the current industry standard for energy storage in a wide variety of commercial applications. This dominant position does not appear to be in jeopardy for at least the next several years. making lithium-ion batteries a viable investment opportunity today.

While doing my research for this article, I was pleasantly surprised to find a potential new battery technology that could turn the battery industry on its head.

It’s been talked about for years, but progression has been slowed by production issues.

This revolutionary battery tech uses raw materials that can be sourced domestically, is environmentally friendly, has 5X the energy capacity of Li-ion, is flexible and can be made into any form factor, has a very long lifespan and super-fast charging times, and is lightweight and thinner than their lithium-ion counterpart.

What is this potential miracle battery?

Graphene batteries.

If you haven’t heard of graphene, it has been touted as the wonder nano-material of our time. Its electrical conductivity is a whopping 13X better than copper, it’s 100 million times thinner than a human hair and 200X stronger than steel.

Graphene is a layer of interlocking carbon atoms that creates a film one-atom thick and has many unique properties that scientists are only now beginning to discover. The material is already being used in a wide variety of industry applications.

The use of graphene in batteries is already promising to be a game changer and boasts to be far superior to lithium-ion in all categories: weight, recharging time, storage capacity, flexibility and stability.

Imagine fully charging your mobile phone in a few minutes, and that charge will last for several days!

Electric vehicles would have ranges in excess of 1,500 miles and could be recharged in 15 minutes or less.

This level of battery technology will open up new industries that can finally make the transition to all electric a true reality.

Specifically I am thinking of the aviation industry that has up to now struggled making an all-electric plane due to the weight and size of lithium-ion batteries required to power the engines. With graphene battery technology, electric planes could become a reality.

The commercial shipping industry should also benefit. Think of seafaring shipping vessels and semi-truck freight hauling all driven by electric motors with great energy storage for extended travel.

I’m excited to think of the possibilities we will see in our lifetime by moving to electric. We are witnessing the complete retooling of entire fossil-fuel dependent industries.

The global goal of net-zero carbon emissions, albeit inching, is becoming closer to reality.

The biggest issue at the moment with graphene-based batteries is the industrial production of graphene sheets. These sheets have proven to be difficult to produce at any commercial scale.

Battery makers are working day and night to fine-tune this new technology and be the first to market. There are already several companies, both public and private, announcing graphene batteries for sale in the coming year.

Read on and find out what battery investment opportunities I uncovered in my research.

The battery market is growing by double digits and does not look to be slowing down anytime soon.

The future of electric vehicles are certainly a major driver of battery technology moving forward.

Electric vehicle adoption and sales have continued to soar globally. Some countries have gone so far as to announce a ban on all gas-powered vehicle sales in the next ten years. In August of 2022, California passed legislation that bans the sale of new gas-powered cars by 2035.[3]

Another driving force in battery or alternative energy market growth is the boom in renewable energy production.

Renewable energy infrastructure growth has been staggering over the past few years.

In April 2022, McKinsey estimated that by 2026, global renewable-electricity capacity will rise more than +80% from 2020 levels (to more than 5,022 gigawatts). Of this growth, two-thirds will come from wind and solar, an increase of 150 percent (3,404 gigawatts).

By 2035, renewables will generate 60 percent of the world’s electricity.[5]

Scientific American reported in October 2022 that the boom in renewable energy has radically slowed the rise in global carbon emissions. “Emissions associated with energy use are on track to increase by only 1 percent this year because of a boom in wind and solar power.”[6]

This is a good thing; the growth of renewable energy offers additional opportunity for the battery market.

One critical part of the transition to a net-zero economy is storing the produced energy for later consumption.

Solar and wind energy producers are reliant on the weather. If the sun does not shine or the wind does not blow, they do not produce power. It is precisely these times that batteries or rather the storage of electricity are critical in providing a constant source of power to end consumers in renewable energy production downtimes.

As investors, we are just beginning to witness what could become a massive retooling of our economy in ways never imagined.

This restructuring of entire industries could become an investors dream. Literally life-transforming wealth can be made with the right investments and plenty of patience. Hear me out…

I recently watched an interview with Warren Buffett, and he was talking about how he invests compared with less-seasoned investors. His main point was that he was investing in companies not where they are today, but where they will be in 10 or 20 years from now. He was not so concerned about the daily ups and downs of the stock. In fact, he said if the stock was down, he saw that as a potential buying opportunity.

My takeaway from this Warren Buffet revelation is when investing in the battery metals market, these are investments that could bear fruit in 2–10 years or more. Investors in these novel technologies must have patience while some of these companies develop their unique technologies and increase their market share and corresponding value.

Choosing from the myriad of investment opportunities really depends on your personal appetite for risk as well as the knowledge and experience you may have with a particular industry.

Below I have listed out what I believe are top-tier investment opportunities that I have found while researching the battery metals sector. They are provided as inspiration in order to help you achieve your financial goals for 2023.

Lithium-ion batteries require an assortment of different metals in their construction. These include lithium, cobalt, vanadium, nickel, manganese and graphite. Each of these metals or materials has their own unique mining challenges and opportunities.

Below are six companies, four juniors and two large cap, that will help you get started investing in the battery metals mining sector which is not going away any time soon.

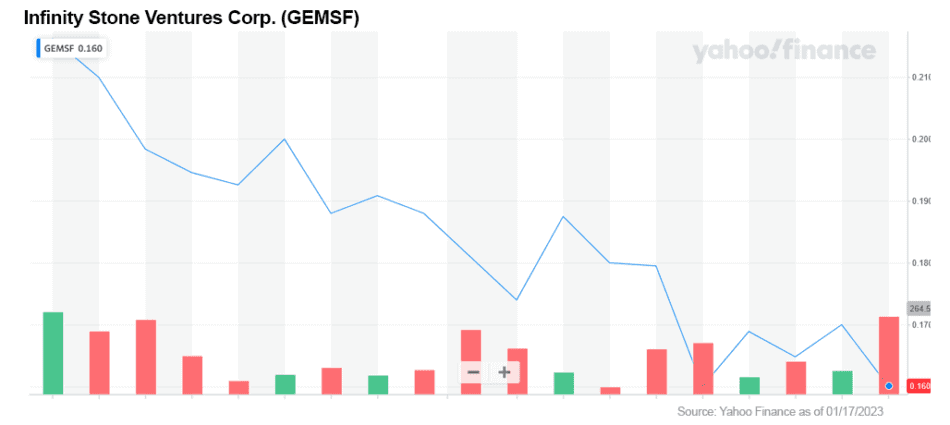

1. Infinity Stone Ventures Corp (OTC: GEMSF / CSE: GEMS)

This junior mining company has a diversified portfolio of projects with high-proven assays of critical battery metals. The company owns a 100% interest in all their properties located in Ontario and Quebec.

Current exploration assets include lithium, graphite, copper, cobalt, nickel and manganese.

The company currently has four active drilling and exploration projects: 2 lithium, one graphite and one copper/cobalt. All current projects are showing very high assay drill results and located adjacent to active producing mines.

They also have three other promising properties in their portfolio that are still to be assayed for resource reserves.

Aside from their strong portfolio of projects, they are located in geopolitically-friendly Canada close to manufacturing centers.

The company management team is also very strong with a proven track record of wins over the past 20 years.

A very promising battery metals company that has strong upside potential in my opinion.

Interested investors should view the interview with the CEO Zayn Kalyan here:

2. Brunswick Exploration Inc. (TSX-V: BRW)

This junior mining company is based in Quebec, Canada and is focused on lithium pegmatite projects. It currently is working on 10 exploration projects.

Brunswick’s strategy is to stake claims aggressively and test the lithium pegmatite reserves in those claims. The company boasts currently having over 200 untested pegmatites in their portfolio of potential reserves.

The company announced last month their closure of $5.5 million CAD in private placement. Brunswick's president said the funds will be used for aggressive exploration programs in 2023.

Watch this company over the year as assay results are announced and potential mining targets are identified.

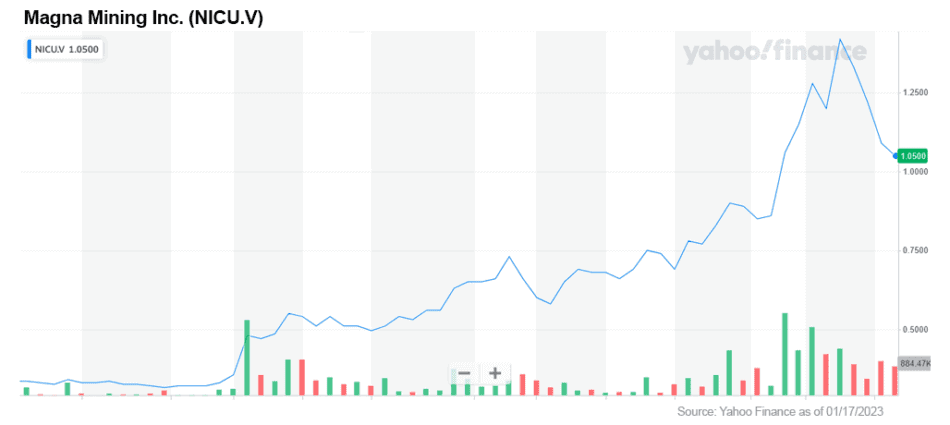

3. Magna Mining Inc. (TSX-V: NICU)

Magna Mining is a junior mining company focused on nickel-copper-PGMs in Ontario, Canada.

Assays from a recent drill program include the “highest-grade intersection of combined platinum, palladium and gold to date on their Shakespeare project.” That specific assay showed 15.5 grams per MT (g/t) platinum, 1.46 g/t palladium and 1.31 g/t gold over 0.35 meters.

The company recently acquired Lonmin Canada with a resource estimate of 500 million pounds of contained nickel.

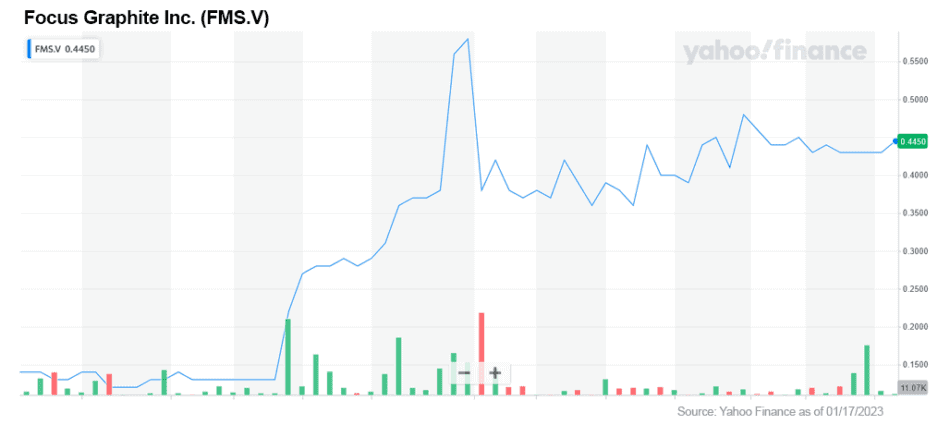

4. Focus Graphite Inc. (TSX-V: FMS)

Another junior mining company, Focus Graphite, is located in Quebec, Canada and is working on developing large-flake graphite projects. Graphite is a main component used in lithium-ion batteries.

Interestingly, China currently provides over two-thirds of the battery-grade graphite in the world. Focus Graphite is working to change this and become the main North American source for graphite.

The company is currently exploring two properties with initial resource estimates showing very high concentrations of natural flake graphite in-situ.

The company also holds a significant equity position in graphene applications developer Grafoid Inc.

Focus Graphite is another company to watch closely over the next year as results come in from their exploration program.

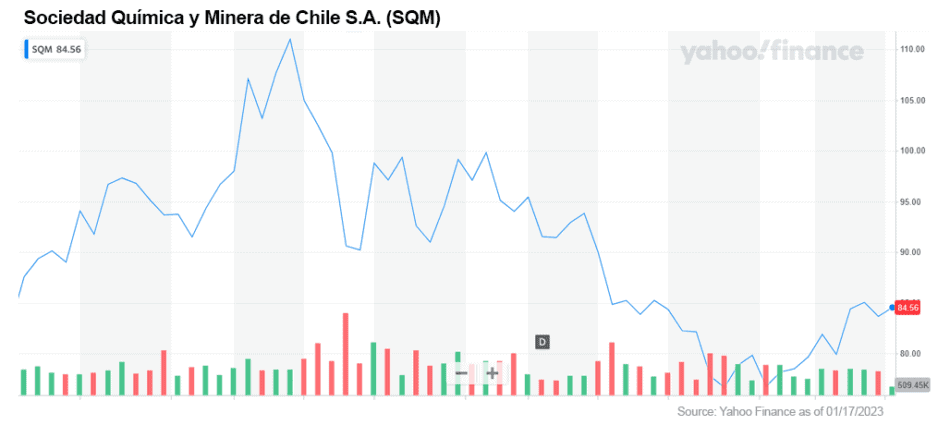

5. Sociedad Química y Minera (NYSE: SQM)

Sociedad Química y Minera de Chile is the world’s largest producer of lithium. Their mining operations are located in lithium-rich Chile. The company also has a diversified portfolio of products such as fertilizers, potassium, iodine and other industrial chemicals.

The company's EPS is expected to grow 530.9% this year, crushing the industry average which calls for EPS growth of 167%.[7]

A strong growth stock candidate for 2023 in my opinion.

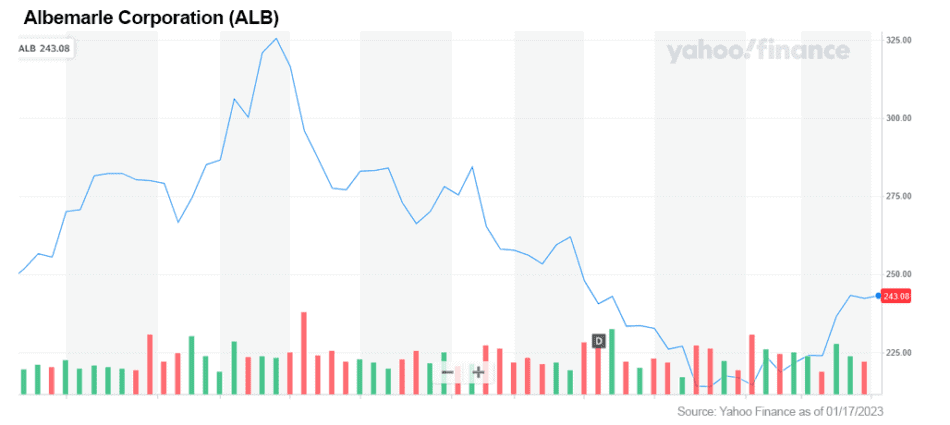

6. Albemarle (NYSE: ALB)

Albemarle Corporation has been one of my stock picks for several years running. It is a strong contender in lithium production as well as bromine and other industrial chemicals.

The company continues to consistently blow away estimates. Q3 2022 was no different with the company boasting an EBITDA growth of over 447% vs the prior year.

As the lithium supply vs. demand continues to tighten, Albemarle is perfectly positioned to capitalize on lithium’s increased spot price

Still one of my favorite companies in the space and a must-have on any investors watch list.

Emerging Battery Opportunities

Graphene battery technology promises to steal the crown from lithium-ion batteries. This battery technology appears to be leagues ahead of lithium-ion alternatives in many respects. The most important feature is that graphene-enabled batteries are suggested to be more stable, however, supporting commercial scale production remains unknown.

Graphene Manufacturing Group Ltd (TSX-V: GMG / OTC: GMGMF)

This company developed and proved its own proprietary production process to manufacture graphene powder from readily available low-cost feedstock. This process produces high-quality, low-cost, scalable and contaminant-free graphene.

Graphene is also working on their own proprietary graphene battery technology in partnership with The University of Queensland Research.

Aixtron SE (OTC: AIXXF / ETR: AIXA)

This company, located in Germany, specializes in graphene production equipment. Aixtron SE is a provider of deposition equipment to the semiconductor industry and offers CVD graphene production systems.

Aixtron has seen explosive share price growth over the past three years and does not look to be letting up anytime soon. The company continues to grow its EPS at a rate of 38% year over three years.

As graphene and graphene production become increasingly important across industries, Aixtron is well-positioned for further share price growth in my opinion.

Skeleton+ (Private)

http://www.skeletontech.com/investors

Skeleton+ has raised over 200 million euros to develop and commercialize their graphene-based energy storage technology.

Their SuperBattery is a technology combining supercapacitor and battery characteristics. It can be charged 100x faster than lithium-ion batteries, has 50,000 life cycles, and is free from cobalt, copper, and nickel. It is also much safer than li-ion batteries, even when crushed, pierced, or overheated.

Check out this video from Tech Space starting at the 4:32 mark for an overview of the company:

Nanotech Energy (Private)

https://nanotechenergy.com/This company holds one of earliest patents on making graphene.

In September 2020, Nanotech Energy announced the groundbreaking achievement of developing a process to produce 95% monolayer graphene, making it the first and only producer to break the 50% content barrier.

The company is working on its proprietary battery technology using graphene.

My followers know that I love technology. Especially cutting-edge technology. Batteries are in a huge cycle of technological development. There is still plenty of room to get in on the ground floor of many of these graphene battery companies.

For those of you that are into mining, the lithium battery opportunities are still being developed as the formulations in lithium-ion continues to evolve and improve.

Investing in batteries and their components is an investment in the future. The green energy revolution is just getting its legs and investors that make their moves now will reap those rewards in the future.

The time to invest in the electric future is now!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.thebusinessresearchcompany.com/report/batteries-global-market-report

[2]https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7215417/

[3] https://news.harvard.edu/gazette/story/2022/09/what-to-expect-from-california-gas-powered-car-ban/

[4] https://theicct.org/publication/global-ev-update-2021-jun22/

[6] https://www.scientificamerican.com/article/a-boom-in-renewable-energy-has-blunted-the-global-rise-in-emissions/

[7] https://finance.yahoo.com/news/why-growth-investors-buy-sqm-164504477.html