The best performing first-day IPO in almost 20 years took place on May 2, 2019.[1]

The company behind it wasn’t a famous ride-sharing start up, or a tech firm promising the next revolutionary gadget… it was an alternative food producer that exclusively creates plant-based meat substitutes called Beyond Meat (NASDAQ: BYND).

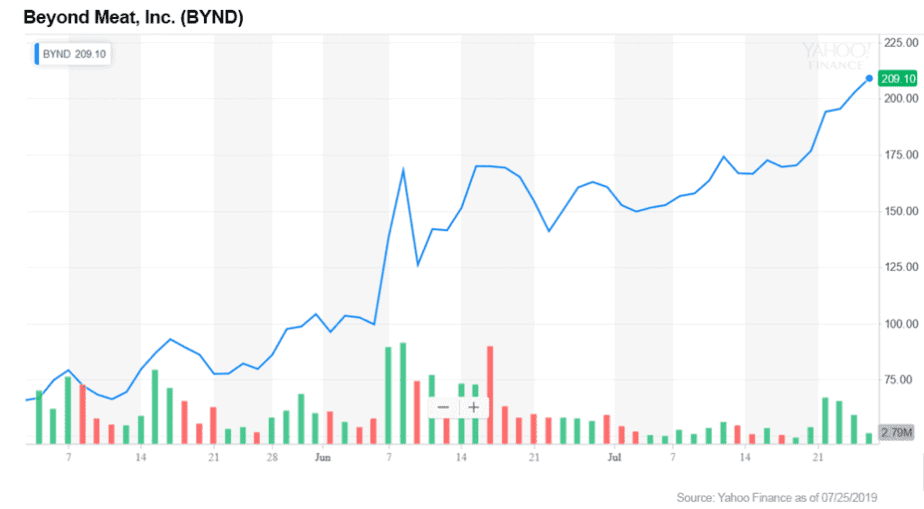

On day 1 of trading, BYND opened at $25 and closed at $65.75, +163% above its IPO price.

Since that time, the stock has climbed an astonishing +650% from its opening price.[2]

I believe this record-breaking debut signals a momentous shift in the public’s attitude towards health and the abundance of newly available food products that can support a healthier lifestyle — and it will have a ripple effect for years to come.

The American market research firm The NPD Group conducted a study last year where they found that 86% of people who purchase vegan products also eat meat.[3] This type of consumer is now being referred to as a “flexitarian,” which describes someone “who wants to reduce their meat consumption without fully converting to vegetarianism.”[4]

And, as The New York Times reports, this group (flexitarians) is “not necessarily motivated by a desire to save the planet… many of them are drawn to plant-based meat more for its perceived health benefits...”[5]

So, it looks like Beyond Meat has hit a cultural sweet spot. Prior to their IPO, “there had been no pure-play public vehicle in which to invest in the plant-based frenzy,” and their massive success shows just how hungry (literally!) investors are to participate in the action.[6]

Keep reading… because it gets better. I’m about to provide an overview of the rapidly expanding plant-based food industry, and the incredible investment opportunities emerging over the next 18 months in this brand-new space.

What constitutes a healthy diet has always been controversial. Everywhere you look there is a different take on what and how we should eat: vegan, vegetarian, organic, plant-based, gluten-free, low-carb, keto, paleo… and the list goes on.

However, there is an increasing amount of scientific evidence which confirms that lowering meat consumption can improve overall health.

Perhaps the most notable study was published in April of 2019. It was a collaboration between EAT, a global non-profit that wants to “transform the global food system” and the prestigious medical journal, The Lancet.[7]

The study was “the first full scientific review of what constitutes a healthy diet from a sustainable food system.”[8] It brought together “more than 30 world-leading scientists from across the globe,” and they concluded that “people who follow vegan, vegetarian, pescatarian or semi-vegetarian diets actually had a 12% lower mortality risk than people who are omnivores.”[9]

The Canadian government also issued their revised food guide in January which “encourages people to focus more on eating protein-rich foods, including plants, rather than just relying on meat.”[10]

Beyond Meat (and its competitors) are well positioned to benefit from these new findings.

Los Angeles-based Beyond Meat was founded in 2009 by Ethan Brown, who left a leadership position at Ballard Power Systems (NASDAQ: BLDP) to start the business.

The company develops and manufactures a variety of plant-based foods (all of which are vegan) including their flagship offering, the Beyond Burger, as well as Beyond Beef, Beyond Beef Crumbles and Beyond Sausage.

Their products are increasingly being stocked in the meat section at grocery stores across North America, which is part of their strategy to actively target meat eaters.

Brown explained in an interview with CNBC in January that 93% of Beyond Meat’s customers eat meat regularly.[11] In fact, the company doesn’t even promote itself to vegans and vegetarians, who comprise less than 5% of the U.S. population. [12]

With flexitarians in mind, Beyond Meat has gone to great lengths to mimic not only the taste of “real” meat but also the way it cooks. Beyond Burgers make a sizzling sound while they’re grilling and are made with beet juice, which makes them “bleed.”[13]

A single Beyond Burger patty also includes 30% of your suggested daily iron intake, while a regular beef burger only contains about 15% — so these plant-based burgers rival traditional burgers in some aspects of their nutritional value as well.[14]

Beyond Meat stocks its products at 17,000 grocery stores in the U.S. alone.[15] In May, they entered the Canadian market, and are now carried at 3,000 grocery stores nationwide, most notably at Whole Foods (owned by Amazon — NASDAQ: AMZN), Save-On-Foods and IGA.[16]

Their burgers are also served at popular fast food chains throughout the U.S. and Canada, including Carl's Jr., Del Taco, Tim Hortons (owned by Restaurant Brands International. — NYSE: QSR, TSX: QSR) and A&W — exposing Beyond Meat to mainstream audiences.[17]

Late last year, Tesco (OTC: TSCDY, LSE: TSCO), the multinational grocery store with over 3,400 locations predominantly in the UK and Ireland, began selling the Beyond Burger.[18] According to Allied Market Research, “Europe accounted for nearly 40% of global sales for plant-based meats in 2017,” so this is a key market for Beyond Meat to target.[19]

Looking at the widespread placement of Beyond Meat’s products this early in the sales cycle, it is clear that plant-based foods are no longer a niche or novel concept, and that vegan/vegetarian meat replacements are gaining steam among meat eaters.

Investors in Beyond Meat include world-famous names like Microsoft founder Bill Gates (NASDAQ: MSFT), venture capital firm Kleiner Perkins, and Evan Williams’ Obvious Ventures. (Williams was the former chairman and CEO of Twitter — NYSE: TWTR). [20]

However, I believe the most important investor is former McDonald’s (NYSE: MCD) CEO Don Thompson, who also sits on Beyond Meat’s board of directors.

There is much speculation about the fast food chain including a vegan burger on its menus.[21] The current CEO of McDonald’s, Steve Easterbrook, revealed to CNBC on May 29 that “McDonald’s is already testing meat alternatives in Europe.” [22] Of note, after the announcement, Beyond Meat’s stock spiked over 13%.[23]

Considering all the excitement around Beyond Meat’s recent IPO and its future partnerships, the business has attracted its fair share of skeptics as well. Multiple articles have been featured in countless publications including the LA Times and Business Insider that argue its stock price is overvalued.[24]

Last year, Beyond Meat’s revenue was almost $88 million, more than double its 2017 numbers. [25] This year, corporate management estimates “top-line growth of at least 140% to more than $210 million in revenue.” [26]

Currently Beyond Meat has a market value of about $10 billion, which is relatively similar to respected food industry company Pilgrim’s Pride (NASDAQ: PPC), America’s largest producer of chicken, which is valued at $6.7 billion. [27] However, Pilgrim’s Pride generated almost $11 billion in revenue in 2018 (125 times more than Beyond Meat!!!). [28]

Looking at these macro numbers, it’s clear why Beyond Meat has garnered criticism — but I think its valuation reflects how hopeful investors are in the alternative meat category.

I believe that investors are expecting the space to follow a similar trajectory to the non-dairy milk industry (including almond, soy, oat and coconut), which has “grown 61% in the past 5 years and now represents 13% of the traditional milk market.” [29]

If plant-based proteins/meat can take even a small share of the $1.4 trillion global “real” meat market ($270 billion in the U.S.), this could potentially sustain Beyond Meat’s valuation in the long run.[30]

Even well-established food companies are scrambling to keep up (and cash in) on this emerging market segment.

America’s largest meat producer, Tyson Foods (NYSE: TSN), is venturing outside of its typical offerings to include meat alternatives.

On June 13, they announced that starting this summer they will be selling “plant-based nuggets,” as well as “blended burgers made with beef and plants” in the fall.[31] Both products will contain pea protein isolate, which is the primary ingredient in Beyond Meat’s burgers.[32]

Similarities in ingredients is to be expected considering that Tyson invested in Beyond Meat in 2016, but sold their 6.5% stake in April 2019 (prior to Beyond Meat’s IPO in May). [33]

Nestlé S.A. (OTC: NSRGY / SWX: NESN), the Swiss-based multinational food and beverage corporation, launched their plant-based Garden Gourmet Incredible Burger in Europe in April, aiming to compete with Beyond Meat in the world’s most lucrative plant-based market. [34] They will also release their burger in the U.S. this fall.[35]

Maple Leaf Foods (TSX: MFI), a multibillion-dollar Canadian packaged meat company, acquired plant-based meat producer The Field Roast Grain Meat Co. in January 2018, as they look to incorporate more vegan and vegetarian friendly options.

IKEA is best known as the largest furniture retailer in the world but is also — maybe surprisingly — the 6th largest food retailer in the world.[36] They announced in May that they are developing plant-based Swedish meatballs, which will be tested in select markets in February 2020.[37]

The influx of multibillion-dollar food companies that have added (or plan to add) a plant-based meat offering speaks to the long-term bets that are being made on shifting consumer demands to more health-friendly options.

Even with giants like Tyson Meats and Nestlé stepping in to the plant-based industry, Beyond Meat’s biggest competitor is Impossible Foods (a private company). Their flagship product is a plant-based burger called the Impossible Burger.

Founded in 2011 with headquarters just south of San Francisco, Impossible Foods has pursued a different go-to-market strategy than Beyond Meat, forgoing placing their product in grocery stores and instead targeting restaurant chains. (Although according to their website, they plan to have their products in grocery stores “later this year.”)[38]

Currently their burger is sold at more than 7,000 restaurants including Burger King, Applebee's, The Cheesecake Factory, White Castle and at Disney theme parks. [39]

Their biggest partnership to date has been with Burger King, who debuted the Impossible Whopper in select restaurants in April and will roll it out nationwide to their 6,400 locations by the end of the year.[40]

José Cil, the CEO of Burger King’s parent company, Restaurant Brands International (NYSE: QSR / TSX: QSR), explained on an earnings call in April that sales of the Impossible Whopper “exceeded expectations.” [41] He continued, saying that Burger King is “not seeing guests swap the original Whopper for the Impossible Whopper…We're seeing that it's attracting new guests.”[42]

It is clear that vegetarian and vegan menu items at large chain restaurants can create opportunities to expand their customer base.

The NPD Group reported in July 2019 that plant-based burger sales at fast food restaurants increased 10% from June 2018–May 2019, compared to sales from June 2017–May 2018.[43] In terms of exact numbers, “That’s 228 million meat-free burgers sold in the past year in all. However, 6.4 billion beef burgers were sold over that same period — so only about 3% of their combined sales came on the plant-based side.”[44]

What may be most notable is that “beef burger sales are steady from where they were a year ago, meaning that meatless burgers don’t appear to be putting a dent in beef sales.” [45]

This suggests that there is plenty of room for the plant-based industry to grow, and these numbers can help explain the enormous current market cap of Beyond Meat. But there are other companies to consider. Read on and I will show you a couple of junior entrants that could represent great investment potential.

I have mentioned several multibillion-dollar corporations that are participating in the plant-based craze, but I also wanted to highlight 2 noteworthy junior companies. This is important because I think these companies could represent the future of plant-based breakthroughs.

Burcon NutraScience Corporation (OTC: BUROF / TSX: BU)

Toronto investment firm Beacon Securities identified Burcon NutraScience Corp. as the “only public pure-play in Canada on the plant-based food industry.” [46]

Beacon Securities analyst Spencer Churchill also began coverage on the stock in early July 2019 with a "buy" rating, and “a 1-year price target of $2.00” (the stock is currently trading in the $1.00 range).[47]

With head offices located in Vancouver, Canada, Burcon develops plant-based proteins which act as alternatives (primarily) to dairy products. Their flagship product is a soy protein called CLARISOY®.[48]

The company has been around for over 20 years and has spent approximately CAN$72 million “developing patented technology to process plant-based proteins.”[49] Their extensive pedigree in the plant-based industry gives them a unique edge within the space, as it is filled with early stage start-ups and businesses that have been operating for less than 10 years.

Burcon’s considerable experience, spanning over two decades, has embedded them with deep knowledge of the processes and technology used to create plant-based proteins, as well as allowed them to deliver high-quality products through comprehensive testing and development.

The company recently announced a joint venture with Merit Functional Foods Corporation to build a 20,000-ton processing facility by mid-2020, which will be able to “swing between producing pea and canola protein.” [50] Burcon’s CEO Johann Tergesen explained to Bloomberg that “it’ll be the only commercial canola protein production facility in the world.” [51]

I believe Burcon should be closely monitored as it continues to expand its distribution and production capabilities.

Else Nutrition Holdings Inc. (TSX-V: BABY)

Israeli-based Else Nutrition creates baby snacks and baby formulates that are non-dairy, non-soy, hormone-free, gluten-free, non-GMO and processed without chemicals.

For the past several months, Else has been gearing up for “commercial scale production and the North American launch of their first products: powder and liquid baby formula for toddlers (12–36 months old).” [52] The release is planned for Q2-2020 via online sales and placement with specialty/regional retailers. [53]

In a recent interview, CEO Hamutal Yitzhak told me that Else hasn’t done any marketing to consumers but continuously receives e-mails from mothers all over the world asking for their products — which can only be a positive for future sales.

They closed their most recent fundraising round on June 12, 2019, which was 100% oversubscribed. [54] The company decided to raise 25% over the original financing amount for a total of $7.5 million.[55]

I am particularly excited to follow this company as I anticipate massive consumer interest to come — especially from expectant mothers and mothers of babies and toddlers. I believe Else offers a unique product that has very few competitors.

It is clear that the general public is growing increasingly aware of individual health and environmental concerns, causing more people to search out alternatives to long-standing dietary staples including meat and dairy.

And this new-found consciousness will need a production pipeline to support it, which bodes well for the entire plant-based protein industry.

This recently emerging sector is only getting started — as evidenced by massive investor interest and growing demand by consumers, as well as national grocery chains and global fast food restaurants adding plant-based meat alternatives to their shelves and menus.

I anticipate there will be several sizable winners along the way, represented by both major and junior companies, opening the door for investors to potentially make big gains in this space.

If you are still not unconvinced…take a taste test! Go to your local Burger King and order an Impossible Burger, or A&W to order a Beyond Burger, or even try a Beyond Taco from Del Taco... I don’t think you’ll be disappointed.

Watch, taste and see… I’m betting on plant-based proteins to take a healthy bite out of the market share of traditional meat products in the years to come.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.marketwatch.com/story/beyond-meat-soars-163-in-biggest-popping-us-ipo-since-2000-2019-05-02

[2] https://qz.com/1655309/beyond-meat-needs-to-communicate-how-it-makes-its-plant-based-burger/

[3] https://www.livekindly.com/complete-vegan-guide-beyond-meat/

[4] https://www.nytimes.com/2019/07/10/business/fake-fish-impossible-foods.html

[5] Ibid.

[6] https://www.cantechletter.com/2019/07/burcon-nutrascience-is-a-plant-based-protein-pure-play-beacon-says/

[7] https://foodinsight.org/EAT-Lancet-Commission-study-diet-sustainable-red-meat/

[8] https://eatforum.org/eat-lancet-commission/

[9] https://www.marketwatch.com/story/americas-biggest-meat-producer-will-soon-offer-vegan-protein-2019-02-14

[10] https://globalnews.ca/news/5197322/beyond-meat-canada-grocery-stores/

[11] https://www.livekindly.com/complete-vegan-guide-beyond-meat/

[12] https://www.marketwatch.com/story/beyond-meat-is-going-public-5-things-to-know-about-the-plant-based-meat-maker-2018-11-23

[13] https://www.bloomberg.com/news/articles/2019-05-01/beyond-meat-ipo-raises-241-million-as-veggie-foods-grow-fast

[14] https://www.womenshealthmag.com/food/a21566428/beyond-meat-burger-ingredients/

[15] https://www.sec.gov/Archives/edgar/data/1655210/000162828019004543/beyondmeats-1a5.htm

[16] https://globalnews.ca/news/5197322/beyond-meat-canada-grocery-stores/

[17] https://www.marketwatch.com/story/beyond-meat-is-going-public-5-things-to-know-about-the-plant-based-meat-maker-2018-11-23 and https://www.fool.com/investing/2019/06/08/3-questions-beyond-meat-investors-should-be-asking.aspx

[18] https://vegnews.com/2019/5/beyond-meat-to-open-first-european-production-plant-in-2020

[19] https://www.washingtonpost.com/business/2019/05/30/crowded-field-big-name-ipos-beyond-meat-emerges-surprise-mvp/?utm_term=.7804135744f3

[20] https://fortune.com/2019/05/02/beyond-meat-ipo-stock-price/

[21] https://www.businessinsider.com/19-facts-about-mcdonalds-that-will-blow-your-mind-2012-4#mcdonalds-sells-more-than-75-hamburgers-every-second-2 and https://web.archive.org/web/20120318210222/https://finance.yahoo.com/news/McDonald-Momentum-Delivers-prnews-2702110553.html

[22] https://www.washingtonpost.com/business/2019/05/30/crowded-field-big-name-ipos-beyond-meat-emerges-surprise-mvp/?utm_term=.7c2ff1158a94

[23] Ibid.

[24] https://www.fool.com/investing/2019/06/13/6-reasons-investors-should-be-leery-of-beyond-meat.aspx and https://seekingalpha.com/article/4265023-beyond-meat-beyond-overvalued and https://www.fool.com/investing/2019/06/10/heres-why-beyond-meat-soared-past-a-10-billion-val.aspx and https://www.latimes.com/business/la-fi-beyond-meat-ipo-stock-analyst-20190521-story.html

[25] https://www.washingtonpost.com/business/2019/05/30/crowded-field-big-name-ipos-beyond-meat-emerges-surprise-mvp/?utm_term=.7804135744f3 and https://markets.businessinsider.com/news/stocks/beyond-meat-stock-price-bear-says-its-time-to-sell-2019-6-1028298313

[26] https://www.fool.com/investing/2019/06/08/3-questions-beyond-meat-investors-should-be-asking.aspx

[27] Ibid.

[28] Ibid.

[29] https://www.washingtonpost.com/business/2019/05/30/crowded-field-big-name-ipos-beyond-meat-emerges-surprise-mvp/?utm_term=.7804135744f3

[30] Ibid.

[31] https://www.marketwatch.com/story/americas-biggest-meat-producer-will-soon-offer-vegan-protein-2019-02-14

[32] Ibid.

[33] https://fortune.com/2019/05/02/beyond-meat-ipo-stock-price/

[34] https://www.nestle.com/media/news/nestle-launch-plant-based-burgers and https://fortune.com/2019/05/02/beyond-meat-ipo-stock-price/

[35] Ibid.

[36] https://www.fastcompany.com/90365173/ikea-is-now-the-worlds-6th-largest-food-chain-and-its-launching-delivery

[37] https://www.cnn.com/2019/05/02/business/ikea-meatless-meatball/index.html and https://www.fastcompany.com/90365173/ikea-is-now-the-worlds-6th-largest-food-chain-and-its-launching-delivery

[38] https://faq.impossiblefoods.com/hc/en-us/articles/360019099893-Is-it-available-in-grocery-stores-

[39] https://www.fool.com/investing/2019/06/08/3-questions-beyond-meat-investors-should-be-asking.aspx and https://www.cnn.com/2019/05/03/business/plant-based-protein-revolution/index.html

[40] https://www.chewboom.com/2019/04/29/burger-king-eyes-nationwide-release-of-the-impossible-whopper-by-end-of-2019/

[41] https://www.cbsnews.com/news/beyond-meat-ipo-gives-veggie-burger-company-a-1-5-billion-market-value-as-meatless-meat-goes-mainstream/

[42] Ibid.

[43] https://www.foodandwine.com/news/plant-based-burger-fast-food-study-vegans-vegetarians

[44] Ibid.

[45] Ibid.

[46] https://www.cantechletter.com/2019/07/burcon-nutrascience-is-a-plant-based-protein-pure-play-beacon-says/

[47]Ibid.

[48] https://ca.finance.yahoo.com/news/burcon-announces-amendment-outstanding-convertible-210200121.html and https://www.streetwisereports.com/article/2019/05/06/shares-of-plant-based-meat-company-spike-53-and-its-not-beyond-meat.html

[49] https://www.stockwatch.com/News/Item.aspx?bid=Z-C%3ABU-2781704&symbol=BU®ion=C

[50] https://www.bloomberg.com/news/articles/2019-07-15/pea-craze-lures-second-processor-to-manitoba-to-open-in-2020

[51] Ibid.

[52] https://finance.yahoo.com/news/labs-closes-cad-7-5-120100780.html

[53] Ibid.

[54] Ibid.

[55] Ibid.