“There cannot be two suns in the sky, nor two emperors on earth”

— Confucius

America’s rivalry with China in the coming decade is of great consequence.

It will determine whether America’s leading role on the world stage will be confirmed or upended.

This competition will run across many countries and battlegrounds such as trade, finance, technology, freedom of navigation, cyber warfare, space, and even obscure rare earths — a market that China has cornered while America slept.

This rivalry is the squaring off of the two largest economies in the world with each country representing strikingly different brands. China seeks to leverage its momentum, scale and authoritarian state-sponsored capitalism to push America and its free market capitalism into second place.

It depends which one has the most talent with a people unified and willing to work and sacrifice in harness for the common good. Which country has the leading economy, finances, and technology? Which country musters the most ambition, builds the strongest middle class and the most resilient culture?

Nothing symbolizes the gravity of this rivalry than its elevation into space.

In 2020, in China’s first mission to another planet, the Tianwen-1 blasted on a seven-month journey to Mars. It orbited the red planet for a few months and then a rover conducted scientific experiments.

Just a couple of weeks later, an American mission landed the Perseverance rover on Mars. It will also deploy the Ingenuity Mars helicopter — amazingly, the first craft capable of powered flight on another planet.

Although the United States had a four-decade lead in space, President Xi Jinping has put China’s national space program at the core of his “great rejuvenation” and urged China’s space scientists to “achieve the early realization of the great dream of building a powerful space nation.”[8]

The back and forth between China and America in this decade will be fascinating but it would be a mistake to believe that this bilateral frame is the best way to view the rivalry.

We need a much wider geographic and ideological lens for two reasons.

First, the rivalry is about sharply different types of government and capitalism. America, Europe, and countries such as India and Japan represent a democratic form of government and a market form of capitalism through which primarily private companies make investment decisions.

China leads a grouping of countries that has an authoritarian form of government and a state-led, mercantilist type of capitalism whereby many companies are owned and controlled by the state and therefore the government influences many investment and business decisions.

China with a blend of authoritarianism, a state-directed semi-market economy, and an assertive foreign policy, is a classic mercantilist power — like Germany and Japan in the late nineteenth century and early twentieth century. Mercantilism is the exercise of state power to control markets at home and abroad. Its Belt and Road Initiative (BRI) is a network of bilateral relationships in which China seeks to re-create its tributary system.

The second way to view the rivalry is through geography. North and South America combined have an annual economic output (GDP) of roughly $26 trillion. The European Union represents $24 trillion and Asia is the largest grouping with about $32 trillion.

Another way to look at this is that Eurasia represents $56 trillion of GDP and North and South America (Western Hemisphere) combined represents $26 trillion. This rough balance between Europe, America and Asia in terms of economic output is a major development that has not occurred since the industrial revolution. These three blocs together represent more than 80% of the world’s economic output.

It seems to be an American pastime over the last century to consistently underestimate Asia.

It is puzzling why many Americans thought that China would ever be an ally or partner of America. Just look at the 20th century. China substantially supported the North Koreans during the Korean War and North Vietnam in the Vietnam conflict.

Japan, South Korea, Taiwan, and now China, on a spectacular scale, have used basically the same game plan to put America on its heels. First, take dead aim at both America’s manufacturing base and consumer markets by leveraging lower labor costs and subsidized capital from high savings rates. Then let market forces move American competition out of the way. Shockingly, over the past two decades, America has decided to let Asia manufacture just about everything.

With Japan and South Korea, U.S. industry took a hit but with China’s massive scale it is more like a huge body blow. China has over the past three decades moved 600 million workers from rural areas to urban manufacturing centers. This has led to incomes rising roughly 900% and China’s share of global GDP going from 2% to a whopping 17%.

In 1990, China had zero companies on the Fortune Global 500, which ranks the largest 500 companies by revenue. By 2002, China had 11 companies while America crested at 197 companies. In 2020, for the first time, China had 124 companies in the rankings versus 121 for the United States.

Make no mistake, the Chinese are smart, talented, determined, ambitious people. They also do their homework. In a country of 1.4 billion people, 10 million students take a university entrance exam each year called Gaokao. Only about 6 million pass.

We need to study China carefully to understand their strengths, vulnerabilities and strategies. Believe me, they have studied America very thoroughly and have a plan to divide and conquer that they will execute with relentless discipline and steely determination.

As America restricts Chinese direct investment in U.S. tech firms, slows the flow of technology to China, restructures global supply chains, and invests more in emerging technologies and manufacturing at home, China is not standing still. China’s Ministry of Commerce also has an “unreliable entity list” of uncooperative foreign companies that could face retaliation bans or restrictions, such as regulatory permits and licenses.

In 2020, while the U.S. Congress was squabbling over a $1.4 trillion pandemic spending package, China’s National People’s Congress unveiled a five-year plan in which it will invest close to $1.4 trillion in new technologies. Beijing also established a $29 billion semiconductor fund to reduce its reliance on American semiconductor companies.

Government-backed chip manufacturers hired scores of engineers, over 100 from Taiwan Semiconductor (NYSE: TSM) which produces 56% of the world’s chips.[1] And a cybersecurity firm recently revealed that China has alarmingly stolen source code, software development kits, and chip designs from seven Taiwanese chip firms.[2]

Alibaba (NYSE: BABA) and Baidu (NASDAQ: BIDU) established semiconductor groups, and with Tencent (OTC US: TCEHY) have announced huge new investments in cloud services and data centers.

America’s lead in advanced technology has also declined relative to its competitors such as China. American federal research and development (R&D) spending peaked in 1965 at 11.7% of federal spending and at 2.2% of gross domestic product. In 2019, total federal R&D spending constituted just 2.8% of all federal spending and just 0.6% of GDP.

Meanwhile, China’s “Made in China 2025” has already created more than 900 innovation funds that collectively intend to seed $350 billion of new R&D investments. The U.S. National Science Foundation reports that total Chinese R&D spending has been growing at an average annual rate of 17% and that China has now surpassed America in total R&D spending.

America’s ability to mobilize resources for new ventures and in times of conflict has also declined to its massive national debt. During the last five years alone, more than $8 trillion has been added to the national debt.

Interest on the national debt is expected to more than double by 2030 and, if interest rates rise sharply, these payments will lead to declines in allocations to defense and other critical programs, not to mention putting entitlement programs at risk.

This is all happening at a time when geopolitical shifts such as the rise of China and the importance of technology in warfare is shifting the battleground to air, sea, seabed, electromagnetic, space and cyberspace requiring the Pentagon to be much more flexible in allocating resources.

Looking outward to international markets where 96% of the world’s consumers live is common sense but pushing backing against China requires a strategic blueprint that restores and strengthens America’s global brand from the inside out.

Bringing the benefits of capitalism to more of America’s middle class should be a core theme on the domestic front.

Another overarching goal should be to highlight and exploit the weaknesses and deep contradictions in the Chinese Communist Party (CCP):

America and its allies also need a coordinated pushback on China’s brazen theft of intellectual property, data and intelligence. Perhaps China digital theft first hit the headlines in 2015 when it hacked into background security files of 22 million current and former U.S. government employees.[3]

While this is absolutely outrageous, China just got more and more aggressive. FBI Director Wray states that every FBI field office has China cases it is working on and is opening more than two new China cases each day.[4]

This is just one of many reasons why America needs to do its best to lead international organizations and make sure that these are run fairly and freely. American taxpayers have made a significant investment in these institutions over the past six decades. I say we stand and fight rather than cut and run.

There are some parallels between the current US-China rivalry and the advent of the Cold War — a time when George Kennan (an American diplomat and historian, and former U.S. Ambassador to the Soviet Union) advocated a policy of firm and patient containment of the Soviet Union.

One of Kennan’s keenest insights had nothing to do with foreign affairs; it had to do with American politics. He warned in his “X” article that “exhibitions of indecision, disunity and internal disintegration” within the United States were the biggest danger that America faced.[5]

Just why did America sleep while China soared, becoming the world’s biggest exporter and home to 30% of the world’s manufacturing — nearly as much as America, Germany and Japan combined.

An AidData study at William & Mary found that total Chinese foreign aid assistance between 2000 and 2014 reached $354 billion, nearing the U.S. total of $395 billion. China’s foreign aid now exceeds that of America.[6]

Between 2002 and 2017, the United States spent $2.8 trillion on funding the war against terror and counter insurgency wars in Iraq, Afghanistan and Syria — equivalent to 16% of the government’s entire discretionary budget according to a study by the Stimson Center.

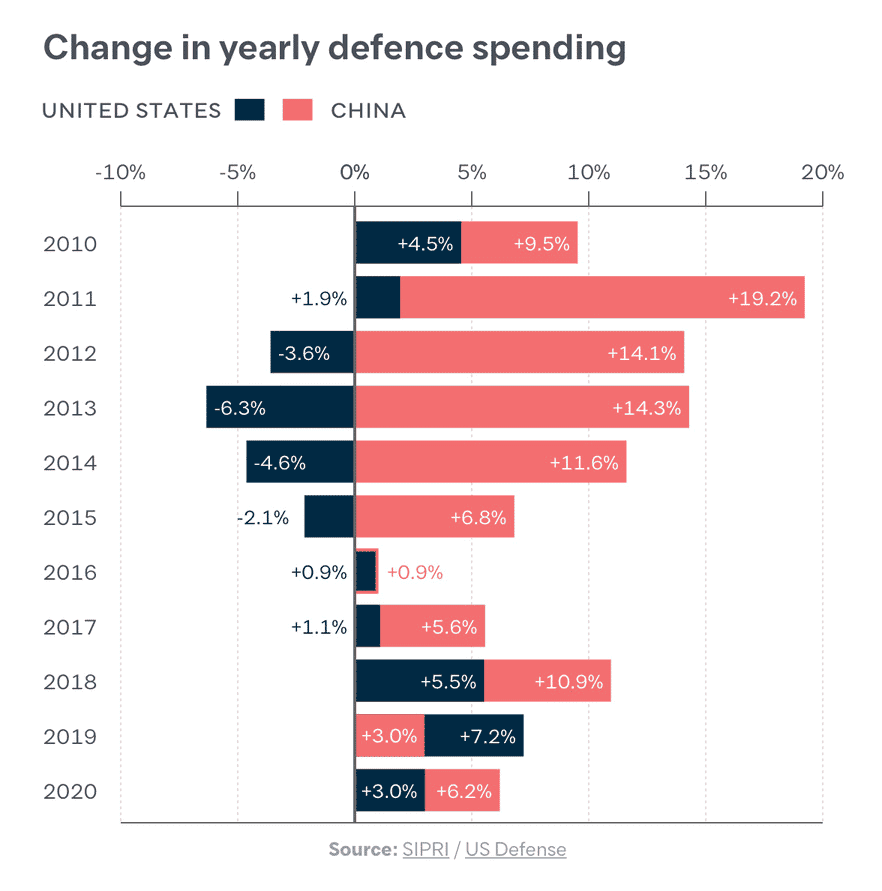

During this time, China’s military capabilities have also grown considerably and in step with its double-digit increases in its defense budget over the last several decades. According to Allen Whiting, writing in the China Quarterly, “war games played against the American ‘enemy’ have been standard since 1991.”[7]

While American policymakers debate whether we should decouple our supply lines with China, China has been decoupling for many years by capturing intellectual property, creating protective trade barriers and controlling strategic areas of the economy — from rare earths and pharmaceuticals to advanced manufacturing.

Nothing symbolizes this strategy more than telecommunication markets, which America handed to Huawei years ago because it seemed a low profit market and state-supported Chinese companies were squeezing their margins.

Now Huawei is by far the most competitive player in this space becoming an “Ericsson (NASDAQ: ERIC), Intel (NASDAQ: INTC) and Apple (NASDAQ: AAPL) rolled into one,” according to analyst Phillip Orchard.

Some cynics may claim that it makes no difference whether China’s “moneybags communism” or America’s “moneybags democracy” is the leading power in the world.

I beg to differ.

How this rivalry plays out in the next decade will not only affect your pocketbook and stock portfolio. It will significantly impact the financial security and way of life of your children and grandchildren as well as the national security of America and democracies throughout the world.

It matters a great deal whether in the next decade America or China sets the rules of the road for our technology economy — especially when almost all companies are now technology companies closely linked to the internet and big data.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://asia.nikkei.com/Business/China-tech/China-hires-over-100-TSMC-engineers-in-push-for-chip-leadership

[2] https://www.latimes.com/world-nation/story/2020-12-17/taiwan-chips-tsmc-china-us

[3] https://www.nytimes.com/2015/06/05/us/breach-in-a-federal-computer-system-exposes-personnel-data.html

[4] Ibid.

[5] https://www.foreignaffairs.com/articles/russian-federation/1947-07-01/sources-soviet-conduct

[6] https://www.wm.edu/news/stories/2020/aiddata-sheds-light-on-chinese-foreign-aid.php

[7] Whiting, Allen S. “The PLA and China's Threat Perceptions.” The China Quarterly No. 146, Special Issue: China's Military in Transition (Jun., 1996)

[8] https://www.nytimes.com/2020/07/22/science/mars-china-launch.html

- The Hell of Good Intentions: America’s Foreign Policy Elite and the Decline of U.S. Primacy, Stephen M. Walt, Farrar, Straus and Giroux, 2018.

- On Grand Strategy, John Lewis Gaddis, Penguin, 2019.

- Destined for War: Can America and China Escape Thucydides’s Trap, Graham Allison, Houghton Mifflin, 2017.

- China’s Future, David Shambaugh, John Wiley, 2016.

- Daron Acemoglu and James A. Robinson, The Narrow corridor: States, Societies, and the Fate of Liberty, Penguin, 2019.

- Niall Ferguson, The Great Degeneration: How Institutions Decay and Economies Die, Penguin, 2012.

- Thomas J. Christensen, The China Challenge: Shaping the Choices of a Rising Power, W.W. Norton, 2015.

- Richard McGregor, Asia’s Reckoning: China, Japan and the Fate of U.S. Power in the Pacific Century, Penguin, 2018

- Alfred Thayer Mahan, The United States Looking Outward, The Atlantic, December, 1890.

- Robert D. Kaplan, Marco Polo’s World: War, Strategy and American Interests in the Twenty-First Century, Random House, 2018.

- Samuel Hammond, The China Shock Doctrine, National Affairs, Fall 2019.