The COVID-19 pandemic is not going away any time soon. The promise of an approved vaccine is still several months away from being released, and even then, it will take months to get it out to a substantial portion of the North American population to have any effect on reducing the transmission of this deadly virus.

As we enter the fall season, health experts are warning that the coronavirus pandemic remains a major health concern, especially when coupled with the upcoming flu season.

Europe is already in a second wave of infections as the number of new cases is spiking again and multiple regions including Ontario, Canada are moving back into greater restrictive orders. And just this past week, the US recorded its highest number of cases since the pandemic began.[1]

We are now more than seven months into COVID-19 recommended community restrictions across North America. Our lives will probably never be the same until a promising vaccine that eradicates the virus is discovered and an obvious distribution plan is in place.

Everything has changed from the way we shop, how we dine, how we work and how we interact socially. Our lives have been radically affected and life now largely takes place within the confines of our homes or limited social bubbles depending on guidance provided within your local state or by city officials.

Forced to stay home, consumers have moved to the digital world to fulfill their needs.

The stay-at-home economy has largely become a digital economy. Let’s think commerce. Websites and mobile apps are the keys to success in this new economic landscape.

The businesses that were digital pre-COVID-19 have reaped the biggest rewards, and their stock prices reflect that. The businesses that were not digital have had to play catch up to adapt to this new economy.

In the words of Satya Nadella, CEO of Microsoft (NASDAQ: MSFT):

"We've seen two years' worth of digital transformation in two months. From remote teamwork and learning, to sales and customer service, to critical cloud infrastructure and security—we are working alongside customers every day to help them adapt and stay open for business in a world of remote everything."[2]

The digital economy has skyrocketed in the past six months and will continue its meteoric rise as long as COVID-19 has us in lockdown—and reaching beyond. As consumers adjust to the digital-age, so will their behaviors moving forward.

We are in the midst of a paradigm shift the likes of which has not happened since the end of the dark ages.

Companies are abandoning their office spaces in lieu of a remote workforce, and it does not look like this is going to be temporary as many had thought. Entrepreneur Inc. reported back in August that 17 major companies had announced that employees can work from home indefinitely, and some are even abandoning once coveted office spaces.[3]

Many schools are not fully open with students attending virtual classes. Many hospitals and doctor’s offices are only open for essential medical services. Restaurants and bars are closed or radically limited in the available space they can use to serve patrons. Large birthday parties, weddings and funerals are a thing of the past, at least for right now.

The COVID-19 virus has shaken our society to the very pillars of its foundation— a calamity not seen in generations.

We as savvy investors know that where calamity exists, so do investment opportunities.

And that is what drove my research for this article. What companies are crushing the markets right now because they were unknowingly already set-up for the stay-at-home economy? What companies took the challenge, had advanced thinking and modernized their respective companies to be a contender in this new age of business and commerce existing online?

Moving into the fall, investors should be looking into digital-related stocks that might already be, or may not be on everyone’s radar.

What do I mean by that? Beware of the “Robinhood stock trades” I warned about in my previous article. Especially the top five tech stocks (FAANG) that young inexperienced traders are pouring into based on popularity alone. They have become overpriced in my opinion and subject to some level (+/-) of correction over the next few weeks and months.

In my research, I have tried my best to shy away from the larger, more popular stocks and looked for less talked about investment opportunities.

I did not get too deep into the medical or vaccine stocks as they seemed too risky in my opinion. I think we need more data before we can pick a winner in the Biotech Covid-19 Sweepstakes, as it is still early in the game. Guessing which pharmaceutical company will come in first with an effective and approved COVID-19 vaccine is an enticing idea but save your hard-earned money for what I believe could be safer bets. Leave those trades to the rookies or deep pocket traders. However, I do have one I like and it’s been on my radar for a few months…

If you are indeed looking for a COVID-19 pharma play, I would suggest taking a closer look at (my honorable biotech mention) Abbott Laboratories (NYSE: ABT). Their vaccine trials did take a turn for the worse recently, but they are still a major supplier of COVID-19 diagnostic tests and have recently come out with an antigen test that could be a game changer with fast results and a low cost per sample. The US government recently signed a $750 million contract for the new tests.[4] I am watching this closely and am intrigued by this potential stock play.

It’s time to dig in.

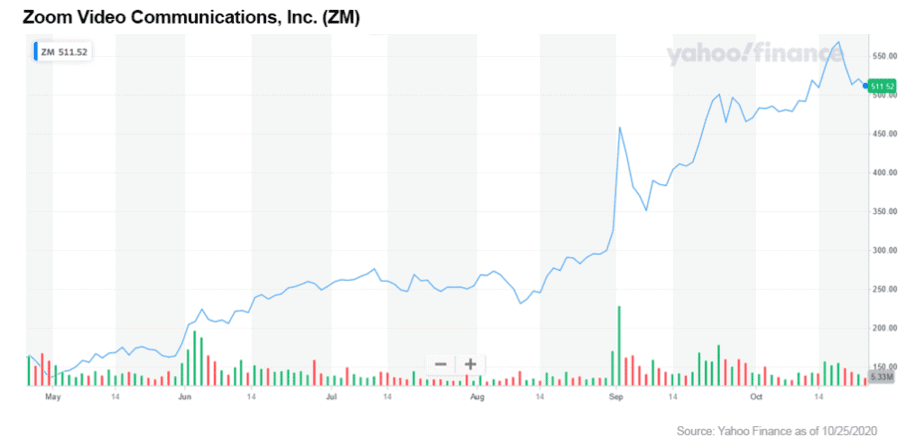

1. Zoom Video Communications Inc. (NASDAQ: ZM) soared to an all-time high on September 1 with the delivery of their 2nd QTR earnings report that blew away all expectations. The stock has since seen a correction and has again found its footing.

Zoom is a perfect example of a company that was at the right place at the right time. The demand for the video conferencing software skyrocketed as people had to telecommute to work, school and the doctor’s office, not to mention visit with grandma on the weekend.

Look for ZM to continue to grow its base and expand operations as long as the COVID-19 pandemic is a factor in our lives, and maybe beyond, as people have become accustomed to using the service.

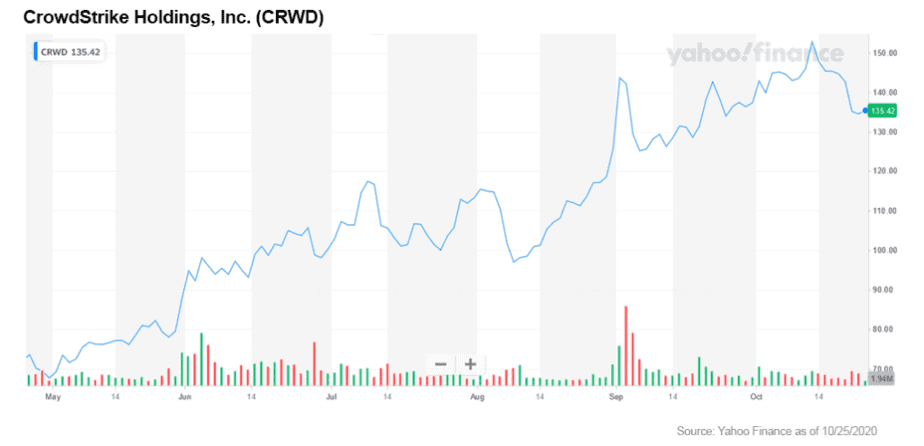

The move of the workforce from physical offices to working from home opened up huge opportunities for cybersecurity companies. Users working remotely and logging into sensitive corporate networks and cloud services from home brings major cybersecurity risks. That “air gap” is what hackers love and ultimately love to take advantage of.

Cybersecurity companies are on the front lines of the war against hackers and malware and are an essential part of the work-from-home economy. For that reason, I have included three cybersecurity stocks in my list to pay attention to!

2. CrowdStrike Holdings Inc. (NASDAQ: CRWD) is one of those companies that has seized the moment to improve endpoint security for the growing remote workforce.

Their weapon in the fight against hackers is using Artificial Intelligence (AI) to gather information on a given attack and learn from it, effectively improving endpoint security. Each incident and the information gleaned from that attack adds to the overall value of the platform because it is shared across the network.

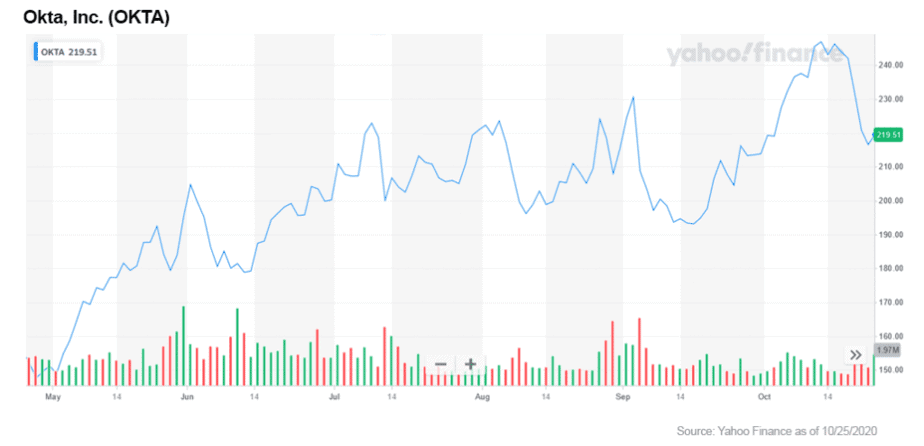

3. Okta Inc. (NASDAQ: OKTA) is another cybersecurity company that has capitalized on the work-at-home migration.

Companies in their transition from office-based workstations to remote workstations have had to move applications and files into the cloud. Each of those applications often requires a different login, which if you are like me is a nightmare.

Okta’s solution is to have a single sign-in for all applications and files in the cloud. The company has integrated with Microsoft products and also with Amazon Web Services (AWS) Single Sign-On (SSO) giving it a huge advantage over its competitors.

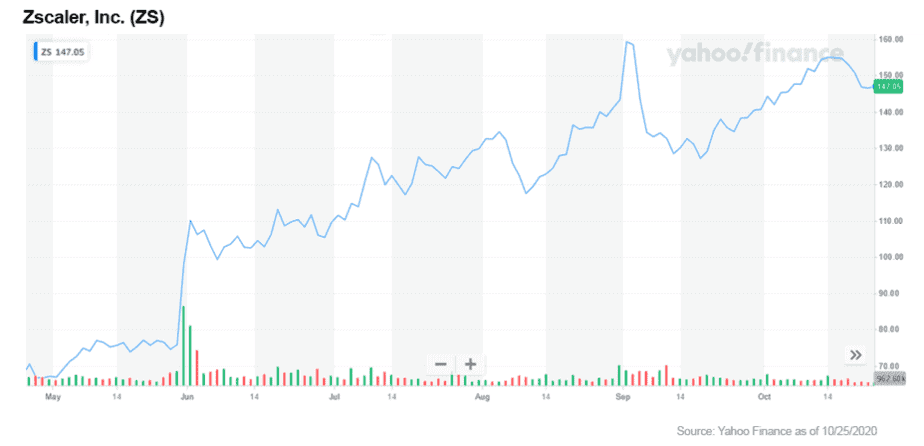

4. Zscaler Inc. (NASDAQ: ZS) is one of the largest providers of cloud-based web security services. Their software scans customers’ data traffic for malware—an essential service for anyone working remotely and logging into sensitive corporate networks.

Their software securely connects users to applications from any device, anywhere. This includes the public cloud and software-as-a-service (SaaS) apps.

"The digital transformation that is driving our business is further accelerating, and we believe the Zscaler cloud security platform is best positioned to help our customers thrive no matter where their teams are working," says Chief Executive Jay Chaudhry.[5]

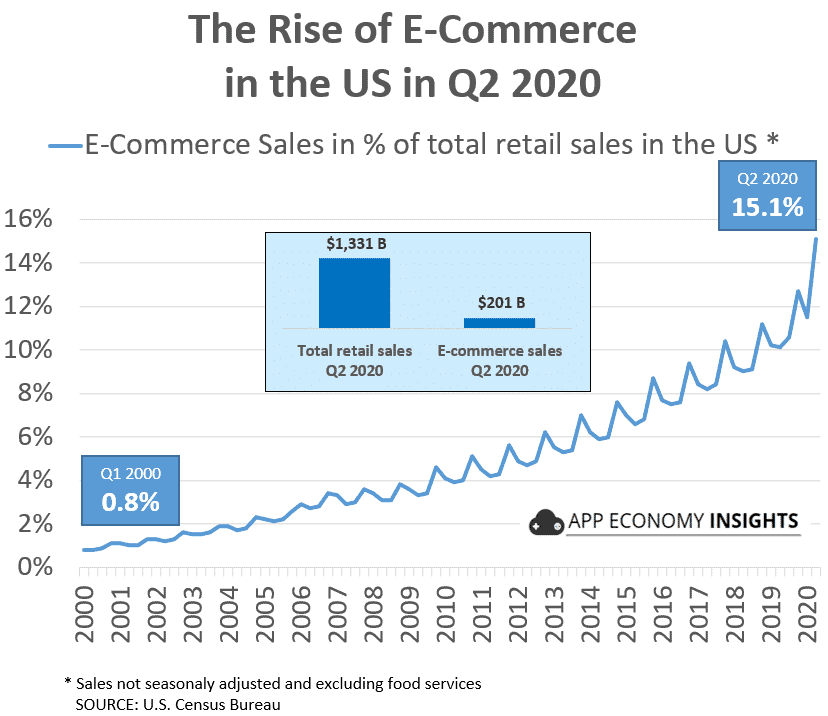

COVID-19 has dramatically accelerated e-commerce adoption. US e-commerce penetration reached a record 15.1% of total sales in Q2 2020.[6]

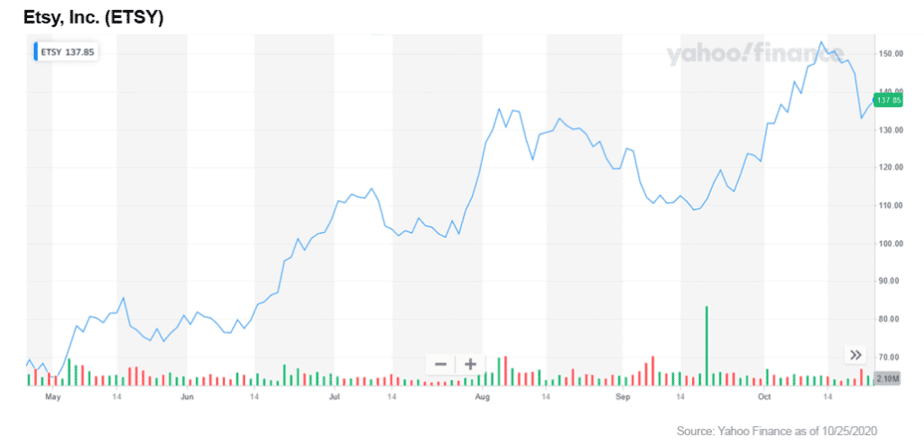

And this is why I absolutely love Etsy right now...

5. Etsy, Inc. (NASDAQ: ETSY) is an outlier in the e-commerce world. Its website focuses on the sale of handmade or vintage items. They primarily sell unique one-of-a-kind items that you will not find on sites like Amazon (NASDAQ: AMZN). The company’s mission is to “keep commerce human.”

That personal touch and the ability to shop boutique stores across major retail categories is helping Etsy build a strong online brand that distinguishes it and uniquely positions it from the garage sale feel of eBay (NASDAQ: EBAY).

Etsy has invested in machine learning to make its website easier to browse, and the company's growth in active buyers shows it is working.[7]

Growth exploded with the onset of COVID-19. Revenue rose +137% Y/Y to $429 million with an adjusted EBITDA margin at 35%.[8]

6. Pinterest, Inc. (NASDAQ: PINS) is what I am going to call the quiet in the storm of social media platforms. User growth has been steady over the last five quarters and for good reason. The platform is more inspirational and apolitical than other platforms like Twitter (NYSE: TWTR) or Facebook (NASDAQ: FB).

It is surprising to point out that Pinterest has more users than Twitter.

In May, Pinterest announced a partnership with Shopify (NYSE: SHOP) to launch a new app that gives merchants the ability to upload catalogs and make their products available for purchase.[9]

With the continued growth in active users and the addition of adding e-commerce to their platform, I believe this stock is set up for growth over the next number of months.

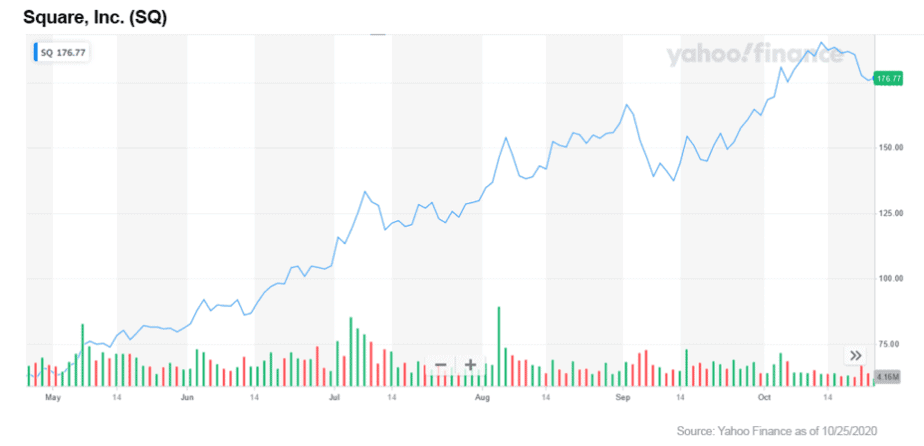

7. Square, Inc. (NYSE: SQ) has capitalized on the peer-to-peer payment system with their highly popular Cash App. The company’s Cash App allows users to make payments between individuals instantly for no or little cost.

The app grew +140% Y/Y and now represents 47% of Square’s gross profits.[10]

The company also offers merchants a point-of-sale (POS) system to accept and process credit cards.

According to the company investor presentation Q2 2020, the company is actively seeking expansion into other financial services offerings to further increase growth, which begs the question of what may come?

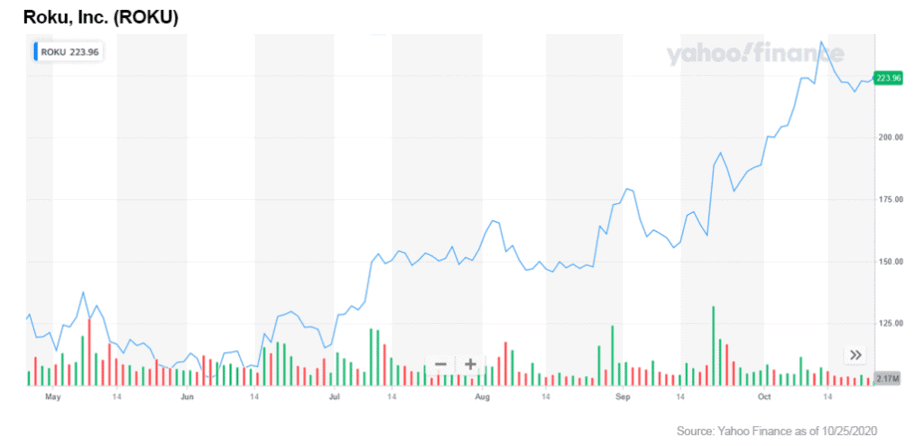

Cable and satellite TV have been dying a slow death for years. Subscribers are ditching the expensive packages of hundreds of TV channels in lieu of inexpensive on-demand streaming content services such as Netflix and Amazon Prime.

8. Roku, Inc. (NASDAQ: ROKU) offers a device that allows you to connect your TV monitor to the internet and select from a variety of streaming content providers. The system is super easy to install and use, and is relatively inexpensive when compared to its competitor AppleTV.

The company has recently made moves to incorporate advertising into its platform which would bring in additional recurring revenue. This I like!

Esports is a category that is still in its infancy. The upside potential is huge as global revenue for the market is growing by double digits annually.

Asia has the largest user base by far with an estimated 57% of the total of esports enthusiasts worldwide.[11] The numbers for the esports market are staggering by any measure. Newzoo reported that the global esports economy would top $1 billion in 2019.[12]

My fellow friend and respected FNN co-contributor Blake Finucane wrote an excellent article on the esports market if you would like to get up-to-speed on this fast-growing segment.

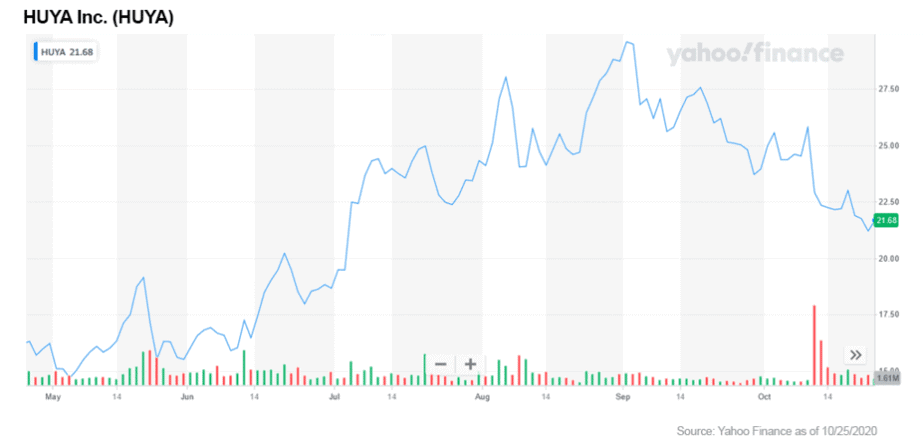

9. China-based HUYA Inc. (NYSE: HUYA) is the largest of the live streaming platforms in China.[13] The company is backed by gaming giant Tencent (OTC US: TCEHY / SEHK: 700) and viewership has grown dramatically during the lockdowns as consumers are looking for entertainment indoors.

HUYA is already profitable, generating healthy cash flow. I am watching corporate developments closely.

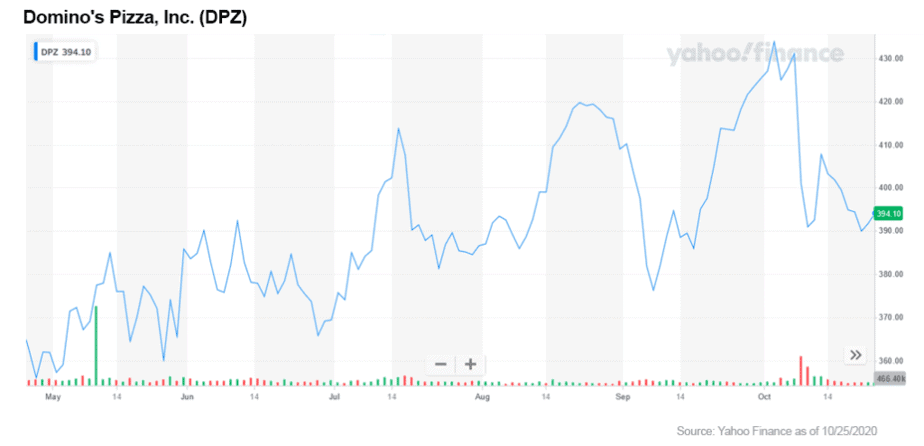

Last but not least is our need to eat pizza when embarking on social distancing for months at a time. This might not seem as the most glamorous stock pick, but sometimes, especially during a pandemic, we need to look to basics…

10. Domino's Pizza Inc. (NYSE: DPZ) has seen dramatic growth during the COVID-19 pandemic and does not appear to be taking its foot off the gas. This could go on for quite some time. Remember my consumer behavior comment above… Domino’s through this COVID period could recognize continued positive consumer behavioral changes affect its business post-COVID and could realize continued demand.

This is an excellent example of a company that has embraced technology long before the COVID-19 pandemic, and the dividends that are paying off now are only a boon to investors.[14]

Domino’s is focused on delivering your pizza in the shortest possible time, and as a consumer, I have to say their game is tight.

The mobile app is super easy to use making ordering a pizza a breeze. You can track your delivery right to your front door. The company continues to push the tech boundaries with autonomous car delivery and Artificial Intelligence (AI).[15]

They have added a variety of different pizza styles to their menu to cater to different tastes. At the end of the day, they have a tasty product that is easy to order and arrives at your door in minutes. I’m a fan, in case you were wondering.

As most savvy investors know, every dark cloud has a silver lining. You just need to do your research, and look for companies along the edges of the new digital stay-at-home economy. Think about what you are doing during this time and the products and services you use daily, or what might represent the next cyclical opportunity.

The COVID-19 pandemic appears to be with us for another year at least, and this provides investors plenty of time to position themselves to capitalize on the economic changes that are shaping a new normal, specifically focused on the digital or online world. Let’s make some money!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.npr.org/sections/coronavirus-live-updates/2020/10/24/927389093/u-s-records-highest-number-of-coronavirus-cases-in-1-day-since-pandemic-began

[2] https://www.microsoft.com/en-us/microsoft-365/blog/2020/04/30/2-years-digital-transformation-2-months/

[3] https://www.entrepreneur.com/article/354872

[4] https://www.fool.com/investing/2020/08/27/abbott-to-receive-order-for-150-million-rapid-covi/

[5] https://ir.zscaler.com/news-releases/news-release-details/zscaler-reports-third-quarter-fiscal-2020-financial-results

[6] https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

[7] https://www.fool.com/investing/2020/09/24/is-etsy-stock-a-buy/

[8] https://s22.q4cdn.com/941741262/files/doc_presentations/2020/08/Investor-Presentation-2Q20-Final2.pdf

[9] https://newsroom.pinterest.com/en/post/pinterest-launches-shopify-app-for-easy-merchant-access-to-catalogs

10]https://images.ctfassets.net/2d5q1td6cyxq/6os6PDODZRAaimpZIShLw8/4e0236c88276db5462344a7c8cb76fe0/Square_Investor_Presentation___June_2020.pdf

[11] https://esportsobserver.com/newzoo-2019-report/

[12] https://newzoo.com/insights/articles/newzoo-global-esports-economy-will-top-1-billion-for-the-first-time-in-2019/

[13] http://ir.huya.com/index.php?s=64

[14] https://diginomica.com/pandemic-pizza-covid-19-takeaways-dominos-digital-transformation-work-pays

[15] https://www.washingtonpost.com/technology/2019/06/17/dominos-will-start-delivering-pizzas-via-an-autonomous-robot-this-fall/