As a follow up to my original article Could Salt Become the Sexiest Opportunity of 2023? Atlas Salt May Have the Answer, I feel Atlas Salt (TSX-V: SALT / OTCQB: REMRF) is even more of a sexy opportunity today. Let me tell you why...

OVERVIEW & RECAP

In the US alone, approximately 25 million tons of salt are used as road salt at a cost of around ~US$58 per ton. Every year America imports a whopping 7–10 million tons of salt from Chile and North Africa.[7]

The advent of climate change has ushered in a troubling trend — increasingly severe winter storms, hurricanes, flooding and worldwide forest fires. This meteorological anomaly could become the new normal.

Let’s look at the existing landscape and aging infrastructure for developing a new potential salt mine — further exacerbated by the absence of anything newly constructed in North America for over two decades — creating a pressing concern... the inability to deliver a true domestic source for what is to become a highly valued commodity.

It looms as a stark reminder that the supply of road salt could dwindle, potentially triggering a surge in demand that warrants investor attention.

Located adjacent to a port connecting to vital waterways, Atlas Salt (TSX-V: SALT / OTCQB: REMRF) could emerge as an unsung hero, offering a sustainable solution to the eastern seaboard’s road salt needs for generations to come...

This invaluable resource promises to guide us through the treacherous terrain of severe winters and the evolving challenges of climate change.

Atlas Salt Reported Its Independent Feasibility Study That Delivers a Staggering $1 Billion Conservative Valuation and a Potential Higher Valuation of a Whopping $4 Billion

Highlights of the Feasibility Study conducted by SLR Consulting (Canada) Ltd. (SLR), a top recognized and respected firm, shows robust economics discussed based on 2.5 million tonnes-per-year production over a 34-year mine life:[8]

Pre-Tax Economics

Updated Mineral Resource Estimate

As Atlas Salt ramps into production, it is expected that production will be increased. SLR has also provided an expansion case to 4.0 million tonnes per year (Mtpa) of road deicing salt over a 47.5-year mine life presented at a Preliminary Economic Assessment (PEA) level analysis. This demonstrates a robust upside production scenario with a pre-tax net present value (NPV) at 8% of CAD$2.015 billion and a pre-tax IRR of 28%. Net NPV of 5% would equate to $4.095 billion.[11]

“...the first thing we have to do once this (new management) team has been assembled, and we have actually started already, is the environmental assessment. We are excited. We have momentum built with this FS [Feasibility Study]. The management team we are going to be bringing in are going to be impressive. I believe they’re going to get us where we want to go.”[12]

— Atlas Salt CEO Rick LaBelle

What a potential golden goose for Atlas Salt shareholders. Yes, this project will take a few years to be in production but with only a direct capital cost for putting this project into production of over CAD$300,000,000, the payback is 4.2 years after commencement of production.[13]

This is the advantage of a ‘shallow deposit’ that Atlas’ Great Atlantic holds which can be obtained by decline ramps versus vertical shafts that Compass’ Goderich mine utilizes.

In the ever-evolving landscape of corporate leadership, few transitions have garnered as much attention and intrigue recently as the appointment of Rick LaBelle as the new CEO of Atlas Salt (TSX-V: SALT / OTCQB: REMRF).

In a decisive move that took many months of searching, the company's board of directors ushered in a new era of innovation, growth, and success. Now, as the dust settles and Atlas Salt steers confidently into salt waters (no pun-intended), we explore why this is the perfect moment for investors to consider placing their bets on this industry stalwart.

Rick LaBelle's ascent to the position of CEO came as no surprise to those who have closely followed his remarkable career. With a track record marked by astute strategic planning and dynamic leadership, LaBelle is poised to lead Atlas Salt to new heights.

His commitment to driving innovation and his passion for sustainability align perfectly with the company's core values. This synergy of purpose has infused the organization with fresh energy and a clear vision for the future.

Mr. LaBelle commented, “I’m delighted to join Atlas Salt. It’s a privilege and a rare opportunity in the mining sector to be involved with such a top tier asset as Great Atlantic with the potential to produce profitability for generations, creating a legacy of accomplishment. I’m quickly going to assemble a world class team to advance this tier 1 asset, which will very soon be anchored by an independent Feasibility Study. I have a record of unlocking shareholder value, a key part of my strategy with Atlas Salt.”[14]

Mr. Rowland Howe, Atlas President, stated, “In my three decades in the salt sector, I’ve never seen an opportunity as exciting as this. Rick is the perfect fit and I’m thrilled to be able to work alongside him and the team he’s going to build. He’s a fourth-generation underground miner who has been involved in one way or another with just about every underground mine in Canada. The skills he learned in private equity, and the network he built, can be leveraged very effectively in the salt sector which has so much private equity involvement. He’s a gifted strategist and deal maker.”[15]

I wholeheartedly concur with Mr. Howe’s assertion, for it is deserving we acknowledge the remarkable vision of (former CEO) Patrick Laracy. His discerning foresight recognized the untapped potential inherent in this salt asset, and he executed a well thought out plan.

Moreover, Mr. Laracy demonstrated exceptional acumen by assembling a cadre of indispensable talents including Mr. LaBelle and Mr. Howe at precisely the right juncture. Equally impressive was his judicious decision to relinquish the role of CEO at the opportune moment.

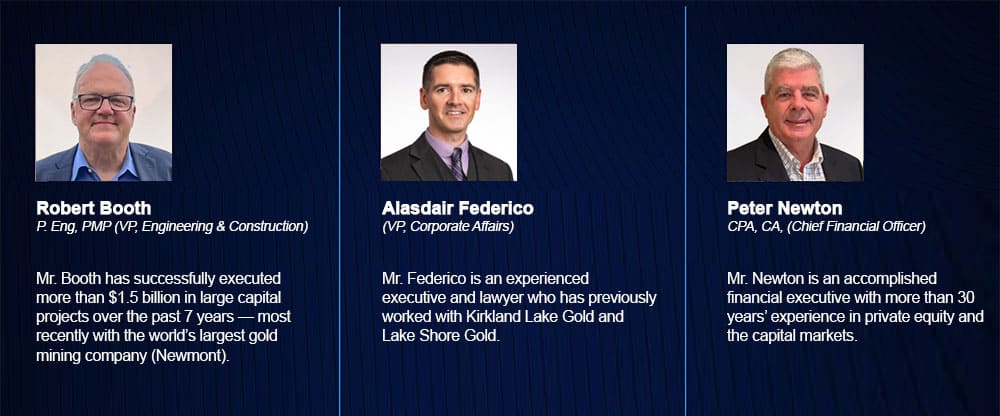

Mr. LaBelle has assembled an all-star team including...[16]

In my opinion, the stock has further been de-risked. Not only does Atlas Salt have a strong management team, Mr. LaBelle has made some key additions to the already impressive management team that could further solidify the company as what I am calling ‘a sexy investment.’

This anticipated upside could be due to LaBelle’s experience in putting all the pieces together, positioning the project for production, or he may well choose to orchestrate a possible takeover of this invaluable asset.

Mr. LaBelle stated that he has been involved in some way with nearly every underground mine in Canada either through drilling / exploration / new discoveries, through mine building, or selling of products.

He brings in a vast array of experience and contacts that could only benefit Atlas Salt and its shareholders:

If you recall the timeless fable of "The Tortoise and the Hare," it was an enduring reminder that it is often the steadfast and methodical who ultimately triumph.

In summation, Atlas Salt (TSX-V: SALT / OTCQB: REMRF) finds itself amidst a profound metamorphosis, guided by the dynamic stewardship of Rick LaBelle.

With a resolute dedication to sustainability, a culture of relentless innovation, a global outlook, and the assurance of a proven leader at the helm, the company stands poised not only for growth but also for resounding success.

For discerning investors in search of a steadfast and visionary investment prospect, this could be an opportune moment to delve into the world of Atlas Salt.

The horizon gleams with promise, and those astute enough to explore the potential of Atlas Salt stand on the precipice of reaping the abundant rewards that await on this exhilarating voyage.

As I gaze into the future, envisioning the company’s trajectory over the next 2–5 years, I see nothing but brilliance. Once more, I am reminded that in the grand scheme of things, it is the patient and unwavering commitment that prevails — as underscored by the timeless moral of "The Tortoise and the Hare" fable... slow and steady wins the race.

And now you can see why I still believe that ‘SALT is absolutely Sexy!’

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Atlas Salt Inc. is a Junior Gold Report (operated by Kal Kotecha) portfolio holding. Junior Gold Report/Kal Kotecha is a consultant for Atlas Salt and is being compensated by Atlas via share options. This relationship with Atlas Salt Inc. may be deemed a potential conflict of interest by some investors. Dr. Kal Kotecha and Junior Gold Report own shares in TSX-V: SALT and may buy and sell at any time.

[1] Fairfield Market Research https://www.fairfieldmarketresearch.com/report/rock-salt-market

[2] Video: A Journey Into the Incredible Story of Atlas Salt That Investors Won't Want to Miss https://www.youtube.com/watch?v=3DrVVleYp4M

[3] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[4] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[5] Atlas Salt Corporate Presentation https://atlassalt.com/investors/

[6] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[7] Atlas Salt Corporate Presentation https://atlassalt.com/investors/

[8] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12] Atlas Salt | PRmediaNow Interview with Rick LaBelle, CEO, Atlas Salt Corp https://www.youtube.com/watch?v=SNOdVL4d-Nc

[13] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[14] Atlas Appoints Rick LaBelle as New CEO https://atlassalt.com/atlas-appoints-rick-labelle-as-new-ceo/

[15] Ibid.

[16] Atlas Unveils Great Atlantic Salt Project Build Team https://atlassalt.com/atlas-unveils-great-atlantic-salt-project-build-team/

[17] Atlas Appoints Rick LaBelle as New CEO https://atlassalt.com/atlas-appoints-rick-labelle-as-new-ceo/

[18] Ibid.

[19] Atlas Salt | PRmediaNow Interview with Rick LaBelle, CEO, Atlas Salt Corp. https://www.youtube.com/watch?v=wxG8qlY3qqQ

[20] Atlas Unveils Great Atlantic Salt Project Build Team https://atlassalt.com/atlas-unveils-great-atlantic-salt-project-build-team/

[21] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[22] Atlas Salts Financial Statements https://atlassalt.com/financialstatements/FS_Q2_2023.pdf

[23] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[24] Near-Term Catalysts & Top 10 Reasons Atlas Brings the Power of SALT to Investors! https://atlassalt.com/scorecard/

[25] Atlas Salt and Triple Point Announce Closing of Triple Point Spin-out https://www.cbj.ca/atlas-salt-and-triple-point-announce-closing-of-triple-point-spin-out/

[26] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/