Editor’s Note: On April 8, 2024, SolarBank Corp. moved to the NASDAQ market with the new symbol NASDAQ: SUUN

If you are anything like me, you read the words “ESG,” “carbon offsetting,” or “green tech” and are immediately skeptical. There are countless projects that claim to be solving the biggest challenge of the modern world… climate change, but once you dig deeper most turn out to be little more than smoke and mirrors.

Despite this, I have been doggedly searching for a green tech stock worthy of bringing to your attention, and I have finally stumbled upon something really special. If you're looking for a stock that has the following...

…then I think I’ve found your perfect pick.

Let's start by diving into why I ended up becoming so obsessed with the topic of Green Tech stocks, most specifically Smart Energy stocks, and view them as the next big untapped opportunity. It all comes down to a combination of momentum, environmental factors (some pun intended), and timing.

Before I get going, I want to get one thing out of the way... our opinions on the potential scale of climate change, the causes of climate change, and the urgency to act don’t really matter.

Governments and businesses globally have come to the collective decision that they need to do something to combat climate change. This means that there are very real opportunities for innovative companies — and their investors — to make money by helping to solve climate change-based challenges.

These challenges range from the renewable energy transition, which promises to fundamentally alter how we generate power, to finding more efficient ways to use brownfield sites, which may be complicated by the presence of hazardous substances, pollutants or contaminants.

We have to address these challenges if we want to keep the pristine forests and wetlands necessary for carbon capture intact.

From an economic perspective, combating climate change will impact every aspect of the way we do business and most aspects of our lives. The question is, how do we do it without giving up on the progress of the past century and the convenience we enjoy every day?

To understand the scale, let’s start by talking about money, specifically with the astronomical costs. New studies have shown that extreme weather events have caused $2.8 trillion in damage between 2000 and 2019.[2] Air pollution from fossil fuels caused 6.4 million premature deaths and cost a staggering $8.1 trillion in health damages, or around 6.1% of global GDP.[3]

In terms of business, rapidly rising global temperatures could reduce agricultural yield by a devastating -30% by 2050 if nothing is done.[4] Resolving these challenges will require real investment to the tune of around $6.9 trillion global spend annually until 2030.[5]

So what does this mean for you as an investor? All of these factors have spurred business and governments into action, creating an opportunity for the right companies to thrive. The tricky part is identifying the factors of this new environment and how you can use them to identify what opportunities you should jump on and which will stumble at the first opportunity.

Let’s start by looking at one of the big momentum points: the race to net zero. This is particularly important for the image of companies that very much need to stay on the consumer’s good side, and those consumers typically want to see action as well as words.

These concerns have spurred many major organizations to make their own net-zero promises. This typically involves reducing emissions where possible by, for example, better insulating buildings or greening their supply chains. However, every business will have some emissions that can’t be reduced, and that’s where they turn to carbon offsets.

Carbon offsetting is a practice of paying someone else to sequester carbon, usually by planting or retaining forests or wetlands, in order to offset your own emissions. This approach has been embraced by companies and consumers alike, but many existing carbon offsetting problems have significant issues. For example, a study found that 90% of all rain forest carbon offsets were worthless.[6]

This is largely down to poor controls over the landholders supposedly protecting or planting trees. This means that companies will soon be forced to find better ways to offset, preferably using properties that they can control.

The Takeaway: Any company that can actually offset emissions, and prove it has done it, is onto something.

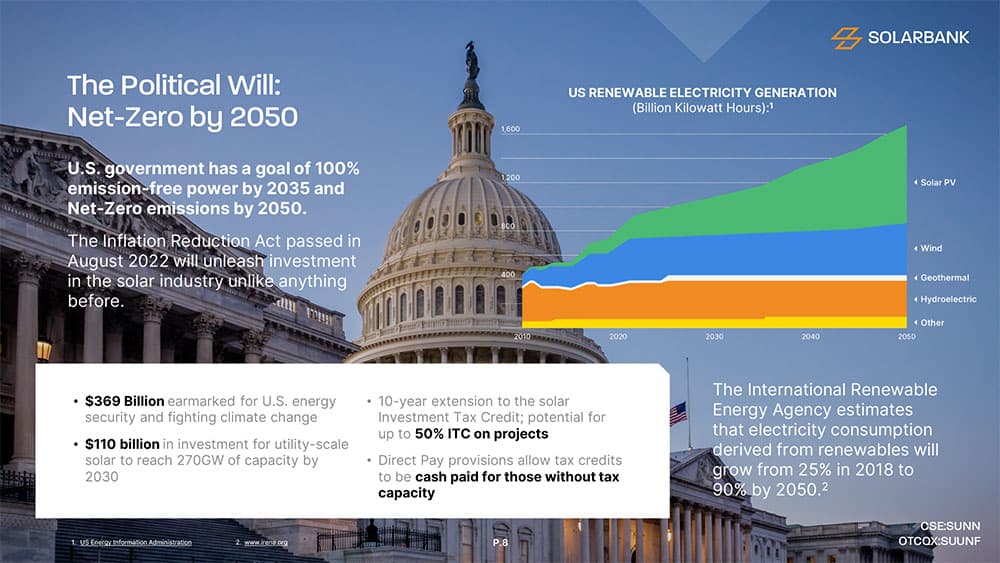

Despite consistent opposition from oil & gas companies, and relatively lackluster government subsidies, renewables are finally getting their moment in the sun.

Renewable energy, and in particular solar, has become increasingly efficient to the point where it is a staggering 5,000 times cheaper to produce than it was in 1958.[7]

This means that despite government subsidies for fossil fuel projects, renewable energy is beginning to make market sense, and as gas infrastructure comes due for renewal, we should begin to see a major uptick in the number of major solar projects.

Now, as with everything, there is a caveat. Renewable energy still isn’t great at base load, but battery technology is increasingly becoming able to handle this problem, and that’s something we’re going to get into as well.

The takeaway: Renewable energy is coming, and companies that are involved in the first stage of the transformation will gain a leading edge, particularly if they can control the infrastructure itself.

The final major ingredient is very much ESG (environmental / social / governance) focused. The troubles with carbon offsetting, combined with significantly more aware consumers, means that companies need better ways to run their ESG programs.

There are plenty of agencies that offer ESG guidance and consulting, but in many cases it amounts to more smoke and mirrors. Any company that can build a way to create actual carbon reduction programs that work with provable results has a very attractive service on their hands.

The takeaway: It’s always about the optics! Companies don’t want to do good just because they can; they need a way to tell everyone about it. Any green stock that offers them that opportunity is setting itself up for success.

These factors give us a useful bar by which to judge a green tech stock worth looking at. Specifically, we’re looking for something that I would call a “Smart Energy” stock. This is a company that is able to integrate a variety of renewable energy solutions together and use them to cleverly meet energy demand while decarbonizing the energy grid. This is no small feat and takes strength, skill and determination.

If they are able to use novel technologies to help solve carbon offsetting challenges while providing companies with a more effective ESG strategy, then you might just be looking at the holy grail that won’t just outcompete other stocks in the green technology category, but could become a giant in its own right.

Think Tesla Inc. (NASDAQ: TSLA) but before that disastrous Q3 earnings call.

After a great deal of searching, I firmly believe that I’ve found a company that will not just begin the smart energy revolution, but become synonymous with it: SolarBank Corporation (NASDAQ: SUUN / Cboe: SUNN).

This isn’t the first time that SolarBank (NASDAQ: SUUN/ Cboe: SUNN) has come up on FNN. My colleague MF Williams highlighted the stock back in March as one of his wildcard picks, and I think that the picture today is stronger than ever for SolarBank.

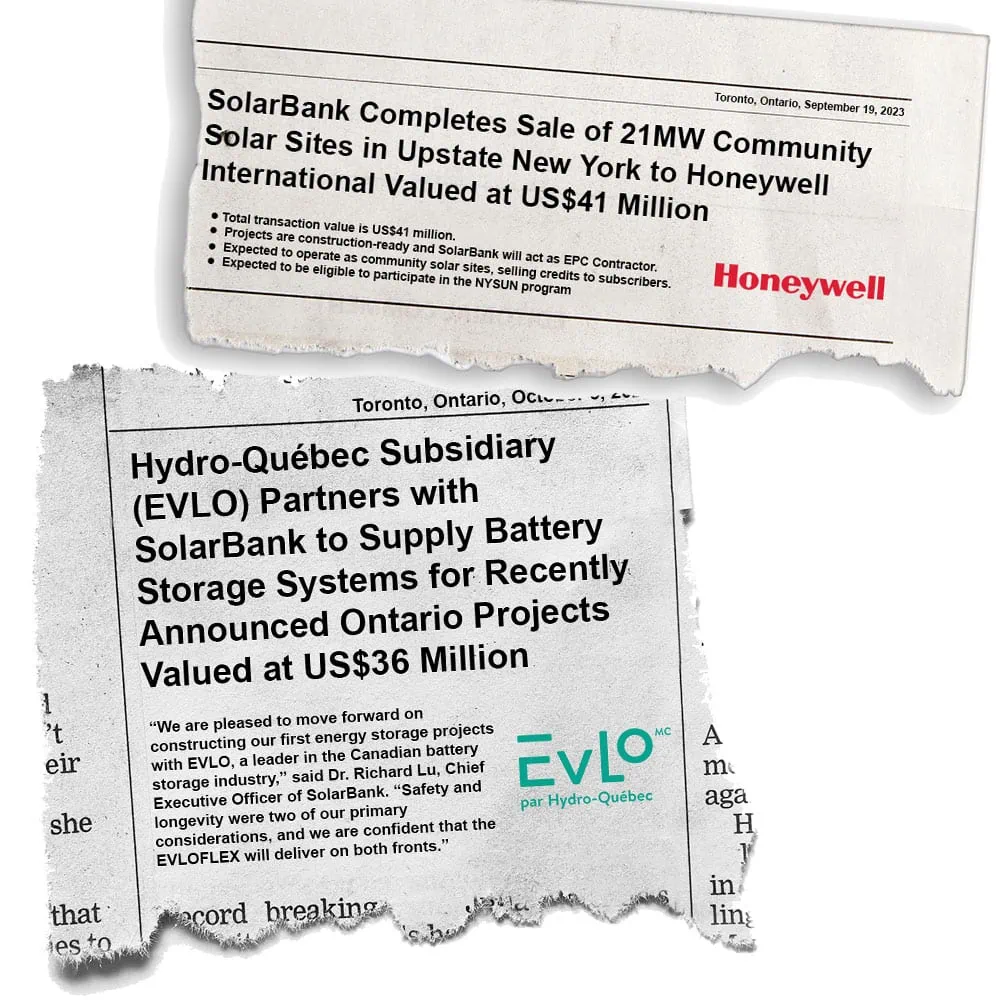

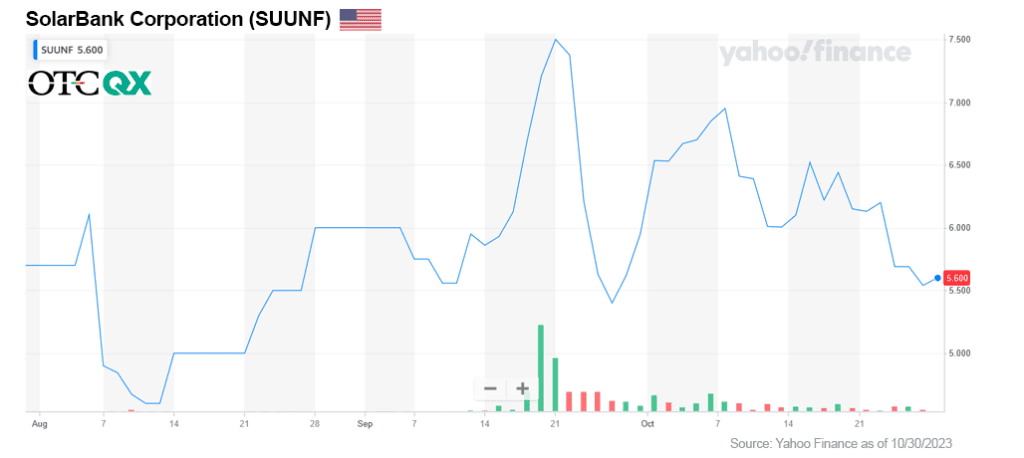

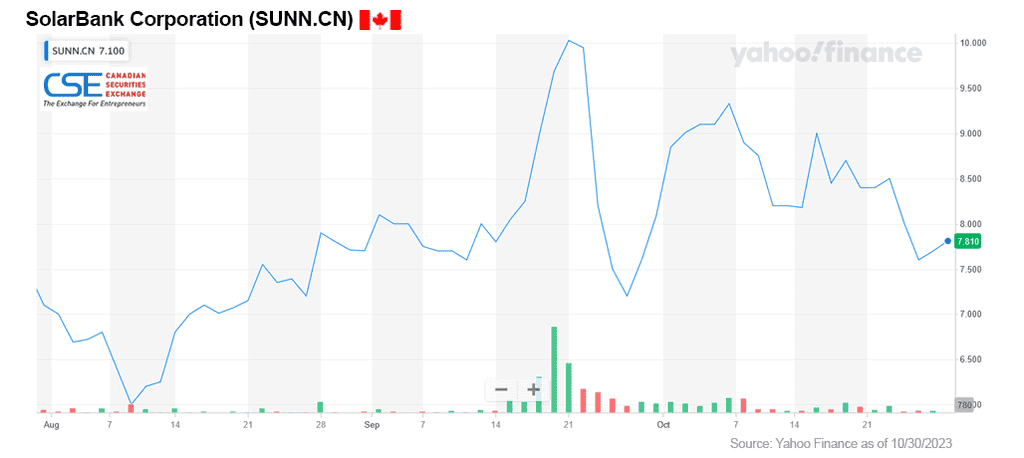

For starters, just check out the stock price. From its IPO it is up an impressive +300%, and up a cool +217% since MF Williams first mentioned it in March. This can be attributed to the company successfully executing on a number of big deals, including inking a $41 million contract with Honeywell International Inc (NASDAQ: HON).[8]

This has all been achieved with zero outside capital investment until the IPO, which is insane to me, and has had a really big benefit for the company — it is incredibly closely held. SolarBank has a tight share structure with just 27 million shares outstanding.

This is rare… and I mean really rare for a junior exchange company. This small supply of shares hits the sweet spot where prices are likely to rise due to limited supply, but liquidity will remain strong enough to attract investors and avoid the “honey pot” trap you sometimes see with overly tight stocks.

To help understand whether SolarBank was the real deal, I interviewed CEO Dr. Richard Lu to determine more about the company’s future direction.

I walked away feeling very positive quite simply because SolarBank not only has a compelling grand vision, but I believe it will be able to follow through.

One big idea struck me during my interview with Dr. Lu — the concept of zero carbon utilities, and most specifically, a zero carbon value chain. Rather than taking the “easy” route of building a few solar plants and calling it a day, Dr Lu has taken a more ambitious Smart Energy path.

Dr. Lu's vision places solar at the heart of a smart energy revolution that helps any major corporation actively reduce their carbon footprint by using solar energy to radically reduce reliance on fossil fuel-based power generation on existing buildings. It is even possible for them to repurpose their brownfield sites in order to turn them into a productive carbon-neutral investment.

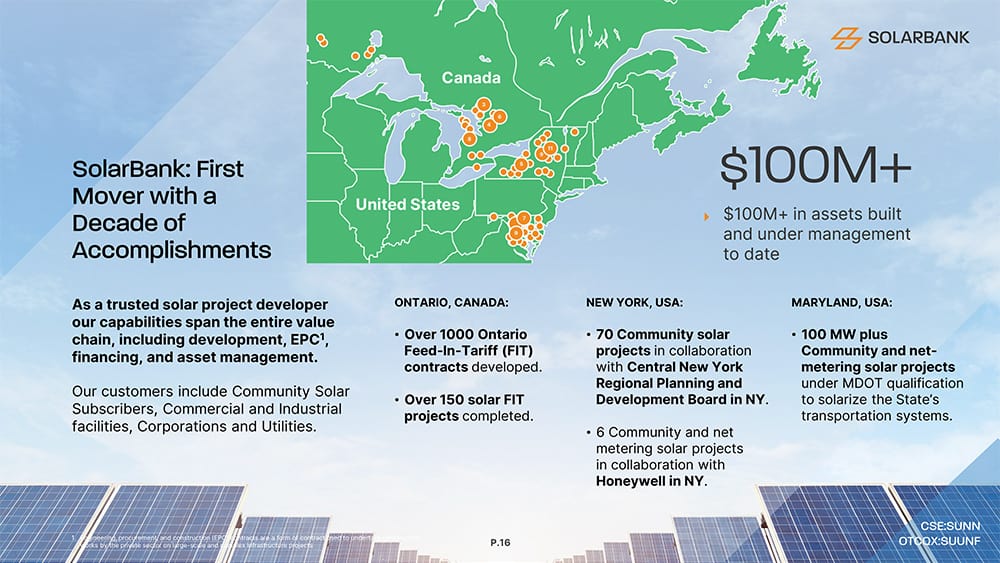

It’s hard for me to state how transformative this is. You have a company that has built large scale solar energy projects — SolarBank has built over 100 plants in North America over the last decade — with many more on the way.

Yet this technical infrastructure-focused company is also able to understand how to sell this as more than just energy transition.

It’s a way for companies to make money, reduce their carbon impact, and transform useless assets into something that brings value to their bottom line.

This forward-thinking approach helps to explain why the company has recently been awarded $36 million in EPC contracts for Ontario Battery Energy System Storage Projects.[9] This enables SolarBank to play a key role in tackling the base load challenge.

Aside from the relatively near-term opportunities available via solar, Dr. Lu revealed to me that the company is actively exploring the possibility of developing hydrogen technology, specifically electrolyzers, which could theoretically enable them to produce hydrogen cost-competitively within the next 3–5 years.

This is another great example of the long-term thinking that has helped SolarBank to thrive. It will help the company grab an early foothold in a technology expected to play an important role in our energy mix in the future, specifically for sectors that are hard to electrify like shipping or aviation.[10]

So we’ve got a company with a solid technology, the know-how to deploy it, and an eye to the future. Now we get to the point where we bring it all together. SolarBank has found a way to combine the benefits of net zero with industry-leading technology and implementation experience to produce a unique high-growth strategy that has massive potential.

The SolarBank team has built deep relationships with governments, large private sector companies, and local officials. This has enabled them to pitch for contracts that would be transformative for companies two or three times their size.

For example, in September the company was able to secure a massive contract with Honeywell International Inc (NASDAQ: HON) worth $41 million.[11]

It could be described as a business relationship and deal in the making… Honeywell International has acquired its proposed community-focused 21 MW (megawatt) solar sites under development in New York. SolarBank originated the sites in upstate New York. The project will be developed into three separate 7 MW projects.

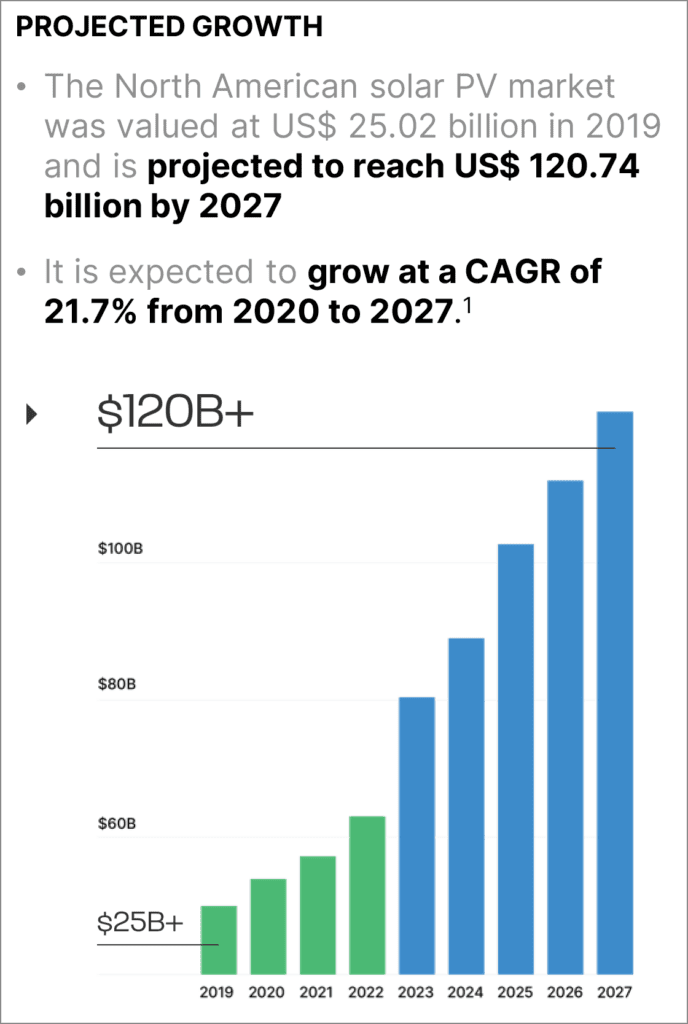

These kinds of big deals for large, environmentally conscious corporations represent a huge deal, and give SolarBank an addressable market of US$120 billion.

It needs to be mentioned that Honeywell is a +US$100 billion dollar corporation executing a deal with a junior traded company… SolarBank.

SolarBank (NASDAQ: SUUN/ Cboe: SUNN) has a lot going for it, and before I dive into where I think the company is going to go over the next few years, I’d like to take a deeper dive into the people who make the company special, beginning with their President & CEO Dr. Richard Lu.

“I’ve been a utility guy. I’ve always been interested in building a zero-carbon utility. If you look at where we are today, we’re seeing the genesis of zero-carbon utility.”

— Dr. Richard Lu, CEO & President

You always need to be careful when speaking to a CEO. It is their job to put their company in the best light possible. However, in Dr. Lu I believe that you’re dealing with someone who has a vision based on very real experience.

Dr. Lu has more than 25 years of experience developing renewable energy projects for organizations in North America, Europe, and Asia, and is an independent director for dynaCERT Inc. (TSX: DYA ), a company specializing in hydrogen applications in the transportation industry.

He was previously a Managing Director at Sky Solar Holdings Co., Ltd. His experience there gave him a very specific vision to develop a vertically integrated zero-carbon utility provider which could help companies around the globe reach net-zero emissions.

Under his leadership, SolarBank was able to grow with zero private equity until its public listing in March 2023. During that time, Dr. Lu perfected the company’s community solar model and helped the company grow from producing 13 megawatts in 2022 to 42 megawatts in 2023 — with a potential pipeline of 700 megawatts still up for grabs.

Of course, Dr. Lu is not solely responsible for the company’s success. If he was, I wouldn’t be recommending it. His company is filled with talented people, and that makes it robust.

For example, company COO Andrew Van Doorn is an industry veteran who was president and chairman of the Canadian Hydro Association back in 2003 and has successfully actioned hundreds of safe, reliable, and low cost projects across North America.

Although, perhaps the most telling example of SolarBank’s long-term approach is the company’s Chief Administrative Officer, Tracy Zheng, who Dr. Lu highlighted during our call. Tracy’s role is to determine whether new projects make business sense, and she has been responsible for some of SolarBank’s most ambitious initiatives, including the company’s EV reverse charging initiative and the ultimate form of its net-zero initiative.

So we’ve got an ambitious vision, a strong team, and proof that this team can work towards their ultimate goal with real-world results and profits. This has been demonstrated by the fact that the company has been able to double their revenue every year for the past three years and is on track to do it again this year.

That in itself should be enough to recommend SolarBank, but I’d like to take a minute to take stock of where the company is today and where they’re going.

Let’s start by looking at what they’ve achieved to this point. The company has successfully completed over 1,000 development projects with large numbers of community solar projects. These are particularly interesting because community solar is able to generate the large amounts of power needed to make a solar project viable, without many of the challenges associated with homeowner-based solar initiatives.

Over time, SolarBank has become very skilled at producing turnkey solar projects and has been able to parley this success into the second step of their expansion plan — moving into high-carbon markets across North America and offering solar projects that will allow companies and consumers to access cheaper zero-carbon energy.

In addition to these bread and butter projects, the company has implemented two other ambitious strategies. The first is a step towards full vertical integration with $36 Million in EPC contracts for Ontario Battery Energy System Storage Projects.[12] To action this, SolarBank has partnered with EVLO Energy Storage Inc. (a subsidiary of Hydro-Québec) to supply EVLOFLEX battery energy storage systems.[13]

The second is perhaps the most interesting aspect of SolarBank — helping major corporations use solar energy to demonstrably reach net-zero without relying on opaque carbon offsetting programs.

SolarBank has built deep relationships with Honeywell and has previously helped the company resolve problems with brownfield sites. As previously mentioned, this has resulted in a $41 million contract to develop 21 MWs of community solar projects for Honeywell.[14]

Dr. Lu also revealed to me that this is just the beginning, and that SolarBank has a conceptual plan that could enable Honeywell to produce the 1.2 GWs of solar energy they’d need to offset their entire carbon emissions.

This creative approach also applies to the company’s technological direction. During my chat with Dr. Lu, he revealed that the company is actively working on connecting its solar plants to bidirectional EV charging stations, and that the company is even exploring developing hydrogen power projects.

Now you understand why I am calling SolarBank a Smart Energy company.

If SolarBank is able to continue to use this strategy with other multinational corporations, and complement it with a long-term technological approach, I think it has a winning business model on its hands that goes well beyond the opportunities available in solar power alone. Happily the markets seem to share my view, given the company’s +300% stock price growth since IPO.

Alright, so the company has the experience, it has the projects, and it has been doubling its revenue every year. What about the stock?

For starters, the company is incredibly closely held. Approximately 18.5 million shares of the total issued and outstanding 27 million shares are escrowed for three years from the date of going public beginning March 2, 2023.

Why? I’ll let Dr. Lu explain...

“We didn’t go public to raise money, but to enable us to own assets.”

— Dr. Richard Lu, CEO & President

This is great news for investors who manage to get in and probably goes some way to explain how the company has been able to keep itself above its IPO levels.

So is now a good time to invest? Let's take a closer look... SolarBank seems to perform well on the back of positive news, and given SolarBank’s strong record of success so far, I believe the company still has a lot of room for growth.

What about uplisting to a senior exchange like NASDAQ?

The company's stock is already performing strongly on the Canadian junior exchange (CSE), and based on its operational results and owning a current CAD$226 million market cap, it is not out of the realm to consider an uplisting to either a senior Canadian stock exchange (TSX) or even NASDAQ in the near future. (As a reminder, the stock also trades on the highest ranked junior board found in the US, the OTCQX.)

However, even if this expectation takes longer than anticipated, I still strongly believe that SolarBank has significant room for growth, although the higher liquidity of a potential senior exchange-listed company would be very welcome to current investors.

Phew, that was a lot of information. Let’s take a minute to step back, and bring it all together. For me, SolarBank ticks all the boxes I look for when sizing up a company. It has an ambitious vision, the team and technology to follow it through, a strong record of success, and a very tight share structure with just 27 million shares outstanding that certainly doesn’t make me want to gouge my eyes out.

It’s a rare opportunity to get involved with a company that is already successful and has real plans to take it even further. Let’s recap why…

With that said, I still think you should do your own research. Take a look at the company for yourself, and decide if this opportunity is right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden may hold stock in SolarBank Corp but will not purchase securities until 10 days following publication of this article.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[2] https://www.theguardian.com/environment/2023/oct/09/climate-crisis-cost-extreme-weather-damage-study

[3] https://openknowledge.worldbank.org/entities/publication/c96ee144-4a4b-5164-ad79-74c051179eee

[4] https://gca.org/adapting-to-climate-change-could-add-7-trillion-to-the-global-economy-by-2030/

[5] https://eciu.net/analysis/briefings/climate-impacts/climate-economics-costs-and-benefits

[6]https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

[7] https://www.snexplores.org/article/green-energy-cheaper-than-fossil-fuels-climate

[8] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[9] https://ca.finance.yahoo.com/news/solarbank-awarded-36-million-epc-113000225.html

[10] https://aben.com.br/wp-content/uploads/2022/06/DNV_Hydrogen_Report_2022_Highres_single1.pdf

[11] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[12] https://ca.finance.yahoo.com/news/solarbank-awarded-36-million-epc-113000225.html

[13] https://ca.finance.yahoo.com/news/hydro-qu-bec-subsidiary-evlo-120000053.html

[14] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html