Thanks to soaring demand – from a variety of industries – a very unique profit opportunity is now developing with one of the world’s most overlooked and hidden resources.

It’s a globally scarce, mission-critical element that is absolutely essential to a number of the world’s fastest-growing, high-tech markets.

Because of the rising levels of demand for this important element, as well as its relative scarcity worldwide, bringing domestic supplies online is now more important than ever. Right now, this could become the backbone of future tech investment.

This hidden gem that I’m talking about is New Era Helium Inc. (NASDAQ: NEHC), and it offers retail investors, brokers and high-net-worth money managers high upside potential in one of the world’s most unique natural resource markets: helium.

And at this critical juncture, this company now appears to be an emerging market leader, with both significant proven and probable reserves on its vast property and key strategic partnerships in place to help drive revenue over the next 10 years.

For many people, the first thing that comes to mind when hearing the word “helium” is the gas used to fill balloons for a child’s birthday party.

But the truth is that helium is used in a number of integral & critical parts of daily life.

Take a look around the room you’re in right now.

Chances are you’ll find a smartphone... a computer... and several other electronic devices.

Now consider this: None of those devices could exist without helium.

And neither could the MRI machine at your doctor’s office… or the computing power behind massive companies like Amazon, Google and Netflix.

What most people don’t know is that helium is a critical element used in many of the world’s largest – and most important – industries.

This includes healthcare, semiconductor manufacturing, aerospace engineering, national defense and high-powered computing, including artificial intelligence (AI).

Helium plays an indispensable role in a growing number of industrial applications.

| Semiconductor Manufacturing – Helium is vital in semiconductor manufacturing due to its unique properties as an inert gas and high thermal conductor and serves various functions throughout the manufacturing process. | |

| Medical Industry – Helium is used in MRI scanners, helium-ion microscopes, laser eye surgery, cryogenics and as part of respiratory treatments. | |

| Aerospace & National Defense – Helium is used in liquid-fueled rockets and in critical processes during lift-off, including separation of hot gases and ultra-cold liquids. National defense applications include rocket engine testing, scientific balloons, surveillance crafts, air-to-air missile guidance systems, and more. | |

| Cryogenics – Liquid helium’s ability for extreme cooling allows it to act as a cryogenic agent for cooling various materials in many applications including precision welding applications, MRI machines and lab use | |

| Internet Connectivity – Fiber-optic cables must be manufactured in a pure helium environment. |

Helium is vital for cooling and operating technology, such as MRI scanners, fusion reactors, quantum computers… and for heat dissipation in semiconductor manufacturing.

In fact, the international helium market is projected to be worth as much as $7 billion annually.[1]

And because of its many critical uses, a scarcity and geopolitical instability-driven scenario is now unfolding in the helium sector… and as a result, little-known New Era Helium Inc. appears poised to thrive.

— MIT Technology Review, February 2024

The AI-driven surge in demand for computing power has proven to be a game changer for the chip manufacturing industry, and the need for helium is at the forefront of this boom.

Simply put, the rise of AI is proving to be one of the most revolutionary technological advances in history. And the increase in demand for AI processing power means there is now a greater need for chip manufacturing. Those chips cannot be manufactured without helium.

And this surge in demand shows no signs of slowing down.

Just take a look at how investors have flocked to AI powerhouse NVIDIA Inc. (NASDAQ: NVDA), which has not only seen a massive spike in its share price but has also become a giant $3.1 trillion market cap company…

It has now become the largest holding in the average retail investor’s portfolio.

Investment research firm Vanda Research collected data on the 15 most widely held stocks and ETFs in the average retail portfolio, and NVIDIA came out on top at an astounding 9.3% of the average retail portfolio.[5]

In other words, more investors own NVIDIA (NASDAQ: NVDA) than own popular tickers like Apple (NASDAQ: AAPL), SPDR S&P 500 ETF Trust (NYSE: SPY), Tesla (NASDAQ: TSLA), Invesco QQQ Trust (NASDAQ: QQQ) and META (NASDAQ: META).

There’s absolutely no way NVIDIA could fire on all cylinders and grow to the enormous market position it’s now achieved without a reliable source of quality helium.

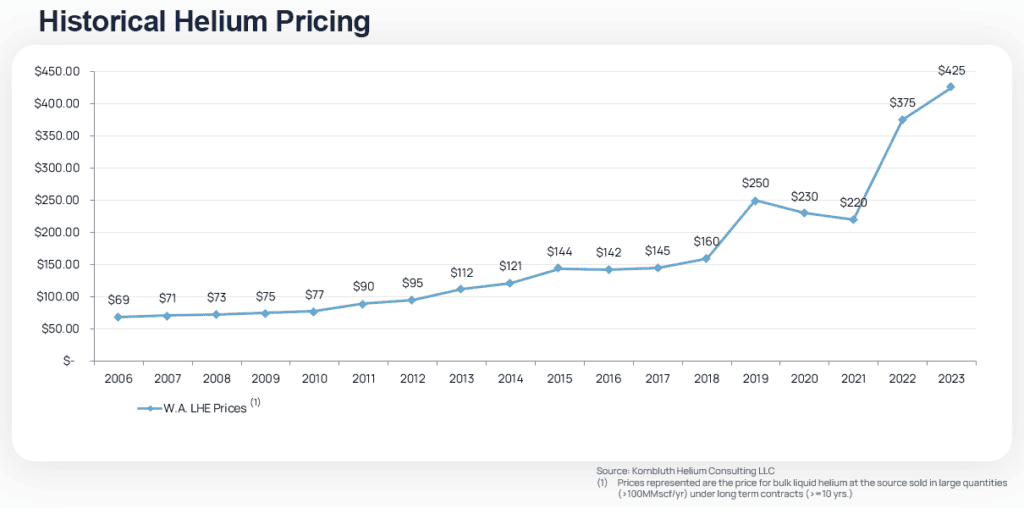

The surge in demand for helium, naturally, coupled with Helium Shortage 4.0, has helped drive higher prices for the resource in recent years.[6]

And with the world’s helium supply dependent on just 6 countries – the US, Qatar, Russia, Canada, Poland, and Algeria – the helium market is particularly sensitive to disruptions.

In fact, helium has now been included on the critical minerals list of major economies such as the United States, Canada, the European Union and mainland China because it is at high risk of supply shortages.

Recently, the European Union announced its latest sanctions package against Russia, with the primary focus of the sanctions reported as the banning of imports of Russian helium and liquefied natural gas.[8]

All of this is likely to put an even further strain on helium supply worldwide… and it makes establishing new sources of helium here in North America – as soon as possible – vitally important.

This combination of unprecedented demand levels for helium and the push to develop new domestic supplies is what has helped trigger such a compelling, high-potential-upside scenario for New Era Helium Inc. (NASDAQ: NEHC).

Now that you know more about the importance of helium as a critical element and the enormous vulnerability this commodity endures, let me tell you more about the company that is rapidly emerging as potentially the best way to play this proven helium reserve scenario.

New Era Helium Inc. (NASDAQ: NEHC) is rapidly emerging as a market leader in the helium space thanks to its existing operations within the Pecos Slope Field. The Pecos Slope Field is located in the Northwest Corner of the Permian Basin in New Mexico.

New Era Helium Inc. currently owns and operates over 400 wells on 137,000 gross acres of leasehold with more than 1.526 billion cubic feet (BCF) of proven and probable gross helium reserves. The company has secured long-term offtake (revenue) agreements with two major international helium buyers that represent an estimated $113 million of helium revenue over the life of the contracts.

These are two important differentiators for the company.

First, New Era Helium Inc.’s more than 1.526 BCF of proven and probable gross helium reserves means that it owns proven and probable reserves – validated by an independent third-party – is worth an estimated undiscounted value of $337 million with an associated PV10 of $69 million. And, as I’ll explain further below, the company could only be at the beginning stages of proving out more helium on its property.

It’s a company entering the early stages of production with approximately 1.526 BCF of proved and probable recoverable helium gross reserves.

And second, the company has already established two 10-year take or pay helium contracts with major international helium buyers that are valued at an estimated $113 million over the life of the two contracts. Please note this dollar amount does not take into account any revenues associated with the company’s natural gas and NGL revenue stream once the Company’s newly manufactured Pecos Slope Gas Plant is online.

An important thing to keep in mind about the helium market is that it is extremely “opaque,” as helium is not publicly traded like other commodities such as oil, wheat or coffee.

Instead, the commodity is traded with volume/price agreements that are negotiated privately. There is no publicly available spot price for helium.

Additionally, the helium industry is an “oligopoly” led by 5 large, multinational industrial gas companies.

This industry structure means that long-term offtake agreements can bring welcome security to exploration and production companies such as New Era Helium.

In the case of New Era Helium Inc., the company’s long-term offtake (revenue) agreements include contractual floor prices that help mitigate the potential risk that could come with an unlikely future oversupply in the helium market.

So, again, when compared with other companies in the helium supply space, New Era Helium Inc. (NASDAQ: NEHC) appears to stand head and shoulders above its closest competitors as it focuses on exploitation and not exploration.

Investors looking for an opportunity to get in early with what already appears to be a meaningful player in this rapidly growing, $7 billion-a-year helium market should strongly consider what is now unfolding with New Era Helium Inc.

The company’s status as a producer – with existing take or pay contracts in place – is thanks in large part to the outstanding location of its property and its existing proven and probable reserves.

The Pecos Slope Field is located in Southeastern New Mexico in the resource-rich Permian Basin.

The Permian Basin has proven to be a significant energy source for the US over the past few decades.

It is among the most important energy-producing regions in the world, as it accounts for nearly 40% of all oil production in the US and nearly 15% of the nation’s natural gas production.

The oil field contributes a staggering ~$153 billion to the economy each year and provides jobs for nearly 700,000 people.

Over time, the region has continued to reinvent itself through additional discoveries, and this includes the listing of helium as one of its many relevant products it provides to the world.

New Era Helium’s Pecos Slope Field is the only field in the Permian Basin that has commercial helium concentration levels that has been independently verified.[9]

Since its discovery by Yates Petroleum in 1977, Pecos Slope has yielded almost 600 Bcf of natural gas while also producing and selling helium since 2017.

New Era Helium’s leasehold and operations cover 137,000 acres in the Permian Basin and has over 1.526 billion cubic feet of proven and probable gross helium reserves per its 3rd party SEC reserve report dated 12/31/23.[10]

There are more than 400 operated producing wells on the property, and the company has an average working interest of approximately 93%.

These wells are producing helium with natural gas and natural gas liquid (NGL’s) as a byproduct.

The company’s sizeable helium reserves at the Pecos Slope Field are conveniently located…

Additionally, the Permian’s status as one of the world’s most significant sources of energy means there are many companies nearby that could offer potential partnership or collaboration opportunities for New Era Helium Inc. (NASDAQ: NEHC) in the months ahead.

With more than 1.526 billion cubic feet of proven and probable gross helium reserves on its property, New Era Helium Inc. is now moving quickly on a number of fronts.

First, the company is continuing its exploitation strategy to expand its Pecos Slope reserves.

As mentioned earlier, its Pecos Slope Field has produced nearly 600 billion cubic feet of natural gas since 1977, and the company believes greater potential is ahead. To that end, there are more than 540 proved and probable locations on the property it can drill to help expand and update its helium reserves.

To date, New Era Helium’s proven + probable reserve development scenario calls for drilling of 540 wells with the full development of 75,840 acres (55.36%) of its total 137,000 gross acre leasehold.

That leaves an additional 61,160 acres (44.64%) that has yet to be developed.

The 2P Development Plan for proved & probable reserves that have been identified by NEH paints a very a positive picture of 44.64% of the NEH leasehold yet to be developed at the end of the 2P Development, with ABO reservoir upside future development essentially equal to the reserves contained in the NEHC 12/31/2023 YE Reserve Report for the Pecos Slope ABO Field.

You can find a sweet spot in this space by conducting your own research now. Download the New Era Helium Investor Presentation below.

Yes! Send me my FREE |

The company’s goal as an emerging player in the helium space is to, at minimum, secure at least 1%–2% of the North American helium market and position itself as a key player in the aggregation of existing helium production across North America.

In addition, as part of this goal, New Era Helium Inc. began construction on its Pecos Slope natural gas and helium processing plant in July 2023.

Construction of this plant is approximately 30% complete with $3.7MM spent thus far. The anticipated completion of the Pecos Slope Plant is sometime in Q2 2025.

Once operational, this plant is capable of processing up to 20 million standard cubic feet per day of inlet gas, producing an outstanding amount of approximately 36 million cubic feet of helium per year.

The plant will also be capable of producing 477,000 MCF of pipeline spec methane and 32,545 BBLs per month of natural gas liquids.

As a broader goal, New Era Helium Inc. (NASDAQ: NEHC) is working to become a US platform for growth and consolidation in the hopes of bringing together a fragmented industry and realize greater efficiencies.

So what type of potential exists for those considering an investment in New Era Helium Inc.?

Let’s take a look at what has happened with other companies in the helium exploration space, as there is absolutely no question there is strong excitement in the space.

Take a look at what happened with Pulsar Helium Inc. (TSX-V: PLSR), an $83 million market cap company trading on the Canadian TSX Venture Exchange.

Investors saw a parabolic rise in share price as the company made news with its helium exploration triggering the stock moving from $0.22 in December 2023 to $1.38 by March 2024.[12]

That’s a staggering +527.27% gain in just three months!

And one of the more recent compelling stories in the sector is with Helix Exploration...

Helix Exploration (LSE: HEX) is a helium exploration company that has only 15,000 acres of property in Montana – and no proven helium reserves.

But the market was so excited about the potential for US domestic helium production that the company’s shares have more than doubled since its initial raise of nearly $9.5 million and its IPO on the London Stock Exchange (LSE: HEX) in April 2024.[12]

That type of heated growth is certainly representative of the market’s potential demand for helium stocks.

Yet compare that opportunity with a company like New Era Helium Inc. (NASDAQ: NEHC).

With any resource venture, success is often heavily dependent on the strength of the company’s leadership team.

In the case of New Era Helium Inc. (NASDAQ: NEHC), the company has the benefit of

an experienced executive team, as well as board of directors, both with decades of impressive success in both the helium and natural resource space.

This highly experienced team includes…

E. Will Gray II

Co-Founder, CEO & Director: 19 Years of Experience

Mr. Gray is a founding partner and current Chief Executive Officer of New Era Helium. He has extensive C-Level experience in Oil & Gas, including as Executive Vice President of Resaca Exploitation (a Torch portfolio company), Chairman and Chief Executive Officer of Cross Border Resources, Chief Executive Officer of Dala Petroleum, and President of WS Oil and Gas. Since 2005, Mr. Gray has directly operated 950+ wells located in New Mexico, Texas, and Oklahoma.

Michael J. Rugen

Chief Financial Officer: 40 Years of Experience

Mr. Rugen, CPA, has 40 years of experience in executive positions in finance, primarily in E&P and oilfield services companies. Mr. Rugen was previously CFO of Riley Exploration Permian, Inc., a NYSE American-listed Permian Basin oil and gas company and was CFO/Interim CEO of Tengasco, Inc., its predecessor.

New Era Helium’s experienced, proven leadership team – with expertise in both helium and conventional gas development – positions the company for long-term success.

Future-proof your portfolio. Continue reading to discover the 7 Powerful Forces driving this amazing and unique investment opportunity.

1

2

3

4

5

6

7

Today, New Era Helium Inc. trades at what could be a fraction of its near-future value. Investors who secure a position in New Era Helium shares today (NASDAQ: NEHC) could be locking in an investment opportunity of a lifetime.

Now is the time to get started.

Yours for Prosperity,

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: MF Wiliams will not purchase New Era Helium Inc. securities until 10 days following publication of this article. MF Williams has been paid $2,500 to endorse this article.

SPONSORED ARTICLE DISCLAIMER: Investing in any securities is highly speculative and involves a high degree of risk. This article must be read in conjunction with the Registration Statement on Form S-4 of Roth CH V Holdings, Inc., filed with the Securities & Exchange Commission under No. 333-280591 available here, which contains risk factors and other important information about New Era Helium and the helium industry. This document does not constitute an offer to buy or the solicitation of an offer to buy any securities and does not constitute an agreement or obligation on the part of any person to purchase or sell any securities of the Company. Read our full disclaimer here.

Sources:

[1] Kornbluth Helium Consulting, LLC (slide 13 of deck)

[2] https://www.technologyreview.com/2024/02/25/1088930/global-helium-market-semiconductors/

[3] https://www.mordorintelligence.com/industry-reports/helium-market

[4] Kornbluth Helium Consulting, LLC (slide 13 of deck)

[5] https://www.morningstar.com/news/marketwatch/20240523343/nvidia-beats-apple-and-tesla-to-become-the-largest-holding-in-average-retail-portfolio

[6] https://www.innovationnewsnetwork.com/helium-shortage-4-0-what-caused-it-and-when-will-it-end/29255/

[7] https://www.technologyreview.com/2024/02/25/1088930/global-helium-market-semiconductors/

[8] https://neighbourhood-enlargement.ec.europa.eu/news/eu-adopts-14th-package-sanctions-against-russia-its-continued-illegal-war-against-ukraine-2024-06-24_en

[8] NEH SEC Reserve Report (Link to be determined)

[9] https://www.globenewswire.com/news-release/2023/07/13/2704497/0/en/Introducing-Permian-Basin-Based-New-Era-Helium-Corp.html

[10] https://www.globenewswire.com/news-release/2023/07/13/2704497/0/en/Introducing-Permian-Basin-Based-New-Era-Helium-Corp.html, https://www.usgs.gov/news/national-news-release/usgs-estimates-306-billion-cubic-feet-recoverable-helium-united-states

[11] PLSR.V shares traded at $0.22 on 12/4/23 and reached a high of $1.38 on 3/4/24

[12] PLSR.V shares traded at $0.22 on 12/4/23 and reached a high of $1.38 on 3/4/24 , https://www.innovationnewsnetwork.com/helix-exploration-plc-climbs-aim-stock-exchange/46183/

[13] https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/09/fact-sheet-chips-and-science-act-will-lower-costs-create-jobs-strengthen-supply-chains-and-counter-china/

[14] https://www.verifiedmarketresearch.com/product/us-and-canada-helium-gas-market/

95% of the world’s helium production is associated with the production of natural gas.

Helium is a non-renewable noble gas primarily obtained through the extraction and processing of natural gas reservoirs, where it is a byproduct.