In Netflix’s latest letter to its shareholders released on January 17, 2019, the company named Fortnite — a video game that was released less than 2 years ago — as a major competitor to its business.

What makes a single video game so influential that it can compete with a corporation that has a market cap of over $140 billion?

Video games — both watching and playing them — are now seen as a legitimate form of entertainment, on par with legacy content like television and movies.

The success of Fortnite, which was developed by Epic Games, is exemplary of the booming business of video games, a sector that brought in revenues estimated at $137.9 billion in 2018.[1]

As a forward-thinking investor, it is important to be familiar with esports. “Esports” or “egaming” is a genre within the video gaming industry, and refers to professional video gaming. This usually takes the form of a tournament or a league, and includes a range of games that are played on several different platforms.

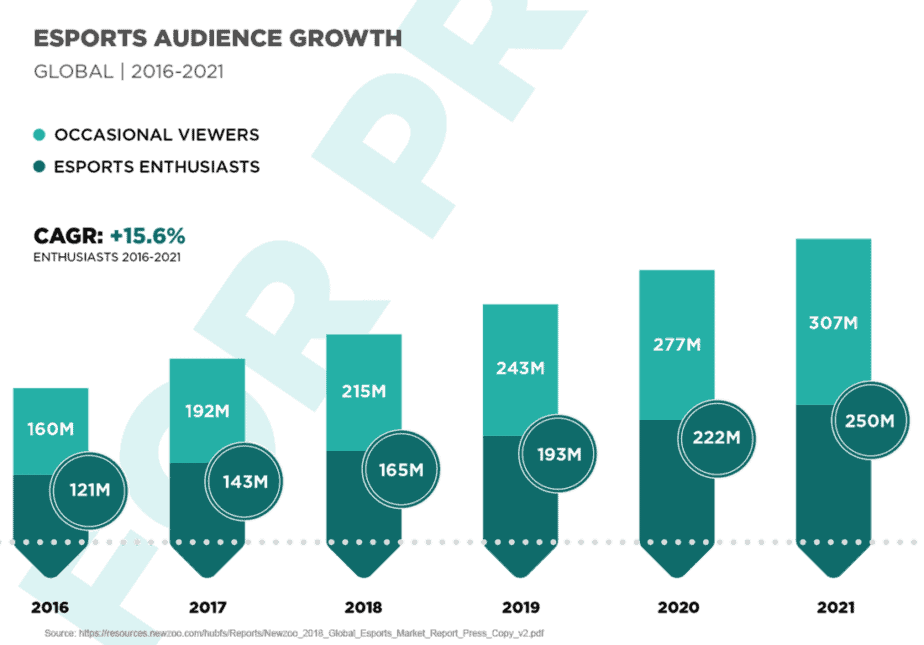

This may seem like a niche activity, but its scope and influence are massive, highlighted by the following numbers:

If you are considering investing in the space, it is useful to know the popular games. Each of these games has a distinct culture as they hold their own tournaments, have their own celebrities and possess unique jargon.

Esports is dominated by MOBAs which stands for “multiplayer online battle arena games,” which pits two teams against each other in a large-scale competition. Some of the most well-known are: StarCraft, Warcraft III, League of Legends and Dota 2. Another notable genre is “first-person shooter” (FPS) with titles that include Call of Duty and Overwatch.

Fortnite has two different modes, “Save the World” and “Battle Royale,” the latter being the most popular, as it is free to play and up to 100 players can participate at once. As its name suggests, it is part of the “battle royale” genre, meaning it is a last person standing, multiplayer game.

Fornite is played by 200 million people, making it the most popular video game in the world.[6] It is also the most watched game on Twitch (the number one streaming service in the world).[7]

It occupies a unique position because unlike most of the prominent titles, it does not have an established esports scene. However, it is designed to be fun to watch, consisting of bright colours and a constantly updated landscape — meaning that there is always something new to explore.[8] It becomes a social activity — you can play it with your friends and share your best game clips online.

These titles have vibrant online communities built up around them, as fans personally identify with their favorite games. The social aspects around video games makes managing and supporting their fan bases crucial to a game's continued success.

Enthusiast Gaming Holdings Inc. (TSX.V: EGLX, OTC: EGHIF) focuses specifically on this aspect of the industry. They develop and operate online video gaming communities, hosting over 80 websites and the largest live egaming expo in Canada.

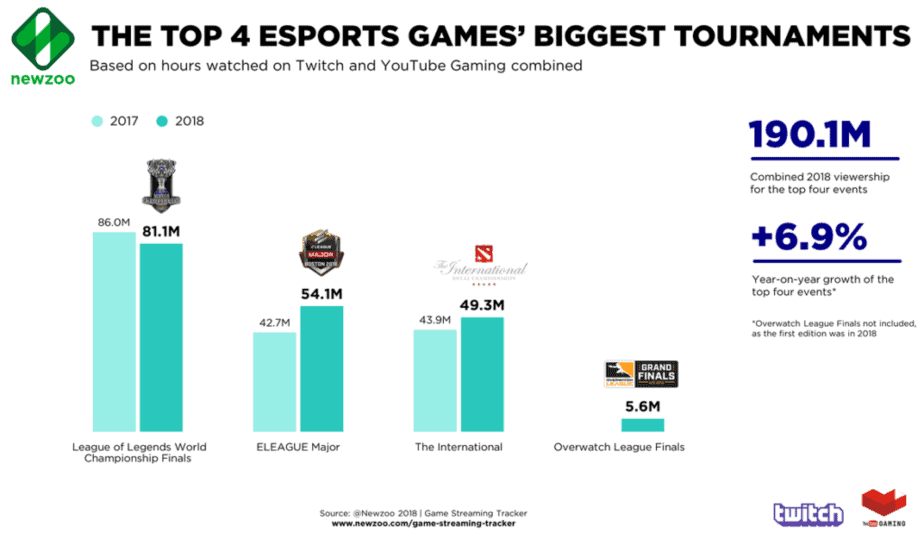

The viewing numbers at the largest esports tournaments underscore the tremendous interest in watching video games, not just playing them. Viewing your favorite game becomes a communal experience, something you can do with friends and/or millions around the world.

The 2018 League of Legends World Championship was viewed by 81.1 million people. For reference, the deciding game of the 2018 World Series was watched by 17.6 million people and the average viewership of the NBA finals was 17.4 million.

These monumental audience figures are matched by the amount of prize money that is up for grabs. In 2018, Dota 2’s The International tournament awarded a total of $25.5 million in prize money — that is just for one tournament (and is over twice as big as the total purse of the 2018 Masters golf tournament).[9]

On the back of its incredible success, Fortnite has recently begun to establish an esports ecosystem of its own. In June 2018, 3,000 attendees and (more than a million viewers online) watched the Fortnite Pro-Am tournament, which consisted of 50 2-person teams, comprised of a professional gamer and a celebrity.

In an attempt to create a larger footprint in esports, Epic Games announced they will provide $100 million to fund prize pools for a tournament they are calling the “Fortnite World Cup” in 2019.

The profitability of esports leagues and tournaments holds so much upside that, in the summer of 2017, Riot Games began selling League of Legends franchises for $10 million; and Activision Blizzard (NASDAQ: ATVI) started offering Overwatch League franchises for $20 million.[10] These prices speak to the revenue growth opportunities in egaming. Several sports teams, including the New York Yankees, have bought in.

With tremendous crossover viewership and promotion potential, it is no surprise that sports teams and leagues have jumped on the opportunity to be a part of esports.

Major League Soccer (MLS) announced in January of 2018 that they partnered with EA Sports (NASDAQ: EA) to create the eMLs, based around EA’s Fifa 18 game. They also recently revealed that they would be adding 3 new teams for their 2019 season.

Following suit, in May 2018, the NBA launched the NBA 2K League with Take-Two Interactive (NASDAQ: TTWO), where all the games are streamed on Twitch.

Television networks are also taking note. Disney (NYSE: DIS), in partnership with Activision Blizzard, broadcast the Overwatch League Grand Finals on ESPN in July 2018. This was the first time an esports competition aired on a premier sports station in North America.[11]

Although large sports channels are incorporating egaming into their schedule, viewing primarily takes place online.

Gaming was largely amateur up to the late 2000s, until live streaming sites emerged, made possible due to improvements in broadband networks and more computational power in PCs and mobile phones. Thus, the largest factor in the exponential growth of egaming has been the rise of these platforms — including Panda.tv, YouTube Gaming, MLG.tv, Smashcast.tv, and Twitch, which is by far the most popular.

Twitch was launched in 2011 and was acquired by Amazon (NASDAQ: AMZN) in 2014 for almost a billion dollars. It has over 15 million unique daily visitors, who each spend about 95 minutes each day watching live gaming.[12]

At any given time, roughly 962,000 are viewing a Twitch stream, which is comparable to (or even surpasses) the typical audiences that tune in nightly to CNN, MSNBC and ESPN.[13]

The proliferation of streaming sites has also allowed gamers to build their own brands, creating gaming-specific superstars. The biggest gaming celebrity in North America is Tyler “Ninja” Blevins, who makes an estimated half million dollars every month streaming himself playing Fortnite on Twitch.

WATCH VIDEO: Meet Tyler "Ninja" Blevins

With most of the viewing taking place on streaming platforms, it may be surprising to learn that there is incredible demand to watch matches in-person — which again, speaks to the social aspect of esports.

The 2017 League of Legends World Championships was held at the 80,000-person capacity Beijing National Stadium — and tickets sold out in less than a minute.[14] The International in 2018 took place over 6 days at Rogers Arena in Vancouver, with a capacity crowd (approximately 18,000) paying $280 for a ticket to attend the finals, hosted on the last two days of the competition. [15]

Considering how audiences engage with esports, traditional entertainment is adjusting their strategy as they look to keep up with audience interests.

The largest movie theatre chain in Canada, Cineplex Inc. (Toronto: CGX) has shifted its content model. It acquired World Gaming in 2015, which now has a competitive league. To attract egaming audiences into its venues, it also hosts exclusive events and live-streams tournaments.

The Luxor Hotel, located on the Las Vegas strip and owned by MGM (NYSE: MGM), installed an egaming arena, the HyperX Esports Arena, in March of 2018. It looks like a typical sports arena, but includes production studios and gaming stations.

Gaming specific stadiums will only become more proliferous, exemplified by the 100,000-square-foot esports stadium that opened in November in Arlington, Texas. Esports Stadium Arlington is currently the largest dedicated esports facility in North America.

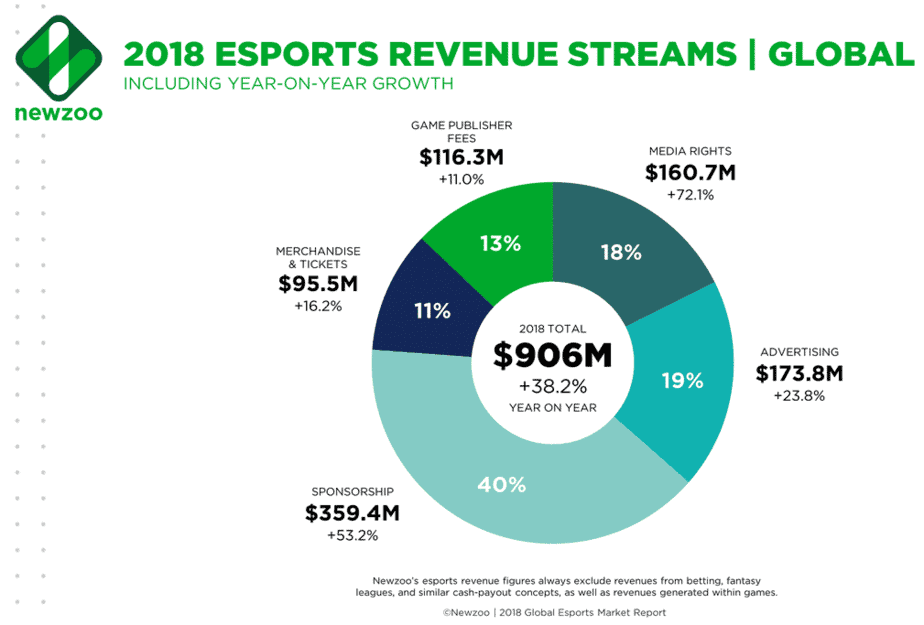

There is tremendous money to be made in all facets of the industry but Newzoo, a research analytics firm specializing in gaming and esports, reports that sponsorship is the biggest moneymaker, accounting for almost 40% of esports’ total revenue.

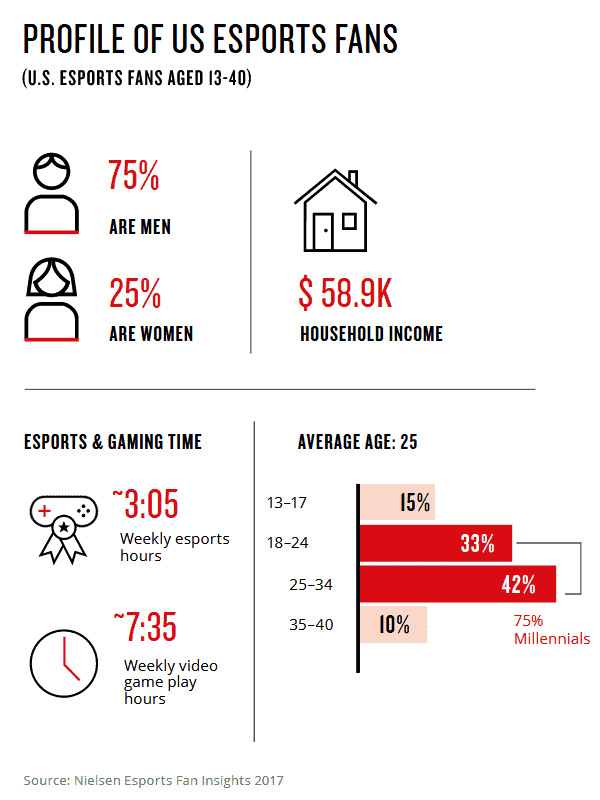

This points to how lucrative egaming demographics are for marketers: 75% of esports fans are men and 75% are millennials (ages 18-34), with an average household income of almost $60,000.[16] This group is somewhat difficult to access through traditional content mediums like television, so companies are jumping at the chance to reach them through alternative means.

Large scale consumer brands like Coke, Red Bull, Monster Energy and Mountain Dew, as well as electronic companies like Intel and Benq, are all involved in sponsoring tournaments and individual gamers.

Mastercard also recently announced a multi-year sponsorship of League of Legends that includes global tournaments. Doritos, Acer, L’Oréal, Gillette and Adidas sponsor regional League of Legends tournaments as well.[17]

The scale of egaming continues to grow. With this massive expansion comes critical infrastructure considerations — one’s experience with a game is only as good as their internet connection, their quality of equipment and the data center where the game is connected.

It is predicted that gaming will be at the forefront of 5G improvements, as this technology enables quicker loading times, lower latency, and boosts streaming connections. Gaming companies will also look to increase data center capabilities to support the enormous number of people playing and streaming their games. [18]

Graphics processing units (GPUs) will become another product that continues to grow in demand.. [19]

They are used in the PCs and consoles that support top gaming performance. 86% of competitive gamers use GPUs from NVIDIA (NASDAQ: NVDA), and Forbes reports that the company is “the official hardware provider for almost every major esports league in the world.”[20]

Major tech corporations are looking to make their mark on the industry as well. Verizon (NYSE: VZ) is testing a streaming service that they plan to be the “Netflix for video games,” which may be released in combination with their 5G rollouts. [21]

Amazon and Microsoft (NASDAQ: MSFT) have also revealed they are working on similar services, and some expect Tencent Holdings Limited (OTC: TCTZF) announcement of a comparable offering to be coming soon.[22] These developments will put massive constraints on telecom networks making advanced infrastructure even more imperative in the coming years.

The deployment of 5G networks, specialty hardware and large-scale telecom infrastructure upgrades will be pushed by gaming, but there are other trends that the industry has also spearheaded. Because esports is a digitally native activity, it has become a space where emerging technology is first deployed.

Both augmented reality (AR) and virtual reality (VR) will continue to grow in popularity in the gaming sector. The possibilities of AR were highlighted by the success of Pokémon Go; and Dota 2 was updated in 2016 so matches could be watched with VR headsets.

It will be interesting to see how these technologies are incorporated into live events as well, which supports community building and promoting sponsoring brands.

YDX Innovations (TSX.V: YDX.V, OTC: YDRMF) specializes in creating AR and VR experiences for large brands like Coke and Nike, and recently announced their creation of Game On Festival. It will include an esports competition, incorporate VR gaming arenas and an interactive exhibition about the history of video games, among other immersive experiences.

The integration of VR and AR into video games and live events provides a testing ground for this technology, as companies figure out how these innovative applications can best be consumed for entertainment purposes and support audience engagement.

Egaming has also demonstrated use cases for virtual currencies. In June 2017, Unikrn, an esports betting platform, created a gambling token called UnikoinGold, a cryptocurrency running on the Ethereum blockchain.

The blockchain technology that underlies the cryptocurrency allows the company to have an advanced tracking system, as well as to carry out extensive due diligence on its users and create loyalty programs.

This is just one example of how crypto technology has been deployed. There is an entire sector of “blockchain games” including Decentraland and Crypto Kitties, where games are built via the blockchain, offering unique security and economic benefits to users.

Esports growth in popularity occurred largely outside of major media outlets, which demonstrates how new technology can create incredibly influential and lucrative communities while bypassing mainstream outlets. Now, the tipping point has come, as esports is comprised of an ever-expanding fan base.

The audience numbers, tournament attendance, sponsorships and technological innovations speak for themselves — egaming is set for massive growth and is an industry that must be watched closely if you want to stay up to date with the investor trends in technology and entertainment.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] Nadia Tuffaha, “Future of Gaming: 5 Tips to Keep Your Gamers Connected,” Digital Realty, November 26, 2018, https://www.digitalrealty.com/blog/future-of-gaming-5-tips-to-keep-your-gamers-connected.

[2] “esports market revenue worldwide from 2012 to 2021,” Statista, February 2018, https://www.statista.com/statistics/490522/global-esports-market-revenue/.

[3] “2018 Global Esports Market Report,” NewZoo, 2018, https://resources.newzoo.com/hubfs/Reports/Newzoo_2018_Global_Esports_Market_Report_Press_Copy_v2.pdf.

[4] Kevin Tran, “Why the esports audience is set to surge – and how brands can take advantage of increased fans and viewership,” Business Insider, November 8, 2018, https://www.businessinsider.com/the-esports-audience-report-2018-11.

[5] Jurre Pannekeet, “Esports, a Franchise Perspective”, NewZoo May 11, 2017 https://newzoo.com/insights/articles/esports-franchises-70-watch-only-one-game-and-42-dont-play/.

[6] Christopher Palmeri, “Fortnite Now Has 200 Million Players, Up 60% from the Last Count,” Bloomberg, November 26, 2018, https://www.bloomberg.com/news/articles/2018-11-26/fortnite-now-has-200-million-players-up-60-from-the-last-count.

[7] “The Most Watched Games on Twitch,” Twitch Metrics, January 2019, https://www.twitchmetrics.net/games/viewership.

[8] Brian Feldman, “The Most Important Video Game on the Planet,” New York Magazine, January 11, 2018, https://medium.com/new-york-magazine/the-most-important-video-game-on-the-planet-c26988a8f497.

[9] “The International 2018,” Dota 2 Prize Pool Tracker, December 2018, http://dota2.prizetrac.kr/international2018.

[10] Mike Ozanian and Christina Settimi, “The World’s Most Valuable Esports Companies, Forbes,” October 23, 2018, https://www.forbes.com/sites/mikeozanian/2018/10/23/the-worlds-most-valuable-esports-companies-1/#2a9c6ff86a6e.

[11] Daniel Roberts, “ESPN says Esports is not a fad,” Yahoo Finance, August 22, 2018, https://finance.yahoo.com/news/espn-says-esports-not-fad-124537864.html.

[12] “Audience,” Twitch Advertising, 2018, https://twitchadvertising.tv/audience/

[13] Joshua Fruhlinger, “Fortnite was the most-streamed and watched game of April,” Thinknum, April 2018, https://media.thinknum.com/articles/heres-how-many-people-were-watching-other-people-play-fortnite-in-march/

[14] Trent Murray, “Overwatch League Finals Sell Out in Two Weeks,” Esports Observer, June 1, 2018 https://esportsobserver.com/overwatch-league-finals-sold-out/

[15] Nick Eagland, “Wish they’d do this every year: The International Dota 2 Championship a boost for Vancouver tourism,” The Vancouver Sun, August 24, 2018 https://vancouversun.com/news/local-news/i-kind-of-wish-theyd-do-this-every-year-the-international-dota-2-championship-a-boost-for-vancouver-tourism

[16] “Games 360 U.S. Report,” 2018, Nielsen Games, https://www.nielsen.com/content/dam/corporate/us/en/reports-downloads/2018-reports/games-360-2018.pdf.

[17] Mathew Chapman, “Mastercard Signs Up as First Global Sponsor of League of Legends Esport,” Campaign, September 19, 2018, https://www.campaignlive.co.uk/article/mastercard-signs-first-global-sponsor-league-legends-esport/1493212.

[18] “Data Center Demand Drivers: Gaming,” Datacenter Hawk, October 2, 2016, https://www.datacenterhawk.com/blog/data-center-demand-drivers-gaming.

[19] Stephen McBride, “Esports Are Exploding: Here Are The 3 Best Stocks To Profit,” Forbes, September 13, 2018, https://www.forbes.com/sites/stephenmcbride1/2018/09/13/esports-are-exploding-here-are-the-3-best-stocks-to-profit/#5c0371ae4e7b.

[20] Stephen McBride, “Esports Are Exploding: Here Are The 3 Best Stocks To Profit,” Forbes, September 13, 2018, https://www.forbes.com/sites/stephenmcbride1/2018/09/13/esports-are-exploding-here-are-the-3-best-stocks-to-profit/#5c0371ae4e7b.

[21] Aaron Mamiit, “Verizon Video Game streaming Service Leaker, Currently Testing on Nvidia Shield,” Digital Trends, January 13, 2019, https://www.digitaltrends.com/gaming/verizon-cloud-gaming-service-leaked/.

[22] Michael K. Spencer, “The Netflix of Games is Coming, Medium,” January 16, 2019, https://medium.com/futuresin/the-netflix-of-games-is-coming-f9a6b00fff62.