The first question you have to ask about electric vehicles (EV) is simple.

Is it for real or just hype?

I have been an EV skeptic for a long time but a deep dive throughout the last year has convinced me that the industry is on a growth path that is very likely to accelerate.

Why?

The most important reason is China.

Electric vehicles are a winning proposition for China because they help solve two big problems. China’s air pollution problem in its severely congested cities is one. The other is a platform to generate significant jobs and help the country capture the commanding heights of the global economy – the key goal of its China 2025 strategic plan.

EVs represent a huge market to take advantage of economies of scale for 1.4 billion consumers, and will create a blend of employment and technology that will drive economic growth for decades to come.

Daimler will begin making electric cars in China in 2019.

There is a reason beyond China’s market potential for automakers like Daimler to come to China – it is the source for many of the materials that go into EV batteries and motors such as rare earths and rare metals.

More on this issue in a moment but first let’s look at the rapidly advancing landscape of electric vehicles and the breakthroughs making EVs more efficient, inexpensive and practical.

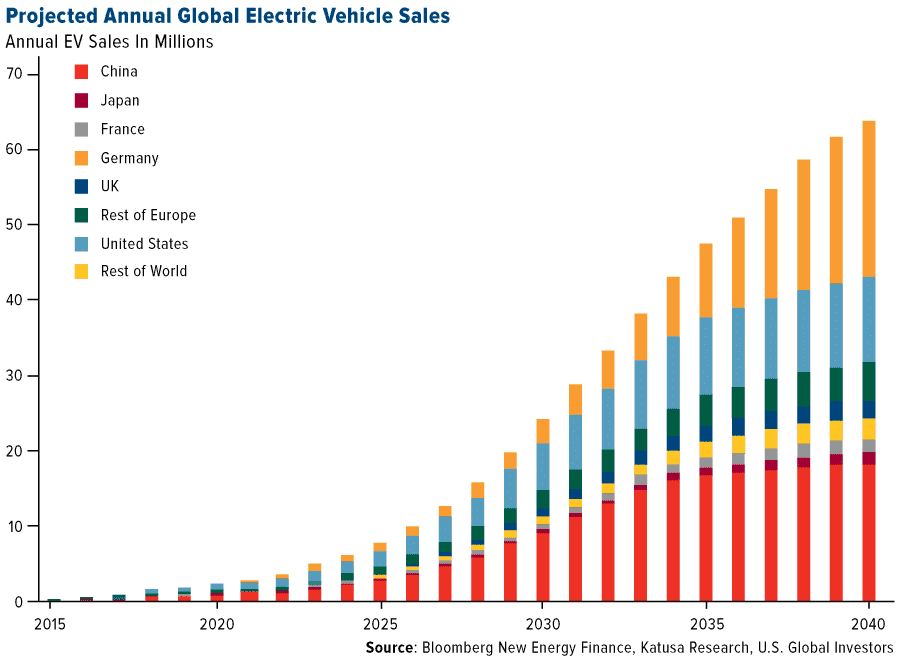

While almost every expert predicts China will be the dominant market for electric vehicles, the momentum is building across the world.

The (above) Rivian electric drive platform delivers remarkable power and torque through four independent motors – with 200 horsepower available at each wheel.

What all this evidence points to is that we are approaching a takeoff point for sharp growth for EV markets.

The stakes are high – the current global auto business generates $2.5 trillion of sales each year.

The world’s automakers are in the beginning stages of a massive transition to electric vehicles and, while the build up often takes more time than expected, the takeoff is oftentimes explosive.

Things take longer to happen than you think they will, and then they happen faster than you thought they could.

— Economist Rudi Dornbusch

You have probably read and heard a lot about lithium and cobalt over the past year. They do play a key role in the production of electric vehicle batteries. Investors jumped on this story in 2018 sending cobalt and lithium stocks soaring.

But in the last quarter of 2018, cobalt stocks came back to earth as cobalt prices fell from $40 a pound to $25 a pound.

But stay tuned for new EV battery investment ideas as ongoing and intensive research is searching for the next generation of electric car batteries.

All across the globe from America to Japan to China to Germany the race is on.

GM, Ford, Toyota, and BMW all know that the key to the electric vehicle (EV) story really taking off is a battery with much shorter recharging times and much longer range from one charge.

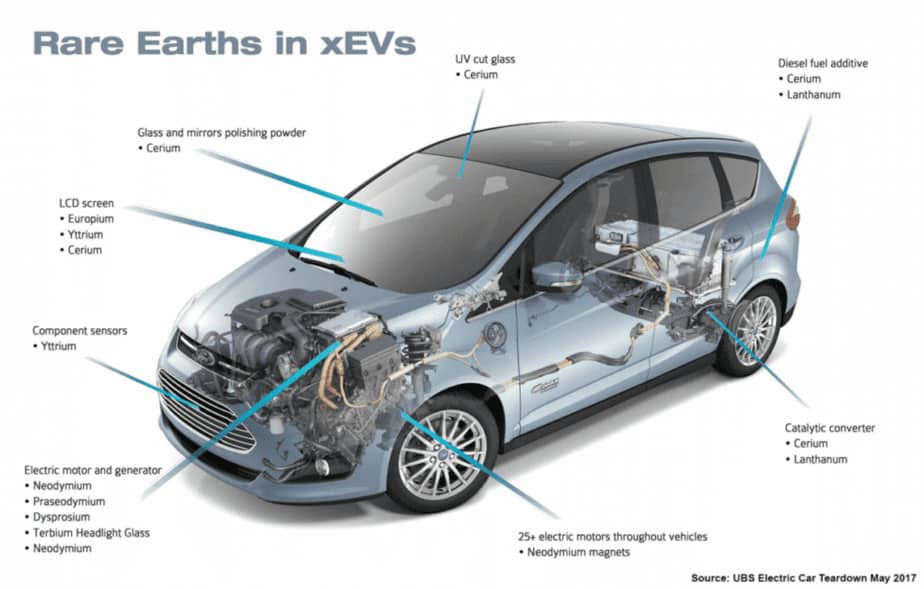

A key ingredient in EV technology overlooked in the mainstream financial media is rare earths.

Since the 1990’s, China has become the Saudi Arabia of rare earths as the country’s favorable geology, low cost labor and lax environmental standards allowed it to produce about 85% the world’s production.

China will no doubt use this leverage to keep more of these rare earths at home and may cut back production or limit these exports to gain a strategic edge.

China may also soon become a net importer of these materials. All this will put upward pressure on rare earth prices.

After a long period of weak pricing and being off the front page, rare earths are now back in the news with prices and headlines on an upward trajectory.

What has changed? In short, the momentum behind clean energy, wind power, robotics and, in particular, electric vehicles (EV) and the entire infrastructure that supports these trends.

Backing these developments is a confluence of trends and events. There has been significant progress in materials science regarding batteries and motors.

The numbers show that we are very close in reaching a point of critical mass – an inflection point when all the benefit of scale start kicking in.

In addition, government emission targets and consumer subsidies for hybrid and electric vehicles are driving markets forward. Finally, China, and to a lesser degree India, have significant producer incentives to scale up EV production.

The electrification of the automotive industry is being driven by ambitious national targets to meet environmental targets. Roskill forecasts that by 2027, close to 70% of new passenger vehicle sales will be hybrids or full battery EVs.

Despite growing demand, the accelerated price bump in 2017 was primarily driven by environmental reforms and closures in China causing a tightening supply from producers, followed by a recovery in prices as producers came back online.

There are two trends in China regarding rare earths that seem clear.

First, China has consolidated production in six state owned companies and closed down smaller independent operators.

Second, it is keeping more of these precious resources at home for better control and to attract foreign manufacturers to produce products in China.

While EV batteries, cobalt and lithium have garnered most investor and media attention, I believe that EV motors have been overlooked and offer significant upside potential.

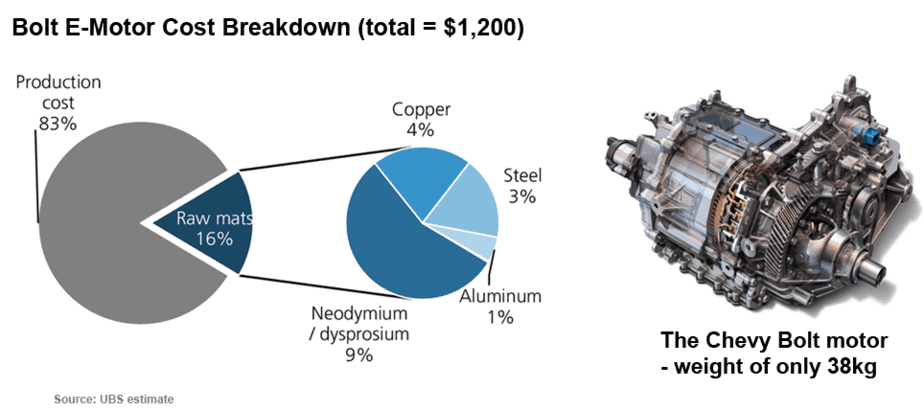

The reason permanent magnets are important is that they allow the motor to be smaller, lighter and more efficient. This is why the Chevy Bolt as well as other leading EV makers use these materials and why Tesla, after experimenting with other options, went with permanent magnets for its Tesla Model 3.

EV motors are, in turn, dependent on rare earth permanent magnets, which are 5-10 times stronger than regular magnets.

This leads to lighter and more powerful, efficient motors. For example, the Chevy Bolt motor weighs only 38 kg.

The average electric car uses ten times more permanent magnets – ones that never lose their magnetism – than a traditional car.

The key ingredients to plug-in hybrid and EV motors are two “hidden” permanent magnet rare earths – Neodymium and Praseodymium – also referred to as NdPr.

A UBS study shows that neodymium represents 9% of production costs and a surprising 56% of raw material costs of its motor.

Importantly, manufacturers need NdPr to make these motors – there are no substitutes. And in addition to the EV motor – there are an additional much smaller 25 motors spread throughout the entire electric vehicle that requires NdPr.

While traditional petrol or diesel combustion engine motor vehicles each use approximately 0.7 kg of NdPr oxide, electric or hybrid vehicles require at least 2 kg.

Prices for Neodymium have fluctuated between $40 and $85 a kilogram over the past year and annual production is estimated to be only 30,000 tons a year.

This is why one company that produces both of these rare earth materials has a stock that has more than tripled over the past 24 months.

Before getting to specific recommendations, let me summarize my breaking research:

Now let’s get to how you could potentially make money on all these emerging trends in 2019.

After China – which controls 85% of rare earth production – comes an Australian company that garners about 13% of global rare earth production.

Lynas (ASX: LYC, OTC: LYSCF), has taken a rare earth deposit in Australia through good times and bad. It has come back strong and is well positioned to benefit from the rare-earths shortage as China’s tougher pollution laws and the growing popularity of electric cars are boosting prices.

Much of the credit should go to Lynas Chief Executive Amanda Lacaze, who stabilized the business, negotiated with creditors and made sure that the Malaysian plant was able to meet customers’ demanding specifications.

She slashed headquarters staff in Sydney and moved the rest and herself to Malaysia. She is still there which highlights that the processing of rare earths is the most challenging part of the business.

The company’s rare earth raw materials come from its Mount Weld mine in Western Australia. It’s an unusual mine because it does not operate continuously. Instead, roughly two “campaigns” a year lasting a few months each are all that’s required to extract enough ore for a year of processing in Malaysia.

Richer in rare earths than most Chinese mines, Mount Weld is a competitive advantage for Lynas and also has facilities to produce a mineral concentrate that is shipped to its modern Malaysia processing plant.

Lynas benefits from strong customer support, especially from a number of Japanese manufacturers keen to support a non-Chinese source of supply. The company has also developed strong supply chains to China.

The rare earths neodymium and praseodymium (NdPr) represent almost 90% of total revenue. The company is driving debt down and cash levels are up as annual revenue has climbed more than 500% since 2014.

Institutional investors are taking notice of balance sheet improvements, a rebound in sales, as well as a rebound in rare earth pricing.

A leading Hong Kong research firm – CLSA – predicts that, based on its bullish supply-demand outlook, the world will face a NdPr shortfall of 7,000 tons by 2020 and that the company’s top line revenue will accelerate.

After a sharp rebound, Lynas shares have pulled back due to media coverage of its negotiations with the Malaysian government on how to handle waste from its processing plant.

UBS has studied a worst-case scenario for Lynas – removing all waste from its Malaysian plant and taking it back to Australia. This scenario would only impact earning by 2 cents a share.

I believe this issue will be soon resolved leading to a potential surge in share price.

Another excellent opportunity is VanEck’s Rare Earth/Strategic Metals (NYSE Arca: REMX), a passively managed exchange traded fund (ETF) launched in 2010.

It is fairly concentrated with 21 holdings – including Lynas – and the top ten holdings represent 61% of assets and about half of the holdings are Chinese companies.

REMX pulled back 45% in 2018 after surging 82% in 2017.

This could be an excellent time to begin building a position.

Some investors may wish to couple the Lynas stock with the REMX for a broader and a bit more conservative play on rare earths.

An intriguing speculative play on rare earths is Medallion Resources (TSX.V: MDL, OTC: MLLOF).

Medallion, in partnership with Rare Earth Salts, is developing the first rare earths supply chain in North America. The company is executing a straightforward low-cost strategy to produce neodymium and praseodymium (NdPr) - the key rare earths for super magnets - through a basic, proven technology and partnerships, all the while keeping the rare earth production chain in North America.

It begins in the Southeastern region of the United States where heavy mineral sands are plentiful. Medallion arranges to source monazite from heavy mineral sand producers and then to extract a rare earth concentrate from this monazite sand. Then it is shipped to Rare Earth Salts in Nebraska where the concentrate is separated into rare earth oxides.

Medallion has already produced earth concentrate, which has been separated successfully into rare earths by Rare Earth Salts. The next step is to build out an extraction facility in Saskatchewan.

Medallion, as a micro-cap speculative company, is off the radar screen of many, if not most, institutional analysts and investors.

It also presents a strategy without mining risk, and represents a significant yet speculative discovery potential as investors look for rare earth opportunities.

Consider taking action to get some rare earths exposure into your portfolio for potential profits in 2019.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] UBS Electric Car Teardown May 2017;