No doubt the year 2020 will go down in stock market history as one of the wildest rides seen since the 2008 financial crisis.

COVID-19 has turned our lives upside down in so many ways. What used to be routine—going to work at the office, visiting with friends and family for a dinner party, or just going to the local bar and having a drink with friends—is now a distant memory in our now “new normal” of living responsibly and practicing social distancing in order to curb the spread of COVID-19.

This upheaval in our living patterns and social interactions has created what I refer to as “COVID Madness.” A good percentage of people have more time on their hands, and some even have extra money in their pocket from government stimulus checks and unemployment benefits. Because of this, people are reacting to the COVID crisis in ways we would have thought extreme only seven months ago. (More on this later...)

And the markets haven’t exactly represented the economy. Take for instance what happened during the first quarter of 2020.

By mid-February the reality of COVID-19 finally hit the US. Subsequently the S&P 500, a broad barometer of the stock market, plummeted -34% and erased five years of market gains overnight.[1]

The US government acted quickly and passed trillions of dollars in economic stimulus funds, which buoyed the US economy and largely helped many Americans who found themselves out of work.

And now the markets are playing with new record highs since the World Health Organization (WHO) announced a pandemic on March 11, 2020, a little over 5 months ago?

To understand the scale of the US government stimulus, we need to understand that US annual production is about $20 trillion. The CARES Act passed by Congress pumped the economy with about $2 trillion dollars in stimulus. That works out to roughly ten cents of every dollar produced in the US in a single year.[2]

That’s a lot of money!

A portion of that money went directly to individuals in the form of one-time stimulus checks and increased unemployment benefits.

Going back to my theory of what I call “COVID Madness,” some individuals had extra money in their pocket and extra time on their hands. The result has been high-risk, extreme behavior where people are using a lot of that stimulus money to speculate in the stock market.[3]

So how can the markets be hitting new daily historic highs when unemployment is sitting at over 10%, small businesses are shutting down across the nation, consumer spending is down almost 9%, the national debt is now tens of trillions of dollars and a pandemic continues to rage across America and is showing no signs of letting up?[4]

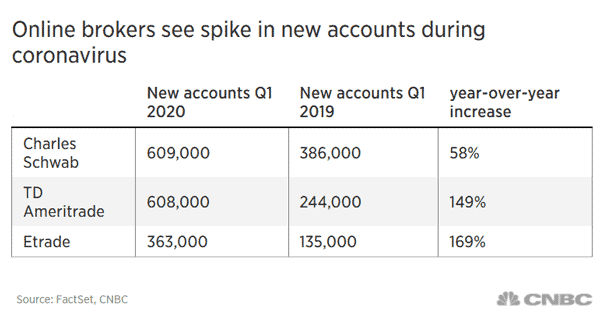

The short answer is a virtual explosion of new trading accounts being opened, with individual investors looking to take control of their investment portfolios. Online discount brokers have seen a record number of new accounts opening this year despite the pandemic.[5][6]

The majority of these new customers are new to the markets and also younger, with an average age of 31. The spike in new accounts coincided with the stimulus check payments.

The result of this proportionate influx of stimulus money into the markets is evident as we are now seeing the major stock market indexes touching on new record highs.

But it should be noted that much of these record highs are attributed to a handful of tech companies, often favored by newly minted retail investors that are familiar with the brands they use every day.

Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Facebook (NASDAQ: FB) and Alphabet (NASDAQ: GOOGL), which owns Google, make up over 39% of the NASDAQ market value and over 22% of the S&P 500, respectively.

And it is not only stimulus money that is pouring into the markets. We are also seeing millions of individual investors being forced into the stock market in search of income using their savings. Traditional safe havens such as savings accounts, certificates of deposit, Treasury securities and money market mutual funds have been crushed by the Feds recent moves to cut interest rates to just above zero.[8]

The dividend yield on an S&P 500 or total stock market index fund, about 1.8 percent for low-cost funds, is almost triple the yield on a 10-year Treasury note (0.66 percent as of June 30) and considerably higher than the 1.41 percent yield on a 30-year Treasury bond.[9]

As a refresher, three of the major and closely followed US market indexes are the S&P 500 Index, Dow Jones Industrial Average and NASDAQ Composite Index.

The S&P 500

Standard & Poor's 500 Index (S&P 500) is an index with 500 of the top companies in the US. The S&P 500 Index represents approximately 80% of the total value of the US stock market.

The Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is one of the oldest, most well-known, and most frequently used indexes in the world. It includes the stocks of 30 of the largest and most influential companies in the United States. In general, the Dow is known for its listing of the US markets’ best blue-chip companies with regularly consistent dividends.

The DJIA represents about a quarter of the value of the entire US stock market.

The NASDAQ Composite Index

Most investors know that the NASDAQ Composite is the exchange on which most technology stocks are traded.

Known for being heavily tech weighted, this index includes several subsectors across the tech market including software, biotech, semiconductors, and more. Its movement generally indicates the performance of the technology industry as well as investors' attitudes toward more speculative stocks.[10]

Much of this surge in trading has been fueled by the health measures of social distancing and isolation. Our social lives are now virtual, played out online with apps such as Zoom (NASDAQ: ZM), Facebook (NASDAQ: FB) and Skype (owned by Microsoft: MSFT) to name a few.

The move to a digital world has been profound as Microsoft CEO Satya Nadella pointed out recently:

In these digital times, it only makes sense that people would be comfortable with online trading and investing.

What we are potentially witnessing are young and inexperienced investors piling into the stock market, who are not fully aware of, or considering, their ultimate capital risk exposure.

Many of these new investors saw the coronavirus downturn as an entry point to begin trading stocks. New accounts grew as much as 170% in the first quarter of 2020.[12]

Online trading apps are more than happy to welcome the new investors onto their platforms.

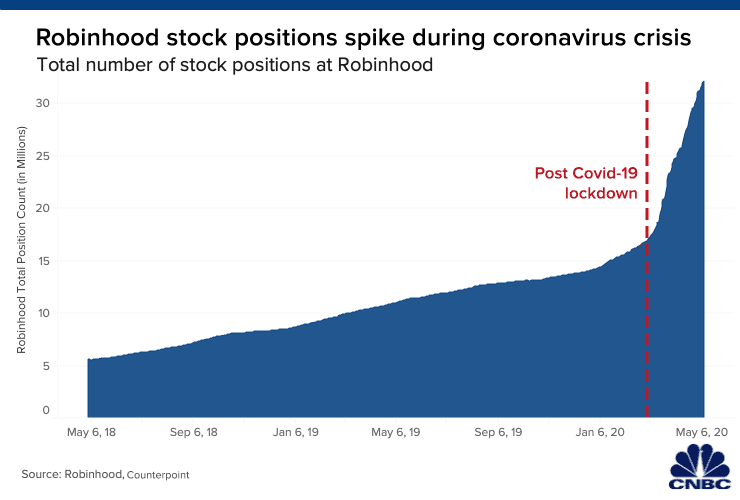

Of those, Robinhood has certainly garnered the most attention. It has literally turned the online brokerage industry on its head.

The Robinhood app is a lesson in marketing and how to appeal to a given demographic. The app was built from the ground up to attract younger investors with one-click trading, zero commission fees, slick graphics and emojis, and phone notifications with confetti that make trading feel more like a game.

The end result is a company that has grown exponentially. The company had 1 million subscribers in 2016. In 2020 that number has risen to over 13 million (so far) with a company valuation of $11.2B.

Three million or a full 23% of those new accounts were opened in just the first four months of this year.[13]

To put that in perspective, TD Ameritrade had 11 million users and E-Trade had 4.9 million brokerage accounts at the end of 2019.[14]

Robinhood co-CEO Baiju Bhatt told CNBC in a phone interview: “People that previously didn’t feel like the markets were for them are for the first time feeling a sense of inclusivity.”[15]

More than half of Robinhood customers are opening their first brokerage account, and the median customer age is 31 years old, according to the company.[16]

The company recently landed number 46 on CNBC’s 2020 Disruptor 50 list.[17]

Other retail brokerages have had to follow Robinhood’s lead in order to remain competitive and have slashed commissions to zero. It has also led to a consolidation in the space with Charles Schwab (NYSE: SCHW) planning to acquire TD Ameritrade and Morgan Stanley buying E-Trade. [18]

Unfortunately to the detriment of inexperienced investors, part of Robinhood’s success has been built on well-known tactics of Silicon Valley: behavioral nudges and push notifications. The result is that users are drawn into high-risk trading. The more the customer engaged in this behavior, the better this was for the company.[19]

The core of Robinhood’s business is to encourage more trading. The company makes money each time its users trade shares in a practice called “payment for order flow.”

What is a payment for order flow and how does it work?

Wall Street firms pay Robinhood for the right to make the actual stock trade. In this transaction, the firm tries to buy or sell the stock for a profit over what they give the Robinhood customer.[20]

More trading equals more company profits. In the first quarter of 2020, Robinhood users traded 9X as many shares as a typical E-Trade customer and 40X as many shares as a Charles Schwab customer. Robinhood customers also traded 88X as many risky options contracts as a Schwab customer.[21]

Turning the stock market into a game and doling out margins and leverage tools to inexperienced investors has led to many users losing everything and going into huge sums of debt.

Studies have shown that the more often small investors trade stocks, the worse their returns are likely to be. And the returns are even worse when they get involved with options.[22]

In one case, a 20-year old user committed suicide after logging into his account to see his balance had dropped to negative $730,000, likely due to incomplete trades of complicated options.[23]

Some disgruntled users have gone so far as to show up at the offices of Robinhood to confront staff about their losses. The company subsequently had to install bulletproof glass at the entrance.[24]

Calls for increased scrutiny of online trading apps on a Federal level are growing louder as more and more users wake-up to the reality they have been duped by an online trading app that is playing to their most basic behavioral patterns and tendencies, with devastating consequences.

Do not be lured into risky trading practices pushed by controversial apps such as Robinhood.

It takes dedication and years of practice to become a successful investor.

Savvy investors know that experience and knowledge are king when making sound trading decisions.

Here are a few tips I have learned through the years that have served me well.

1. Start off with a “demo account” and practice and test various trading strategies.

All online trading apps offer what is called a demo account. A demo account is just what the name describes: an account where you can make test or “paper” trades without risking real money.

It is a great way to test trading strategies without losing your investment.

2. Do your due diligence. Research the stock you are planning to buy.

Know the company you are about to invest in. Who are they? How long have they been in business? Are they profitable? What industry are they operating in? Is there room for upside or increased market share by the company?

Do not throw your money into a stock on a “hot tip” from a friend without doing the leg work and finding out if the company is viable and has a long-term future.

3. Do not trade on emotion.

This is one of the hardest lessons I have had to learn as a trader. Panic, excitement, euphoria, sadness — all recipes for disaster when making a trade.

If you are feeling any extreme emotion, do not open your trading application. Take a break. Wait a day until your emotions subside and you can think rationally about your next investment move.

4. Invest for the long term.

Day traders are not often successful. For large cap stocks, think for the long term of five years and plan your investment strategy accordingly. For juniors or small cap stocks, look at 6-months because things can change quickly. The biggest gains are realized on juniors and small caps, however they also come with more risk.

Ask yourself where the prospective company could be in 3 years and what are its chances of becoming a success.

5. Become well-educated before investing in complex trades.

Trades such as options and short selling are another level of trading that requires significant education. If you are interested in taking your trading to the next level, look into online classes and do your homework first. Work on your skills using your demo account to test strategies before investing real money. Get educated!

6. Learn about limit orders and stop orders.

Limit and stop orders are a great way to take the emotion out of trading decisions. Limit orders are where you decide at what specific price (or better) you are willing to spend to purchase a share. Stop orders set the share price where you will sell. Once the limit or stop order is placed, the trade is executed when the predetermined share or limit price is reached. The trade is executed without any action on your part.

7. Sign up for reputable investment newsletters that offer trading tips and advice.

Follow seasoned traders on their personal picks and trading strategies. It will save you years of work and help you to understand the markets more quickly.

Although I am biased, I have to recommend Financial-News-Now (FNN) as a great source for up-and-coming companies to research further. You can subscribe here.

The current COVID-19 stock market environment is unpredictable and may become more volatile, largely built up thanks to early stimulus money infused by inexperienced investors.

Although, the markets have seen enormous gains in the past few months, those gains are not based on corporate fundamentals for the most part. They are merely a representation of the top five technology stocks (FAANG) that young inexperienced investors know because they use them every day.

On your path to becoming a savvy investor, it is critical that you take your time and do your homework. Fortunes are not gained overnight. Look at the long haul and you will be rewarded by your sound investment strategies.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.nytimes.com/2020/03/20/business/coronavirus-trump-stock-market.html

[2] https://www.forbes.com/sites/simonmoore/2020/07/20/why-the-stock-market-remains-firm-despite-covid-19/#551198703949

[3] https://www.cnbc.com/2020/05/21/many-americans-used-part-of-their-coronavirus-stimulus-check-to-trade-stocks.html

[4] https://www.statista.com/chart/22091/change-in-consumer-spending-due-to-coronavirus/, https://www.statista.com/statistics/273909/seasonally-adjusted-monthly-unemployment-rate-in-the-us/

[5] https://www.cnbc.com/2020/05/21/many-americans-used-part-of-their-coronavirus-stimulus-check-to-trade-stocks.html

[6] https://www.cnbc.com/2020/06/17/robinhood-drives-retail-trading-renaissance-during-markets-wild-ride.html

[7] Ibid.

[8] https://www.washingtonpost.com/business/2020/06/30/stocks-interest-rate-fed/

[9] Ibid.

[10] https://www.investopedia.com/insights/introduction-to-stock-market-indices/

[11] https://www.microsoft.com/en-us/microsoft-365/blog/2020/04/30/2-years-digital-transformation-2-months/

[12] https://www.cnbc.com/2020/05/12/young-investors-pile-into-stocks-seeing-generational-buying-moment-instead-of-risk.html

[13] https://www.forbes.com/sites/jeffkauflin/2020/08/03/robinhood-doubles-its-second-quarter-trading-revenue-reaching-180-million/#217b6c0768cd

[14] Ibid.

[15] https://www.cnbc.com/2020/06/17/robinhood-drives-retail-trading-renaissance-during-markets-wild-ride.html

[16] Ibid.

[17] https://www.cnbc.com/2020/06/16/meet-the-2020-cnbc-disruptor-50-companies.html

[18] https://www.cnbc.com/2020/06/17/robinhood-drives-retail-trading-renaissance-during-markets-wild-ride.html

[19] https://nyti.ms/2DorkW7

[20] Ibid.

[21] Ibid.

[22] http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.408.1468&rep=rep1&type=pdf

[23] https://www.nytimes.com/2020/07/08/technology/robinhood-risky-trading.html

[24] https://www.businessinsider.com/robinhood-office-installed-bulletproof-glass-after-frustrated-traders-visited-report-2020-7?r=MX&IR=T