The COVID-19 Coronavirus Has Put Food Front and Center

Sheltering in place has caused most of us to think about food differently.

We’ve had more time to cook at home, and trips to the supermarket have become at least half-day events, as we must diligently organize our shopping lists for a week’s worth of groceries.

Even with meticulous planning, you may not be able to get everything on your list. Empty shelves have become commonplace, as food producers and distributors struggle to adjust to the new restrictions put in place due to COVID-19.

It is safe to say that these last few months have put a massive emphasis on food supply chain issues, and it appears that meat products are especially vulnerable. Slaughterhouses and meat processing plants have had difficulties staying open and/or operating at full capacity in the midst of the coronavirus pandemic, causing meat shortages all around the US (more on that below).

However, these complications have also created significant opportunities, particularly for companies who make plant-based substitutes, as their products provide viable replacements for the dwindling and unpredictable supply of animal meat.

Keep reading to learn more about the complications that COVID-19 has caused the meat supply chain, the compelling alternatives that plant-based meat companies offer and the exciting investment opportunities that have emerged as a result.

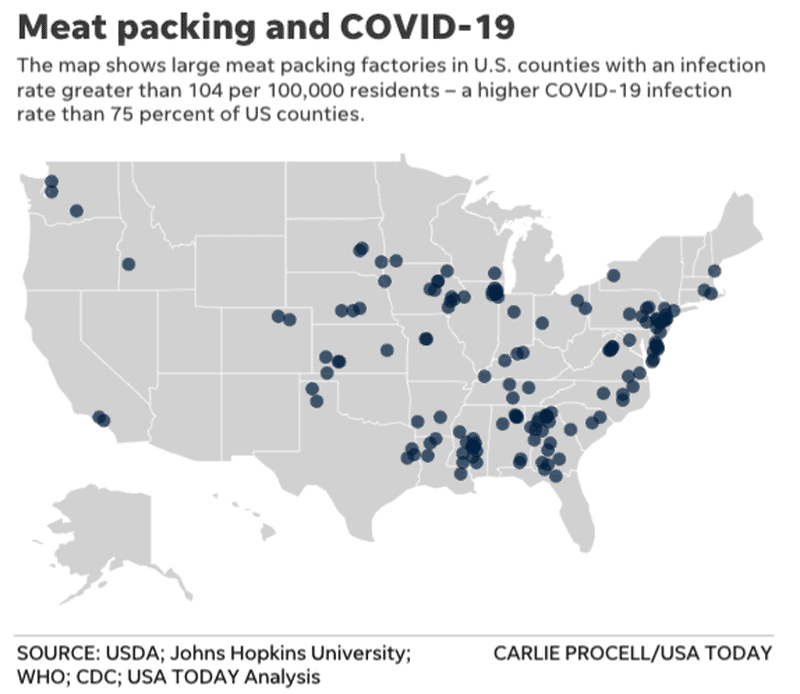

The coronavirus outbreak in North America has served as a notable tipping point, revealing the vulnerabilities of industrial animal farming.[1]

In April 2020, “beef, pork, and poultry processing plants across the US emerged as hot spots” for COVID-19, forcing dozens of plants to temporarily halt production.[2]

The Smithfield pork plant in North Dakota, which produces 5% of the country’s pork, had one of the highest infection rates in the country, and a Tyson Foods Inc. (NYSE: TSN) plant in Iowa had almost 60% of its employees test positive.[3] China even announced on June 21, 2020 that it would “ban imports from a Tyson poultry plant in Arkansas because of a coronavirus outbreak [in early June] at the facility that infected 227 workers.”[4]

Large COVID-19 clusters have also appeared in meatpacking plants in Canada, Spain, Ireland, Brazil and Australia.[5]

The Center for Disease Control (CDC) explained that meat packers are at such high risk for contracting and spreading COVID-19 because they are “in prolonged close proximity to other workers in cold temperatures.”[6]

What may play an equal role is that meat processing is an “exhausting, labor-intensive job done primarily by underpaid, undocumented workers,” meaning they often lack access to health care and are less likely to seek medical attention if they are sick.[7]

Despite the continued risks, many processing facilities have begun to reopen in the US and are operating at 70%–90% capacity, with new policies around social distancing and sanitation.[8] Nevertheless, even with these increased safety precautions, the complications around meat production caused by the coronavirus are still greatly impacting meat supply chains and will have residual effects for months to come.

The New York Times reported in May 2020 that “The union that represents plant workers estimates that pork production had fallen by as much as 25%, with beef down 10%.”[9] Even now, with most plants reopened, pork production is still lower than it was during this time last year.[10]

Things have gotten so bad that farmers have been forced to euthanize animals because they can’t afford to continue to house and feed them.[11] This means that “farmers are less likely to keep animals moving through the system so 18 months from now, there are going to be far fewer pigs than we have now.”[12] Clearly, this is an issue that isn’t going away anytime soon.

As you may have predicted, “wholesale pork prices have spiked sharply.”[13] In May, wholesale beef prices were the highest they had been in two decades and still remain higher than they were in 2019.[14]

In some regions, supply was so low in April and May that Kroger (NYSE: KR) and Costco (NASDAQ: COST) had to limit customer purchases of fresh beef, poultry, and pork.[15] Most of these restrictions have now been lifted, however, demand is still exceeding reduced supply in some cases.[16]

It is also likely that the supply chain could soon be significantly interrupted again, with many predicting a “second wave” of coronavirus cases at the end of this year.[17]

It is vital to outline these issues to further underscore how the coronavirus pandemic has revealed just how sensitive the meat supply chain is. It seems like consumers are noticing too and are ready for substitutes…

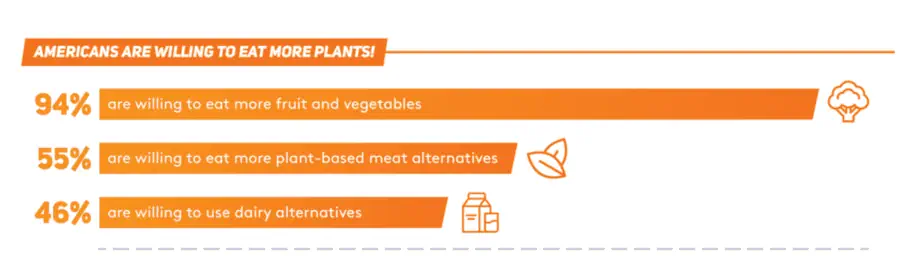

Nielsen reported that from March 1 to May 2, sales of meat alternatives in US grocery stores were up by a whopping 264%![18] This number demonstrates that shoppers are adjusting to animal meat shortages by purchasing plant-based alternatives or replacements.

What is crucial to note is that even though demand for plant-based products is at an all-time high, there have been no shortages![19]

As Wired magazine explained in May 2020, “animal-based products require lead times of months or years; plant-based products can begin rolling off the manufacturing line within a matter of hours or days…” and can be made from shelf-stable ingredients.[20] This is a big disruption to the traditional meat production industry!

Considering the current conditions, it is no surprise that Beyond Meat’s (NASDAQ: BYND) stock has risen almost 150% since March 18![21]

California-based Beyond Meat is the most well-known public company that produces plant-based meat, and their biggest competitor is Impossible Foods (a private company), also headquartered in California.

I'm sure by now you have seen one or both products at your local grocery store or favorite restaurant, but to learn more about their specific product offerings, please refer to my preceding article.

Since that article was published in July 2019, Beyond Meat announced a massive partnership. They launched their plant-based beef called “Beyond Beef” across all of Starbucks’ (NASDAQ: SBUX) 3,300 stores in China.[22] The global coffee chain has also included Beyond Meat offerings on their Canadian menus, with plans to introduce them at their American locations later this year.[23]

Starbucks is one of the most influential fast food restaurants in the world. Their collaboration with Beyond Meat is a clear signal of the mainstream acceptance of plant-based alternatives and continued positive momentum for Beyond Meat’s (NASDAQ: BYND) share price.

It might surprise you that plant-based burgers from Beyond Meat and Impossible Foods offer a similar nutritional profile to a typical beef burger in terms of calories, saturated fats and protein.[24] However, there is a stark contrast when it comes to the usage of natural resources.

A Beyond Meat spokesperson said that compared with a quarter-pound US beef burger, its same-sized patty uses 99% less land and 93% less water.[25]

These are crucial statistics to consider, as The Wall Street Journal reported in May 2020 that millennials cite environmental concerns as the primary reason that they want to eat less meat.[26]

I believe the sustainability of plant-based meat, which the pandemic has further highlighted due to animal-meat supply chain issues, is a major reason why more than 55% of Americans include plant-based foods in their diets and why 25% of Americans between the ages of 25–34 say they are vegetarians or vegans.[27]

I predict these numbers will increase as more people consider the impact of large-scale agricultural animal farming.

If this data still doesn’t convince you of the major opportunities in the plant-based market, consider that UBS (NYSE: UBS / SIX: UBSG) analysts predict that the alternative meat market could grow 28% a year to $85 billion in the next 10 years![28]

It is no wonder then, that shortly after Beyond Meat (NASDAQ: BYND) went public last year, companies such as Tyson Foods (NYSE: TSN), Nestle S.A. (OTC US: NSRGY / SIX: NESN), Hershey (NYSE: HSY) and Kroger (NYSE: KR) jumped on the bandwagon and introduced plant-based meat alternatives to their product lines.[29]

Even with the influx of plant-based options, I think Beyond Meat and Impossible Foods have a major advantage because they exclusively use plant-based ingredients, removing themselves from the ethical, environmental and supply issues that animal-based meat producers still face.

I am also confident that this anticipated market expansion will result in a growing demand for more specialized plant-based products. For example, I predict that millennial parents will want to incorporate plant-based, high-quality foods into their children’s diets as well, searching out baby food that aligns with their values.

Baby food may not be the first thing you think of in regards to plant-based food, but this is a growing sector with significant upside…

According to Fortune Business Insights, “the US infant formula market was valued at USD$2.7 billion in 2018 and is expected to reach USD$5.07 billion by 2026.”[30] Globally, it was valued at USD$45.12 billion in 2018 is projected to reach USD$103.75 billion by 2026.[31]

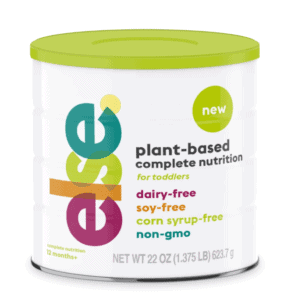

Israeli-based Else Nutrition Inc. (OTC US: BABYF / TSX-V: BABY) is setting its sights on getting a piece of this market, carving out its own niche with infant nutrition products that are vegan, plant-based and non-GMO (genetically modified organisms).

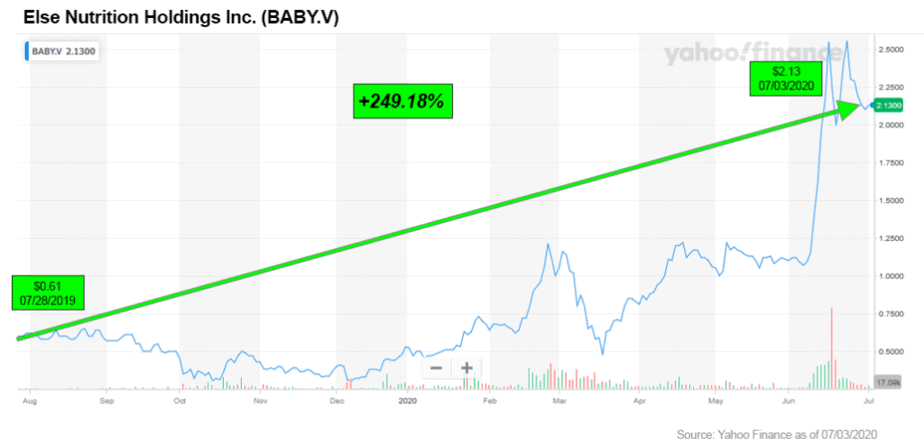

I profiled the company in July 2019 when they were trading around CAD$0.60 on the TSX-V. Since then, their stock price has more than tripled on the back of an updated website, capital infusion from strategic investors (more on that later), and the March announcement of their first commercial product launching in the US.[32]

Else is introducing a toddler formula (for children 12–36 months of age) in mid-July 2020, and according to the company, it is “the first clean, minimally processed, plant-based toddler nutrition drink.”

It is organic — made primarily with almonds, buckwheat and tapioca. It is also free from dairy, soy, gluten, hormones, antibiotics, palm oil and corn syrups.[33]

I think this exceptional ingredient list will spark the interest of parents, especially as North America attempts to recover from the pandemic and awareness about health is at an all-time high!

Else’s offering comes as a challenge to a conservative baby formula industry, which has largely been producing the same dairy and soy products for over 100 years.

Milk is the number one food allergen in children, with 41% of 1- to 2-year old’s allergic to it.[34] It often contains a high amount of antibiotics, hormones and pesticides, so even if kids are not allergic, it is something many parents want to avoid. Fifty percent of kids with a cow’s milk allergy are also allergic to soy.[35]

Else’s CEO and co-founder Hamutal Yitzhak emphasized to me during a recent phone interview that their product not only stands out because of the quality of its ingredients but because these ingredients are processed without harmful chemicals. This means they contain more macro and micronutrients compared to the broken-down isolated components that most of their competitors sell.

I see Else’s processing techniques as a significant differentiator, making their product offering unlike anything else on the market.[36]

The importance placed on both manufacturing and natural ingredients that are soy and dairy-free become especially attractive when considering some of the recent controversies involving infant formulas.

When diving deeper into the business of baby nutrition, it appears that some of the world’s largest producers have not always prioritized the health and safety of their products.

In 2017, The Environmental Defense Fund found 20% of 2,164 baby food samples tested contained lead. Of course, no amount of lead is safe to ingest.[37]

That same year, another study was released by The Clean Label Project, a non-profit advocating for transparent labeling. They tested approximately 530 baby food products, and found 65% contained arsenic, 36% had lead, 58% had cadmium and 10% had acrylamide.[38] All of these chemicals pose potential dangers to developing infants.[39]

Recently, there has also been controversy with Nestle S.A. (OTC US: NSRGY / SIX: NESN), the Swiss company worth over USD$310 billion which has close to 25% global market share of infant milk products.[40] In 2019, they were “accused of violating ethical marketing codes and manipulating customers with misleading nutritional claims about its baby milk formulas.”[41]

Perhaps the most famous baby formula scandal happened in China in 2008. Eleven batches of infant formula milk powder were found to have been tainted with melamine, a chemical compound used in plastic and fertilizer. Within a span of four months (July–October 2008), 300,000 babies became sick and six died as a result of the contaminated formula.[42]

There were a total of 22 companies involved, most notably The Sanlu Group who at the time had a national market share of milk power sales of almost 20% and has since gone bankrupt.[43]

This sent shockwaves throughout the entire industry, and created a distrust with Chinese baby food products that is still present today. It has since resulted in sustained spikes in formula sales across several countries including New Zealand, the UK, Germany and Australia. Formula that normally retails in Australia for about AUD$30 each can be resold in China for upwards of AUD$45 — a 50% mark up![44]

Considering this array of controversies in the infant food sector, it’s no wonder that Else secured a strategic investment from a global leader in the industry.

On March 4, 2020 Else received CAD$8 million from NewH2 Limited in exchange for 11.15% of their issued and outstanding common shares. NewH2 Limited is a subsidiary of Hong Kong based nutrition and wellness company Health and Happiness (H&H) International Holdings Ltd. (HKSE: 1112.HK), who has a market cap of over USD$21 billion.

Else also announced a Memorandum of Understanding (MOU) with H&H International Holdings Ltd. for future distribution of their products in France, Hong Kong China (SAR), Cross-Border China, Australia, Italy, and Mainland China.[45]

Considering these encouraging announcements and the upcoming release of Else’s first formula within an infant nutrition market that is ready for disruption, I suggest investors should keep a close eye on the company, if you are not already positioned, in the next six to twelve months.

The plant-based food industry looks extraordinarily promising well into the future, especially considering that the COVID-19 pandemic has put a further emphasis on health and wellness and exposed production issues in the animal meat supply chain.

The increased demand of plant-based meat recently highlights just how willing the public is to make the switch, which I trust will influence how these same consumers choose to feed their families, including their infants and children.

Currently, there are very few purely plant-based public market plays, but I will keep you updated as this category continues to grow with new products and companies emerging. Stay tuned for another article coming in the near future.

This sector is in hyperdrive and ever-expanding, and I suggest the best way to keep up is to start regularly adding plant-based products to your grocery list and see which ones are your favorites — you just might find an investment opportunity along the way.

Blake Finucane, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.wired.com/story/opinion-modernizing-meat-production-will-help-us-avoid-pandemics/

[2] https://www.wired.com/story/why-meatpacking-plants-have-become-covid-19-hot-spots/

[3] https://www.nytimes.com/2020/05/21/opinion/coronavirus-meat-vegetarianism.html

[4] https://www.foxnews.com/us/meat-plants-questioned-pork-shipments-china-coronavirus

[5] https://www.wired.com/story/why-meatpacking-plants-have-become-covid-19-hot-spots/

[6] https://www.wired.com/story/why-meatpacking-plants-have-become-covid-19-hot-spots/

[7] Ibid.

[8] https://www.cnet.com/health/is-there-still-a-meat-shortage-the-current-situation-with-chicken-beef-pork-prices-and-supply/

[9] https://www.nytimes.com/2020/05/05/business/coronavirus-meat-shortages.html and https://www.nytimes.com/2020/05/14/business/coronavirus-farmers-killing-pigs.html

[10] https:-/www.wsj.com/articles/meat-plants-reopen-but-burgers-stay-pricey-11590933601

[11] Ibid.

[12] https://www.wired.com/story/why-meatpacking-plants-have-become-covid-19-hot-spots/

[13] Ibid.

[14] Ibid.

[15] Ibid.

[16] https://www.wsj.com/articles/meat-plants-reopen-but-burgers-stay-pricey-11590933601

[17] https://www.cnet.com/health/is-there-still-a-meat-shortage-the-current-situation-with-chicken-beef-pork-prices-and-supply/

[18] https://www.wsj.com/articles/coronavirus-meat-shortages-have-plant-based-food-makers-mouths-watering-11589371206

[19] https://www.wired.com/story/opinion-lets-rebuild-the-broken-meat-industry-without-animals/

[20] Ibid.

[21] This number is measured from March 18, 2020–June 15, 2020 (USD$54.02–USD$144.74)

[22] https://www.beyondmeat.com/whats-new/beyond-meat-launches-in-china/

[23] https://finance.yahoo.com/news/starbucks-beyond-meat-deal-in-canada-081039951.html

[24] https://www.health.harvard.edu/blog/impossible-and-beyond-how-healthy-are-these-meatless-burgers-2019081517448

[25] https://www.wired.com/story/covid-faux-meat/

[26] https://www.wsj.com/articles/coronavirus-meat-shortages-have-plant-based-food-makers-mouths-watering-11589371206

[27] https://worldin2019.economist.com/theyearofthevegan and https://www.theglobeandmail.com/investing/markets/stocks/BABY-X/pressreleases/4411610/

[28] https://www.businessinsider.com.au/beyond-meat-ubs-plant-based-meat-market-85-billion-2030-2019-7

[29] https://investorplace.com/2020/05/dont-expect-good-bynd-stock-earnings/

[30] https://www.fortunebusinessinsights.com/industry-reports/infant-formula-market-101498

[31] Ibid.

[32] As of June 26, 2020, TSXV: BABY.V was trading at CAD$1.19 and OTC: BABYF was trading at USD$1.61

[33] https://www.nutritioninsight.com/news/else-nutrition-unveils-plant-based-toddler-milk-amid-broader-tensions-in-formula-space.html and https://www.dairyreporter.com/Article/2020/02/21/Alternatives-to-traditional-infant-nutrition-hit-US-market

[34] https://acaai.org/news/milk-allergy-affects-half-us-food-allergic-kids-under-age-one

[35] https://www.nutritioninsight.com/news/else-nutrition-unveils-plant-based-toddler-milk-amid-broader-tensions-in-formula-space.html

[36] https://www.dairyreporter.com/Article/2020/02/21/Alternatives-to-traditional-infant-nutrition-hit-US-market

[37] https://www.usatoday.com/story/news/nation-now/2017/10/25/these-baby-foods-and-formulas-tested-positive-arsenic-lead-and-bpa-new-study/794291001/ and https://www.usatoday.com/story/news/nation-now/2017/06/17/report-lead-baby-food/398926001/

[38] https://www.usatoday.com/story/news/nation-now/2017/10/25/these-baby-foods-and-formulas-tested-positive-arsenic-lead-and-bpa-new-study/794291001/

[39] Ibid.

[40] https://www.theguardian.com/business/2018/feb/01/nestle-under-fire-for-marketing-claims-on-baby-milk-formulas

[41] Ibid.

[42] https://qz.com/1323471/ten-years-after-chinas-melamine-laced-infant-milk-tragedy-deep-distrust-remains/

[43] Ibid.

[44] https://www.abc.net.au/news/2018-12-11/abc-investigation-uncovers-chinese-baby-formula-shoppers/10594400

[45] https://ca.finance.yahoo.com/news/else-nutrition-announces-c-5-123000516.html