There are a lot of unusual things happening out there in finance and investments. Base interest rates are practically zero but no one wants more debt except the federal government. The real economy is struggling while the stock market is soaring.

Enthusiasm is so high that investors seem perfectly fine with investing in companies with no ongoing business — just a promise that high-level sponsors will acquire or merge with another company before too long.

This last example is called a “Special Purpose Acquisition Company” or in shorthand, SPAC. Previously, it was referred to as a “blank check” company.

SPACs are all the rage on Wall Street right now for a number of reasons, and all indications are that they will be around for a while. They are generating big fees for banks, raising big capital for entrepreneurs, and in some cases, big returns for investors.

“It’s SPAC 2.0,” said NYSE Vice Chairman John Tuttle. “They were around a while ago but didn’t have the same appeal. Now, they are larger and have some of the most well-known business leaders sponsoring them, which makes them more attractive to investors.”

Here are some of the most talked-about SPACs this year.

A SPAC is really not all that complicated but like most things, the devil is in the details. First, I will explain the process of launching a SPAC as simply as possible by comparing it to a traditional initial public offering (IPO), then go into a bit more detail and give a few examples leading to some guidance on what to consider before investing in a SPAC. Then I’ll conclude with some specific SPAC ideas to consider investing in right now.

Since a SPAC is a shortcut initial public offering (IPO) of stock, let’s begin by briefly reviewing what exactly is an IPO?

An IPO (Initial Public Offering) is the first sale of stock to the public by a company’s existing shareholders. To do a successful traditional IPO requires a number of things that take a lot of time and money.

A battalion of lawyers is required to prepare and file a lengthy prospectus with the Securities & Exchange Commission. The idea is to carefully present the companies financial position, its markets and strategy, its management team, and the potential gains and risks going forward.

Then the management goes out on a road show to court investors and Wall Street analysts to follow its stock. This leads to the tricky part that bedevils investment bankers and investors alike. Just what is a reasonable price per share or valuation for any given company’s stock?

Like with any investment, one has to be careful not to overpay — so a reasonable valuation against peers and reasonable growth and profit assumptions are critical. It’s important to price any IPO and leave some room for the market to make some money out of the gate. Identifying high-quality companies can be daunting, but focusing on the common characteristics is essential.

These characteristics include:

The last step is an investment banker pricing the public offering with hopes of attracting investor interest. Then management, analysts and market makers all work to provide follow up efforts to stabilize and promote the stock price. The company, of course, wants to bring in as much capital as possible for the shares it offers to the public.

Unfortunately, IPOs usually deliver sub-optimal results. A study from the Warrington College of Business at the University of Florida found that over the last ten years, IPOs have been underpriced by up to 21% and left an average of $37 million on the table. From this point forward, the management has to deal with all the responsibilities and costs of being a public company.

Now let’s turn to a faster, cheaper and more flexible way to raise capital and go public.

SPACs are formed and go public for the sole purpose of raising capital to merge with or acquire another company.

There are two key related factors that allow for a SPAC to raise significant capital by going public before it has identified a business to acquire, normally at $10 a share. The first is the credibility and track record of the company’s management team. The second is the stature of the investment banking firm handling the transaction for the SPAC.

Although less formal than during an IPO, there will be a road show that will incorporate one-on-one meetings between institutional investors like hedge funds and private equity funds and the SPAC’s management team to drum up interest in the offering.

After the capital is raised, the SPAC management retains 2% of the SPAC value, plus $2 million to cover the initial underwriting fee and the operating expenses of the SPAC, from the initial cost to launch it to the ongoing due diligence process on potential acquisition targets. The remaining capital is placed in an escrow account until at target company is identified.

In practice, SPACs rarely trade below their trust values because, at the time of a SPAC’s merger, shareholders have the option of redeeming their shares for a proportionate share of the cash — usually $10. Outside of periods of extreme market stress such as in March, it tends to be the floor for where SPAC shares trade.

Some SPACs from high-profile sponsors do trade quite a bit above their trust values as investors bet that the team will put together an attractive merger with an operating company worth more than the cash in the escrow account.

Normally, the SPAC has up to two years to identify a company to acquire, and then it meets with its investors to confidentially reveal its new partner and obtain shareholder approval.

The bankers then take out the new operating team to get the story out to analysts who cover the industry so that when the combined new company is revealed, it receives the kind of support that holds the interest of public shareholders.

After the target company accepts, the merger goes through, and the combined entity changes its name and ticker symbol to better reflect the acquired company's business.

Perhaps the best way to understand the SPAC process is with an example.

Mr. Chamath Palihapitiya, a well-respected investor and former member of Facebook’s management team, really got the SPAC ball rolling in 2017 when he raised $600 million for a SPAC called Social Capital Hedosophia Holdings (then listed as NYSE: IPOA).

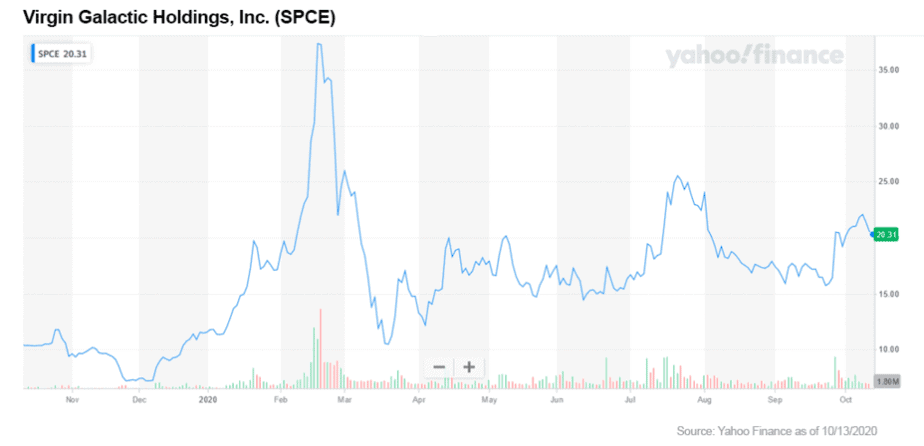

Subsequently, the SPAC acquired a 49% stake in space tourism company Virgin Galactic co-founded by Sir Richard Branson and then began trading under the stock ticker NYSE: SPCE.

Palihapitiya has since revealed he has reserved the symbols from "IPOA" to "IPOZ" on the New York Stock Exchange, signaling an intention to launch a series of SPACs.

The next two are already up and trading while evaluating potential companies to acquire: Social Capital Hedosophia Holdings Corp II (NYSE: IPOB) and Social Capital Hedosophia Holdings Corp III (NYSE: IPOC). The latest news is that Social Capital is acquiring Medicare Advantage insurance company Clover, in a deal valuing the company at $3.7 billion.

Fortress Value Acquisition Corp (NYSE: FVAC) is another SPAC that is merging with MP Materials, a mining company producing rare earth that are critical to developing permanent magnets, an essential ingredient in electric vehicle motors and wind turbines.[2]

And most recently, Hyliion Inc. and Tortoise Acquisition Corp. announced the closing of their business combination on October 1. The combined company will be called Hyliion Holdings Corp., and will trade on the NYSE under the ticker symbol HYLN.

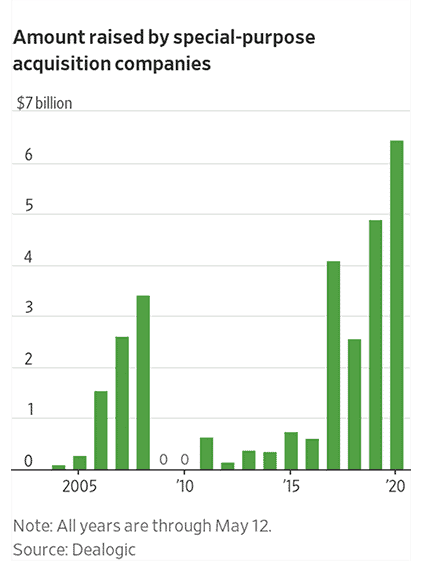

The number of and average size of SPACs has been accelerating with 34 in 2017, 46 in 2018, 59 in 2019 and through October 1, 2020, a big jump to 127 SPACs in 2020 according to SPACdata.

The key factor for investors is the level of confidence they have in the ability of management to acquire the right company — nothing more.

This is financial engineering at its finest.

Let’s turn now to some specific ways you can invest in the SPAC trend either by investing in a SPAC or by investing in a company that has been brought public through a SPAC.

Keep in mind that your highest priority is to examine the track record of the management team of the SPAC. Have they successfully put money to work in the past?

Your first option is to invest in an exchange-traded fund. I’ll mention one trading on the NYSE and one in Canada.

The Defiance NextGen SPAC (NYSE: SPAK) ETF tracks the performance of a SPAC index, but it is more of an index of companies that already went public via SPAC mergers since these get an 80% weight in the index.

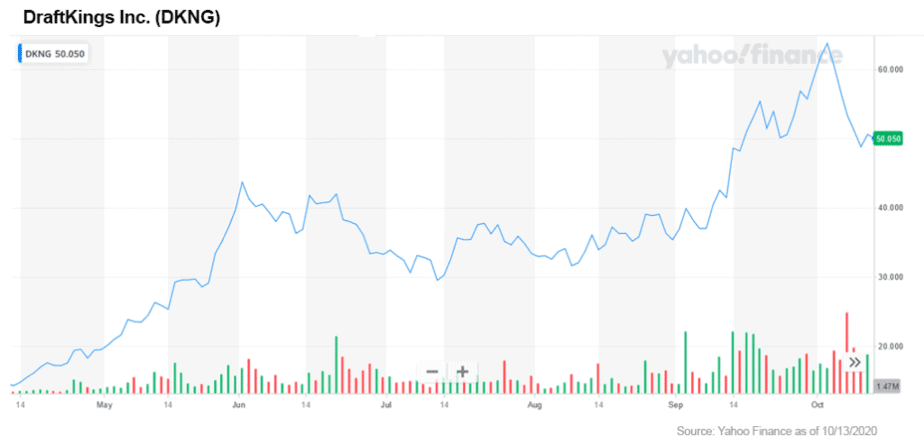

This ETF is highly concentrated with about 40% its assets in just three SPACs. DraftKings (NASDAQ: DKNG) makes up about 19% of the assets in the ETF basket.

The ETF removes the need for you to pick SPAC winners from losers. Investors get a diversified portfolio of the most liquid SPACs. Their initial portfolio has twenty-nine stocks and rebalances quarterly. In addition, this ETF is not actually participating in IPOs at the normal $10 share price but is purchasing shares in the secondary market right after they go public.

Canada is a pioneer in what is very similar to a SPAC strategy. The Capital Pool Company program (or often referred to as the CPC program) is a unique two-stage listing process offered by the TSX Venture Exchange (TSX), which brings together experienced participants in public capital markets with entrepreneurs seeking funding and a public listing.

In stage one of the process, a new company (known as a “Capital Pool Company”) is listed on the TSX by way of an initial public offering. In stage two (the “Qualifying Transaction”), the Capital Pool Company acquires an asset or completes a transaction with a private business, which results in the listing of the acquired business on the TSX.

Canadian investors have had access to the AltShares Merger Arbitrage ETF (TSX: ARB) since April. It employs an actively managed SPAC merger arbitrage strategy.

Next up is a fascinating concept stock that was brought public through a SPAC in 2017 and has performed well since then.

Space exploration and commercializing space has captured the imagination of many, including those with a lot of cash to burn.

Elon Musk spent $100 million in 2006 to launch SpaceX. Jeff Bezos is reportedly injecting $1 billion a year into Blue Origin.

Blue Origin hopes to go the moon for passenger trips by 2024 while Musk has Mars in his sights, with SpaceX planning its first cargo mission to the red planet in 2022. A crewed mission is to follow a couple of years later.

Since 2000, Goldman Sachs estimates that $13.3 billion has been invested in space startups. We certainly have come a long way from Sputnik 1, the first satellite launched by the Russians in 1957.

Incrementally lower costs, new technology, and increased commercial activity could make space the next trillion-dollar industry. And one of the most intriguing segments of the space economy is space tourism.

Dennis Tito paid $20 million to become the first space tourist in 2001 while prepaid tickets for 90-minute suborbital flights in 2020 with Virgin Galactic went for a cool $250,000. Over the next ten years, the company plans on bringing this price down to $40,000 or so over time.

Virgin’s flamboyant and well-connected entrepreneur Sir Richard Branson has brought in heavy hitters like Chamath Palihapitiya, the billionaire tech investor and former Facebook executive mentioned earlier.

More than 600 people from 60 countries have secured a spot on one of Branson’s first space flights by making a deposit representing half the total fare price. Virgin has an additional 2,500 people on the waiting list.

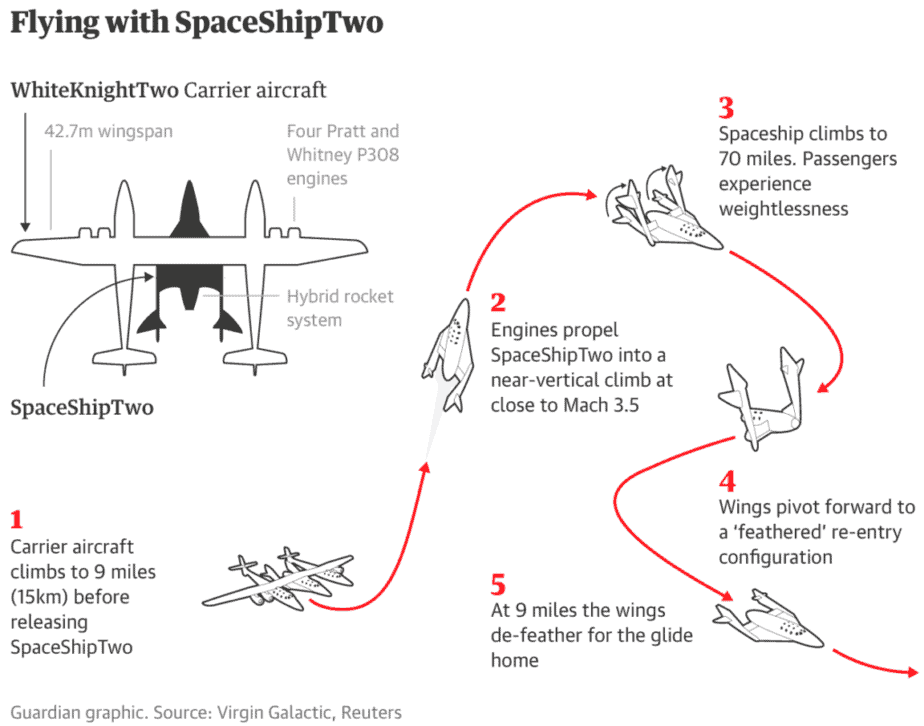

This 90-minute flight will escape the Earth’s atmosphere allowing passengers to experience weightlessness and see the planet’s rim from space.

Virgin Galactic was founded and won the X Prize for its SpaceShipOne in 2004. The company has been at the forefront of commercial space and produced the first private space vehicle to put humans into space.

In 2010, George Whiteside joined the team from NASA and he is currently CEO. In 2016, the company was awarded a commercial operator license by the FAA.

Credit Suisse recently concluded that Virgin would have a “near-term monopoly” on the space tourism market once SpaceShipTwo begins operations in 2021.

Virgin Galactic (NYSE: SPCE) operates the reusable SpaceShipTwo spaceflight system. This consists of WhiteKnightTwo, a custom-built, carrier aircraft, and SpaceShipTwo, the world’s first passenger carrying spaceship to be built by a private company and operated in commercial service.

My recommendation of Virgin Galactic at this time is based on the following:

The chief risk is, of course, the possibility of a failed or unsuccessful flight, which would, without question, hit the stock hard. For this reason, I see Virgin Galactic as a very aggressive idea and recommend investors implement a 20% trailing stop loss.

As I have done my research, I’m impressed with the seriousness of this enterprise and the team of investors and management that has been pulled together to prepare for 2021 launch of private flights.

On the positive side, the company expanded its waiting list for space flights, which are expected to begin in the first quarter of 2021. It also unveiled plans for a Mach 3 delta-wing aircraft with capacity for 9 to 19 people traveling at an altitude of 60,000 feet. Curious investors, not to mention the entire world, will be watching this event closely!

The company also signed a memorandum of understanding with Rolls-Royce Holdings (LSE: RR / OTC US: RYCEY), one of the world’s leading aircraft engine makers. Rolls-Royce was responsible for the engine of the Concorde, the only supersonic commercial aircraft ever used for passenger travel.[3]

In fact, Virgin Galactic announced this past May that it would be partnering with NASA to work towards high-speed, high altitude point-to-point travel for commercial airline passengers.[4]

In addition to space tourism, Morgan Stanley believes that Virgin Galactic could be a key player in the hypersonic point-to-point market that could be worth up to $400 billion by 2040. For example, a flight from New York to Shanghai that takes 12 hours now might be shorted to as little as 40 minutes. How amazing is that?

In closing, as you evaluate SPACs, always keep in mind the credibility of the management team and people leading the SPAC, their track record of acquiring and bringing companies public. After a target company is acquired and is merged into the SPAC, you need to shift to fundamental analysis just as you would with any other stock.

SPACs have been around for quite some time, however, they are now becoming a popular form of financing and taking companies public. I believe, new SPACs and transactions will only increase over the next number of years. I recommend paying extra special attention to the SPAC space.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.businesswire.com/news/home/20201001006126/en/Hyliion-Inc.-and-Tortoise-Acquisition-Corp.-Announce-Closing-of-Business-Combination-Hyliion-to-Trade-on-the-NYSE-under-“HYLN”

[2] https://www.reuters.com/article/us-mp-materials-ipo/u-s-rare-earths-miner-mp-materials-to-go-public-in-1-47-billion-deal-idUSKCN24G1WT

[3] https://www.virgingalactic.com/articles/virgin-galactic-unveils-mach-3-aircraft-design-for-high-speed-travel-and-signs-memorandum-of-understanding-with-rolls-royce/

[4] https://www.virgingalactic.com/articles/virgin-galactic-signs-space-act-agreement-with-nasa-for-private-orbital-spaceflight-to-the-international-space-station-iss/

CNBC, September 30, 2020, “Apollo co-founder Josh Harris Says the SPAC Trend is Here to Stay”, https://www.airdberlis.com/docs/default-source/default-document-library/aird-berlis-capital-pool-company-program-backgrounder.pdf?sfvrsn=0

www.deallawwire.com/2015/10/28/the-capital-pool-company-getting-private-companies-ahead/

University of Florida IPO Study, https://site.warrington.ufl.edu/ritter/files/IPOs2019Statistics.pdf

https://spacdata.com

https://www.virgingalactic.com

Bubble warning: even college kids are touting SPACs,

https://www.ft.com/content/e64c3e5e-b990-4904-adfe-139e41a5845b