Silver, the ‘white metal,’ has been referred to as the poor man’s gold, and more consciously and socially, as the silver medal in an event. It is always considered second, the runner up, and the other option to gold; and I have to say it feels rather good to be second.

Silver has thousands of years of influence and history for civilization. It has imprinted itself in our DNA as not only a store of value of wealth due to its portability, beauty, and malleability, but also today for its industrial use. Because it is so adaptable, it is perfect for crafting art and jewelry, making it ideal for traveling with wealth – albeit much less valuable than gold due to its abundance. However, silver is still rare though since it’s not easy to get out of the ground.

Due to its properties, silver lends itself to being flattened into sheets and thin flexible wire, making it the best choice for numerous industrial applications. Silver resists corrosion and oxidation, and is the best thermal and electrical conductor of all the metals. Its antimicrobial, non-toxic qualities make it useful in medicine and consumer products. And while its high luster and reflectivity make it perfect for jewelry, silverware and mirrors, by far its primary use is in electronics.

The span of applications is vast, whether you are talking about solar panels, mobile devices, circuits, or other advancements. Imagining some solutions for the future are things like solar carports as one of the most viable options for refueling EVs.

The push for this electric future is happening, and regardless of the politics, there are some exciting opportunities ahead because every solution for this electrification of the future involves mining. Even during this pandemic, silver has garnered some attention because of its antimicrobial properties. We are talking about an exciting, dynamic foundational metal for our civilization, and more people are showing great interest.

Just recently, I attended a wild weekend celebrating all things silver at the SilverFest 2020 Virtual Conference. This event was packed with all the silver bugs one could possibly imagine, but there were also many generalist investors and curiously interested people of all age ranges inquiring about silver.

Almost 3,000 people attended the event just on the Saturday when I was a panelist. Let me just reiterate that this was an outstanding event. It was run smoothly and had full private virtual rooms to have Q &A and discussions. The event had the feeling of a collaborative and friendly exchange of ideas.

I usually find these virtual conferences can be a bit tedious but the energy, enthusiasm, optimism, and the amount of curious new investors created an air of excitement. SilverFest 2020 focused not only on the commodity COMEX and market for trading silver, but it also had a great deal of discussion around the economic crisis developing, particularly since 2008. This includes the extreme printing of money from that decade, to the obscene amount of money printed lately – before what the World Economic Forum calls “The Great Reset.”[1]

Some of the guests of the virtual conference included prominent names in the sector like David Morgan (The Morgan Report), Dr. Marc Faber (Gloom, Boom, & Doom Report), Gwen Preston (Resource Maven), Dave Kranzler (Investment Research Dynamics), Alasdair Macleod (GoldMoney.com), Maurice Jackson (Proven and Probable), Alex Newman (The New American), Scott Craig (The Silver Independent) and Dr. Jim Willie (The Hat Trick Letter).

My panel included our gracious host Chris Marcus of Acadia Economics, Jerry Huang of Jemini Capital and Robert Kientz of GoldSilverPros.com. As we spoke primarily about stocks, we were asked to consider: When Silver Hits $50, Which Stocks Will Go Up the Most?

There was much consensus to this discussion. And I decided to tackle this silver possibility on a few fronts: from a conservative investor, a generalist investor, and a speculator.

A Conservative Take

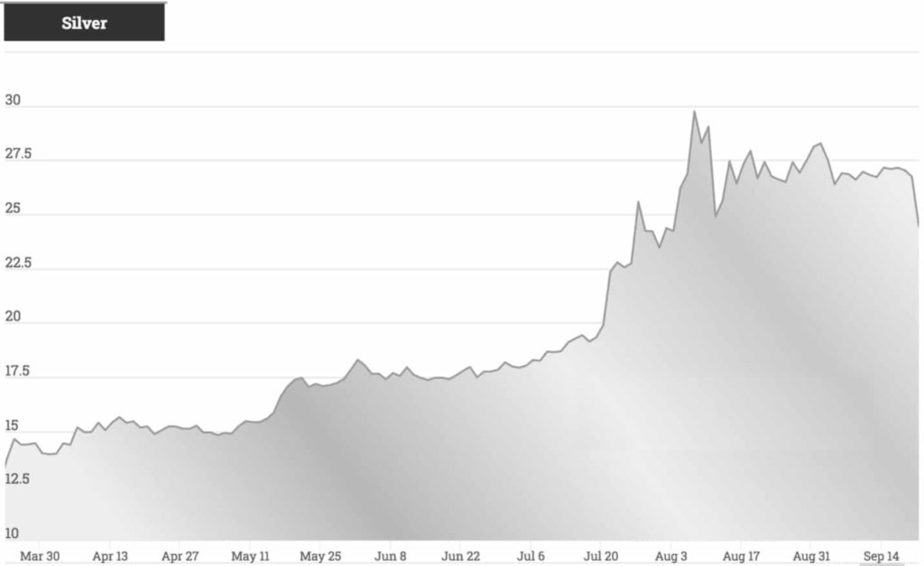

First off, as I have said for the past three years, gold and silver have performed better than most investment positions – never mind fiat currency, Canadian Guaranteed Investment Certificates (GICs) and bonds.[2] You should be taking this paper (or more likely number) sitting in GIC positions, which are consistently being depreciated by inflation, and buy gold or silver. Silver is an outstanding option because anyone can afford it since it’s trading below $30/ounce.

The rationale is that I do not want to have a cash position in any currency right now other than for day-to-day use. By default, sitting in cash is taking a forex position. If I could be paid in gold and silver, I would gladly do it.

The fiat currency system is an entirely whole other conversation that is based on ‘trust’ or confidence in the ability of the government to support or back their paper either through taxes or force. This is becoming less and less believable or reconcilable with any financial models. The negative yields and rates of bonds is another key factor that highlights future reported inflation.

There is a lot to unpack here because as most of us know it is absurd to try and convince people there is little to no inflation. Not only does it take two people in a household to have full-time jobs in order to scrape by in cities like Vancouver, Toronto, New York, or even Los Angeles, it actually takes two lawyers’ salaries in order to have what would have been considered a decent income in the 1950s.

The cost of living is extremely high and will continue to be as reported inflation starts climbing and defaults start occurring. This is even before considering the effects of COVID-19. Based on this, I can see silver certainly hitting $50 again.

For the Generalist or New Investor

The next round of consideration was to appeal to a specific generalist investor. I chose Wheaton Precious Metals (NYSE: WPM / TSX: WPM), which is a precious metals streaming company, as a stock to research further. This company has been having outstanding success, and although it’s not a pure silver play, about 60% of its streaming revenue is derived from silver.

On August 12 of this year, the Company showed record sales volume and revenue with about 13 revenue streams.[3] There is no day-to-day operation/mining – but instead multiple investment streams and exceptionally high precious metals margins. And with Randy Smallwood at the helm, the Company has excellent management.

On September 21, the Company announced its intention to list on the London Stock Exchange.[4]

Below are additional stocks I would suggest generalist or new investors to the silver sector consider researching in the space:

First Majestic Silver (NYSE: AG / TSX: FR)

The San Dimas Silver/Gold Mine is 100% owned and operated by First Majestic Silver Corp. and is the cornerstone asset, having been acquired in May 2018 in the acquisition of Primero Mining Corp. The flagship property contains 71,867 hectares of mining claims located in the state of Durango, Mexico. The Company also has two other producing assets, but the potential of this one alone is impressive:

2020E PRODUCTION: +6 to 7 million silver OZ

MEASURED & INDICATED: +70.7M AG, + 823K AU OZ

First Majestic is progressing so well that billionaire Eric Sprott invested $78 million in the Company on September 10, 2020.[5] This is a production story with exploration upside – a silver stream boosting recovery rates for silver around 93-95%. The Company started an implementation phase of technology in 2018 that is bringing efficiency to the mine and infrastructure to provide optimal performance. The future looks outstanding for this well-known company.

Reyna Silver (OTC US: RSNVF / TSX-V: RSLV)

Reyna Silver was an IPO that came out on June 4, 2020, and I was fortunate to speak to the family offices about this high-grade, district scale gold and silver project in Mexico. This was a fascinating opportunity because it brought with it truly world-class expertise in a historically rich region with a long history of mining.

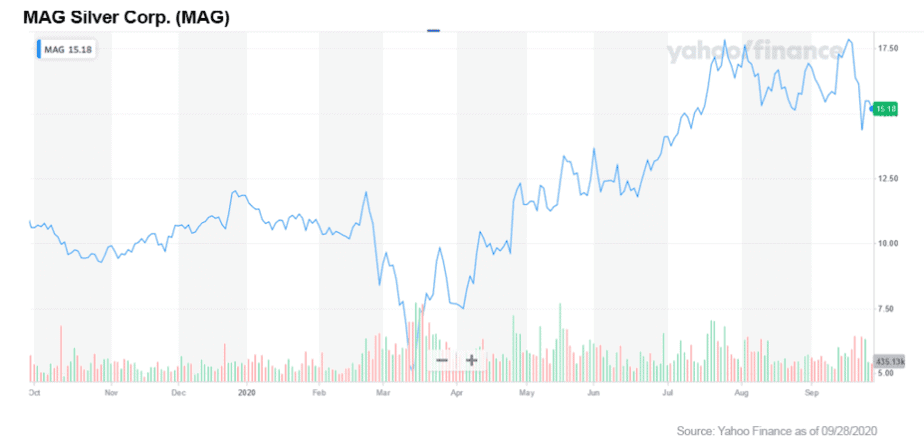

The Company has a financing team that can support their opportunity and thesis. Thus far, the finance team has raised $6.5 million, and investors come from Asia, Europe, and North America. MAG Silver (NYSE: MAG / TSX: MAG) has 19.9% ownership, and 21.5% ownership is by Management and the Board. Some notable institutional investors in Reyna includes Sprott Asset Management, Commodity Discovery Fund, Plethora Capital, Terra Capital, and BIA Gold Fund.[6]

So the question for Reyna Silver remains: is this the coming of a new Mag Silver?

Some notable names on the Reyna team include:

Reyna has five properties in total, but their primary focus is on the Guigui and Batopilas projects:

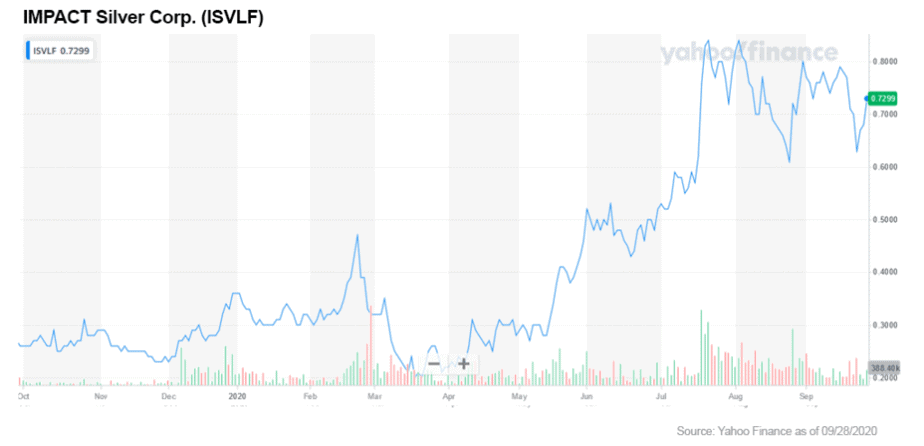

Impact Silver (OTC US: ISVLF / TSX-V: IPT)

Impact Silver’s focus is to grow into a mid-tier, low-cost, pure and profitable silver producer in a prolific Mexican district with almost 500 years of production. For the past six years, the Company has been able to operate a small-scale operation successfully, and in 2018, signed a strategic partnership with Samsung C&T. It is now looking at an outstanding silver market.

The Company currently operates three producing silver mines which feed the Guadalupe plant: the underground San Ramon Deeps Mine, the Mirasol Mine and Cuchara-Oscar Mine.

Exploration continues to evaluate the 5,000+ historic mine workings located on hundreds of mapped veins (red lines on map) on an extensive mineralizing system. 10.0 million plus ounces of silver were produced since 2006 with over 90% revenue from silver.

For the Speculative Investor

Carlyle Commodity Corp, (OTC US: DLRYF / CSE: CCC)

This is the dark horse of the group and one that has potential, vigor, and energy, with a capital structure and properties that impress. Carlyle Commodity specializes in acquiring, financing, and developing growth-stage exploration projects. Their first deal was with Riverside Resources (OTCQB: RVSDF / TSX-V: RRI) to option their flagship property, the Cecilia Gold-Silver Project, in Mexico.[9]

Riverside Resources has a strong reputation not only for the quality of their work but for their reputation in Mexico and in the mining sector in general. They add value to projects.

Making a deal with such a strong and competent company is a great feat in a hungry market looking to advance quality projects. This project looks to be just that.

I would be remiss not to mention two of the other sponsoring companies, Dolly Varden Silver (OTC US: DOLLF / TSX-V: DV) and Silver Elephant Mining (OTCQX: SILEF / TSX: ELEF), which both are advancing compelling projects. (More on these companies in the future...)

The outlook for silver is looking optimistic, and we have only just begun this mining sector bull market. There will be so much news on many developments as the world attempts to pivot and shift to The Great Reset that we hear so much about.

There is a reason so many central banks like China and Russia have been stockpiling gold reserves quarter after quarter for years. Commodities are the key to this new shift and reset. The new world needs electric power, green power, and clean power – and all of that comes from mining.

Silver is more than a safe harbour for the financial harm occurring and coming – it is the industrial metal that helps connect circuitry with the energy of tomorrow.

Andrew O’Donnell, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Andrew O’Donnell holds no direct investment interest in any company mentioned in this article.

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.weforum.org/great-reset/

[2] https://www.investopedia.com/terms/g/gic.asp

[3] https://www.newswire.ca/news-releases/wheaton-precious-metals-announces-record-revenue-and-sales-volumes-in-the-first-half-of-2020-883295592.html

[4] https://www.prnewswire.com/news-releases/wheaton-precious-metals-announces-intention-to-list-on-the-london-stock-exchange-301134352.html

[5] https://www.juniorminingnetwork.com/junior-miner-news/press-releases/1082-tsx/fr/83887-first-majestic-announces-cdn-78-million-bought-deal-investment-by-billionaire-eric-sprott.html

[6] https://www.globenewswire.com/news-release/2020/06/04/2043949/0/en/Completion-of-Acquisition-Transaction.html

[7] https://reynasilver.com/projects/guigui

[8] https://reynasilver.com/projects/batopilas

[9] https://www.newsfilecorp.com/release/59840/Carlyle-Announces-Property-Option-Agreement-with-Riverside-Resources-Inc.-for-The-Cecilia-GoldSilver-Project-in-Sonora-Mexico