One little-known junior exploration company now sits at the intersection of two prominent Nevada gold trends responsible for over 24 million ounces of gold production – and counting!1

It’s one of the biggest – and most exciting – investing stories on the planet.

Gold has gained significant momentum and has continued climbing to all-time record highs.

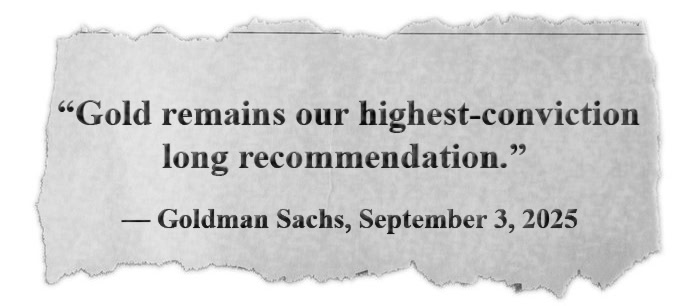

At this very moment, gold is defying all odds to become one of the best safe-haven assets for investors today, and it could become even more so… In fact, Goldman Sachs, the leading financial giant, has proclaimed that gold now stands poised to continue soaring to new heights.2

Gold recently hit a record-high $4,379 on October 173 for the first time in history as central banks and investors continue to stockpile this precious metal at a record pace. And Goldman also sees a scenario where $5,000 gold is possible – perhaps as soon as next year.4

In the midst of this red-hot gold bull market, I believe this could be a unique profit opportunity with a little-known company that could offer early investors upside potential.

That company is Surface Metals Inc. (OTCQB: SURMF / CSE: SUR), an under-the-radar US$7 million explorer sitting beside billion-dollar neighbors in Nevada.

In just a moment, I’ll tell you more about the opportunity with Surface Metals – including how this US$7 million/ CAD$9 million market-cap5 company could potentially be sitting on $210 million6 or more in gold, with ambitions to scale this into the billions. But first I need to stress how important it is that…

Gold has gained significant momentum. The metal is defying all odds to become the best safe-haven asset for investors in recent times. Goldman Sachs, the leading financial giant, has shared how gold is poised to hit new highs.

Goldman Sachs predicted gold would hit $4,000 an ounce, which it did on October 7, 2025 as the price of the asset soared. All the while, central banks and investors continue to stockpile gold at a record pace.

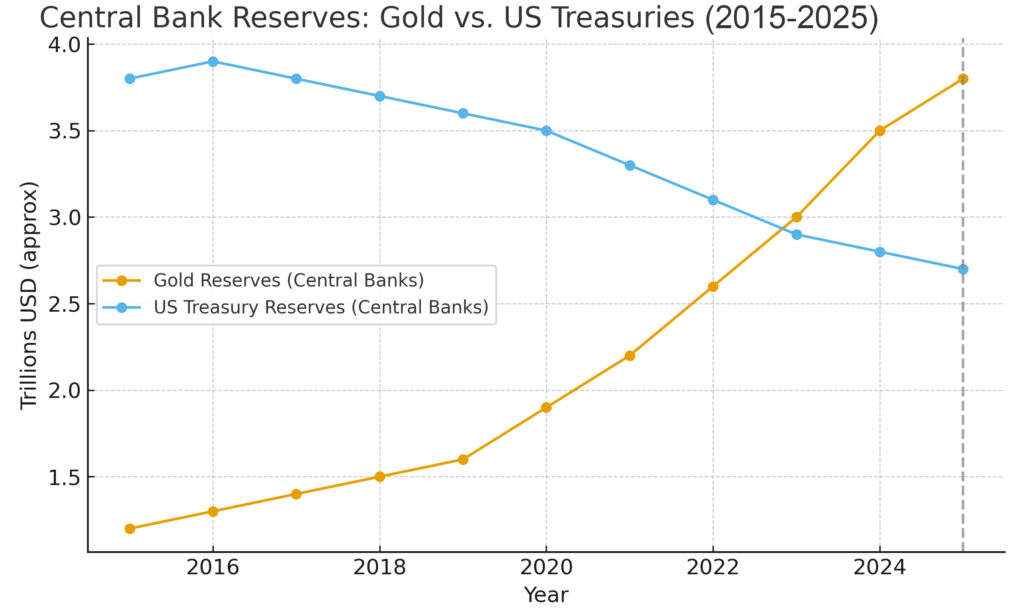

In their most recent communication, Goldman Sachs shared the potential impact of the independence of the Federal Reserve being compromised. Simply put, should the Federal Reserve appear to be significantly impacted, a pivot to gold could begin immediately.

The firm shared its outlook that even a modest 1% investor pivot from the US Treasury to gold could be enough for the metal to reach a $5,000 price spot.

According to Goldman Sachs’ analysts: “A scenario where Fed independence is damaged would likely lead to higher inflation, lower stock and long-dated bond prices, and an erosion of the dollar’s reserve-currency status. In contrast, gold is a store of value… We estimate that if 1% of the privately owned US Treasury market were to flow into gold, the gold price would rise to nearly $5,000 an ounce, assuming everything else remains constant."7

To be clear, there are a number of experts and analysts that feel we are still in the early stages of what could be a long-term bull market for gold.

On the lower side of gold’s price predictions is one of the top investment banks in America, JP Morgan, who issued a conservative gold price target of $4,000 on June 10.

After that was exceeded in September 2025, the same JP Morgan analysis projected a gold price of $4,250 per ounce in the fourth quarter of 2026.8

Well, that projection has already been reached on October 17, 2025 with gold topping +$4,300 per oz. Gold is so hot right now that even capital market analysts can't keep up to its hot pace.

Nigel Green, chief executive of deVere Group, a highly-respected financial advisory firm, recently stated, “We predict the (gold) price will reach $5,000 per ounce by the end of the first quarter of 2026. The drivers are already in place and momentum is compounding.”

“Each [interest rate] cut removes oxygen from cash and bonds, leaving gold as the standout alternative,” Green added. “With inflation still above target and government debt expanding at record speed, investors are seeking a store of value that requires no political guarantees.”9

In addition, billionaire investor John Paulson has also issued his most bullish gold outlook yet, stating that, “Central bank gold buying and global trade tensions are likely to push bullion prices to near $5,000 an ounce.”10

This type of sustained bull market has the potential to ignite explosive moves in junior gold companies.

In fact, gold exploration and junior mining companies often exhibit leveraged returns relative to the gold price. In favorable market conditions, particularly when gold is rising and investors are optimistic, a gold rally of +20% can lead to much larger percentage gains for well-positioned exploration companies, sometimes +50% or more.

History has shown that when gold surges, small-cap explorers with credible projects in proven jurisdictions typically deliver the most dramatic percentage gains.

And that description could fit Surface Metals (OTCQB: SURMF / CSE: SUR) perfectly.

The simple truth is that smart capital seeks out those names that offer maximum leverage to a commodity in the midst of an extreme bull market.

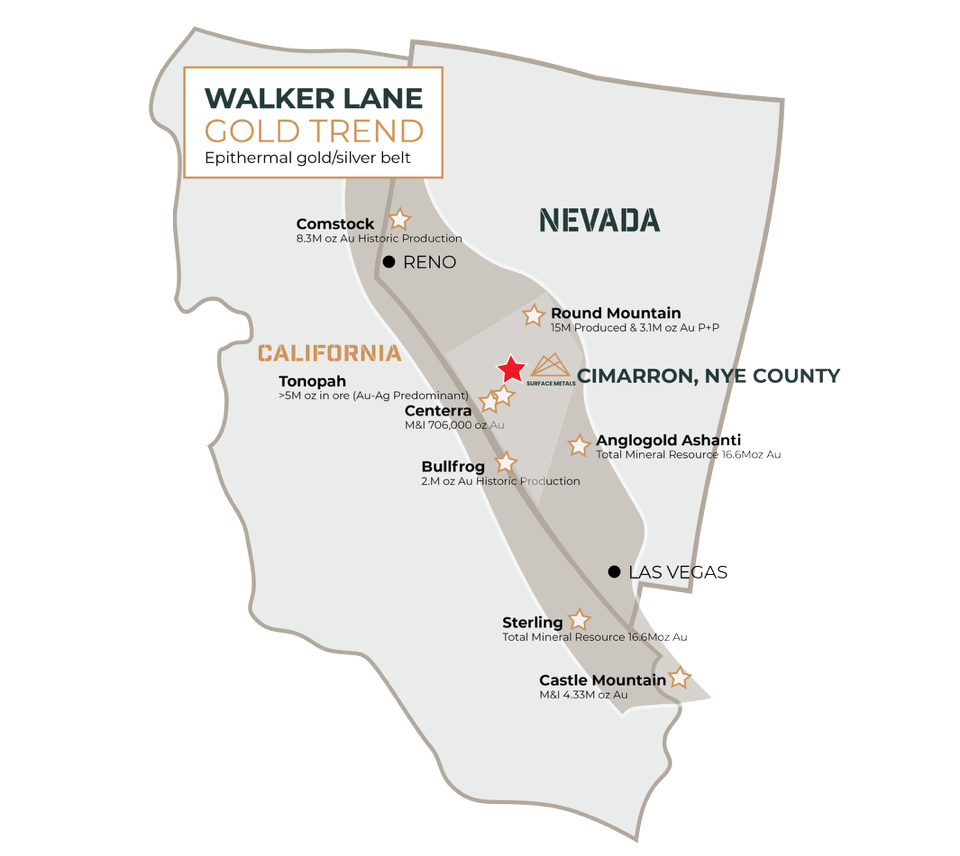

With its flagship Cimarron Gold Project in Nevada – in the heart of the legendary Walker Lane trend and surrounded by billion-dollar operators – Surface Metals is exactly where you may want to be in order to play this extreme gold bull market for maximum potential upside.

Surface Metals’ flagship Cimarron project is located in Nye County, Nevada… in the middle of the prolific Walker Lane trend, which is one of North America’s most productive gold hunting grounds.

This district is a proven hub of mining success. Located just 28 miles away, Kinross (NYSE: KGC), with a US$27 billion market cap, operates their world-class Round Mountain mine, which has produced more than 15 million ounces of gold

In fact, the Surface Metals Cimarron Gold Project sits at the intersection of two prominent Nevada gold trends responsible for a total of more than 24 million ounces of gold production – and counting!

Cimarron is a project where an extensive amount of work has already been completed. The project carries an extensive historical drill database of more than 190 holes and an estimated current resource of roughly 50,000 ounces of gold (non-NI 43-101 compliant).

The Surface Metals Cimarron asset could potentially be sitting on $210 million or more worth of gold, with the ambitions to scale this into the billions.

High-grade drill intercepts at 20–40 meters (65-131 feet) already show the kind of mineralization that builds wealth in strong gold markets. We're talking about 3–5 grams per tonne in a region where anything above 1.3 grams is considered solid.

And here’s the kicker: mineralization hits the surface and stays shallow, making future development possibly cheaper than other deep underground projects.

Modern 3D modeling applied to the historical data at Cimarron could redefine targets, potentially expanding the known footprint of the project. Let’s be clear – this remains speculative – but Surface Metal’s ambitions are to grow a resource to 1–3-million-ounces of gold with further drill programs and discoveries.

Another huge advantage for the Cimarron property is infrastructure. Access roads and historic drill pads are already in place, and its location – just 45 minutes away from Tonopah’s established mining hub ensures ready access to power, skilled labor and essential services.

This means Surface Metal’s Cimarron gold asset offers both promising exploration upside as well as practical development economics.

To sum it up: Nevada ranks among the top mining jurisdictions in the world… and gold prices have reached all-time highs. Cimarron combines scale, grade and location in a way that few other projects can.

For investors seeking smart, leveraged exposure to the gold bull market, Surface Metals’ Cimarron project could be the crown jewel driving the Company’s high-upside portfolio.

However, the Company’s impressive gold project is just one part of the story…

While Surface Metals (OTCQB: SURMF / CSE: SUR) offers smart, potential high-upside exposure to the red-hot gold bull market, the Company also offers a “bonus” resource play for investors with significant upside potential as well.

This is happening with the Company’s astonishing lithium assets.

Lithium, of course, is the critical element necessary for EVs, batteries and national energy security, and the industry is showing signs of a powerful rebound as supply chains tighten and China clamps down on production.

For investors, Surface Metals offers something rare in the junior resource sector: two powerful paths to value creation.

This is a true “double-play” resource opportunity. Surface Metals offers investors the combination potential from the Company’s Cimarron gold project PLUS longer-term upside from a lithium portfolio positioned to capture dramatic growth as the energy transition accelerates.

|

Yes! Send me my FREE |

|

In my opinion, Surface Metals holds one of the strongest portfolios of North American projects – each strategically located in areas with proven gold and lithium production, development and exploration.

In the near term, gold provides the most immediate catalyst, with the Cimarron Gold Project well positioned to capitalize on today’s red-hot gold bull market.

At the same time, lithium serves as the Company’s long-term backbone. Hear me out…

Surface Metals controls an NI 43-101 compliant inferred lithium resource of over 300,000 tons of lithium carbonate equivalent (LCE) at Clayton Valley in Nevada with a potential to be worth ~US$3 Billion at current LCE prices.11

This lithium resource sits adjacent to Albemarle’s (NYSE: ALB) Silver Peak resource. Albemarle Corp is a US$9 billion market cap company, and the only producing lithium mine in the US. It is responsible for production of more than 5,000 metric tons of lithium per year.12

Additionally, Surface Metals also controls lithium properties in Nevada that are also positioned alongside billion-dollar operators. It literally doesn’t get any better…

Surface Metals’ unique combination of gold and lithium means multiple “shots on goal” for investors.

Even as the gold bull market fuels near-term hysteria, Surface Metals (OTCQB: SURMF / CSE: SUR) maintains the potential to deliver significant upside in the years ahead as lithium demand continues to accelerate. Here’s where this unique “Double Play” is an advantage for investors…

Take a look around where you’re reading this message right now. It’s very likely that lithium is powering the very technology you’re using at this minute – your smartphone, laptop, cordless power drill… or maybe your car (EV)?

It’s also around us in renewable energy storage, defense systems… lithium is everywhere. And the global push toward clean energy? It’s impossible without lithium.

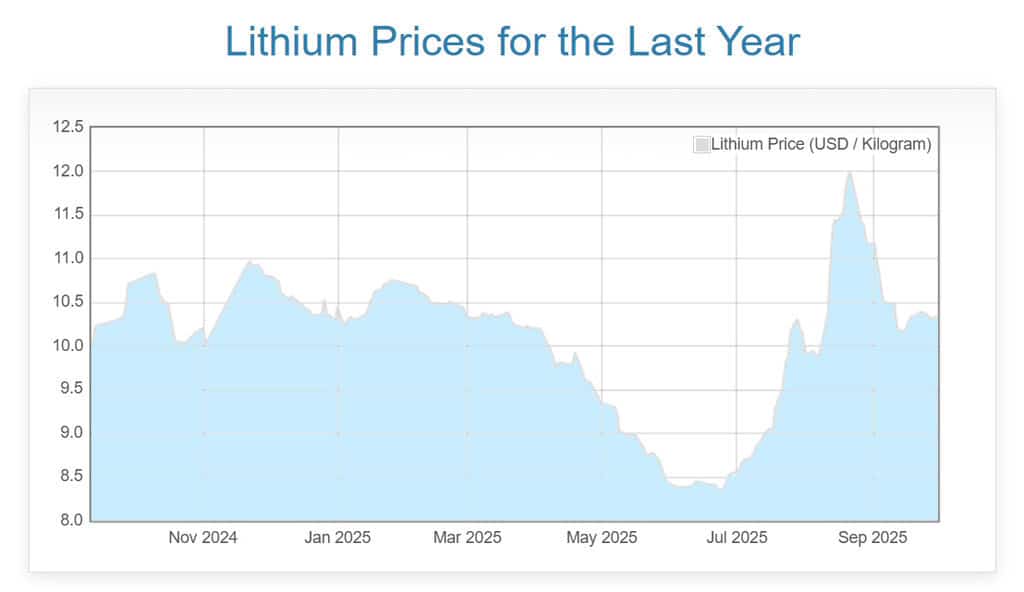

Now, it’s true that lithium prices did cool recently after years of rapid growth… and that type of reset is typical after a major commodity surge.

But here’s what hasn’t changed: demand fundamentals remain incredibly strong.

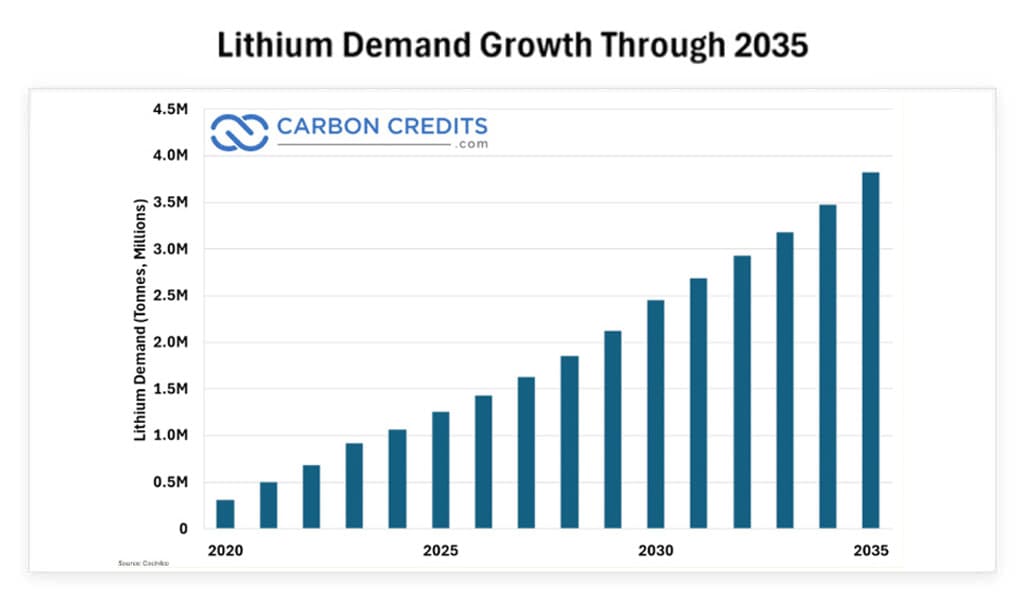

In fact, BloombergNEF projects that lithium demand will nearly triple to 3 million metric tons LCE by 2030… and that it remains on pace for further growth beyond that, fueled by surging EV adoption and grid-scale storage.14

All across the globe, nations are scrambling to lock down reliable supply chains for this critical element. And in North America, securing domestic lithium sources is now viewed as vital to energy security.

This makes for an ideal setup, as while lithium prices have pulled back since early 2023, the long-term fundamentals for lithium still scream that a rebound is ahead.

Lithium often delivers sharp cyclical moves… and when sentiment flips, companies with strategic assets in proven districts – as is the case with Surface Metals, Inc. – could see their valuations quickly skyrocket.

And over the past several months, lithium prices have begun to climb higher once again…

What this means is that Surface Metals (OTCQB: SURMF / CSE: SUR) appears to be in a great position. As you’re about to see, the Company’s lithium assets give shareholders a rock-solid foundation for the long term.

The Company’s Cimarron Gold Project drives near-term hyperaction, but lithium represents additional shots on goal for Surface Metals… and could potentially be as valuable to the Company’s gold assets as the energy transition accelerates.

One more very important point about what’s happening with lithium…

There’s no question that China dominates global lithium production and processing. When China moves in a certain direction, markets explode.

Recent mine shutdowns and export restrictions by the Chinese have already sparked major volatility and provided a brutal reminder of how fragile global supply chains really are.

SOURCES: Financial Times15 and Wired16

This recent activity supercharged the North American push to cut its dependence on China and develop secure, domestic lithium sources.

For Surface Metals, that shift has the potential to create significant momentum. If China tightens supply further, strategically domestically located projects like Surface Metals’ could become immediate beneficiaries.

Surface Metals’ impressive lithium portfolio delivers a long-term foundation for success. Its projects in Nevada are positioned directly beside billion-dollar neighbors and world-class producers, providing investors with smart exposure to this very critical commodity.

At the heart of the Company’s lithium portfolio is Clayton Valley, Nevada, home to Albemarle’s Silver Peak mine – the only producing lithium operation in the United States.

As I mentioned earlier, Albemarle, with a US$9 billion market-cap, operates its Silver Peak resource and is responsible for production of more than 5,000 metric tons of lithium per year.

Surface Metals controls 122 claims along the same area as $9 billion market cap Albermarle’s (NYSE: ALB) property. You could literally throw a baseball from the Surface Metals site and hit Albermarle’s property – that’s how close it is. This is exciting.

Surface Metals totals nearly 2,500 acres here and has already outlined a NI 43-101 compliant inferred resource of over 300,000 tonnes of lithium carbonate equivalent (LCE). It does not get much better than this.

Historic and modern drilling has confirmed lithium-bearing brines in the same horizons Albemarle has been producing since the mid-60s. Think about that!

This makes Clayton Valley a true cornerstone asset, with the added potential to leverage Direct Lithium Extraction (DLE) technologies that are now being demonstrated in the region.

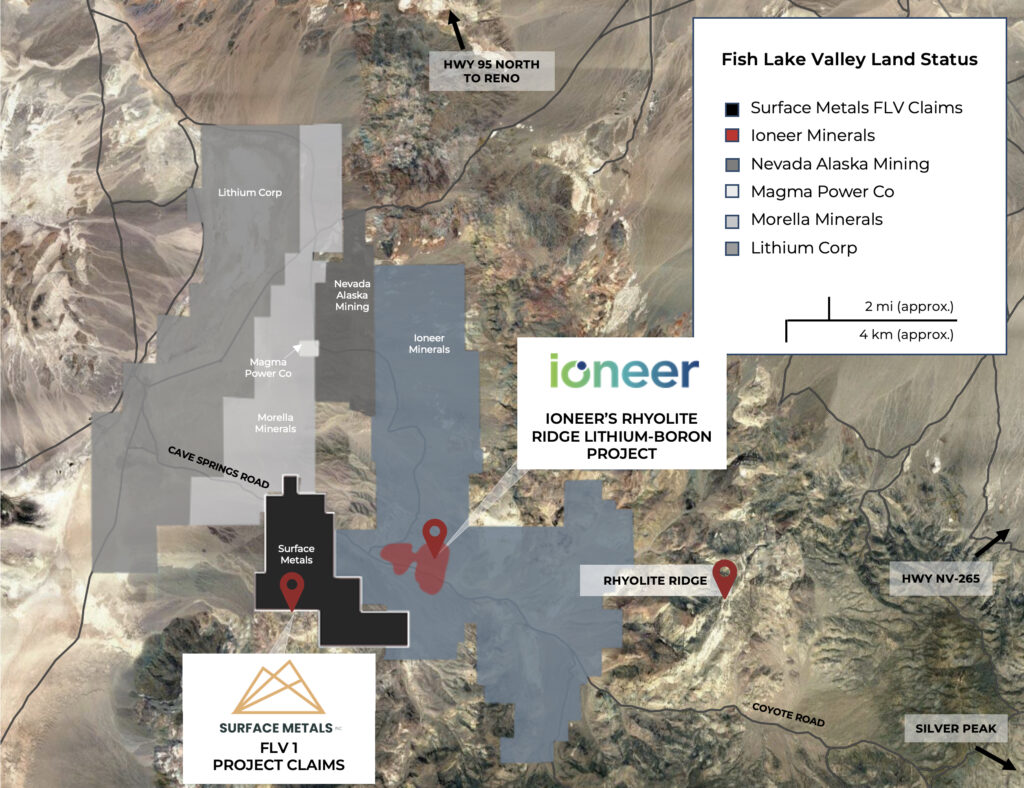

Just one valley over, Surface Metals holds a 100% interest in its Fish Lake Valley project, a 1,694+ acre sedimentary lithium claystone property.

What makes Fish Lake so compelling is its location next door to Ioneer’s Rhyolite Ridge, a world-class lithium-boron project that recently announced nearly $1 billion in US Department of Energy (DOE) funding and offtake agreements with Ford, Toyota and Panasonic.

Surface Metals’ sampling work at Fish Lake has returned lithium values up to 1,418 ppm, confirming the presence of high-grade material, and the project is considered drill-ready. With global attention already focused on the district thanks to the Ioneer Ltd. (NASDAQ: IONR) project backed by the DOE and a market cap of over US$225 million, Surface Metals is in a potentially ideal location.

Taken together, these two lithium assets give Surface Metals a unique blend of scale, diversity and credibility in the lithium space:

For investors, that means Surface Metals offers a true rarity in the junior resource sector: two powerful paths to value creation.

Look, you could buy Ioneer Ltd (NASDAQ: IONR) at over $4 per share when looking at lithium stocks. You could also buy Albemarle Corporation (NYSE: ALB). But in my opinion, junior stocks represent the greatest upside potential.

This also holds true in the gold space. Sure you could have bought Newmont Mining Corporation (NYSE: NEM) at $49 per share in May of this year and seen the stock recently deliver over +100% returns. But that's not always the case.

Gold mining giant Barrick Gold (NYSE: B) could be a buy today with a $88 billion market cap. It also has seen some similar appreciation. But how high can these go?

I'm betting on junior's, like Surface Metals With identified high-quality assets that could totally outperform, and believe it or not, deliver better shareholder results.

Surface Metals’ astonishing Nevada Cimarron Gold project offers leveraged exposure to the red-hot bull market and could potentially be sitting on $210 million or more worth of gold, with ambitions to scale this into the billions. Add to this a location at the intersection of two prominent Nevada gold trends responsible for over 24 million ounces of gold production… this is crazy, right?

And second, an impressive portfolio of two, high-upside lithium properties well positioned to offer an exceptional opportunity as lithium prices rebound in the months ahead!

This is well… just incredible. With strategic land positions in one of the most important jurisdictions, Nevada, the Company offers multiple pathways to creating shareholder value as demand for lithium continues to increase.

Continue reading to discover the…

1

2

3

4

5

6

7

Surface Metals (OTCQB: SURMF / CSE: SUR) now represents one of the most compelling opportunities in today's resource markets.

Think about that for a moment... With just under 44 million shares outstanding and a stock price trading around the US$0.20 range, you can own a piece of Nevada's Walker Lane gold district, home to billion-dollar discoveries, alongside strategic lithium assets positioned next to Albemarle, Ioneer, and other absolute industry giants.

These kinds of investment opportunities are worthy of a closer look.

"Goldman Sachs is calling for $5,000 gold. Lithium demand is set to explode as the energy transition accelerates. And Surface Metals sits directly in the path of both bull markets with an astonishingly low market cap."

— Saul Bowden

That means that Surface Metals’ Cimarron gold potential and lithium portfolio, which includes an NI 43-101 compliant resource and drill-ready projects beside billion-dollar neighbors, could be an opportunity not to be missed.

But windows like this don't stay open forever. As gold continues its historic run and lithium sentiment shifts, Surface Metals' true value will become impossible for investors to ignore.

The double-play opportunity is here, it’s also rare. The valuation is above compelling. The question is: will you act while you still can?

I recommend that you take the time to look closely at the Company for yourself, do your own due-diligence and decide if this opportunity is right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden owns stock in Surface Metals Inc., purchased in the open market, but will not purchase additional securities until 10 days following publication of this article to conform with Financial News Now publishing rules.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

This article contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

DISCLAIMER: This webpage contains information, qualifications, and disclaimers to protect the investor or potential investor when reviewing information on this webpage. Investors are urged to review the information on this webpage in its entirety and be aware that investing in junior mining companies represents considerable risk. Investors are urged to consult investment professionals at all times before making and investment decision.

All material found on this webpage may still contain technical or other inaccuracies, omissions, or typographical errors, of which Financial-News-Now, nor Surface Metals Inc., the featured company, assumes no responsibility. Financial-News-Now & Surface Metals Inc. does not warrant or make any representations regarding the use, validity, accuracy, completeness and reliability of any claims, statements or information in this webpage. Under no circumstances, including, but not limited to, negligence, shall Financial-News-Now or Surface Metals Inc. be liable for any direct, indirect, special, incidental, consequential, or other damages, including but not limited to, loss of programs, loss of data, loss of use of computer or other systems, or loss of profits, whether or not advised of the possibility of damage, arising from your use, or inability to use, the material found on this webpage. This information is not a substitute for independent professional advice before making any investment decisions.

TECHNICAL INFORMATION: Unless otherwise noted, the scientific and technical information contained on this webpage has been reviewed and approved by Surface Metals Inc. With regard to the Cimarron Project potential quantity and grade of mineralization described within content on or accessible through the Site is conceptual in nature as there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in targets being delineated as a mineral resource. As used within these Terms of Use, “mineral resource” has the meaning ascribed to such term by the Canadian Institute of Mining, Metallurgy and Petroleum, as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended.

Financial-News-Now and Surface Metals Inc. has not undertaken any independent verification of drill results from historical drilling not completed by Surface Metals Inc. Financial-News-Now and Surface Metals Inc. have not independently analyzed the results of the historical exploration work in order to verify the results. Surface Metals Inc. believes that the historical drill results may not all conform to the presently accepted industry standards and as such should not be relied upon by the reader. Financial-News-Now and Surface Metals Inc. considers these historical drill results relevant as Surface Metals Inc. will use this data as a guide to plan future exploration programs. Surface Metals Inc. also considers the data to be reliable for these purposes, however, Surface Metal Inc.’s future exploration work will include verification of the data through drilling.

FORWARD-LOOKING STATEMENTS: This webpage contains certain statements which may constitute forward-looking statements, such as estimates and statements that describe future plans, objectives or goals, including words to the effect that we expect or Surface Metals Inc. expects a stated condition or result to occur. Such forward-looking statements are made pursuant to the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The following list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

SPECIAL NOTE: Actual results relating to exploration, mine development, mine construction, mine operation, and mine reclamation related to projects could vary materially from those expectations. Capital costs and operating costs could vary materially from those expectations. Resource and reserve calculations could vary materially from those expectations. Reason or factors that may cause such variability in expected results includes resources and reserves differing from expectations, changes in general economic conditions and conditions in the financial markets, changes in demand and prices for the products that may be produced. Other factors may include litigation, legislative, environmental and other judicial, regulatory, political and competitive developments in domestic and foreign areas in which we operate, technological and operational difficulties encountered, productivity of our resource properties, changes in demand and prices for minerals, labor relations matters, labor, material, and supply costs, and changing foreign exchange rates. This list is not exhaustive of the factors that may affect forward-looking statements related to this webpage. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Further information regarding these and other factors is included in Surface Metals Inc.’s filings with the Canadian provincial securities regulatory authorities (which may be viewed at www.sedar.com).

CAUTIONARY NOTE TO INVESTORS CONCERNING ADJACENT PROPERTIES: This webpage contains information about adjacent properties on which Surface Metals Inc. has no right to explore or mine. Investors are cautioned that mineral deposits on adjacent properties are not indicative of mineral deposits on Surface Metal Inc. properties.

CANADIAN NATIONAL INSTRUMENT NI 43-101 GUIDE QUALIFIED PERSON: Mineral Resource and Mineral Reserve estimates and resulting Technical Reports must be prepared by or under the direction of, and dated and signed by, a Qualified Person. A Qualified Person (“QP”) means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association.

Sources:

“New demand drivers have pushed gold prices higher, but we believe room remains for historical catalysts – such as US dollar weakness, falling yields or increased investor interest – to raise prices further.” [18]

“Gold could rapidly escalate beyond $4,500, possibly breaching $5,000/oz over the next 12–18 months, if not higher, which would mirror historical crises—1970s-style fiscal dominances and runaway deficits—where gold soared multiple-fold in short order.” [19]

“Could gold and Bitcoin $BTC swap places on the valuation scale? At the very least, gold could easily match Bitcoin pricing, since it is just as scarce and just as onerous to produce as Bitcoin, with one major caveat in its favor: Gold actually exists.” [19]