If there ever was a product category prime for disruption, it’s energy drinks. Millions of Americans consume these beverages for the quick boost of a caffeine high... but it’s a rush, then a crash.

Additionally, the long-term health effects of caffeine-based energy drinks are just now becoming known, and consumers don’t like what they’re learning. This may represent a significant opportunity for a substitute product that does not cause a “crash” following an energy boost, or cause adverse long-term health effects.

The list of ailments stemming from energy drink use is simply staggering. Side effects range from headaches and migraines, to type 2 diabetes, to cardiac arrest, to high blood pressure. Plus, many more ailments... and none of them are good.[1]

In fact, the downsides are so negative that the U.S. Center for Disease Control (CDC) flatly recommends that adolescents should not consume energy drinks,[2] and the Dept. of Defense (DoD) is now warning troops against using them.[3]

What is driving consumers to such risky habits? Americans want to be more alert, more effective, and more tenacious. That singular American ethos gave rise to the energy drink category, pushing it to a $16 billion market in the United States alone in less than a decade, and it is growing still at a blistering 7% annual rate.[4]

A next-generation beverage that can do the same things as popular energy drinks but without the downsides could quickly break this market wide open.

A disruptive new category called “nootropics” is on track to totally disrupt the entire energy drink and functional beverage marketplace by giving users all of the benefits of traditional energy drinks, but with none of the downsides.

Koios Beverage Corp. could quickly rise to become a leading brand in the world of functional beverages. Now is the time to get in front of this explosive new trend with this early player in the nootropic beverages space!

I’m just getting started…

Read on to discover what is building in this market, and how these developments can lead to dramatic changes in brand loyalties and consumer preferences.

With these changes comes opportunities upon which Koios Beverage Corp. (OTC: KBEVF / CSE: KBEV) and its shareholders can capitalize for long-term growth.

And later in this report, you will read more details about Koios-branded products and how disruptive they can be to the functional beverage market. First, you’ll want to wrap your head around the magnitude of this opportunity, and how much traction Koios is already gaining.

Let me explain…

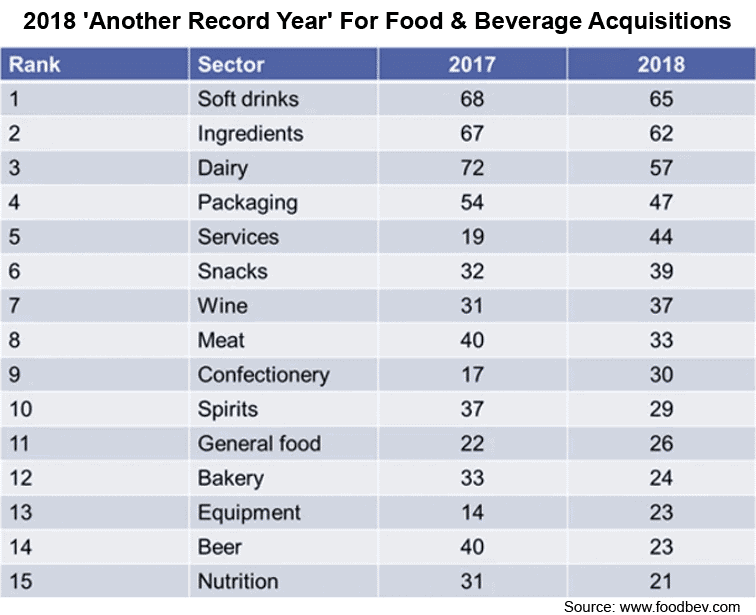

While I may be speculating, leading retailers are positioning Koios in a way that cannot be unnoticed by industry giants, such as PepsiCo and Coca-Cola. It is well-known that these leaders can only stay leaders by adapting to and staying ahead of market trends, which makes acquisition a core strategy for the survival of these companies.

The “thirst” for bottled beverages (both in the Americas and globally) has undergone enormous change over the last decade. Mega-bottlers Coca-Cola and PepsiCo have seen plunging sales of flagship brands as billions of dollars have flowed out of these brands, and into new product categories and alternative brand ideas.

Shifting trends in brand loyalty has become the biggest existential threat to big bottlers in their history. In response to this, big bottlers have been on a massive buying spree to retain control of their market share!

Even seemingly questionable threats to Coca-Cola’s or PepsiCo’s market dominance trigger stunning buyouts. For example, PepsiCo recently bought out SodaStream for a whopping USD $3.2 billion![5]

More shockingly, that buyout was for a share position in a $2.3 billion market space...about one-seventh the size of the energy drink market! [6]

Prior to that, PepsiCo bought out a probiotic brand, KeVita, for $1.2 billion to secure a share position in that space.[7] They also spent $465 million to buy the CytoSport business, which includes the “Muscle Milk” brand, from Hormel Foods![8]

It’s not just brands that have already become a household name that are of interest for acquisitions…

Coca-Cola is throwing billions at emerging brands as well. The company has an entire division focused solely on acquisition opportunities named Venturing and Emerging Brands (VEB).[9]

In 2018 alone, Coca-Cola ran a buyout spree ranging from a $5.1 billion acquisition of coffee chain Costa Coffee to a minority stake in sports drink brand, BodyArmor.[10] [11]

It’s a good bet that the glory days for caffeine-based energy drinks are numbered...

The Chicago Tribune summed it up under this headline:

The killer ingredient? Caffeine.

For the most part, energy drinks are nothing more than flavored sugar water with a dash of vitamins to suggest that the beverage has healthy properties, all to deliver massive doses of caffeine, including the questionable additives such as taurine and guarana.[14]

Consumers (young people in particular) are put under the impression that these drinks fuel their brain, but they deliver nothing more than a high-dose caffeine rush followed by a sudden drop in energy known as a “crash.”[15]

What’s worse, the longer-term health impacts are frightening. Consumers (as well as media) are just now taking notice. This has led to soaring new interest in nootropic beverages as an alternative to caffeine-based energy drinks — which I’m betting could draw attention to Koios-branded products in particular.

Health experts are finally being heard and health-focused consumers are paying attention. Nootropics, the next-generation alternative to energy drinks, have arrived and Koios-branded drinks are leading the charge as consumer awareness rises.

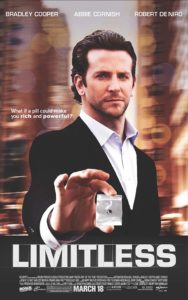

Nootropics are reported to improve all manner of brain function, which is gaining mainstream attention. Think of it this way...in the 2011 movie Limitless, the lead character Edward Morra (played by Bradley Cooper) supercharged his brain with a fictional nootropic drug called NZT-48. The drug gave him access to 100% of his brain’s capabilities, and that brain boost vastly improved his lifestyle and fortunes.

While the Limitless movie was science fiction, the idea of nootropics is not — it’s here and it’s available now in beverage and powder form.

Koios products are loaded with brain-boosting nutrients that are reported to deliver significant improvements in executive functions, memory, focus and alertness.

These nutrients are rapidly gaining popularity — particularly among white- and blue-collar workers, computer programmers, e-gamers and college students who report significant benefits over the harsh stimulants found in energy drinks.

As you conduct your due diligence, you will learn more about these benefits and why Koios products could rapidly drive consumers away from caffeine-based energy drinks, and towards nootropic functional beverages.

The emergence of the Koios brand on the shelves and online stores of GNC, Walmart, and Amazon could mark the beginning of a downward spiral in the popularity of high-caffeine energy drinks.

For Koios (OTC: KBEVF / CSE: KBEV), it is a huge opportunity to get in front of a fast-growing trend that could radically alter the $16 billion U.S. energy drink market.

Aside from being positioned to gain a profitable market share, this could lead to a buyout from a big-name soft drink brand that is looking for an up-and-coming, alternative beverage company to replicate or replace the growth from its current or historical brand decline.

Health food retailer GNC got the ball rolling with nootropic supplements that health-focused consumers would find interesting to provide cognitive functions — particularly executive functions, memory, creativity, and motivation.[16]

Early adopters in the nootropics space have traditionally been high-achievers (e.g. university students, executives, engineers), but now the trend of using nootropics is going mainstream.

Seniors are beginning to use nootropics for the benefits of improved brain function, memory, and alertness. Working moms and dads are doing the same to improve on-the-job performance and to maintain alertness off the job.

The key is that consumers are shifting focus from body health to brain health. They don’t want stimulants — they want fuel for the brain that can make them more efficient at work, more focused in tasks and more effective in decision-making.

The trend is crystal clear… Americans want sharper, healthier minds, and that is propelling a seismic shift in brand choices that could make Koios beverages the number one choice in this space.

Now let’s talk more about buyouts…

The track record is clear. Beverage giants don’t fight, they buy!

With early adoption of Koios products by GNC, Walmart, and Amazon, it does not only stand to ignite interest in the capital markets to buy Koios shares (OTC: KBEVF / CSE: KBEV)... I strongly believe, based on my research, this could also prompt potential interest from beverage giants such as Coca-Cola and PepsiCo, or the likes of...

These major beverage companies have a well-established record of snapping up leading brands in new and expanding consumer categories.[17]

As reported above, Coca-Cola operates an independent entity within its organization, Venturing and Emerging Brands (VEB), with the primary objective of identifying and targeting merger and acquisition opportunities.

Their recent acquisition of Costa Coffee for $5.1 billion clearly shows that they not only have deep pockets, they’re ready to write checks!

PepsiCo operates a similar unit called PepsiCo HIVE which seeks to acquire emerging brands and scale them using PepsiCo’s marketing and distribution muscle.[18] Under the company’s CEO, Ramon Laguarta, the company’s acquisition strategy and objectives remain guarded, but the industry expects more of what has been historically consistent.

Big beverage will consistently pursue acquisition over brand innovation. As a new market moves in — or an old market begins to fail — you can count on big beverage to stake big claims in new niche categories in which there is consistent and continued consumer interest.

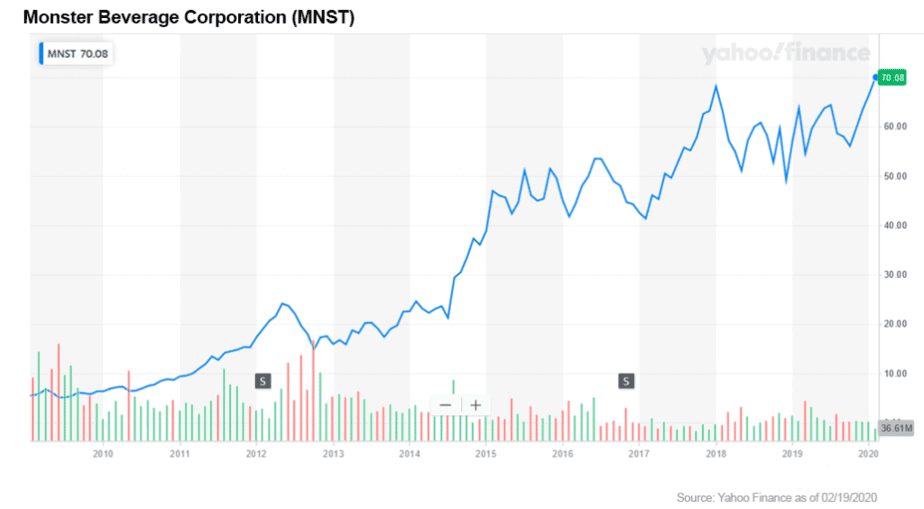

Just look at what Coca-Cola paid for Monster Beverage brands, one of the leaders in the energy drink space.

Just five years ago as Monster was carving its place in the market, Coca-Cola stepped in and paid $2.15 billion cash for just a 16.7% interest in the company![19]

Early shareholders in Monster profited handsomely. In the mid-2000s, shareholders were buying Monster for as little as 9¢ a share! Now it trades north of $65![20]

With Koios beverage products turning over inventory from the specialty health food retailer GNC to the mainstream aisles of Walmart and Amazon, Koios’ revenue growth could stand to see continued growth.

This is a major step forward in a process that could disrupt the $16 billion market for energy drinks.

Koios’ market disruption strategy is to displace popular caffeine-based energy drinks that currently dominate store shelves. This could be possible since these drinks are literally raising the risk of heart damage and other adverse health side-effects in users! [22]

As is the case with many investments, purchasers of shares in Koios are cautioned that there is a high risk associated with the purchase of Koios shares — it being a junior-level investment opportunity. There is a possibility of substantial or total loss of one’s investment.

With this high risk, however, comes a potential for a correspondingly high reward. Remember, Monster Beverage was high risk at the outset when it was selling for as little as 9¢ a share. Now it sells at over $65!

1

2

3

4

5

Koios is a fast-moving company that could announce major distribution breakthroughs at any moment. The company has announced expansion into 210 new GNC locations, bringing its total distribution to 4,300 locations across the United States.

With the further expansion expected into Walmart and Amazon, news about Koios could begin flowing fast... If that time comes, you will want to consider having a position in Koios!

Put OTC: KBEVF / CSE: KBEV on your stock watch list or consider getting some skin in the game right away. Of course, whatever you do, be sure to do your own due diligence before investing.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

SPONSORED ARTICLE: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.caffeineinformer.com/top-10-energy-drink-dangers

[2] https://www.cdc.gov/healthyschools/nutrition/energy.htm

[3] https://www.military.com/daily-news/2016/12/29/dod-health-experts-want-troops-to-cut-back-on-energy-drinks.html

[4] https://www.grandviewresearch.com/industry-analysis/us-energy-drinks-market, https://www.grandviewresearch.com/industry-analysis/energy-drinks-market

[5] https://www.cnbc.com/2018/08/20/pepsico-to-buy-sodastream-for-3point2-billion.html

[6] https://www.dallasnews.com/business/business/2017/10/02/breaking-coca-cola-buy-texas-cult-favorite-sparkling-water-brand-topo-chico

[7] https://www.reuters.com/article/us-kevita-m-a-pepsico-idUSKBN13H1LN

[8] https://finance.yahoo.com/news/pepsico-closes-cytosport-buyout-fortifies-125912097.html

[9] https://www.coca-colacompany.com/stories/fearless-pursuing-the-next-big-thing-in-beverages

[10] https://money.cnn.com/2018/08/31/investing/coca-cola-company-costa/index.html

[11] https://www.fooddive.com/news/coca-cola-takes-stake-in-bodyarmor-in-effort-to-unseat-gatorade/530035/

[12] https://www.forbes.com/sites/garystern/2018/09/04/whats-driving-coca-colas-recent-acquisitions/#160f385b202a

[13] https://www.chicagotribune.com/opinion/commentary/ct-energy-drinks-dangerous-caffeine-20170530-story.html

[14] https://www.huffingtonpost.ca/entry/energy-drink-ingredients_n_5964df55e4b03f144e2ddfa8

[15] https://health.usnews.com/wellness/for-parents/articles/2018-06-06/teens-and-energy-drinks-a-potentially-dangerous-combination

[16] https://en.wikipedia.org/wiki/Nootropic

[17] https://www.nutraingredients-usa.com/Article/2018/11/01/PepsiCo-Coca-Cola-battle-it-out-in-functional-food-and-beverage-arena#

[18] https://www.fool.com/investing/2018/12/03/will-pepsicos-new-ceo-radically-alter-its-strategy.aspx

[19] https://www.forbes.com/sites/maggiemcgrath/2014/08/14/coca-cola-buys-stake-in-monster-beverage-for-2-billion/#e62ac465427b

[20] Current market quote from June 7, 2019

[21] https://www.fooddive.com/news/coca-cola-in-fight-with-monster-over-new-energy-drinks/541805/

[22] https://health.usnews.com/wellness/for-parents/articles/2018-06-06/teens-and-energy-drinks-a-potentially-dangerous-combination