One thing is certain: The coronavirus outbreak will get worse before it gets better.

More people will become infected, and the global economy and markets will see the virus’s impact negatively impact GDP and select stocks.

That markets and economies will take a hit is certain. The question is only which ones and how much.

If you own stocks of luxury brands, airlines, casinos, hotels, cruise lines, travel booking agencies, or any company with a large presence in China, you might see losses of 20% or more.

On the other hand, if you would like to find some big bargains on solid stocks, buying during the coronavirus dip might be just the thing.

Right now, some of these stocks are trading as much as 18% off of their pre-outbreak, mid-January highs.

That could give you some tasty returns as the virus becomes contained, business as usual resumes for these companies, and investors jump back in.

But not every China-hit stock is a buy, and you need to know which ones to stay away from, whether that means selling stock you own now or just not buying what may look like a great bargain today.

A few industries aren’t going to bounce back too easily, and will see sales fall significantly, with proportional earnings losses.

Let’s take a look at the stocks that are most exposed to the coronavirus. But first, a little background to give you an idea of the size and scope of the problem.

The name “coronavirus” actually refers to a large family of viruses that are transmitted between animals and humans.

The official name is the 2019 novel coronavirus or Covid-19, and it is the third in the past 30 years to jump from animals to humans.[1]

The first, SARS, is a coronavirus transmitted to humans by civet cats, which claimed more than 700 lives in 2003-04.

The second, MERS, transmitted from camels to humans, has killed over 800 since it emerged in 2012.

The current coronavirus originated in December in Wuhan, China, and is believed to have originated in bats, then transmitted to humans by pangolins, an ant-eating mammal.[2]

Already there have been more than 71,000 confirmed infections in 28 countries, with an estimated 3% death rate depending on how data is received and calculated.[3]

In comparison, SARS has a mortality rate of about 10%, and MERS 35%. The flu, which claims around 400,000 deaths every year, has a 1% mortality rate.

The good news is that the global response to the fast-moving novel coronavirus has been quick and efficient.

Countries are airlifting their citizens out of China, shutting down border crossings, and barring or quarantining travelers who have been in China recently.

China’s response too is unprecedented. The country has taken dramatic measures to stop the spread, quarantining more than 50 million people living at the outbreak epicenter around Wuhan from the rest of China.

WATCH VIDEO: Leishenshan Hospital is the second SARS treatment-model hospital in Wuhan to battle the novel coronavirus.

In effect though, the entire country of China is quarantined.

Across China, museums, theme parks, public transport, thousands of movie theaters, restaurants, and airports have closed. So has the entire island of Macau, which has closed all its famous high-rolling casinos.

Airlines, including United (NASDAQ: AAL), Delta (NYSE: DAL), British Airways, and Lufthansa (XETRA: LHA / OTC US: DLAKY) have halted nearly all service to China.

Cruise lines have cut China destinations from their itineraries, and are banning passengers who have been recently in China.

Within Wuhan, 7,500 laborers worked around the clock to build a new 645,000 square foot hospital with 1,000 beds and 30 intensive care units in just 10 days.

A second hospital has also already been built, and about a dozen other facilities, including a sports stadium and an exhibition center have been converted to makeshift hospitals, adding an additional 10,000+ beds.

In the U.S., travel from China has been severely restricted, and the 195 Americans evacuated from Wuhan have been quarantined, the first such action our government has taken in more than 50 years.[4]

So far, the threat within our borders is small. Says Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases at the Centers for Disease Control and Prevention, “We continue to believe that the immediate health risks from the 2019 coronavirus to the general American public is low at this time. But the threat is serious, and our public health response is aggressive, with the aim of helping protect Americans."[5]

The U.S. State Department issued a Level 4 warning – its highest level – banning Americans from traveling to China until further notice.

Now economists are analyzing how big the outbreak’s effect on the economy will be. They’re studying past epidemics for a better idea of what might happen.

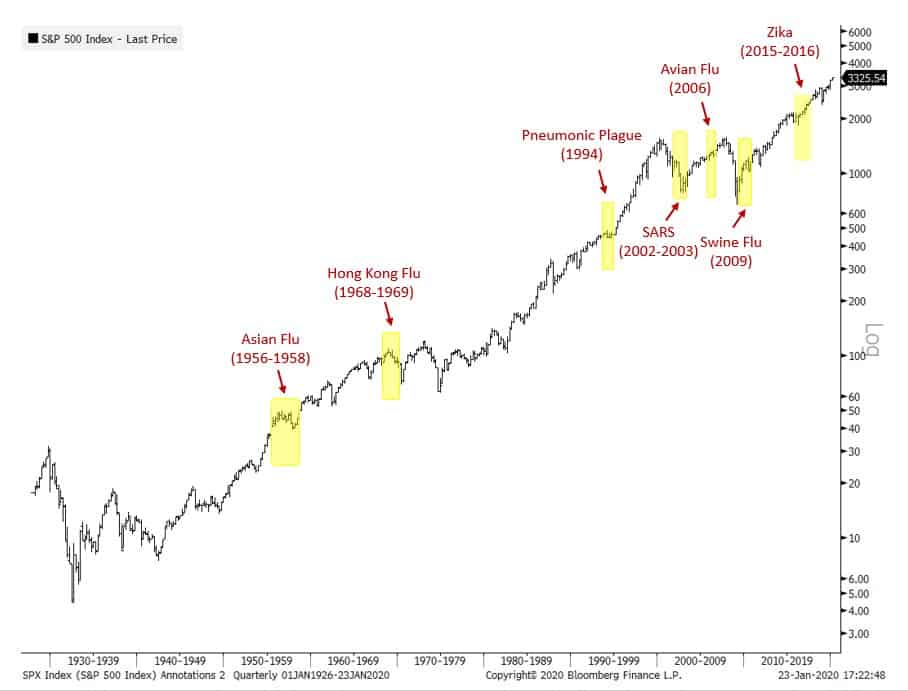

When you look at the 12 significant health epidemics since 1981, you’ll see that only two of them produced negative 12-month stock market returns.

To be fair, the double-digit losses suffered during the AIDS crisis came in the middle of an epic bear market, the so-called “Volker’s Bear,” named after the Chairman of the Federal Reserve at the time, who famously raised the federal funds rate from 11.2% to 20% to break the inflationary spiral.

That leaves only one negative return of just 0.73% that occurred after the measles outbreak of 2014, when 644 cases were reported in the U.S., the highest number in two decades, and more than 50,000 cases in the Philippines.

If any of the other 10 epidemics affected stock returns, it’s hard to see. In eight of the times, the 12-month change in the S&P 500 was in the double digits, with some registering returns as high as 26% and 36%.

As Bloomberg News notes, “Even when the human toll risks becoming grim, financial markets have shown resilience.”

Of course, that’s the case for stocks. Hits to the economy and virus-adjacent stocks are another matter.

A study from the Brookings Institute estimates that a mild pandemic would cause a 0.8% decline in GDP, ramping up to an “ultra” pandemic that would cause an extremely destructive 8.67% GDP decline.[6]

Even so, judging by the effect of past viral outbreaks on markets, analysts aren’t too worried about the coronavirus.

Goldman Sachs chief Asia economist Andrew Tilton says, “The negative impact on growth and asset prices from viral outbreaks typically normalizes within a few months.”[7]

JP Morgan economist Bruce Kasman agrees, saying that the effects will be mainly contained in the first half of the year.

That means there are some incredible bargains right now, after jittery investors sold off stocks with significant exposure to China, as well as some that got caught in the crossfire.

In 2002-03, SARS caused an estimated $40 billion in lost economic activity.[8]

Today, because of the sheer growth of the Chinese economy over the last 17 years, the novel coronavirus could wreak far greater damage, says Warwick McKibbin of the Australian National University.

In 2003, China made up just 4% of global GDP. That share has now ballooned to 17%.

Because of China’s role as the world’s factory, the global supply chain could suffer a disruption that Panos Kouvelis of Washington University estimates could top $400 billion and last for two years.[9]

“China is shut down,” asserts fashion industry trade journal Women’s Wear Daily, with typical flourish.

But for the luxury apparel industry, it’s not much of a stretch.

The Chinese consumer accounts for a whopping 35% of the global market for luxury goods, as well as two thirds of its growth.[10]

Investment advisory William O’Neil & Co. expects analysts to cut their earnings estimates for key players in the luxury goods sector by about 10% for the year.

That could hit companies like LVMH Moët Hennessy Louis Vuitton (OTC US: LVMUY / PARIS: MC), Burberry Group (OTC US: BURBY), and Ralph Lauren (NYSE: RL) hard.

Burberry withdrew its financial guidance for 2020, Estee Lauder (NYSE: EL) cut its profit forecast, Pandora A/D (OTC US: PANDY) said traffic at their stores in China is “at a standstill.”[11]

The CFO of luxury fashion marketer Tapestry Inc. (NYSE: TPR) told analysts on a conference call that their Coach brand could see an 80% drop in sales across China this year because of the outbreak.[12]

Tapestry shares fell by 10% in the week following news of the outbreak as nervous investors unloaded the stock.

China accounts for about 15% of Tapestry’s global sales, translating to a forecasted $200 to $250 million loss in sales during the second half of the year, and a related earnings hit of $97 million to $124 million (35 to 45 cents a share).

Likewise, Capri Holdings (NYSE: CPRI), owner of the Michael Kors, Versace, and Jimmy Choo luxury brands, saw its stock fall by 16.69%.

The company has closed 150 of its 225 stores within China. This comes at a bad time (as though any time would be good) because it comes during Chinese New Year, when a significant sales bump usually occurs.

As a result, Capri lowered 2020 revenue guidance by $100 million, a drop of 7.6%, and earnings per share by 45 cents, a drop of 7.6% and 10% respectively.[13]

The coronavirus effect will also ripple out to U.S. apparel sales on account of China’s role as the world’s largest apparel producer.

Nearly a third of all U.S. apparel imports are sourced from China, with a value of $24.9 billion.[14]

That will not only hit apparel makers, but retailers too. Wells Fargo indicates that stores could see inventories shrink within 60 to 90 days.[15]

This would impact companies like Target (NASDAQ: TGT), Best Buy (NYSE: BBY), Dick’s Sporting Goods (NYSE: DSK), G-III Apparel Group (NASDAQ: GIII) and Walmart (NYSE: WMT) the most.

Since the start of the outbreak, more than $18 billion has been wiped off the market value of Macau casinos run by Wynn Resorts (NASDAQ: WYNN), MGM (NYSE: MGM), and Las Vegas Sands (NYSE: LVS).[16]

All 41 of the Chinese territories have been closed for more than two weeks. The closure is costing Wynn $2.6 million per day. The company generates 60% of its revenue in Macau, the world’s richest gambling market.[17]

Macquarie Capital gaming analyst Edward Engel expects first quarter gaming revenues to drop by more than 40% for that two-week closure, adding that a longer closure will drive up those losses.

When it comes to airlines, China giveth and China taketh away.

The country’s explosive growth helped power a global aviation boom over the last decade. But the coronavirus could hit the industry extraordinarily hard.

The 2003 SARS outbreak caused a 45% plunge in passenger demand in Asia.[18] Since then, many airlines have become even more reliant on the region for their revenue.

China is now the world’s biggest outbound international travel market and the second-largest domestic aviation market.

United Airlines (NASDAQ: UAL), American Airlines (NASDAQ: AAL), Delta (NYSE: DAL), Lufthansa (XETRA: LHA / OTC US: DLAKY), and British Airways have all cancelled some or all China flights.

Still, U.S. and European airlines rely on Asia travel for just around 7% of overall revenue. Even so, if you look again at the effect of the 2003 SARS outbreak, U.S. airline stocks lost about 30% of their value.[19]

The big hits will be felt by airlines that include China Southern (NYSE: ZNH), China Eastern (NYSE: CEA), Cathay Pacific (OTC US: CPCAY), and Air China (OTC US: AIRYY).

China Southern stock lost as much as 21% since the outbreak, with the others also suffering losses in the high teens.

Analyst Luya You of BOCOM International Research forecasts “a very, very large impact,” with key airlines seeing earnings setbacks of 30% to 50%.[20]

Right about now you might be asking, if these are the stocks and industries that are being hit hard, are they worth buying on any potential pullback?

Here are a couple that could bounce back.

The stock market lost several percentage points in the days following the announcement of the coronavirus outbreak, but it bounced back quickly and went on to reach record highs.

That shows that the bull market still has strength, and should help the stocks hit hardest to recover even faster.

The stocks listed below have been hit by coronavirus-related losses. But both should rebound quickly. In fact, both have already started retaking losses, which means to take advantage of their bargain-basement prices you’ll have to act fast…

So think about investing in these stocks…but don’t think too long. Available early investment entries can change quickly.

Both of the companies already mentioned in this article are solid, growing companies with good fundamentals. They should bounce back in a few weeks to six months, depending on the industry and how long this coronavirus scare lasts.

But there are a couple others to consider too. And surprise, surprise. They are Chinese companies.

Both of them trade on major U.S. exchanges, are quite liquid, and sport great fundamentals. And both of them have been hit hard by the one-two punch of trade wars and coronavirus. Which gives you an opportunity to bargain hunt.

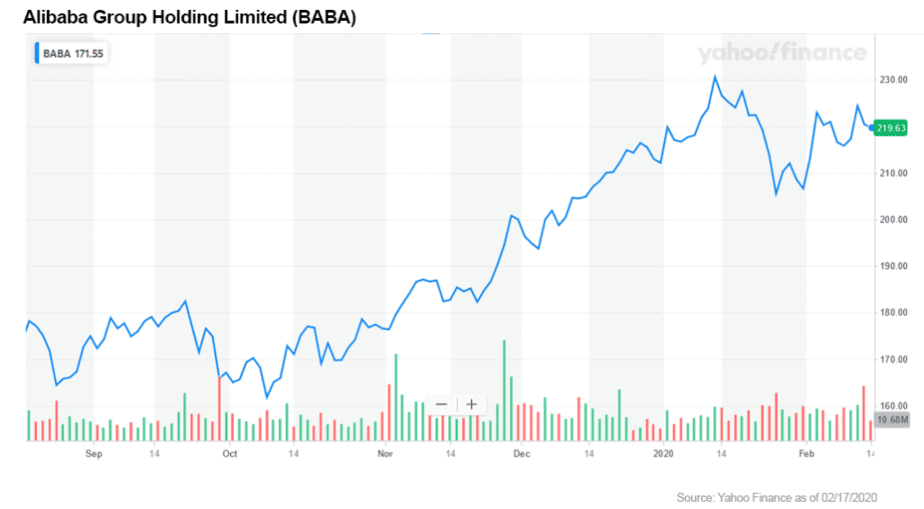

With a market cap of $609.58 billion, Alibaba, the “Amazon.com of China,” is one of that country’s tech superstars.

The stock has been beaten down by trade war concerns, but also recovering nicely, and reached its all-time high on January 13, 2020. Then came the coronavirus, and just like that 13.85% was lopped off the stock’s value.

BABA is trending back toward its highs, and chances are it will be setting even higher highs for what is forecasted at least in the near-term.

Especially with China currently on lock-down from the coronavirus, revenue could benefit from shoppers who are stranded in their homes but still want to shop and require essential supplies.

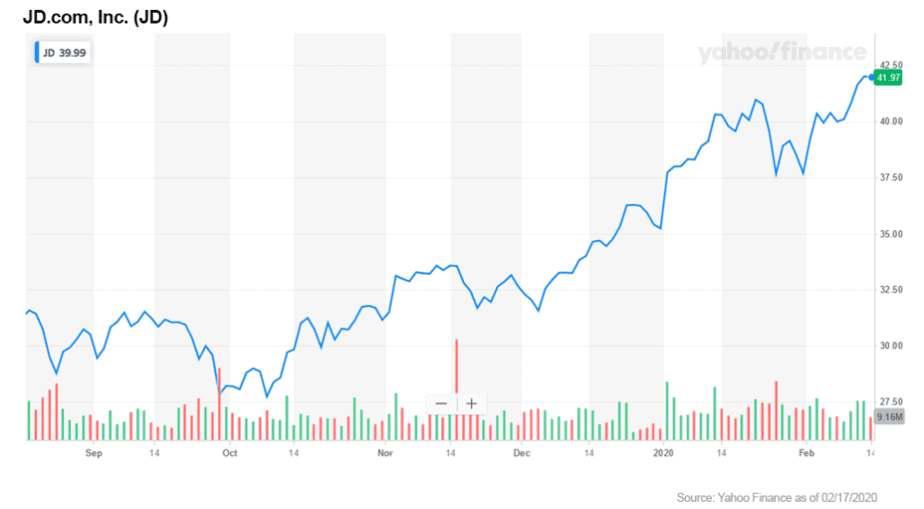

As China’s largest online retailer, JD.com was the world’s first company to use drones to deliver commercial products to customers in 2015.

Now that advantage is showing itself all the more at a time when a good share of the country’s storefronts are shuttered because of the coronavirus.

Along with drones, the company uses self-driving delivery vehicles in at least 10 Chinese cities, and is partnering with Japanese e-commerce leader, Rakuten, to provide both drones and autonomous vehicles for deliveries.[21]

When China’s economy slowed as the trade wars dragged on, JD.com slowed right along with it. Revenue growth fell, margins shrunk, and profits were dismal. Investors were not pleased, and the stock lost half its value.

Things started looking better again in early 2019, and since then the stock has soared. But with it still trading at 22% below its previous high, it still has plenty of room to run.

Markets shook off the coronavirus early and while volatility remains, markets have generally stayed strong to the upside. Some companies with business ties to China will need to pedal hard to make up for lost ground, but they’ll ultimately make it. Look for bargains in companies with STRONG FUNDAMENTALS and you could potentially see good gains fairly quickly.

As always, do your own due diligence before investing in any stock.

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.wired.com/story/what-is-a-coronavirus/

[2] https://www.nature.com/articles/d41586-020-00364-2

[3] https://edition.cnn.com/asia/live-news/coronavirus-outbreak-02-16-20-intl-hnk/index.html, https://www.worldometers.info/coronavirus/

[4] https://www.nafsa.org/regulatory-information/coronavirus-critical-resources

[5] https://www.washingtonpost.com/world/asia_pacific/coronavirus-china-latest-updates/2020/01/26/4603266c-3fa8-11ea-afe2-090eb37b60b1_story.html

[6] https://www.brookings.edu/research/global-macroeconomic-consequences-of-pandemic-influenza/

[7] https://www.marketwatch.com/story/5-reasons-coronavirus-fears-are-overblown-and-14-stocks-to-buy-now-2020-01-28

[8] https://www.bloomberg.com/news/articles/2020-01-30/economist-who-said-sars-cost-40-billion-sees-bigger-hit-now

[9] https://source.wustl.edu/2020/02/washu-expert-coronavirus-far-greater-threat-than-sars-to-global-supply-chain/

[10] https://fortune.com/2020/02/12/sars-coronavirus-business-impact-luxury-goods/

[11] https://finance.yahoo.com/news/sparkle-fades-coronavirus-risks-wiping-121636031.html

[12] https://wwd.com/business-news/financial/coronavirus-fallout-six-months-burberry-canada-goose-tapestry-capri-michael-kors-coach-1203467095/

[13] https://www.marketwatch.com/story/michael-kors-versace-parent-capri-lowers-revenue-by-100-million-due-to-coronavirus-2020-02-06

[14] Ibid

[15] https://www.pymnts.com/news/international/2020/coronavirus-concerns-hit-retail-supply-chain/

[16] https://www.ft.com/content/5dfa0250-43e4-11ea-a43a-c4b328d9061c

[17] https://www.gamingtoday.com/industry/News/article/88883-Macau_stays_quiet

[18] https://www.reuters.com/article/us-china-health-airlines-analysis/for-airlines-china-boom-now-exposes-them-to-risk-as-coronavirus-slams-market-idUSKBN1ZS0P9

[19] https://www.forbes.com/sites/danielreed/2020/01/30/coronavirus-will-cut-into-big-airlines-profits-short-term-but-history-teaches-that-shareholders-best-play-is-to-wait-patiently-for-stock-prices-to-recover/#5325dab5784e

[20] https://www.msn.com/en-us/money/news/coronavirus-crisis-may-set-first-quarter-earnings-of-airlines-back-by-30percent-to-50percent-says-analyst/vp-BBZRZVi

[21] https://global.rakuten.com/corp/news/press/2019/0221_04.html