Now that America and China have declared a truce, is it time to jump into Chinese stocks?

And will concerns over Chinese growth slowing and its high corporate debt, aging population, and tougher American stance on technology combine to force it to play defense?

And there is another issue that most investment gurus have missed or conveniently overlooked…

Investors have a false picture of just how Chinese stocks have performed over the past decade.

Just how have Chinese stocks stacked up against global stock markets over the past decade?

According to MSCI, the Shanghai Composite has delivered negative returns over the past ten years (2010–2020) while Nasdaq is up 280% and the S&P 500 index is up 175%.

In addition, the Thailand SET, the Nikkei 225 and India’s Sensex index are all up more than 100% during this same time period.

Is there a better way to capture Chinese economic growth without the volatility and lackluster stock market performance?

Let’s take a look at all these issues and then highlight a market and some specific stocks that may allow you to capture Chinese growth with less political risk and volatility.

The first point I would like to emphasize is that we need to understand that any trade deal, summit or tweet will not bring relations between China and America back to “normal.”

Rather, we are now in an enduring age of U.S.–China rivalry.

This has many implications for investors.

The Indo-Pacific region is a prime arena of competition since this is where China is already well on its way to become the dominant regional player, and America is just as determined to prevent this from happening.

But the battlegrounds of finance, economics, resources, foreign policy and technology span the world chessboard with the key pieces being Japan, South Korea, Australia, Russia, India, Southeast Asia, Europe, Latin America and Africa.

China’s key advantage is its scale since it has a population of 1.4 billion, more than four times that of the United States.

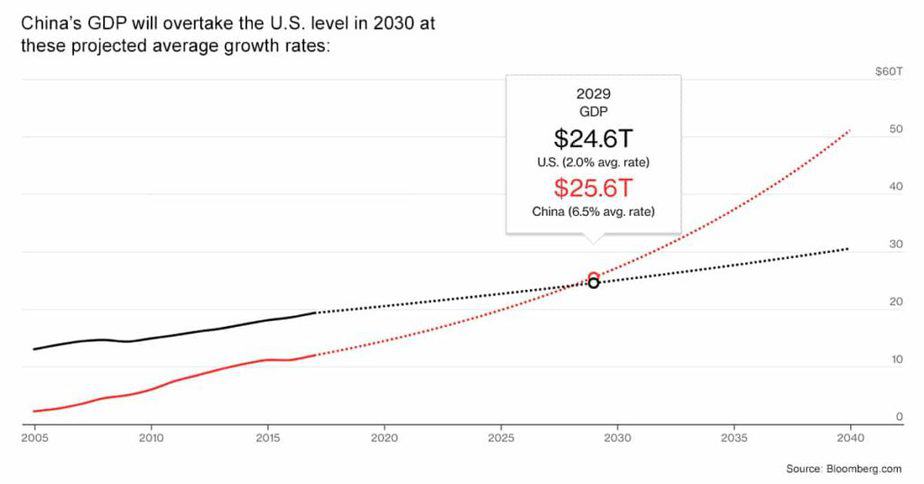

The size of China’s economy is roughly 75% of America measured in nominal U.S. dollars, and China is already the world’s largest manufacturer (achieved in 2010 and ending a reign of 110 years by America) and is also the world’s largest exporter.

According to CIA statistics, China’s economy has grown three times faster than America’s every year during the last four decades.

And unlike Russia, China has a 9,000-mile coastline and in addition to having the largest army in the world, it is building a formidable navy, coast guard and air force — and is therefore both a land and sea power.

And remember, the Indo-Pacific is a home game for China and an away game for America — more than 6,000 miles away.

America stands for private enterprise, freedom, liberty, religious and civil liberty, openness, democracy, human rights and transparency.

China, as a centrally controlled one-party authoritarian surveillance state, is on the other side of all these ideals.

It is on this point that the chasm between America and China is widest.

While America constitutionally protects freedom of expression and worship, China sharply restricts it.

This titanic rivalry is also unique because China is not just a country — it is an ancient civilization that for centuries was the world’s leading power, far before America took its leading position in the world.

America is not just a country either — it is a bold experiment that went from a fledgling frontier market to become the world’s largest economy in 1890, and has been the world’s hegemonic superpower since 1945.

As Winston Churchill aptly put it; “America is an idea, not a place.”

America is what ideas it stands for, what ideals it strives for, and how these fit together to form its brand — its ideology.

Let’s zoom out for a moment and look at this rivalry from 20,000 feet and then get down to brass tacks.

According to a 2019 Credit Suisse survey, China now has a whopping 100 million citizens in the top 10% of world wealth, just edging America with 99 million citizens.[1]

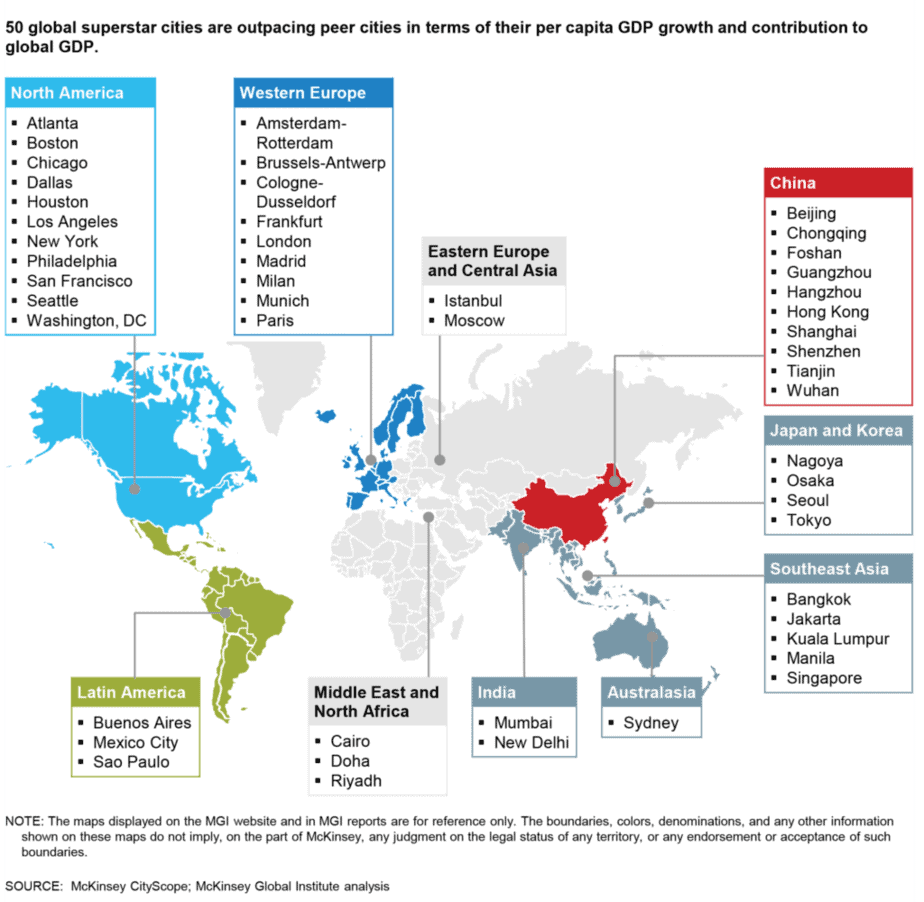

Talk about close, McKinsey & Company recently completed a study of leading cities around the world and developed a list of fifty global “superstar cities” based on their contribution to the world economy. America had eleven cities on the list followed by China with ten cities.[2]

The Fortune Global 500 ranking of the world’s largest companies by revenue highlights the dominance of companies based in America and China.[3]

America has 121 firms in the Fortune Global 500 while China is nipping at her heels with 119 companies.

Underlining the stark difference in their economic systems, 89 of China’s 119 companies on the Fortune Global 500 list are state-owned companies.

These companies benefit from Beijing’s helping hand in terms of generous subsidies, access to low cost capital from state-owned banks, as well as advantages over competitors.

Take shipping and shipbuilding, which is so important because roughly 90% of all goods are transported by ship.

Due to foreign subsidies and other advantages, of the 41,000 ocean-going cargo ships on the seas today, only 182 are American. The Wall Street Journal noted in 2019 that of the 2,900 commercial ships currently under construction worldwide, America is building eight.

Meanwhile, China is building 1,291 ships. Japan is building 697, and South Korea 475. China has a 45% global market share in cargo ships.

Technology is a key battleground because it is at the heart of our global economy, and the country that leads in technology will control the commanding heights of the 21st century.

The digital economy also is tilting toward China with its enormous 800 million plus Internet users and giant platform companies such as Baidu (NASDAQ: BIDU), Tencent (OTC US: TCEHY / SEHK: 700) and Alibaba (NYSE: BABA).

And nothing represents China’s rapid rise and looming challenge better than Huawei which, through a combination of Chinese state support and American indifference, led to Huawei capturing a leading market share of the world’s telecom market.

Think about this… even at a slower economic growth rate of 5%, China’s scale allows it to add the equivalent of the entire Australian economy to its GDP every year.

And McKinsey & Company cites a consensus of experts projecting that China will add an incredible $6 trillion in consumption from 2020 to 2030 — more than America and Western Europe combined.

But let’s not get too far ahead of ourselves… China’s vulnerabilities are also clear.

It still imports five times as much intellectual capital-intense product than it exports.

Its opaque and relatively closed financial system masks enormous amounts of debt. America’s capital markets are far more advanced while China still has capital controls. The U.S. dollar is clearly the world’s reserve currency and likely to stay that way.

Chinese companies lack brand power while America’s S&P 500 companies are sophisticated and well managed with on average 40% of revenue derived from international markets.

And despite all the headlines about China’s growth, America’s stock markets, and many other overseas markets, have bested Chinese markets by a significant margin over the past decade.

Are you getting a bit tired of the on-again, off-again “deal” between China and America?

Meanwhile the formerly named Trans-Pacific Partnership (TPP) trade and investment pact was inked by its eleven members without the U.S. or China onboard.

The 15 members have a combined gross domestic product of about $25 trillion with some of the fastest-growing countries in the world. It looks like India is taking a pass on this one due to their fear of intense competition.

One enthusiastic member of both pacts is Australia, which is for all practical purposes a regional Asian country.

Australia represents a safe backdoor Pacific growth play supported by rock-solid fundamentals. China, Japan, South Korea, India and Hong Kong are its leading export destinations.

China buys 35% of Australia's exports (America buys only 6%) and boatloads of its oil, gas, coal and iron ore. Millions of Chinese tourists visit Australia each year and more than 150,000 Chinese students head to Australian universities.

Australia offers many advantages over the competition. A low national debt, the safest banks with the highest dividends in the world, and a location near the world's fastest-growing continent within Asia, with other countries eager to snap up its resources and products.

China buys more than $50 billion of Aussie coal each year, Japan buys trillions of yen of LNG, and South Korea buys huge amounts of its beef, wine, and wheat.

Australia is not only engaged with China and Asia — it is becoming year by year more integrated into the Asian economic machine.

Trade ties between Australia and Asia have been on a dramatic rise since 2000 and a new report from HSBC forecasts that Asian markets will absorb roughly 80% of Australia's exports by 2020. This is a massive amount.

But even with Australia's already strong penetration of Asia's largest export markets, HSBC says the Pacific region's rising middle class will boost sales in the areas of high-quality food, as well as education and leisure opportunities.

The number of Chinese tourists visiting Australia has doubled since 2010 and emerging Asian middle class is consuming more protein-rich diets as incomes rise.

The resource sector will likely lead the way. HSBC projects iron ore exports will rise more than 50% by 2020, while liquefied natural gas (LNG) exports will more than quadruple as new projects come on line.

No wonder Australia is signing trade deals with regional partners like hotcakes.

No question about it; Australia represents a great proxy on China and Pacific economic growth as the world's 8th largest stock market and the second largest within the Asian region.

Read on… most of these stock suggestions trade on North American markets, where investors would gain an investment buying advantage. So, Australia's top "nifty fifty" stocks present some great opportunities for international investors.

There are several ways to boost your portfolio’s exposure to the “lucky country.”

Two broad-based plays would be the actively managed Aberdeen Australia Fund (NYSE: IAF), which has $128 million in assets and is up 19% so far in 2019.

Another is the iShares Australia ETF (NYSE: EWA), which is larger with more than $1.5 billion in assets in 70 stocks. About half of the assets in both funds are in the financials, health care and materials sectors, and this ETF delivers an annual dividend yield of just under 4%.

EWA is in a strong uptrend, up 22% over the last year.

A solid Australian stock that is ranked third in the iShares Australia ETF is BHP Group (NYSE: BHP). Founded in Melbourne in 1885, BHP is engaged in natural resources such as petroleum, copper, and iron ore as well as silver, gold, zinc and nickel worldwide. BHP’s business is widely diversified and it offers a nice 5.2% dividend yield as a bonus.

BHP is already reacting well to the U.S.–China trade truce, and the fundamentals of the commodity cycle seem to be a tailwind for the company and the stock.

The trade war has been perceived as a drag on the global economy and putting this issue on the back burner to just a simmer can only be a positive.

And BHP is an excellent proxy for China as it derives over half of its revenue from China.

With copper and iron ore prices on the rebound, BHP is enjoying stronger revenue and cash flow.

Iron ore is a key feedstock for steelmaking. Plus, stronger demand from China as well as supply disruptions from Vale after its dam disaster, as well as other suppliers, works in its favor.

Iron ore is now trading at around $90 a ton, and with mining cost of about $15 a ton, the margins are indeed sizable.

China is on a buying spree ahead of the Lunar New Year and the spring construction season.

While I expect Chinese stocks to do well near term, having a sizable allocation to Australia is what could be a conservative and smart way to play Chinese and regional Asian growth.

They don’t call it the “lucky country” for nothing.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

MSCI

Fortune Global 500

iShares website

Bloomberg

HSBC website

[1] https://www.cbsnews.com/news/for-the-first-time-there-are-fewer-wealthy-americans-than-chinese/

[2] https://www.mckinsey.com/featured-insights/innovation-and-growth/superstars-the-dynamics-of-firms-sectors-and-cities-leading-the-global-economy

[3] https://fortune.com/global500/2019/