You’ve no doubt heard about the next generation of communications networks known as 5G.

You might have even heard it called the “fourth industrial revolution.”

Yet with only around four million 5G connections globally so far, you probably aren’t benefiting from 5G.

But make no mistake: Just because you haven’t seen 5G networks take hold yet, 5G is coming. And it’s going to have a walloping impact.

The World Economic Forum calls 5G a change so breathtaking that “it will be as revolutionary as electricity or the automobile.”[1]

They say it “will be unlike anything humankind has experienced before” and that it “will fundamentally alter the way we live, work, and relate to one another.”[2]

5G is just starting to roll out, and it’s coming with the force and speed of a tidal wave.

Market intelligence heavyweight Boston Consulting Group says that wireless is now “the fastest adopted technology of all time.”[3]

It is forecast that by next year, there will be 29 billion connected devices worldwide.[4]

And by 2025 5G will be an $11 trillion market.[5]

That means in five short years it will be bigger than the global IT industry…bigger than oil and gas…bigger than computers.

It also means this will be…

Bigger than the introduction of first generation wireless, or second generation, or third or fourth generation of cell phones.

Just how big were those technological innovations for investors?

With companies collectively investing billions of dollars to develop and deploy 5G, now is the time to consider investing in top tier stocks. Then sit back and watch your profits grow.

In this report, I’ll reveal which stocks might be the best choices for investors to research now.

First, take a look at how…

By 2025 you’ll be living in a world of driverless cars…mobile hospitals…fully robotic factories….drone delivery fleets…remotely monitored crops…and even smart kitchens that do everything from having your dinner ready when you get home from work to telling you when you’re low on milk.

The World Economic Forum asks you to…

If you ride your bicycle on a busy street, you might avoid a crash when the virtual display in your helmet or on your bike alerts you to a fast-approaching car coming up from behind.

If you shop for clothes, you might “try them on” by looking into a mirror that virtually overlays an image of pants and a shirt onto you.

If you’re cruising along in your self-driving car, the traffic light ahead will tell your car how much time it has before the light changes, and your car then calculates how fast you should be going. Instead of braking completely, you might drop your speed enough to pass through the intersection as the light turns green.

These futuristic technologies are already being tested and deployed, and this is all based on 5G.

At last year’s Mobile World Congress in Barcelona, a driver remotely drove a semi-truck that was 2,500 kilometers away in Sweden.[7]

At the same event, a team of doctors at a hospital removed a cancerous tumor from a patient’s colon, guided by the chief surgeon who was three miles away.[8]

Applications like these are why London’s Financial Times says “5G promises to be a game-changer for humanity.”[9]

And why The Telegraph calls 5G “one of the most important developments in human history.”[10]

And why everyone from investment banks UBS and Barclays to stock pickers like Jim Cramer are calling 5G…

Upgrading to 5G will require multiple components, from the networks to infrastructure companies, down to the chips used to facilitate high-level data transmissions.

Behind the scenes, companies are ramping up capital spending.[11] They’re building out high frequency networks to deliver faster delivery speeds. They’re building chips and processors that can handle 5G radio frequencies.[12] They’re performing market trials in more than two dozen cities—from Atlanta and Detroit to Indianapolis and Washington, D.C.[13]

Tech companies are developing 5G-enabled robots, connected appliances, driverless cars, remote monitors, and countless other smart devices and applications.

Some are ready now, waiting only for 5G networks to be installed. But who is installing these networks?

One thing’s for sure. When it’s time to roll out 5G networks both here and globally, it will happen at lightning speed, creating an investor opportunity that could be bigger than the introduction of personal computers or the Internet.

Which means if you haven’t taken your position in the companies leading the 5G revolution by then, you will have missed your chance.

Says Wedbush analyst Dan Ives...[14]

To see how massive the 5G revolution is for investors, take a look at what happened in a previous era of technological innovation: 4G.

The rise of 4G was a boon for investors.

Without the advent of 4G, there would have been no smartphone revolution.

That new generation of connectivity ushered in an era of video streaming, e-commerce, photo sharing, social media, and other mobile applications that are now part of our daily routine.

With 4G’s rise from 2012 to 2018, mobile operators spent well over $1 trillion in capital expenditures to build out 4G-enabled networks.[15]

Companies like wireless telecom service providers, network infrastructure hardware makers, smart phone makers, semiconductor manufacturers, and social media companies were the drivers.

By 2017, those companies were responsible for a whopping 4.5% of global GDP, totaling $3.6 trillion in annual economic value.[16]

Investors who recognized the opportunity early scored big.

Investors are already finding big profits in the 5G ramp-up.

Look at a handful of 5G-related stock returns compared to the S&P 500.

In the past 12 months the S&P has given investors a decent 27%.[17]

During the same period, companies that are a part of the 5G revolution have filled their investors’ pockets with wealth-making gains like these:[18]

So where can you find profits like these today?

Here are three companies that stand to profit big from the 5G rollout.

American Tower is a REIT, and in fact is one of the largest REITs in the world.

The company owns the towers used by major telecom companies to host their antenna and network equipment.

Companies like Verizon (NYSE: VZ) and AT&T (NYSE: T) lease space from tower owners who are locked in to five to 10 year contracts, giving tower owners steady and reliable income.

Much of American Tower’s revenue is generated through something called colocation, which means they get to lease the same tower to more than one company.

While the original tenant covers most of the cost of the tower, subsequent leases are nearly 100% profit. One tower can handle equipment from three or four additional tenants.

There are three major publicly traded tower REITS, which in addition to AMT include Crown Castle (NYSE: CCI) and SBA Communications (NASDAQ: SBAC).

American Tower is the biggest of the three with a $103 billion market cap to CCI’s $60 billion and SBAC’s $28 billion.

Analyst firm Markets and Markets projects that 5G infrastructure will grow at a whopping 65% compound annual rate through 2027, from three quarters of a billion dollars now to $47.8 billion in 2027.

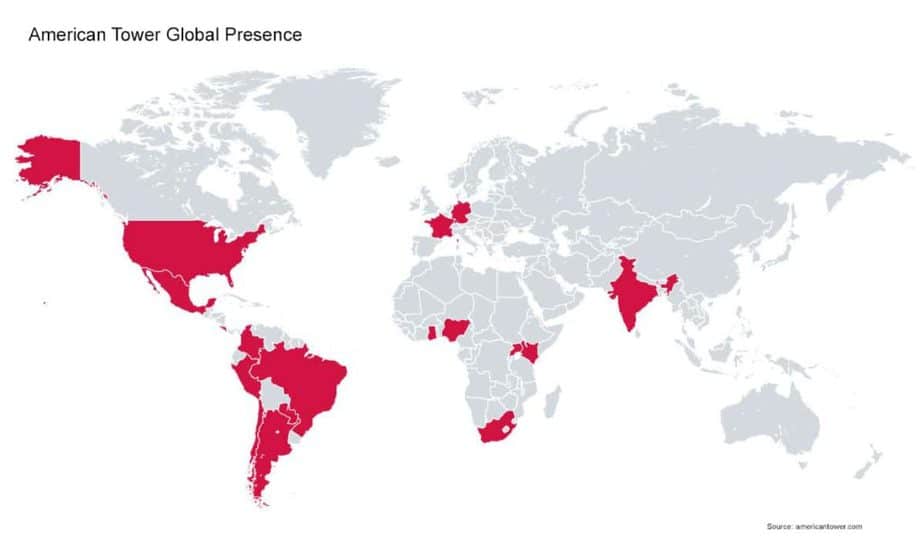

American Tower has a global footprint, owning more than 170,000 sites worldwide, including 75,000 in Asia and India, 40,000 in the US, 37,000 in Latin America, and around 16,000 in the rest of the world.

Their strong Asian presence is a significant advantage for the company, as Asia and India are considerably further ahead than the US in 5G adoption. Data usage in India, for example, has been growing by 100% per year.[19]

On January 13, Goldman Sachs upgraded AMT to a buy with a price target of $270, an upside of 16%.

But increasing stock price isn’t your only source of profit from American Tower. The company also pays a 1.7% dividend, which it has increased every single quarter since early 2012. That is an annual dividend growth of about 24%.

Skyworks makes the semiconductors that are used in radio frequency (RF) and mobile devices.

The company is a major chip supplier to Apple (NASDAQ: AAPL), which is expected to own a projected 64% of the 5G-enabled smartphone market into the near future.[20]

With sales of 5G smartphones projected to be 123.5 million units in 2020 alone, that could be a significant source of new revenue for Skyworks.

What’s more, demand for RF chips is projected to jump by nearly 50% over the next three years, giving even more upside potential for Skyworks.[21]

A third product offering of the company is the small cell wireless transmitters and receivers that are necessary for 5G.

Trade group CTIAS forecasts that small cells will grow more than 800% in the next few years, from an estimated 86,000 in 2018 to 800,000 by 2026.[22]

Major competitors in the small cell space include Broadcom (NASDAQ: AVGO) and Qorvo (NASDAQ: QRVO). Broadcom was at one time the go-to supplier, but Skyworks managed to win the business of the major supplier to Verizon (NYSE: VZ) and Vodafone (NASDAQ: VOD).[23]

SWKS traded sideways for much of 2019 before soaring 61% since October.[24] But analyst consensus sees more upside for the stock, with Raymond James and Cowan both rating it as Outperform, and B. Riley (NASDAQ: RILY) giving SWKS a potential price target of $145, up 17% from its current $124.[25]

If you look at Marvell’s fundamentals, you’ll wonder if I’ve got rocks for brains.

With negative earnings growth, negative net income, and a decline in return on equity from last year, the company doesn’t look all that great on paper.

So why did Mad Money host on CNBC, Jim Cramer say that Marvell will be “the purest 5G play there is” on January 7, 2020?[26]

That’s where it helps to look beyond the books.

About three years ago Marvell began a major transformation from a company whose product line was rapidly becoming commoditized to a leading innovator of storage and networking technology designed for emerging technologies, including 5G, artificial intelligence, and cloud computing.

Cramer calls Marvell “one of the most exciting companies I’ve ever seen, and yet it wasn’t exciting five years ago.”

Marvell is, he says, “the easiest, clearest, and best way to play the biggest cycles out there, which is 5G.”

J.P. Morgan forecasts that Marvell’s 5G revenue, currently at $600 million, or 22% of total revenue, could grow to $1 billion over the next few years.[27]

The investment bank reiterated its Outperform rating on MRVL in December.

Rosenblatt Securities followed suit, giving MRVL a $32 price target, an upside of about 16% from its current price level. This comes on the heels of an upgrade to Outperform by Wells Fargo in November, and a comment from investment bank Needham Group that Marvell is "the best play on the adoption of 5G wireless infrastructure.”[28]

One of the reasons for the upgrades is Marvell’s solid business with both Nokia (NYSE: NOK) and Samsung (KSE: 005930) for 5G base station technology.

MRVL stock is up 10% in the last six months, trailing the broader S&P by 1%. But if these analysts are right, you could see significant upside to MRVL in the next year and beyond.

You don’t have to look far to see the excitement surrounding the advent of 5G.

Forbes says that the road to 5G is “paved in gold,”[29] going on to say that “The next year or so will be a very, very exciting time to own the right 5G stocks.”

You’ve just seen three of the top picks. There are many others that will be profiting from the 5G rollout too. Namely, upcoming infrastructure stocks to come that will help build the 5G dream…

From telecom service providers to semiconductor makers, thousands of companies will make their fortunes as they empower the 5G revolution.

As always, please ensure you do your own due diligence before investing in any stock mentioned.

And don't forget to sign-up now to FNN and stay up to date as 5G opportunities continue to develop!

Cynthia Berryman, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.weforum.org/agenda/2018/01/the-world-is-about-to-become-even-more-interconnected-here-s-how/

[2] https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/

[3] https://www.bcg.com/publications/2015/telecommunications-technology-industries-the-mobile-revolution.aspx

[4] https://www.ericsson.com/en/mobility-report/internet-of-things-forecast

[5] https://www.mckinsey.com/mgi/overview/in-the-news/by-2025-internet-of-things-applications-could-have-11-trillion-impact

[6] https://www.fool.com/investor-alert/rule-breakers/rb-lp-5g/?source=erbgglwdg0213087&testId=vp-rb-5g&cellId=0&campaign=rb-5g

[7] https://spectrum.ieee.org/telecom/wireless/mwc-barcelona-2019-on-the-road-to-selfdriving-cars-5g-will-make-us-better-drivers

[8] https://www.cnn.com/2019/02/27/tech/5g-surgery-mobile-world-congress/index.html

[9] https://www.ft.com/content/7be7ee18-0b37-11e8-bacb-2958fde95e5e

[10] https://www.telegraph.co.uk/technology/2019/07/05/five-outlandish-predictions-5g-will-change-world/

[11] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-wireless-leaders-ramp-up-capital-spending-amid-5g-deployments

[12] https://www.fool.com/investing/2019/08/07/marvell-technologys-5g-catalyst-is-ramping-up.aspx

[13] https://www.inc.com/magazine/202002/jennifer-alsever/5g-wireless-network-broadband-high-speed-gigabit-technology.html

[14] https://markets.businessinsider.com/news/stocks/top-10-tech-predictions-trends-2020-faang-stocks-dan-ives-2019-12-1028788381#1-2020-is-about-the-5g-super-cycle-10

[15] https://www.globalxetfs.com/what-4g-can-teach-us-about-5g/

[16] Ibid

[17] As of 1-13-20

[18] All returns through 1-13-20

[19] https://finance.yahoo.com/news/american-tower-safe-way-dial-100000904.html

[20] https://www.fool.com/investing/2019/12/21/skyworks-solutions-vs-qorvo-which-is-the-better-5g.aspx

[21] https://www.fool.com/investing/2019/12/21/skyworks-solutions-vs-qorvo-which-is-the-better-5g.aspx

[22] https://www.lightreading.com/mobile/small-cells/inside-the-5g-small-cell-opportunity-big-and-messy/d/d-id/751403

[23] https://www.fool.com/investing/2017/03/18/why-small-cells-could-be-a-big-deal-for-skyworks-s.aspx

[24] As of 1-19-20

[25] https://www.marketbeat.com/stocks/NASDAQ/SWKS/price-target/

[26] https://www.cnbc.com/video/2020/01/07/cramer-remix-wait-for-this-stock-and-it-could-be-the-purest-5g-play.html

[27] https://www.thestreet.com/technology/marvell-technology-will-outperform-thanks-to-5g-ramp

[28] https://www.thestreet.com/investing/stocks/marvell-technology-drops-as-needham-removes-stock-from-conviction-list-15119546

[29] https://www.forbes.com/sites/moorinsights/2017/06/21/will-5g-change-lives-infrastructure-providers-carriers-even-dell-emc-and-hpe-are-betting-it-will/#59f9d23c685f