Cannabis stocks have been badly beaten up over the past several months — which is good news for the contrarians among us. With the overarching sentiment so negative, there are sure to be good values to be found for the astute investor.

But a word to the wise: Caution! 2020 is likely to see more rough waters on the “Sea of Cannabis” as early runners capitulate, and those with staying power begin to rise.

We’re talking real companies with professional management and the ability to steer a steady course through tough times without diluting the life out of share structure or capsizing in the ravages of high financing costs and evaporating margins.

That having been said, the sector still has immense growth potential as individual U.S. states continue to legalize cannabis and as increased pressure mounts on the U.S. government to end prohibition at the federal level — not to mention the expectation of more international markets opening up to cannabis acceptance.

But even without those factors, the continued tough removal of market share occupied by the current black market in Canada and in certain approved U.S. states is going to have an impact.

Right now, it is a bit of a tough road to get to a fully legalized platform without the black market interrupting and getting in the way of what I will call legal growth.

As the legal production and distribution chains further establish themselves in broader jurisdictions, the winners in the market will likely see tons of growth.

Moreover, these potential winners will benefit from consolidation and capitulation, as the little fish discover they can’t swim with what may become the big sharks.

Of course, the big question is who these winners will be.

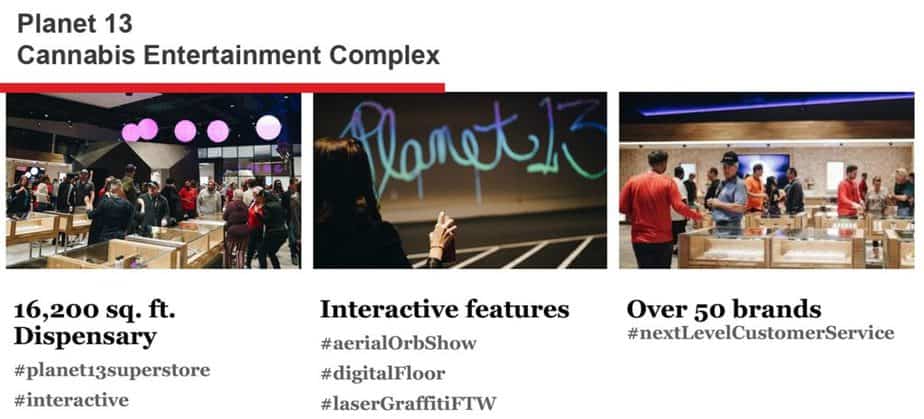

Planet 13 Holdings Inc. is positioning itself as the Walmart of Cannabis. Its first location in Las Vegas is the largest cannabis dispensary in the world at 112,000 square feet.

Planet 13’s mission is to build a recognizable global brand known for world-class dispensary operations and a creator of innovative cannabis products.

The Planet 13 Superstore and Entertainment Complex in Las Vegas has the capacity to serve up to 5,000 customers per day, and the company has achieved a near 10 percent market share of cannabis total dollar volume in the state of Nevada. This is a growth story with plenty of blue sky.

Indicative of that potential, Planet 13 reports an increase of more than 1,595 percent in terms of average daily customers and an increase in average ticket size of $26.85 or 39.7 percent from October 2018 to October 2019.

The company has created a retail immersive experience that includes a bistro/pizzeria and a 14,000 square foot production facility, which was opened in the final quarter of 2019. Planet 13 bills itself as an entertainment complex that includes 115 feet of windows where visitors can watch and learn what goes into the creation of its individual products.

The point is that Planet 13 gets it when it comes to modern retailing and competing against online stores by providing a unique and compelling shopping experience.

The company has immediate plans to move beyond Las Vegas, starting with California, the world’s largest cannabis market. Ultimately, they aim to become a national presence, with a Planet 13 in any location in the U.S. that can support a pro sports team. This is part of their mandate and tie-in.

The company is also positioned now to become fully vertically integrated, offering its own premium-branded products in flower, oils, edibles, and accessories under the Trendi label.

The ability to dominate a local market and control who gets shelf space will prove to be a critical advantage for Planet 13.

Canaccord Genuity estimates $127M in revenues and $35M EBITDA, which reflect continued top-line growth and margin expansion within the company’s Nevada market — with a $4.00 per share price target.[1]

Canaccord also forecasts that PLNHF will complete its outstanding California acquisition and commence sales at their Los Angeles dispensary in the next few months with contributions coming in either Q2 or Q3. [2]

PLNHF will arguably look to use its strong balance sheet and positive cash flow from its Superstore retail operation in Las Vegas to expand beyond the western U.S. this year with a likely focus on Illinois, Massachusetts or Michigan.[3]

In short, Planet 13 could serve as the future of cannabis retail and categorically is definitely a stock to put on your watch list.

Staying power is a key factor in cannabis investment at this stage in the market. So it helps immensely that Altria Group (NYSE: MO) paid $1.8 billion for a 45 percent stake in Cronos Group (NASDAQ: CRON / TSE: CRON).

Altria Group holds diversified positions across tobacco, alcohol and cannabis. Notable brands include Phillip Morris (NYSE: PM) and Anheuser-Busch InBev (NYSE: BUD), the world’s largest brewer, among others.

That’s the kind of strength that gives Cronos both the staying power to sail through current and possible choppy markets to come. And that’s not even taking into account the depth and breadth of resources Cronos has at its feet to give investors increased confidence and exposure to the long-term growth plan of the company — knowing there is a cast and crew of support along the way.

The strategic partnership with Altria provides Cronos Group with additional financial resources, product development input and commercialization capabilities, as well as deep regulatory expertise to better position the company to compete in the global cannabis industry.

Cronos has international production and distribution across five continents, addressing both the medical and adult-use markets. The company operates two wholly-owned license holders and has established five strategic joint ventures in Canada, Israel, Australia, and Colombia.

Cronos Group is developing a diversified cannabis global sales and distribution network by leveraging established partners in order to meet scale, salesforce, and market expertise.

The company also plans to develop a global supply chain, which will employ a combination of wholly-owned production facilities, third-party suppliers and global production partnerships — all of which support the manufacturing of cannabinoid-based consumer goods.

The company’s numbers are headed in the right direction.[4] Net revenue for the nine months ended September 30, the latest reporting period available, was up 48 percent over the previous year. Sales topped 3,142 kilograms in non-U.S. markets in Q3 2019, representing a 511 percent increase from 514 kilograms sold in Q3 2018.

Cost of sales before fair value adjustments per gram sold for the non-U.S. market was $2.27 in Q3 2019, representing a 31 percent decrease from $3.28 in Q3 2018 and a 25 percent decrease from $3.01 in Q2 2019.

Share price has been beaten down from $25.10 at last year’s highs to a low just over $6.00, with the beginnings of market recovery seeing the stock push back to current levels just in the $7.00 to $8.00 range. Be sure to keep your eye on Cronos.

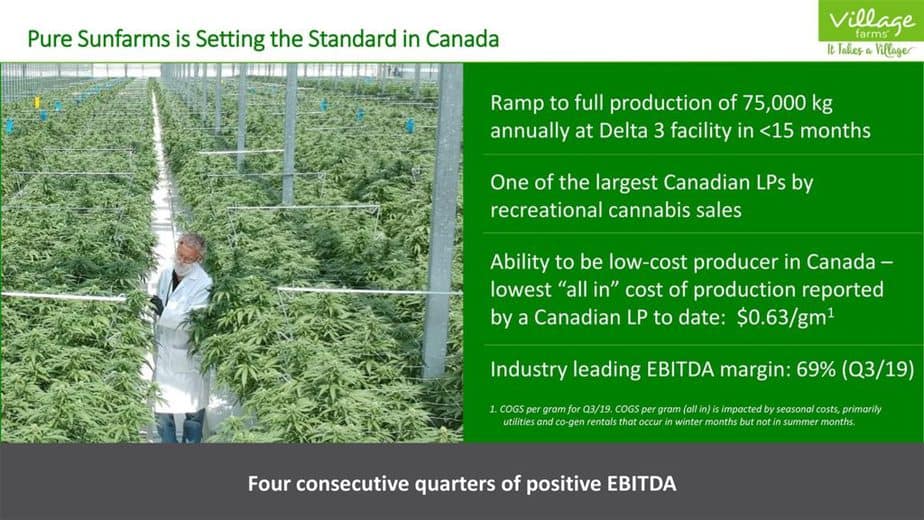

As I expected, commoditization has begun to shape the cannabis flower market moving forward. So it would make sense that a large commercial farmer will succeed where little boutique growers can’t compete on logistics, reliability, production standards, and large economies of scale.

Village Farms International (NASDAQ: VFF / TSX: VFF) is one of the largest and longest-operating vertically integrated greenhouse growers in North America and the only publicly traded greenhouse produce company in Canada.

Village Farms produces and distributes fresh, premium-quality produce with consistency 365 days a year to national grocers in the U.S. and Canada. Produce comes from its more than nine million square feet of Controlled Environment Agriculture (CEA) greenhouses in British Columbia and Texas, as well as from its partnered greenhouses in British Columbia, Ontario and Mexico.

Village Farms is a significant producer of tomatoes including tomatoes on-the-vine, beefsteak, cocktail, grape, cherry, roma, Mini San Marzano and other specialty tomatoes, along with long English cucumbers. The company also distributes and markets premium tomatoes, bell peppers and cucumbers in the United States and Canada, produced by other greenhouse growers located in Canada and Mexico.

VFF is now leveraging its 30 years of experience as a vertically integrated grower for the rapidly emerging global cannabis opportunity through its majority ownership position in British Columbia-based Pure Sunfarms, one of the single largest cannabis growing operations in the world.

As of August 1, 2019, tomato production in 5,115 square meters of their tomato facility had been discontinued to allow the company to start the conversion of this space to cannabis production. An additional 43,219 square meters of tomato production was discontinued as of October 7, 2019, for the purpose of continued conversion to cannabis production. [5]

So here we have a well-diversified, large-scale, commercial farmer with all of the know-how and 30 years in business adding cannabis to its crop portfolio. Their ability to control costs and produce high-quality product at a very low cost-per-gram makes Village Farms a very interesting prospect for more conservative investors looking for exposure to the cannabis space, while remaining diversified at the same time.

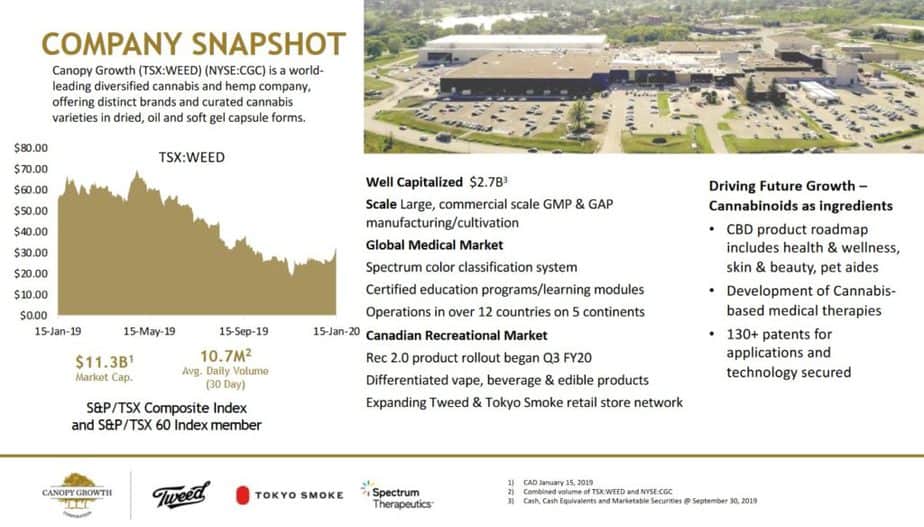

By now most investors in the space are aware of the Canopy Growth story (NYSE: CGC / TSX: WEED), a large part of which included global beer, wine and spirits giant Constellation Brands Inc. (NYSE: STZ). At the current market price, Constellation's $4.1 billion investment in Canopy is now worth only $3.1 billion.

On December 9, 2020, David Klein would move from his role as Constellation’s CFO to serve as Canopy’s chief executive officer. Since then, Canopy’s stock price has come off the floor at the $18 level to recover to current levels around $23.

Constellation gives Canopy the same kind of muscle that Altria gives to Cronos. With $4.2 billion tied up in the company, obviously Constellation wants Canopy to succeed, and they have the resources to make sure that happens.

The question is whether or not CGC is fully valued at any given time. But given the volatile nature of the market at this early stage of development, over-reliance on trailing numbers, even in comparative analysis, is of limited use.

If you think the cannabis market has growth potential, as I do, then consider that Canopy should not only rise with the tide as the sector comes back into favor, but has the ability, backed by Constellation, to become a major presence in the global cannabis market as more jurisdictions see the wisdom of ending prohibition.

Short-term choppiness in the market generally expected this year may present an entry point for more savvy investors, so get to know Canopy in a different light and be ready to move when opportunity arises.

Sproutly Canada is one of the “under the radar” companies in the cannabis space still remaining in its infancy.

Despite the fact that they have a pending deal with Canada’s largest independent brewery, Moosehead, Sproutly shares remain priced to give investors the potential for plenty of leverage. I originally wrote about Sproutly way back in July 2018 and many investors may have profited from this.

What caught Moosehead’s interest was Sproutly’s unique licensed water extraction process that results in super high-quality extract that doesn’t need emulsifiers to stay suspended in liquids. You can see why a beverage company might like that.

Furthermore, because Sproutly’s extract is fully natural and water-based, the onset and offset times, the time it takes for THC to take effect and to wear off, is exactly the same as inhaled forms — meaning people don’t have to sit around waiting for 45 minutes to feel the effect.

Just as important, Sproutly’s water-based extraction method doesn’t alter the active molecule the way chemical extraction does. Therefore, products that include Sproutly’s extract can make claims of “all natural” as well as claims attached to specific cannabis strains — typical of the way cannabis has been marketed and differentiated for decades.

The company targets food and beverage makers (such as the Moosehead deal) who give them immediate exposure to global market channels and business development resources.

Sproutly’s business makes real sense at this stage in what remains an early development cycle of the cannabis market. However, the company’s ability to continue to raise capital in order to execute on its business plan remains a risk.

This is a junior cannabis company with breakthrough natural water-soluble technology that mimics inhalation competing with the bigger, more established companies such as Cronos or Canopy. Additional risk remains with the pending closing of the deal with Moosehead Breweries. Keep Sproutly on your radar and watch for further company developments.

The cannabis market may be down, but it’s far from out… and is on the rebound. That’s usually the best time to buy in. As always, check with your financial advisor, do your due diligence, and stay diversified in a portfolio built for your risk tolerance and long-term investment goals.

Blake Desaulniers, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Sproutly Canada Inc. is a Blake Desaulniers portfolio holding. I have traded in and out of this security a number of times over the past 12 months, and will continue to trade Sproutly as profit potential arises or exists.

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://bit.ly/2vfqQgW

[2] https://www.canaccordgenuity.com/capital-markets/what-we-do/research--strategy/

[3] https://www.usatoday.com/story/news/nation/2019/12/01/legal-weed-michigan-illinois-know-recreational-marijuana/4339486002/, https://www.planet13holdings.com/

[4] https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00035844

[5] https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00029410