Whenever gold starts to go on a run, you see no shortage of gold bulls proclaim very positive targets.

For instance, the great Frank Holmes, CEO of U.S. Global Investors has stated that he expects gold to move towards the $10,000 level based on monetary policy and economic conditions.[1]

Exploration has been overlooked for many years as investors have chased tech stocks in the United States or cannabis stocks in Canada. This has resulted in a stall on new discoveries and a slowdown in supply.

Now that gold is starting to trend upwards again, investors are looking at the yellow metal with keen interest as the economics behind it support higher prices.

Let’s face it, the U.S. government is a two-headed animal that will not change its stripes any time soon. Whether Democrat or Republican, what both political parties have in common is the willingness to kick the debt can down the road, as well as the ability and motive to print a lot of cash out of thin air.

What has kept the demand for cash so high? People have received great returns in the stock market. Tesla (NASDAQ: TSLA / FSE: TL0) is priced in U.S. dollars. So is Facebook (NASDAQ: FB), Apple (NASDAQ: AAPL) and Netflix (NASDAQ: NFLX). As long as you have demand for U.S. technology stocks, there will be a demand for U.S. dollars.

But what if the stock market goes on a prolonged decline? The demand for U.S. dollars should drop. There’s a limit to how many people will accept near-zero or possibly even negative interest rates, which will be a near inevitability if central banks drop already low interest rates to fend off recessionary pressures. Therefore, T-bills and bank accounts will have limited appeal to those investors seeking yield.

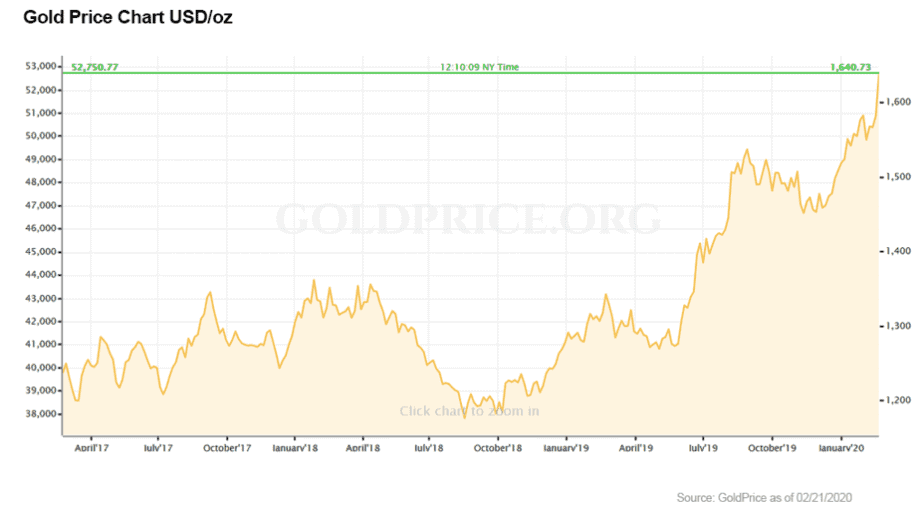

As the U.S. dollar drops, the price of gold will rise. It’s an adage from the stock market nearly as old as time. But there may be another dynamic at play. We are in unchartered waters when it comes to the disconnect between the stock market and the economic reality of governments and their people. Debt levels are at record highs. Gold has been pushed aside despite strong fundamentals in favor of sentiment for unicorns. But how long will this house of cards last?

Gold has always been revered thanks to its robustness and rarity, making it a perfect store of value, unit of account and medium of exchange that we associate with currencies for any well-functioning society.

This was the case with the United States as well, until it abandoned the Gold Standard.

In the 1920s, the price of gold was fixed at $20.67 per ounce.[2] The United States M2 money supply peaked at $46.6 billion in 1929 right before the market and economy fell off the cliff.[3] It has grown to $15,401.8 billion at the end of 2019, an increase of over 330 times.[4]

If we were to apply that level of growth to the price of gold prior to the United States abandoning the Gold Standard, its price would be $6,800 per ounce. The United States Central Bank claims to have 8,134 tonnes of gold in storage, equating to 287 million ounces. Reverting back to the Gold Standard based on U.S. reserves would imply a price of over $53,000 per ounce![5]

Before gold bulls rejoice, we have to look at the global economic reality when it comes to monetary policy. The United States is not going to ever return to the Gold Standard. Particularly as the U.S. dollar replaced gold as the world’s peg currency decades ago.

The United States government fostered a monetary policy that favored economic growth over one that limited inflation and most of the world followed suit. In the developed world, we enjoy a greater standard of living than our grandparents, so is that such a bad thing? Even if it is aided by runaway printing of fiat currency and record levels of government and personal debt.

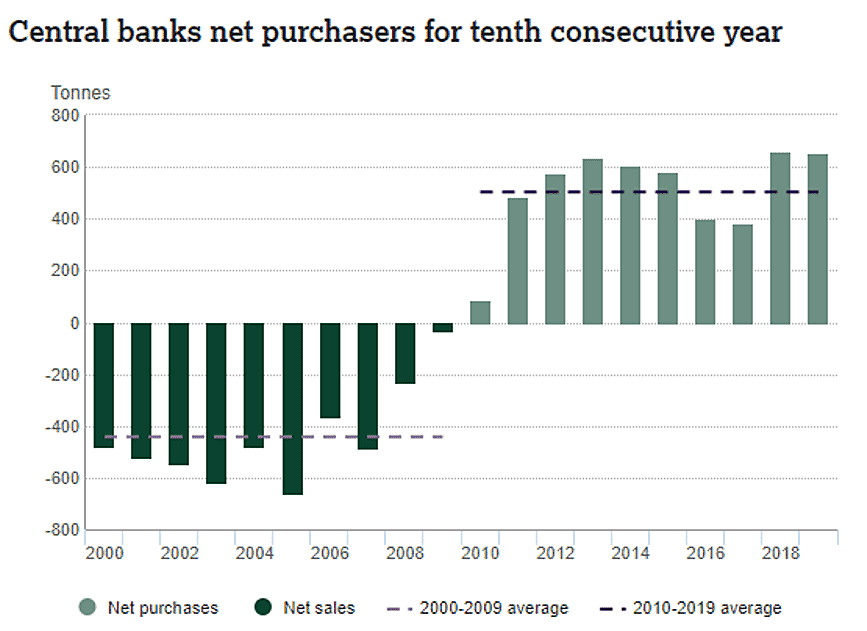

However, just because central banks have abandoned the Gold Standard does not mean that they are totally blind to the value of gold as a store of wealth and the dangers of unsound fiscal policy. That lesson appears to have been learned right at the last global market meltdown threat of 2008 if we look at the central banks’ net purchases of gold over the last 20 years.[6]

2019 marked the tenth straight year that central banks have, on aggregate, been net buyers of gold. They added 650.3 tonnes of gold to their reserves in 2019 and have a total of 34,700 tonnes. That reversed the net selling that took place in the ten years prior at the start of the century.

This prudent purchase of gold reduces the likelihood of global economic calamity under the weight of debt, but it increases the probability that the price of gold pushes upward in a steady fashion as demand for the yellow metal is increasing and supply is locked away in vaults.

The Chinese government in particular is making a concerted effort to increase its gold reserves. It may be stepping towards a political or economic power play that includes backing its currency by gold. That would be a significantly positive disruption to the gold market.

The World Gold Council estimates that there was 190,040 tonnes of gold above ground and 54,000 tonnes in reserves with about 2,000 to 3,000 tonnes mined every year at the end of 2017. Two-thirds of all gold mined was done so since 1950.[7]

If gold was to be valued at $10,000 per ounce, the 6.7 billion ounces above ground would be worth $67 trillion. This is almost as much as the global M2 money supply proxy of approximately $73 trillion.[8]

In the post-gold linked world that we have lived in for nearly 50 years, not everyone is going to take their fiat currency and immediately buy gold with it. Even if the Chinese are. It is very unlikely that we will have a run on gold equivalent to M2 money supply.

The U.S. government severed the link between gold and the dollar in 1971 when global M2 money supply was approximately $2 trillion.[9] There was approximately 80,000 tonnes of gold above ground at that time.[10] At a price of $40 per ounce, the 2.8 billion ounces above ground would be worth $113 billion.

That’s only around 5% of the global money supply back at a time when the U.S. and other world governments were still making some kind of effort to link their currencies to gold. Once that link was severed, free trading gold skyrocketed to more than ten times that price by the end of the decade.

By 1980, there was 90,000 tonnes above ground while global M2 money supply tripled to approximately $6 trillion. At $500 per ounce, the value of the gold above ground was $1.6 trillion, about 26% of global M2 money supply at that time. At today’s price of $1,500 per ounce, the entire value of gold above ground is 14% of M2 money supply. So, we sit comfortably between the two extremes seen at the beginning and end of the 1970s.

One thing to keep in mind is that the extreme profitability of gold at a high price would encourage investors to spend far more risk capital in the search for more gold deposits. Output would rise, quelling upward pressure in price. But just as output would rise, so would the cost of that output. The cost per ounce for mining would drastically increase.

This would create a floor price in gold at substantially higher prices than today at which, if it was crossed, companies would slow down or cease production and the delicate supply-demand dynamic would once again head back up. This simple economic principle leads me to my final section.

Just like everything else in economics, the price of gold is determined by supply and demand dynamics. That should be evident by the consistent buying of gold by central banks and that correlating to the higher price of gold during the 2010’s when compared to the previous decade.

No investment strategy is more economically pure than going out and buying physical gold. When you buy an ounce of gold and hide it somewhere safe in your possession, you take that ounce out of the global supply. You directly do your part in helping the gold price go up by forcing the demand-supply equilibrium to move upwards.

However, not everyone is in the position to purchase and safely store physical gold. Some prefer the liquidity of gold ETFs, futures contracts or similar kinds of “paper gold.” While that might be okay for day trading and speculation, paper gold is NOT the same as buying physical gold. It is just a contract or a promise of gold. A reputable source for buying hard assets online would be Kitco.com.

But if the financial markets were to go haywire and a demand for physical gold skyrocketed, do you really think that the entity on the other side of the contract would be willing or able to provide you with physical gold on request? Buying paper gold defeats the entire purpose of buying gold in the first place. If you must buy paper, it is better to buy shares in gold companies.

The Barrick’s of the world are great for the hedge funds that need large and liquid stocks to park a lot of money for speculation. But just look at the price of Barrick Gold (NYSE: GOLD / TSX: ABX) today and its price back in 2000 when gold was less than one-quarter of where it is now. Buying a stock like that does not necessarily correlate well to the price of gold over long periods of time.

As the price of gold increases, a large producer like Barrick will also see cost pressures as it gets harder and harder to find and mine that next ounce of gold. Equipment must be purchased and personnel must be paid. Both of those will see inflationary pressures in any large gold bull run.

And just like I mentioned in the previous section, any downturn in the price of gold would cause companies like Barrick to slow down or cease production. Sometimes not under the greatest of circumstances.

Barrick tanked to less than $7.00 in 2015 as investors were worried it was going to have financial issues. Not surprisingly, this occurred right at the five-year low for gold which also looks to be gold’s floor of $1,000 per ounce.

Junior mining is the best bet for high beta returns in a bullish gold market. Explorers that make the next major discovery become an instant buyout target at many multiples of their pre-discovery stock price. They take on the risk of drilling for a new discovery, but they don’t take on the heavy capex burden of building out a mine.

The TSX Venture Exchange in Canada remains the best proxy for junior gold bull runs. When the price of gold took off from less than $300 in 2002 to hit record highs right before the economic collapse in 2008, the Venture Exchange more than tripled from 1,000 to over 3,000 points during that time.

There were numerous junior gold and silver companies that moved up ten times or more in months or weeks on news of a decent discovery or even just on the hype and hope of one.

As asset prices recovered and the price of gold hit over $1,800 in 2011, the TSX Venture experienced another monster run. It went from a low of 700 points at the end of 2008 to once again more than triple to over 2,400 by spring 2011.

Reviewing the performance of the TSX Venture Exchange since then shows the risks of long-term investments in microcap stocks. The Venture is a victim of selection bias as successful companies graduate to the senior TSX and the companies that don’t progress either dilute or delist.

The TSX Venture Exchange has sunk to less than 600 points though it has experienced a 10% increase since mid-November as gold prices have been steadily hitting multi-year highs. It might be pointing upward for another sustained bull run as speculative dollars move out of cannabis stocks and into gold, and dollars made at the top on the TSX and NASDAQ trickle down to more speculative ventures.

When you invest in junior resource companies, make sure that you get to know the management team and their geologists. You have to assess if the company is actually going to do any real work on their property and if that work will lead to anything. Be wary of management teams that are looking at the uptick in gold price as nothing more than an opportunity to fund their salaries for the next two years.

Investing is not meant to be easy. If it was, everyone would be a millionaire. If you believe the current economic climate of running up debt and printing money will continue to stoke demand for gold like I do, there are two great ways to maximize returns.

You can either go to the effort of physically purchasing gold and safely storing it in your possession. Or you can carefully research junior mining companies to determine several candidates for a potential investment and seek counsel of a professional investment advisor.

In my next article, I am going to share three junior gold exploration companies that could turn out to be quite prosperous. Be sure to watch your inbox, and as always, do your own due diligence.

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] Gold price at $10,000 is not crazy talk says Frank Holmes, Kitco.com

[2] Historical Gold Prices, onlygold.com

[3] Watkins, Thayer. “The Money Supply and the Banking System Before and During the Great Depression”. San José State University Department of Economics

[4] United States Money Supply M2, tradingeconomics.com

[5] Top 10 Countries with Largest Gold Reserves, usfunds.com

[6] “Gold Demand Trends Full year and Q4 2019”. World Gold Council

[7] "How much gold has been mined?". World Gold Council

[8] Burgess, Robert (2019). What’s Really Behind the Global Risk Rally? Follow the Money. Bloomberg.com

[9] Hewitt, Mike (2009). Growth of Global Money Supply. Goldseek.com

[10] Popescu, Dan (2014). Above-Ground Gold Stock - How Much Is There and Why Does It Matter?. Goldbroker.com