In times of high uncertainty and geopolitical turmoil, many investors look to invest in safe havens such as US government bonds or gold.

You don’t have to look far today to see potential market upheaval.

But even in calm times, an investor should have an allocation to an asset class that may rise when most asset classes such as growth stocks are falling. This will help to cushion a portfolio from a pullback in stock markets as well as reduce portfolio volatility.

Gold and silver can oftentimes serve as this “shock absorber” purpose, but not always.

Government bonds are less risky, but if interest rates rise due to turmoil in financial markets, US Treasury bonds could easily go the other way and lose value.

Part of the allure of gold as a safe haven is its long history of serving as a universal, global currency of sorts.

The expression “Good as gold” is more than just an adage, but it is hardly bulletproof.

This begs the question, are there other precious metals that investors should consider as a safe haven?

The best-known precious metals are the coinage metals, which are gold and silver. Although both have industrial uses, they are better known for their uses in jewelry and coins.

Other precious metals include the platinum-group metals (PGMs): ruthenium, rhodium, palladium, osmium, iridium and platinum — of which platinum is the most widely held and traded.

The metals are hybrid because the demand for them is a blend of practical uses as well as investments, and a store of value.

Today I’ll compare and contrast two of these rare precious metals, platinum and palladium. We’ll weigh the probabilities of higher prices by looking at supply and demand fundamentals, psychological and technical factors, and hardball geopolitics.

Platinum and Palladium are like siblings — a lot alike but with different personalities.

Similar to gold and silver, platinum is purchased and sold as a commodity all across the globe. However, platinum is considerably rarer than gold and silver, and so scarce that some say the entire amount of metal ever mined might fit in a large living room.

Even though platinum has considerable industrial and technology applications, as well as use in jewelry and art, it also serves as a financial metal and an investment vehicle.

Around 75% of platinum comes from South Africa. Demand for both platinum and palladium is chiefly driven by high demand from the auto industry, particularly in China and India.

Often found as a byproduct of platinum mining and refining, palladium is actually 15 times rarer than platinum. Similar to platinum and silver, palladium is an industrial metal with numerous applications in dentistry, electronics and automobile production. Over the last several years, palladium has been substantially outperforming gold and silver.

Although platinum is denser than palladium, they can be substituted for each other when it comes to industrial applications, such as to keep emissions down through use in catalytic converters in the auto industry. Which metal automakers use is dependent on the price of the metal, technology, and the dependability of supply lines.

In fact, platinum was the original metal used in all catalytic converters for decades. It was only around the 2000’s that automakers transitioned to palladium for most car engines (except diesel) because at that time, palladium was many hundreds of dollars per ounce cheaper than platinum.

Now, however, palladium prices are significantly higher than platinum prices.

Why has this happened? What could lead to a reversal of prices?

What should an investor buy now?

These are all good questions.

Let’s begin with the fundamentals.

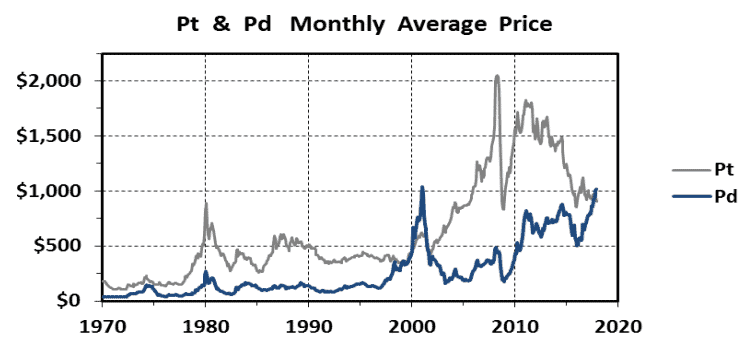

To begin, platinum rose to an all-time peak at $2,308 per ounce in March of 2008 in a rally that began in 2001 and lasted for seven years.

But as automakers switched to the cheaper palladium for catalytic converters, and the global financial crisis hit markets in October 2008, the demand for, and therefore the price of, platinum fell to a low at $762 per ounce — a decline of over 67% in a little over half a year.

The price of platinum rebounded to just under the $1,920 level in 2011, the year that gold rose to its record high.

From there, platinum fell back again to its lowest level since 2003 before staging a comeback and showing some momentum in 2019 to approach the $950 level.

In 2008, platinum was at an over $1,600 per ounce premium to palladium, and an over $1,140 premium to gold.

Now the situation is the reverse, with palladium trading at substantial and surprising premiums to both gold and platinum.

Keep in mind that nearly 85% of palladium is being used in the auto industry, which has been a main factor pushing its price higher.

That said, if electric vehicles do become the dominant mode of transformation, demand for palladium for producing catalytic converters would gradually diminish.

Investors have been frustrated by the platinum price stubbornly lagging the palladium price for years now.

You would think that the economic fundamentals would drive automakers and other industrial users to shift to cheaper platinum, but that has not yet happened.

So far, automakers have not switched back to the much cheaper platinum probably because it takes years to adjust and redesign the automobile production process to enable the transition.

This could change if platinum remains significantly cheaper than palladium for the next few years. Then a one-time expense to redesign the production process could be worthwhile and economic.

In March 2019, according to the Financial Times, the chief executive officer of Anglo American (LSE: AAL / JSE: ZAR / OTC: NGLOY), Mark Cutifani, one of the largest palladium producers, said:

“It is a bubble but . . . as new models get developed in the auto industry, adjustments will take place and maybe there will be some substitution there. Palladium will stick around these sorts of levels for a while because the cost of changing is probably not worth the change. But over time it will change and platinum will come roaring back.”

Also, the average global cost of palladium production is around $750 an ounce with the price of palladium currently over twice that figure.

This means that incentives for supply will likely continue to rise for a long period of time while demand may slow or fall.

But it is not just the significant price gap between palladium and platinum that got my attention.

It is also where these sister precious and technology metals are produced.

Let’s look deeper…

Let’s now move to where the production of these two precious metals comes from in terms of country and region according to the US Geological Survey.

Palladium production in 2018:

Russia and South Africa produce about 80% of the world's palladium, while Canada, the US and other countries account for about 20% of the world's production.

Platinum production in 2018 tells us a somewhat different story:

For platinum, the single country of South Africa dominates the world's production of the supply, representing 75% of world production.

Russia and Zimbabwe produce about 15% of the world's platinum supply while Canada, the US and all other countries only produce about 10% of the world's platinum supply.

Looking at the production gap another way, America produces more than three times as much palladium as it does platinum, and Canada and other countries produce almost twice as much palladium as they do platinum.

Now let’s pivot to the decisive issue…

In short, South African economic and political risk is rather high and increasing.

South Africa faces rising public debt, inefficient state-owned enterprises, a weakening currency, and spending pressures, which have reduced the country’s global competitiveness.

Still, South Africa has an advanced economic infrastructure, making the country the leading African economy and home to 75% of the largest African companies.

The economy cannot seem to grow more than 1% a year.

According to a report by South Africa’s Treasury, its national debt will rise by almost a trillion rand (US$65 million) between 2017–2020, to nearly two-thirds of gross domestic product. The gross loan debt is expected to reach $247 billion in 2020 as the government accelerates borrowing in local and international markets.

The hopefulness that followed the appointment of Cyril Ramaphosa as president in 2018 has run out of steam; and the stubborn political uncertainty in the country seems to have eroded business and consumer confidence.

South Africa's unemployment rate has exceeded 27% since 2017, and unemployment rates are much higher among the young population and the black majority of South Africans in a country considered one of the most unequal in the world.

Additionally, South Africa has the biggest HIV epidemic in the world, with an estimated 7.2 million people infected — about 19% of the population.

The economy and mining industry are struggling with rolling blackouts, as its credit rating stays just above Junk status. In late-August of this year, the National Treasury proposed selling off coal-fired power stations owned by Eskom in a bid to help reduce the financially troubled, state-owned electricity provider’s high debt burden.

Other state-owned companies such as arms-maker Denel and airline SAA have asked the government for additional bailouts to ensure they can continue operating.

The anemic economy has to be seen against a backdrop of poor governance and high levels of corruption.

The projected growth of the country’s major trading partners, such as Brazil, and Russia and other countries in Africa, are uninspiring; and the decline in global demand due to growth slowdowns in China, Japan, the European Union and America is muted at best.

So while the current palladium supply is extremely tight and investors may make additional profits by investing in this precious metal, I believe the smart play is to invest in both palladium and platinum.

Investors should lean towards platinum due to its significant discount to both gold and palladium.

The increasing likelihood that it will be substituted for palladium in industry, and the increasing political and industrial labor strike risk in South Africa where most of it comes from, are also investment factors to consider

In addition, consumption of platinum in fuel cells is expected to see another year of double-digit gains in 2019.

To simply, safely and inexpensively invest in platinum, I suggest the GraniteShares Platinum Trust (NYSE: PLTM) which follows the performance of platinum prices. It established a fresh 2019 high of $9.87 per share on September 4 and now trades at $8.70.

This exchange-traded ETF physically holds platinum bars in a London vault with ICBC Standard Bank as custodian.

Another option is the ETFS Physical Platinum Shares (NYSE: PPLT) managed by Aberdeen. Both of these platinum ETFs are up 16% so far in 2019.

For palladium, there is the Aberdeen Standard Physical Palladium Shares ETF (NYSE: PALL), which is up 32% so far in 2019.

Having both of these in your portfolio is a smart move, and time will tell whether my preference for platinum will play out.

But one thing is for sure: When your friends and colleagues ask you what you think about gold or silver as alternatives to stocks, watch their heads turn when you casually mention platinum and palladium.

This alone might be worth it.

Carl Delfeld, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

Yahoo Finance

US Geological Survey (usgs.gov)

http://www.platinum.matthey.com/documents/new-item/pgm%20market%20reports/pgm_market_report_february_2019.pdf

Source: Johnson Matthey PLC 2019 PGM Market Report, Johnson Matthey 2019 PGM Market Report, https://www.lppm.com

https://seekingalpha.com/news/3501289-gold-silver-enjoy-safe-haven-action-palladium-pops-new-record-high

https://www.ft.com/content/b638b628-5074-11e9-b401-8d9ef1626294