Healthcare historically has been an attractive sector in which to invest over the long term. Healthcare companies, in aggregate, have demonstrated stronger earnings growth relative to the broader market, as well as defensive attributes during economic downturns.

Now is a particularly good time to consider investing in the senior healthcare sector, as the industry is experiencing unprecedented change driven by demographic trends and technological innovations in delivering services remotely.

Here are some sobering facts that show how age demographics are evolving in the US.

What we are witnessing is nothing short of a senior demographic revolution — an aging megatrend that is changing the economies of developed countries now and into the future.

Because of this revolution, we are now at the front end of a senior healthcare market boom and this will continue to grow and make its mark on economies in the coming years.

For you, the savvy investor, the investment opportunities could be enormous.

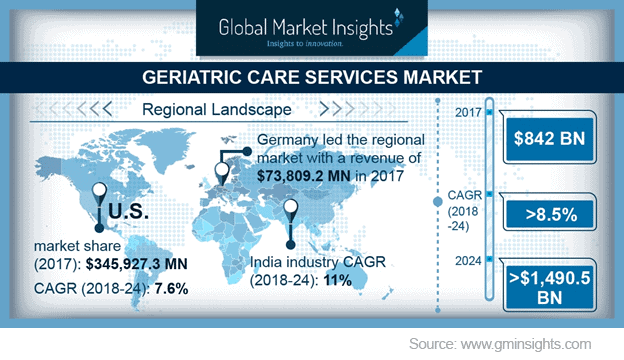

This increasing elderly population has and will necessitate more senior healthcare services.

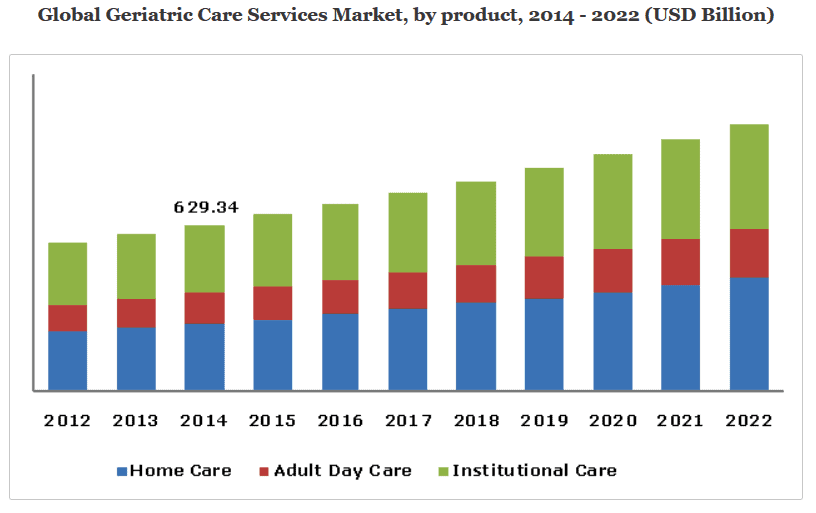

One estimate for the global home healthcare sector, just one part of the overall industry, should see revenues grow to $300Bn in 2020 from $180Bn in 2014 — a compound annual growth rate (CAGR) of 8%.[3]

Charles Schwab recently rated healthcare at "outperform," citing:

Demand should continue to rise for healthcare products and services, driven by an aging US population.[4]

Senior healthcare services are primarily broken into live-in or institutional care, home care in the patient’s home with visits from medical support staff, and adult day care which as the name implies, is primarily centers for seniors during the day.

Outside of the direct healthcare services, technology will be a driving force in how healthcare services are rendered. 5G wireless will play a huge role as devices can connect from the patient’s home directly to their doctor’s office at data speeds of 100 times what is possible today on 4G wireless.

Institutional Healthcare Market

Nursing homes, hospitals, assisted living centers, and independent senior living centers for medical care of elderly patients are all contributors to business growth in the institutional healthcare market in the coming years.[5]

The global long-term care market size was valued at USD $946.6 billion in 2018 and is expected to register a CAGR of 7.5% over the forecast period.

An aging demographic, and subsequent illnesses associated with aging, are expected to drive the increase in this market. People are living longer, which also increases the number of disability cases such as memory loss, chronic illnesses, and post-hospital care. These factors will drive demand for affordable senior institutional care.[6]

Home Healthcare Market

Several advantages associated with home healthcare, such as lower risk of rehospitalization, better quality of life and lower medical bills, will continue to boost growth in this sector. Additionally, some of the best home care companies offer enrichment programs for elderly patients that are tailored to each person, further driving industry growth.[7] [8]

The events, gatherings and outings included in life enrichment programs aren't just to give seniors something to do. Attending a painting class, for instance, provides a chance for residents to be creative, use their memories and work on fine motor skills.

Advances in Technology and the 5G Wireless Standard

The upcoming 5G wireless standard, in tandem with advances in artificial intelligence (AI), can reduce healthcare costs while broadening access to more patients. Future high bandwidth data enabled by 5G makes possible the adoption of telemedicine, telesurgery and expanded home healthcare.[9]

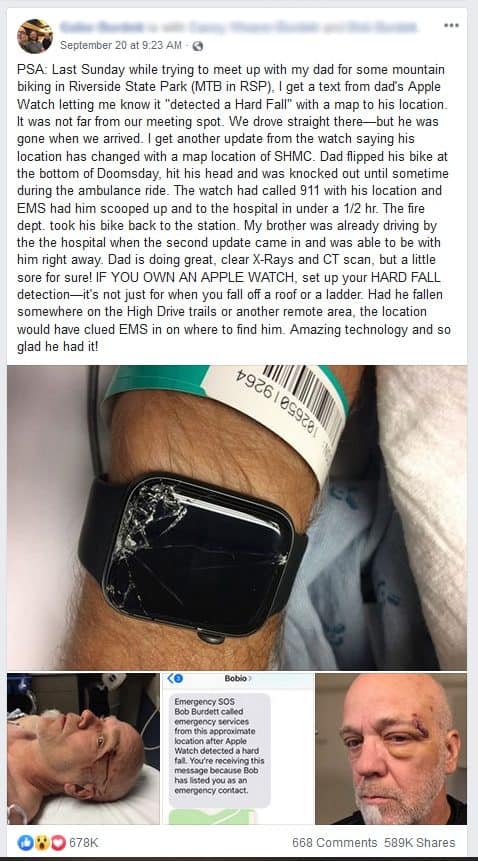

Telehealth has been working its way into senior care for some time — from laptops and smartphones with large buttons and displays for easier use by seniors to pendants worn around the patients neck in case of an emergency or fall (think the well-known "I've fallen and I can't get up" commercials).

Healthcare providers are beginning to harness these technologies to increase connectivity with patients in their homes.

Seniors can now remotely access their entire care team without having to leave home. And device apps are also helping seniors with exercise regimes, diets and medicine intake.

Physical devices worn by patients can monitor blood pressure and pulse rates, and check for irregularities. These devices can connect to a smart device app and relay this data directly to a healthcare team member for further analysis, possibly cutting down on unnecessary hospital visits and resources, while reducing costs.

Voice assistants such as the Amazon (NASDAQ: AMZN) Echo (aka Alexa) and Google (NASDAQ: GOOG) Home are helping seniors remember their daily schedules, such as when to eat, take medicine, or visit their doctors. Smart pillboxes help with dosage control and timing of medication.

Even some smart clothing is already helping doctors monitor their patients' movements to check for irregular gaits, or to alert the care team if a fall occurs. Beyond that, motion detectors, smart mattresses, and even personal robots can help make the assisted living experience more palatable.

So enormous are the future aging population investment opportunities that I had a very hard time narrowing down the many individual investment ideas for this article.

I finally ended up with 3 ETFs that look to be bright spots among the pack. ETFs offer the advantage of a diversified investment, which minimizes the impact of holding just one company’s stock during an economic downturn.

But first, let me explain a bit about what an ETF is and why I chose it as an investment vehicle in this sector.

ETFs (Exchange Traded Funds)

An ETF is a type of fund that holds a collection of stocks from a particular sector of the market — in this case, senior healthcare. Because there are multiple assets held within an ETF, they can be a popular choice for diversification.

This diversification can alleviate the pain of any downturns or softening in any single security. They tend to be lower risk than purchasing a company’s stock directly, and they are managed so the companies in the fund will change over time to maximize earnings.

What you should know about ETFs:

Based on the unprecedented changes in aging demographics, along with technological innovations, I have compiled my top three ETF picks for starting your investment research in the senior healthcare market.

Global X Longevity Thematic ETF (NASDAQ: LNGR)

The Global X Longevity Thematic ETF seeks to invest in companies positioned to serve the world’s growing senior population through exposure to healthcare, pharmaceuticals, senior living facilities and other sectors that contribute to increasing lifespans and extending quality of life in advanced age.

The Global X Longevity Thematic ETF tracks an index of equities from companies involved in lifespan extension and improved quality of life efforts for senior citizens. The selection includes small, mid, and large cap companies from developed countries who derive the majority of their revenue or whose stated business objective falls under the “longevity” label are eligible for inclusion.

“Longevity” crosses traditional sector lines to incorporate a variety of businesses including biotech and healthcare products related to age related diseases, medical devices, healthcare services, and senior living properties.[11]

Vanguard Health Care Index Fund ETF Shares (NYSE: VHT)

The Vanguard Health Care Index Fund ETF is made up of stocks of large, mid-size, and small US companies within the healthcare sector.

It's a cap-weighted fund that holds over 300 US healthcare firms, stretching across multiple industries from the broadly defined healthcare space.

VHT is cheap to hold, with a low fee and excellent tracking. Like all Vanguard funds, VHT has limited transparency, as holdings are only published monthly with a roughly two-week delay. However, for the long-term investor looking for broad coverage, a lack of transparency shouldn’t be a deal breaker.[12]

Fidelity MSCI Health Care Index ETF (NASDAQ: FHLC)

The Fidelity MSCI Health Care Index ETF invests at least 80% of its assets in securities included in the MSCI USA IMI Health Care Index, which represents the performance of the healthcare sector in the US equity market.

FHLC casts a wide net across the entire healthcare market, capturing over 300 large-, mid- and small-cap companies spanning more than 10 subsectors. This diversification gives the fund less exposure to the big pharma companies that dominate the market, and more exposure to sectors like drug retailers and insurance.[13]

The senior healthcare market is growing and will continue to expand over the coming years as baby boomers continue to age, and the need for healthcare services expands. The aging megatrend is an investment opportunity of a lifetime. (No pun intended!)

From housing to pharmaceuticals, biotechnology to telemedical devices… I’m continuing to research the healthcare sector and will be on the lookout for special investment opportunities and individual stocks that could deliver outstanding returns. In the short term…

The three ETFs I highlighted above are a good starting point for investing in the aging demographic. As noted, ETFs offer a diversified asset with lower risks to the broader markets and economic downturns.

Of note, please do your own due diligence before making any investment decisions.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.fool.com/investing/2018/09/22/high-yield-healthcare-stocks-perfect-for-retiremen.aspx

[2] https://www.cnlhealthcarepropertiesii.com/investment-strategy/four-dimensons-of-seniors-housing-and-healthcare.stml

[3] https://www.franchisehelp.com/industry-reports/senior-care-industry-analysis-2018-cost-trends/

[4] https://www.investopedia.com/top-5-health-care-stocks-of-2018-4581511

[5] https://www.gminsights.com/pressrelease/geriatric-care-services-market-size

[6] https://www.grandviewresearch.com/industry-analysis/long-term-care-services-market

[7] Ibid.

[8] https://www.grandviewresearch.com/industry-analysis/geriatric-care-services-market

[9] https://www.cisco.com/c/en/us/solutions/enterprise-networks/5g-network-infrastructure-telehealth.html

[10] https://www.investopedia.com/terms/e/etf.asp

[11] https://www.etf.com/LNGR#overview

[12] https://www.etf.com/VHT

[13] https://www.etf.com/FHLC#overview