A little over two and a half years ago, the world as we knew it was turned upside down.

The first cases of COVID-19 emerged and threatened to take down global modern civilization as we knew it.

So far, the virus has taken 6.3 million lives worldwide and 1 million here in the US.

As horrific as these numbers are, thankfully the worst of the apocalyptic predictions did not come true.

Without a doubt the virus has certainly taken its toll on all of us, both mentally and physically.

Today, lockdowns and mask mandates have largely been lifted around the globe. People are getting back some normalcy in their daily lives and learning to live with a virus that’s not yet endemic and looks like it is here to stay for a while.

Currently we are now in the fifth wave of COVID cases. The virus has proven adept at recreating itself in new forms that evade our latest vaccines. While the latest variant appears to be more infectious than past variants, thankfully the symptoms seem to be milder with a much lower risk of death.

To be sure, the virus is not to be taken lightly, and biotech and pharmaceutical companies are still scrambling to find the silver bullet to bring the nightmare of COVID to an end.

Until a ‘cure’ is found, there will be continued high demand for vaccines and booster shots that keep the COVID virus in check. In addition, many parts of Africa and the Middle East are way behind in its vaccination programs, further increasing the demand for more vaccine production.

Is it too late to profit from the biotech and pharmaceutical companies battling the COVID virus?

The answer is no. The virus continues to ravage many parts of the world, constantly creating new variants and pushing the capacity of hospitals to treat patients to the brink of collapse.

There are numerous companies that are directly working on a COVID cure and intelligent investors can still see handsome gains by picking up a few shares in select biotech and pharmaceutical companies.

As an added bonus for profit seekers, many of the novel technologies that are being developed to combat COVID are now being applied to other ailments such as cancer, hepatitis and AIDS — to name a few. Treatments and cures in those fields could be a nice windfall for investors lucky enough to pick the right company that strikes gold by happening upon a new cure.

In addition, the broader market pullback is an excellent opportunity to buy these stocks at a deep discount. The markets have taken a beating this year and select healthcare stocks are now trading at bargain valuations.

Overall many biotech and pharmaceutical companies have managed to weather the economic storm quite well when compared to the S&P or Dow Jones averages.

This is in large part due to the healthcare sector being a ‘defensive-growth’ play.

Defensive: The sector is relatively immune to economic swings and global macro conditions. Historically the sector has seen strong performance during recessionary periods.

Growth: The sector is now seeing increased growth due to demographic trends as an aging population translates into growing demand for healthcare.

The Centers for Medicare and Medicaid Services projects that the healthcare sector as a whole will average about 5% annual growth between 2022 and 2030.[1] They also project health spending to reach $6.8 trillion by the end of the decade.

The fact is healthcare will always be in demand as it is an essential service. This makes this sector very attractive to investors especially during times of economic uncertainty and turbulent market conditions.

All said, intelligent investors can still see handsome gains by investing in select healthcare companies, and specifically in the sub-sectors of biotech and pharmaceutical companies focused on COVID-19 vaccines and antiviral research.

Investors should be considering a variety of positions in healthcare stocks.

After careful research, here are 7 healthcare stocks that I believe show the most promise in the field in my opinion. Many are directly related to the fight against the COVID pandemic. I also included a few that are indirectly related and that show promise to continue to pull in strong quarterly results for the long term.

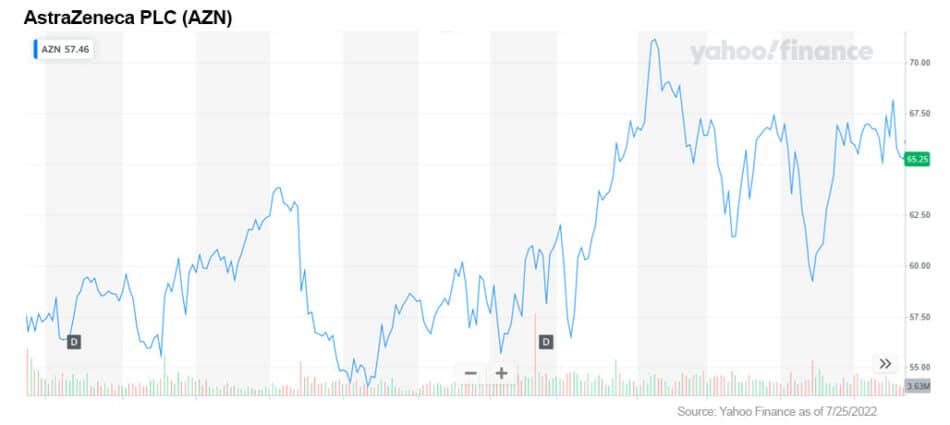

1. AstraZeneca PLC (NASDAQ: AZN)

The company was an early favorite in the fight against COVID-19. Its vaccine was one of the first released and approved in Europe. At the time, the US government purchased 300 million doses.

Ironically the company’s vaccine was never approved in the US, and the company is having problems in Europe where they recently reached a settlement with the EU over failure to fulfill its supply commitments.

AstraZeneca’s struggle with a successful COVID vaccine launch was further complicated by reported side effects that more or less shelved the project. There were also concerns over quality control as production was moved to facilities in India where faults in quality control were found.[2]

Overall, the COVID vaccine program is a small part of its bottom line. The company has a whopping 183 projects in its pipeline, 16 new molecular entities in its late-stage pipeline and 2 new molecular entities under review.[3] These projects cover a wide range of illnesses and conditions with many in late-stage review.

The drug company's lineup includes several products with strong sales growth — especially its cancer drugs Imfinzi and Lynparza.

AstraZeneca has shown strong resilience to economic headwinds and continues to pay a dividend twice a year to investors.

A strong candidate for portfolio inclusion in my opinion.

2. Johnson & Johnson (NYSE: JNJ)

J&J was an early entrant in the COVID vaccine push. They touted a one-shot vaccine that unlike its competitors took effect with only one dose.

The company secured US approval for distribution but ran into problems as blood clotting side effects were reported. Also, its vaccine was found to have a lower efficacy rate when compared to its peers.

In addition, the company’s vaccine was found to be not as effective against the quickly emerging COVID variants, and a booster was recommended.

Like AstraZeneca, J&J’s vaccine program has little impact on its bottom line. The company has been selling the vaccine at cost and has a robust pipeline of projects that contribute to overall profitability for the company.

The company has deeply diversified operations across a wide range of healthcare subsectors.

The company holds a rare title of Dividend King in the S&P 500. Those are companies that have increased dividends for at least the last 50 years. Impressive to say the least and a true sheltered investment for investors looking for a safety zone stock for the long term.

3. Pfizer Inc. (NYSE: PFE)

Pfizer was one of the first effective COVID vaccines approved by both the US and EU. The vaccine has sent the company’s share price soaring and has proven to be a huge commercial success story.

Earlier this month, the company announced that its antiviral drug Paxlovid would be available directly from pharmacists.

This move by the FDA promises to get the drug in the hands of more patients in a timely manner since the drug is only effective within five days after symptoms begin. The drug has shown it reduces hospitalizations and deaths by nearly 90% among high-risk patients most likely to get a severe case of COVID-19.[4]

The pullback on the share price this year makes the company very attractive to long-term investors. The company consistently has reported strong double- and triple-digit growth numbers for several years.

With COVID continuing to be a global health issue, demand for its highly effective vaccine, boosters and antiviral Paxlovid will continue to contribute to the bottom line of the company.

Pfizer appears well-positioned to deliver solid price growth at least for the next five years or more. The company pays an attractive dividend, making the stock a favorite of income-seeking investors.

4. BioNTech SE (NASDAQ: BNTX)

BioNTech was a partner in the development of the Pfizer COVID vaccine. Its research in the novel technology called messenger RNA (mRNA) was critical in the success of the vaccine.

The company continues to explore the possibilities of this new technology and applying it to other ailments such as melanoma and other solid tumors.

The company touts a number of early-stage drug candidates in the pipeline that target a variety of types of cancers.

BioNTech’s bottom line will continue to be boosted by its Pfizer vaccine and booster production well into the foreseeable future.

A solid company to add to your portfolio as well as the promise of a blue sky opportunity if one of its new therapies successfully clears human trials and review.

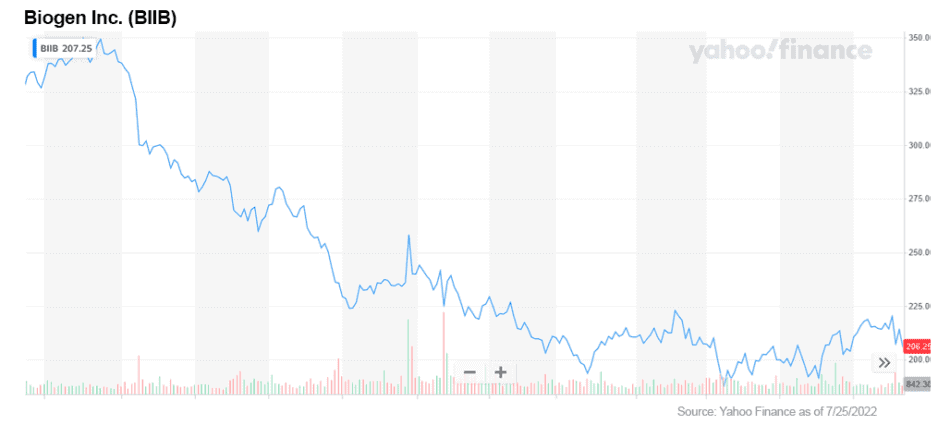

5. Biogen Inc. (NASDAQ: BIIB)

While this company is not a direct COVID play, it does land squarely in the biotech subsector. The company has shown a nice comeback since it ran into some problems with its Alzheimer’s drug approval, which hit the share price back in the spring of 2022.

Biogen is focused on research in treatments of multiple sclerosis and Alzheimer’s disease.

The company recently released its 2nd QTR financials with some very strong numbers. Net profit margin was up over 152% Y/Y squarely beating EPS estimates by almost 30%.

The company’s share price has struggled despite the positive financial news.

I went ahead and included this in my list as a long-term play. The company has strong royalty revenues from past projects and a solid pipeline of new therapies that could turn the stock around once approved in clinical trials.

6. Bristol-Myers Squibb Company (NYSE: BMY)

Bristol has been on a roll this year despite the S&P 500 flirting with bear market territory.

The share price has seen gains of +20% this year.

The company boasts a solid pipeline of 50 new drugs in clinical trials. If even a few are approved, they will offer blockbuster potential for the company. One drug in particular, Opdualag, a metastatic melanoma treatment, has already been approved by the FDA. In addition, the FDA also approved Camzyos, which treats a heart ailment.

Keep this company on your radar and consider picking up a few shares in the dips.

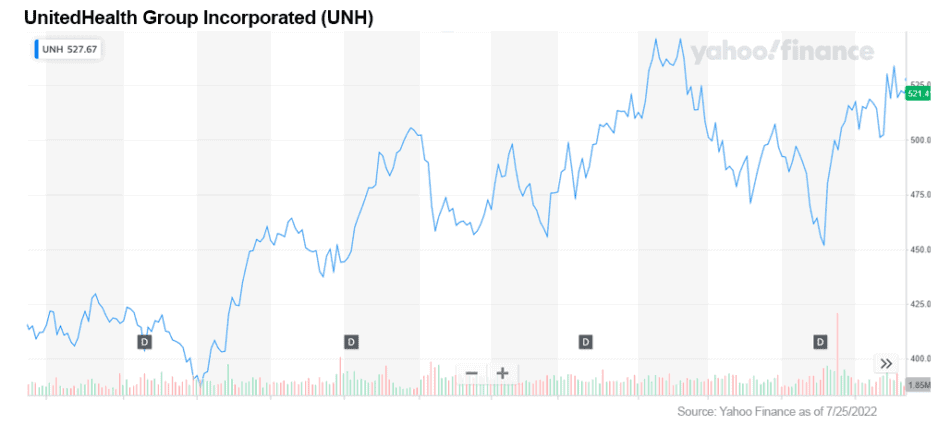

7. UnitedHealth Group Incorporated (NYSE: UNH)

UnitedHealth Group is one of the largest health insurers in the world. This blue-chip company is a must for any investor, especially during these rocky market conditions.

The company’s 2nd QTR earnings report soundly beat estimates sending the share price further north.

The company upped its full-year earnings guidance and looks to continue its solid growth for many years to come.

A not to be missed stock in any intelligent investor’s portfolio.

The healthcare sector is one that intelligent investors should be exploring for potential money-making companies. The sector has weathered the recent economic troubled waters and promises to remain a relatively safe haven for the coming decade.

Healthcare is an essential service. The sick and dying have little choice but to use the healthcare facilities offered to them. Inflationary costs are passed on directly to consumers, further insulating the healthcare companies from fluctuations from outside macro-economic factors.

Add to this the fact that baby boomers are rapidly aging and are now entering a phase in their lives where healthcare will become a bigger part of their monthly expenditures.

With markets reaching bottoms, valuations of many of these select biotech and pharmaceutical companies are at bargain basement prices. Picking up a few shares in various companies could help investors ride out this storm until brighter days come again.

For me, the blue sky potential of picking one of these biotech companies that is doing vital antiviral research — and to later find out that they have discovered an amazing new cure sending the share price skyrocketing up — makes me sit up in my chair and pay attention.

Things are moving fast in the markets these days. Don’t be left out as markets begin to recover and share prices once again begin to move north.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.cms.gov/newsroom/press-releases/cms-office-actuary-releases-2021-2030-projections-national-health-expenditures

[2] https://www.europeanpharmaceuticalreview.com/news/171545/emergent-destroyed-almost-400mn-covid-19-vaccines-due-to-quality-issues-finds-report/

[3] https://www.astrazeneca.com/our-therapy-areas/pipeline.html

[4] https://www.nxsttv.com/nmw/news/us-pharmacists-can-now-prescribe-pfizers-covid-19-pill/