Like apple pie and bald eagles, Harley-Davidson Inc. (NYSE: HOG) is an American icon deeply woven into the cultural fabric of this great country.

The brand is synonymous with freedom and the rebel lifestyle. It is literally the physical embodiment of the American dream.

Everyone knows that low rumble of the Harley V-Twin engine. A low, almost rhythmic pulse like an off-kilter heartbeat that reaches inside and touches your soul. And the ferocious roar as the engine screams to life when the light turns green.

The Harley-Davidson brand has become so powerful that even if you have never ridden one, you can put on a t-shirt or any of the vast catalog of apparel emblazoned with the Harley logo and feel you are part of the club. Tough. Edgy. Non-conformist. A true branded rebel.

You might have dreamed about riding a Harley in high school or early in your adult life, or watched someone riding alongside your car on the highway, thinking… how cool would that be? Harley-Davidson has been pretty good at selling the open road dream over the years. Look, they’ve been actually doing it successfully for 120 years.

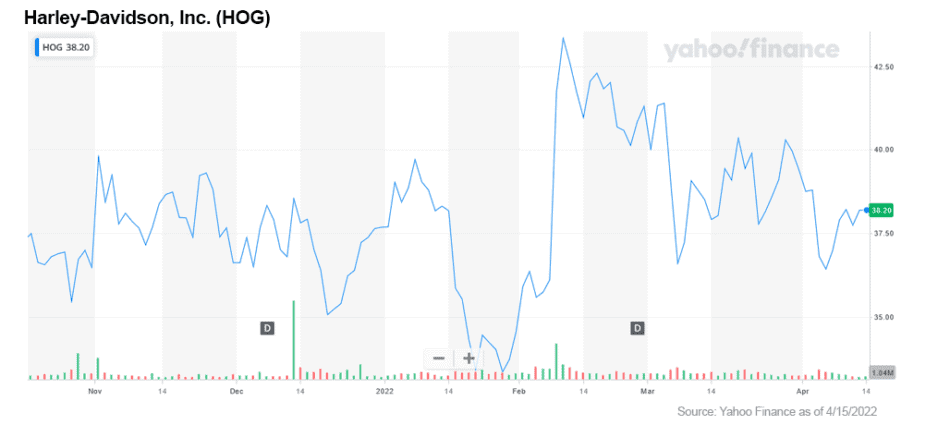

The company’s share price has weathered the COVID pandemic and the most recent market correction. The current share price is now at attractive levels and, in my opinion, now offers a good entry point to maybe adding a few shares to your portfolio.

The ultimate question is, will Harley-Davidson’s share price continue to push higher and ultimately deliver positive returns for shareholders within the next months and years to come?

Read on to learn more about the company, what challenges and opportunities lie ahead and how they will affect the company’s growth in the coming years.

In 1901, two young men in their early 20s started work on a gas-powered bicycle inside a small garage located in Milwaukee, Wisconsin. Two years later, the boys realized their dream and successfully produced their first “power cycle.”

The year was 1903. William S. Harley and his buddy Arthur Davidson would go on to refine their work and found one of the greatest American motorcycle companies in the world.

Since that time, the company has certainly had its share of ups and downs. Sometimes it seemed the company would certainly fail only to surprise everyone and come back bigger and better than ever.

Their motorcycles were long-time workhorses for the Army through two World Wars and the Korean War, as well as the go-to bike for North American law enforcement.

In the company’s early years, the bikes were marketed as respectable and refined, targeting customers with images of men in well-fitted suits courting upscale ladies with parasols.

By the early 60s, the brand sought to distinguish itself from the influx and quite frankly stiff competition of Japanese produced motorcycles, often referred to as “metrics” by Harley loyalists.

In particular, Honda arrived on the scene and marketed a clean-cut rider image with the slogan, “You meet the nicest people on a Honda.” The marketing campaign was a huge success and marked a downturn in domestic sales of Harley-Davidson motorcycles.

From that time forward, Harley-Davidson’s marketing took a 180-degree turn from the clean cut “squares” portrayed by Honda. The company branded their product as American working class, macho and the anti-social brand. It embraced and fostered the counterculture custom Harley scene which ultimately cultivated the “bad boy” image of bikers and motorcycle clubs.

The Harley-Davidson motorcycle became the trademark of the feared Hell’s Angels motorcycle gang, roaring up and down the streets on their “choppers & big loud bikes” in the late 60s and early 70s.

I remember riding in the family car while driving down the highway as a young kid and seeing a pack of bearded, large, and what would be described as mean looking guys blasting past us on their motorcycles with their roaring exhaust. I was terrified!

Those guys were no joke, and this period established Harley-Davidson motorcycles as synonymous with the dark side or bad boy image of motorcycle culture. Over the years, this persona helped fuel future sales.

Things certainly changed at Harley-Davidson over the last few decades though, including the company’s internal corporate culture. Insiders and board directors drove the next phase of Harley-Davidson to market and sell to a wider audience and improve product quality. These changes enabled the company to make the move to become a much larger production builder of the high-quality motorcycles Harley sells today.

In many ways, the early Harley marketing campaigns of the 60s and 70s were truly brilliant. It differentiated the brand from its competitors and breathed new life into the company that has carried it into modern times. More importantly, Harley-Davidson cemented its place as something truly American.

Today, the brand has been appropriated by what I call “weekend warriors.”

This group of motorcycle enthusiasts love to ride, with many being white-collar professionals who are drawn to the Harley brand for what it has come to represent: rebellion, freedom, counterculture, and macho raw power.

In 2020, Harley appointed a new and charismatic CEO who certainly embodies the brand.

Jochen Zeitz, CEO and chairman of the board of Harley-Davidson, has already made many positive changes that look to carry the Harley brand well into the next decade, and beyond.

This video of CEO Zeitz discussing his 2021-2025 plan and the future of the company is definitely worth checking out. This worthwhile video can be found halfway down the page at https://www.harley-davidson.com/us/en/about-us/company.html.

His visual style is perfect, playing right into the bad boy image that is the Harley brand. Definitely not the clean-shaven stereotypical corporate CEO seen over at some of the other motorcycle companies.

Zeitz arrived at the helm of Harley with a long list of accolades and corporate success stories in his pocket. To his credit, he was instrumental in saving the almost defunct Puma sportwear brand while he led the company over 18 years.

Jochen Zeitz is a German native and is the first foreign CEO in Harley’s history.

He appears to be the perfect fit for propelling the Harley brand into the future.

I found it interesting that his resume includes a great deal of involvement with socially and environmentally conscious businesses and promoting sustainability. This history plays out in his five-year plan for the company as it begins to transition into electric bikes. But more on that later...

Zietz has laid out a series of corporate plans that are currently being implemented: Rewire, Hardwire and Livewire. The 3-pronged series of plans looks to clean up the company and make it more efficient; grow the core business and secure its income base; and position itself as a leader in the electric motorcycle market.

Zeitz’s Rewire plan has already been implemented and was a “critical overhaul of its business.”

The plan included a 14% reduction in Harley’s overall workforce or about 700 jobs company-wide. The plan also included a refocus on core products, a 30% cut in the model lineup, a pullback from under-performing markets, and focus on eliminating manufacturing inefficiencies.

Harley boasts that the Rewire plan has set the company on a firm foundation again, and it is now ready for future growth.

According to Harley, Rewire succeeded in:

— Jochen Zeitz, CEO Harley-Davidson Inc.

With the Rewire plan fully executed, Harley is now in the process of implementing its 5-year business plan (2021–2025) called Hardwire.

Goals of the Hardwire plan include:

The Hardwire plan consists of six key priorities:

Zeitz has said the company will be focusing 70% on its core segments, 20% on new segments and 10% on other opportunities including small displacement models.

The move by the new CEO has drawn some criticism, but I believe it is a sound business plan as its core Internal Combustion Engine (ICE) motorcycle segment, including traditional high-end cruisers, mid-level bar hoppers, fully dressed tourers and trikes, have proven to be highly profitable for the company. This allows the company to establish a strong core business that could begin to fund development of newer segments.

The Rewire and current Hardwire plans have already proven themselves to be highly successful for the company.

2021 4th quarter results saw earnings surge +133% year-over-year. Revenues grew 40% to $1.02 billion.[2]

And Harley is not stopping there. It now has its eye on the future.

Harley-Davidson launched its first electric motorcycle in 2019. At about the same time, the company bought the StaCyc brand of kids’ electric bikes.

Harley created a sub-brand called LiveWire that includes all of its electrically powered products (including the StaCyc brand). This gave the company full autonomy in EV development.

Since its inception, the division has seen solid sales of its electric bikes, primarily led by the electric balance bikes for kids which accounted for over half of sales figures.

Harley’s LiveWire electric motorcycle was the #1 selling electric motorcycle in the US in 2021, according to the company.[3]

The Livewire motorcycle is a beauty and testament to the design and engineering skills at Harley. It perfectly combines the visual elements of gasoline powered bikes into an electric version. The design is sleek without being too futuristic, paying homage to its roots.

Given Zeitz’s long support of environmentally sustainable business practices and initiatives, it is no surprise that he is 100% behind the electrification of the Harley brand.

“Our combustion motorcycles will drive our business for years to come, however our electric motorcycles are important to our long-term success,” says Zeitz. “We are fully committed to, and passionate about leading in electric motorcycles.”[4]

The LiveWire or electric division is now in the process of being spun out and planning to go public via a SPAC (Special Purpose Acquisition Company) sometime in later 2022, sponsored by AEA-Bridges Impact Corp (ABIC).

KYMCO USA is also a partner in the deal.

Harley will preserve its ownership of LiveWire with the company holding about a 74% share.

Both KYMCO and Harley-Davidson each put up a $100 million investment. The merger is expected to have a value of about $1.77 billion with a post-money equity value of $2.31 billion at closing.

The deal is expected to close in the second half of 2022.[5]

Zeitz will help guide the new public company serving as chairman of the board, as well as serving as acting CEO for up to two years.

Upon closing of the transaction, LiveWire will be the first publicly traded EV (Electric Vehicle) motorcycle company in the US and is anticipated to trade on the NYSE under the symbol LVW.

This is a big step for Harley and could set them up to become a leader in the electric motorcycle industry.

After doing my research, I have to say the company has certainly won me over.

The new CEO comes to Harley as a proven successful leader and marketing guru. In my opinion, he perfectly embodies and wears the brand.

His business plan is already having a positive impact on the company’s bottom line. Also, his vision to further support and drive sales to Harley’s core gasoline (ICE) model lineup makes complete sense as a transition to EV motorcycles. Sales of gasoline-powered motorcycles will help in further development of their EV motorcycle initiatives, which are deemed as the future of personal transportation.

The recent market correction has brought the company’s share price into what I call value territory. Analysts across the board see the share price in the mid-$40 range which could give investors a nice bump in their portfolios this year.

There is also something rewarding about owning part of American history. Harley-Davidson (NYSE: HOG) is a true American icon that promises to keep rolling well into the future. Not unlike the loud roar from a Harley-Davidson motorcycle, I think it is full throttle at the company right now, led by CEO Jochen Zeitz. Ever increasing investor interest within the capital markets may further provide the extra horsepower that could send HOG’s stock price much higher.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.globenewswire.com/news-release/2021/01/12/2157510/0/en/Harley-Davidson-Successfully-Completes-The-Rewire-and-Announces-Date-to-Reveal-New-2021-2025-Strategic-Plan-The-Hardwire.html

[2] https://www.investors.com/news/stocks-to-watch-harley-davidson-sees-rs-rating-jump-to-83/

[3] https://electrek.co/2021/01/12/harley-davidson-likely-wont-cancel-the-livewire-electric-motorcycle/

[4] https://www.motorcycle.com/mini-features/harley-davidson-reveals-the-hardwire-plan.html

[5] https://techcrunch.com/2021/12/13/harley-davidsons-ev-motorcycle-unit-livewire-to-go-public-via-spac/

[6] PHOTO CREDIT https://commons.wikimedia.org/w/index.php?curid=25153909