Artificial Intelligence (AI) has transformed what was once mere science fiction into tangible reality. Its influence and power are expanding exponentially on a daily basis. It is literally changing the world before our very eyes.

ChatGTP made its explosive public debut back in November 2022 using data up until 2021.

Now, ChatGTP offers a real-time internet chatbot that uses current data.

And just this week, the company launched a ChatGTP app on Apple IOS in the US, with expansion to additional countries as well as on Android soon to follow.[1]

The investment opportunities seem limitless, making it imperative for any astute investor to read this article until the end and start researching to build their AI portfolio today.

There really is no time to waste. This unprecedented tech revolution is moving at lightning speed, and only the most highly motivated investors will reap the enormous rewards that await over the next 10 years.

Let’s get started.

New awe-inspiring AI apps and chatbots are being released daily that help users write articles; compose novels, edit copy, create original visual images, research any given topic, assemble and edit movies, write lines of computer programs, solve and explain complex topics, and convert text into speech.

There are already reports of AI sifting through terabytes of data and cracking decades old problems in physics, mathematics and medicine in a matter of days or hours.[2][3][4]

We are literally entering a brand new world that could revolutionize the way we live and play.

The future of AI technology and how it will be fully utilized is still unclear as we navigate into uncharted territory. It is a time of both excitement for the future and a fear of the unknown.

This massive paradigm shift may even be bigger than what we experienced in the mid-1990s, when the internet reached the public en mass. At the time, it was extremely difficult to understand how internet technology would dominate our daily lives. Now we cannot imagine a world without it.

This I believe is where we are again, but this time it will be 100X bigger.

To put it simply, generative AI chatbot technology used by Open AI’s ChatGPT, Microsoft’s Bing and Google’s Bard (among others) is being built on top of the previous iteration of the internet information revolution and the massive data set that has been accumulated over the past 25 years.

These programs scour the internet searching through millions of websites, blogs, social media posts, user comments, and academic papers to compile massive datasets that they use to generate answers to the millions of questions and queries received daily.

Estimates for ChatGPT usage in just January 2023 (only five months ago) was 590 million visits from 100 million unique visitors.

Generative Chatbot AI has only become possible due to huge advances in computing power and large data storage.

With chatbots powered by AI, users are empowered to learn and create in new and exciting ways.

The possibilities are mind blowing, and in a word… generative. AI could be one of the most promising investment opportunities of our time.

Think PayPal big. Did you know Elon Musk and Peter Thiel made their fortunes on early investments in Paypal? When introduced, Paypal was a revolutionary online payment system that allowed its users to pay for goods and services directly from their Paypal accounts or use their traditional bank accounts without using credit cards.

Early investors in Paypal saw the need for a revolutionary and different kind of payment system, and were willing to take a risk on a digital payment platform technology that was still very new.

Their reward was well worth the risk. PayPal was acquired in 2002 by eBay for $1.5 billion in stock, of which Musk alone walked away with an eye-popping payday of $175.8 million from the deal.[5]

As an intelligent investor, this should be a good lesson. Early investors in technology can see handsome gains. You should be asking yourself, where will this technology be in 5 or 10 years, and how should I position my portfolio today to capitalize on this once-in-a-lifetime investment opportunity?

There are literally fortunes to be made.

Keep reading to learn how...

Investing in artificial intelligence today has the potential to be a game changer for early investors.

Future AI technology has the ability to massively transform industries like healthcare, transportation, finance, retail, manufacturing, agriculture, energy, education, media and entertainment.

The full impact of AI on these industries is still unfolding, but it is clear that AI has the potential to transform the way we live and work.

AI is becoming crucial as businesses enhance their operations, cut costs, and even create innovative new and exciting products and services.

For investors, this technological revolution presents a unique opportunity to potentially generate impressive returns, and what might become generational wealth.

One of the key advantages of investing in AI now is the potential for long-term growth as this move could take some time to play out.

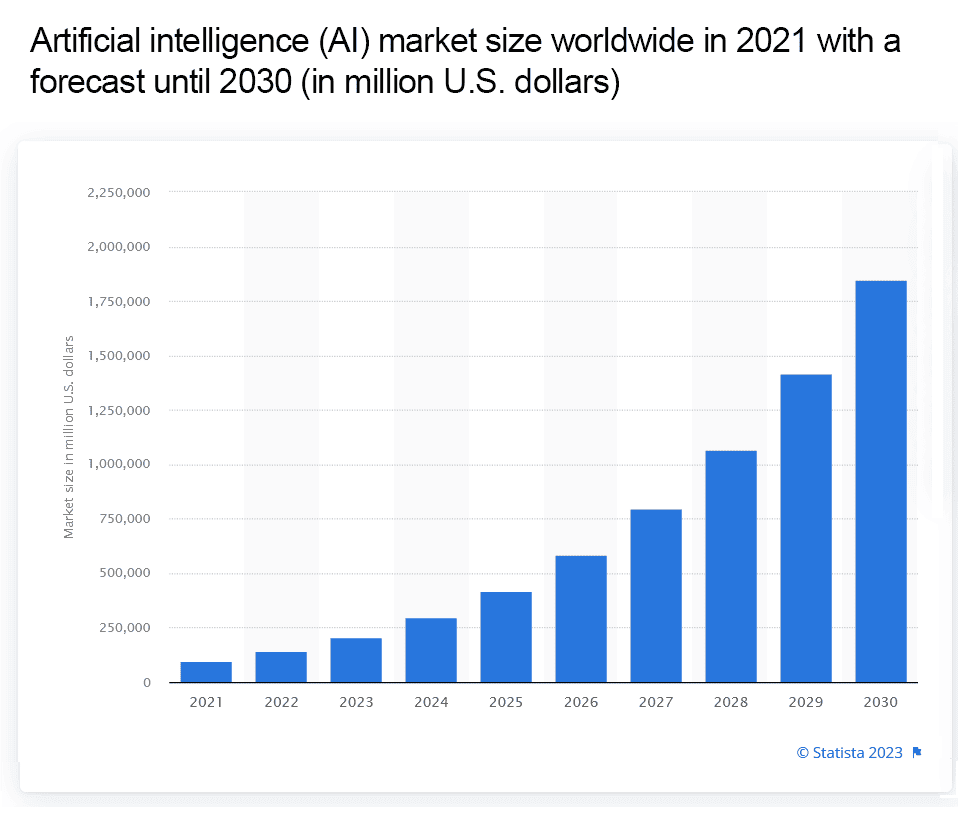

Continued Growth: The AI market is expected to grow at a rapid pace in the coming years. According to a report by Next Move Strategy Consulting, the AI market size was valued at $95.60 billion in 2021 and is predicted to reach $1.847 trillion by 2030, registering a CAGR of 32.9% from 2022 to 2030.[6]

Another report by Grand View Research found that the global artificial intelligence market size was valued at $136.55 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030.[7]

There are three factors that are driving the astronomical interest and growth in AI:

In addition to substantial long-term growth, the following factors are also at play in this dynamic fast-moving investment opportunity:

Increased Adoption: As AI technology becomes more widespread and accessible, we can expect to see increased adoption of AI across many industries as described above.

Disruption: The AI industry has the potential to disrupt many industries. Companies that are able to effectively leverage AI technologies could potentially gain a significant competitive advantage over their peers.

New Investment Opportunities: As the AI industry continues to evolve, we can expect to see new investment opportunities emerge.

On the flipside, intelligent investors should also understand that there are risks associated with investing in the current hyped AI environment.

First, AI is a new and developing technology. This means that there is a certain amount of uncertainty about how it will advance and develop, and how it will be fully utilized in the future.

Second, AI is a remarkably new and complex technology to understand and adopt. This means that it can be difficult for investors to navigate how it will work and how it could ultimately benefit multiple businesses and most importantly, your investment portfolio.

The takeaway is that investors who are considering taking a position in an AI company should spend the time and do their homework, while thoroughly learning about the space before making any investment decisions.

Here is a short list of things to consider when doing your investment research.

Overall, I believe that the potential rewards of investing in AI far outweigh the risks. I believe that AI could be a major investment opportunity that has an unprecedented potential to generate significant returns for investors over the next decade.

There are several ways for investors to gain exposure to the AI industry. Each approach comes with its own set of advantages and risks. Investors should carefully consider their investment objectives and risk tolerance before deciding which approach to pursue.

After meticulous research and careful analysis, I have found the following top 4 individual AI stocks and one AI ETF that are currently showing tremendous potential for substantial gains in the foreseeable future.

Use this as a starting point in your own personal research for wealth.

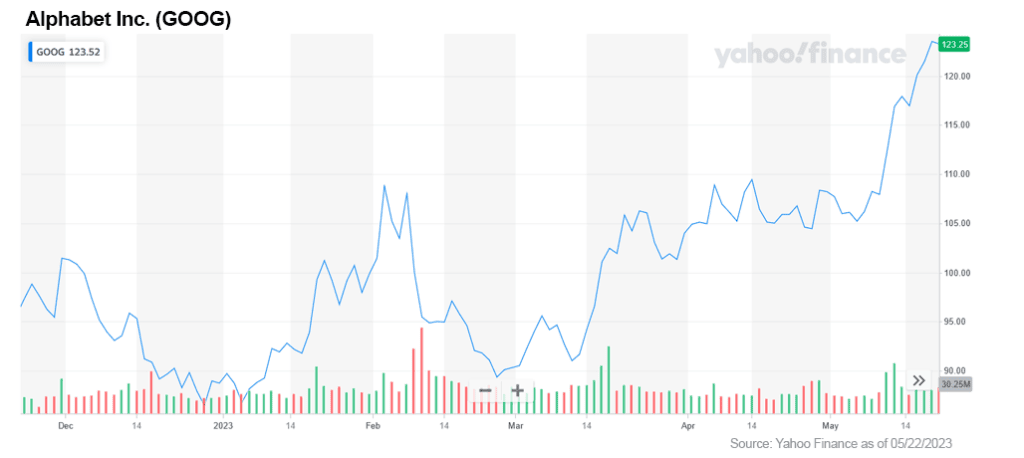

1. Alphabet Inc. (NASDAQ: GOOG)

The tech behemoth just unleashed its highly-anticipated AI-powered chatbot called Bard, making it available to 180 countries and territories. The EU was not included in the list, with most speculating that Google is waiting for finalization of the EU’s AI Act scheduled for approval on June 14 of this year.

Google was late to the AI powered chatbot game. Bard is only now becoming available months after the popular ChatGPT by OpenAI took the world by storm back in November 2022.

With the release of Bard, Google is looking to reassert its dominance within the AI space.

At first glance, Bard looks to be a powerful contender. The program will be fully integrated across its suite of business applications to help improve productivity as well as its iconic search engine.

Here are three reasons to consider investing in GOOG:

These factors make GOOG a good investment choice for investors who are looking to get exposure to the AI market.

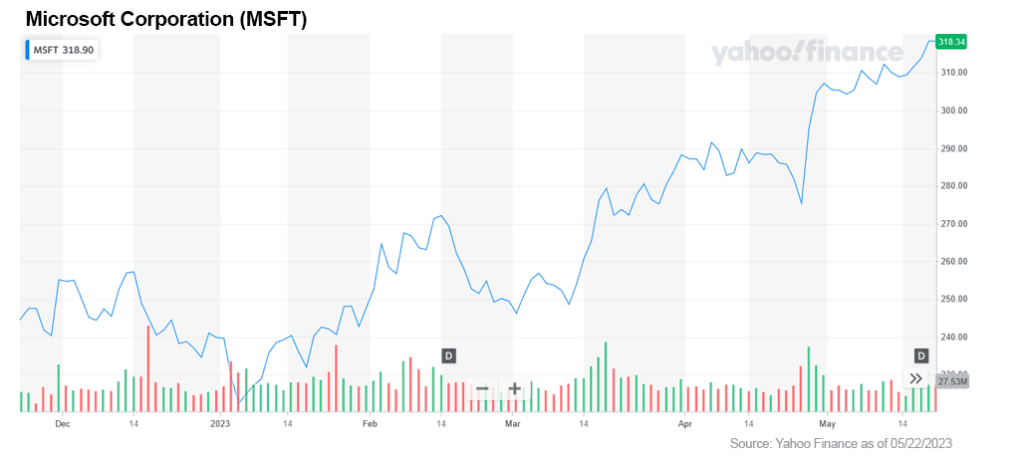

2. Microsoft Corporation (NASDAQ: MSFT)

Microsoft made some very early investments in OpenAI chatbot technology that finally came to fruition with the release of ChatGPT in November 2022.

Microsoft says it has invested billions into OpenAI in a multiyear deal that will see the software giant become OpenAI’s exclusive cloud provider. The investment comes just weeks after Microsoft was rumored to be investing $10 billion into OpenAI.

Unconfirmed reports suggest Microsoft is getting the right to 75% of OpenAI's profits until its earns back this $10 billion commitment plus an additional $3 billion it has already invested.[11]

Microsoft has become a leader in the artificial intelligence race and so far, has the most to gain…

The company’s continued support & investment in AI, namely OpenAI should benefit the company for many years to come.

For example, Microsoft's Azure cloud platform is used by businesses of all sizes to run AI applications. Microsoft also develops AI-powered products and services for consumers, such as its Cortana virtual assistant and its Bing search engine, recently incorporating ChatGPT’s tech.

The company has a team of AI experts who are continually working on developing future AI applications for the future.

I love Microsoft as an AI investment. The company has obviously taken the lead in AI research and is now benefiting from being first to market with its very large investment into OpenAI. Their continued willingness to invest in artificial intelligence technology could really position investors for a serious win well into the future.

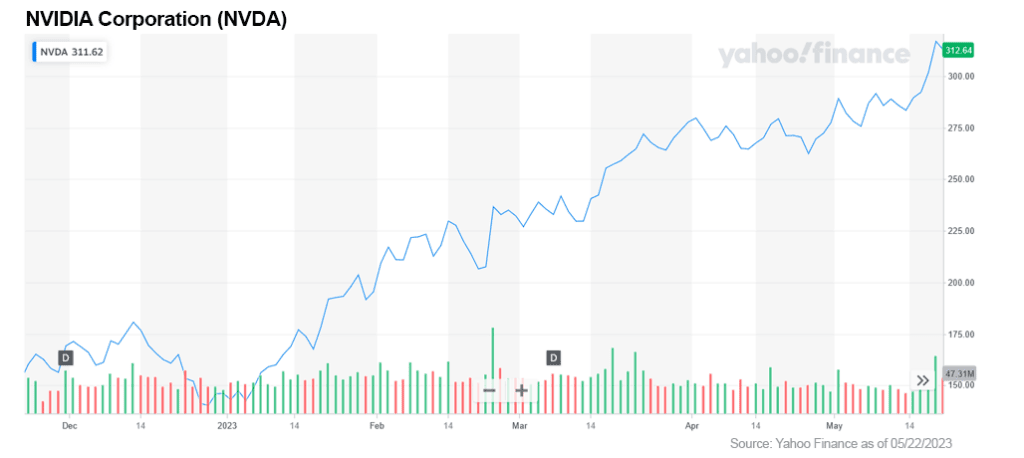

3. NVIDIA Corporation (NASDAQ: NVDA)

My readers already know that NVDA has been a long-time favorite of mine. If you had followed my original recommendation when I first called out this company back on February 3, 2019 when the stock was trading at $37.29 per share, you would be up an impressive +722% to date.

The company is constantly innovating and adapting to the changing technology landscape and providing hardware and software solutions to meet those challenges.

Its work in the AI space is no different.

The company is a leading provider of graphics processing units (GPUs). GPUs are used in a wide variety of AI applications, such as machine learning, natural language processing, and computer vision. As AI technology continues to develop, the demand for GPUs is expected to grow significantly.

NVIDIA makes most of the GPUs for the AI industry, and its primary data center workhorse chip costs $10,000.[12]

In addition to its strong position in the GPU market, NVIDIA is also investing heavily in AI research and development. The company has a team of AI experts who are working on developing new AI technologies that will be better suited for businesses and consumers.

The company has also partnered up with ServiceNow, a developer of enterprise-grade generative AI capabilities that can transform business processes with faster, more intelligent workflow automation.[13]

NVIDIA is also working on further development in using their GPUs in chip manufacturing to make the process faster and more economical.[14]

While many of my readers who may have bought NVIDIA back in February 2019 when I originally called a “buy” were able to experience gains of 722%, I still feel there is room for more gains in the coming years.

NVIDIA should be considered as a strong candidate for any AI portfolio in my opinion.

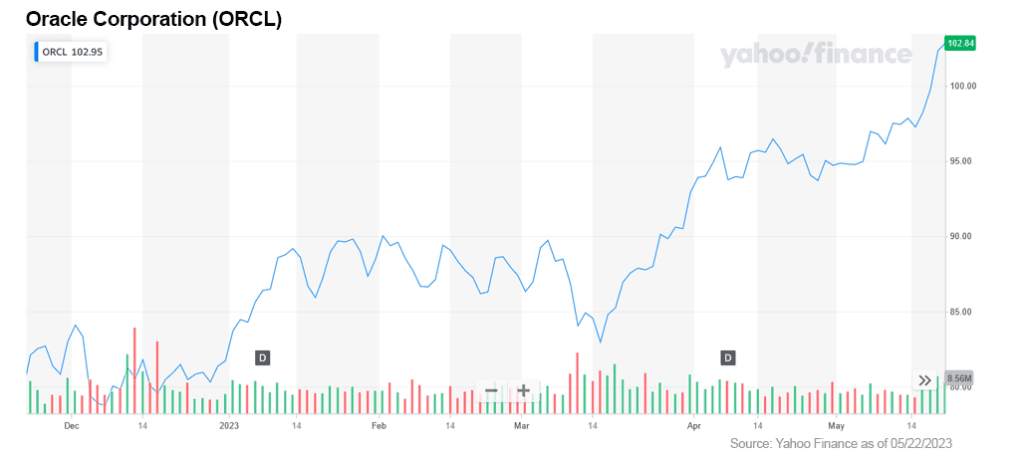

4. Oracle Corporation (NYSE: ORCL)

Oracle Corporation is a leading provider of cloud computing and enterprise software. Cloud computing is a key enabler of AI, and Oracle is a major player in this market.

Oracle's cloud platform, Oracle Cloud Infrastructure (OCI), is used by businesses of all sizes to run AI applications. Oracle also develops enterprise software that is used by businesses to manage data and operations. This software can be used to support AI applications.

Oracle is also investing heavily in AI research and development.

The company has strong fundamentals and should be a strong candidate when doing your research.

The One ETF I Am Excited About

As I mentioned above, exchange-traded funds could provide diversified exposure to the AI industry. Consider AI-focused ETFs but be aware of heightened management fees and expenses.

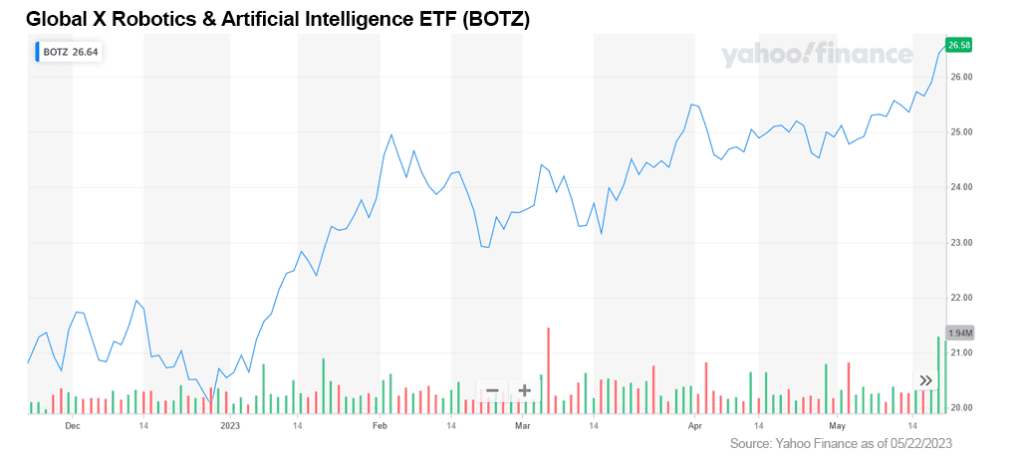

Global X Robotics & Artificial Intelligence ETF (NASDAQ: BOTZ)

The Global X Robotics & Artificial Intelligence ETF (BOTZ) is one of my favorite AI ETFs and should be a solid investment choice for investors that do not have the time to fully research and choose individual AI stocks to invest in.

This ETF tracks the Indxx Global Robotics & Artificial Intelligence Thematic Index. The index is composed of stocks of companies that are involved in the development, manufacturing or use of robotics and artificial intelligence (AI).

The Global Robotics & Artificial Intelligence ETF invests in a diversified basket of stocks, which helps to reduce risk. BOTZ also has a low expense ratio, which means that investors keep more of their investment returns.

I believe that BOTZ could be a good investment for investors who are looking to get exposure to the AI market.

Now is the perfect moment to seize the incredible potential of investing in AI. Generative AI is revolutionizing the way we learn and create by tapping into over 25 years of internet data. This groundbreaking technology is empowering users to explore uncharted territories of knowledge and unleash their creativity like never before.

Industries across the entire spectrum are embracing the power of AI to redefine their business operations and offer innovative services at a reduced cost.

With what could become the world's growing future dependence on AI technology, investing in artificial intelligence now opens the door to unheard of opportunities for significant portfolio growth.

Amidst an early investment in AI technology, you are potentially positioning yourself to reap the rewards of a shrewd early investment decision.

Remember, it is the daring and adventurous who often find fortune on their side. In my humble opinion, investing in AI today holds the promise of shaping a prosperous tomorrow.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://openai.com/blog/introducing-the-chatgpt-app-for-ios

[2] https://www.newscientist.com/article/2320662-ai-solves-complex-physics-problems-by-looking-for-signs-of-symmetry/

[3] https://cosmosmagazine.com/technology/ai/deepmind-ai-complex-mathematics/

[4] https://thechainsaw.com/business/chatgpt-ai-healthcare-doctor/

[5] https://en.wikipedia.org/wiki/Elon_Musk

[6] https://www.nextmsc.com/report/artificial-intelligence-market

[7] https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-market

[8] https://healthit.com.au/how-big-is-the-internet-and-how-do-we-measure-it/

[9] https://www.nbcnews.com/tech/innovation/openai-chatgpt-ai-jobs-contractors-talk-shadow-workforce-powers-rcna81892

[10] https://www.cnbc.com/2023/05/04/white-house-announces-ai-hub-investment.html

[11] https://www.theverge.com/2023/1/23/23567448/microsoft-openai-partnership-extension-ai

https://fortune.com/2023/01/23/microsoft-investing-10-billion-open-ai-chatgpt/

https://fortune.com/2023/01/24/whos-getting-the-better-deal-in-microsofts-10-billion-tie-up-with-chatgpt-creator-openai/

[12] https://www.cnbc.com/2023/03/13/chatgpt-and-generative-ai-are-booming-but-at-a-very-expensive-price.html

[13] https://nvidianews.nvidia.com/news/servicenow-and-nvidia-announce-partnership-to-build-generative-ai-across-enterprise-it

[14] https://blogs.nvidia.com/blog/2023/05/16/itf-world-2023/