Tesla Inc (NASDAQ: TSLA) might be experiencing a severe case of Twitter contamination, but the electric vehicle (EV) sector is still ready and raring to go.

Whether it's battery metals, the vehicles themselves, or charging infrastructure, there are a lot of opportunities out there for investors, but it can be challenging to understand how all the threads tie together.

To help you navigate this evolving space, I’ve prepared a deep dive into the things investors need to know about the EV industry and where I think it’s going to go in the next few years.

However, before we dive into the details, let’s settle an important question…

If you follow the headlines, the answer seems to be yes. The EU is planning on banning the sales of fossil-fueled cars by 2035,[1] California has pledged to do the same,[2] and there are similar rumblings in China.[3]

Fossil fuel vehicles, at least in the consumer category, are on their way out — and if the narrative is to be believed, EVs are the best bet we have to replace them.

There is at least some truth here. The two main alternatives to EVs — biofuel and hydrogen engines — have major stumbling blocks.

Biofuels require significant amounts of agricultural land. To make matters worse, biofuel is still relatively polluting, and there are also concerns that combustion biofuel engines will still emit particulate matter and contribute to 4.2 million premature deaths annually.[4] This makes biofuel impractical as climate change continues to accelerate.[5]

Hydrogen engines on the other hand do show real promise. Hydrogen is clean when extracted using renewable energy, and there is less electronic waste than EVs. However, the technology is still “just around the corner.” While the Ukrainian War and resultant gas crisis have increased interest in hydrogen fuel cells in Europe, David Holderbach, CEO of Hyvia, argues that the technology is still around 10 years away from being viable in consumer-level vehicles.[6]

With this in mind, governments around the world have decided that electric vehicles are the way forward. They have implemented aggressive purchase incentives, ranging from an average of US$8,800 in Norway, to US$6,000 in the United States, and US$3,000 in China.[7]

This is expected to lead to significant growth in EV sales, translating to a market worth $137.43 billion by 2028 in just the US alone.[8]

This is clearly an enormous investment opportunity, but the EV industry isn’t just about consumer vehicle sales. There is enormous potential for the electrification of our shipping systems, particularly in the “last mile.” Additionally, there are entire industries that will be dedicated to providing the raw materials necessary to build these vehicles, and the infrastructure (such as charging stations) needed to run and maintain these vehicles.

Let’s break down some of the key challenges that the growing EV industry will face and how investors can benefit from them.

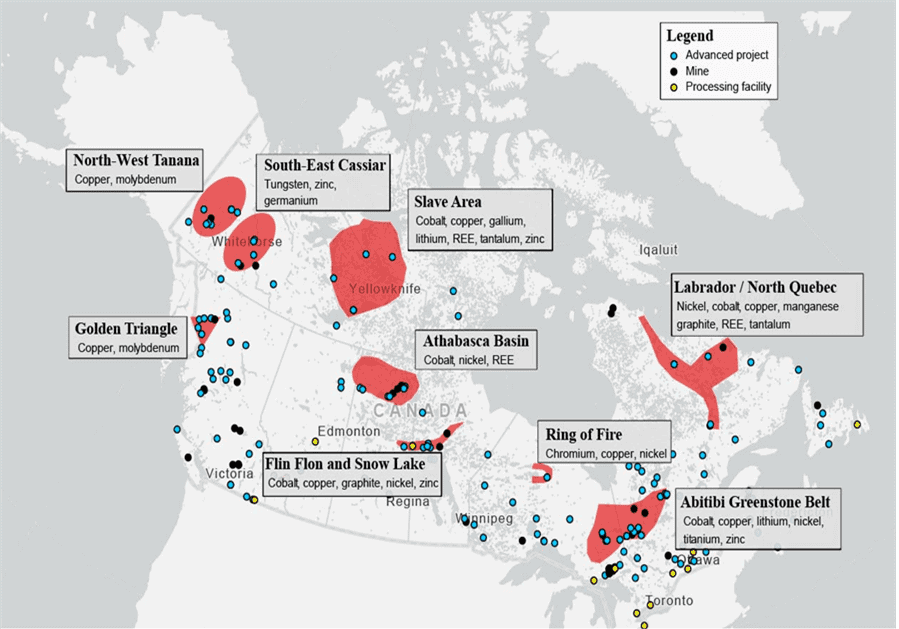

The EV industry is going to require enormous amounts of strategically important raw materials, and the global supply chain is currently unable to meet the demand for key minerals like lithium or graphite.[9]

This challenge has already been recognized by global governments, and the US has drawn up plans to award $2.8 billion in grants to expand the US manufacturing of batteries for electric vehicles and domestic mineral production.[10]

In fact, the Government of Canada has just ordered the divestiture of investments by foreign companies in Canadian critical minerals companies.[11]

Canada reviewed a number of investments in Canadian companies engaged in the critical minerals sector, including lithium. These companies were reviewed via the multi-step national security review process, which involves rigorous scrutiny by Canada’s national security and intelligence community. As a result of that process, the Government of Canada has ordered the divestiture of the following investments by foreign investors in Canadian critical mineral companies including:

This move is significant because it demonstrates just how key these e-metal companies are going to be for the EV industry, and eventually the industry as a whole. It also highlights why investors should be looking for new projects in this space that will have a deep market to sell their product to.

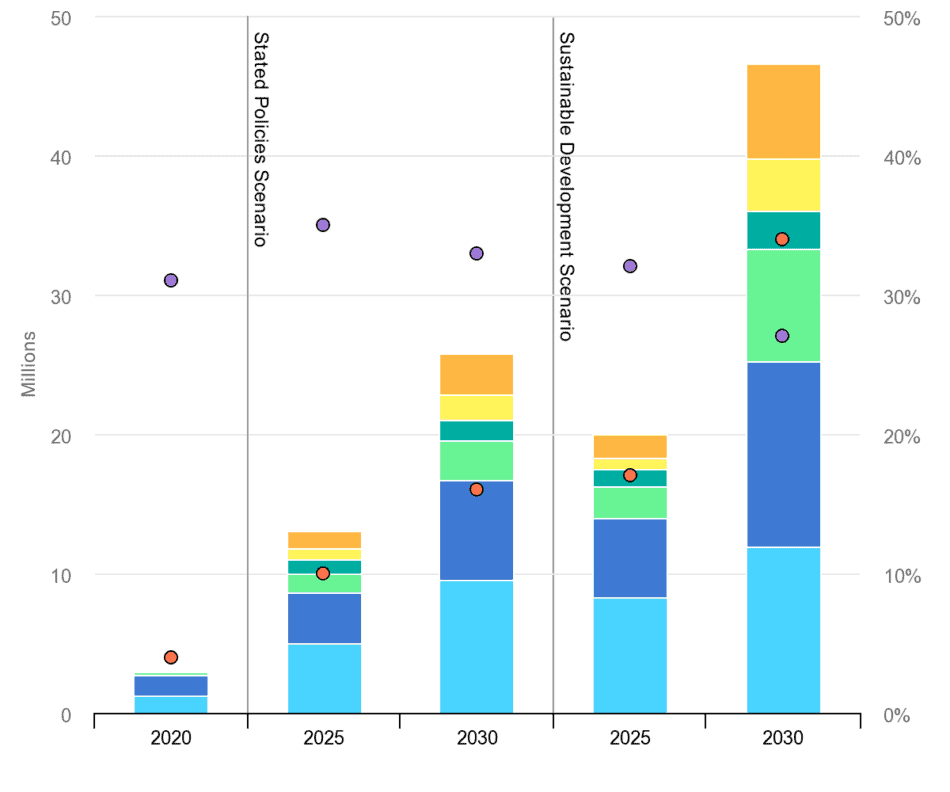

In general, the demand for all e-metals will vastly outstrip supply. Over 3.3 million tonnes of Lithium are needed, 3.4 million tonnes of nickel, and a staggering 6.1 million tonnes of natural graphite will be needed to meet demand. This may change as technology improves, but it showcases the drastic and immense scale for demand for e-metals. This begs the question: Are we headed for a supply vs demand situation?

The challenge for investors is predicting where demand will go. The current mix of e-metals is likely to change as battery technology improves, which adds a layer of uncertainty when investing.

For my money, the best bet is graphite, which the US government has named a resource critical to national security.[12] The average EV needs around 220 pounds (100 kilograms) of graphite, and it’s still unclear exactly how this demand will be met.[13] This is where the opportunity for investors comes in...

In general, my analysis of the graphite sector has not changed appreciably since my last article on the topic. Most emerging graphite plays will not yet be profitable, so investors will need to look at other criteria.

If I’m looking at a graphite play (or any other e-metal play for that matter), there are three basic questions I want answered before I dive deeper. If a company has two out of three, then I’d move forward:

By far the biggest challenge for any new EV owner is finding a charging port. Homeowners with garages who have been able to upgrade to advanced charging can simply charge at home. However, renters or people living in condos and apartments may not necessarily have that luxury, and may be forced to hunt for a public charging port. When you throw in needing to find a charging station while traveling, you can easily see why not everyone is keen on the EV revolution.

This pain point is, in my view, one of the driving factors behind Tesla’s success up to this point. For non-Tesla drivers, the EV experience is one of fragmented charging point providers.[14] This leads to drivers needing to download apps to charge their car once, sign up with strange companies they’ve never heard of, and struggle to find functional charging points when they travel.[15]

In established markets, Tesla (NASDAQ: TSLA) drivers don’t have these problems. Tesla used its first mover advantage to build 13,000 charging stalls, or 58% of all available fast-charging plugs in the US. These stalls also tend to be placed at the most convenient locations between major cities or on the way to tourist destinations.[16]

This gives Tesla a massive first-mover advantage. Especially as the company has begun to open up its supercharging network to other drivers as part of the Non-Tesla Supercharger Pilot in preparation for a full roll-out in the United States.[17] This move will make it easier for Tesla to benefit from the Biden administration’s $900 million investment in EV charging stations.[18]

Where does that leave investors? Well, a good option is to invest in the company that already dominates the ecosystem, TSLA itself. However, for some investors, Elon Musk’s recent exploits with Twitter might give them pause for thought.

Musk’s Twitter adventure has already proven costly, with the company now needing to make $1 billion in interest payments annually.[19] To make matters worse, fears about Twitter contamination of TSLA stock are not unfounded.

Musk has already pulled 50 Tesla employees, mostly engineers from the company’s troubled Autopilot project, into Twitter. I would argue that this move implies that Musk himself may not see significant distinction between his two companies and could be willing to put TSLA at risk if it means Twitter succeeds.[20]

If we want to look for alternatives to TSLA, how about investing in the companies making charging points themselves like ChargePoint Holdings, Inc. (NYSE: CHPT). CHPT is a good example because it demonstrates many of the problems with direct investments in charging companies. Its $4.71 billion market cap is around 14 times revenue, which is a pretty big multiple, especially as the company has low recurring revenues annually.

CHPT is essentially a commodity stock for the large auto manufacturers, and I probably wouldn’t invest in it, or any other charging point manufacturers, without evidence that they had a significant USP over their competition.

If you want to get exposure to charging points, you’d be better off investing in TSLA, Ford Motor Company (NYSE: F), or other major players who are actively developing charging networks.

Moving away from charging networks and back to automobiles, it’s worth taking another look at how Tesla was able to become one of the world’s most successful vehicle manufacturers.

In some ways, I view Tesla through the same lens as Apple Inc (NASDAQ: AAPL). While both companies are innovative, that’s not the key to their success — it’s in taking an idea and making it cool. Tesla was designed to build an EV targeted at the high-end market, and make EVs in general desirable products.

Now that they’ve done the hard work, there’s an opportunity for other companies to innovate and do the same for other niches. Right now, one of the most promising is in electrifying our logistics industries.

While we will likely see electrified cargo ships and even planes, the long product cycles in those industries mean that it will be some time before investors reap the rewards. Instead, we should be looking at something much more achievable: the electrification of the last mile, the final stage of delivery where a product reaches its destination, often by van.

There are two reasons for this. Firstly, e-commerce volumes are predicted to grow significantly, which will require an increase in the number of delivery vehicles. Increased traffic from last-mile deliveries could increase carbon emissions by 25% in city centers.[21]

Secondly, Amazon (NASDAQ: AMZN) has committed to electrifying its delivery fleet with a €1 billion commitment to establishing a fleet in Europe.[22]

In this context, there’s one company we need to talk about: Rivian Automotive Inc (NASDAQ: RIVN). RIVN debuted with a bang and had the largest IPO in US history. Since then, the company has struggled to find its feet, but a relatively successful product launch (recalls aside) might signal that it’s time for another look.[23]

I’m not the only one saying this… One of Europe’s largest asset managers, DNB Asset Management, recently bought up more shares of RIVN, and ditched larger manufacturers like Ford.[24] So why might they have done that?

Well, a key component is Rivian’s deal with Amazon, which will see the e-commerce giant purchase 100,000 custom-built delivery vans.[25] This provides RIVN with a locked-in way to grow their business, with room for more growth if they do well.

An additional factor is that Rivian is at the stage Tesla was before it broke out, but it already has vehicles on the market. While it might take a long time for investors to realize their gains, RIVN already has most of the negatives of the market priced in. I believe it has the potential for significant growth over the long term, and it currently sits at an attractive entry point.

I really like the EV space for a number of reasons. It’s relatively young, it has massive growth potential, and it touches almost every aspect of modern business. There’s an enormous amount of opportunity for the savvy investor, and I believe that the number of these opportunities will only grow as time goes on.

There is unlikely to be a better moment to enter this market than now. However, as always, you should do your own research, and determine whether these opportunities are right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds LION and other commodity stocks.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.rac.co.uk/drive/news/motoring-news/eu-confirms-banning-sale-of-fossil-fuel-cars-from-2035/

[2] https://www.nytimes.com/2022/08/24/climate/california-gas-cars-emissions.html

[3] https://www.usnews.com/news/news/articles/2022-08-24/chinese-province-plans-ban-on-sale-of-gasoline-cars

[4] https://ourworldindata.org/data-review-air-pollution-deaths

[5] https://unu.edu/news/news/the-benefits-of-biofuels-unrealistic-expectations.html

[6] https://autovista24.autovistagroup.com/news/hydrogen-vehicles-in-europe/

[7] https://blogs.worldbank.org/transport/if-you-build-it-they-will-come-lessons-first-decade-electric-vehicles

[8] https://www.fortunebusinessinsights.com/u-s-electric-vehicle-market-106396

[9] https://www.weforum.org/agenda/2022/07/electric-vehicles-world-enough-lithium-resources/

[10] https://www.cnbc.com/2022/10/19/biden-awards-2point8-billion-for-electric-vehicle-battery-manufacturing-.html

[11] https://www.canada.ca/en/innovation-science-economic-development/news/2022/10/government-of-canada-orders-the-divestiture-of-investments-by-foreign-companies-in-canadian-critical-mineral-companies.html

[12] https://www.nytimes.com/2022/03/31/business/economy/biden-minerals-defense-production-act.html

[13] https://www.cnbc.com/2021/12/02/tesla-seeks-tariff-exemption-for-graphite-from-china-for-batteries.html

[14]https://press.which.co.uk/whichpressreleases/fragmented-electric-car-public-charging-networks-must-be-overhauled/

[15] https://www.eenews.net/articles/ev-charging-stations-are-annoying-ford-wants-to-fix-them/

[16] https://www.eenews.net/articles/tesla-well-open-our-charging-network-for-federal-cash/

[17] https://electrek.co/2022/08/17/tesla-preparing-supercharger-membership-non-tesla-ev-owners/

[18] https://techcrunch.com/2022/09/14/biden-to-announce-900m-to-build-ev-charging-stations/

[19] https://www.nytimes.com/2022/10/30/technology/elon-musk-twitter-debt.html

[20] https://www.nbcnews.com/tech/tech-news/elon-musk-pulled-50-tesla-employees-twitter-takeover-rcna54946

[21]https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/efficient-and-sustainable-last-mile-logistics-lessons-from-japan

[22] https://www.teslarati.com/amazon-commits-1-billion-euro-ev-truck-van-fleet-europe/

[23] https://edition.cnn.com/2022/10/27/business/rivian-owners-r1t/index.html

[24]https://www.barrons.com/articles/nvidia-stock-rivian-ford-and-gm-51666274684

[25] https://www.cnbc.com/2022/08/28/how-amazon-is-giving-rivian-an-edge-in-the-ev-industry.html