The US healthcare system is bursting at the seams with a tidal wave of senior patients. Two demographic factors are driving this massive growth in the senior population:

1. People are living longer

2. A generation of baby boomers (those born between 1946 to 1964) are entering their golden years

The result is the rapid expansion of senior healthcare services that could soar as high as $2.36 trillion dollars by 2028.[1]

Intelligent investors should consider taking a position in healthcare equities as a reliable defensive sector investment that could buffer your portfolio when equity markets turn volatile.

Read on to learn more about the current demographic trend driving senior healthcare growth and 5 ways you could potentially profit.

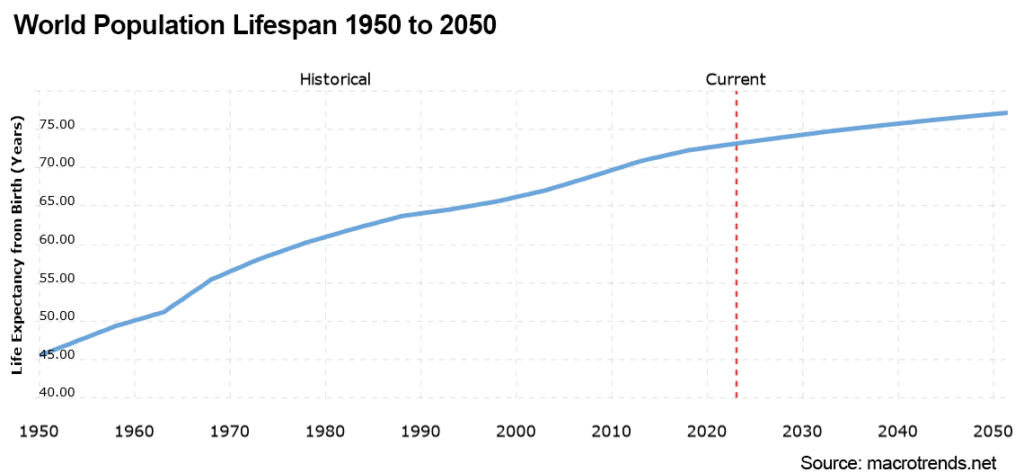

Humans living in industrialized countries have seen a dramatic increase in life expectancy over the past 70 years.

In 1950, the world’s overall life expectancy was just 45.51 years. Today, the current life expectancy has increased to 73.16 years.[2]

That is a +60% increase in longevity.

Often referred to as the “Longevity Revolution,” this demographic phenomena will only become more exaggerated as the baby boomer generation (those born from 1946 to 1964) become 65 years and older in the next few years.

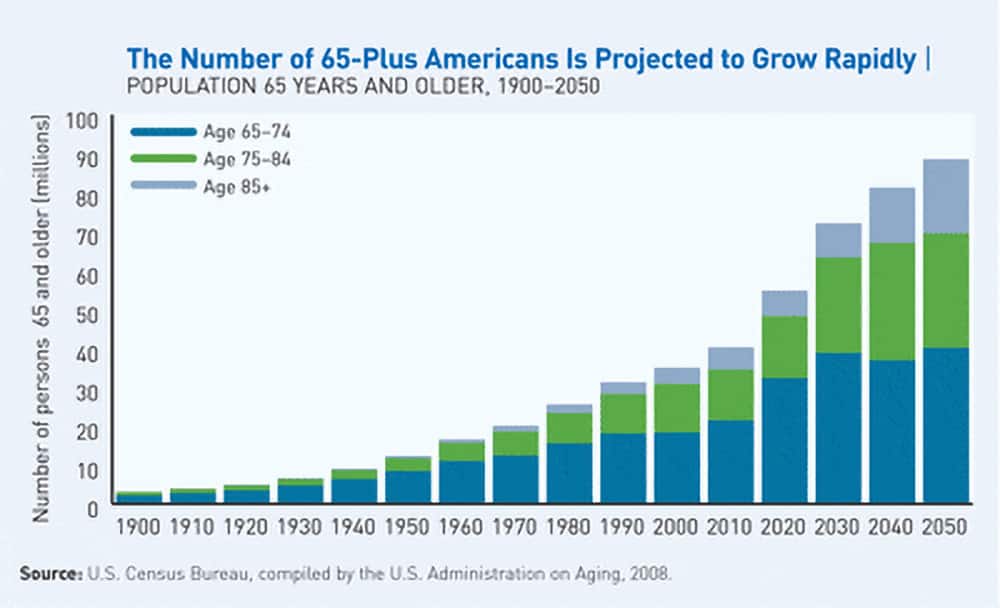

According to the US Census Bureau, more than 56 million adults ages 65 and older live in the United States, accounting for about 16.9% of the nation's population.[3]

By 2030, when the last of the baby boomer generation ages into older adulthood, it is projected that there will be more than 73.1 million older adults. That means more than 1 in 5 people will be of retirement age.

Here is another way to think of the explosive growth of this demographic.

In 2022, the US Census Bureau estimated that around 10,000 people turn 65 years old every day in the United States.[4]

The Census Bureau further predicts that seniors will outnumber children by 2035.

The explosive senior demographic growth is driving demand for a wide range of healthcare services.

From my perspective, investing in the healthcare market is a great defensive investment opportunity as the sector is practically recession-proof. Historically, healthcare costs have been insulated from greater economic pressures.

Read on to learn more about this growing investment opportunity and my 5 investment opportunities that promise to see solid growth over the coming decade.

The explosive growth of the senior population is having a significant impact on the healthcare industry as a whole. There is growing demand for services that cater to seniors' unique needs.

A report by Markets N Research projected that the US elderly care market, which had an estimated market size of $1.59 trillion in 2021, will grow at a CAGR of 6.8% to a staggering $2.36 trillion by 2028.[5]

Historically, the healthcare sector has been resilient during various market corrections, exhibiting lower volatility and drawdown. The sector is considered defensive due to its place as an essential service with demand remaining constant no matter the current economic conditions. The increase in the aging population will only fuel growth into the future.

As an investor, overweighting your portfolio with healthcare stocks could be a way to capture solid returns while lowering overall risk exposure.[6]

From my perspective, investing in the healthcare market is a great option for defensive investment, as it tends to be recession-proof due to the insulating effect of healthcare costs.

In a recent interview, Tony DeSpirito, BlackRock’s Chief Investment Officer of US Fundamental Active Equity, pointed out that he believes healthcare is a resilient sector in the current recessionary environment and that it is their “single largest overweight position.”[7]

He went on to explain that the industry’s strong performance can be attributed to a trifecta of reasons including better long-term prospects, good recessionary prospects and better valuations.

For investors interested in the healthcare market, there are several areas to consider.

The capital markets over the past year have been brutal on investors. Sell-offs in equities and a banking scare have shaken investor confidence. But now is exactly the time to leave behind any fear and get back into the markets as they have already begun to make a recovery.

As Warren Buffett, one of the greatest investors in our generation says, “…be greedy when others are fearful.”

Healthcare stocks are a relatively safe investment as the demand for medical services is not affected by the ups and downs of the overall economy. People will get sick and will need to go see a doctor. It is as simple as that.

For the average retail investor, there is a great way to access diversified portfolios of healthcare stocks: exchange-traded funds, also known as ETFs.

ETFs are a collection of selected equities based on a sector. There are literally hundreds of different healthcare ETFs available, all with different combinations of equities in various subsectors of the healthcare industry.

Another advantage of investing in an ETF is that they are managed by a professional. The individual equities in the ETF are bought and sold in the background to maximize the overall return of the ETF.

These are equities that an investor who does not have a lot of time to check their portfolio daily can buy and forget.

ETFs also minimize risk by diversifying the investment over many different companies. If one company is having a bad day, the overall effect on the ETF is minimal. The overall risk exposure to one company is much lower in an ETF.

Investing in healthcare ETFs over individual healthcare stocks is also a great way for risk-averse investors to gain exposure to some of the best-in-class names in the healthcare sector, which include Johnson & Johnson (NYSE: JNJ), Pfizer Inc. (NYSE: PFE) and UnitedHealth Group, Inc. (NYSE: UNH).

As the outlook for the economy has improved over the past 3 months, the healthcare sector has recently seen a bit of a selloff as investors move out of defensive stocks.

Valuations are now lower and offer a good price point to get into these stocks in what I believe to be at a bargain.

In this section, we will explore 3 healthcare ETFs that have performed well and are worth considering. Each ETF offers a unique approach to investing in the healthcare sector including global exposure, focus on medical devices and an equally-weighted strategy.

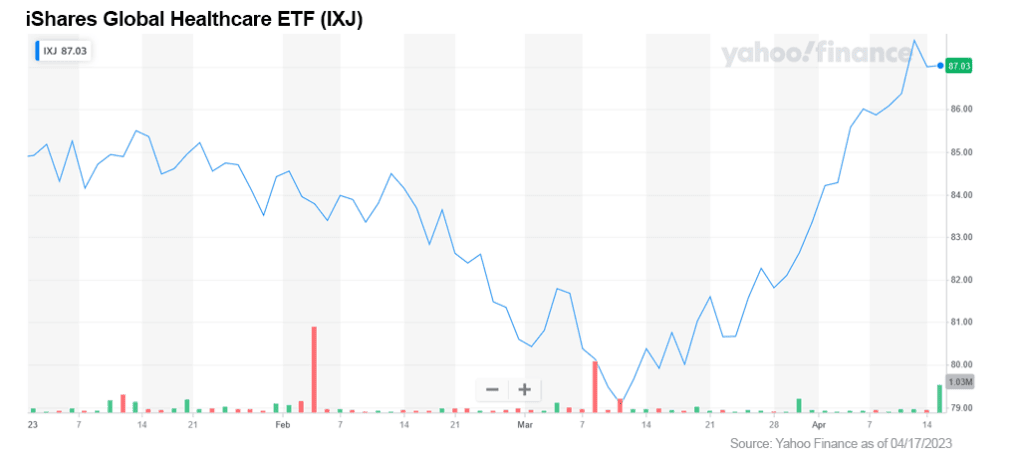

1. iShares Global Healthcare ETF (NYSE: IXJ)

iShares Global Healthcare ETF focuses on healthcare stocks on a global level. It tracks the S&P Global 1200 Health Care Sector Index and includes over 100 global healthcare stocks.

This ETF gives investors exposure to pharmaceutical, biotechnology, and medical device companies.

About 71% of the holdings in the ETF are held in US healthcare stocks like UnitedHealth Group Inc. (NYSE: UNH), Johnson & Johnson (NYSE: JNJ) and Merck & Co. Inc. (NYSE: MRK).

The remaining 29% is concentrated in foreign healthcare stocks — largely in the eurozone — like Novartis AG (NYSE: NVS), Roche Holding AG (OTCQX: RHHBY / SIX: ROG) and AstraZeneca PLC (NASDAQ: AZN).

Management fees for the ETF are reasonable at an expense ratio of 0.4%.

As of Dec. 31, 2022, the ETF had a 10-year annualized return of +12% with distributions reinvested.

I like this ETF with its focus on pharmaceuticals, biotech and medical devices.

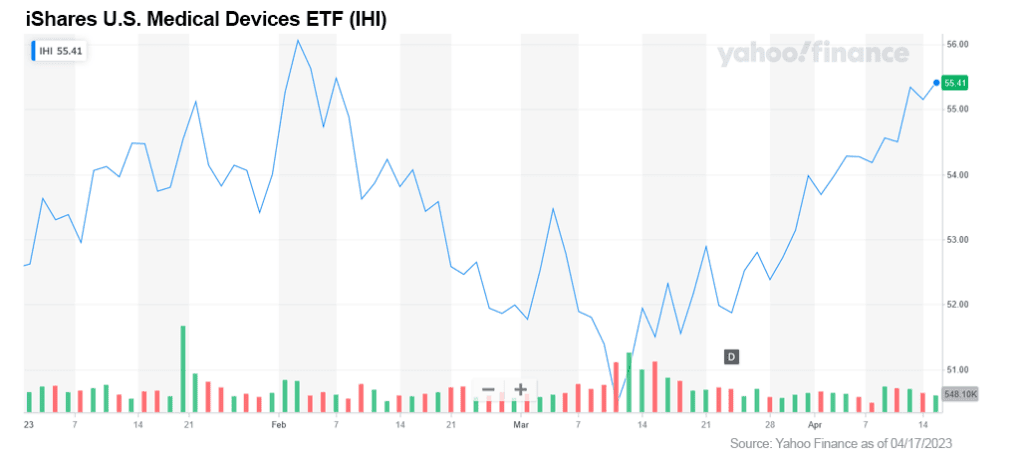

2. iShares US Medical Devices ETF (NYSE: IHI)

Medical equipment is a fast-growing segment within the overall healthcare sector.

The iShares US Medical Devices ETF tracks the Dow Jones US Select Medical Equipment Index and holds 64 US-based companies that manufacture and distribute medical devices.

Some of the top holdings in this ETF include Thermo Fisher Scientific Inc. (NYSE: TMO), Abbott Laboratories (NYSE: ABT) and Medtronic PLC (NYSE: MDT).

Over the past 10 years, the medical equipment industry has outperformed the broader healthcare sector, with +17.2% annualized returns.

The ETF does charge a management fee of 0.39% expense ratio.

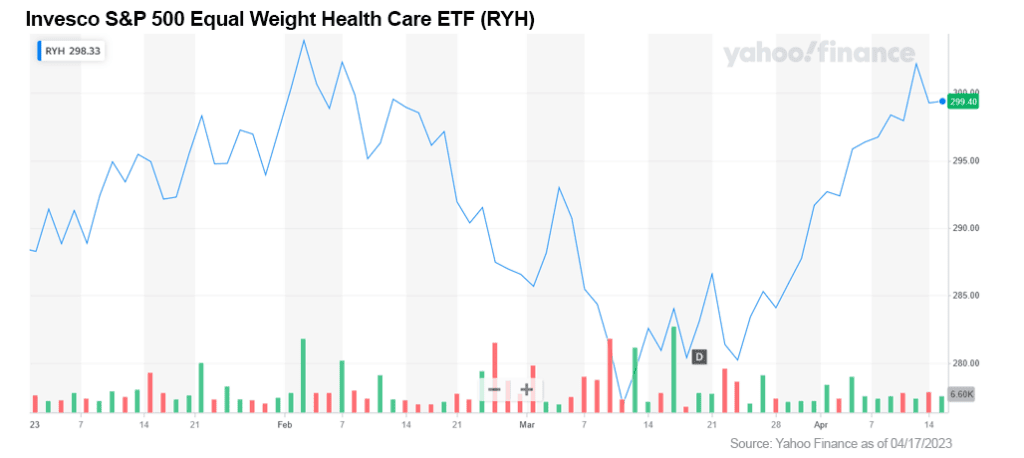

3. Invesco S&P 500 Equal Weight Health Care ETF (NYSE: RYH)

Many ETFs use what is called a market-cap weighted strategy where performance tends to be dominated by a handful of large-cap stocks. The negative to this strategy is that it can lead to a concentration of risk and under-diversification in the overall ETF.

This Invesco S&P 500 Equal Weight Health Care ETF uses a different strategy when purchasing individual holdings. The strategy is called equally-weighted where each equity is given equal allocation regardless of their individual valuation.

For example, the weight of a large-cap stock like UnitedHealth (NYSE: UNH) is about 1.6%, the same as a smaller stock like Elevance Health Inc. (NYSE: ELV).

This ETF tracks the S&P 500 Equal Weight Health Care Index and holds about 64 equities.

Over the past 10 years, RYH brought in a +15% annualized return.

The expense ratio is similar to the two other ETFs above at 0.4%.

For investors that prefer a bit more risk exposure to the capital markets, investing in individual equities may be something to consider.

There is certainly more risk when investing in an individual company, as your investment is directly tied to one company’s performance. If they are doing well, your portfolio does well. If they are down, so is your portfolio.

However, while investing in individual equities is higher risk, there is also the potential for higher gains.

Investors must maintain some level of daily attention to each company and how it is performing. Maintaining stop-loss orders is a requirement of mine when investing in individual equities.

I have found 2 companies that I would recommend exploring further...

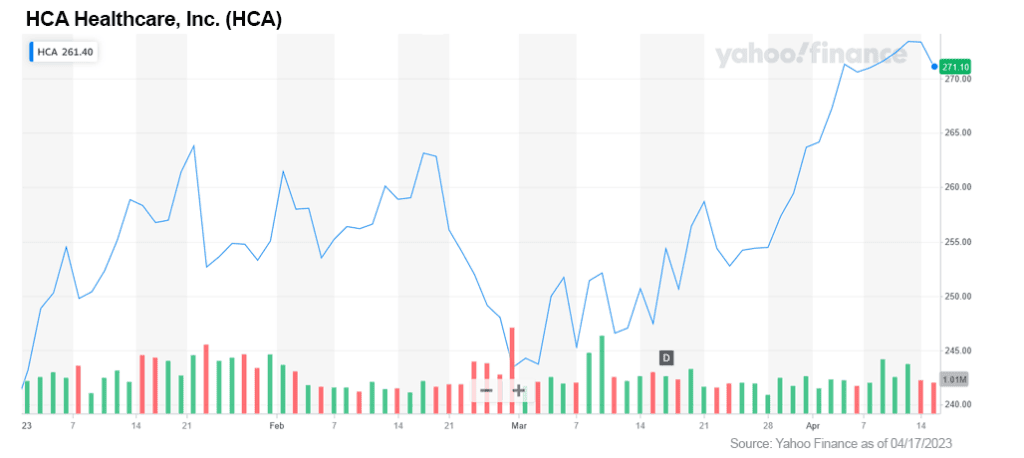

1. HCA Healthcare, Inc. (NYSE: HCA)

HCA Healthcare is a leading hospital chain in the US, operating 182 fully staffed hospitals. The company makes money based on occupancy rates as well as the services that physicians order for their patients.

While the company has struggled over the past couple of years with higher expenses and labor supply shortages, not unlike many other sectors experiencing the same, it seems to have gotten these issues under control.

HCA is in a good position to profit from the increase in the aging population. Their wide range of services makes them appealing to patients who are looking for a one-stop-shop for medical treatment.

A solid addition for investors looking to diversify their portfolios with an individual healthcare stock pick.

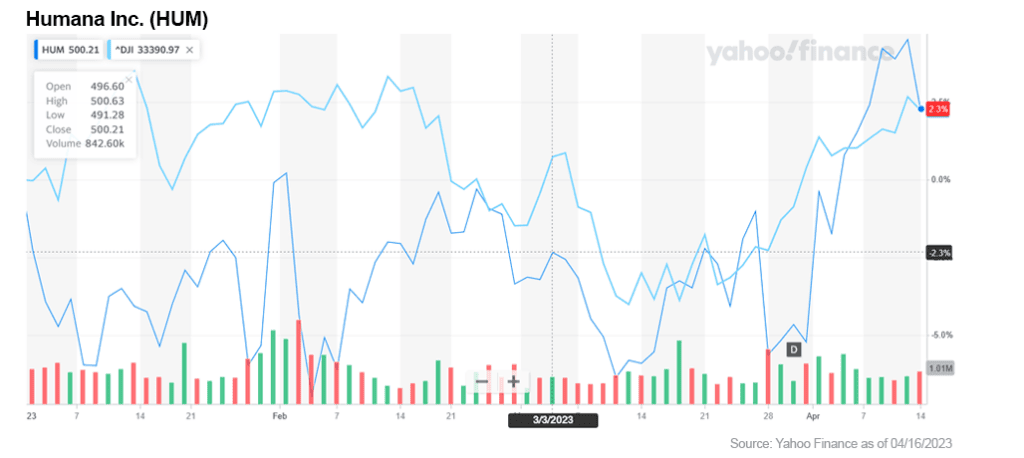

2. Humana Inc. (NYSE: HUM)

Humana is laser-focused on the senior-aged customer base. More than 84% of its revenue comes from insurance premiums, while the remaining 16% comes from its newer CenterWell business, which provides home care, pharmacy services, and primary care to seniors.

Humana offers Medicare Advantage plans for seniors, including HMOs and prescription drug plans.

That business generated nearly $73 billion in sales in 2022, or 80% of Humana’s insurance revenue. The company is the second-largest player in the space, just behind UnitedHealth Group (NYSE: UNH).

I like this company as a pure senior healthcare play. As the senior population continues to grow, so could their customer base and revenues.

Investing in the healthcare sector has historically been an attractive sector for long-term investment, with healthcare companies, in aggregate, often exhibiting stronger earnings growth and defensive attributes during economic downturns when compared to the broader market.

By investing in the greater defined senior healthcare sector, in particular, is becoming increasingly compelling as a result of demographic trends and technological innovations that are transforming how healthcare services are delivered remotely.

While investing in individual equities could be considered higher risk, exploring healthcare ETFs and well-established companies that operate within the senior healthcare sector — including long-term care facilities, home healthcare, telehealth, medical devices, and pharmaceuticals — could offer investors promising investment opportunities.

For you, the savvy investor, the immediate healthcare-focused investment opportunities could be enormous for long-term growth. Do your own due diligence and stay up-to-date on market developments and company performance to make informed investment decisions.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.globenewswire.com/en/news-release/2022/11/21/2559955/0/en/Elderly-Care-Market-Size-is-Projected-to-Reach-USD-2-366-4-Billion-in-2028-At-CAGR-of-6-8-Markets-N-Research.html

[2] https://www.macrotrends.net/countries/WLD/world/life-expectancy

[3] https://www.americashealthrankings.org/explore/senior/measure/pct_65plus/state/ALL

[4] https://www.hhs.gov/aging/index.html

[5] https://www.globenewswire.com/en/news-release/2022/11/21/2559955/0/en/Elderly-Care-Market-Size-is-Projected-to-Reach-USD-2-366-4-Billion-in-2028-At-CAGR-of-6-8-Markets-N-Research.html

[6] https://money.usnews.com/investing/etfs/slideshows/best-health-care-etfs-to-buy-now

[7] https://finance.yahoo.com/news/blackrock-singles-health-care-largest-204500458.html