The world is a magnificent place, full of wonderful nature providing us with all the resources we need and/or the means to develop them.

Unfortunately, over time mankind has taken for granted these resources and as such, we find ourselves in an environmental crisis. Oceans we admire, the air we breathe, the silence we crave have all been hampered by our own ambitions to develop, develop, develop.

Finally, we are waking up. People are starting to really realize that they need not only to invest financially in their future, but they also need to make decisions that will be an investment in their family’s future well-being.

Across the globe, countries are giving into the pressure and implementing measures to try to, at least in some way, repair the damage caused by centuries of human consumption.

Enter the Paris Agreement, a legally binding international treaty on climate change. On December 12, 2015, it was adopted by 196 parties and entered into force on November 4, 2016. The purpose of the agreement is to limit global warming which would require social and economic transformation. To keep track of countries’ progress, the enhanced transparency framework (ETF) was formed. Under the ETF, starting in 2024, countries will report on actions taken, adaptation measures and progress.[1] This was a giant wake-up call for countries to take action. After all, there is nothing like peer pressure to motivate those involved.

One such measure which is becoming increasingly popular is to advocate for the use of Electric Vehicles (EVs) in a bid to reduce the stress on the environment and in doing so, reduce carbon footprints.

There is no denying that EVs, powered by primarily lithium-ion batteries, are definitely better for the environment for a number of reasons.

As such, countries are jumping on the EV bandwagon. In August 2021, it was announced that President Joe Biden had signed an executive order setting a national goal for zero-emissions vehicles to make up half of the new cars and trucks sold by 2030.[3] This is a very aggressive timeline and order!

Canada’s plan for 2030 Emissions Reduction Plan will be unveiled in 2022, with a target to reduce greenhouse gas emissions by 40% from 2005 levels. It is anticipated that it will include an EV mandate.[4]

The European Union has announced that it will end the sale of polluting vehicles by 2035, including hybrids. In addition, the auto industry will be required to slash the average emissions of new cars by 55% by 2030. In fact, with 2050 as a goal, Europe wants to be the first continent to be climate neutral.[5]

Obviously, with all of this movement towards the future of Electric Vehicles (EVs), companies that produce elements, notably lithium and graphite, that are crucial in the manufacturing of lithium batteries are going to become more and more interesting to investors.

And indeed, to quote Elon Musk on the future of the lithium market, “Our goal here is to fundamentally change the way the world uses energy. We're talking terawatt scale. The goal is complete transformation of the entire energy infrastructure of the world.”[6] Given Musk’s heightened background, he probably knows what he is talking about![7]

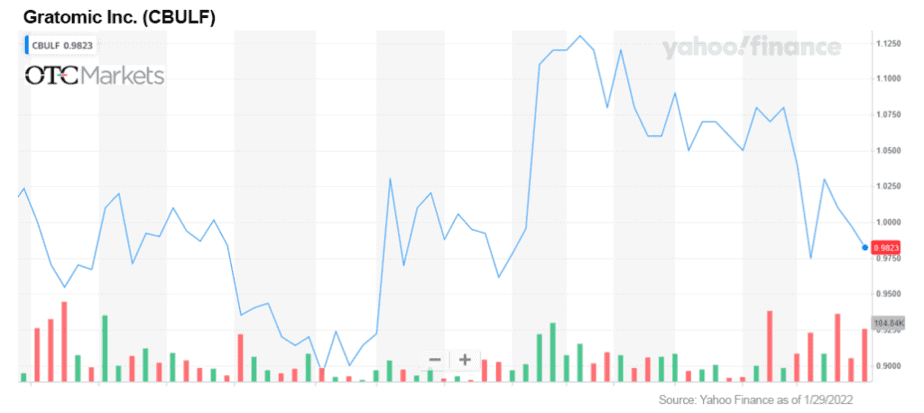

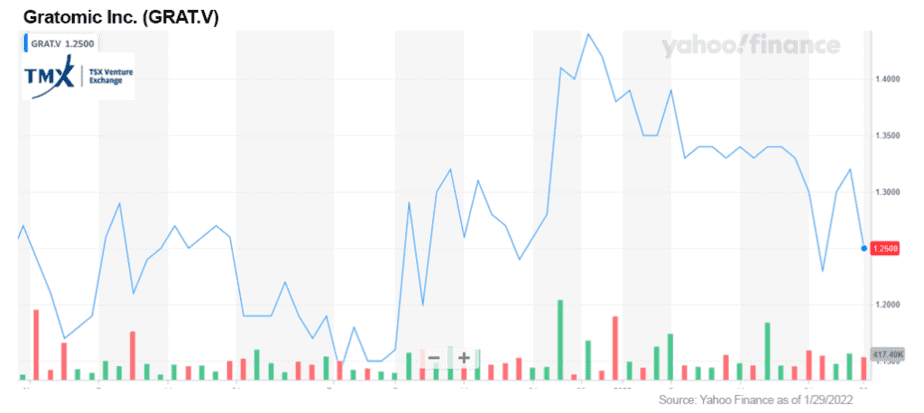

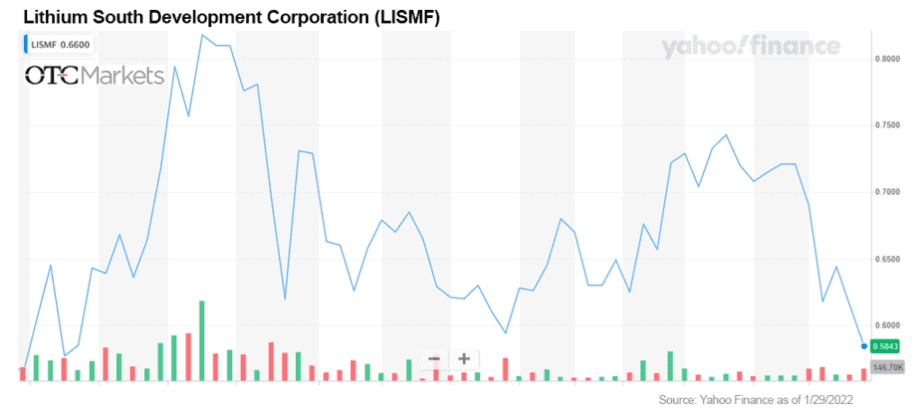

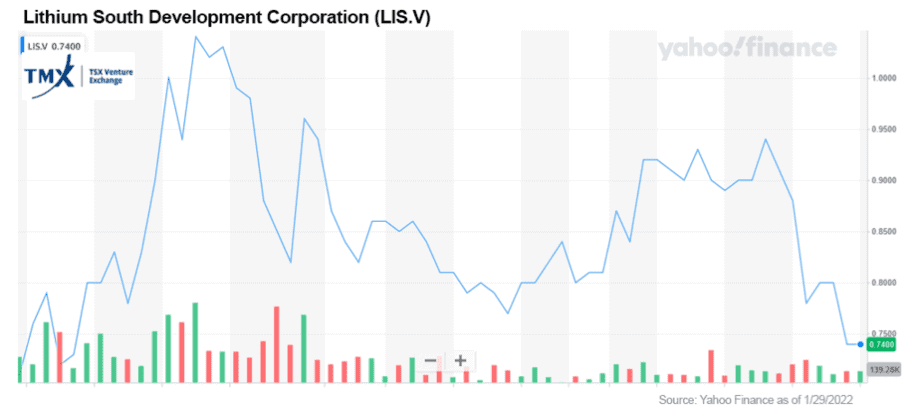

A few companies that are involved in various ways in this market are Gratomic Inc. (OTCQX: CBULF / TSX-V: GRAT / FRANKFURT: CB82), Lithium South (OTCQB: LISMF / TSX-V: LIS / FRANKFURT: OGPQ) and Sony Group Corporation (NYSE: SONY).

It is commonly known that graphite powder is used as an anode material in the majority of lithium-ion batteries.

Gratomic Inc., with a foundation built on being an eco-conscious company, engages in exploration and mining focusing on low-cost mine to carbon-neutral, eco-friendly, naturally high-quality vein graphite. This multinational entity has several projects on the roster in very desirable locales, including in the Karas Region of Namibia (Aukum), the Bahia State of Brazil (Capim Grosso) and Buckingham, Quebec (Buckingham).

So far, the company has been successful in upscaling the naturally pure vein graphite from the Aukam Graphite Project to a battery grade level of 99% + Cg through the addition of air classification, and the commissioning and calibration of its onsite Aukam Vein Graphite Processing Plant remains on schedule as planned.[8][9] From there, it is anticipated that the company will be moving into full operational capabilities within the first quarter of 2022.

I find the Aukam Project very interesting for several reasons. This region, which covers a historical vein graphite mine, is significant. Data obtained over the past 9 years of the project has demonstrated significant potential for expansion. Other variables that contribute to Aukam’s attractiveness are year-round road access as well as nearby power, water, and rail line sources.[10]

At the beginning of 2021, Gratomic provided an update on the commissioning process of several key equipment pieces for the Aukam project in preparation for the final stage of grinding, flotation, and drying circuits. The Product Thickener assembly had been completed, and the vibrating feeder installed in readiness for calibration. This included the process of relocating material from the historical stockpiles to the feed pad.[11]

Clearly, Gratomic is on the move, despite roadblocks faced globally due to the current pandemic.

“Our Aukam construction team has demonstrated resilience in the face of adversity. Even during the holiday period, they never stopped finding ways to push our project forward and keep us ahead of the game.” [12]

— Armando Farhate, COO & Head of Graphite Marketing and Sales

I like to see that determination in a company. I find that it inspires confidence that despite whatever barriers (expected or unexpected) may pop up, determination will supersede difficulties.

With all the positives this unique asset presents, in combination with being one of the only jurisdictions of viable vein graphite outside of Sri Lanka, it may be poised to replace a large part of declining production capacity of vein graphite from Sri Lanka.[13]

In summary, I believe that Gratomic has all the necessary elements to power up success. It is one of my favorite companies.

Based in Salta, Argentina, Lithium South’s focus is the Hombre Muerte North (HMN) Lithium Project, a flagship lithium brine project containing six separate claims and located in the lithium triangle, the nexus for the coveted mineral. In fact, Argentina, Bolivia, and Chile in South America hold more than half of the world’s lithium deposits. It is this huge on a world scale![14]

The company is currently evaluating a Direct Lithium Extraction (DLE) using an absorbent. The exciting part of this is that, if effective, it may have the capability to reduce production time from months to hours and increase recovery from traditional extraction methods of 42% to over 80%. Given how the need for lithium may exponentially increase over the coming years as countries strive to meet their promises, in my opinion, this could be a game changer for the company.

Highlights of the HMN project include:

Two production wells have been drilled and cased, with a 2,000-meter drill program to follow.[16] With everything LIS has in place, in my opinion, this company has strong fundamentals and I am keeping a very close watch on this one.

In my opinion, this is only the tip of the iceberg.

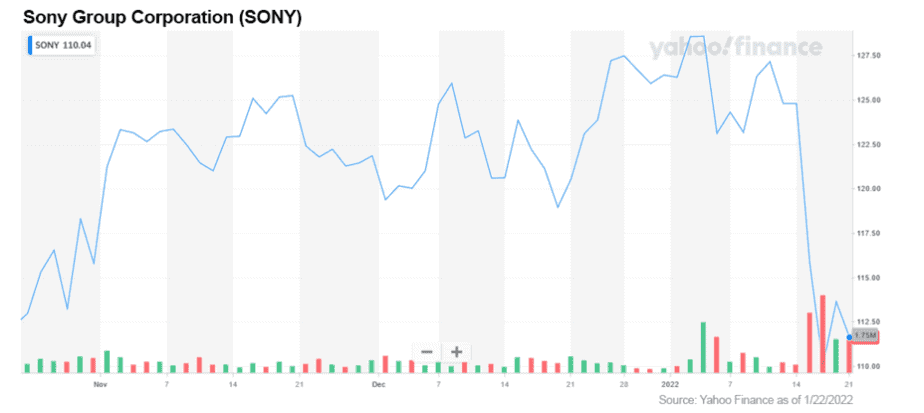

Last but not least, on January 5, 2022, Sony announced that they are launching a new company to explore entry into the electric vehicle market. The company is set to announce the plans to open their subsidiary, to be known as Sony Mobility, at the 2022 Consumer Electronic Show in Las Vegas according to Kenichiro Yoshida, Sony chief executive. The announcement sent Sony’s shares up more than 4.5 percent.[17]

The stock is currently sitting at around $112.50 on the NYSE board.

It will be interesting to see where things go when this tech giant unleashes its’ EV program at full strength.

In summary, I believe that it is an opportune time for investors to look at companies either offering components for the EV market, or the end-products. It is the way the world is heading and more importantly, if we want to help our planet, I feel it is a necessary avenue.

And let’s face it… investing in helping our planet IS investing in our family’s future in the most important way, because if you don’t have a healthy and safe environment, money doesn’t matter so much. We should all be doing our part and, in my opinion, supporting companies that are trying to do theirs is a win-win situation.

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Gratomic Inc. and Lithium South are Kal Kotecha portfolio holdings under his Junior Gold Report. Junior Gold Report (Dr. Kotecha) is currently engaged and paid by Gratomic for marketing/consulting services. His relationship with Gratomic and holdings of Gratomic Inc. and Lithium South should be deemed a potential conflict of interest.

[1] United Nations Climate Change : The Paris Agreement : https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement

[2] Caroline Fortuna (March 25, 2019) : EVObsession : Why Electric Cars Are Better : https://evobsession.com/why-electric-cars-are-better/

[3] Josh Lederman : August 5, 2021 : Biden Signs Order Aiming for Half of New Vehicles to be Electric by 2030 : https://www.nbcnews.com/politics/politics-news/biden-sign-order-aiming-half-new-vehicles-be-electric-2030-n1275995

[4] Electric Automony (December 8, 2021) : Canada’s emissions plan for 2030 targets to be released in spring 2022 as strategic consultations begin : https://electricautonomy.ca/2021/12/08/canada-emissions-plan-consultations/

[5] Charles Riley, CNN Business : Europe aims to kill gasoline and diesel cars by 2035 : (https://www.cnn.com/2021/07/14/business/eu-emissions-climate-cars/index.html

[6] Tesla’s Powerful Event: The 11 Most Important Facts https://www.bloomberg.com/news/articles/2015-05-01/tesla-s-powerwall-event-the-11-most-important-facts

[7] Energy & Capital : Why Lithium Investments Are Wall Street’s Hottest Stocks : https://www.energyandcapital.com/report/the-coming-lithium-revolution/1450

[8] Gratomic (September 7, 2021) : Gratomic Provides Update on Pre-Feasibility Study, Independent Lab Results, and the Aukum Vein Graphite Project : https://gratomic.ca/2021/09/07/gratomic-provides-update-on-pre-feasibility-study-independent-lab-results-and-the-aukam-veingraphite-project/

[9] Gratomic (January 11, 2022) : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphiteprocessing-plant-in-namibia/

[10] Gratomic : Aukam : https://gratomic.ca/aukam/

[11] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[12] Gratomic (January 11, 2021) : Gratomic Announces Update on the Commissioning of its’ Aukum Graphite Processing Plant in Namibia : https://gratomic.ca/2022/01/11/gratomic-announces-update-on-the-commissioning-of-its-aukam-graphite-processing-plant-in-namibia/

[13] Gratomic Inc. Profile : https://agoracom.com/ir/Gratomic/profile

[14] Explainer: Latin America's Lithium Triangle https://www.as-coa.org/articles/explainer-latin-americas-lithium-triangle

[15] Lithium South Development Corporation : www.lithiumsouth.com

[16] Lithium South Development Corporation : www.lithiumsouth.com

[17] Christopher Grimes, Leo Lewis (January 5, 2022) : Sony Launches Electric Vehicle Company to ‘Explore’ entering market. https://www.irishtimes.com/business/manufacturing/sony-launches-electric-vehicle-company-to-explore-entering-market-1.4769241

Lithium (Li) is used in everything from smart phones to laptops, and is now found in advanced battery technologies that power electric vehicles and store energy generated from renewable sources such as solar and wind.

Lithium producers could be set to reap huge gains in the coming years as the demand for lithium continues to soar, and as we continue to reduce greenhouse emissions and move to an electric powered future.

The lithium investment opportunity currently at hand is huge, and investors should act now to stake their claim in this fast-moving evolving space.

Read on to learn more about lithium and the forces that are driving this metal to record valuations.

Putting Mexico on the Map

Bacanora Minerals (recently taken over by Chinese company Ganfeng) recently discovered what they are calling “the largest lithium deposit” in the world in northwestern Mexico. The deposit has estimated reserves of 243 million tons of lithium embedded in rock and clay.

Bacanora announced a 50-year concession with the Mexican government for mining rights and will pour about $2 billion dollars into developing the reserve. The company is set to commence operations in 2023.[1]

The discovery and subsequent operations could put Mexico on the map as a major world lithium producer. Something to keep an eye on for future investment opportunities.

Lithium is a soft, silver-white metal. It is the lightest known metal and lightest solid element. The metal is highly reactive and flammable when exposed to air.

Lithium is used in several industrial applications such as heat-resistant glass and ceramics, lubricants, flux additives for iron, steel and aluminum production, as a medical supplement to treat various mental illnesses, and, of course, lithium rechargeable batteries.

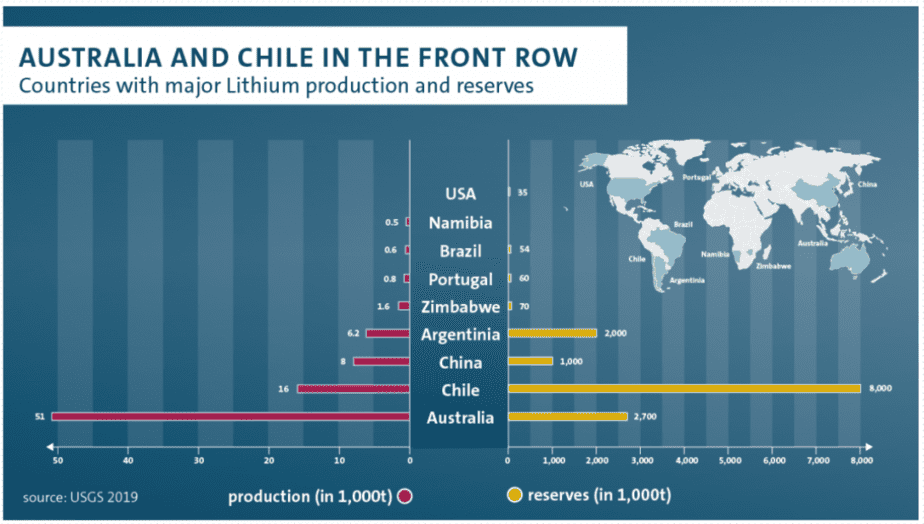

Most of the world’s lithium reserves are concentrated in just a few countries. Chile claims to hold over half of the world’s lithium reserves. Australia, Argentina and China are the next largest holders of lithium reserves.

Currently, the biggest lithium producers in order of production are Australia, Chile, Argentina and China.

The largest lithium importers are China, Japan, South Korea and the United States.[2]

Lithium is mined in three different ways:

Lithium mined from spodumene can be turned into both lithium carbonate and the highly valued lithium hydroxide used in lithium battery production. Australia lithium production is primarily from hard rock spodumene mines.

A second extraction method comes from brine operations which is produced much like sea salt mines. The brine is held in large holding ponds where it is dried out by the sun. Once the water has evaporated the salt is then collected and lithium carbonate salt is extracted from the mixture.

Lithium hydroxide is created from a secondary chemical reaction with the lithium carbonate. Brine production is mainly concentrated in South America.

A third lithium extraction method, geothermal water, is in its early stages of development but promises to be a much more sustainable and commercially viable option. This method uses geothermal wells to extract lithium rich water. The lithium is extracted as both the more valued lithium hydroxide and lithium carbonate.

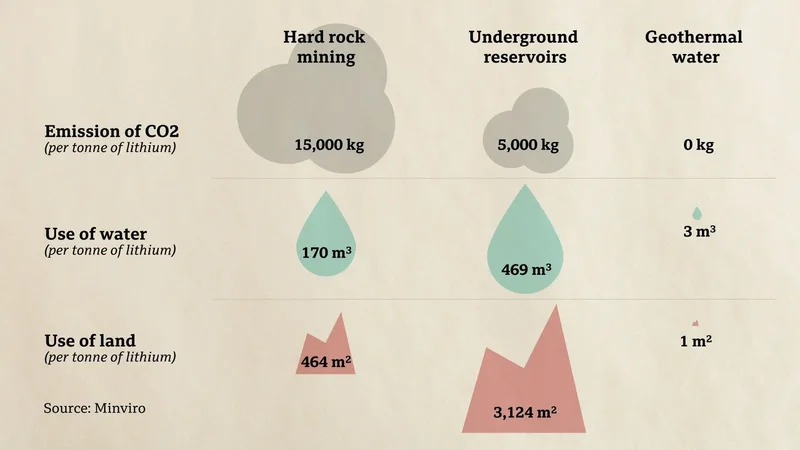

From a green energy perspective, both hard rock mining and brine deposits extraction methods have their drawbacks.

Green Lithium Mining in Germany

Vulcan Energy Resources (OTC US: VULNF / ASX: VUL) is currently exploring the use of geothermal water extraction at its main site located in the Rhine Valley, Germany. They announced significant reserves with lithium concentrations of 181mg/liter of water. Full commercial production is set to commence in 2023–2024.

Vulcan’s chief executive Francis Wedin told an industry conference, “We have a resource which is large enough to satisfy a very substantial amount of the demand in the European markets here for many, many years to come.”[3]

Hard rock lithium is extracted from open pit mines which scars the landscape and uses fossil fuels to heat the rock during the extraction process.

Brine operations use a large of amount of water and are often located where water is scarce, leading to another set of environmental problems.[4]

Of the three extraction methods, geothermal promises to be the greenest as it emits zero carbon and uses very little water and land.

Something to consider as an investor as the world moves to a carbon-free economy and more and more investors demand zero-carbon and environmentally sound lithium investment opportunities.

By far, EVs (Electric Vehicles) are the biggest driving force of lithium production bar none.

In 2020, EVs used about 39% of production. Estimates see that demand rising to more than 60% by 2025. The remaining demand comes from consumer demand surrounding electronics batteries, energy storage batteries and other industrial uses.[5]

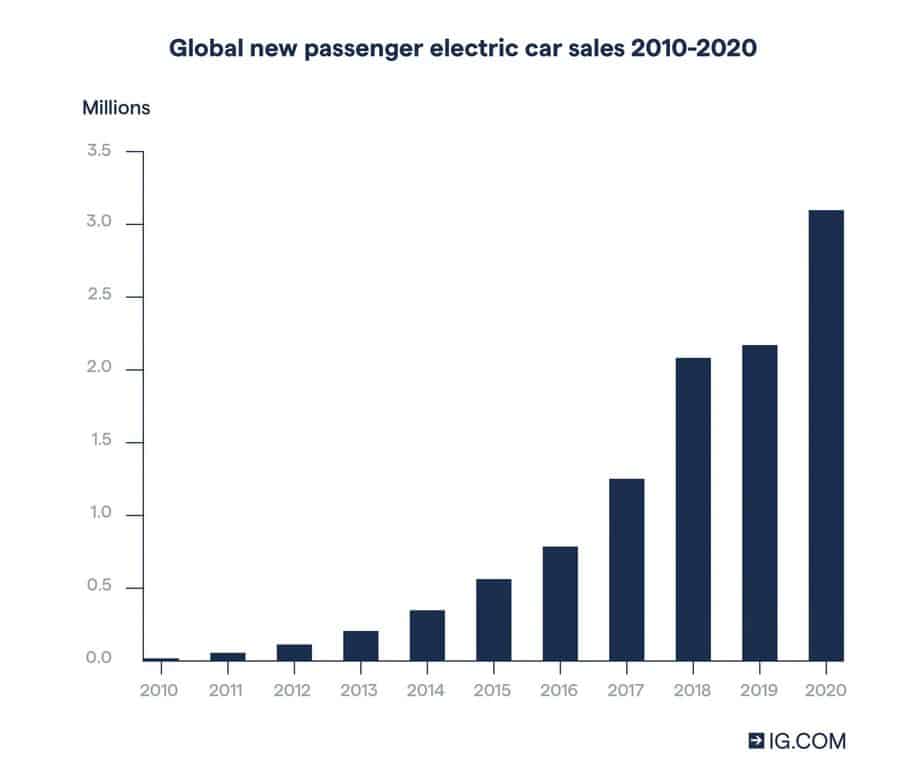

Sales of EVs will continue to grow rapidly as world governments continue to embrace this EV movement and offer further incentives to consumers.

Sales of new EVs grew significantly leading up to 2019, when the market experienced a temporary slowdown to 2.1 million vehicles due to the COVID pandemic.

— Bloomberg News, October 2021[6]

In 2020, however, existing policies and targeted stimulus responses spurred demand, increasing by 40% to over 3 million vehicles or 4% market share of new car sales.

By early 2021, estimates of passenger EVs around the world was more than 10 million vehicles.[7]

The International Energy Agency (IEA) predicts that by 2030 this number may be a whopping 125 million vehicles as world governments adopt increasingly aggressive policies to curb carbon emissions.

Estimates go as high as 220 million vehicles in this timeframe.[8]

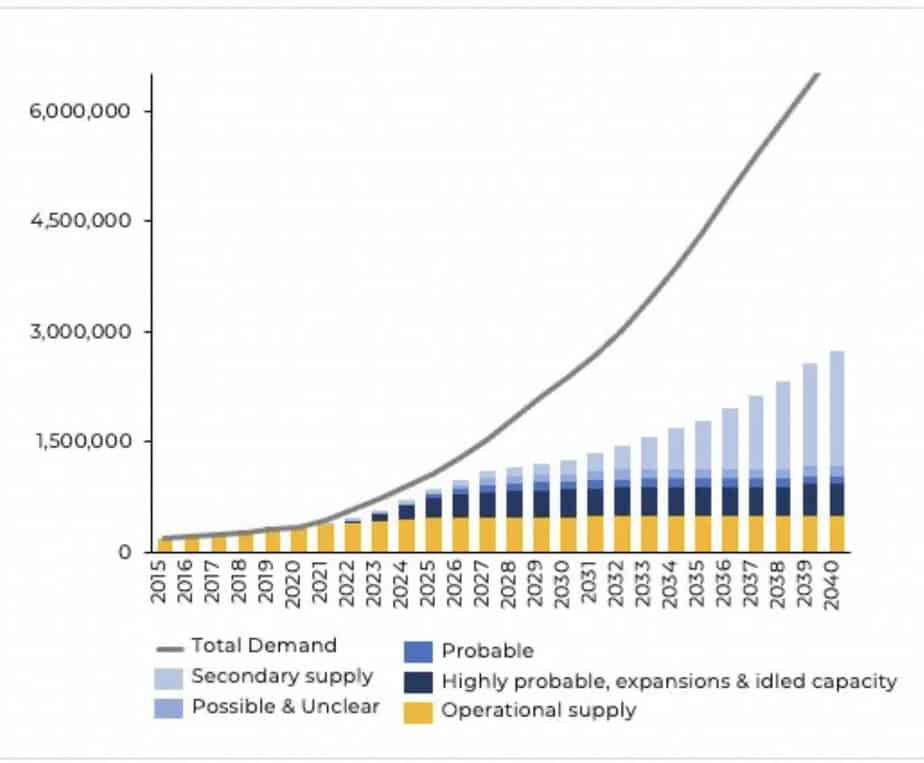

Estimates for growth in lithium demand vary with no clear consensus on a baseline. Needless to say, all the estimates for growth in demand that I found in my research were huge.

My guess why these estimates vary so widely stems from a lack of historical precedent. The world is quite literally at a watershed moment where our entire civilization as we know it is retooling from a fossil fuel-based energy platform to one of solar, wind and other renewable sources of energy that have a low or zero carbon footprint.

Nothing like this has occurred in the course of human history.

This is why I believe that investing in lithium now is a generational investment opportunity. We are in the beginning stages of a new energy era where lithium is central to energy usage & storage.

Current lithium mining operations are insufficient to keep up with expected demand. That means lithium prices will continue to go parabolic, and lithium miners and producers could see their stock prices explode.

Benchmark Mineral Intelligence sees global deficits in lithium supplies surging more than 60 times to 950,000 tons in 2030 driven by increased sales of EVs.[13]

As demand skyrockets, China is snatching up mining rights to lithium reserves around the world, essentially putting a noose on lithium supply.

The effect of this Chinese land grab has exacerbated global lithium shortages and prices have surged for the critical metal.

In 2021 alone, China acquired 6.4 million tons of lithium in reserves and resources. That is about the same amount that was acquired by ALL companies globally in 2020.[14]

Currently, Chinese companies own about 90% of the world’s rare earth mines and manufacture 80% of the lithium batteries.[15]

— Seth Goldstein, senior equity analyst at Morningstar

The lithium market used to be dominated by just three companies — Albemarle (NYSE: ALB), Sociedad Quimica y Minera de Chile (NYSE: SQM) and FMC Corp (NYSE: FMC) — which used to account for 85% of market share.

This has changed dramatically as Chinese companies such as Tianqi Lithium (SZ: 002466) and Ganfeng Lithium (OTC US: GNENF) have become significant players.[17]

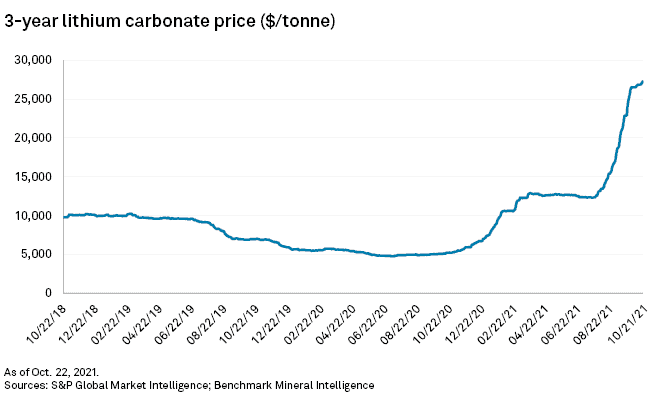

Tight supply coupled with intense demand has pushed lithium prices to near-historic levels.

Historically, lithium reached an all-time high of $31,519/ton in November of 2021.

In my research I found three lithium producers that look to be the best in the field. Of course, you will have to do your own research, but this should be a good starting point.

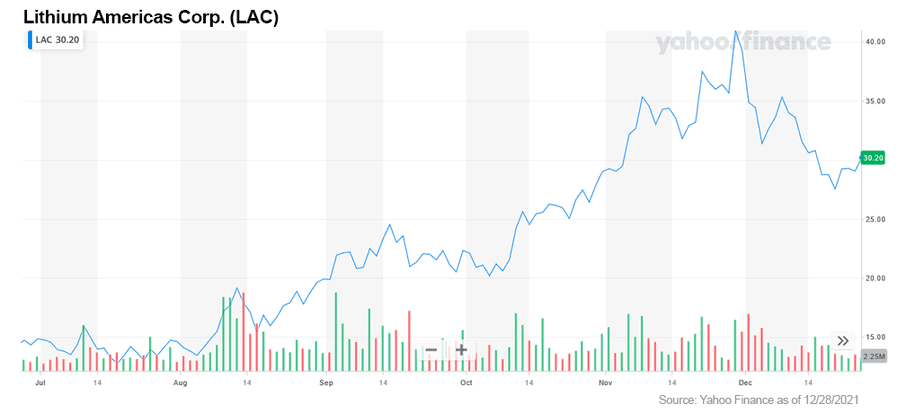

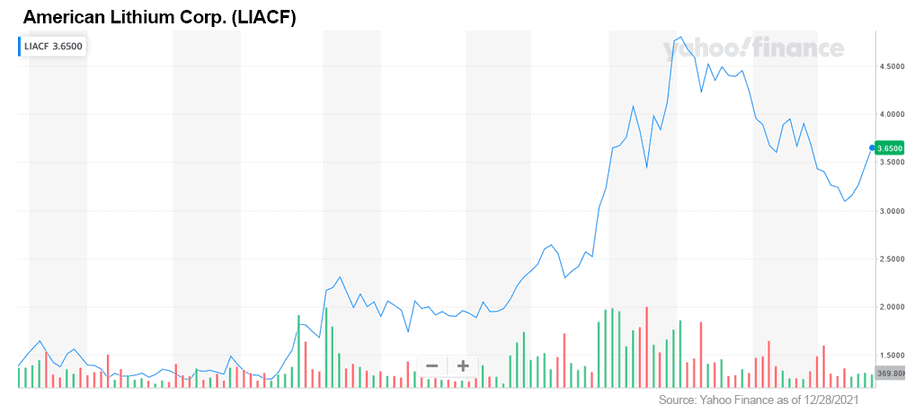

Note: all charts are for the past 6 months from the publishing date of this article.

1. Alpha Lithium Corporation (OTC: APHLF / TSX-V: ALLI)

Alpha Lithium is a junior mining play located in the famed lithium-rich region of the “Lithium Triangle” in Argentina. The company holds 100% ownership of almost 68,000 acres surrounded by other multibillion-dollar lithium assets. They also own over 12,000 acres in the lithium-producing region known as Hombre Muerto, also located in Argentina.

The company is currently testing their proprietary extraction process to increase lithium extraction with a lower impurity ratio.

Alpha Lithium recently announced they secured $30 million dollars in investment from Uranium One. The funds will go to further development of their holdings.[18]

In addition, the company also announced it closed an oversubscribed $25 million bought deal offering conducted by Echelon Markets. The net proceeds will be used to fund strategic acquisitions, exploration and general working capital.[19]

By all indications, this company could be positioned to become a major player in the lithium mining world. Definitely one to keep on the radar.

2. Lithium Americas Corp. (NYSE: LAC / TSX: LAC)

Lithium Americas is currently in the exploration phase and is confirmed to begin production in mid-2022. Their goal is to be producing 40k tons of lithium carbonate equivalent.

The company has holdings in the US and Argentina and has recently partnered with Ganfeng Lithium, working on a brine project in Argentina.

Recently, the company announced that the initial purchasers of convertible senior notes due in 2027 have exercised their option to purchase an additional $33,750,000 aggregate principal amount of notes.

“With the Offering complete and our US$205 million senior secured facility fully repaid, we have significantly enhanced our balance sheet while minimizing potential dilution to shareholders and reducing interest cost.”

— Jon Evans, President and CEO[20]

In addition to repaying the loan, the company intends to use the remainder of the proceeds to repay other indebtedness, further enhancing the company balance sheet.

Lithium Americas currently has a reported $480 million in cash.

Additionally, management is very strong with deep experience in lithium mining and production.

Don’t miss adding this onto your radar and potential trading list.

3. American Lithium Corp. (OTCQB: LIACF / TSX-V: LI)

American Lithium is an exploration-stage company currently exploring and developing lithium brine deposits in Nevada and hard rock lithium in Peru. In addition, the company is developing a uranium reserve also located in Peru.

The Nevada property is located in the same region as Albemarle’s (NYSE: ALB) Silver Peak lithium mine and several other advanced-stage lithium projects. It is also located near the Tesla (NASDAQ: TSLA) Gigafactory.

Their Peruvian hard rock lithium deposit is touted as the world’s 6th largest deposit.

Echelon Capital Markets recently initiated coverage of the company with a speculative buy rating and 12-month target price of $6.48/share. Roth Capital has called for $5.93/share and VSA Capital projects $5.50/share.

The stock is deemed a speculative buy and investors should be aware of the risks when investing in any exploration-stage company, however... overall, American Lithium has performed well. I believe there is more to go!

Renewable investments & technology is growing rapidly and the key element to power this tech, right now, is lithium.

Without a doubt, lithium metals should be in every intelligent investor’s portfolio.

Demand is already outstripping supply. Countries like China are putting further pressure on supply by buying up known reserves around the world.

I see a great opportunity in the space for the next few years as world governments continue to move their economies into a carbon free economy.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.reuters.com/article/us-mexico-mining-lithium-exclusive-idUSKCN2E52FN

[2] https://tradingeconomics.com/commodity/lithium

[3] https://www.thinkgeoenergy.com/vulcan-energy-produces-battery-grade-lithium-from-geothermal/

[4] https://www.bbc.com/future/article/20201124-how-geothermal-lithium-could-revolutionise-green-energy

[5] https://investors-corner.bnpparibas-am.com/investing/what-you-need-to-know-about-lithium/

[6] https://www.bloomberg.com/news/articles/2021-10-27/lithium-s-rally-isn-t-slowing-as-costs-rise-for-electric-vehicles-batteries?sref=SAPiUD9B

[7] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[8] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[9] https://investors-corner.bnpparibas-am.com/investing/what-you-need-to-know-about-lithium/

[10] https://www.marketwatch.com/story/lithium-demand-to-grow-at-average-annual-rate-of-30-in-2021-23-bacanora-says-commodity-comment-271631179864

[11] https://english.elpais.com/usa/2021-10-21/the-white-gold-dream-why-mexico-wants-to-control-lithium-exploitation.html

[12] https://finance.yahoo.com/news/global-lithium-mining-market-industry-104300637.html

[13] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[14] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[15] https://www.msn.com/en-gb/money/other/block-chinese-takeover-of-lithium-miner-ministers-told/ar-AARx6a1

[16] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/china-mining-battery-companies-sweep-up-lithium-supplies-in-acquisition-blitz-67205411

[17] https://www.ig.com/uk/trading-strategies/what-are-the-best-lithium-stocks-to-watch--200824#information-banner-dismiss

[18] https://finance.yahoo.com/news/investmentpitch-media-video-discusses-alpha-080500942.html

[19] https://alphalithium.com/alpha-lithium-closes-oversubscribed-25-million-bought-deal-offering/

[20] Ibid.