The words I am about to write are tantamount to a cardinal sin for a pro-crypto writer & investor. They will most likely clash with everything you have read about cryptocurrency so far. It’s possible it may even make some of you want to angrily email me explaining how wrong I am. Here we go…

Bitcoin (BTC) is not a safe-haven asset. Despite what Bank of America (NYSE: BAC) says, Bitcoin does not act like an inflation hedge.[1] As much as the cryptocurrency community wishes it were, Bitcoin is not digital gold. It always has been, and will remain so for the foreseeable future, a high-risk asset with more correlation to tech stocks than most commodities.

Now that I’ve thoroughly ruined my credentials as a bona fide pro-crypto investor, please allow me to explain why I believe this, what I think the future for Bitcoin actually is, and why that future is brilliant news for cryptocurrency investors.

The big problem with Bitcoin lies in the gulf between the vision of its founder Satoshi, and the reality of how the cryptocurrency has been used. Bitcoin’s reputation as “digital gold” is derived from the way that the token is created and distributed rather than from any real connection to the shiny yellow stuff.

The maximum amount of Bitcoin that can ever exist is 21 million BTC tokens. These tokens are slowly extracted by a network of computers competing to solve calculations in order to mint or “mine” BTC. As time goes on, the difficulty of finding new BTC increases, and thus the scarcity of liquid BTC will also decrease.

This scarcity is part of what drives Bitcoin’s value. The theory is that it makes Bitcoin an anti-inflationary asset, thereby giving it intrinsic value so long as investors use it as a store of value for their hard-earned cash. This should give BTC the same characteristics as an anti-inflationary commodity, like gold, and could potentially make it a safe haven in hard times.

It is likely these beliefs that led to the following line in Bank of America’s memo regarding the potential for a recession in April 2022:

"Inflation shock worsening, rates shock just beginning, recession shock coming," Bank of America chief investment strategist Michael Hartnett wrote in a note to clients, adding that in this context, cash, volatility, commodities and cryptocurrencies could outperform bonds and stocks. [2]

This memo is important because Hartnett is grouping cryptocurrencies generally, not just Bitcoin, with anti-inflationary commodities and cash. If you agree with the thesis that Bitcoin is digital gold, then it’s easy to see why Hartnett would make that assertion, however, let’s see what the data says.

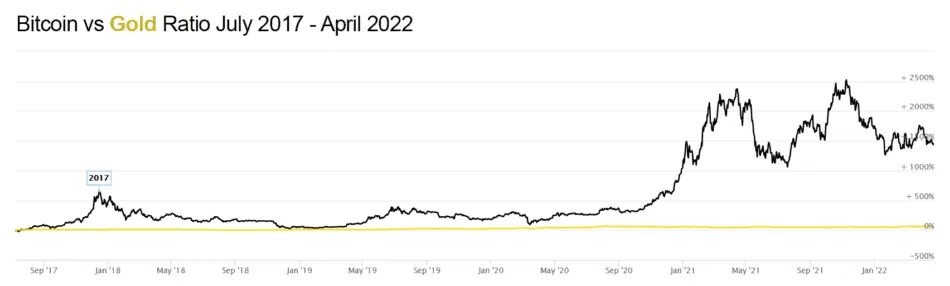

Since we’re talking about the threat of looming high inflation, let’s begin by comparing Bitcoin to the “gold standard” in anti-inflationary assets, the yellow metal itself — gold.

For me, this chart demonstrates two things. The first is that gold remains relatively flat throughout this period. The second is that Bitcoin price rises don’t seem to have any real correlation with gold prices. This also seems to hold true when we zoom out.

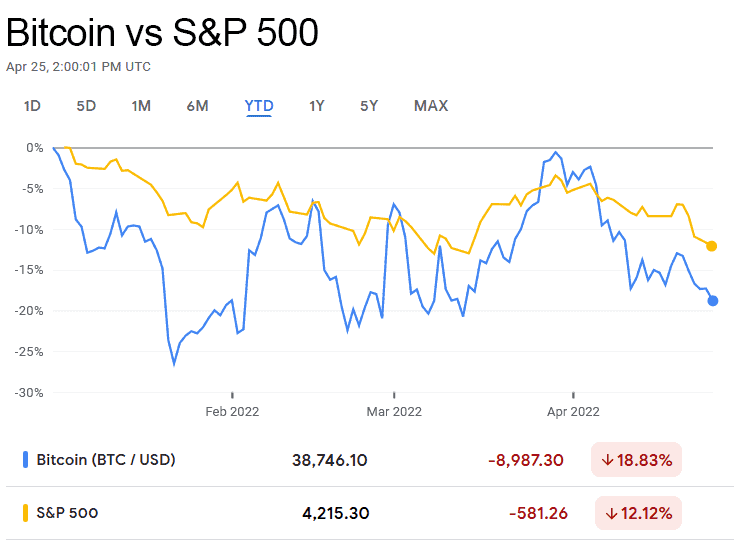

So if Bitcoin isn’t correlated with gold, what is it correlated too? Well let’s start by looking at what Bitcoin actually is — it is a new technology that is seeing significant interest from funds that focus on risk capital.[3] This would theoretically place Bitcoin in the same sort of realm as tech stocks, so let’s try using the S&P 500.

Now we’re getting somewhere. The correlation isn’t perfect, but Bitcoin appears to have far more in common with the S&P 500 than it does with gold. This means that investors are indeed treating Bitcoin as something closer to a speculative tech investment, rather than a commodity like gold or silver.

It isn’t just me coming to this conclusion. A Bank of America analyst, Alkesh Shah, noted this back in February, stating that Bitcoin was acting more like a risk asset than it was as an inflation hedge. [4] Other analysts have also noted that Bitcoin’s correlation to the S&P 500 hit a 17-month high in March 2022.[5] In short, the data shows that Bitcoin is closer to a tech stock than it is to gold.

Before we discuss the implication of this, let’s take a quick look at why investors are reacting this way.

At first glance, Bitcoin’s technological underpinnings make this outcome surprising, but you need to remember one thing — gold is old. Humans have coveted this shiny, malleable, metal for over 5,000 years.[6]

Since then it has been used in jewelry, as a primary medium of exchange, and in modern times, as the best of the anti-inflationary assets.

Bitcoin does not have that storied history. It is an emerging asset-class, riddled with contradictions and uncertainty. Its community is divided between blockchain evangelists with a noble belief in a decentralized libertarian future where BTC is used in lieu of fiat currency and people who just want to make a quick buck.

The political establishment remains at best ambivalent — and at worst outright hostile to Bitcoin. Finally, the technology remains deeply controversial with environmentalists due to its high energy use, although this situation is improving. [7]

I’m not trying to paint Bitcoin negatively here, although it may seem like it. I am trying to explain why the market reacts to Bitcoin in the way that it does. As much as crypto enthusiasts may wish it otherwise, for the time being most investors still view Bitcoin as a speculative high-risk asset.

Now that we know what is happening and have at least some grasp on why it is happening, we can decide what to do about it. In general, we should approach Bitcoin and other cryptocurrencies the same way that we would approach stocks or ETFs. “Blue-Chip” cryptos like Bitcoin and to a lesser extent Ethereum, I believe, will broadly follow the S&P 500.

It also means that we shouldn’t expect Bitcoin to perform strongly in a climate that doesn’t favor the stock markets. Tech stocks typically struggle during times of economic uncertainty since they are reliant on fundraising. As investors shy away from risky assets, their sources of revenue can dry up which can lead to a potential collapse. This same risk aversion will impact Bitcoin during any possible recession, and we can expect to see the price decrease markedly.

In practical terms, it means that we are likely going to see a period of marked instability in the price of stocks and crypto over the next year or so.

As my colleague Carl Delfeld highlighted in his excellent piece How to Protect Your Stock Portfolio From Increasing Inflation & Geopolitical Conflict, there is a very real risk that we are entering a period of inflation, even stagflation. This means that investors who are worried about their pocketbook should be avoiding weighting their portfolios too heavily in favor of cryptocurrency. If you’re thinking about offloading tech stocks, then it’s probably time to offload your Bitcoin as well.

This could also provide an opportunity for risk-tolerant investors. Buying while others are selling and fearful is an excellent way to grab valuable assets at a potential discount. If the overall markets in general are down, then investors may have an opportunity to buy Bitcoin on the cheap while waiting for the general capital markets to rebound.

What is true for Bitcoin tends to be true for other cryptocurrencies. The crypto market will generally track Bitcoin’s trend upwards or downwards, so by extension, you can use the S&P 500 to understand the broad direction of the overall cryptocurrency markets at the moment as well.

However, each individual project will have its own drivers that could increase risks or potential rewards. Investing in small niche projects can net much higher gains than simply investing in Bitcoin. For example, we’ve previously talked about Decentraland (MANA), which saw +4,000% growth in 2021, vastly outstripping Bitcoin’s 59.8%. (Read more on that here: KEY TRENDS FOR CRYPTO: Why the Metaverse, Polygon (MATIC), and Institutional Investors Could Make 2022 a Breakout Year for Cryptocurrency.)

With that said, there are some nuances that I want to emphasize. While Bitcoin is correlated to tech stocks and the S&P 500 Index, that doesn’t mean that it is the same as a tech stock. Cryptocurrency has its very own specific set of risk factors that should play into your investment strategy.

The first, and most worrisome, is the legal landscape. In the wake of Russian sanctions, there have been a number of voices in the political establishment, most notably Elizabeth Warren, calling for greater restrictions on cryptocurrency.

Setting aside the questionable logic upon which Warren’s argument stands, governments have good reasons to want to legislate for cryptocurrency.

Even when used for benign purposes, cryptocurrency creates an environment that is difficult for governments to control.

This is an anathema to these organizations, and many governments are working on Central Bank Digital Currencies, which they will undoubtedly want to push in favor of decentralized solutions. Even the whisper of Bitcoin-negative legislation could send the price tumbling down compared to the S&P.

Another thing to consider is the Decentralized Finance (DeFi) angle. DeFi can be understood as the cryptocurrency-powered mirror of the traditional financial system. Users can buy and sell cryptocurrency through decentralized exchanges, take out loans, or even insurance contracts.

This all operates in isolation of the rest of the global financial system through stablecoins, with the potential to completely disrupt the global banking system as we know it. (This likely explains why global governments still haven’t figured out a reasonable regulatory structure, but that’s for another time.)

This ecosystem is crucial to the success of cryptocurrency as a whole, but it is particularly important to Ethereum (ETH), which operates as the backbone of the whole system through the ERC20 smart contract standard. New projects within this ecosystem represent high-risk, high-reward investment options for investors with the industry knowledge and risk tolerance to back it up.

So now that I’ve (hopefully) justified my assertion that Bitcoin is a terrible hedge against inflation, I’d like to answer where I think it will go from here. In my view, there are too many technical, legal, and practical obstacles towards Bitcoin becoming legal tender. In the one country where it’s been tried, El Salvador, the rollout has been an unmitigated disaster.

However, I think that this is actually good news for investors. Of course, news about adoption will cause brief spikes in the price of BTC. However, I think that is because many observers miss the point: Bitcoin doesn’t need to be integrated into the real-world financial system to be useful. Indeed, doing so might even undermine its value.

Instead, we should view Bitcoin as an entry point into a wider cryptocurrency sphere. In this specific crypto context, it could be considered to be akin to gold — a (relatively) safe asset by cryptocurrency standards that investors can turn to when crypto markets become too unstable.

In other words, Bitcoin will continue to be an excellent store of value for investors interested in exposure to the wider cryptocurrency space. I expect to see more capital continue to pour into the token, as investors attempt to gain general exposure to the cryptocurrency space. It is even possible that Bitcoin will eventually decouple from the stock market, but for that to happen, the cryptocurrency space it represents would need to mature significantly.

This all brings us to the big question: Is now the right moment to invest in Bitcoin? For me, the answer is that the only better moment to invest in Bitcoin or other cryptocurrencies was earlier, but now works too.

I think that Bitcoin is likely to weather the storms ahead, and that there will be some great opportunities to purchase at a discount. However, at the end of the day, only you can decide whether a Bitcoin investment is the right choice for you. Take your time, do your research, and decide what entry point is right for you in an ever-changing cryptocurrency marketplace.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] There is some disagreement here, I’ll get to that later!

[2] https://www.reuters.com/world/us/global-markets-flows-urgent-2022-04-08/

[3] https://www.forbes.com/sites/danrunkevicius/2021/01/14/myth-busted-wall-street-is-not-investing-in-bitcoin/?sh=389b69205510

[4] https://www.coindesk.com/business/2022/02/09/bofa-says-bitcoin-trades-more-as-risk-asset-less-as-inflation-hedge/

[5] https://finance.yahoo.com/news/bitcoins-correlation-p-500-hits-083740983.html

[6] https://www.metaltek.com/blog/the-golden-age-the-history-of-gold/

[7] https://www.nasdaq.com/articles/a-comparison-of-bitcoins-environmental-impact-with-that-of-gold-and-banking-2021-05-04