Recession. The mere mention of the word strikes a stomach-wrenching fear in investors. They know the pain is coming.

Throughout 2022, the US economy has been teetering on the edge of a dreaded recession — but based on my research I don’t believe we are necessarily headed into what would be referred to as a deep recession.

The economic signals across the widespread economy are showing some level of stability, and much of what lies ahead depends on the Feds and how far they will go with raising interest rates.

The two questions for investors today are:

While the answer to question one is anyone’s guess, question 2 has some clear answers that I will get into later in this article...

While the economic headwinds are strong, I believe there are still many opportunities for investors to protect their financial portfolios and even realize some gains in these uncertain times.

Read on and I’ll show you what I believe are some solid opportunities that I have found in my research that will help guide you in developing your personal investment strategy.

The US economy has been through a brutal year:

Beginning in early 2022, a chain reaction of events, starting with Russia’s invasion of Ukraine, led to a disturbing spike in inflation levels, and the Federal Reserve was quick to respond.

Since last year, the Fed started hiking interest rates in an attempt to cool down the economy and squash skyrocketing inflation rates that had not been seen in over 40 years.

The idea behind the strategy is to slow the economy down by discouraging borrowing, investment and spending in the hope of killing inflationary pressures.

Anytime you start tapping the brakes on the economy, you run the risk of hitting them too hard, and a slowdown turns into a recession.

The Feds are playing with a razor-thin margin of error. Ultimately, the Fed is seeking a balanced approach.

Too many interest rate hikes, and the economy will sway into a recession. Too little, and inflation continues to spiral.

By all accounts, the US economy is teetering on the edge of a recession with some pundits pointing out that we are already in a recession.

The Bureau of Economic Analysis announced that Q2 GDP contracted by -0.9%. This followed a Q1 negative GDP print of -1.6%.[1]

Some economists believe a recession is marked by two consecutive quarters of economic contraction.

Others, such as The National Bureau of Economic Research (NBER), consider a recession to be a significant decline in economic activity spread across the economy for more than a few months.

Both points of view are merely semantics at this point. The fact is that the US economy is certainly looking like it is slowing down from a GDP perspective.

My take is we are in a recession now.

It seems that the jury is still out whether we are in a recession now or we will enter one in the next year.

Economists are firmly set into two camps at the moment.

One side saying the worst is yet to come in 2023.

The other side is saying that we are already beginning to experience a recession and that we should be out of it in early 2023.

On the bright side, the labor market remains strong — and even some would argue, even thriving. Also, corporate earnings are still coming in relatively strong.

The war against inflation numbers are beginning to show a glimmer of hope. In October 2022, the Bureau of Labor Statistics report showed that wholesale prices rose by +8% in October from a year before.[2]

While historically still high, it was the smallest increase since July of last year and much better than had been forecasted by analysts.[3]

Optimists see these points as positive signs for an economy struggling to find both footing and traction.

On the pessimist side of the argument, the Ukraine conflict continues to drag on, pushing three critical consumer commodities to record high prices. Fuel, fertilizer and wheat are three of the most critically affected commodities driving inflation.

The US Fed is also signaling that they will continue to raise interest rates until inflation is firmly under control, even if that means pushing the economy into a potential recession.

Pessimists see these points as proof that the US economy will significantly slow down and undoubtedly be pushed into a real recession into 2023.

Either way you look at it, the US economy is in a precarious place, and the legitimate fear of a recession has understandably been growing.

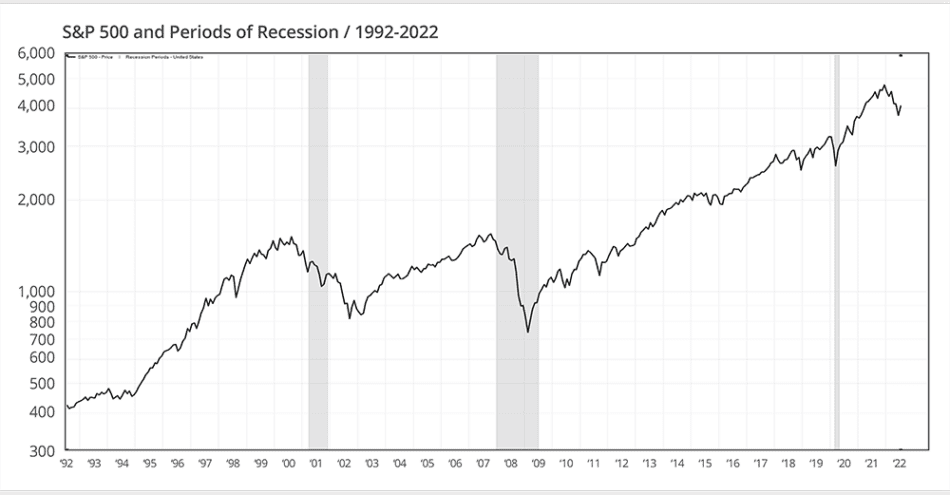

Here is an interesting bit of optimistic data: Tim Holland, chief investment officer at Orion Advisor Solutions pointed out that, “We also remind ourselves that recessions are uncommon, as our economy was in recession just 8% of the time over the past 30 years.”[4]

Given the current data and economic outlook, intelligent investors should be looking for equities that have shown a historical resilience to recessions, as well as the potential to lock in some gains during the current slowdown. Often called ‘defense mode stocks,’ these are companies in the sectors of the economy that will continue to function no matter how bad a recession may become.

These five sectors are a great starting point when doing your research into other defense mode stocks.

Use these five sectors as a guide when searching for other recession-proof ‘defense mode stocks.’

Below are 8 stocks that I believe to be solid investment opportunities that should be considered by intelligent investors when creating their personal recession investment strategy.

As an added bonus, many of these equities are now trading at bargain prices. Any uptick in economic conditions could render handsome gains for patient investors.

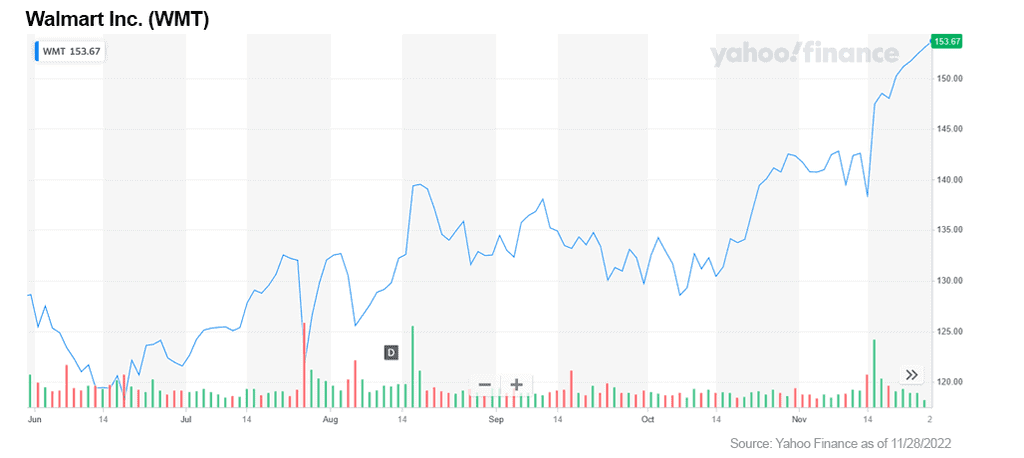

1. Walmart Inc. (NYSE: WMT)

Walmart is the go-to place for Americans looking for bargains while shopping for groceries and basic staples. Tough times in the past have pushed consumers to Walmart checkout stands.

The company has outperformed during the two past recessions.

The company is well-positioned for the current economic slowdown. Current company initiatives to modernize include a strong e-commerce platform, cashierless checkout and other technologies to aid in inventory control.

A strong long-term investment in my opinion, especially given the current economic conditions.

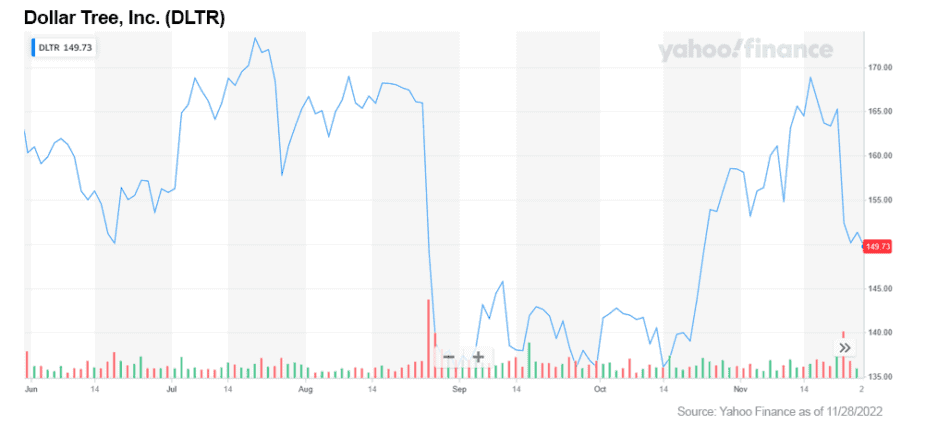

2. Dollar Tree, Inc. (NASDAQ: DLTR)

Dollar Tree is another discount retailer that will fair well in any downturn. Their two branded stores, Dollar Tree and Family Dollar, offer a variety of basic consumer products perfectly geared to the current economic times.

The company recently increased their iconic $1 price point to $1.25, which has increased margins and revenues for the company. They also recently announced that they firmly beat 3rd quarter estimates.[5]

A report from Placer.ai that was recently released outlined that dollar stores are seeing “greater foot traffic and revenues as inflation pushes customers down from traditional superstores such as Walmart.”[6]

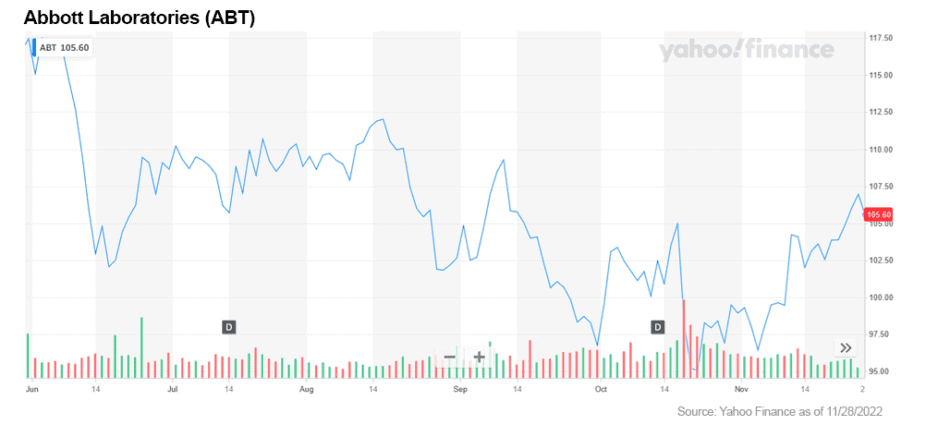

3. Abbott Laboratories (NYSE: ABT)

Abbott Laboratories has a diversified healthcare product list that has proven to be very recession-proof including medical devices, diagnostics, branded generic medicines and nutritional products.

The company has shown historic strength over the past two recessions, outperforming in both the 2008 and the 2020 recessions.

The company has paid out a dividend over the past 95 years. Over the past 47-year period, the company has consecutively increased its dividend payouts.

The company is experiencing some contraction in revenues from their COVID testing products but has a diversified portfolio of products that will help the company continue to generate revenue growth.

4. Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson is an American institution in healthcare products. Founded in 1886, the company has survived several economic downturns. A proven winner in my opinion.

The company sells a wide variety of both over-the-counter and prescription medications as well as general consumer healthcare-related goods like band-aids, diapers, and skin health & beauty products.

No matter how bad the economy will get, consumers will continue to buy Johnson & Johnson medications and consumer healthcare products.

As an added bonus, the company pays a dividend of 2.72% yield.

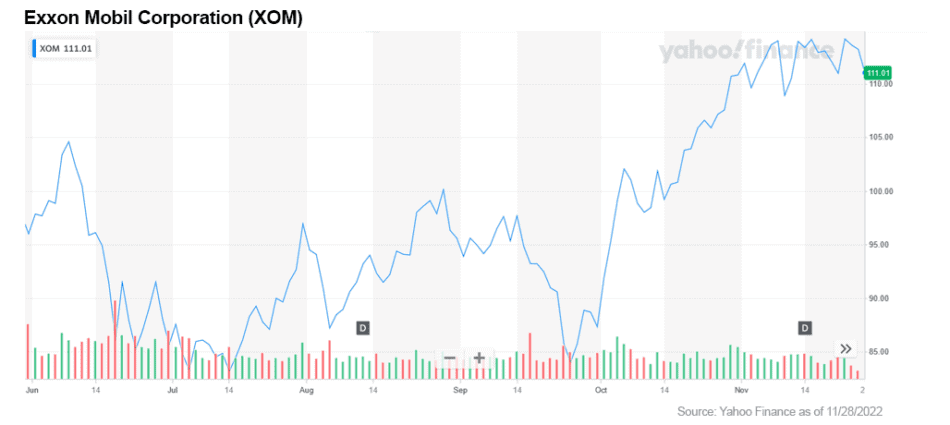

5. Exxon Mobil Corp (NYSE: XOM)

Exxon Mobil is the largest producer of oil in the US.

The current rise in energy prices has pushed its share price up over +63% in 2022 making this company a strong candidate for any investor looking for shelter from a recession.

As the world oil supply continues to be constrained by OPEC, the company’s growth trend should not come to an end anytime soon.

The company recently announced they beat 3rd QTR estimates.[7]

Consumers will continue to buy petroleum products no matter how slow the US economy becomes.

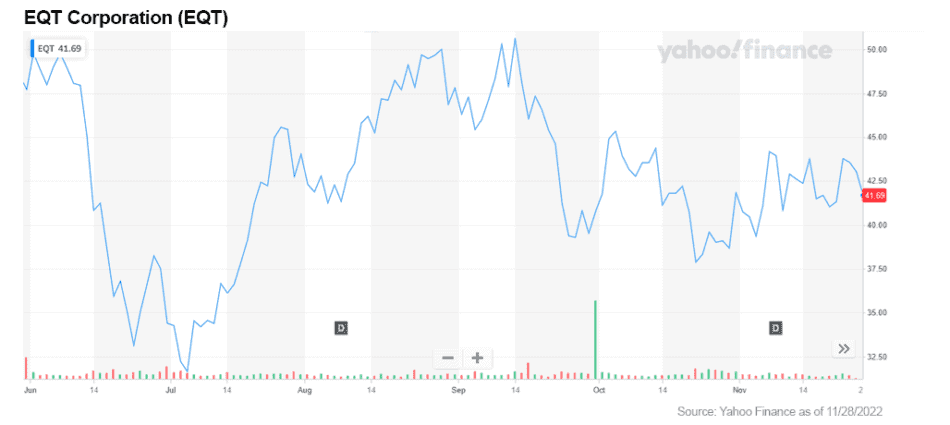

6. EQT Corporation (NYSE: EQT)

EQT is a natural gas producer that has faired very well as a result of the sanctions on Russian natural gas exports.

The company shares have rocketed up over +91% YTD. The company is looking to make record profits this year and US exports have surged.

EQT will likely continue to be a winner in my opinion.

7. The Home Depot Inc. (NYSE: HD)

Home Depot has a proven track record of surviving economic ups and downs. It’s a solid company that has generated outperforming returns over many years.

The company is the largest home improvement retailer in the world with over 2,300 retail locations in Canada, Mexico and the US.

The recent increase in interest rates has cooled investor sentiment, but the company is still a strong buy in my opinion and investors should consider picking up a few shares at these bargain prices.

The company recently reported 3rd QTR revenue grew by +5.6% compared to last year. Operating margins also increased showing that the company has a tight grip on managing higher costs associated to supply chain issues and inflation.

8. T-Mobile US Inc. (NASDAQ: TMUS)

T-Mobile is now the second largest wireless provider in the US following their merger with Sprint.

The company has a proven track record of consistent growth even during economic downturns.

The company share price has seen an increase of over +36% YTD.

T-Mobile has beat their competition to a 5G network rollout which puts them firmly in the lead in the transition to 5G wireless technology. This advantage should lead to further gains in market share from competitors such as AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ).

A solid recession play as consumers will not be readily giving up their mobile phones no matter how dire the economy may get.

I’m a follower of Warren Buffett and I too believe in the overall strength of the US economy coming through in the long term.

Warren Buffett once said that it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.”

Intelligent investors should listen to these pearls of wisdom from a man who has made his massive fortune trading in equities for over 80 years.

While the current trading environment within the capital markets may seem dire, the fact is that given enough time, the US economy will once again regain its footing, inflation will recede, and the Fed will start to lower interest rates. This process takes time…

While it is impossible to predict when bull markets begin, historically recoveries happen quickly. It is my opinion that investors should buy and hold stocks even during times when markets are falling. Perhaps my eight suggested investment targets discussed here could make a meaningful impact on your investment portfolio.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.bea.gov/data/gdp/gross-domestic-product

[2] https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/

[3] https://edition.cnn.com/2022/11/15/economy/us-ppi-inflation-october/index.html

[4] https://clients0.brinkercapital.com/we-are-in-a-recession-right/

[5] https://finance.yahoo.com/news/dollar-tree-third-quarter-2023-100818135.html

[6] https://www.placer.ai/blog/dollar-general-in-command/

[7] https://www.investors.com/research/exxon-stock-buy-now/?src=A00220