As 2024 came to a close, everything was looking up for crypto. Bitcoin had smashed the $100,000 barrier, and a pro-crypto Trump administration was set to take power. Then reality hit, and it’s been a wild ride for the crypto market in 2025 thus far.

While many analysts point to the 4-year Bitcoin cycle, there’s a lot going on today that could upend that. A potent cocktail of global instability, a perhaps overly ambitious Trump administration, and some crypto-specific trends could make or break crypto this year.

Let’s dive into the world of crypto again and figure out what we should look for in 2025, and how you can take advantage of it.

Let’s start with the big question: the 4-year cycle. This is a common term for how the Bitcoin market has historically operated. A simplified version of the cycle looks like this:

BTC operates this way because of how its price is determined. Bitcoin doesn’t have the same inherent value as a publicly traded company or a commodity. The price of BTC literally represents what sellers are willing to sell their coins for, and what buyers are willing to pay for them. In other words, the price of 1 BTC is a pure expression of supply and demand of BTC itself.

New BTC is minted by miners who use specialized computers to compete to find the answer to complicated equations. The miner who successfully finds the answer first gets a portion of all transaction fees paid for that block and some newly minted BTC. Every four years, or 210,000 blocks, this reward is cut in half in order to control inflation.

When the block reward is cut in half, the number of new Bitcoins being minted is also reduced by 50%. This reduced supply leads to Fear of Missing Out (FOMO), and miners delay selling their BTC to take advantage of rising prices. This leads to a supply shock, where demand far exceeds supply, and BTC explodes.

Some investors think that BTC gains are tapped out, so they turn to alternatives. This drives price increases for alt coins, eventually Altcoin Season begins, and Bitcoin’s market dominance decreases as a series of competitor coins, like ETH, spike in value.

Eventually, the market overheats, and Bitcoin holders get cold feet and start to sell to avoid losses. This leads to panic, the market crashes as people try to take to profit, and crypto is plunged into a multi-year winter until the next halving.

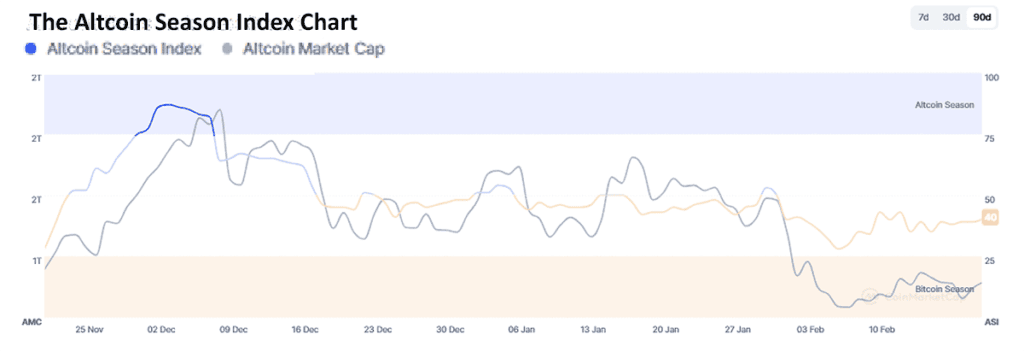

Typically, Altcoin Season begins 9–12 months after Bitcoin and has two key indicators: the Bitcoin Dominance Rate (BTDR) and Altcoin Market Cap (ALTCAP).

Normally at this point in the cycle we’d begin to see BTDR decrease and ALTCAP increase in anticipation of a bull run on altcoins. However, so far this has failed to materialize. While Bitcoin has hit new all-time highs, the total ALTCAP has failed to reach a new all-time high by 5%. In fact, it has sharply declined over the past few months and in February has actually dipped as low as US$1.24 trillion.

Instead, we’ve seen Altcoins briefly peak in December, before tumbling and stubbornly remaining below a US$2 trillion market cap. Additionally, BTDR has consistently grown since the halving on April 20, 2024. For context, at the same time after the halving in 2022, BTCD was at 42.5% — today it is 59%.

In short, it looks like Altcoin Season has either been delayed, or might not actually happen this time around. Unfortunately, historical data isn’t always applicable. There are two key resistance points. If the Bitcoin Dominance Rate dips below 60%, that might spark a reassurance for Altcoins like Ethereum (ETH), Ripple (XRP), or Solana (SOL).

If this resurgence can push the Altcoin market cap past the $1.2 trillion resistance point, that might be the spark needed to launch a true Altcoin Season. Unfortunately, the indicators are blurry, and we can’t use this data to draw any accurate conclusions from the general crypto market beyond. BTC is currently doing better than alt coins.

Since raw data can’t give us the whole picture, we need to zoom out a bit and look at the big trends impacting crypto in 2025. Some of these also affect the broader stock market, and could push crypto into a deep winter, or rocket it into a fresh bull run. Let’s start with the big one, geopolitics.

Let’s start with what’s happened so far, beginning with the infamous February 3, 2025 sell-off.[1] In just one day, US$400 billion in market cap was wiped off from the crypto market, and over 700,000 traders were liquidated to the tune of US$2.2 billion in a flash crash.

The spark was instability generated by President Trump’s announcement of new tariffs, which would place 25% imports on goods from Mexico and Canada, and 10% on goods from China.[2]

On February 24, 2025, this scenario played out again. President Trump stated that his planned tariffs will go forward, and risk assets like crypto reacted accordingly. The crash isn’t entirely due to tariffs, but rather a general feeling of instability caused by the administration’s policies.

Unfortunately this instability is likely to continue. Tariffs have sparked fears that prices in the US will increase as other nations impose their own retaliatory measures. Both the European Union and China have proposed reciprocal tariffs in response, and this could escalate to a full-blown trade war.[3] If this happens, risk assets like crypto will take a major hit, and it could plunge crypto into a deep winter.

The Key Takeaway: A deepening trade war is one of the biggest risk factors facing crypto today.

While President Trump’s foreign trade policy could undo crypto, his domestic policy could kick a bull season into high gear. When he was elected, there was a lot of hope in the crypto space that his administration would be pro-crypto, with some believing there would be day-one executive orders to build a Bitcoin strategic reserve.[4]

While those orders didn’t materialize, there are still a lot of signs that this administration is going to be significantly more pro-crypto than the Biden administration. Trump’s crypto czar, David Sacks, has previously stated that a crypto “golden age” is coming, with the goal of “ensuring American dominance in digital assets.”[5]

So far, Sacks has remained silent on the possibility of a Bitcoin reserve, but the plans we do know about already look positive. The administration has laid out plans to properly regulate digital assets, and ultimately provide clear guidelines for digital asset providers. This move could form the foundation of a truly legitimate crypto industry in the United States.

Additionally, Sacks has teased a new announcement. While we don’t know the details, it is likely that we think it will at least be crypto-friendly legislation, which could have a positive impact on pricing. If it is indeed a BTC reserve announcement, then demand for Bitcoin should skyrocket, which may eventually lead to a renewed Altcoin Season.

The Key Takeaway: Crypto-positive legislation in the US should have a big impact on price action globally, and BTC will likely be the early beneficiary.

Zooming in on the crypto market, there’s one major trend we need to talk about: meme coins. In many ways these can be compared to the NFT craze — they’re tokens that don’t have any intrinsic value, can be easily created, and are typically based on popular memes in order to gain traction.

These coins have been popularized by Pump.Fun, a platform built on the Solana (SOL) blockchain. The platform makes it possible for anyone to create a token by simply entering basic information like name, ticker symbol, description, and an optional image. The goal is to enable token creators to focus on building communities to drive value, rather than the technical aspects of creating a token.

These meme coins have been the source of big gains and eye-watering losses, and have been the primary driver behind SOL’s strong performance in this cycle. However, there has also been a lot of controversy surrounding them, including a few high profile rug pulls.

One of the most well-known examples is the Hawk Tuah coin, which immediately plummeted in value after its launch, leading to accusations of a scam from analysts like CoffeeZilla.

In general, I would recommend that most investors avoid meme coins. If you don’t understand the specific anatomy of this market, it’s easy to get caught out, even with legitimate projects.

For example, President Trump's Trump Coin (TRUMP) saw an initial massive spike in value, before dropping to below US$20, where it remains to this day. This is a pretty normal lifecycle for a meme coin, where insiders and early investors are able to sell their coins into early buying pressure, profiting at the expense of those who sell a little too late.

If you do want to invest in meme coins, you should spread your risk across as many projects as early as possible. Try to target coins that fit into the social media zeitgeist and set reasonable sell targets. Otherwise, you may find yourself holding a heavy bag.

Aside from investors’ ability to profit from these coins, they also pose a significant risk to the crypto market as a whole. High-profile pump and dump schemes can lead to sudden market corrections that impact BTC and other tokens that have nothing to do with the meme coin market.

The Key Takeaway: Meme coins pose a significant risk to the crypto market in general.

With those general factors out of the way, let’s look at some specific tokens, their performance, and what we can expect over the course of 2025.

Bitcoin has been the standout performer in this cycle so far. It has consistently outperformed alt coins, and BTC Dominance remains relatively high, hovering at around 60% of the total crypto market cap.

This means that maintaining a significant portion of your crypto portfolio in BTC is a safe bet in any crypto market, and in this one it is even beginning to look like the winning bet.

If the Trump Administration’s plans for a BTC reserve come to fruition, we should expect to see BTC reap most of the rewards. However, if BTC dominance begins to dip below the key 60% resistance point, you may consider increasing your holdings in Alts in anticipation of Altcoin Season. If that happens, it may make sense to begin slowly taking profits to avoid being caught in a flash crash.

My Strategy: Buy and Hold BTC with plans to diversify as BTCD decreases.

Longtime readers will know that I am a big believer in Ethereum (ETH). It was one of the first successful Altcoin projects, with ambitions to become a platform that other crypto projects can build upon. Unfortunately, the platform has been plagued by problems, and the switch to Proof of Stake (PoS) has not been the success story many hoped.

So far, Ethereum has failed to reach new highs, and has been underperforming against its rivals. This has gone against expectations that new Ethereum ETFs would increase liquidity. Instead, Ethereum usage has remained fairly static compared to rivals, and its price reflects that.

There are some analysts who believe that ETH’s lagging price is due to heavy shorting activity by hedge funds. There has been a 500% surge in the number of short positions, as hedge funds bet on Ethereum’s decline.[6]

These short bets are likely based on two key indicators. The first is that Ethereum’s usage, called on-chain activity, might be too static to facilitate a price resurgence. The second is the strong performance of Ethereum’s main competitors.

For example, Cardano (ADA) has seen a boost on the back of Greyscale applying for the first ADA ETF in the United States.[7] Solana has also consistently outperformed ETH this cycle, making some investors consider it a better bet.

With that said, there is one potential ray of light for ETH: a short squeeze. If ETH is able to overcome the key $3,000 resistance point, that might give it the energy it needs for a new bull run. With the huge number of short positions, this might lead to a supply squeeze, giving ETH a quick boost.

The catalyst for breaking the $3,000 barrier could be the Ethereum Foundation’s decision to put 45,000 ETH (US$117 million) into DeFi platforms, rather than selling it.[8] This move is designed to show that the organization has confidence in its own coin, and to address criticisms that its sales were hurting the ETH price.

Despite these concerns, I still believe that Ethereum is one of the strongest crypto projects out there, and its strong underlying technology will eventually translate into price increases.

My Strategy: Maintain most of my Ethereum holdings in anticipation of a short squeeze, while taking profits to diversify further into ADA and SOL.

XRP has been a surprise outperformer in this crypto cycle, and it has forced me to eat my hat. Ripple had been engaged in a brutal disagreement with the SEC since 2020, where the SEC accused the foundation of conducting a $1.3 billion unregistered securities offering.[9]

Given Ripple's focus on processing transactions, many commentators, myself included, believed this was a death sentence for the company and its blockchain.

Boy was I wrong.

Despite the SEC's best efforts, President Trump’s election marked the end of SEC Chair Gary Gensler’s tenure.[10] Gensler had been criticized for his anti-crypto stance and was one of the primary drivers behind the XRP lawsuit.

News of his departure sent XRP into a bull run, skyrocketing by 142% between the announcement on November 21 and December 2, where XRP’s price finally started to consolidate. This pushed the token into third place by market cap, where it remains to this day.

The future of Ripple continues to look bright. The SEC has recently taken the first step to approve Grayscale’s XRP ETF, which has seen the price of XRP jump once again.[11] This isn’t just because of the ETF, but because it’s a sign that XRP is likely to be able to operate without the Sword of Damocles hanging over its head. This will allow the organization to make inroads with institutional finance and should allow the price of XRP to continue to grow.

My Strategy: Slowly accumulate XRP with the intention of taking profit as the Altcoin market picks up.

Despite uncertainties, I think it is likely that we will see the beginnings of an Altcoin Season at some point in late February or Early March, with a caveat. The Trump Administration often announces tariffs as the opening barrage of a tough negotiation and then softens its stance as concessions are made.

If negotiations break down and a trade war ensues, the crypto market, and every other market, will suffer. This could be enough to trigger a new crypto winter, before Altcoin Season even gets kicked off.

With that said, I don’t believe that the Trump Administration, or anyone else, actually wants a trade war. While rhetoric might cause market instability, it is likely that a compromise will be found, preventing a complete collapse.

I also think that this administration's pro-crypto stance has the potential to support a particularly strong bull run, and I am planning my strategy accordingly: starting with BTC, before diversifying into a range of Altcoins, with a focus on Solana, ADA, and XRP.

As always, remember to do your own research, don’t invest money you can’t afford to lose, and decide what tokens are right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds BTC, ADA, ETH, XRP and other cryptocurrencies or cryptocurrency companies.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.ccn.com/news/crypto/crypto-liquidation-2025-donald-trump-trade-war/

[2]https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/

[3] https://www.politico.eu/article/eu-strategy-donald-trump-tariffs-trade/

[4]https://cryptoslate.com/trumps-pro-crypto-pledge-could-see-day-one-executive-orders-industry-players-hope/

[5] https://www.coindesk.com/policy/2025/02/04/trump-s-crypto-czar-sacks-says

[6] https://cointelegraph.com/news/ethereum-hedge-funds-short-bets-price-struggles

[7]https://cryptoslate.com/ada-outperforms-bitcoin-as-grayscale-seeks-approval-for-first-us-cardano-etf-in-sec-filing/

[8] https://www.cryptotimes.io/2025/02/13/ethereum-foundation-deploys-45000-eth-to-defi-platforms/

[9] https://www.sec.gov/newsroom/press-releases/2020-338

[10] https://www.sec.gov/newsroom/press-releases/2024-182

[11]https://finance.yahoo.com/news/grayscales-spot-xrp-etf-takes-215028266.html