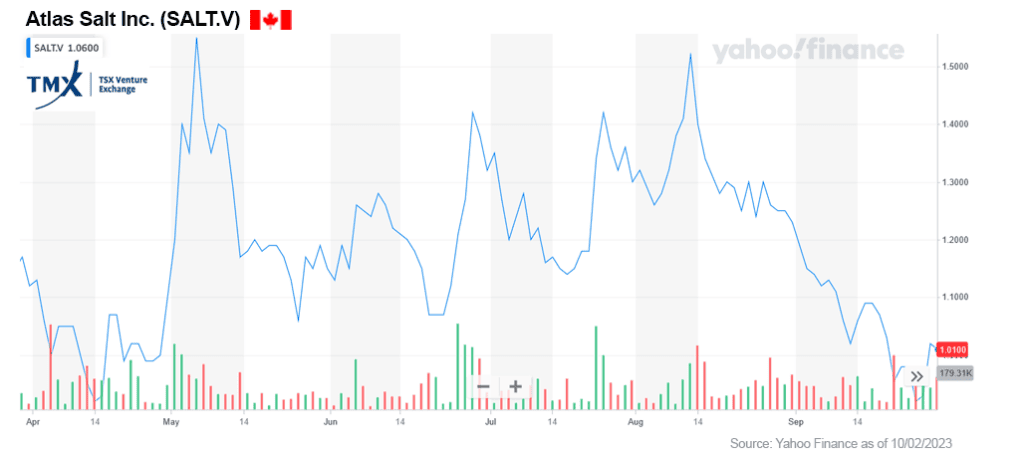

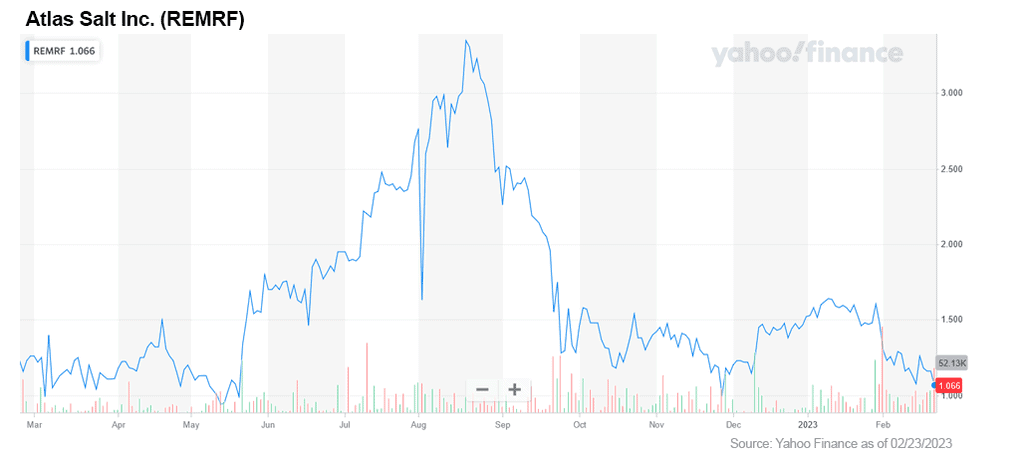

As a follow up to my original article Could Salt Become the Sexiest Opportunity of 2023? Atlas Salt May Have the Answer, I feel Atlas Salt (TSX-V: SALT / OTCQB: REMRF) is even more of a sexy opportunity today. Let me tell you why...

OVERVIEW & RECAP

In the US alone, approximately 25 million tons of salt are used as road salt at a cost of around ~US$58 per ton. Every year America imports a whopping 7–10 million tons of salt from Chile and North Africa.[7]

The advent of climate change has ushered in a troubling trend — increasingly severe winter storms, hurricanes, flooding and worldwide forest fires. This meteorological anomaly could become the new normal.

Let’s look at the existing landscape and aging infrastructure for developing a new potential salt mine — further exacerbated by the absence of anything newly constructed in North America for over two decades — creating a pressing concern... the inability to deliver a true domestic source for what is to become a highly valued commodity.

It looms as a stark reminder that the supply of road salt could dwindle, potentially triggering a surge in demand that warrants investor attention.

Located adjacent to a port connecting to vital waterways, Atlas Salt (TSX-V: SALT / OTCQB: REMRF) could emerge as an unsung hero, offering a sustainable solution to the eastern seaboard’s road salt needs for generations to come...

This invaluable resource promises to guide us through the treacherous terrain of severe winters and the evolving challenges of climate change.

Atlas Salt Reported Its Independent Feasibility Study That Delivers a Staggering $1 Billion Conservative Valuation and a Potential Higher Valuation of a Whopping $4 Billion

Highlights of the Feasibility Study conducted by SLR Consulting (Canada) Ltd. (SLR), a top recognized and respected firm, shows robust economics discussed based on 2.5 million tonnes-per-year production over a 34-year mine life:[8]

Pre-Tax Economics

Updated Mineral Resource Estimate

As Atlas Salt ramps into production, it is expected that production will be increased. SLR has also provided an expansion case to 4.0 million tonnes per year (Mtpa) of road deicing salt over a 47.5-year mine life presented at a Preliminary Economic Assessment (PEA) level analysis. This demonstrates a robust upside production scenario with a pre-tax net present value (NPV) at 8% of CAD$2.015 billion and a pre-tax IRR of 28%. Net NPV of 5% would equate to $4.095 billion.[11]

“...the first thing we have to do once this (new management) team has been assembled, and we have actually started already, is the environmental assessment. We are excited. We have momentum built with this FS [Feasibility Study]. The management team we are going to be bringing in are going to be impressive. I believe they’re going to get us where we want to go.”[12]

— Atlas Salt CEO Rick LaBelle

What a potential golden goose for Atlas Salt shareholders. Yes, this project will take a few years to be in production but with only a direct capital cost for putting this project into production of over CAD$300,000,000, the payback is 4.2 years after commencement of production.[13]

This is the advantage of a ‘shallow deposit’ that Atlas’ Great Atlantic holds which can be obtained by decline ramps versus vertical shafts that Compass’ Goderich mine utilizes.

In the ever-evolving landscape of corporate leadership, few transitions have garnered as much attention and intrigue recently as the appointment of Rick LaBelle as the new CEO of Atlas Salt (TSX-V: SALT / OTCQB: REMRF).

In a decisive move that took many months of searching, the company's board of directors ushered in a new era of innovation, growth, and success. Now, as the dust settles and Atlas Salt steers confidently into salt waters (no pun-intended), we explore why this is the perfect moment for investors to consider placing their bets on this industry stalwart.

Rick LaBelle's ascent to the position of CEO came as no surprise to those who have closely followed his remarkable career. With a track record marked by astute strategic planning and dynamic leadership, LaBelle is poised to lead Atlas Salt to new heights.

His commitment to driving innovation and his passion for sustainability align perfectly with the company's core values. This synergy of purpose has infused the organization with fresh energy and a clear vision for the future.

Mr. LaBelle commented, “I’m delighted to join Atlas Salt. It’s a privilege and a rare opportunity in the mining sector to be involved with such a top tier asset as Great Atlantic with the potential to produce profitability for generations, creating a legacy of accomplishment. I’m quickly going to assemble a world class team to advance this tier 1 asset, which will very soon be anchored by an independent Feasibility Study. I have a record of unlocking shareholder value, a key part of my strategy with Atlas Salt.”[14]

Mr. Rowland Howe, Atlas President, stated, “In my three decades in the salt sector, I’ve never seen an opportunity as exciting as this. Rick is the perfect fit and I’m thrilled to be able to work alongside him and the team he’s going to build. He’s a fourth-generation underground miner who has been involved in one way or another with just about every underground mine in Canada. The skills he learned in private equity, and the network he built, can be leveraged very effectively in the salt sector which has so much private equity involvement. He’s a gifted strategist and deal maker.”[15]

I wholeheartedly concur with Mr. Howe’s assertion, for it is deserving we acknowledge the remarkable vision of (former CEO) Patrick Laracy. His discerning foresight recognized the untapped potential inherent in this salt asset, and he executed a well thought out plan.

Moreover, Mr. Laracy demonstrated exceptional acumen by assembling a cadre of indispensable talents including Mr. LaBelle and Mr. Howe at precisely the right juncture. Equally impressive was his judicious decision to relinquish the role of CEO at the opportune moment.

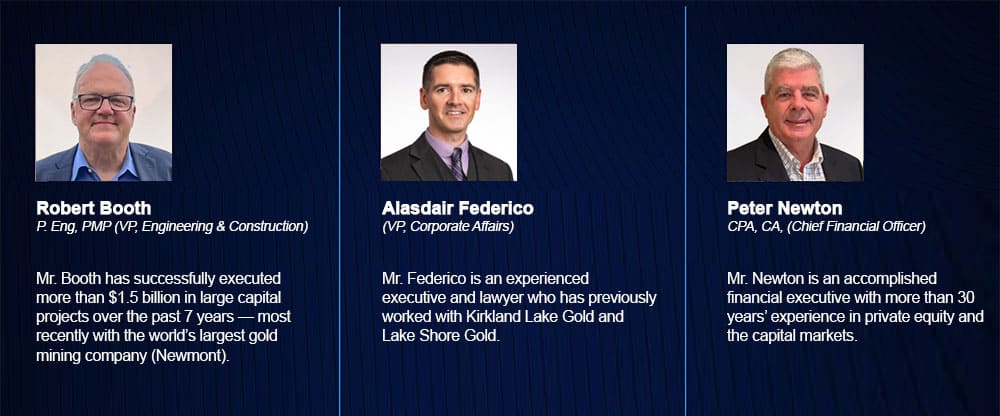

Mr. LaBelle has assembled an all-star team including...[16]

In my opinion, the stock has further been de-risked. Not only does Atlas Salt have a strong management team, Mr. LaBelle has made some key additions to the already impressive management team that could further solidify the company as what I am calling ‘a sexy investment.’

This anticipated upside could be due to LaBelle’s experience in putting all the pieces together, positioning the project for production, or he may well choose to orchestrate a possible takeover of this invaluable asset.

Mr. LaBelle stated that he has been involved in some way with nearly every underground mine in Canada either through drilling / exploration / new discoveries, through mine building, or selling of products.

He brings in a vast array of experience and contacts that could only benefit Atlas Salt and its shareholders:

If you recall the timeless fable of "The Tortoise and the Hare," it was an enduring reminder that it is often the steadfast and methodical who ultimately triumph.

In summation, Atlas Salt (TSX-V: SALT / OTCQB: REMRF) finds itself amidst a profound metamorphosis, guided by the dynamic stewardship of Rick LaBelle.

With a resolute dedication to sustainability, a culture of relentless innovation, a global outlook, and the assurance of a proven leader at the helm, the company stands poised not only for growth but also for resounding success.

For discerning investors in search of a steadfast and visionary investment prospect, this could be an opportune moment to delve into the world of Atlas Salt.

The horizon gleams with promise, and those astute enough to explore the potential of Atlas Salt stand on the precipice of reaping the abundant rewards that await on this exhilarating voyage.

As I gaze into the future, envisioning the company’s trajectory over the next 2–5 years, I see nothing but brilliance. Once more, I am reminded that in the grand scheme of things, it is the patient and unwavering commitment that prevails — as underscored by the timeless moral of "The Tortoise and the Hare" fable... slow and steady wins the race.

And now you can see why I still believe that ‘SALT is absolutely Sexy!’

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Atlas Salt Inc. is a Junior Gold Report (operated by Kal Kotecha) portfolio holding. Junior Gold Report/Kal Kotecha is a consultant for Atlas Salt and is being compensated by Atlas via share options. This relationship with Atlas Salt Inc. may be deemed a potential conflict of interest by some investors. Dr. Kal Kotecha and Junior Gold Report own shares in TSX-V: SALT and may buy and sell at any time.

[1] Fairfield Market Research https://www.fairfieldmarketresearch.com/report/rock-salt-market

[2] Video: A Journey Into the Incredible Story of Atlas Salt That Investors Won't Want to Miss https://www.youtube.com/watch?v=3DrVVleYp4M

[3] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[4] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[5] Atlas Salt Corporate Presentation https://atlassalt.com/investors/

[6] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[7] Atlas Salt Corporate Presentation https://atlassalt.com/investors/

[8] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[9] Ibid.

[10] Ibid.

[11] Ibid.

[12] Atlas Salt | PRmediaNow Interview with Rick LaBelle, CEO, Atlas Salt Corp https://www.youtube.com/watch?v=SNOdVL4d-Nc

[13] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[14] Atlas Appoints Rick LaBelle as New CEO https://atlassalt.com/atlas-appoints-rick-labelle-as-new-ceo/

[15] Ibid.

[16] Atlas Unveils Great Atlantic Salt Project Build Team https://atlassalt.com/atlas-unveils-great-atlantic-salt-project-build-team/

[17] Atlas Appoints Rick LaBelle as New CEO https://atlassalt.com/atlas-appoints-rick-labelle-as-new-ceo/

[18] Ibid.

[19] Atlas Salt | PRmediaNow Interview with Rick LaBelle, CEO, Atlas Salt Corp. https://www.youtube.com/watch?v=wxG8qlY3qqQ

[20] Atlas Unveils Great Atlantic Salt Project Build Team https://atlassalt.com/atlas-unveils-great-atlantic-salt-project-build-team/

[21] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

[22] Atlas Salts Financial Statements https://atlassalt.com/financialstatements/FS_Q2_2023.pdf

[23] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[24] Near-Term Catalysts & Top 10 Reasons Atlas Brings the Power of SALT to Investors! https://atlassalt.com/scorecard/

[25] Atlas Salt and Triple Point Announce Closing of Triple Point Spin-out https://www.cbj.ca/atlas-salt-and-triple-point-announce-closing-of-triple-point-spin-out/

[26] Independent Feasibility Study and Expansion Case for Atlas Salts Great Atlantic Project https://atlassalt.com/independent-feasibility-study-and-expansion-case-for-atlas-salts-great-atlantic-project/

When I think of salt, the last word I think of is ‘sexy.’ It’s that mundane, everyday white stuff that you shake out of a shaker onto your dinner plate or that is spread on winter roads to try to keep your vehicle from sliding all over the place. Salt has been known for being practical but not exactly sexy.

Now what if I were to say a ‘shiny red Ferrari?’ You would probably think ‘sexy but not practical.’

So why am I writing an article about salt? One simple reason... I have come across a company that shakes up the initial perception of salt being categorized as mundane — to a transformative sexy Ferrari of an opportunity — practicality also included.

The company I am referring to is Atlas Salt (TSX-V: SALT / OTCQB: REMRF) based in Newfoundland and Labrador (NL) in Canada.

I will admit that when I first heard of Atlas Salt, I wasn’t that intrigued — yet. At that time, Atlas (formerly known as Red Moon Resources) was trading at about a dime. I was not yet convinced that this was something that might present the type of outstanding opportunity that I am always seeking to inform my readers about.

I am the first one to admit that once I looked into it further, I found some extremely remarkable information about the company, the product, and the management team. That’s when I started buying shares in the $1+/share range.

I do sometimes kick myself for not getting into this stock in the early stages, but you can’t dance with every beautiful woman that you see. But I at least am dancing now and, in my opinion, the best dance — doing the tango — is yet to come for SALT!

Here’s what initially happened to change my mind. I met the key players of Atlas Salt: Patrick Laracy, CEO & Director, and Rowland Howe, President & Director. To say I was impressed is an understatement.

Laracy, the founder of the company, has over 30 years of domestic and international experience in the petroleum and mineral exploration business in various capacities.

Howe started his mining career in the coal mines of Northern England, moving onto salt mining and eventually being offered a management position in the Goderich Salt Mine in Ontario operated by Sifto Salt under Compass Minerals (NYSE: CMP). In his 16 years of management on the site, he developed the Goderich mine into the largest underground salt mine in the world.[4]

When I met Laracy and Howe, I was struck by their down-to-earth attitudes along with the strong enthusiasm they both shared for the company and the product. To me, those are always contributing factors to the success of any company. Of course, other factors that come into play deal with asset or mining location, product uses, and market need, and I feel SALT checks all the boxes.

When Laracy and Howe invited me to Newfoundland (Canada) to see first-hand what the company was about, I immediately jumped at the chance.

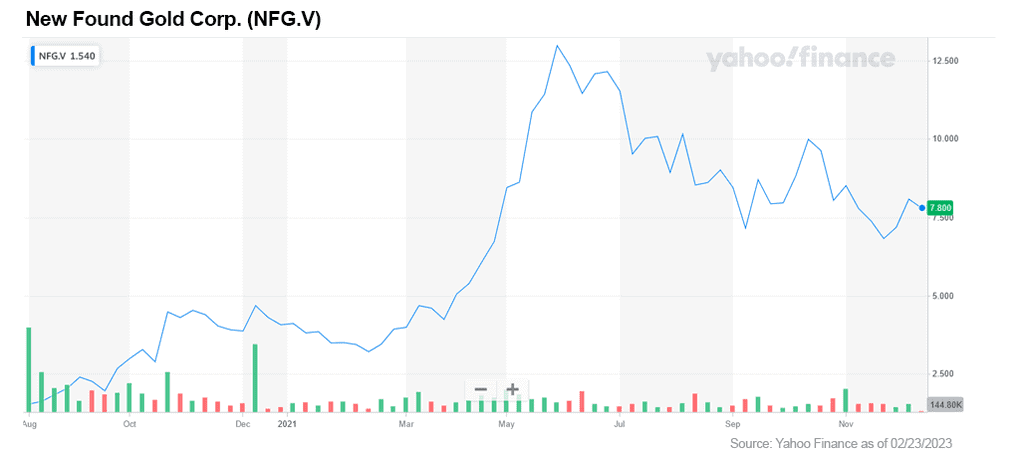

Before I go into the amazing experience I had in Newfoundland and why I became more and more excited about this incredible investment opportunity, I need to mention that the team has been strengthened by the addition of John Anderson as Director.

As the founder of multiple start-up companies and a former director of Newfoundland-based New Found Gold (TSX-V: NFG), Anderson has 25 years of successful corporate and financial capital market experience. He is currently President of Purplefish Capital Management Ltd., a private investment company focused on the resource sector.[5]

Now I want to talk a bit about the history of the company and the factors I mentioned above.

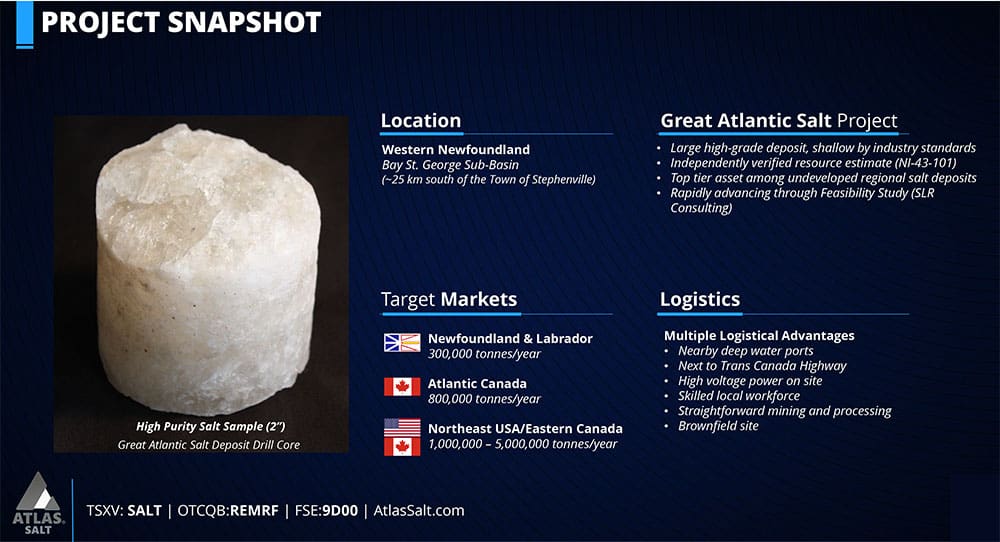

Atlas Salt was founded in 2011 as Red Moon Resources. It claims 100% ownership of the Great Atlantic Salt Project in Western NL.[6]

The location presents a superb advantage of having direct access to Turf Point, an ocean-going vessel-loading facility only 2 km away. Turf Point is located on St. George’s Bay, a sub-basin of the Gulf of St. Lawrence which flows into the Atlantic Ocean. The salt mined can be loaded directly from the tunnel’s conveyor belts onto the ship, ready for transport to other ports in North America and beyond. Talk about convenience!

Newfoundland has a long history of mining. Many of the residents of this beautiful province have depended on mining for their livelihood. As such, the industry is one of pride and one that is very well respected. Other industries which have played a huge part in the economy of this beautiful province are fishing and lumber. However, in recent years there has been a decline in these industries. Atlas could be well-positioned to breathe economic positivity into the province.

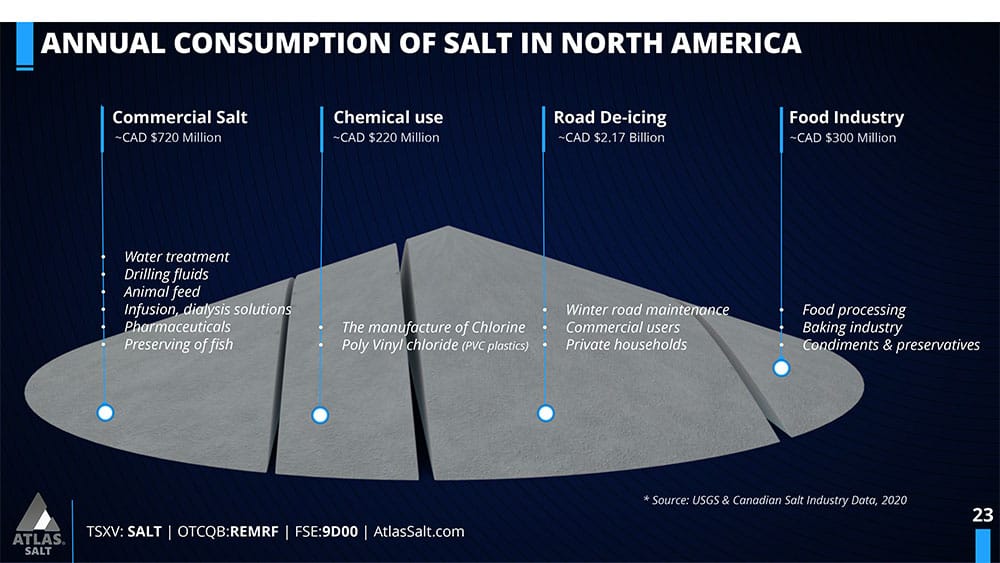

Let’s look beyond the salt shaker… you will quickly realize what a valuable commodity salt is. If you live anywhere that possesses a winter full of ice and snow, you know the remarkable value of salt in ensuring safety from slippery roads and sidewalks.

In the US alone, approximately 25 million tons of salt are used as road salt at a cost of around ~US$58 per ton. Every year America imports a whopping 7–10 million tons of salt from Chile and North Africa.[7]

Atlas is ideally & strategically located to deal with the US market. As the US could face potential supply insecurity or other issues such as difficult logistics and/or escalating shipping costs from the current markets they use, the logical conclusion would be to turn to a closer source or supplier.

Salt sourced from Canada is not only convenient but dramatically reduces shipping costs at a time when fuel prices are soaring. As Atlas Salt ramps up its environmentally friendly operations, there could be growing attention from a vast US market.

The Newfoundland market for road salt is also impressive — especially for a local province with a population of just slightly over 500,000. As per Howe, the province uses about 300,000 tonnes a year of road salt. At approximately CDN$70 per/tonne, that has the potential of $21 million in revenue just in Newfoundland. Add a few more provinces across Canada into the mix and you can see how total sales could quickly ramp up. Now if you really want to get excited, the global market for salt was valued at over US$29 billion in 2021 with a production of 290 million metric tonnes.[8]

Following my trip to Newfoundland, Atlas Salt produced a fascinating video that examines the process and the potential opportunity —The Story Behind Atlas Salt: A Journey Into the Incredible Story of Atlas Salt That Investors Won’t Want to Miss. You can watch this informative video below:

The fact that the Great Atlantic deposit is so close to major waterways provides the opportunity for ship transport to the markets that need salt for winter. It is also close to the Stephenville Airport and to the Trans-Canada Highway — a perfect logistic situation.

According to Howe in the video, the Great Atlantic deposit is the largest homogeneous salt deposit in North America. He also feels that because the project’s design is scalable, they will be able to ramp up production to perhaps 4–6 million tonnes a year.

Currently in North America, the salt market is CDN$3.14 billion a year with a deficit of 7–10 million tonnes according to the video. You don’t have to be a genius to imagine what can happen to the value of the company if Atlas can bridge or come close to bridging that gap. That doesn’t take into account any other markets that may have potential for development such as Europe.

Also according to the video, there really is no other point of comparison to Atlas Salt’s Greater Atlantic project in Canada except for the Goderich mine. Let’s look at the similarities and differences between the two.

As I mentioned earlier, under Howe’s management, Goderich became the largest underground salt mine in the world. In the video Howe refers to the Goderich mine as being like the ‘Gold Standard’ of salt. He refers to the Great Atlantic Salt Deposit as being the next Goderich. Did that pique your interest? It definitely did mine. The similarities include:

Mr. Rowland Howe, Atlas President, commented: “In my 30+ years in this industry I have not come across a salt project as unique as Great Atlantic given its combination of size, shallowness, and logistical advantages. This robust PEA confirms our vision for the project.”

Mr. Howe added, “Even assuming a conservative flat production rate at 2.5 million tonnes over only 30 years, the cash flow model provides a base case evaluation that is quite compelling. Significant additional value can be attributed to the project given that mine infrastructure is designed for up to 4 million tonnes production with ample resources to extend production beyond 30 years. Future additional infrastructure could push annual production even higher. Long life cash flow comes at a premium.”[9]

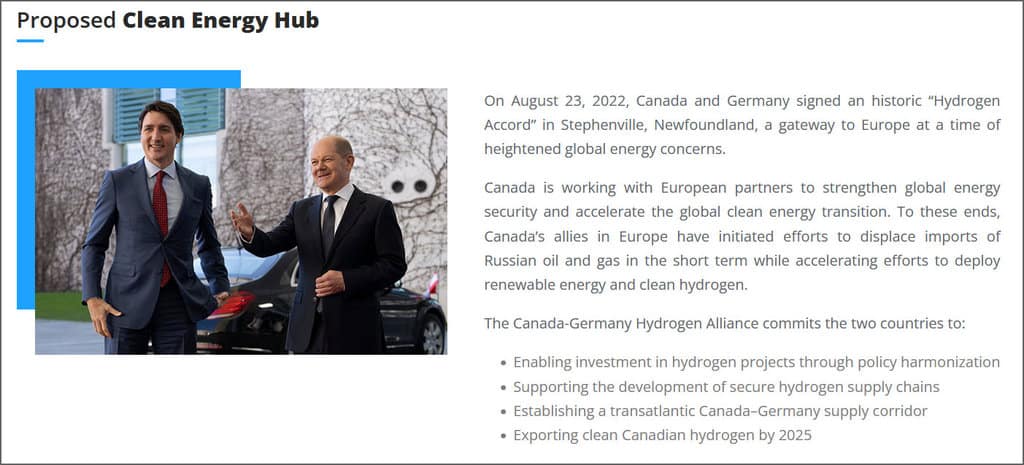

A second and fascinating project that may prove to be an incredible bonus to Atlas shareholders is the Fischell’s Brook Salt Dome ‘Clean Energy Hub’ located 15 km south of the Great Atlantic deposit along the Bay St. George Basin.[10]

The Fischell’s Brook Salt Dome is comprised of a large salt dome that covers an area exceeding 5 sq km, and has the potential for underground storage of fluids and or gas depending on the pressure limits the dome or cavern can provide.[11] According to a gravity survey, there is potential for a second dome a few of kilometers east of the area.[12]

What’s the potential for Fischell’s Brook? With the world finally waking up to the effects of climate change resulting in a global movement towards clean energy and net zero emissions by 2050, salt, as a naturally occurring phenomena, is starting to earn its place in the spotlight.

Salt as a means of storing renewable energy started in Europe and the trend is making its way to North America. It appears we are in the beginning stages of an opportunity that I think could become quite substantial.

Atlas Salt was awarded the mineral rights to Fischell’s Brook by the Government of Newfoundland in 2019.[13]

In June 2022, Atlas announced the spinout of the Salt Dome Property and the transfer of mineral licenses comprising 226 sq. km to Triple Point Resources Ltd, a subsidiary of the company.[14] According to The Canadian Business Journal, as part of the arrangement, Atlas Salt distributed 23,750,000 common shares of Triple Point that it received under the arrangement to holders of common shares of Atlas Salt on a pro rata basis, such that Atlas Salt shareholders as of 12:01 am on the Record Date received one share of Triple Point for every 3.68 shares owned of Atlas.[15]

Atlas is Triple Point’s largest single investor with 27.5 million shares. Salt domes have multiple uses and are now being increasingly targeted for storing hydrogen safely and efficiently underground.[16]

From 1968 to 1998, six diamond drill holes, totalling 4,820 metres, are reported to have been completed at Fischell’s Brook by four different operators including Hooker (1968), Amax Exploration Ltd. (1976), Pronto Exploration Ltd. (1980), Canadian Nickel Company Ltd. (Inco) (1987) and Leeson Resources Inc. (1998). The holes drilled vertically had depths between 358 and 1,099 metres, averaging 803 meters. Four of the six drill holes ended in the Basal Halite Member, with end-of-hole depths ranging from 642 to 1,099 metres.[17]

Triple Point Resources, formed from the spinout of Atlas Salt, will have its own management team consisting of members holding expertise in underground storage, wind energy and the hydrogen space. Endowed with wind resources that have yet to be exploited combined with potential storage, the use of green energy for the production of hydrogen, and the global push present and increasing for green energy, I feel that this could greatly enhance shareholder value.

Now a bit on the hydrogen market. The Government of Canada conducted a study that predicted the global market for hydrogen could reach CDN$11 trillion within 30 years. European governments are also backing hydrogen production.[18]

Newfoundland is purported to have the best potential for hydrogen development and storage due to the abundance of its natural resources, which are, in fact, considered to present greater hydrogen production than even the other Canadian Atlantic Provinces. With the potential for, at this time, two domes, Atlas could be well poised to become a major player in the hydrogen storage market.[19]

At this point, salt domes are already becoming more popular in Europe, a sentiment that is spreading throughout North America. While Fischell’s Brook would of course, face some competition, the location of the main dome, not to mention the second dome, presents a great advantage.

As a stunning indication of this potential, on August 23, 2022, it was announced that Canada and Germany signed a hydrogen pact which is essentially a long-term agreement for the production and transport of hydrogen from Canada to Germany. The signing took place in the presence of Prime Minister Justin Trudeau and German Chancellor Olaf Scholz in Stephenville, Newfoundland.

The event significantly impacted the number of global eyes that are now focusing on this geographical region. This historic pact is set to kick-start a transatlantic supply chain. First deliveries are expected to commence in 2025. German Economics Minister Robert Habeck termed the agreement a milestone as green hydrogen is key to a climate-neutral environment.[20] And this, in my opinion, is just the beginning.

With all this being said, Atlas Salt (TSX-V: SALT / OTCQB: REMRF) could be a natural takeover target for companies both in the salt space and from companies looking for yearly returns on their investment. I am excited for SALT’s future!

1. Atlas Salt has strong and experienced leadership.

2. There have been no new salt mines developed in North America in the past 20 years.[21]

3. The current deficit of salt supply could lead buyers to seek a company like Atlas that should be able to deliver.

4. Atlas is strategically located for quick, cost-efficient delivery to multiple markets within the United States and Canada. With the management team poised to prove out the Great Atlantic Salt Project, and the US facing possible shortages from more distant suppliers, the market for road salt alone could lead to potentially massive growth.

5. With green energy initiatives coming more and more into play, Atlas is poised to potentially become significant in the Hydrogen Storage Market via its spin-off of Fischell’s Brook.

6. Atlas Salt just completed its Great Atlantic Mineral Resource Estimate report (better defined as its Preliminary Economic Assessment or PEA). The published numbers look very good. This includes a pre-tax internal rate of return (IRR) of +22%.[22]

7. The company could become a potential take-out target. Atlas has entered discussions with interested suitors and parties. With an independent Preliminary Economic Assessment (PEA) on its assets held now in hand, management expects these discussions only to accelerate.[23]

8. SALT has only 92.6 million shares outstanding, dominated by strong retail investors, management and close associates, while strategic long-term investor Vulcan Minerals (TSX-V: VUL) owns about 32% of the company. A warrant overhang in SALT was removed during 2022. SALT has been one of the top performing resource stocks in Canada over the past two years and Atlas was selected as a 2022 Venture 50™ winner.[24]

9. Atlas is in a strong financial position with approximately $18 million in cash and no debt, thanks to a series of increasingly higher-priced private placements with strategic investors since 2021 and the exercise of almost all of the company’s warrants. Atlas is also the largest shareholder in Triple Point Resources.[25]

10. Great Atlantic would feature environmentally friendly straightforward processing, operating very much like a “Salt Factory” with the potential to be carbon net-neutral. Unlike traditional metal deposits, no chemical processing is involved with an underground salt mine and practically all “ore” is shipped directly to market. New technology such as “continuous miners” cut the salt underground (no drilling or blasting). It is then screened to get it to the right particle size before being dropped onto a conveyor belt that brings it to surface. Processed salt is then delivered to the nearby port by conveyor. Replacing overseas imports with Great Atlantic production aids in the battle to reduce global carbon emissions.[26]

So, now you can see why I am convinced Atlas Salt (TSX-V: SALT / OTCQB: REMRF) is on top of my list of companies to continue to watch and personally invest in.

And that’s why I now believe that ‘SALT is absolutely Sexy!’

Kal Kotecha, PhD

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

DISCLOSURE: Atlas Salt Inc. is a Junior Gold Report (operated by Kal Kotecha) portfolio holding. Junior Gold Report/Kal Kotecha is a consultant for Atlas Salt and is being compensated by Atlas via share options. This relationship with Atlas Salt Inc. may be deemed a potential conflict of interest by some investors. Dr. Kal Kotecha and Junior Gold Report own shares in TSX-V: SALT and may buy and sell at any time.

[1] Video: A Journey Into The Incredible Story of Atlas Salt That Investors Won't Want to Miss https://www.youtube.com/watch?v=3DrVVleYp4M

[2] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[3] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[4] Atlas Salt: Company Overview https://atlassalt.com/about-us/

[5] Atlas Salt: Our Team https://atlassalt.com/team/

[6] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[7] Atlas Salt Corporate Presentation https://atlassalt.com/investors/

[8] M. Shahbandeh: Statista (Sept 1, 2022): Salt Industry Worldwide – Statistics & Facts: https://www.statista.com/topics/5939/salt-industry-worldwide/

[9] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[10] Atlas Salt Tweet https://twitter.com/AtlasSalt/status/1562440082321129477

[11] The Power of Salt: MarketSmart Commentary by Corner by Lemuel Daher https://mailchi.mp/405fc5704571/the-power-of-salt

[12] Atlas Salt (June 3, 2022): Gravity Survey Unveils Second Potential Salt Dome in SALT’S Bay St. George District: https://atlassalt.com/gravity-survey-unveils-second-potential-salt-dome-in-salts-bay-st-george-district/

[13] Atlas Salt: https://atlassalt.com/renewable-energy-storage/

[14] Atlas Salt (June 30, 2022): Atlas Salt Prepares for Planned Spin-out of “Triple Point Resources Ltd.” https://atlassalt.com/atlas-salt-prepares-for-planned-spin-out-of-triple-point-resources-ltd/

[15] Near-Term Catalysts & Top 10 Reasons Atlas Brings The Power of SALT to Investors! https://atlassalt.com/scorecard/

[16] Atlas Salt and Triple Point Announce Closing of Triple Point Spin-out https://www.cbj.ca/atlas-salt-and-triple-point-announce-closing-of-triple-point-spin-out/

[17] Atlas Salt: https://atlassalt.com/fischells-brook-salt-unit-interpreted-to-extend-to-depth-of-2400-metres/

[18] Federal investment advances Alberta’s hydrogen economy https://www.canada.ca/en/prairies-economic-development/news/2021/11/federal-investment-advances-albertas-hydrogen-economy.html

[19] Atlas Salt: https://atlassalt.com/renewable-energy-storage/

[20] Energy Central News (August 29, 2022) Germany: Hydrogen alliance with Canada https://energycentral.com/news/germany-hydrogen-alliance-canada

[21] Atlas Salt: A Rare Opportunity https://seekingalpha.com/article/4554706-atlas-salt-rare-opportunity

[22] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[23] Independent Preliminary Economic Assessment for Atlas Salt’s Great Atlantic Project Supports State-of-the-Art “Salt Factory” Vision (January 23, 2023) https://atlassalt.com/independent-preliminary-economic-assessment-for-atlas-salts-great-atlantic-project-supports-state-of-the-art-salt-factory-vision/

[24] Near-Term Catalysts & Top 10 Reasons Atlas Brings The Power of SALT to Investors! https://atlassalt.com/scorecard/

[25] Near-Term Catalysts & Top 10 Reasons Atlas Brings The Power of SALT to Investors! https://atlassalt.com/scorecard/

[26] Near-Term Catalysts & Top 10 Reasons Atlas Brings The Power of SALT to Investors! https://atlassalt.com/scorecard/