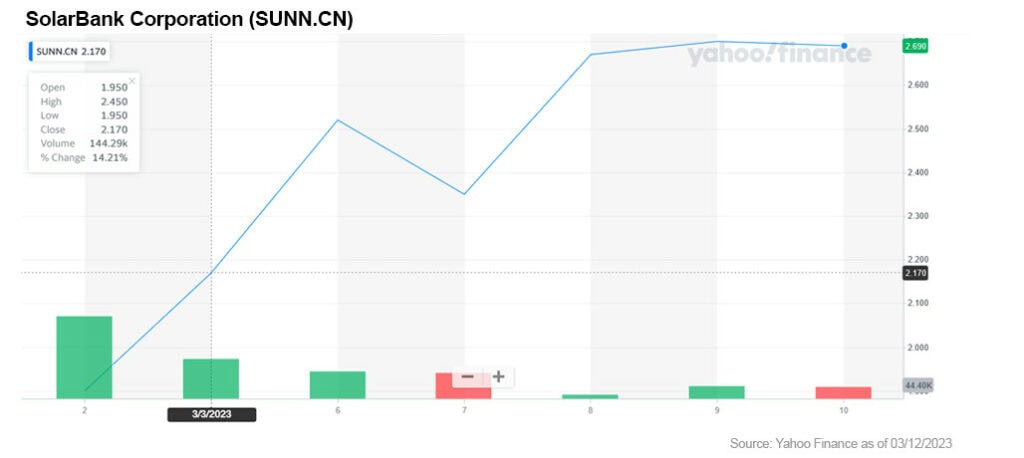

Editor’s Note: On April 8, 2024, SolarBank Corp. moved to the NASDAQ market with the new symbol NASDAQ: SUUN

If you are anything like me, you read the words “ESG,” “carbon offsetting,” or “green tech” and are immediately skeptical. There are countless projects that claim to be solving the biggest challenge of the modern world… climate change, but once you dig deeper most turn out to be little more than smoke and mirrors.

Despite this, I have been doggedly searching for a green tech stock worthy of bringing to your attention, and I have finally stumbled upon something really special. If you're looking for a stock that has the following...

…then I think I’ve found your perfect pick.

Let's start by diving into why I ended up becoming so obsessed with the topic of Green Tech stocks, most specifically Smart Energy stocks, and view them as the next big untapped opportunity. It all comes down to a combination of momentum, environmental factors (some pun intended), and timing.

Before I get going, I want to get one thing out of the way... our opinions on the potential scale of climate change, the causes of climate change, and the urgency to act don’t really matter.

Governments and businesses globally have come to the collective decision that they need to do something to combat climate change. This means that there are very real opportunities for innovative companies — and their investors — to make money by helping to solve climate change-based challenges.

These challenges range from the renewable energy transition, which promises to fundamentally alter how we generate power, to finding more efficient ways to use brownfield sites, which may be complicated by the presence of hazardous substances, pollutants or contaminants.

We have to address these challenges if we want to keep the pristine forests and wetlands necessary for carbon capture intact.

From an economic perspective, combating climate change will impact every aspect of the way we do business and most aspects of our lives. The question is, how do we do it without giving up on the progress of the past century and the convenience we enjoy every day?

To understand the scale, let’s start by talking about money, specifically with the astronomical costs. New studies have shown that extreme weather events have caused $2.8 trillion in damage between 2000 and 2019.[2] Air pollution from fossil fuels caused 6.4 million premature deaths and cost a staggering $8.1 trillion in health damages, or around 6.1% of global GDP.[3]

In terms of business, rapidly rising global temperatures could reduce agricultural yield by a devastating -30% by 2050 if nothing is done.[4] Resolving these challenges will require real investment to the tune of around $6.9 trillion global spend annually until 2030.[5]

So what does this mean for you as an investor? All of these factors have spurred business and governments into action, creating an opportunity for the right companies to thrive. The tricky part is identifying the factors of this new environment and how you can use them to identify what opportunities you should jump on and which will stumble at the first opportunity.

Let’s start by looking at one of the big momentum points: the race to net zero. This is particularly important for the image of companies that very much need to stay on the consumer’s good side, and those consumers typically want to see action as well as words.

These concerns have spurred many major organizations to make their own net-zero promises. This typically involves reducing emissions where possible by, for example, better insulating buildings or greening their supply chains. However, every business will have some emissions that can’t be reduced, and that’s where they turn to carbon offsets.

Carbon offsetting is a practice of paying someone else to sequester carbon, usually by planting or retaining forests or wetlands, in order to offset your own emissions. This approach has been embraced by companies and consumers alike, but many existing carbon offsetting problems have significant issues. For example, a study found that 90% of all rain forest carbon offsets were worthless.[6]

This is largely down to poor controls over the landholders supposedly protecting or planting trees. This means that companies will soon be forced to find better ways to offset, preferably using properties that they can control.

The Takeaway: Any company that can actually offset emissions, and prove it has done it, is onto something.

Despite consistent opposition from oil & gas companies, and relatively lackluster government subsidies, renewables are finally getting their moment in the sun.

Renewable energy, and in particular solar, has become increasingly efficient to the point where it is a staggering 5,000 times cheaper to produce than it was in 1958.[7]

This means that despite government subsidies for fossil fuel projects, renewable energy is beginning to make market sense, and as gas infrastructure comes due for renewal, we should begin to see a major uptick in the number of major solar projects.

Now, as with everything, there is a caveat. Renewable energy still isn’t great at base load, but battery technology is increasingly becoming able to handle this problem, and that’s something we’re going to get into as well.

The takeaway: Renewable energy is coming, and companies that are involved in the first stage of the transformation will gain a leading edge, particularly if they can control the infrastructure itself.

The final major ingredient is very much ESG (environmental / social / governance) focused. The troubles with carbon offsetting, combined with significantly more aware consumers, means that companies need better ways to run their ESG programs.

There are plenty of agencies that offer ESG guidance and consulting, but in many cases it amounts to more smoke and mirrors. Any company that can build a way to create actual carbon reduction programs that work with provable results has a very attractive service on their hands.

The takeaway: It’s always about the optics! Companies don’t want to do good just because they can; they need a way to tell everyone about it. Any green stock that offers them that opportunity is setting itself up for success.

These factors give us a useful bar by which to judge a green tech stock worth looking at. Specifically, we’re looking for something that I would call a “Smart Energy” stock. This is a company that is able to integrate a variety of renewable energy solutions together and use them to cleverly meet energy demand while decarbonizing the energy grid. This is no small feat and takes strength, skill and determination.

If they are able to use novel technologies to help solve carbon offsetting challenges while providing companies with a more effective ESG strategy, then you might just be looking at the holy grail that won’t just outcompete other stocks in the green technology category, but could become a giant in its own right.

Think Tesla Inc. (NASDAQ: TSLA) but before that disastrous Q3 earnings call.

After a great deal of searching, I firmly believe that I’ve found a company that will not just begin the smart energy revolution, but become synonymous with it: SolarBank Corporation (NASDAQ: SUUN / Cboe: SUNN).

This isn’t the first time that SolarBank (NASDAQ: SUUN/ Cboe: SUNN) has come up on FNN. My colleague MF Williams highlighted the stock back in March as one of his wildcard picks, and I think that the picture today is stronger than ever for SolarBank.

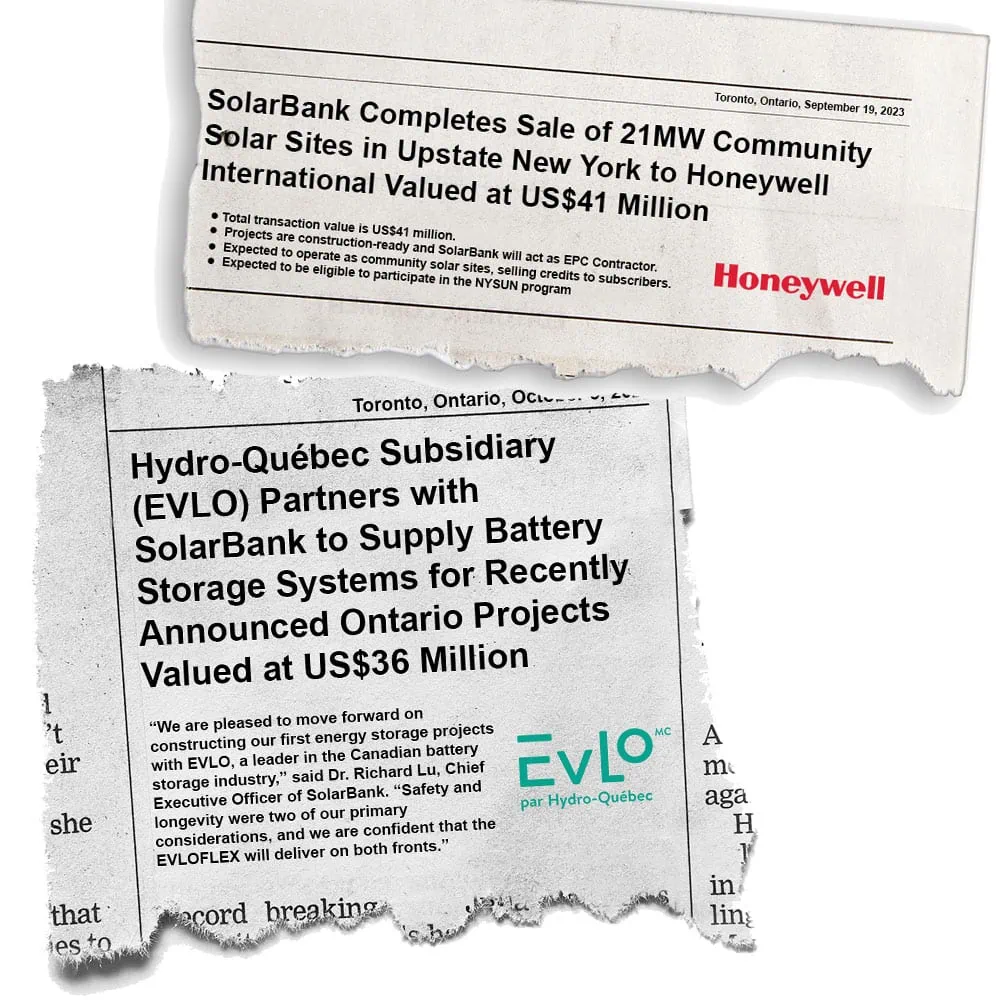

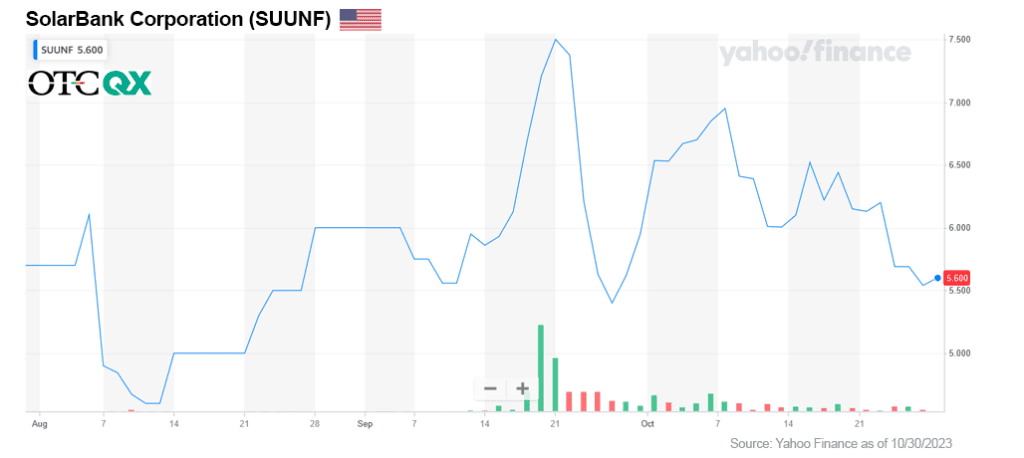

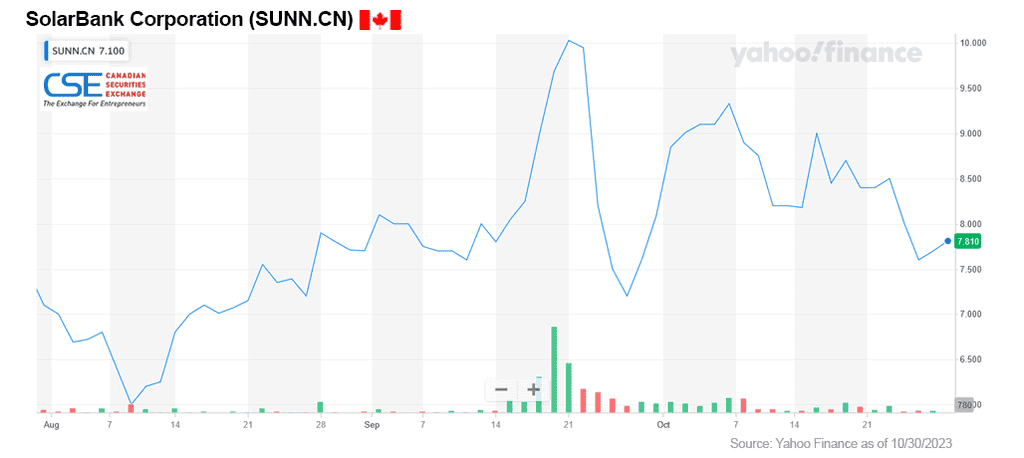

For starters, just check out the stock price. From its IPO it is up an impressive +300%, and up a cool +217% since MF Williams first mentioned it in March. This can be attributed to the company successfully executing on a number of big deals, including inking a $41 million contract with Honeywell International Inc (NASDAQ: HON).[8]

This has all been achieved with zero outside capital investment until the IPO, which is insane to me, and has had a really big benefit for the company — it is incredibly closely held. SolarBank has a tight share structure with just 27 million shares outstanding.

This is rare… and I mean really rare for a junior exchange company. This small supply of shares hits the sweet spot where prices are likely to rise due to limited supply, but liquidity will remain strong enough to attract investors and avoid the “honey pot” trap you sometimes see with overly tight stocks.

To help understand whether SolarBank was the real deal, I interviewed CEO Dr. Richard Lu to determine more about the company’s future direction.

I walked away feeling very positive quite simply because SolarBank not only has a compelling grand vision, but I believe it will be able to follow through.

One big idea struck me during my interview with Dr. Lu — the concept of zero carbon utilities, and most specifically, a zero carbon value chain. Rather than taking the “easy” route of building a few solar plants and calling it a day, Dr Lu has taken a more ambitious Smart Energy path.

Dr. Lu's vision places solar at the heart of a smart energy revolution that helps any major corporation actively reduce their carbon footprint by using solar energy to radically reduce reliance on fossil fuel-based power generation on existing buildings. It is even possible for them to repurpose their brownfield sites in order to turn them into a productive carbon-neutral investment.

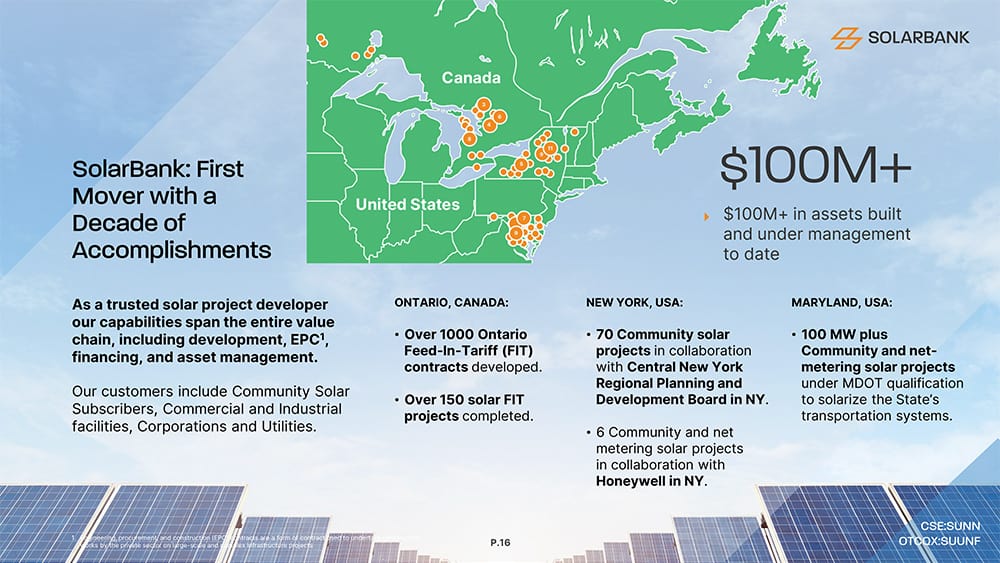

It’s hard for me to state how transformative this is. You have a company that has built large scale solar energy projects — SolarBank has built over 100 plants in North America over the last decade — with many more on the way.

Yet this technical infrastructure-focused company is also able to understand how to sell this as more than just energy transition.

It’s a way for companies to make money, reduce their carbon impact, and transform useless assets into something that brings value to their bottom line.

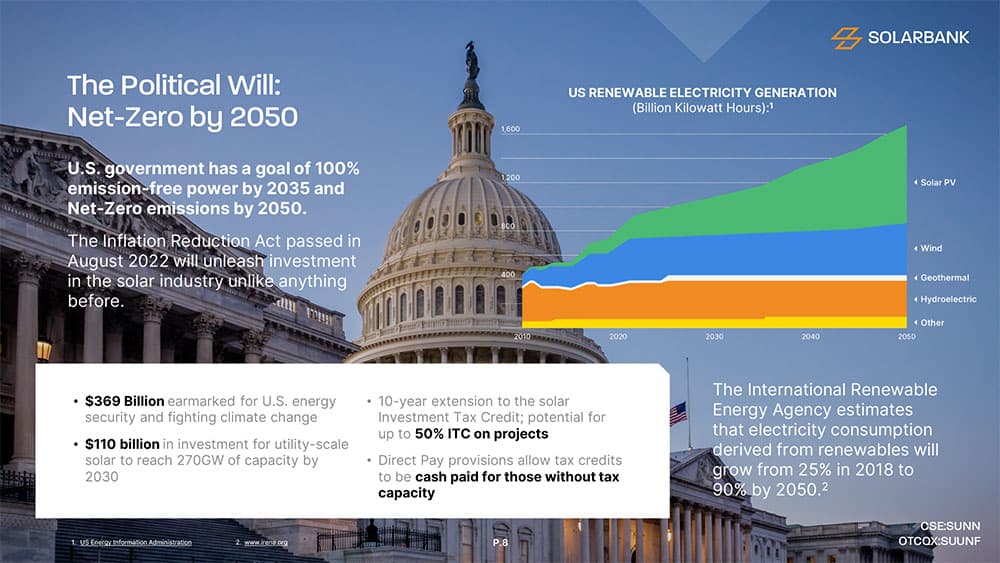

This forward-thinking approach helps to explain why the company has recently been awarded $36 million in EPC contracts for Ontario Battery Energy System Storage Projects.[9] This enables SolarBank to play a key role in tackling the base load challenge.

Aside from the relatively near-term opportunities available via solar, Dr. Lu revealed to me that the company is actively exploring the possibility of developing hydrogen technology, specifically electrolyzers, which could theoretically enable them to produce hydrogen cost-competitively within the next 3–5 years.

This is another great example of the long-term thinking that has helped SolarBank to thrive. It will help the company grab an early foothold in a technology expected to play an important role in our energy mix in the future, specifically for sectors that are hard to electrify like shipping or aviation.[10]

So we’ve got a company with a solid technology, the know-how to deploy it, and an eye to the future. Now we get to the point where we bring it all together. SolarBank has found a way to combine the benefits of net zero with industry-leading technology and implementation experience to produce a unique high-growth strategy that has massive potential.

The SolarBank team has built deep relationships with governments, large private sector companies, and local officials. This has enabled them to pitch for contracts that would be transformative for companies two or three times their size.

For example, in September the company was able to secure a massive contract with Honeywell International Inc (NASDAQ: HON) worth $41 million.[11]

It could be described as a business relationship and deal in the making… Honeywell International has acquired its proposed community-focused 21 MW (megawatt) solar sites under development in New York. SolarBank originated the sites in upstate New York. The project will be developed into three separate 7 MW projects.

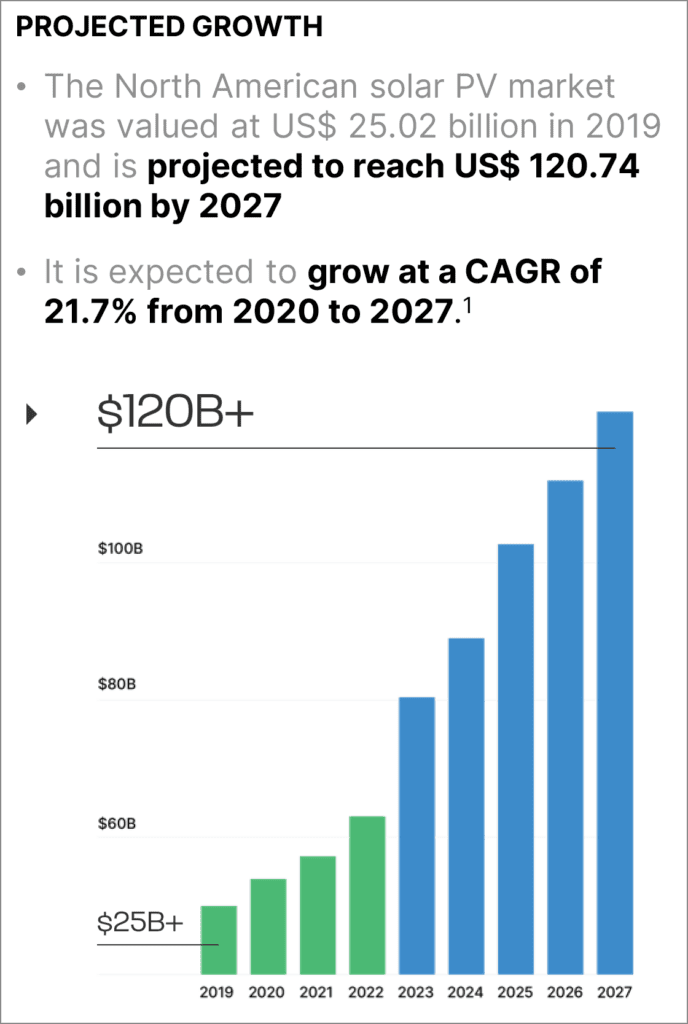

These kinds of big deals for large, environmentally conscious corporations represent a huge deal, and give SolarBank an addressable market of US$120 billion.

It needs to be mentioned that Honeywell is a +US$100 billion dollar corporation executing a deal with a junior traded company… SolarBank.

SolarBank (NASDAQ: SUUN/ Cboe: SUNN) has a lot going for it, and before I dive into where I think the company is going to go over the next few years, I’d like to take a deeper dive into the people who make the company special, beginning with their President & CEO Dr. Richard Lu.

“I’ve been a utility guy. I’ve always been interested in building a zero-carbon utility. If you look at where we are today, we’re seeing the genesis of zero-carbon utility.”

— Dr. Richard Lu, CEO & President

You always need to be careful when speaking to a CEO. It is their job to put their company in the best light possible. However, in Dr. Lu I believe that you’re dealing with someone who has a vision based on very real experience.

Dr. Lu has more than 25 years of experience developing renewable energy projects for organizations in North America, Europe, and Asia, and is an independent director for dynaCERT Inc. (TSX: DYA ), a company specializing in hydrogen applications in the transportation industry.

He was previously a Managing Director at Sky Solar Holdings Co., Ltd. His experience there gave him a very specific vision to develop a vertically integrated zero-carbon utility provider which could help companies around the globe reach net-zero emissions.

Under his leadership, SolarBank was able to grow with zero private equity until its public listing in March 2023. During that time, Dr. Lu perfected the company’s community solar model and helped the company grow from producing 13 megawatts in 2022 to 42 megawatts in 2023 — with a potential pipeline of 700 megawatts still up for grabs.

Of course, Dr. Lu is not solely responsible for the company’s success. If he was, I wouldn’t be recommending it. His company is filled with talented people, and that makes it robust.

For example, company COO Andrew Van Doorn is an industry veteran who was president and chairman of the Canadian Hydro Association back in 2003 and has successfully actioned hundreds of safe, reliable, and low cost projects across North America.

Although, perhaps the most telling example of SolarBank’s long-term approach is the company’s Chief Administrative Officer, Tracy Zheng, who Dr. Lu highlighted during our call. Tracy’s role is to determine whether new projects make business sense, and she has been responsible for some of SolarBank’s most ambitious initiatives, including the company’s EV reverse charging initiative and the ultimate form of its net-zero initiative.

So we’ve got an ambitious vision, a strong team, and proof that this team can work towards their ultimate goal with real-world results and profits. This has been demonstrated by the fact that the company has been able to double their revenue every year for the past three years and is on track to do it again this year.

That in itself should be enough to recommend SolarBank, but I’d like to take a minute to take stock of where the company is today and where they’re going.

Let’s start by looking at what they’ve achieved to this point. The company has successfully completed over 1,000 development projects with large numbers of community solar projects. These are particularly interesting because community solar is able to generate the large amounts of power needed to make a solar project viable, without many of the challenges associated with homeowner-based solar initiatives.

Over time, SolarBank has become very skilled at producing turnkey solar projects and has been able to parley this success into the second step of their expansion plan — moving into high-carbon markets across North America and offering solar projects that will allow companies and consumers to access cheaper zero-carbon energy.

In addition to these bread and butter projects, the company has implemented two other ambitious strategies. The first is a step towards full vertical integration with $36 Million in EPC contracts for Ontario Battery Energy System Storage Projects.[12] To action this, SolarBank has partnered with EVLO Energy Storage Inc. (a subsidiary of Hydro-Québec) to supply EVLOFLEX battery energy storage systems.[13]

The second is perhaps the most interesting aspect of SolarBank — helping major corporations use solar energy to demonstrably reach net-zero without relying on opaque carbon offsetting programs.

SolarBank has built deep relationships with Honeywell and has previously helped the company resolve problems with brownfield sites. As previously mentioned, this has resulted in a $41 million contract to develop 21 MWs of community solar projects for Honeywell.[14]

Dr. Lu also revealed to me that this is just the beginning, and that SolarBank has a conceptual plan that could enable Honeywell to produce the 1.2 GWs of solar energy they’d need to offset their entire carbon emissions.

This creative approach also applies to the company’s technological direction. During my chat with Dr. Lu, he revealed that the company is actively working on connecting its solar plants to bidirectional EV charging stations, and that the company is even exploring developing hydrogen power projects.

Now you understand why I am calling SolarBank a Smart Energy company.

If SolarBank is able to continue to use this strategy with other multinational corporations, and complement it with a long-term technological approach, I think it has a winning business model on its hands that goes well beyond the opportunities available in solar power alone. Happily the markets seem to share my view, given the company’s +300% stock price growth since IPO.

Alright, so the company has the experience, it has the projects, and it has been doubling its revenue every year. What about the stock?

For starters, the company is incredibly closely held. Approximately 18.5 million shares of the total issued and outstanding 27 million shares are escrowed for three years from the date of going public beginning March 2, 2023.

Why? I’ll let Dr. Lu explain...

“We didn’t go public to raise money, but to enable us to own assets.”

— Dr. Richard Lu, CEO & President

This is great news for investors who manage to get in and probably goes some way to explain how the company has been able to keep itself above its IPO levels.

So is now a good time to invest? Let's take a closer look... SolarBank seems to perform well on the back of positive news, and given SolarBank’s strong record of success so far, I believe the company still has a lot of room for growth.

What about uplisting to a senior exchange like NASDAQ?

The company's stock is already performing strongly on the Canadian junior exchange (CSE), and based on its operational results and owning a current CAD$226 million market cap, it is not out of the realm to consider an uplisting to either a senior Canadian stock exchange (TSX) or even NASDAQ in the near future. (As a reminder, the stock also trades on the highest ranked junior board found in the US, the OTCQX.)

However, even if this expectation takes longer than anticipated, I still strongly believe that SolarBank has significant room for growth, although the higher liquidity of a potential senior exchange-listed company would be very welcome to current investors.

Phew, that was a lot of information. Let’s take a minute to step back, and bring it all together. For me, SolarBank ticks all the boxes I look for when sizing up a company. It has an ambitious vision, the team and technology to follow it through, a strong record of success, and a very tight share structure with just 27 million shares outstanding that certainly doesn’t make me want to gouge my eyes out.

It’s a rare opportunity to get involved with a company that is already successful and has real plans to take it even further. Let’s recap why…

With that said, I still think you should do your own research. Take a look at the company for yourself, and decide if this opportunity is right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden may hold stock in SolarBank Corp but will not purchase securities until 10 days following publication of this article.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[2] https://www.theguardian.com/environment/2023/oct/09/climate-crisis-cost-extreme-weather-damage-study

[3] https://openknowledge.worldbank.org/entities/publication/c96ee144-4a4b-5164-ad79-74c051179eee

[4] https://gca.org/adapting-to-climate-change-could-add-7-trillion-to-the-global-economy-by-2030/

[5] https://eciu.net/analysis/briefings/climate-impacts/climate-economics-costs-and-benefits

[6]https://www.theguardian.com/environment/2023/jan/18/revealed-forest-carbon-offsets-biggest-provider-worthless-verra-aoe

[7] https://www.snexplores.org/article/green-energy-cheaper-than-fossil-fuels-climate

[8] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[9] https://ca.finance.yahoo.com/news/solarbank-awarded-36-million-epc-113000225.html

[10] https://aben.com.br/wp-content/uploads/2022/06/DNV_Hydrogen_Report_2022_Highres_single1.pdf

[11] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

[12] https://ca.finance.yahoo.com/news/solarbank-awarded-36-million-epc-113000225.html

[13] https://ca.finance.yahoo.com/news/hydro-qu-bec-subsidiary-evlo-120000053.html

[14] https://ca.finance.yahoo.com/news/solarbank-completes-sale-21mw-community-172600089.html

One of the most attractive investment opportunities to cross my desk in a while is the significant transformation of our energy landscape that is now taking place.

Countries around the world are making massive investments to transition away from fossil fuels and put renewable energy technologies and related infrastructure in its place.

By any measure this task ahead is enormous. Estimates to fully transition away from fossil fuels run in the tens of trillions of dollars. The fact is, governments around the world are facing the reality that the transition to green energy is not only necessary but urgent.

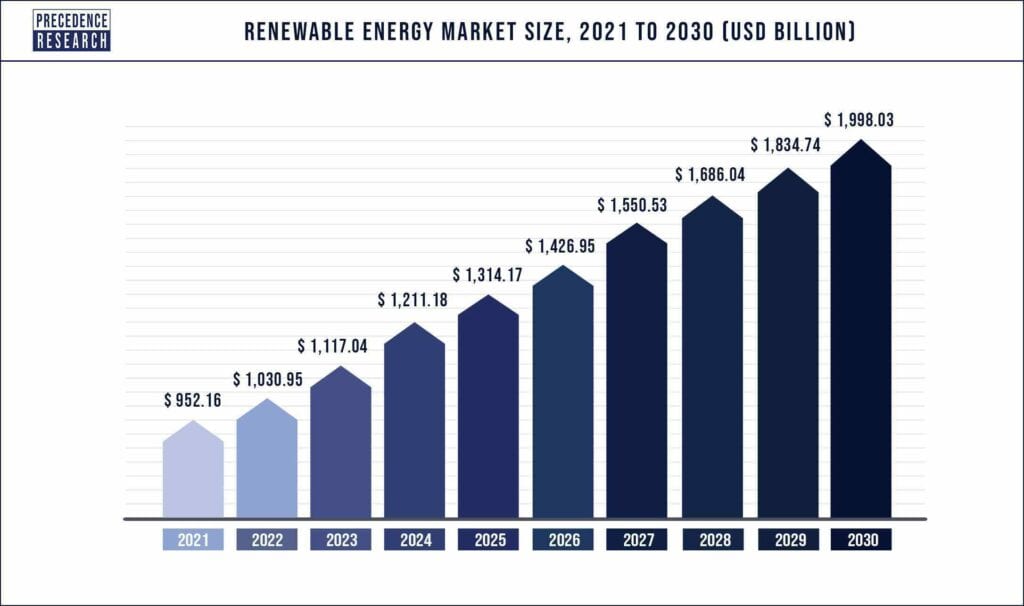

The global renewable energy market size was estimated at just over US$1 trillion in 2022 and is expected to hit about US$2 trillion by 2030, with a registered CAGR of 8.6% from 2022 to 2030.[1]

The decarbonization megatrend is exploding and early investors in the space could very well see their investments skyrocket over the coming years.

Do I have your attention now?

Keep reading and learn why investing in renewable energy stocks is one of the smartest moves an investor could make today.

As a bonus I’ll throw in my 5 top stock picks in the field to kick-start your investment research!

Now let’s get started...

Three key factors have come into play that are forcing governments and corporations alike to reconsider their energy policies and investment strategies.

1. The War in Ukraine

Europe’s dependence almost entirely on Russian oil and gas was laid bare with the invasion of Ukraine by Russia last year. The fact that Russia’s war machine is largely funded by sales of its oil and gas to Europe set off a political and existential crisis.

All across Europe the people raised their voices, “How can we buy Russian oil and gas knowing the money is going directly to buy bullets and bombs being used against Ukraine?

The renewable energy movement has been well underway for many years in Europe and the Ukrainian invasion was the tipping point to put that movement into high gear.

2. Climate Change Has Unleashed Devastating Effects

The second key factor that is driving the renewable energy transition is one we all know about.

Climate change.

Climate change experts have been warning for decades of the effects of rising CO2 levels, rising global temperatures and the extreme weather events that would follow.

We are now beginning to see some of those predictions come true as the weather worldwide begins to change drastically.

Extremes in weather patterns are sending large swaths of the globe into severe drought or devastating 100-year event flooding in certain parts of the world. Rising temperatures are breaking all known records on a regular basis resulting in the rapid melting of huge glaciers not only in the polar regions but also in continental mountain chains that supply the majority of drinking water to to major cities below. Coastal flooding from rising ocean levels is already taking place and displacing populations around the world.[2]

And recently Lufthansa Air experienced extreme turbulence over Tennessee on a flight from Texas to Switzerland. The flight had to be diverted to Washington Dulles International Airport, and seven passengers were taken to the hospital with what were believed to be minor injuries. Scientists are saying this will become more common due to severe wind shear from temperature extremes caused by climate change.[3]

Without a doubt climate change has moved from theory to reality, and governments around the world are now beginning to act with earnest.

3. Socially Responsible Investing

Increasingly, investors are moving their money out of destructive fossil fuel industries and into greater future-focused green renewable energy companies.

This movement is called socially responsible investing, and there has been a dramatic increase in the number of investors participating in this movement over the past few years.

In 2020, approximately $15 trillion of professionally managed assets in the US was considered Environmental, Social, and Governance (popularly known as ESG). That is a huge increase from just ten years prior when less than $2 trillion was invested in ESG equities.[4]

The pros and cons of this type of investment strategy can be discussed at extreme length but suffice to say that there are a significant number of investors that do consider the environmental impact a company makes when choosing where to put their money.

This investment strategy does ultimately encourage companies to establish environmental goals that help in mitigating climate change.

All said and told, these three factors have made the transition away from historical fossil fuels a top priority for governments and corporations around the world. The paradigm shift is just beginning, and early investors in the space have the potential to profit handsomely over the next several years.

By all measures the global renewable energy transition is seeing record growth, and I believe we are still at the very beginning of the adoption curve with plenty of time to re-position your portfolio now for maximum gains.

Double or even triple-digit growth is well within the realm of possibility as more money is invested in renewable energy companies.

Take a look at these estimated annual growth rates that are predicted to last for at least the next 7 years:

Forecasts for the green energy market sees the valuation doubling over the next 7 years to almost US$2 trillion dollars!

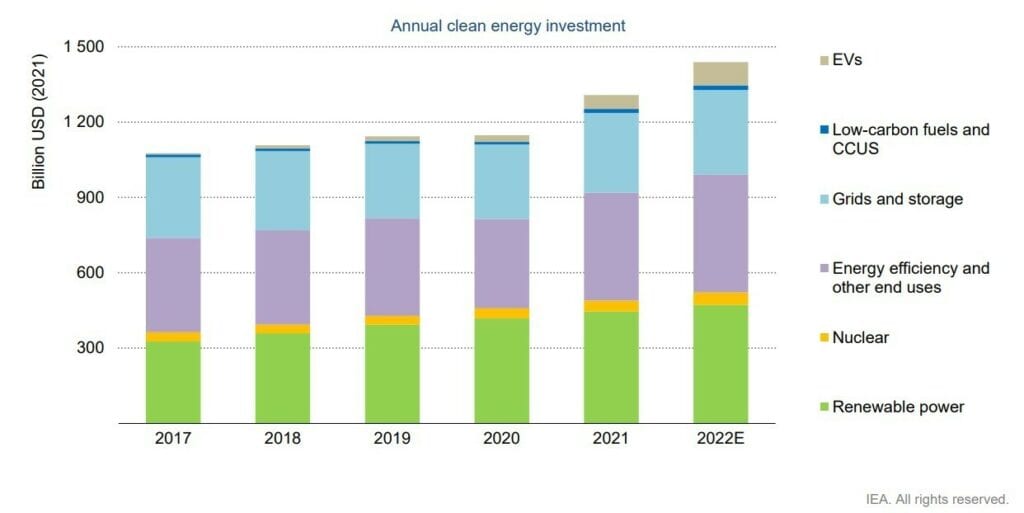

Since 2020, the pace of growth in clean energy investment has accelerated significantly to 12%. This increase has been fueled by government support as well as socially responsible investors.

According to the IEA’s World Energy Investment 2022 report, the fastest growth in energy investment is coming from the power sector — mainly in renewables and grids — and from energy efficiency.

Renewables, grids and storage now account for more than 80% of the total power sector investment.[6]

The decarbonization megatrend is already driving trillions of investment dollars into renewable energy. This trend will not be ending anytime soon.

The global price tag for fully transitioning to renewable energy sources is estimated at around US$62 trillion according to a Stanford University study.[7]

Time magazine recently reported that clean energy investment set a $1.1 trillion record, matching fossil fuels for the first time.[8]

President Biden signed a $1.2 trillion infrastructure package in November 2021 that includes funding to accelerate clean energy investments.[9] Meanwhile, Congress worked through the summer of 2022 to reach an agreement on a $369 billion climate and tax bill to further accelerate the country’s transition away from fossil fuels.[10]

The climate funding would move forward Biden’s proposal to cut US carbon emissions in half by 2030 and achieve net-zero emissions by 2050.

Some of Biden’s spending areas on climate include:

Most see these massive spending bills as merely a down payment on the real cost of decarbonizing the economy. For sure more government spending is in the pipeline to continue to drive the transition to clean energy. Renewable energy companies will be the beneficiaries of these massive public works, and ultimately savvy investors in the right companies could see their portfolio valuations grow exponentially.

There are several investment opportunities that investors should consider when evaluating renewable energy companies.

Here are 5 areas that I believe are the most profitable and where intelligent investors should be focusing their attention:

1. Solar Energy

Solar energy has become one of the most prominent renewable energy sources in recent years. There are opportunities for investment in solar panel manufacturers, installation companies, and solar energy project development firms.

2. Wind Energy

Wind energy is another growing sector in the renewable energy industry. Investment opportunities can be found in wind turbine manufacturing companies, wind farm developers, and companies that provide wind energy storage solutions.

3. Geothermal Energy

Geothermal energy utilizes the natural heat from the earth's core to generate electricity. There are opportunities for investment in geothermal power plant developers and companies that specialize in geothermal drilling and exploration.

4. Energy Storage

As renewable energy sources become more prevalent, energy storage solutions are becoming increasingly important. Investment opportunities can be found in companies that manufacture energy storage systems, such as lithium-ion batteries, and companies that provide energy storage management and optimization solutions.

5. Hydropower

This energy source is the backbone of low-carbon electricity generation, providing almost half of the world’s energy needs today. Hydropower’s contribution is 55% higher than nuclear and larger than that of all other renewables combined, including wind, solar PV, bioenergy and geothermal.

In 2020, hydropower supplied 17% of global electricity generation, the third‑largest source after coal and natural gas. Over the last 20 years, hydropower’s total capacity rose 70% globally, but its share of total generation stayed stable due to the growth of wind, solar PV, coal and natural gas.

While doing my research on renewable energy stocks, I was shocked by the number of quality companies that exist. To be frank, it was actually difficult to narrow down the field to five of my favorites.

From a chart perspective, many of these companies have followed the majority of Wall Street and taken their respective hits over the past year. I’m looking at these as long-term investments — and buying now when their valuations are low could represent a win-win situation — especially for new investors to the space.

We also must consider the fact that this megatrend is just getting started. As more investment dollars pour into the space, companies that are well-positioned now could stand to profit the most.

1. First Solar (NASDAQ: FSLR)

First Solar is one of the largest solar panel manufacturers globally, and develops some of the most advanced solar panels in the world.

They are leaders in what is known as thin-film solar modules that are super-efficient and reliable. Their solar panels generate more energy than competing technologies, making them ideal for utility-scale solar energy projects.

They are also conscious of keeping their manufacturing processes with a low carbon footprint. All of their solar panels are fully recyclable as well.

They have a diversified business model with operations in multiple countries around the world. They also offer a wide range of products and services, including solar modules, project development, and engineering, procurement and construction services.

This diversification helps to mitigate risks associated with changes in market conditions or regulatory environments in any one region.

As one of the world's leading solar panel makers, the company is in an excellent position to capitalize as demand for solar panels accelerates. It’s actively investing to increase its capacity to produce solar panels and meet demand. As of 2022’s second quarter, it had sold out all its capacity through 2024 except for a new plant being built in India. Meanwhile, it has contracts in place to sell panels stretching out into 2026, giving it significant visibility into future revenue.

First Solar has the means to continue expanding because it boasts one of the best balance sheets in the sector. The company has consistently reported strong financial results, with increasing revenues and profits over the years. In its most recent quarter, the company reported net sales of $2.6 billion for 2022. First Solar is also sitting on $2.4 billion in net cash reserves.[12]

First Solar is already up over +43.1% this calendar year. In comparison, Oils-Energy companies have returned an average of -0.5%.[13]

A must add for any investor in renewable energy in my opinion.

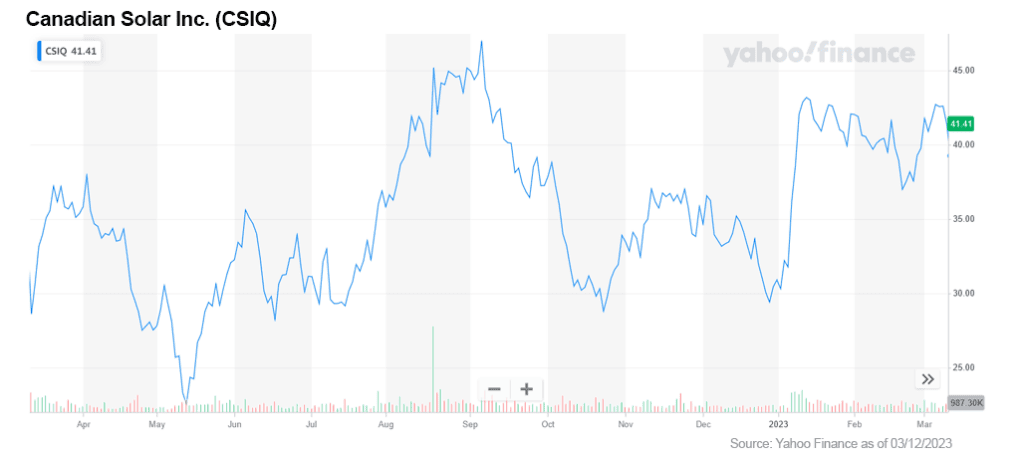

2. Canadian Solar Inc. (NASDAQ: CSIQ)

Canadian Solar is a leading vertically integrated solar energy solutions company that designs, develops, and manufactures solar photovoltaic (PV) modules and systems for both on-grid and off-grid applications.

Canadian Solar has consistently reported strong financial results with increasing revenues and profits over the years. For the third quarter ended September 30, 2022, the company reported +57% year-over-year revenue growth for a total of $1.93 billion.[14]

Canadian Solar will announce its full fourth quarter of 2022 and full year of 2022 results on March 21, 2023.[15]

The company expects shipments for 2023 to grow over 56% year-over-year.

Canadian Solar has a diversified business model with operations in over 20 countries and a wide range of products and services, including solar modules, inverters, and energy storage solutions. This diversification helps to mitigate risks associated with changes in market conditions or regulatory environments in any one region.

Despite its strong financial performance and growth prospects, Canadian Solar's stock is currently undervalued compared to its peers in the solar energy industry. This presents an opportunity for investors to buy into the company at a relatively low price.

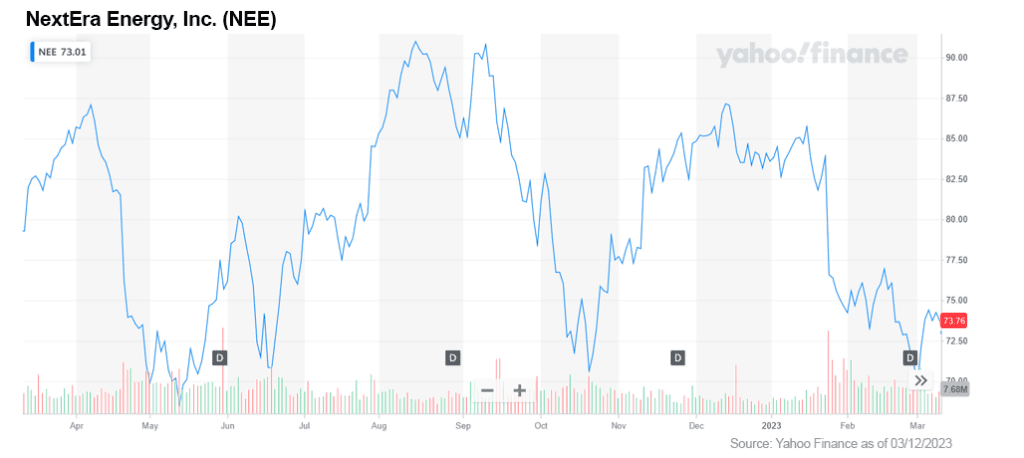

3. NextEra Energy (NYSE: NEE)

NextEra Energy is a Florida-based electric utility holding company that is primarily engaged in the generation, transmission, and distribution of electricity, as well as in the development and construction of renewable energy projects. It is the world's largest producer of wind and solar energy.

NextEra Energy has a strong financial position, with steady revenue growth and high profitability margins. The company has consistently increased its earnings per share (EPS) over the past several years and has a strong balance sheet with manageable debt levels.

The company recently reported a profit of $1.52 billion, or 76 cents a share, compared with a profit of $1.2 billion, or 61 cents a share, a year earlier.[16]

NextEra Energy has a robust growth pipeline, with plans to invest heavily in renewable energy projects over the next several years. The company is also expanding its transmission and distribution networks to support the growth of renewable energy and to enhance the reliability of its services.

NextEra Energy has consistently increased its dividend over the past several years and has a current dividend yield of around 2.54% as of March 8, 2023. NextEra has increased its dividend for more than 25 consecutive years, earning it the S&P Dividend Aristocrat distinction.[17]

The company expects its investments to continue paying dividends for shareholders. It predicts earnings will increase at or near its 6% to 8% annual target range through at least 2025, powered by continued investments in renewable energy.

The company is a solid play in the renewable energy space and one to strongly consider adding to your portfolio.

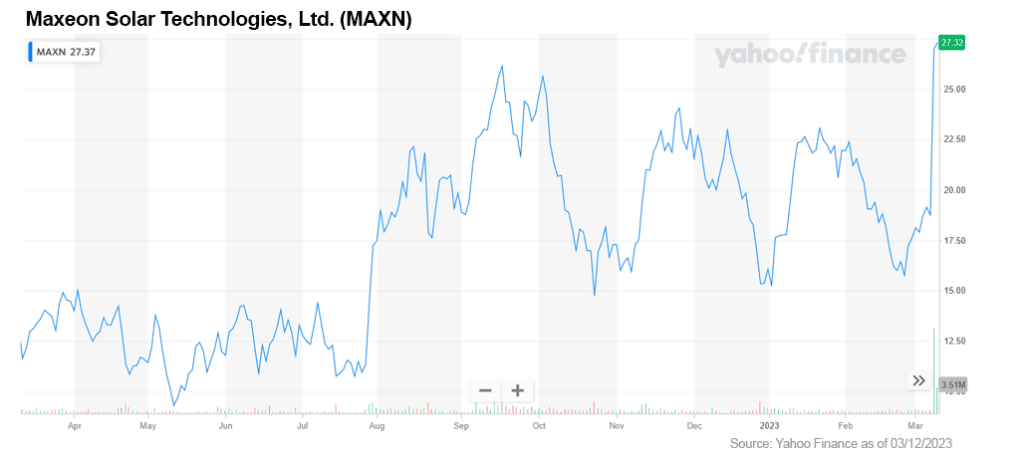

4. Maxeon Solar Technologies, Ltd. (NASDAQ: MAXN)

Maxeon Solar Technologies is a leading global manufacturer of premium solar panels, with a strong focus on innovation, sustainability, and quality.

The company is an innovator in the solar industry with a strong focus on research and development. It has a number of patented technologies, including its Maxeon® solar cell technology, which has been shown to be highly efficient and reliable.

Maxeon Solar Technologies has a strong financial track record, with consistent revenue growth and profitability. In its most recent quarter, the company posted Q4 2022 earnings with strong revenue generation of $324 million, slightly ahead of the market consensus $316 million, and up +46.3% from $221.5 million in revenue generated in Q4 2021.

“The company’s gross profit increased to $20 million in the fourth quarter due to strong operational performance and prudent supply chain management, a record for Maxeon.”[18]

- Bill Mulligan, Chief Executive Officer of Maxeon

A strong choice for any intelligent investor.

5. SolarBank Corporation (OTCQX: SUUNF / Cboe: SUNN)

SolarBank Corporation is a solar energy solutions company that provides end-to-end services for residential, commercial, and industrial customers.

The company recently IPO’d on the Canadian Securities Exchange (CSE) in Canada and has seen significant investor attention over the past week since it has gone public.

SolarBank reports over 100 solar power plants completed and under management in Canada and the US over the last decade.

The company also touts a strong and loyal customer base with a whopping 100% customer retention rate since inception, 4,000+ community solar subscribers, 90% government contracts, and several Fortune 500 companies as customers.

Future booked projects look very strong for the coming fiscal year; the company has reported 700 megawatts of solar development pipeline.

The company has a strong management team with deep industry experience and a proven track record of success. The team has demonstrated the ability to execute on the company's growth strategy, while creating value for shareholders.

SolarBank has a number of innovative technologies that set it apart from competitors, such as its patented SolarSkin™ technology, which allows solar panels to blend seamlessly into a building's exterior.

This is my wildcard pick which could turn investors an easy 10-bagger over the next couple of years. Get in early and ride the wave.

Intelligent investors should be starting their own research and due diligence in this rapidly developing megatrend today. The adoption curve is still at its beginning stage and there is still time to create your green energy portfolio.

Investing in green energy is just common sense in my opinion. Without a doubt the world will transition to these renewable energy sources and leave fossil fuels in the ground. Governments around the world are pouring money into the space to rapidly develop and deploy green energy projects to lessen their dependence on fossil fuels and fight climate change.

I am providing my top 5 picks of viable and profitable companies that are leading the charge into our clean energy future. You may have noticed four out of five of my picks are in the solar space. I feel very strongly solar represents the very best near-term opportunity right now!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.precedenceresearch.com/renewable-energy-market

[2] https://apnews.com/article/turbulence-lufthansa-dulles-flight-injuries-3c0d7d7839c9bad7ad4e84f86cb8e204

[3] https://apnews.com/article/turbulence-lufthansa-dulles-flight-injuries-3c0d7d7839c9bad7ad4e84f86cb8e204

[4] https://blogs.worldbank.org/allaboutfinance/pace-change-how-quickly-can-socially-responsible-investors-create-impact

[5] https://www.precedenceresearch.com/renewable-energy-market

[6] https://www.iea.org/news/record-clean-energy-spending-is-set-to-help-global-energy-investment-grow-by-8-in-2022

[7] https://unfccc.int/sites/default/files/resource/climate-finance-roadmap-to-us100-billion.pdf

[8] https://time.com/6250469/clean-energy-investment-sets-1-1-trillion-record-matching-fossil-fuels-for-the-first-time/

[9] https://www.cnn.com/2021/11/05/politics/house-votes-infrastructure-build-back-better/index.html

[10] https://www.cnbc.com/2022/08/15/investors-flock-to-green-energy-funds-as-congress-passes-climate-bill.html

[11] https://www.cnbc.com/2023/03/09/bidens-budget-proposal-calls-for-boosting-climate-resilience-funding.html

[12] https://investor.firstsolar.com/news/press-release-details/2023/First-Solar-Inc.-Announces-Fourth-Quarter-and-Full-Year-2022-Financial-Results-and-2023-Guidance/default.aspx

13] https://finance.yahoo.com/news/first-solar-fslr-outperforming-other-144002134.html

[14] https://investors.canadiansolar.com/news-releases/news-release-details/canadian-solar-reports-third-quarter-2022-results

[15] https://finance.yahoo.com/news/canadian-solar-preannounces-selective-q4-120000759.html

[16] https://www.morningstar.com/news/dow-jones/202301254987/nextera-energy-logs-higher-4q-profit-revenue

[17] https://www.marketbeat.com/dividends/aristocrats/

[18] https://pv-magazine-usa.com/2023/03/09/maxeon-posts-q4-2022-revenue-beat-increased-shipments-stock-up-44/