This is not your typical hysterical cryptocurrency price piece. I will not be obsessing over whether Bitcoin (BTC) will go to zero (it technically could, but probably won’t) or hit $100K (it probably will eventually, but it might not be this year).

Instead, I’d like to take a step back and look at what I believe are the key trends for crypto in 2022 and how investors can use these to identify the best opportunities in the cryptocurrency space today.

The Non-fungible Token (NFT) craze of 2021 was worth $22 billion.[1] This is not because it introduced the art world to cryptocurrency, but rather because the first wave of NFTs represented an early experiment in monetizing digital assets.

Whereas one Bitcoin is pretty much the same as any other, each NFT is designed to be non-fungible, and therefore unique. It is possible to trade it for another thing, but you can’t trade it for the same thing. In physical terms, NFTs are like baseball cards with ID numbers; you can trade them for another card, but each card has its own unique properties and value. For example, the holy grail of sports cards, Honus Wagner, is worth significantly more than a more common card.[2]

Why is this important? Because the company formerly known as Facebook, Meta Platforms, Inc. (NASDAQ: FB), has fired the starting gun on the Metaverse.

This concept takes the idea of blending our digital and physical realities to the next level by combining online marketplaces, digital scarcity, and cutting-edge virtual reality/mixed reality technologies.

This promises to create a whole new way for people to interact in the digital world, whether that’s in the way we work or the way we spend our leisure time. It also opens up countless new revenue opportunities for businesses, who will find it easier to monetize digital assets.

However, many consumers are understandably a little concerned about allowing Facebook/Meta to access even more of their lives. As a result, there is a growing movement of companies such as Roblox (NYSE: RBLX) looking to build alternative metaverses. The big challenge they will need to overcome is interoperability, and that is where NFTs and cryptocurrency come into their own.

Hear me out…

NFTs will enable the two key features of a decentralized metaverse to function: interoperability and scarcity. Each NFT token can be appended to a specific digital asset and can then be traded for anything else or even ported into different platforms. This provides a way for creators to directly monetize their content, and an aftermarket for users to trade unique digital content amongst themselves.

NFTs are already being deployed in novel concepts. For example, the world’s first “NFT restaurant,” the seafood inspired New York-based Flyfish Club, has raised $14 million using NFTs. As a members-only dining experience, customers would require an NFT to prove their membership before going to the restaurant.[3]

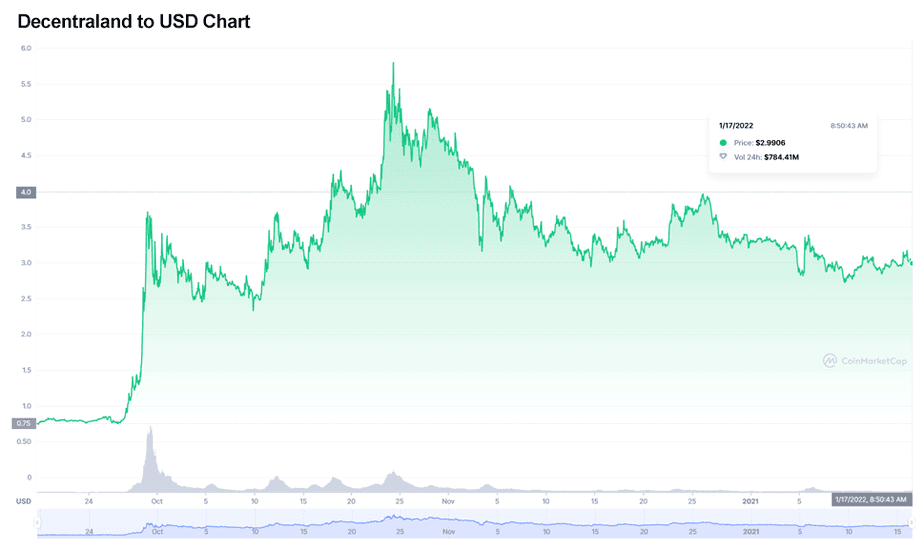

In the digital realm, crypto projects that focus on this concept already exist. One of my favorites is Decentraland (MANA), which saw +4,000% growth in 2021. MANA represents an early attempt to build a decentralized metaverse and has around 300,000 monthly active users.[4]

Decentraland is based on the Ethereum blockchain and relies upon two kinds of tokens in order to function: LAND (not to be confused with the blockchain project Landshare), an NFT that defines ownership of land parcels representing digital real estate, and MANA, a cryptocurrency that allows users to purchase LAND, goods, and services in the Decentraland marketplace.

Rather than being governed like a normal company, Decentraland is governed by a decentralized autonomous organization (DAO). These organizations are designed to mimic a corporate governance structure, but instead of decisions being taken by the board or a CEO, they are taken by community members who hold tokens in the project.

In the case of Decentraland, this structure allows holders of MANA to vote on the future direction of the project and control things like upgrades, new products or LAND distributions.

Investors who are looking to get involved in Decentraland can either buy MANA directly on an exchange or invest in more traditional instruments that have strong exposure to MANA. The two best examples are Tokens.com Corp (OTCQB: SMURF / NEO: COIN), which I talk about in more detail here, or the Grayscale Decentraland Trust, which provides exposure to Decentraland’s MANA and all the assets underpinning it.

Despite positive efforts by the Ethereum team, gas transaction fees remain a significant challenge. It can cost a lot of money to make simple transactions, and when network load is high, it is often financially prohibitive to make small transactions.

This problem is not unique to any one platform. All the top ten smart contract platforms have significant challenges with fees and transaction times.

The big problem occurs when a transaction takes so long, it doesn’t get entered into any blocks. In this case, a fee is still charged, but the transaction doesn’t go through. If this can’t be solved, it could be an existential threat to crypto adoption.

One of the best solutions proposed for this are so-called zero-knowledge rollups (zk-rollups). A zero-knowledge rollup is a layer-2 scalability solution that allows blockchains to process more transactions at a cheaper rate than traditional layer-1 blockchains like Ethereum (ETH) or Bitcoin (BTC) by offloading most of the transactions away from the blockchain, and then bundling them into a single transaction.

To understand how this works, let’s take a look at a theoretical example. Let’s say that I want to buy a token — let’s call it Awesomecatscoin on Uniswap (UNI) — that doesn’t have a USD Coin (USDC)-to-Awesomecatscoin pairing. In order to purchase it, the decentralized exchange would need to do the following:

Each of these transactions requires a gas fee, which could significantly increase the cost of running what should be a simple trade, and could even make the trade unprofitable. In the worst case scenario, my transaction might fail because of a sudden spike in gas price. This is because each transaction currently needs to be processed on the primary (or layer-1) blockchain.

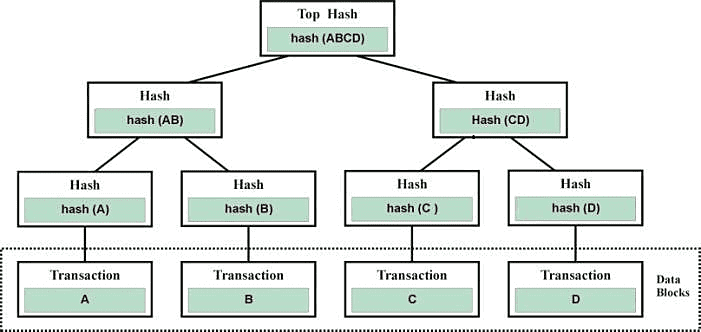

The solution to these problems is “rollups.” This is a broad term that covers many kinds of solutions, but the crux of it is that they use clever implementations of solutions like merkle trees in order to process most of the data off-chain and compute the final result onto the blockchain.

Understanding exactly how merkle trees work isn’t hugely important, but in essence they form a data structure that makes it easier to process large volumes of data on a blockchain. The top hash groups a number of transactions together (data blocks), and these will themselves be grouped under other hashes.

This makes it possible for users to verify large numbers of transactions by simply querying the top hash and means that they don’t need to process every transaction in the merkle tree to confirm that one is correct.

All blockchain technologies use merkle trees in one form or another, but zk-rollups store the “root” (or top hash) of the tree in a smart contract. The rest of the tree is processed off-chain rather than using the blockchain itself.

When transactions within a particular tree are complete, the smart contract confirms a non-interactive zero-knowledge proof (zk-SNARK)[6] to make sure that it is correct, and then processes this single confirmation on the blockchain. This can turn what may have been dozens of on-chain transactions into a single transaction.

For the sake of brevity, I have greatly simplified this process. If you’re interested in the specific processes, you can find more in the references at the end of this article.[7]

The concern is that almost all previous layer-2 solutions created new security, trust, or assumption challenges that would not be present if you were just using the layer-1 solution. A zk-rollup is designed to provide the same security as directly using its parent blockchains, while massively increasing scalability and without sharing any user data.

There are quite a few zk-rollup solutions in the works, but for the purpose of this discussion let’s focus upon Ethereum-based solutions. For me, there are two solutions that stand out: Loopring (LRC) and Polygon (MATIC).

Polygon (MATIC): Building Interoperable Blockchains

Of the two solutions, Polygon is the most well-known and stands as the 14th largest coin by market cap at the time of writing. The purpose of Polygon is to simultaneously allow processing Ethereum transactions off-chain, while also allowing developers to launch interoperable blockchains.

This is huge. Rather than simply bolting a solution on top of Ethereum, developers can actually create their own blockchains with specific modules that are more tailored to their needs. Polygon is composed of four layers: Ethereum layer, security layer, Polygon networks layer, and execution layer. Each of these layers performs a specific function that allows Polygon-developed blockchains to operate.

Polygon Has Experienced Runaway +8,888% Growth Over the Past Year

Investing in Polygon (MATIC) essentially means that you are investing in a tool that will enable developers to more easily create and maintain specialized blockchains, while still using Ethereum as the basic infrastructure. This helps to maintain decentralization and makes it easier to implement blockchains in more businesses in an interconnected landscape.

If that isn’t enough, Polygon has experienced an insane +8,888% growth rate over the last year.[8] While past performance is no guarantee of future results, that shows that there is considerable momentum behind MATIC.

You can buy MATIC on most exchanges. For more details, click here.

Loopring (LRC): Lowering the Barrier to Crypto Trading

Loopring (LRC) is a similar solution, but more focused on making it easier to create decentralized exchanges on top of Ethereum’s blockchain. Rather than solving transactions on the Ethereum blockchain directly, Loopring instead processes transactions off-chain, batches them together, and sends a single transaction to the Ethereum chain.

This is a big improvement in user experience and opens the door to making decentralized exchanges more user-friendly. Despite recent dips, the token has seen +251% growth over the past year.[9] This might seem small compared to MATIC’s explosive growth, but I believe it also makes LRC a crypto with significant room for upward mobility.

As with Polygon (MATIC), Loopring (LRC) can be purchased on most major cryptocurrency exchanges such as Kraken, Coinbase, or BinanceUS. You’ll find more details by visiting our page on exchanges here.

The final key trend, and this is a big one, is that institutional investors are likely to finally begin throwing their full weight around the crypto market come 2022. This will probably begin with so-called “blue-chip” cryptocurrencies like Ethereum and Bitcoin. This trend already began in 2021, with Venture Capital investing more than $30 billion in cryptocurrency over the course of 2021.[10] I expect this trend to accelerate in 2022.

The key driver of this will be stability. Governments are increasingly beginning to form real frameworks for how they want to actually want to handle cryptocurrency. They took the first steps in 2021 with both the European Union[11] and United States[12] building new frameworks describing how they want to handle stablecoins, the main on-ramp into the cryptocurrency space.

This combined with the fact that Bitcoin has managed to weather multiple bear markets has built confidence in cryptocurrency as an asset class. We are now at the point where there are real hopes that the SEC might approve the Spot Bitcoin ETFs proposed by NYDIG, Valkryie, Grayscale and Bitwise, although the organization has once again delayed its decision on the matter until March.[13]

These moves are all positive but leave an important open question: How can we “normal” investors benefit from the machinations of institutional capital?

Well, I’m glad you asked. While some companies are jumping in head first, a number are concerned about the risks of cryptocurrency and are adopting a “wait and see” approach in order to gain more clarity on the subject.[14]

This gives the rest of us an opportunity to strike first by jumping in now and buying blue-chip cryptocurrencies, in particular Bitcoin (BTC), before the institutional whales decide it's worth taking the risk. With the crypto markets down since January, it could be an opportunity to get Bitcoin at a steep discount.

This advice might seem simple on the surface but there is a reason I am bringing it up. The most important blue-chip crypto (Bitcoin) has a hard-capped, limited supply. This supply has become increasingly illiquid with over 76% of all Bitcoin now being held in long-term wallets.[15] The most liquid of all cryptocurrencies, those currently held on exchanges, are now down to just 6.3% of all circulating supply.

In short, when institutional capital finally comes pouring in, we could be looking at a supply squeeze. There will be a lot of people looking to buy Bitcoin, but it's possible that not so many will be willing to sell. This will provide investors who got in before the big institutions an opportunity to take profit while the market is at a high point.

For crypto investors, 2022 is sure to be another rollercoaster ride, but there are some very positive signs. A culmination of improved layer-2 technologies, the evolution of the Metaverse, and improved institution sentiment could help to drive overall adoption, and therefore the market more generally.

That being said, there are still risks ahead. The rise of central bank backed coins, such as China’s digital Yuan, could cause governments to take a more hostile stance to some forms of cryptocurrency. Additionally, it is likely that we will see more high-profile crypto failures in 2022, which could damage market confidence if they come at the wrong moment.

Despite these risks, I am still positive about the opportunities in the cryptocurrency market for 2022, and I look forward to sharing insights with you over the course of the year. As always, remember to do your own research, and find out if these opportunities are right for you!

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.artnews.com/art-news/market/2021-nft-sales-report-1234613782/

[2]https://www.bespokepost.com/the-post/the-mysterious-story-behind-the-worlds-most-valuable-baseball-card

[3] https://fortune.com/2022/01/13/nft-restaurant-new-york/

[4] https://nwn.blogs.com/nwn/2021/12/decentraland-blockchain-metaverse-user-revenue-stats.html

[5] Current Trends and Future Implementation Possibilities of the Merkel Tree - Scientific Figure on ResearchGate. Available from: https://www.researchgate.net/figure/An-example-of-Merkle-Tree_fig1_327601654 [accessed 14 Jan, 2022]

[6] https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof

[7] https://medium.com/fcats-blockchain-incubator/how-zk-rollups-work-8ac4d7155b0e

[8] https://www.coingecko.com/en/coins/polygon

[9] https://www.coingecko.com/en/coins/loopring

[10]https://markets.businessinsider.com/news/currencies/venture-capital-crypto-investment-record-30-billion-pitchbook-data-2021-12

[11] https://www.ceps.eu/ceps-publications/regulating-crypto-and-cyberware-in-the-eu/

[12]https://www.coindesk.com/policy/2021/11/01/biden-administration-to-congress-put-stablecoins-under-federal-supervision-or-we-will/

[13]https://www.coindesk.com/policy/2022/01/04/sec-delays-decision-on-nydigs-spot-bitcoin-etf-proposal/

[14]https://www.institutionalinvestor.com/article/b1vkvjjpnf0c2c/Here-s-How-Institutional-Investors-Bets-on-Crypto-Are-Performing

[15] https://cointelegraph.com/news/wait-and-see-approach-3-4-of-bitcoin-supply-now-illiquid