This is Part 1 of a 2-part series on investment opportunities in real estate and neo-investments. For Part 2, click here.

Want to buy a house? You might not be able to. Runaway real estate prices mean that it's harder than ever to buy homes, and new properties are almost immediately snatched up. And this isn’t just happening in America.

From Vancouver to Los Angeles to London, residential real estate prices are soaring. This removes the traditional source of wealth building — homeownership — and could leave millions of people forced to rent into their retirement.

Why is this happening, and what can people do to build wealth if they can’t get their foot onto the housing ladder? The driving forces are complicated, but boil down to a perfect storm of supply and demand pressures.

Runaway housing prices aren’t caused by any single factor. Instead, there are a larger number of trends emerging simultaneously that all exacerbate each other. The first big challenge comes down to supply. We simply aren’t building enough housing that so-called “normal” people can afford.

The United States has been gripped by a housing shortage since 2000. The country has consistently required 6.5 million more homes to build each year in order to reach demand.[1] Keep in mind that this was before the 2008 recession and that the US construction market still hadn’t recovered to pre-recession levels by 2019.

Where housing is being built, it is often not the right kind. This isn’t necessarily because developers are trying to lock poor people out of the market. Rather, it is because building low-income housing is difficult to make a profit from. Regulatory factors, such as density limits, encourage developers to build fewer, larger “luxury” apartments, rather than more small ones.

Sure, the simple solution to this is to build more housing, but the construction industry is facing a number of significant challenges. The first is a labor shortage — America’s construction industry is still around 600,000 workers short.[2] The second is the high price of raw materials, particularly lumber and concrete. This makes it very difficult for developers to make any money on building entry-level homes.

These supply issues were bad enough before but are even worse now as demand for increased ownership is skyrocketing. The first issue is increased competition from normal buyers. A pandemic spent trapped in cramped apartments convinced many city dwellers that they needed to upsize and move out to greener pastures.

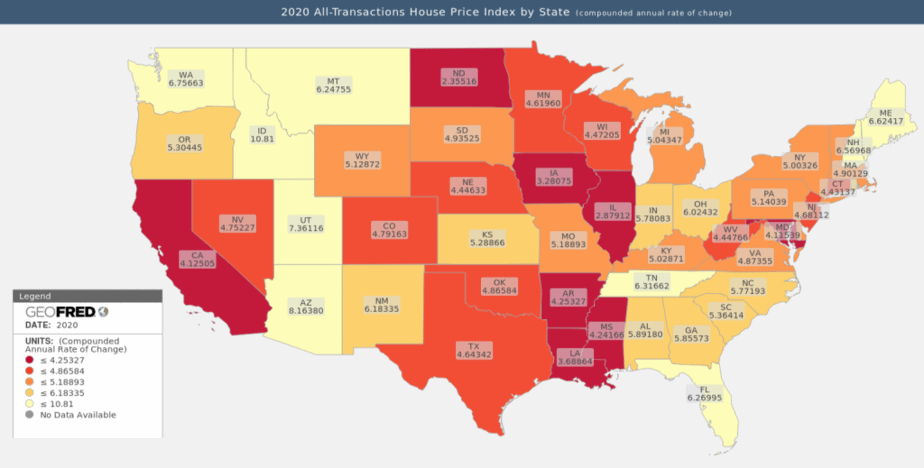

Interestingly this demand is no longer confined to wealthy urban-centric areas. The number of active listings in states that have historically been overlooked by potential home buyers are now seeing a surge in demand. This has partially been driven by the rise of remote work, which has enabled tech employees to look into more rural homes while still maintaining their premium Silicon Valley salaries.

Interestingly, the removal of one of the key demand pressures, which happens to be foreign buyers, does not appear to have had a major effect. For example in London, British buyers purchased 62% of luxury homes in Q1 2021.[3] These buyers did not pay the same premium as international buyers, but luxury real estate prices in London still only decreased by 1.9%, barely a blip on that market.

Government policy is another factor. The US tax code is structured in a way that rewards not just homeownership, but ownership of expensive homes. The specific policies can be broken up into three key areas:

These benefits and others, such as the imputed rent exemption, have given about $150 billion to homeowners in 2020 alone.[4] This isn’t necessarily a bad thing, but it artificially inflates demand for luxury properties — as the tax breaks you can get become much more attractive the more valuable your real estate becomes.

This has contributed to locking first-time buyers out of the market, and is forcing a growing proportion of Americans to rent rather than buy. Just over 34% of Americans nationally rent their homes, but in high-population states like Texas that number is in excess of a whopping 60%.[5]

This demand for rental properties has helped to fuel another far more concerning phenomenon: institutional capital is now flowing into the property market.

There is a lot of capital floating around and not that much to invest it in. Stock prices are, by most sane measures, detached from reality. Gold is still an option, but it offers very little in the way of upside and acts more as a method to protect your assets in a bear market.[6] Government bonds are also now at risk of being eaten away by inflation, removing even the safest (and most boring) form of wealth building.

In short: There is so much floating capital and investment dollars looking to invest in something meaningful, but for many, there are few desirable investment opportunities.

This has led banks and institutional capital to look for new ways to generate wealth. They are increasingly looking to the same place as the rest of us: Real Estate. Investors bought $49 billion in homes in Q2 2021.[7]

This means that investors own around 15.9% of all homes in the US. These investors appear to be targeting multifamily properties and mid-sized cities. For example in Phoenix, over a quarter of all properties in Q2 were purchased with investor capital.

This new influx of demand increases the upward pressure on the housing market. Investors often pay in cash and can afford to bid above asking price to beat would-be homeowners. However in some particularly hot markets like Vancouver, even investors require credit. This ensures that first-time buyers are locked out of the housing market, and they then become tenants in the very homes they sought to own.

When combined with generous tax incentives, this creates a vicious cycle that locks first-time buyers out of the market and gives investors gains they can’t find elsewhere. As demand for rental properties continues to rise, I fully expect this situation to worsen in the absence of government intervention or any significant market shifts to address this.

The crux of the issue here is that the traditional source of intergenerational wealth building, homeownership, could soon be out of the reach of many Americans, Canadians and others across the globe.

We could see many Millennials, and even Gen Xers, forced to rent into their retirement. This could create a class of people who are forever one rent increase away from homelessness and could have a significant impact on the prosperity of the United States, as well as other high-profile countries, in the long term.

Many of the proposed solutions rely on government intervention — whether this is rent control, adjusted tax incentives, or direct grants to homeowners. Indeed, some of these concepts have been trialed with some success in the United Kingdom in the form of government assisted mortgages.[8]

That being said, government intervention is not always positive. The true impact of policies can take decades to reveal themselves. For example, take Margaret Thatcher’s right-to-buy scheme which came into force in 1980. The program, which gave social housing tenants the right to purchase the homes they were renting from the government, was heralded as a huge success at the time.

However, 40 years later, the policy has contributed to the acute housing shortage in the UK, as the supply of social housing has significantly decreased. This is not to say that the policy was bad, it wasn’t, but it had unintended effects that wouldn’t become apparent until far later.[9]

The problem is that this places the middle class at the mercy of politicians. They are reliant on the right decisions being made in their interest, which is often not the case. The only way to ensure your own prosperity is to take active steps to build your own wealth.

If you find yourself priced out of the real estate market, your best option might be to invest in the very companies that are buying up all these homes. One obvious route is to invest in the companies snapping up properties across the United States. A relatively low-risk way to do this is to invest in a real estate exchange traded fund.

An exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset. They can be purchased or sold on a stock exchange in the same way that any other stock can. In the case of a real estate ETF, it would have investments in various companies involved in the real estate sector.

A natural go-to here is the Vanguard Real Estate Index Fund ETF Shares (NYSE: VNQ). This fund tracks the broad US Real Estate market and has a relatively low expense ratio. This enables investors to benefit from rising housing prices even if they can’t afford to buy property themselves.

Another option that is becoming increasingly popular with investors are real estate investment trusts (REITS). These investment vehicles own and manage a portfolio of properties which can be real estate or commercial.

The advantage of a REIT primarily comes down to its liquidity — it's easier to buy and sell stock than properties. Additionally, REITs are legally required to distribute 90% of their profits.

There are two main ways to invest in REITs. The first is via a REIT-focused EFT. A solid example is the Schwab US REIT ETF (NYSE: SCHH). Rather than tracking the broad property market, SCHH tracks a number of real estate investment trusts (REITS). This allows you to broaden risk without needing to research many individual REITS.

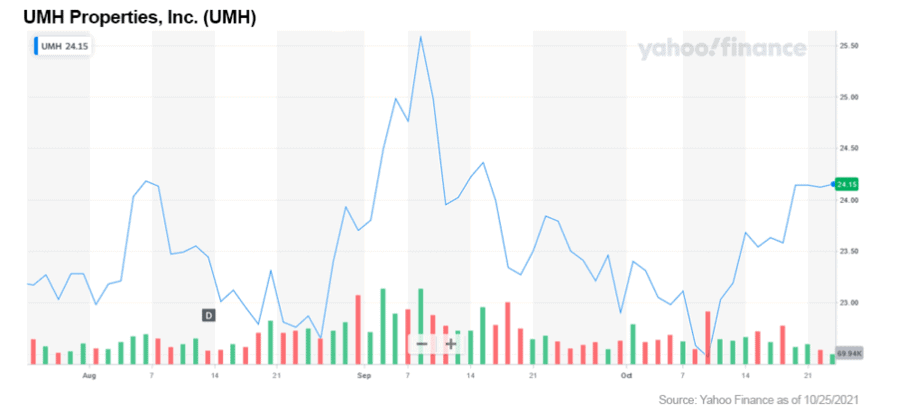

More risk-tolerant readers might be interested in picking specific REITs. When picking a REIT there are three things to look for: the management team, the diversification of the portfolio, and the company’s funds from operations and cash available for distribution. If those figures are healthy, then the REIT is likely a decent choice.

An example of an excellent stock that fits this bill is UMH Properties, Inc. (NYSE: UMH). The company has an experienced management team and a strong track record. The REIT owns 127 communities across 10 US states with rental unit occupancy of 95.9%. It’s portfolio also has room for expansion with undeveloped land that could support 7,500 new sites.

Asides from ETFs and REITs, there is another option that investors should be looking at that has the potential to significantly grow their portfolio. Long-time readers know where I’m going with this.

For many investors, the best route to building wealth quickly is to add cryptocurrency to your portfolio. I am not saying that you should dump all your savings into Bitcoin. However, placing 10-15% of your investment capital into cryptocurrency is an excellent strategy.

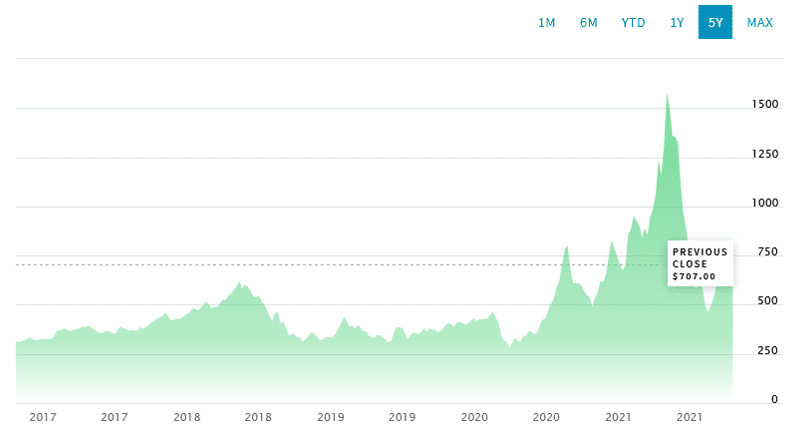

Even Bitcoin, which is one of the “slower” growing cryptocurrencies, represents an excellent choice. Let’s take the example of a family with the median net worth of $121,700.[10] If they had invested 10% of that into Bitcoin (BTC) a year ago, their investment would have grown by 455.6%. That means that this family would have turned $12,170 into $55,446.52 in just 12 months, with relatively little risk to their overall portfolio.

In the cryptocurrency space, these figures are fairly conservative. The right picks can net gains upwards of 1,000%, or even 10,000%. Over the next few months, we will be looking at some of these high-potential tokens, so keep your eyes on your inbox.

That being said, cryptocurrency isn’t the only solution for investors. There are a number of innovative new solutions to the real estate crisis in the works, and we will cover these in a future article.

In the meantime, the best way to weather the current real estate market is to actively invest. Waiting for government action to fix the housing crisis is not going to help. Instead, take the time to research the opportunities out there that match your current capital, and take your future into your own hands.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, Uniswap and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.businessinsider.com/housing-shortage-making-homes-so-expensive-2021-8?IR=T

[2] https://www.forbes.com/advisor/mortgages/new-home-construction-forecast/

[3] https://www.bloomberg.com/news/articles/2021-06-23/londoners-snap-up-luxury-homes-as-rich-foreigners-are-locked-out

[4] https://www.sightline.org/2021/02/12/the-problem-with-us-housing-policy-is-that-its-not-about-housing/

[5] https://ipropertymanagement.com/research/renters-vs-homeowners-statistics

[6] https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

[7] https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

[8] https://www.premierguarantee.com/resource-hub/how-successful-was-the-help-to-buy-scheme/

[9] https://www.if.org.uk/2017/05/09/right-buy-britains-greatest-intergenerational-blunder/

[10] https://www.businessinsider.com/personal-finance/average-american-net-worth?IR=T