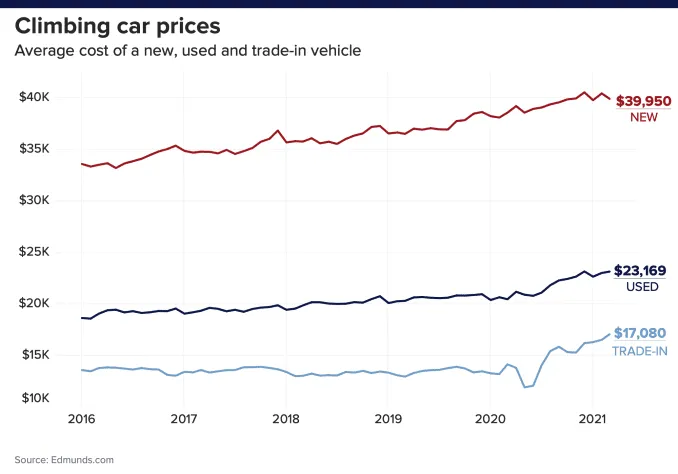

Auto prices for both new and used models have skyrocketed this year. So much so that it is now contributing to the overall national inflation rate.

Why is this happening?

The answer is three-pronged.

The end result is that new car buyers are lining up ready to buy a new vehicle, but dealership lots are approaching empty.

In-demand new cars are almost impossible to find today, and dealers are not budging on the price or giving any incentives to new buyers.

Consumers, seeking inventory and value, are now being pushed into the used car market, driving up demand and forcing used car prices through the roof.

CarGurus reports that used car price trends are up almost 30% year-over-year (YoY).[1]

It has been a little over a year since I wrote my article on the growing sector of online used auto sales.

You can read my full report here.

As a savvy investor, you know it’s always a good exercise to go back in time and look at the research you have done in the past and compare it to where we are today.

That’s how we learn and fine-tune our investment strategies moving forward. It’s following these simple investment principals to better align the average retail investor to the pros.

After rereading my previous article and crunching some numbers, I am happy to report that all of my picks in that article have made our readers some handsome gains this past year.

Check out these impressive numbers!

Note: Based on the publication date of May 18, 2020 through market close September 24, 2021

I do not see this trend ending anytime soon…

On the new car inventory side of things, the major roadblock is the lack of semiconductor supply.

The semiconductor industry is a mess right now. There are only a handful of chip manufacturers in the world, and they are scrambling to retool their production lines from consumer gadgets to chips used in autos.

Chip makers are also working with international governments to open new factories and expand production.

All of this takes time and the backlog for chip orders literally grows daily.

Until the semiconductor traffic jam is cleared, new car inventories will continue to suffer. My guess is we are looking at a minimum of six more months of this, and possibly up to two more years.

This will continue to drive demand in the used car market, further squeezing inventory and raising prices.

When I wrote my article about online auto sales, the industry was still relatively new and just getting traction.

The COVID-19 epidemic was beginning to rear its ugly head, and everyone was going into lockdown. If you wanted to buy a car, one of the few options available was to go online and make a purchase there.

This fact saw existing online car companies’ sales explode. It also forced dealerships to get off their laurels and develop viable online ecommerce websites where consumers could view inventory, make their purchase online and have the car delivered to their door all with minimal contact with others.

That trend does not appear to be reversing. Online used car sales are up.

Carvana (NYSE: CVNA) recently announced 2nd QTR 2021 results. They realized a +96% increase of retail units sold YoY! Total gross profit saw and increase of 268% YoY giving the company its first positive net income quarter.[2]

Here we are over a year later and while COVID has waned, we again find ourselves in the middle of a fourth wave of infections fueled by a novel COVID variant, newly adjusted lockdowns being announced and some businesses shuttering their doors once again.

Online car sales are not going away anytime soon, and the savvy investor is already positioning his/her portfolio accordingly.

Below are my favorite stocks that are in the right place at the right time to capitalize on the current auto sales turmoil.

The auto sales crunch is not going away anytime soon, and these companies will continue to see fat bottom lines at least through the end of this year.

The first six companies are directly related to online auto sales. I have covered these companies in my article from May of 2020 and still feel these picks will continue to garnish gains for investors through the end of this year.

For each of those companies, I have included a chart from when I first alerted our readers to the symbols back in May 2020 through market close September 24, 2021.

The last three companies are directly related to auto parts retailers. The fact that more people are buying used cars will drive sales in auto parts. Buyers of used cars inevitably will want to replace worn-out parts and potentially do cosmetic upgrades to their used vehicles.

1. Carvana (NYSE: CVNA)

Carvana is the king of online used auto sales. I loved this company when I covered it last year and I still love it today.

It was one of the pioneers of putting used car sales online.

Carvana made every step of the process self-serve, easy and transparent with more than 25,000 vehicles available to shop for from home, no-haggle pricing, financing decisions in minutes, detailed 360-degree virtual vehicle tours and a 7-day return policy.

Vehicles are delivered directly to the customer’s home complete without even a handshake.

Supersmart management keeps the company on the cutting edge of technology making it easy for customers to find and buy their car online.

Carvana still has a winning COVID strategy as we move into our second year of lockdown. Definitely one to consider adding to your portfolio.

Note: The charts below start from my recommendation back in May 2020 through the publication date of this article.

2. CarGurus (NASDAQ: CARG)

This company is an earnings beast. It recently came out with the 2nd QTR earning report which blew away Wall Street estimates.

Revenue was up +130% YoY. Earnings surged +70.83% [3]

Over the last four quarters, the company has surpassed consensus EPS estimates four times.

As of June 30, 2021, CarGurus had cash, cash equivalents and short-term investments of $269.6 million and no debt.[4]

These are the kind of numbers that should have investors clamouring to get in. Unfortunately that is not the case with a chart that has its ups and downs.

The 13 analysts offering 12-month price forecasts for CarGurus Inc have a median target of $36.00, with a high estimate of $46.00 and a low estimate of $31.00.[5]

I can’t find a solid reason why this stock has languished over the past year or even the last three months. The company is on solid footing financially and kicking ass on Wall Street estimates. Future growth potential looks good as well.

I am still a fan of CARG and believe it will give investors a lift. At the very least, it is worth including this stock on your watchlist.

3. Cars.com (NYSE: CARS)

Cars.com continues to shine.

The company announced 2nd QTR revenue was up +52% YoY, blowing past Wall Street estimates once again.

Website monthly unique visitors was up a respectable +16% YoY.

The company is swimming in free cash flow and is aggressive in paying down its debt and maintaining a strong balance sheet.[6]

The company recently made a huge overhaul of their website and mobile app with cutting-edge ecommerce features.

Look for Cars.com to continue a solid run of earnings into the early part of 2022.

There is still room for upside on this stock in my opinion.

4. TrueCar (NASDAQ: TRUE)

TrueCar announced 2nd QTR 2021 earnings as meeting expectations, but remained flat.

Eight polled analysts still see the stock as a “buy” to “outperform.”

The company has been hit the hardest by the new car inventory slump and probably will not recover any sales until the semiconductor crisis is fully resolved.

I am only adding it to my watchlist at this point, as I recommend you should too. Keep a close eye on this one.

5. CarMax (NYSE: KMX)

CarMax is a retailer of new and used cars and light trucks. It is one of the largest retailers of used vehicles in the US. Value addons include financing, warranties, accessories and repair services.

Earning have grown 7.7% YoY over the past 5 years.

CarMax will continue to deliver for investors, at least through the end of this year.

The company's EPS is expected to grow +48.8% this year, crushing the industry average of +26.1%.

6. RumbleOn (NASDAQ: RMBL)

I have to be honest about this stock. I have been following this company for a couple of years now. I love their business model. It makes total sense to me. But things got rocky with management about a year ago, and I was not sure they would be able to pull out of the deep ditch that formed, and their share price had fallen as a result.

To my surprise they got the train back on the tracks and the share price has recovered nicely.

The company announced 2nd QTR results with +100% YoY revenue growth.

Keep this one on your radar or consider adding a few shares to your portfolio to keep things interesting. This is not just a car play, the company acts as an agent for recreational vehicles, boats and motorcycles. Everyone needs a dark horse candidate in the pack. This might be it!

I believe this company will continue to perform well into FY 2022.

My research led to an interesting angle on the auto crunch that should be considered, and it makes total sense.

Of course consumers are going to purchase aftermarket parts and potential upgrades for their newly purchased used cars. Auto parts retailers will be a big winner in the next few months as consumers are forced into buying a used car and having to put extra money in parts and upgrades.

Below are my three picks for auto parts retailer companies that I believe have the strongest chance of winning.

Note: All chart snapshots are for 3 months prior to publication.

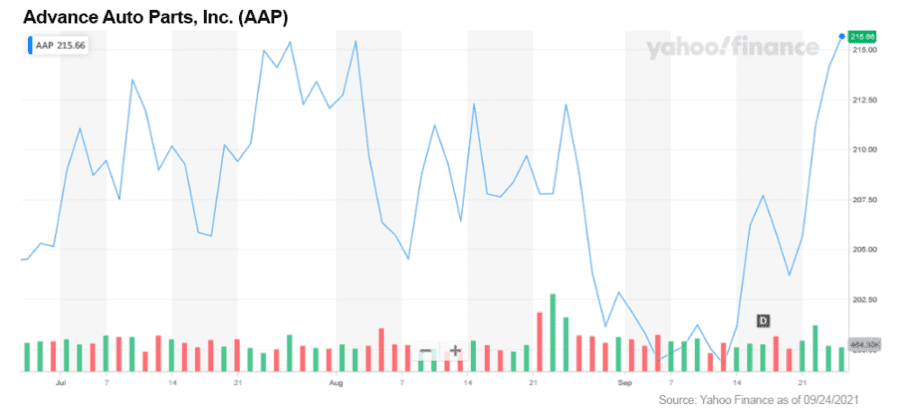

7. Advance Auto Parts, Inc. (NYSE: AAP)

Auto parts retailer Advanced Auto Parts has outperformed earnings estimates three out of the last four quarters.

2nd QTR earnings were recently released and again they beat Wall Street estimates by +15.25%.

I believe Advanced Auto Parts is a strong choice when considering adding an auto parts retailer to your portfolio.

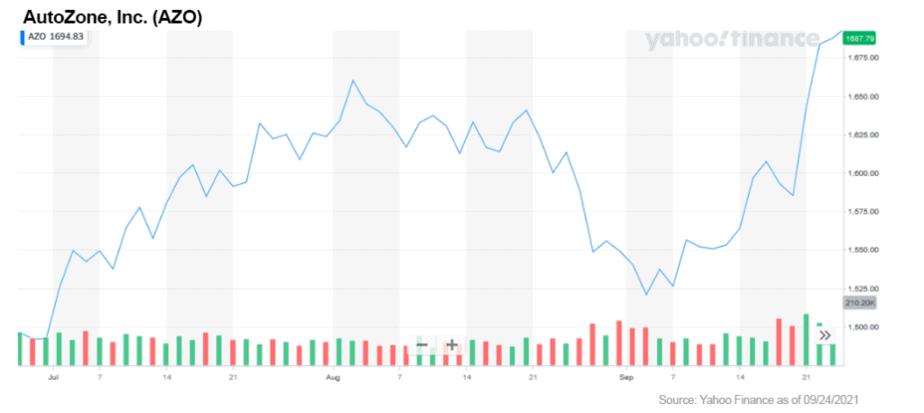

8. AutoZone, Inc. (NYSE: AZO)

AutoZone is one of the leading specialty retailers and distributor of automotive replacement parts and accessories in the United States. At the end of fiscal 2020, the company had 5,885 stores in the United States, 621 in Mexico and 43 in Brazil.

AutoZone’s EPS has grown steadily +23% each year, compounded over the last three years. These are good numbers by anyone’s standards.

Insider holdings also point to management who have a lot of skin in the game. $115MM worth of skin to be exact. That shows a high confidence in where the company is going by its leadership. Certainly gives confidence to shareholders.[7]

The company announced in May that 3rd QTR same store sales had increased +28.9% and EPS increased to $26.48.

Look for continued growth from this auto parts retailer in the coming six months.

I’m a fan of AutoZone. The stores are always well run and the staff knowledgeable. Customer service is super from my experience.

Definitely consider adding this to your watchlist.

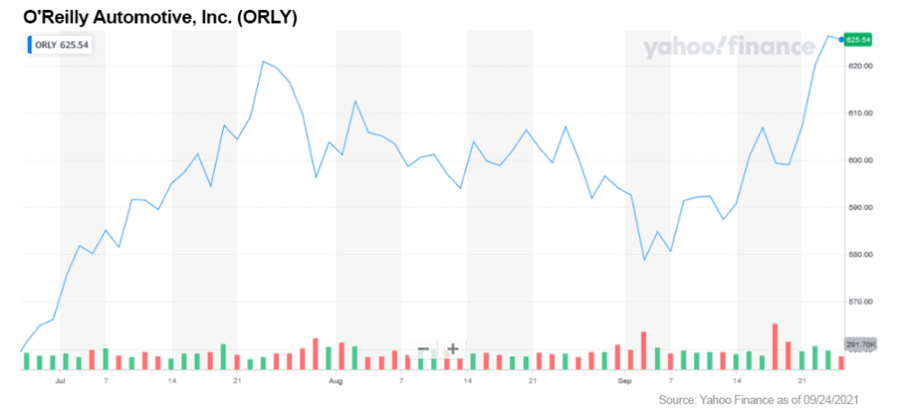

9. O'Reilly Automotive, Inc. (NASDAQ: ORLY)

O’Reilly was founded in 1957 and now boasts 5,710 stores operating in the US and 22 ORMA stores in Mexico as of June 30, 2021.

The company is a money machine. It has been generating record revenues for 28 consecutive years.

2nd QTR earnings handily beat Wall Street estimates with an earnings surprise of +14.42%. The company has consistently beat estimates in the last four quarters.

The company does not look like it will slow down anytime soon and should give investors some nice gains for a long-term hold.

As readers and followers of my trading articles know, every crisis could potentially be a trading opportunity. This auto sales crunch is no different.

Until the backlog of semiconductors used by auto manufacturers is cleared and manufacturing comes back to normal levels for new cars, the used car market will continue to see increased pressure in demand and soaring prices. It could take until 2023 before chip manufacturing equals production.

I suggest looking into online car sales companies and auto parts retailers to help diversify your portfolio over the next 12 months.

The market has several good options for investing. Hopefully some of my investment ideas will be of help to you in your personal research.

Happy trading!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.cargurus.com/Cars/price-trends/

[2] https://www.businesswire.com/news/home/20210805006008/en/Carvana-Announces-Second-Quarter-2021-Results-First-Positive-Net-Income-Quarter/

[3] https://finance.yahoo.com/news/cargurus-announces-second-quarter-2021-202700609.html

[4] https://finance.yahoo.com/news/cargurus-announces-second-quarter-2021-202700609.html

[5] https://money.cnn.com/quote/forecast/forecast.html?symb=CARG

[6] https://finance.yahoo.com/news/cars-reports-second-quarter-2021-113000789.html

[7] https://finance.yahoo.com/news/heres-why-think-autozone-nyse-055158935.html