As stock valuations climb to ever greater heights, economists and investors are beginning to take heed of several warning signs that are flashing.

The DOW took a dip a few weeks ago, and already seasoned investors are hoping that the end of the ‘meme’ stock craze might be coming to an end.

But is the party really over? Are we looking at an imminent equities market correction?

In my opinion the answer is NO — at least not in the near term.

In this article, I will dig into the current market bubble that is building and where we are in the 5 stages of a stock bubble. Next, we will look at the two most respected market indicators and why they are showing signs of stress. And finally, I will go over some sectors and stocks to consider when readjusting and diversifying your investment portfolio.

Even if you do not feel a stock bubble is happening, it is still a good idea to learn about the signs of a bubble and how to react accordingly before the herd runs for the exits and you are left holding the bag.

Take it from someone who has been burned in the past.

A basic tenet of bubbles is the suspension of disbelief by investors when the prices are surging under speculative pressures. Bubble prices for a particular stock will have no basis on company fundamentals and are purely driven by emotional speculative demand.

There are many types of bubbles: stock bubbles, market bubbles, credit bubbles and commodity bubbles, to name a few. For our purposes here, I will largely be talking about stock bubbles.

As we know from history, all bubbles eventually pop, leading to dramatic selloffs of any equity in question and subsequent price declines in the double digits over a relatively short time period.

Potential market corrections are notoriously difficult to call and historically are not seen until after the fact. That said, the warning signs were always there beforehand, and it pays to be aware of those signs as well as market sentiment.

Becoming familiar with the stages of bubble formation will help you spot the next one and avoid losing your shirt.

In 1986, economist Hyman P. Minsky first identified the five stages of a credit cycle in his groundbreaking theory on financial instability covered in his book Stablilizing an Unstable Economy (1986). This theory has since been used and modified to understand other bubbles as the cyclical patterns are the same.[1]

Understanding those five stages, which I have listed below, can help investors prepare their investment positions accordingly.

"A rapid price rise, high trading volume, and word-of-mouth spread are the hallmarks of typical bubbles. If you learn of an investment opportunity with dreams of unusually high profits from social media or friends, be particularly wary — in most cases, you’ll need uncanny timing to come out ahead."

— Timothy R. Burch, Associate Professor of Finance at the Miami Herbert Business School [2]

Currently there are two widely respected market indicators that are flashing red, or at least have not been seen at their current levels since the infamous market crash of 1929.

People tend to read into these things what they want to see, but the indicators have made correct predictions on past market crashes since the mid-70s.

Both the (1) Buffet indicator and the (2) Shiller PE (price-to-earnings) Ratio indicator are showing the markets to be extremely overvalued and warn of an impending market correction.

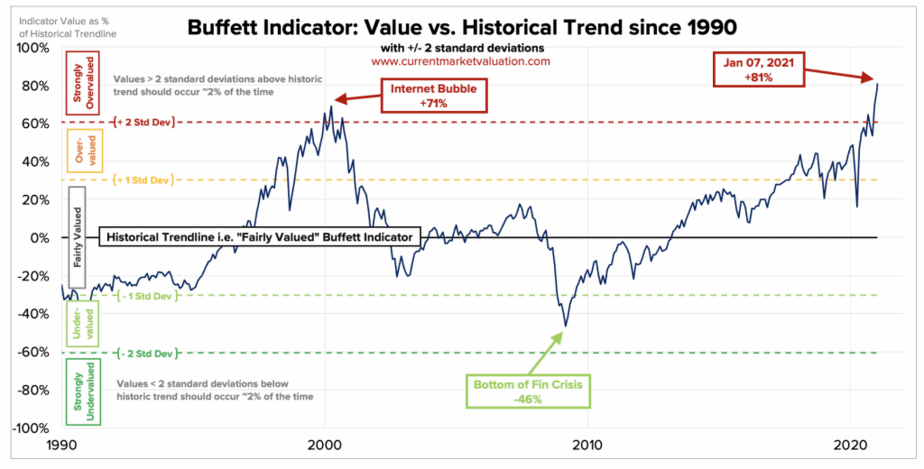

The Buffett Indicator takes the combined market capitalization of publicly traded US stocks and divides it by the more recent quarterly gross domestic product or GDP figure.

As of January 7, 2021:

This is currently 81% higher than the historical average, suggesting that the market is Strongly Overvalued.[3]

While it is a good indication of market value, it does have its flaws. It compares the stock market’s current value to the previous quarter’s GDP.

Another issue is that many US-listed companies do not contribute to the US economy, and GDP does not count income from abroad.

The chart below shows where the current market is compared with past financial crises.

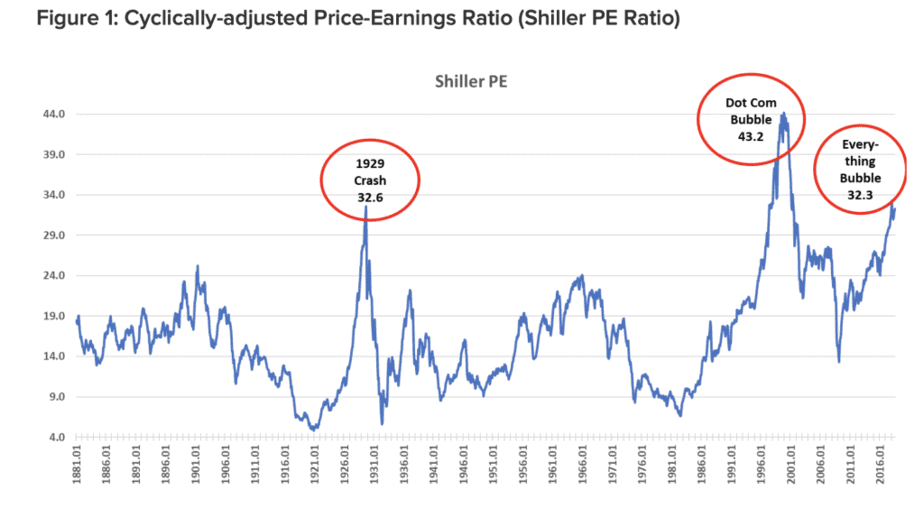

Another widely followed and respected market measure is the Shiller PE Ratio chart.

Professor Robert Shiller of Yale University invented the Shiller PE Ratio to measure the market’s valuation. The Shiller PE Ratio is a more reasonable market valuation indicator than the standard PE ratio because it eliminates fluctuation of the ratio caused by the variation of profit margins during business cycles.

Today the Shiller PE ratio is around 34.4, about double the historical average of 17.1, and on par with the market crash of 1929.

The concern is that in the previous four instances where the S&P 500's Shiller P/E Ratio topped and sustained 30, the index went on to lose at least 20% not long thereafter.[4]

Historically, when the Shiller PE Ratio has been over 25, it has actually been a precursor for sizeable market corrections.[5]

The short answer is NO.

Stocks have been overvalued for several years and investors do not need to take drastic action immediately.

Sundial Capital Research explains:

"The current high reading for the Shiller P/E is NOT a 'call to action.' It is more of a 'call to pay close attention.' There are always 'things' to be concerned about that may upset the apple cart." [6]

The Financial Times makes a good point:

The Federal Reserve forecasts that the US economy will notch up a heady 6.5 percent growth rate this year. That should boost corporate earnings and support asset prices, especially as US companies plan to pass on any rise in producer prices to consumers rather than let their profits take the hit.[7]

My best guess is the stock market will most likely see some sort of correction, especially for ‘meme’ stocks with ridiculous valuations with no basis in reality.

Even if the pessimists are correct and there is a market correction, I do not believe that every stock will plunge.

There are obviously some stocks that are trading at ridiculously high valuations, and these companies will never be able to realize and trade within their respective high threshold again. Those will be the primary targets in any market short or correction.

Take for example Tesla (NASDAQ: TSLA), currently trading at over $1,500 P/E ratio. The valuation makes no sense, no matter how positive you are about the company and its potential for growth.

This is a classic example of speculation and assumptions at play.

Corrections during a bull market can be healthy. Stocks will most likely continue a bull market run for at least another year, if not two, for several reasons:

In my opinion, there are still many good investment opportunities for the savvy investor that are still reasonably valued.

“…how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

— Alan Greenspan, former Federal Reserve Board Chairman, December 5, 1996

Alan Greenspan made this quote in a speech discussing the dotcom boom. This was about four years before the dotcom bust.

While Mr. Greenspan nailed the underlying economic factors and emotional investing at play, the results were not realized for FOUR more years.

In other words, don’t sell all your stocks today and hide the cash under the bed. Be aware of what is going on in the markets and adjust your portfolio accordingly depending on your appetite for risk.

Just because a stock market correction is inevitable does not mean you have to cower in the corner in fear or pull your money out of the market.

On the contrary, every market correction in history has proven to be an outstanding buying opportunity for long-term investors.

Investors should begin to build a diversified portfolio with exposure across a wide variety of industries and assets. It is important to hold a solid core of these diversified stocks that can withstand any economic condition and market shock.

It is also a good idea to move into more conservative equities that are paying dividends. While the returns will not have your blood boiling, you will get some sleep at night.

American Tower (NYSE: AMT), Crown Castle International (NYSE: CCI), Skyworks Solutions (NASDAQ: SWKS)

5G speeds are unimaginable and the technology will be a game changer on so many levels. 5G stocks and 5G infrastructure stocks make a ton of sense. 5G is the future and as the US begins to roll out service, these companies will profit handsomely.

Any company related to 5G such as cell tower real estate assets, and 5G installations to 5G specific semiconductor development and manufacturing will all profit handsomely in my opinion. This sector of the economy will be huge no matter what happens to the market.

Facebook (NASDAQ: FB)

With over 2.85 billion users on a monthly basis and another 600 million on WhatsApp and Instagram, Facebook is by far and away the largest platform to reach people with advertising messages. The company has weathered previous market corrections and would be a reasonable addition to any portfolio.

Alphabet (NASDAQ: GOOG)

Alphabet is an octopus with its hands in so many businesses that all promise huge potential for the company’s bottom line. Advertising, Autonomous Vehicles, Mobile Phones, Cloud Computing, AI, Robotics... the list literally goes on and on. A company this diversified will be self-insulated from any stock shock the market may see.

CrowdStrike Holdings (NASDAQ: CRWD)

As hackers sling malware and ransomware in every part of the internet, suffice to say that cybersecurity firms will have plenty of customers to help. CrowdStrike touts a 98% customer retention rate which says a lot of good things about their services and growth potential.

Intel (NASDAQ: INTC)

Intel is the world’s largest chipmaker and has plans to open new semiconductor foundries in the US in the coming years. They have also just inked an agreement with Qualcomm (NASDAQ: QCOM) to produce their chips. The company is trading at about 13 times earnings and pays a solid dividend of 2.39%.

MercadoLibre (NASDAQ: MELI)

Think of Amazon, but for Latin America. The company is in a dominant position for Central and South America, providing sellers with an ecommerce platform. They also process payments and arrange shipping logistics for its sellers.

Ecommerce in Latin America is, believe it not, still relatively new and not widely accepted. Winning customers’ confidence in making online purchases will be the biggest hurdle for the company, but if they win that confidence, they will see a huge windfall in company profits as more customers come online.

BioNTech SE (NASDAQ: BNTX)

Vaccine stocks are a good bet in any pandemic. BioNTech has partnered with Pfizer (NYSE: PFE) to develop a vaccine that targets the Delta variant of COVID-19. Testing is to begin in August 2021. BioNTech is the smallest of the companies with COVID-19 vaccines already on the market.

While some market indicators are flashing warning signs, the market can stay overvalued for many years without seeing any type of correction. It is impossible to predict how big a bubble can get before it deflates. This could takes months, maybe even years…

The point I want to make is that as a savvy investor, you will need to approach the market with eyes and ears open. Do not be blind to the bubbles forming in some corners of the market.

If you are up +100%, +200% or even +500% since last year, it may be a good time to move some of those positions in other areas of the market that are less vulnerable to any stock shock.

In a word: diversify.

Look for the stocks that are still value priced and are paying dividends.

It all depends on your appetite for risk.

As always, do your due diligence and let’s go make some money!

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.forbes.com/2010/06/17/guide-financial-bubbles-personal-finance-bubble.html?sh=1079ad627af3

[2] https://www.investopedia.com/articles/stocks/10/5-steps-of-a-bubble.asp

[3] https://kishen-das.medium.com/stock-market-bubble-2021-2022-8aeeaabf8fb0

[4] https://www.nasdaq.com/articles/a-stock-market-crash-is-coming%3A-where-to-invest-%2410000-when-it-happens-2021-06-05

[5] https://finance.yahoo.com/news/warren-buffetts-favorite-stock-market-indicator-isnt-alone-in-hinting-stocks-are-due-for-a-breather-192030974.html

[6] https://finance.yahoo.com/news/warren-buffetts-favorite-stock-market-indicator-isnt-alone-in-hinting-stocks-are-due-for-a-breather-192030974.html

[7] https://www.ft.com/content/ac7cfe19-54a5-4e9a-b059-bbce3e78e354