Special Purpose Acquisition Companies (SPACs) are facing some troubles. In 2020, these blank check vehicles raised over $82.1 billion.[1]

Unfortunately, increased SEC scrutiny has put a dent in the market, and SPAC ETFs in particular are suffering.

This demonstrates that the nature of SPACs makes them poorly suited to an ETF, and that investors should work to identify individual opportunities instead.

Before getting into the problems with SPAC ETFs, let’s take a look at what an actual SPAC is. A SPAC (Special Purpose Acquisition Company) is an entity created by what are called investment “sponsors” with no commercial operation of its own, for the purpose of merging with operating companies that the management team considers promising.

When the SPAC merges with a private entity, they become a single publicly traded entity, thus providing the private company with a public listing.

This might remind savvy readers of a reverse merger (also known as a reverse takeover), another alternative to the traditional IPO process. In a reverse merger the private company goes public by acquiring a controlling stake in a dormant shell company.

The problem with reverse takeovers was that they were easy for malicious investors to abuse for pump and dump schemes. In contrast SPACs require a clean company, and have a number of key differences that make them harder to abuse.

The SPAC consists of two stages. The first is an IPO where investors buy units at a specified price, for example, for $10 each. Each unit consists of a common share, which is regular stock and a warrant, which allows investors to buy additional shares at a predetermined exercise price. These are traded publicly on a fully diluted basis once the merger or business combination completes.

The second stage is called “private investment in public equity (PIPE)." This involves private institutional investors coming in to provide additional capital and buy additional shares. These can be anything from sovereign wealth funds to venture capital firms, and even high net worth investors.

One of the key features that has made SPACs viable again is the invention of the $10 redemption backstop, although not all SPACs take advantage of this mechanism. This means that investors are able to get their money back if either a SPAC fails, or they don’t like the outcome of a deal.

If you want to dive a little deeper into the specific mechanics of SPACs, fellow FNN contributor Carl Delfeld wrote an excellent explainer about SPACs in his article last October. (See Carl’s article here.)

SPACs have existed since 1993, so why are they only beginning to become popular now? Part of the answer lies in changing market dynamics and partly in the aforementioned redemption backstop. This is important because it neatly solves two of the biggest problems faced by investors and businesses: access to opportunities and access to capital.

Capital hungry businesses have been reliant upon private equity as IPOs have increasingly been considered prohibitively time consuming and expensive. A dearth of public companies, combined with historically low interest rates, have left investors with limited options and locked out most retail investors from the most promising opportunities on the market. SPACs could provide a solution to that.

For private companies, a merger with a SPAC is considered to be a cheaper, faster route to go public rather than undertaking their own IPOs.

This is because SPACs don’t have the same rigorous reporting requirements, which is particularly useful for startups and other pre-revenue private companies that need large amounts of capital now to reach their planned and ultimate potential.

From an investor’s perspective, SPACs democratize access to promising early-stage companies, something that has been monopolized by private equity. This is particularly important as early-stage investments bring the most return for investors. For example, early investors in the SPAC Switchback Energy Acquisition (SBE), now ChargePoint Holdings, Inc. (NYSE: CHPT), saw returns of +323% in 2019 for investors who sold during this period.[2]

In short, SPACs help to fulfill businesses’ demand for fast capital, and investors’ demand for fresh early-stage opportunities. However, this doesn’t mean that they are perfect.

Despite their utility, investing in SPACs is inherently high risk. The ‘team’ behind the SPAC is not obligated to share as much information as a company operating an IPO. They are not even required to reveal their target. This means that the ‘team’ is often the only information that investors have to base their buying decision.

This is problematic because researching management teams is time consuming. There is also no guarantee that the SPAC team itself won’t make a mistake. For an example of this in action, we need look no further than the Momentus SPAC deal.

A filing on July 16, 2021, confirmed[3] that the Stable Road Acquisition Corporation (NASDAQ: SRAC) would be complying with a settlement that would allow PIPE investors to drop out of the SPAC without a penalty.[4]

This resulted in investors accounting for more than half the money involved in the project dropping out and enabled those who remained to alter their deals in order to create a net gain of around $5 million on their side.

The problem started due to a combination of false claims from Momentus about the maturity of its technology and national security concerns surrounding the company’s Russian co-founder and former chief executive Mikhail Kokorich. Stable Road was also accused of failing to do proper due diligence on Momentus, and the settlement included $7 million in penalties against Momentus, and $1 million against Stable Road.

The Momentum-Stable Road debacle demonstrates two things. The first is that SPACs are not low-risk ventures. The second is that the management or principal investment team is absolutely critical to a SPAC achieving success. However there is a third challenge — and that is… uncertainty.

If you invest in a SPAC pre-deal, as I mentioned earlier, you are doing so with very little information beyond the management or main investment team. You don’t know what project they want to invest in, and you don’t know their exact plan. This means that the only information an investor has to go off is the team backing the SPAC, based on the information I’ve discussed above. The problem is that even experienced teams can make missteps.

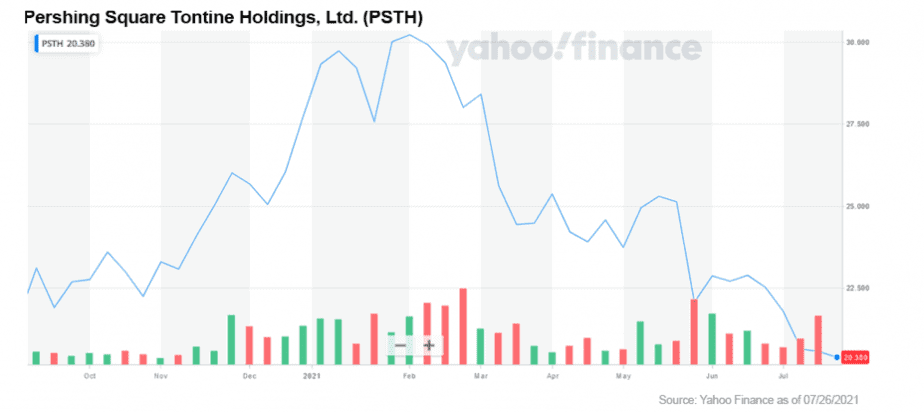

A recent example of this is the scandal surrounding William Ackman’s $4 billion SPAC, Pershing Square Tontine Holdings Ltd (NYSE: PSTH), the largest SPAC to date.[5] Ackman is an experienced hedge fund manager and has even conducted SPACs in the past, so the project would theoretically be in safe hands.

Unfortunately Ackman may have fallen victim to his own machinations. Instead of focusing on identifying a merger target, PSTH announced that it would look to acquire a 10% stake in Universal Music Group, which was already planned to be spinned off into a separate entity by Vivendi SA (OTC US: VIVHY). The most interesting part of this move is that it would technically allow PSTH to still complete a merger, increasing the overall value of the SPAC.

There was just one problem — the SEC. In late July, PSTH announced that it would not be able to accept its 10% stake in Universal Music Group because of concerns from the SEC regarding the transaction.[6] The deal also had a negative effect on Tontine’s stock price, driving it down by -18% and taking it to all-time lows.

The main issue of the deal was Ackman himself — he broke convention by going for an investment instead of a merger, and it came back to bite him.

Conventional wisdom says that in high-risk markets diversification is key, and that the best way to get diversification for minimal effort is an ETF. So why not forget about all this and simply invest in one of the SPAC ETFs available right now?

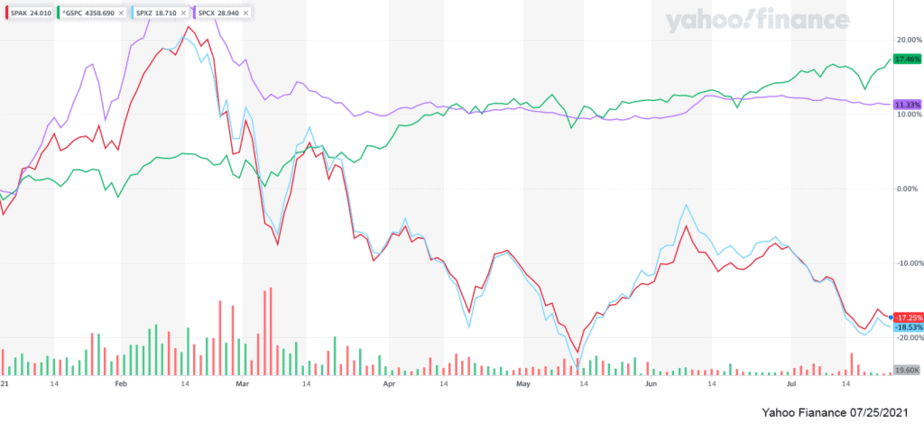

There’s just one problem with that thesis. SPAC ETFs are seriously underperforming.

For example let’s look at some of the first SPAC exchange traded funds: ETF Series Solutions - Defiance Next Gen SPAC Derived ETF (NYSE: SPAK), year-to-date, is down by over -16%, and -8% since its launch in October 2020. Morgan Creek - Exos SPAC Originated ETF (NYSE: SPXZ) has performed even worse and is down a painful -32% year-to-date.

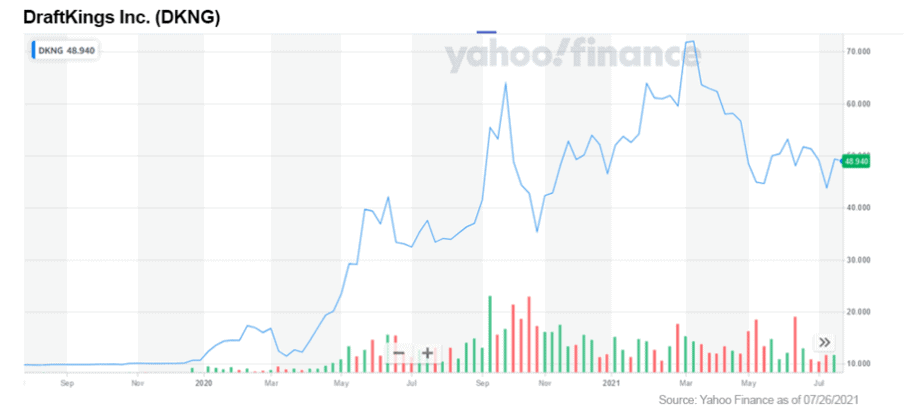

There is one notable exception, the Collaborative Investment Series Trust - The SPAC and NEW Issue ETF (NYSE: SPCX). This actively managed fund has been able to outperform other SPACs, but it is still lagging behind the S&P 500 by -4.25%. Compare this to DraftKings Inc. (NASDAQ: DKNG), one of the more successful SPACs with lifetime returns of +346% and great for investors who found the sweet spot of when to capitalize on their trade.

The dynamics behind this are complicated but can be boiled down to a combination of increased combination of SEC (US Securities and Exchange Commission) scrutiny and a general cooldown of IPOs.[7] In any case, the main takeaway is that SPAC ETFs do not significantly mitigate investor risk through diversification.

In fact, I would argue that SPAC ETFs completely miss the point of SPACs. A SPAC itself is essentially an investment vehicle, specifically a high-priced reverse merger, which sometimes comes with additional protections for early investors.

The main advantage of this investment vehicle is that investors get entry to an opportunity pre-IPO, which gives them access to opportunities normally reserved for private or what can be called specialized capital.

An ETF (Exchange Traded Fund) dilutes this opportunity. The investor will typically have less exposure to each individual company. The diversification of risk doesn’t make sense because all SPACs could be considered high risk, which leaves these ETFs open to extreme volatility in a way that a properly stacked portfolio wouldn’t be.

SPACs are high-risk, high-reward investments that should be treated as such. Rather than diluting their exposure via an ETF, investors should look for opportunities and balance that risk with other safer assets in their portfolio. A good rule of thumb to follow is that between 5–15% of your portfolio should be devoted to “fun” investment projects, with safer assets providing as your anchor.

With this in mind, let’s dive into the main things investors should consider when investing in SPACS:

This particular piece of advice holds true for almost all investing — you should stick to industries and technologies that you know and understand. If you have extensive experience in the biotech sector, you should look for SPACs in that area.

Following this strategy, you may have identified an opportunity like Arya Sciences Acquisition Corp II back in 2020, which merged with Cerevel Therapeutics Holdings, Inc. (NYSE: CERE), and is up +116% since its IPO last year.

As we have established, when investing in a SPAC there are a lot of unknowns. If you are investing pre-deal, the only piece of information that you can get a full picture on is the company’s management team. You are looking for a team that has a track record in operating SPACs, and has significant experience and connections in their target market.

When doing your research you should look closely at the investing founders. You specifically want to research their bios and if they have successfully completed deals in the past. You should also spend some time researching whether they have been involved in pump and dumps or rug pulls in the past, which is a serious red flag.

In the same vein, and this is my personal opinion, you should probably avoid celebrity-backed SPACs. These are usually style over substance and will likely lose momentum once the IPO is completed. This point can be ignored if the celebrity has actual pedigree or experience in the sector they’re supporting.

The biggest decision when investing in SPACs is deciding when to invest. If you trust a management team, or believe that a SPAC is trading at a discount, it can make sense to invest pre-deal. This means that you won’t know what the team is investing in, and are taking on considerable risk, but if the deal works out well you could be better rewarded.

More cautious investors may prefer to wait for a deal to be announced. This may mean that you have to pay a premium to get in, and will likely be in for the long haul, but it does give you more certainty, which has its own benefits of reducing risk to investor capital.

This may seem obvious, but it is important to talk about. At an IPO, SPACs typically use units, which are a combination of a share and a warrant. Warrants operate like a long-dated call option, usually within a two- to five-year duration. The unit ticker will typically trade with a “u” at the end.

However it is possible to only buy one share, without the upside/risk of a warrant, or only one warrant. You should be very careful about your choice here. If the warrant fails to meet its strike price, then the warrant can go to zero. This won’t happen with the share. Generally, I would suggest that you take the units and get that upside with the surety that it won’t go to zero.

Investors can redeem invested funds for a SPAC at any time if they decide they are unhappy with the direction the SPAC is taking. The number of redemptions can be a useful bellwether for determining a deal’s viability. Sometimes there are absolutely massive amounts of redemptions.

For example, Sandbridge / Owlet Baby Care (NYSE: OWLT) had to give around $197.6M in redemptions, or around 86% of the original IPO amount. This left the company with just $15 million and left many investors who didn’t redeem in a difficult position.[8]

This is a problem partly because sponsors aren’t badly hit when this happens — only investors. One way around this is to focus on companies like Far Peak Acquisition Corporation (NYSE: FPAC), which has included an agreement to forfeit for cancellation 1.95 million class A ordinary shares if more than 15 million class A ordinary shares are redeemed. You can find more details in their form 8-K if you’re interested (see here).[9]

There are a lot of SPACs out there, and not all succeed. While it will be possible to get your money back if a SPAC fails to merge, there is a lot of opportunity cost at stake. This makes picking the right one fairly important.

One example of a SPAC that fits most of the marks, but I still don’t like, is 7GC & Co Holdings (NASDAQ: VII). VII is the result of a partnership between 7GC (a boutique technology-focused venture capital fund) and Hennessy Capital Investment, a serial SPAC issuer who on paper has a solid team. The problem with it is its acquisition target: Vice Media.

I am skeptical that Vice Media is a company I’d want to own. The company has consistently failed to live up to its lofty valuation, and I struggle to see how a roll-up of its competitors would change the fundamentals of its business.[10]

At the opposite extreme, there are SPACs that seem worth considering but have very little available information. The travel SPAC Go Acquisition Corp (NYSE: GOAC) is an excellent example of why SPACs are so difficult. The only information available is based on the company's website, which is sparse.

We can see GOAC is aiming at the travel sector, and that they have a management team that is experienced with SPACs and has some pedigree in the space. For example, Greg O’Hara is on the board of TripAdvisor, American Express Global Business Travel, and the World Travel and Tourism Council.

The travel sector is also struggling at the moment due to COVID-19, which means that it is likely that they can merge with a really solid company at a good price. However without more information, an investment in GOAC is essentially a calculated gamble.

There is one deal that I personally find interesting and that is the Far Peak Acquisition Corporation (NYSE: FPAC) I discussed earlier. The company has announced a $9 billion merger with the Thiel-backed crypto exchange Bullish, which is a sector I understand.[11] There is also institutional interest, with a unit of Softbank purchasing 7.5 million Bullish shares.[12]

This is interesting because Bullish is clearly attempting to position itself as a competitor to the other regulated exchanges, for example Coinbase, while implementing more DeFi, and DeFi-like features, such as yield farming. This could give it an edge over incumbents in the space.

Another interesting example in the cryptocurrency space is the deal between Concord Acquisition Corp. (NYSE: CND) and the company behind the stablecoin USD Coin, Circle Internet Financial.

This deal is particularly interesting to me because it could capitalize on the serious transparency problems surrounding the current market-leading stablecoin, Tether. This is particularly interesting as Circle has specifically cited improved transparency around the USD Coin as a focus of the deal.

For me personally, these deals tick a lot of the right boxes. I understand the space, I see the potential of the acquisition targets, and I think the sponsors and PIPE investors involved in both deals make a lot of sense. But there are a couple of questions hanging over the deals, which also demonstrate some of the challenges with investing generally, and SPACs specifically.

A handful of law firms have announced “investigations” into the deals. In each case, the firms are claiming that the deals are unfair to CND and FPAC shareholders, as they will only obtain a small percentage of the target companies (4.9% for CND and 6.6% for FPAC).

At a cursory glance, this is concerning — it even gave me pause for thought. But once you start digging, it becomes less concerning. The first side is that, in my view, both Circle and Bullish have huge upside potential, and are likely to trade well above the valuations specified in the deals. I believe it is fair to predict that even 4.9% of the deal will be worth more than the money CND’s investors put in in the long term.

Setting aside these deals specifically, there has been a proliferation of SPAC-focused lawsuits. Many of these are fairly standard lawsuits that often get bought up when registered securities are involved.[13]

In our specific case, let’s take a look at the firms involved. The first, Brodsky Smith, has 271 cases active relating to securities and mergers in 2021 alone. You can find that list here. The second, Moore Kuehn, mentioned four separate SPACs in a single PR, which you can find here.

In my opinion, this indicates that law firms are targeting any SPAC deal where they feel there is a small chance of gathering a case to launch a class action lawsuit.

This is not to say that all these cases don’t have merit — but simply that the firms involved (and many others) are casting a wide net to see what they can catch. This is obviously frustrating for those of us involved in the deals they target, but it is also the nature of the securities law business.

In these specific deals, I’m not overly concerned by the investigations. Especially as both of these deals will need to be approved by CND and FPAC shareholders. However it does demonstrate that investing is always high risk, and shows the large number of factors that investors need to take into account when conducting due diligence.

SPACs are one of the most interesting developments to happen to the capital markets in a long time. They democratize access to early-stage companies, which is brilliant, but they also come with a great deal of risk.

This is in part eased by the innovation of the redemption backstop that enables investors to back-out if they don’t like a deal. However, a large number of redemptions can still leave the remaining investors with a heavy bag, which is far from ideal.

Despite all that, if you have the stomach for a risky play and are willing to do some really deep dives, I think that SPACs deserve a place in the “fun” part of your portfolio.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds positions in both CND and FPAC, which could be viewed as a conflict of interest.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.investopedia.com/top-performing-spacs-of-2020-5093918

[2] https://www.forbes.com/advisor/investing/spac-special-purpose-aquisition-company/

[3] https://www.sec.gov/Archives/edgar/data/1781162/000121390021037295/ea144329-8k_stableroad.htm

[4] https://spacenews.com/investors-drop-out-of-momentus-spac-deal/

[5] https://www.reuters.com/business/finance/spac-u-turn-mars-ackmans-hedge-fund-pivot-2021-07-20/

[6] https://www.businesswire.com/news/home/20210718005031/en/Pershing-Square-Holdings-Ltd.-Provides-Update-to-Investors

[7] https://www.bassberrysecuritieslawexchange.com/spac-sec-scrutiny-litigation-risks/

[8] https://www.thestreet.com/boardroomalpha/spac/spac-risk-exposed-redemptions-sponsor-promote

[9] https://www.sec.gov/Archives/edgar/data/1829426/000119312521211360/d198478d8k.htm

[10] https://www.wsj.com/articles/vice-media-raised-money-at-a-sky-high-valuation-now-the-bill-is-coming-due-11581450643

[11] https://finance.yahoo.com/news/thiel-backed-crypto-firm-public-123000598.html

[12] https://finance.yahoo.com/news/softbank-unit-invest-thiel-backed-143010311.html

[13] https://www.law.com/2021/06/11/law-com-litigation-trendspotter-spacs-arent-new-but-they-are-hot-and-so-are-lawsuits-targeting-them/