If I had to pick one word to describe 2025, it would be instability.

President Trump’s second term and first year in office has been marked by extreme volatility at home and abroad, and the markets reflect it. That being said, turmoil also creates opportunities for investors to thrive, and two assets have performed incredibly in 2025.

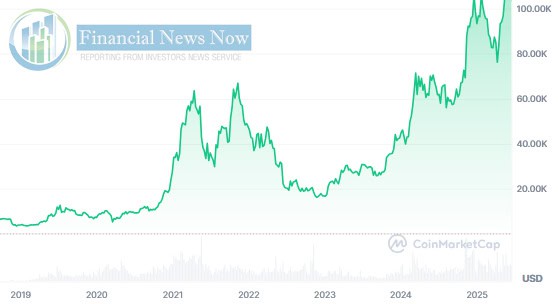

Both physical GOLD, and its more volatile digital counterpart Bitcoin (BTC), have hit new all-time-highs. Is Bitcoin finally living up to its digital gold nickname? Or is something else going on here? Let’s find out…

Let’s start by looking at some macro-effects. Despite some promising economic indicators, people feel like the economy is getting worse, and there’s even been rumblings of a stealth recession that began months ago.1

The reasons behind this are complicated, but in essence: Inflation is understated compared to GDP (Gross Domestic Product, a key measure of a country's economic output) because its impact has hit the goods people need the most. If you’re interested in why, Peter Schiff explains it here…

Aside from that feeling, other market data also points to use being in a difficult situation. One of the best measures of this is the VIX index, which reflects the expected 30-day volatility of the S&P 500. While it is not at true crisis levels, it is significantly inflated versus norms, and reflects a market that is primarily driven by uncertainty.

So what is creating this uncertainty? The first culprit is President Trump’s tariffs. While these are designed with long-term goals in mind, specifically the re-shoring of American manufacturing from China, they create significant short-term volatility. This is, in part, due to uncertainty about what the final tariff rates are going to be.

While analysts predict we will likely see effective tariffs of around 15–18%, recent court orders, and the Administration’s regular changes, have only worsened the uncertainty.2

This has led to the highest level of Daily Trade Policy Uncertainty (TPU) in the last four decades.3 Governments are ramping up retaliatory tariffs, and the global nature of trade means that businesses remain uncertain about what costs they will be facing.

In addition to tariffs, global events are creating more shocks. The ongoing war between Russia and Ukraine does not appear to have any end in sight. Additionally, Israel’s strikes on Iran have sparked a shooting, well a missile, war between both sides.

If this conflict escalates, global oil prices are expected to surge, with Baker Hughes and Woodsides declining to make predictions about the price of oil. This situation could be further complicated as tensions between India and Pakistan continue to mount following terror attacks in Kashmir in April.4

Combined, this has had a significant impact on global growth predictions. The IMF’s April 2025 outlook cut global growth to ~2.8%, with projections for the US, Euro areas and China lowered to roughly 1.8%, 0.8% and 4.0% in 2025.5

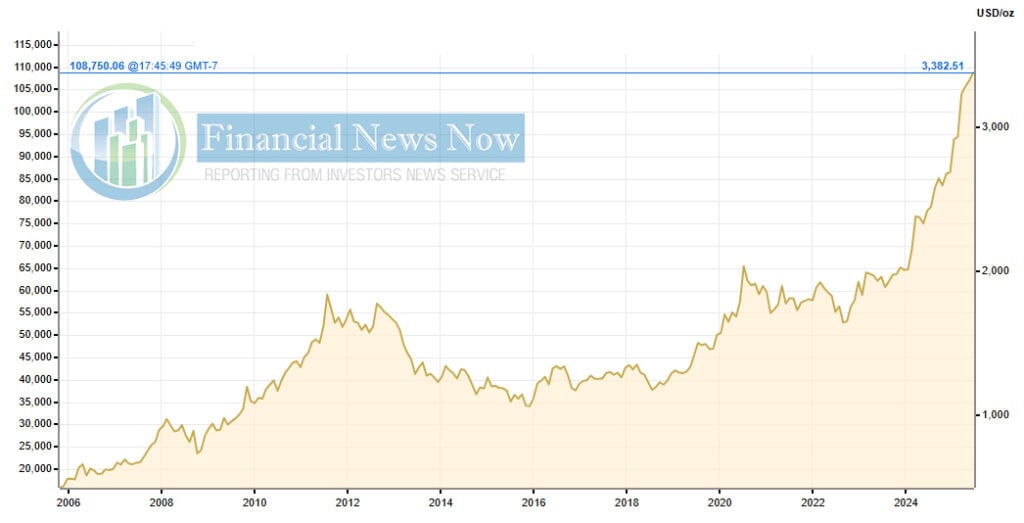

With this chaotic picture, it shouldn’t be surprising that (some) safe-haven assets are doing well. Gold is considered a classic hedge against uncertainty, and has hit record highs of $3,434/oz in April 2025, with another surge in June.

Gold demand has primarily been driven by geopolitical risks, and fears surrounding lackluster growth and inflation. For example, weak US economic data in early June drove prices up by 1%.6 This has driven demand not just for physical gold, but also ETFs, which saw record inflows in April 2025.7

While gold has performed well, another safe-haven asset has struggled — US treasury bonds. In that same April, redemptions from US Bond Funds hit their highest level since the final week of Q1 2020. However, this has mostly hit long-term US treasury bonds, and there is still demand for short-term bonds. Instability caused by a potential trade war has made investors wary of long-term bets.

In short, instability has driven people to classic safe haven assets. Everybody, from big institutional banks to normal retail investors, are trying to load up on gold to protect themselves from instability. However, if this is the case, why is Bitcoin, a quintessential risk asset, performing so strongly?

To its early adopters, Bitcoin has always been considered digital gold. This isn’t because it is tied to physical gold or because it acts like gold in the market. It’s down to the technology behind Bitcoin (BTC).

Like gold, Bitcoin has a total limited supply — specifically 21 million Bitcoin. New Bitcoin is minted on a specific schedule and this theoretically ensures that the price is more stable. This leads to proponents describing it as a digital “store of value.”

However, BTC is a relatively new asset and is very volatile. Despite the digital gold namesake, Bitcoin has typically had more in common with stock indices. For example, when US futures bounced in mid-June, BTC recovered alongside tech stocks.8

However, Bitcoin’s strong performance in 2025 has led some observers to believe that the asset is transforming, with Chainlink co-founder Sergey Nazarov saying, "For the first time now, it’s starting to get decoupled from tech stocks. So, if you wanted to choose a second safe haven asset after gold, Bitcoin would now be a logical choice."9

So is Nazarov correct? I’d say no. While Bitcoin’s strong performance does have correlation with gold, I think that the underlying reasons are very different. The general economy might be facing significant uncertainties, but crypto actually looks to be moving into a more stable situation thanks to new regulations being enacted by the Trump Administration.

The big problem facing crypto at the moment is regulatory clarity. EY Research has shown that 88% of institutions rank regulator clarity as a key factor that needs to be solved before investing in crypto.10 The hope for this new regulation drove BTC to just under $110,000 once Trump was elected President, with Bitcoin ETFs seeing an inflow of $4.5 billion in January alone.

Progress towards actually actioning on the Administration’s promises has been slow, and a driver of some volatility in the crypto market in 2025. However, things are looking up with the potential passage of two key bills: The GENIUS (Guiding and Establishing National Innovation in US Stablecoins) Act and the Digital Asset Market Structure Act.

The GENIUS Act is the first stage. The goal is to formalize stablecoins and exchanges and put them under Federal oversight. The focus on stablecoins, which are tokens pegged to another asset such as USD, is particularly important for the industry. It would provide a clear structure for what defines a stablecoin, how one can get a license to create them, and what consumer protections are in place to protect investors.

The GENIUS Act is still awaiting final approval, but is expected to pass, which would set the foundation for the Digital Asset Market Structure Act. This bill is specifically designed to provide a set of codified rules for exchanges, which would give retail users clear on-ramps into cryptocurrency.

It is also designed to reduce legal uncertainty for exchanges and wallets by defining when platforms must register with the Commodity Futures Trading Commission (CFTC) vs the US Securities and Exchange Commission (SEC) and also provides exemptions to blockchain developers.

I would argue that this improved clarity is the real driver behind BTCs positive price action in June 2025. While investors remain wary about the general legislative environment, the small piece of certainty provided by this legislation has done more to provide certainty for Bitcoin, and could mean lower volatility in the long term.

The takeaway here is that investors should continue to treat gold as a safe haven asset, and BTC as a risk asset and a relatively safe way to gain exposure to the cryptocurrency market. Let’s take a deeper look at both assets, and define a balanced investment approach that can help you make the most of them.

Today, in 2025 gold demand is driven by more central bank buying, rather than just retail investors, and this has led to positive price action on gold. Global instability doesn’t look like it’s set to go anytime soon, and the potential of a gold re-evaluation by the United States could cause a true supply squeeze, driving prices even higher.11

In this context, adding around 10–15% of gold, or gold ETFs to your portfolio could help to improve your overall resilience. Exposure methods include:

Buying gold bars or government-minted coins (e.g. American Eagles) for custody can help to give you a tangible asset with no counterparty.

Physical gold is a universally recognized store of value and provides a hedge if the USD begins to weaken. However, it has very low liquidity, and the premium charged by dealers can eat into your profits. Gold is also taxed as a collectible, with up to a whopping 28% tax on long-term gains.12

The final big risk is security. Gold held at home is always at risk of theft, and large amounts might represent an unacceptable risk depending upon where you live and what security measures have been taken.

Exchange-traded funds or mutual funds that hold physical gold offer a slightly simpler alternative to physical gold. Popular ETFs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU).

These are easy for any investor to trade, and offer high liquidity and ease of access. They essentially offer an easier alternative to physical gold that offers similar hedge benefits.

Most importantly, large gold ETFs have strong liquidity, and even in extremely volatile markets, should be able to accurately track the spot price.

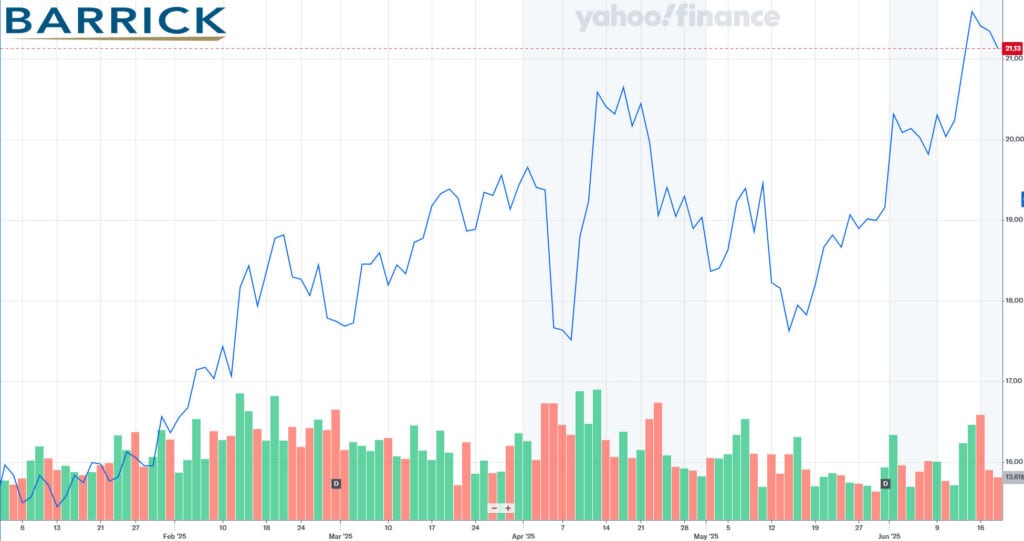

The final option is to identify specific gold mining companies, and directly buy their stock. This slightly increases your risk, as your returns depend on a single company. However, you may be able to benefit from dividends, and these stocks are typically highly liquid and able to be held in your US Individual Retirement Account (IRA) or Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) in Canada.

There are a lot of gold stocks available, so investors should identify what’s important to them. For most investors, finding a balance between growth, Environmental, Social, and Governance (ESG) compliance, and dividend payments is probably key. A good example is Barrick Gold Corporation (B), both for its dividends and solid reserves.

In terms of dividends, Barrick has a solid yield of around 2.3%, paying around $0.10 per share quarterly. The company's proven and probable gold reserves jumped by +28% in 2024, building on a strong track record.13 The company also has several key growth projects, with management aiming to grow gold-equivalent output by around 30% by 2030.

Barrick is also facing certain troubles, specifically a conflict with officials in Mali over unpaid taxes.14 However, I don’t think that these troubles damage the long-term prospects of the company.

Bitcoin is still a high-growth, high-volatility asset, so it should only account for a small portion of your portfolio, usually about 1–5%. The BTC price is likely to rise in the short term, and better regulations should shore up demand — so getting in before legislation is passed will likely be a benefit.

Exposure methods include:

It is possible to take full ownership of BTC by opening an account on an exchange, such as Coinbase or Kraken. You can then buy and sell BTC, either keeping it in an exchange wallet, or storing it in a hardware or software wallet if you plan to hold it for long periods of time. The only non-market risks here are security. If an exchange is hacked, or your wallet keys are compromised, you are at risk of losing your whole asset. There are custody options available if you prefer the extra layer of safety.

For investors who prefer traditional financial instruments should look at Bitcoin ETFs. The safest option is Grayscale Bitcoin Trust ETF (GBTC). These ETFs trade on US stock exchanges and have minimal fees. The big discount is that ETFs won’t perfectly track BTC spot price in volatile markets, which may cause you to trade at a gain or loss compared to market average.

There are a number of solid companies that are either directly involved in mining or trading BTC. Investors can get exposure through a variety of different companies. The best choice here is probably Strategy Incorporated (MSTR), formally MicroStrategy.

MSTR acts like a leveraged Bitcoin proxy. Its strategy has yielded over a whopping +3,000% stock gain since 2020 — compared to Bitcoin’s +735% thanks to issuance-fueled “infinite money glitch” leverage.15 This comes with a risk though. MSTR is very debt leveraged, and a sudden crash in the price of BTC (Bitcoin) might make it impossible for them to service this debt.

However, if you believe that BTC (Bitcoin) is set to stabilize and grow with new regulations, MSTR is an attractive way to gain exposure to that potential.

The takeaway is that investors probably need both gold and its digital counterpart Bitcoin in their portfolios today. The world is more unstable and by owning gold provides some leverage against that for the next number of years.

On the other hand, as cryptocurrency becomes more normalized, and on-ramps become easier for retail investors to use, BTC should reap real rewards. Now might be a good moment to begin the accumulation of Bitcoin before that happens.

One key thing I also consider when looking at volatile markets, like the one we’re seeing in 2025, is that it is an opportunity to accumulate assets before the next big bull run. I think that many investors are fearful right now, which means that those who are bold enough to keep putting money into the market are set to reap the greatest rewards.

As always, please do your own research, and decide if these investment opportunities are right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds BTC, ADA, ETH, and other cryptocurrencies or cryptocurrency companies.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

Sources: