Ding-dong, Bitcoin’s dead. At least that’s the prevailing narrative from the usual suspect (here’s looking at you, Jamie Dimon).[1]

Crypto veterans will be rolling their eyes right now. After all, Bitcoin (BTC) has been declared dead at least 467 times now.[2]

But there’s a nagging question… What if the pundits and naysayers are right? Despite recent recoveries, could 2023 be the year that finally kills cryptocurrency?

To find out, let’s take a dive into what’s happened in the crypto world over the past 12 months and what that means for cryptocurrency in 2023 — and we’re going to start with the worst of it. Yes, we’re going to get into the collapsed FTX crypto exchange debacle.

By far the biggest piece of crypto news in 2022 was the failure of the major exchange, FTX. At its peak, FTX was valued at a staggering US$32 billion at the beginning of 2022 and was considered to be a key player in the offshore exchange crypto market. However, there were problems brewing under the surface.[3]

Like many cryptocurrency exchanges, including giants like Binance, FTX issued its own token, called FTT. These tokens are roughly analogous to shares, without all those pesky regulations or SEC governance. From a user’s perspective, the FTT token had three main purposes:[4]

This is all relatively standard. Many cryptocurrency exchanges, including Binance, offer some kind of token native to their ecosystem. The problem was the company managing the funds backing FTT: Alameda Research, a sister fund also owned by FTX CEO Sam Bankman-Fried.

FTT itself was unable to receive wires. Instead, money was transferred to Alameda, and FTX would credit a user’s account once Alameda received the funds. Unfortunately for FTX’s customers, Alameda wasn’t clear about how they were using these funds. In reality, they were trading these funds, often at a loss, without informing customers, and using the FTT token as collateral for high-risk loans.[5]

The way Alameda actually made their money was not complicated. It purchased Bitcoin in one part of the world, sold it in another, and then pocketed the difference. The company used leverage, that is borrowed money, to fuel its trades and make bigger returns. As more investors and funds piled in and the price of cryptocurrency skyrocketed, this business became more and more lucrative — until it didn’t.

The problem with this model is that leverage is a double-edged sword — when you win, it amplifies your gains, but when you lose, it amplifies losses as well. And Alameda lost big. Unfortunately for FTX customers, the company wasn’t using its own resources as leverage, but those of FTX customers, and Alameda had some very angry creditors demanding payment as the company’s trades went bad.

Everything began to really fall apart when Binance realized something was wrong and announced that it was liquidating its FTT holdings following rumors that FTX was insolvent.[6] This crashed the value of FTT, which was no longer sufficient collateral to cover Alameda’s loans. A market run then led to a liquidity crisis that ultimately resulted in FTX ceasing trading and withdrawals following a hack that stole around US$477 million.[7]

FTX collapsed due to a bad actor, namely Mr. Sam Bankman-Fried himself, abusing the lack of regulations around cryptocurrency to misappropriate customer funds.[8] This is doubly concerning as FTX was widely considered to be a relatively responsible actor — until it wasn’t.

A number of major celebrities had received cast sums of money to promote FTX. For example, Kevin O’Leary, who lost around US$10 million, has admitted that he was paid a staggering US$15 million to be a spokesman for the exchange.[9] O’Leary also revealed the concerning fact that everyone was relying upon everybody else’s due diligence regarding FTX, highlighting a group-think that can affect even highly sophisticated investors when significant gains are on the table.

The true scale of the corruption at FTX is best described by its new CEO, bankruptcy attorney, John J Ray III, the CEO who led Enron after its storied collapse in 2001:

“Never in my career have I seen such a complete failure of corporate controls . . . as occurred here.”[10]

The corruption at FTX was deliberately well hidden, and it appears that only a small cabal at the top of the company were even aware anything was amiss. The fact that even institutional investors were fooled raises a particularly terrifying thought for the rest of us…

Longtime followers of FNN probably have a nagging feeling that I’ve talked about this before, and that is because I did here.

The biggest stablecoin on the market today, Tether (USDT), supposedly contains around US$65 billion in assets.

USDT is designed to act as a bridge between USD and the cryptocurrency market generally, but there are serious concerns that USDT is also being used as collateral for high-risk loans and that there are not enough real assets to cover USDT in the event of a bank rush.[11]

A USDT collapse would undoubtedly be the worst thing that could happen to the cryptocurrency industry. It underpins the entire cryptocurrency ecosystem, and nearly all exchanges rely on USDT to some extent. There are alternatives, but it is unclear whether they’d be able to step in to plug a $65 billion gap. Some exchanges are beginning to wake up to this, and crypto.com has recently delisted Tether in order to comply with the Ontario regulator.[12]

In an effort to reassure users, exchanges are becoming a lot more open about their holdings. For example, crypto.com (CRO) has released a full audit of its reserves, which is positive. Although, it did reveal the somewhat concerning fact that a full 20% of crypto.com’s reserves consist of the meme coin SHIB.[13] Other exchanges, like Binance and Coinbase, are also showing proof of reserves.

However, readers should keep in mind that not all these audits are equal, and those conducted by unregulated offshore exchanges, like Binance, need to be viewed with particular skepticism. This is evidenced in Binance’s most recent “audit,” where even the company conducting it, Mazars, has been cagey on the exact methodology used.[14] As a rule: Assume that any unregulated exchange is at risk of collapse until proven otherwise.

It is also of note that Decentralized Exchanges (DEXs) appear to be weathering the storm.[15] Decentralized platforms tend to be built with survivability in mind, and there is no “human factor” which could disrupt the way they operate. This seems to have been attractive to users, and in November they controlled approximately 16.8% of spot trade volume.[16]

DeFi also seems to be able to win over certain crypto skeptics, with JP Morgan making their first transfer on a variant of the DeFi protocol Polygon in November 2022.[17] I am comfortable stating that tokenization and other elements of DeFi will continue to grow in popularity even as centralized crypto companies struggle.

In my estimation, it is highly unlikely that we will see a complete collapse of the cryptocurrency sector within the next 12 months, even if we see a complete breakdown of USDT. Crypto has proven remarkably resilient to these sorts of crashes.

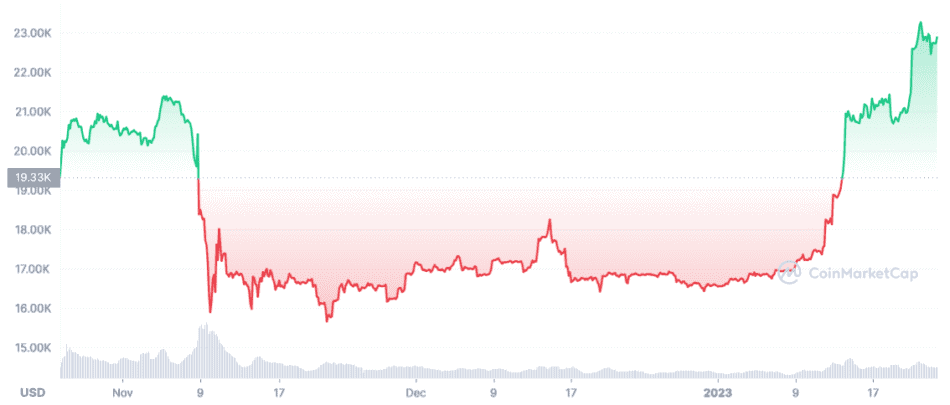

For example, when Mt. Gox collapsed in 2014, it accounted for a staggering 70% of global trading volume — FTX accounted for just 10%.[18] To illustrate this point with a more recent example, Bitcoin has already recovered to pre-FTX levels.

However, this doesn’t mean that there aren’t troubles ahead. The FTX debacle has attracted the ire of a number of global regulators, who are using it as a reason to crack down further on cryptocurrency.

The European Central Bank in particular has been arguing the narrative that Bitcoin is on “the road to irrelevance” as recently as November 30th.[19]

Their argument rests on the fact that Bitcoin and blockchain (or distributed ledger technology more generally) have yet to be shown to have a compelling practical use and is still largely used in experiments or money grabbing operations. The European Central Bank (ECB) believes that Bitcoin can serve neither as a currency nor a stable investment, and as such should not be promoted by governments.

Setting aside the large flow of venture capital and institutional funds that would disagree, the argument looks at Bitcoin in a vacuum, particularly in light of its importance to the cryptocurrency industry more generally.

BTC acts as a crypto-specific store of value for many investors. To them, it is analogous to a sort of crypto-only savings account, with the high level of risk that this entails.

Crypto investors are often happy to swap the safety of a fully insured bank account for the convenience of being able to instantly convert BTC to another cryptocurrency during bull markets. The ultimate effect of this is that Bitcoin has become the “reserve” currency of cryptocurrency and functions as the USD of the cryptocurrency ecosystem.

It’s also worth noting that BTC is still holding above previous levels seen during the 2018–2020 “crypto winter.” This is cold comfort for anyone who invested over the last two years, but it does demonstrate that BTC isn’t exactly dying — more like entering a second crypto winter.

For the uninitiated, a crypto winter is a term used to define a prolonged bear market in the cryptocurrency space. It is typically characterized by loss of mainstream interest in cryptocurrency and spans multiple years. It is characterized by lower volumes and a consolidation of investments into blue-chip cryptocurrencies like BTC or ETH.

This particular crypto winter has been triggered by the same problems afflicting the broader stock market. However, there are still a number of interesting developments happening in the cryptocurrency sector, such as novel uses of NFTs, that we’ll get into soon.

For now, the takeaway is this: So long as the cryptocurrency sector remains relevant, so will Bitcoin. Which leads us to the next big question…

I (sadly) do not have a crystal ball, so please view these as my predictions based on analyzing important data and my understanding of prevailing crypto market trends, and not just gospel beliefs. With that disclaimer out of the way, there are a number of trends from 2022’s otherwise anemic performance that provide good insight into how the crypto market will evolve in 2023.

As Bloomberg strategist Mike McGlone recently said, “This isn’t a crypto winter, it’s an everything winter.”[20]

Aside from the FTX collapse, cryptocurrency has faced headwinds from bad economic indicators. The Fed looks set to continue tightening up its monetary policy, which has made investors look for ways to shift out of high-risk assets. This includes technology stocks, startups, and of course cryptocurrencies.

However, all winters must eventually come to an end. In my view, the fact that we saw institutional investor activity on the exchange BitStamp increase by 57% in November 2022 is a sign that Bitcoin may be considered de-risked by many investors, who will feel validated by the recent upswing in value.

This doesn’t just extend to direct crypto ownership. Goldman Sachs has expressed interest in purchasing a number of cryptocurrency companies while their valuations are low.[21] This seems to chime with wider data showing that Web 3.0 and decentralized finance investments still lead funding activity in the venture capital space outpacing both FinTech and BioTech.[22]

In short, the big money is taking this opportunity to stock up in advance of the next bull run, but crypto does still face a major external challenge: regulators.

The big challenge for cryptocurrency is still the fuzziness surrounding regulations. While many cryptocurrency nerds still cling to the mantra “code is law,” governments prefer to enforce actual law. Efforts by the industry to self-regulate, either through Decentralized Finance instruments or by becoming more transparent about their reserves, will likely prove to be too little, too late.

For the moment, the ECB is leading the charge with the Markets in Crypto-Assets (MiCA) bill, which comes into force in late 2023. However, the Europeans are worried that in the absence of a global framework, incidents like FTX could impact broader markets and are looking for a global approach to insulate cryptocurrency.[23]

Unfortunately for the EU, there is still little consensus in the United States about what form crypto regulation should actually take. Although, it is likely we will see more alignment between the US and European regulators after the US Treasury’s Wally Adeyemo called for more global cooperation on crypto regulations.[24]

This will cause problems for a number of exchanges, particularly those that are considered offshore or outside of US regulations, including the behemoth Binance. If global regulations begin to tighten, these exchanges will find it increasingly difficult to operate without completely changing their business model. This will give established entities like Kraken, Coinbase, or crypto.com, who are already in compliance, a significant competitive edge.

Whatever happens with regulators, it is likely that crypto will begin to recover in 2023 if economic conditions improve — and there’s one token that will particularly benefit from this.

Out of all the cryptocurrencies on the market today, it is the 2nd largest that holds the most promise — Ethereum (ETH). I’ve covered the reasons for this in detail in this piece, but in brief:

Ethereum provides the infrastructure for the entire decentralized app (dApps) ecosystem, and the slow march towards Ethereum 2.0 continues without any major hiccups.

As a part of this march, Ethereum shifted towards Proof of Stake. This removed the need for miners, and has essentially eliminated any concerns about Ethereum’s environmental impact nearly overnight.[25] It has also helped to set the groundwork to eliminate the high fees and bottlenecks that have plagued the cryptocurrency ecosystem so far, and most importantly, acted as a restriction on the overall supply of ETH.

Aside from Ethereum’s own fundamentals, there is an old trend that may help drive its adoption: non-fungible tokens (NFTs). While they’ve not attracted the same fanfare as the first wave of NFT art did, there has been a quiet revolution happening in the space in the form of Reddit Avatars.

Reddit, Inc. is a major social media platform, and in late 2022 they quietly launched a unique digital avatar project.[26] While Reddit hasn’t openly called these NFTs, and you don’t need an external wallet to use them, Reddit avatars function exactly the same way as traditional NFTs do — with some selling for as much $45,000 in the middle of a bear market.[27]

These strange little avatars have proven popular with users. Over 225,000 avatars were minted in a single day in early December.[28] An important thing to note, Reddit avatars are based on the Polygon (MATIC) blockchain, which relies on our good friend Ethereum to function. While Reddit isn’t willing to directly associate itself with NFTs, the company has stated that blockchain remains a part of its long-term plans.

These kinds of projects will prove to be key drivers for Ethereum, and if the Reddit experiment lasts, it could provide more confidence and utility for blockchain in a social media and community setting.

Whether you believe these predictions mean that this is a good time to buy or not is entirely up to you, but I will say this: I do not believe that it is possible to “time” markets — at least not without leaving a great deal up to luck. I have been able to meet this bear market relatively unflinchingly because I have carefully accumulated assets over an extended period of time, rather than trying to catch falling knives, or chase tops.

I am personally convinced that cryptocurrency, particularly Ethereum, will continue to be an important, if niche, asset class. That is why I spend so much time writing on this topic and why I continue to put resources into ETH, ADA, and other cryptocurrencies. I believe that now is a good moment to do your own research and decide whether cryptocurrency is the right investment for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds BTC, ADA, ETH, UNI, and other cryptocurrencies or cryptocurrency companies.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://fortune.com/2022/12/07/jamie-dimon-crypto-investing-like-buying-pet-rock-cnbc-interview/

[2] https://99bitcoins.com/bitcoin-obituaries/

[3] https://www.nytimes.com/2022/11/11/business/ftx-bankruptcy.html

[4] https://linen.app/articles/what-is-ftx-token-ftt-explained-in-plain-english/

[5] https://www.cnbc.com/2022/11/13/sam-bankman-frieds-alameda-quietly-used-ftx-customer-funds-without-raising-alarm-bells-say-sources.html

[6] https://www.investopedia.com/binance-to-sell-ftt-6826211

[7] https://www.cnbc.com/2022/11/12/ftx-says-its-removing-trading-and-withdrawals-moving-digital-assets-to-a-cold-wallet-after-a-477-million-suspected-hack.html

[8] https://www.cnbc.com/2022/11/13/sam-bankman-frieds-alameda-quietly-used-ftx-customer-funds-without-raising-alarm-bells-say-sources.html

[9] https://www.forbes.com/sites/jonathanponciano/2022/11/17/new-ftx-ceo-says-former-billionaire-bankman-fried-led-unprecedented-failure-incessant-tweets-undermine-bankruptcy-case/?sh=2d8a00414268

[10] https://www.forbes.com/sites/jonathanponciano/2022/11/17/new-ftx-ceo-says-former-billionaire-bankman-fried-led-unprecedented-failure-incessant-tweets-undermine-bankruptcy-case/?sh=2d8a00414268

[11] https://www.pymnts.com/cryptocurrency/2022/tether-stablecoins-face-renewed-scrutiny-post-ftx/

[12] https://decrypt.co/118812/crypto-com-delist-tether-canada

[13] https://decrypt.co/114248/crypto-com-holds-20-of-its-reserves-in-shib

[14] https://mishtalk.com/economics/binances-alleged-crypto-audit-failed-not-even-its-auditor-would-vouch-for-it

[15] https://hbr.org/2022/12/why-decentralized-crypto-platforms-are-weathering-the-crash

[16] https://www.forbes.com/sites/leeorshimron/2022/11/23/dexs-gain-market-share-as-faith-in-centralized-crypto-players-erodes/

[17] https://thepaypers.com/cryptocurrencies/jp-morgan-executes-its-first-cross-border-transaction-using-defi--1259030

[18] https://coinchapter.com/mt-gox-fiasco-shows-bitcoin-champion-ftx-exchange-fud/

[19] https://www.ecb.europa.eu/press/blog/date/2022/html/ecb.blog221130~5301eecd19.en.html

[20] https://www.youtube.com/watch?v=Jw15qnYyGCY

[21] https://cointelegraph.com/news/goldman-sachs-reportedly-looking-to-buy-crypto-firms-after-ftx-collapse

[22] https://decrypt.co/115927/crypto-remains-largest-investment-sector-in-2022-outpacing-fintech-and-biotech

[23] https://www.cnbc.com/2022/12/07/crypto-regulation-europes-mcguinness-pushes-for-global-rules-after-ftx-collapse.html

[24] https://www.reuters.com/technology/us-treasurys-adeyemo-calls-global-cooperation-crypto-regulations-2022-12-01/

[25] https://www.reddit.com/r/CryptoCurrency/comments/zf10j5/ethereums_energy_switch_saves_as_much_electricity/

[26] https://www.socialmediatoday.com/news/reddit-launches-new-nft-like-avatar-project-enabling-users-to-purchase-cu/626806/

[27] https://www.one37pm.com/nft/reddit-collectible-avatars-trending

[28] https://www.coindesk.com/markets/2022/12/05/minting-of-reddit-avatar-tokens-climbed-to-record-high-over-weekend/

Ding-dong, Bitcoin’s dead. At least that’s the prevailing narrative from the usual suspect (here’s looking at you, Jamie Dimon).[1]

Crypto veterans will be rolling their eyes right now. After all, Bitcoin (BTC) has been declared dead at least 467 times now.[2]

But there’s a nagging question… What if the pundits and naysayers are right? Could 2023 be the year that finally kills cryptocurrency?

To find out, let’s take a dive into what’s happened in the crypto world over the past 12 months and what that means for cryptocurrency in 2023 — and we’re going to start with the worst of it. Yes, we’re going to get into the collapsed FTX crypto exchange debacle.

By far the biggest piece of crypto news in 2022 was the failure of the major exchange, FTX. At its peak, FTX was valued at a staggering US$32 billion at the beginning of 2022 and was considered to be a key player in the offshore exchange crypto market. However, there were problems brewing under the surface.[3]

Like many cryptocurrency exchanges, including giants like Binance, FTX issued its own token, called FTT. These tokens are roughly analogous to shares, without all those pesky regulations or SEC governance. From a user’s perspective, the FTT token had three main purposes:[4]

This is all relatively standard. Many cryptocurrency exchanges, including Binance, offer some kind of token native to their ecosystem. The problem was the company managing the funds backing FTT: Alameda Research, a sister fund also owned by FTX CEO Sam Bankman-Fried.

FTT itself was unable to receive wires. Instead, money was transferred to Alameda, and FTX would credit a user’s account once Alameda received the funds. Unfortunately for FTX’s customers, Alameda wasn’t clear about how they were using these funds. In reality they were trading these funds, often at a loss, without informing customers, and using the FTT token as collateral for high-risk loans.[5]

The way Alameda actually made their money was not complicated. It purchased Bitcoin in one part of the world, sold it in another, and then pocketed the difference. The company used leverage, that is borrowed money, to fuel its trades and make bigger returns. As more investors and funds piled in and the price of cryptocurrency skyrocketed, this business became more and more lucrative — until it didn’t.

The problem with this model is that leverage is a double-edged sword — when you win, it amplifies your gains, but when you lose, it amplifies losses as well. And Alameda lost big. Unfortunately for FTX customers, the company wasn’t using its own resources as leverage, but those of FTX customers, and Alameda had some very angry creditors demanding payment as the company’s trades went bad.

Everything began to really fall apart when Binance realized something was wrong and announced that it was liquidating its FTT holdings following rumors that FTX was insolvent.[6] This crashed the value of FTT, which was no longer sufficient collateral to cover Alameda’s loans. A market run then led to a liquidity crisis that ultimately resulted in FTX ceasing trading and withdrawals following a hack that stole around US$477 million.[7]

FTX collapsed due to a bad actor, namely Mr. Sam Bankman-Fried himself, abusing the lack of regulations around cryptocurrency to misappropriate customer funds.[8] This is doubly concerning as FTX was widely considered to be a relatively responsible actor — until it wasn’t.

A number of major celebrities had received cast sums of money to promote FTX. For example, Kevin O’Leary, who lost around US$10 million, has admitted that he was paid a staggering US$15 million to be a spokesman for the exchange.[9] O’Leary also revealed the concerning fact that everyone was relying upon everybody else’s due diligence regarding FTX, highlighting a group-think that can affect even highly sophisticated investors when significant gains are on the table.

The true scale of the corruption at FTX is best described by its new CEO, bankruptcy attorney, John J Ray III, the CEO who led Enron after its storied collapse in 2001:

“Never in my career have I seen such a complete failure of corporate controls . . . as occurred here.”[10]

Ray's concerns were apparently shared by the US attorney for the Southern District of New York, who filed charges against Sam Bankman-Fried on December 12th. This culminated in Bankman-Fried being arrested in the Bahamas, pending a likely extradition to the United States.[11]

For now, it appears that the corruption at FTX was limited to Bankman-Fried and a small cabal at the top of the company. However, the fact that FTX employees, and even institutional investors were fooled raises a particularly terrifying thought for the rest of us…

Longtime followers of FNN probably have a nagging feeling that I’ve talked about this before, and that is because I did here.

The biggest stablecoin on the market today, Tether (USDT), supposedly contains around US$65 billion in assets.

USDT is designed to act as a bridge between USD and the cryptocurrency market generally, but there are serious concerns that USDT is also being used as collateral for high-risk loans and that there are not enough real assets to cover USDT in the event of a bank rush.[12]

A USDT collapse would undoubtedly be the worst thing that could happen to the cryptocurrency industry. It underpins the entire cryptocurrency ecosystem, and nearly all exchanges rely on USDT to some extent. There are alternatives but it is unclear whether they’d be able to step in to plug a $65 billion gap.

In an effort to reassure users, exchanges are becoming a lot more open about their holdings. For example, crypto.com (CRO) has released a full audit of its reserves, which is positive. Although, it did reveal the somewhat concerning fact that a full 20% of crypto.com’s reserves consist of the meme coin SHIB.[13] Other exchanges, like Binance and Coinbase, are also showing proof of reserves.

However, readers should keep in mind that not all these audits are equal, and those conducted by unregulated offshore exchanges, like Binance, need to be viewed with particular skepticism. This is evidenced in Binance’s most recent “audit,” where even the company conducting it, Mazars, has been cagey on the exact methodology used. As a rule: Assume that any unregulated exchange is at risk of collapse until proven otherwise.

It is also of note that Decentralized Exchanges (DEXs) appear to be weathering the storm.[14] Decentralized platforms tend to be built with survivability in mind, and there is no “human factor” which could disrupt the way they operate. This seems to have been attractive to users, and in November they controlled approximately 16.8% of spot trade volume.[15]

In my estimation, it is highly unlikely that we will see a complete collapse of the cryptocurrency sector within the next 12 months, barring a complete breakdown of USDT. Crypto has proven remarkably resilient to these sorts of crashes.

For example, when Mt. Gox collapsed in 2014, it accounted for a staggering 70% of global trading volume — FTX accounted for just 10%.[16]

However, this doesn’t mean that there aren’t troubles ahead. The FTX debacle has attracted the ire of a number of global regulators who are using it as a reason to crack down further on cryptocurrency.

The European Central Bank in particular has been arguing the narrative that Bitcoin is on “the road to irrelevance” as recently as November 30th.[17]

Their argument rests on the fact that Bitcoin and blockchain (or distributed ledger technology more generally) have yet to be shown to have a compelling practical use and is still largely used in experiments or money grabbing operations. The European Central Bank (ECB) believes that Bitcoin can serve neither as a currency nor a stable investment, and as such should not be promoted by governments.

Setting aside the large flow of venture capital and institutional funds that would disagree, the argument looks at Bitcoin in a vacuum, particularly in light of its importance to the cryptocurrency industry more generally.

BTC acts as a crypto-specific store of value for many investors. To them, it is analogous to a sort of crypto-only savings account, with the high level of risk that this entails.

Crypto investors are often happy to swap the safety of a fully insured bank account for the convenience of being able to instantly convert BTC to another cryptocurrency during bull markets. The ultimate effect of this is that Bitcoin has become the “reserve” currency of cryptocurrency and functions as the USD of the cryptocurrency ecosystem.

It’s also worth noting that BTC is still holding above previous levels seen during the 2018–2020 “crypto winter.” This is cold comfort for anyone who invested over the last two years, but it does demonstrate that BTC isn’t exactly dying — more like entering a second crypto winter.

For the uninitiated, a crypto winter is a term used to define a prolonged bear market in the cryptocurrency space. It is typically characterized by loss of mainstream interest in cryptocurrency and spans multiple years. It is characterized by lower volumes and a consolidation of investments into blue-chip cryptocurrencies like BTC or ETH.

This particular crypto winter has been triggered by the same problems afflicting the broader stock market. However, there are still a number of interesting developments happening in the cryptocurrency sector, such as novel uses of NFTs, that we’ll get into soon.

For now, the takeaway is this: So long as the cryptocurrency sector remains relevant, so will Bitcoin. Which leads us to the next big question…

I (sadly) do not have a crystal ball, so please view these as my predictions based on analyzing important data and my understanding of prevailing crypto market trends, and not just gospel beliefs. With that disclaimer out of the way, there are a number of trends from 2022’s otherwise anemic performance that provide good insight into how the crypto market will evolve in 2023.

As Bloomberg strategist Mike McGlone recently said, “This isn’t a crypto winter, it’s an everything winter.”[18]

Aside from the FTX collapse, cryptocurrency has faced headwinds from bad economic indicators. The Fed looks set to continue tightening up its monetary policy, which has made investors look for ways to shift out of high-risk assets. This includes technology stocks, startups, and of course cryptocurrencies.

However, all winters must eventually come to an end. In my view, the fact that we saw institutional investor activity on the exchange BitStamp increase by 57% in November 2022 is a sign that Bitcoin may be considered de-risked by some investors who believe it will bounce back and that now is an acceptable entry point.

This doesn’t just extend to direct crypto ownership. Goldman Sachs has expressed interest in purchasing a number of cryptocurrency companies while their valuations are low.[19] This seems to chime with wider data showing that Web 3.0 and decentralized finance investments still lead funding activity in the venture capital space outpacing both FinTech and BioTech.[20]

In short, the big money is taking this opportunity to stock up in advance of the next bull run, but crypto does still face a major external challenge: regulators.

The big challenge for cryptocurrency is still the fuzziness surrounding regulations. While many cryptocurrency nerds still cling to the mantra “code is law,” governments prefer to enforce actual law. Efforts by the industry to self-regulate, either through Decentralized Finance instruments or by becoming more transparent about their reserves, will likely prove to be too little, too late.

For the moment, the ECB is leading the charge with the Markets in Crypto-Assets (MiCA) bill, which comes into force in late 2023. However, the Europeans are worried that in the absence of a global framework, incidents like FTX could impact broader markets and are looking for a global approach to insulate cryptocurrency.[21]

Unfortunately for the EU, there is still little consensus in the United States about what form crypto regulation should actually take. Although, it is likely we will see more alignment between the US and European regulators after the US Treasury’s Wally Adeyemo called for more global cooperation on crypto regulations.[22]

This will cause problems for a number of exchanges, particularly those that are considered offshore or outside of US regulations, including the behemoth Binance. If global regulations begin to tighten, these exchanges will find it increasingly difficult to operate without completely changing their business model. This will give established entities like Kraken, Coinbase, or crypto.com, who are already in compliance, a significant competitive edge.

Whatever happens with regulators, it is likely that crypto will begin to recover in 2023 if economic conditions improve — and there’s one token that will particularly benefit from this.

Out of all the cryptocurrencies on the market today, it is the 2nd largest that holds the most promise — Ethereum (ETH). I’ve covered the reasons for this in detail in this piece, but in brief:

Ethereum provides the infrastructure for the entire decentralized app (dApps) ecosystem, and the slow march towards Ethereum 2.0 continues without any major hiccups.

As a part of this march, Ethereum shifted towards Proof of Stake. This removed the need for miners, and has essentially eliminated any concerns about Ethereum’s environmental impact nearly overnight.[23] It has also helped to set the groundwork to eliminate the high fees and bottlenecks that have plagued the cryptocurrency ecosystem so far, and most importantly, acted as a restriction on the overall supply of ETH.

Aside from Ethereum’s own fundamentals, there is an old trend that may help drive its adoption: non-fungible tokens (NFTs). While they’ve not attracted the same fanfare as the first wave of NFT art did, there has been a quiet revolution happening in the space in the form of Reddit Avatars.

Reddit, Inc. is a major social media platform, and in late 2022 they quietly launched a unique digital avatar project.[24] While Reddit hasn’t openly called these NFTs, and you don’t need an external wallet to use them, Reddit avatars function exactly the same way as traditional NFTs do — with some selling for as much $45,000 in the middle of a bear market.[25]

These strange little avatars have proven popular with users. Over 225,000 avatars were minted in a single day in early December.[26] An important thing to note, Reddit avatars are based on the Polygon (MATIC) blockchain, which relies on our good friend Ethereum to function. While Reddit isn’t willing to directly associate itself with NFTs, the company has stated that blockchain remains a part of its long-term plans.

These kinds of projects will prove to be key drivers for Ethereum, and if the Reddit experiment lasts, it could provide more confidence and utility for blockchain in a social media and community setting.

Whether you believe these predictions mean that this is a good time to buy or not is entirely up to you, but I will say this: I do not believe that it is possible to “time” markets — at least not without leaving a great deal up to luck. I have been able to meet this bear market relatively unflinchingly because I have carefully accumulated assets over an extended period of time, rather than trying to catch falling knives, or chase tops.

I am personally convinced that cryptocurrency, particularly Ethereum, will continue to be an important, if niche, asset class. That is why I spend so much time writing on this topic and why I continue to put resources into ETH, ADA, and other cryptocurrencies. I believe that now is a good moment to do your own research and decide whether cryptocurrency is the right investment for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds BTC, ADA, ETH, UNI, and other cryptocurrencies or cryptocurrency companies.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://fortune.com/2022/12/07/jamie-dimon-crypto-investing-like-buying-pet-rock-cnbc-interview/

[2] https://99bitcoins.com/bitcoin-obituaries/

[3] https://www.nytimes.com/2022/11/11/business/ftx-bankruptcy.html

[4] https://linen.app/articles/what-is-ftx-token-ftt-explained-in-plain-english/

[5] https://www.cnbc.com/2022/11/13/sam-bankman-frieds-alameda-quietly-used-ftx-customer-funds-without-raising-alarm-bells-say-sources.html

[6] https://www.investopedia.com/binance-to-sell-ftt-6826211

[7] https://www.cnbc.com/2022/11/12/ftx-says-its-removing-trading-and-withdrawals-moving-digital-assets-to-a-cold-wallet-after-a-477-million-suspected-hack.html

[8] https://www.cnbc.com/2022/11/13/sam-bankman-frieds-alameda-quietly-used-ftx-customer-funds-without-raising-alarm-bells-say-sources.html

[9] https://www.forbes.com/sites/jonathanponciano/2022/11/17/new-ftx-ceo-says-former-billionaire-bankman-fried-led-unprecedented-failure-incessant-tweets-undermine-bankruptcy-case/

[10] Ibid.

[11] https://www.cnbc.com/2022/12/12/ftx-founder-sam-bankman-fried-arrested-in-the-bahamas-after-us-files-criminal-charges.html

[12] https://www.pymnts.com/cryptocurrency/2022/tether-stablecoins-face-renewed-scrutiny-post-ftx/

[13] https://decrypt.co/114248/crypto-com-holds-20-of-its-reserves-in-shib

[14] https://hbr.org/2022/12/why-decentralized-crypto-platforms-are-weathering-the-crash

[15] https://www.forbes.com/sites/leeorshimron/2022/11/23/dexs-gain-market-share-as-faith-in-centralized-crypto-players-erodes/

[16] https://coinchapter.com/mt-gox-fiasco-shows-bitcoin-champion-ftx-exchange-fud/

[17] https://bit.ly/3FIPFCG

[18] https://www.youtube.com/watch?v=Jw15qnYyGCY

[19] https://cointelegraph.com/news/goldman-sachs-reportedly-looking-to-buy-crypto-firms-after-ftx-collapse

[20] https://decrypt.co/115927/crypto-remains-largest-investment-sector-in-2022-outpacing-fintech-and-biotech

[21] https://www.cnbc.com/2022/12/07/crypto-regulation-europes-mcguinness-pushes-for-global-rules-after-ftx-collapse.html

[22] https://www.reuters.com/technology/us-treasurys-adeyemo-calls-global-cooperation-crypto-regulations-2022-12-01/

[23] https://bit.ly/3VaZizw

[24] https://www.socialmediatoday.com/news/reddit-launches-new-nft-like-avatar-project-enabling-users-to-purchase-cu/626806/

[25] https://www.one37pm.com/nft/reddit-collectible-avatars-trending

[26] https://www.coindesk.com/markets/2022/12/05/minting-of-reddit-avatar-tokens-climbed-to-record-high-over-weekend/