Do you feel like penny stocks and their potential of high returns have lost their allure? You’re not alone. Many investors, drawn in by tales of +1,000% gains, are beginning to overlook high-risk / high-return penny stocks in favor of the hottest new investment: cryptocurrency.

The problem is that many investors don’t know where to start. Buying cryptocurrency is complicated, and the technology backing it is often opaque, adding an additional risk factor that many investors may not be comfortable with. That may be about to change with the rollout of crypto ETFs and stocks operating within the crypto sector.

Longtime readers may be a little surprised that I’m even bothering to talk about crypto stocks. After all, I keep most of my cryptocurrency in wallets that I directly control. Why not just explain the best way to do that?

Well, many of you may own your own physical gold coins or bullion, a hedge or a hard asset. The advantage of this is that you own it and have it on hand should anything truly terrible happen. The disadvantage is that you are forced to store, protect, and care for it yourself. This means you need to take precautions to protect these hard assets from alternative risk factors, such as theft.

The same is true of cryptocurrency, but the risk factors are significantly higher. Your Bitcoin (BTC) or Ethereum (ETH) is not a physical asset, but a digital one, which means you need to take significant effort to secure an attack vector you may not fully understand.[1] To put this in context, around a whopping $10.5 billion worldwide has been lost due to Decentralized Finance (DeFi) fraud and theft in 2021.[2]

For individual investors who lack in-depth knowledge of best practices for cybersecurity (that would be most of us), this can create a level of risk that you can’t control, which puts many investors off investing directly in cryptocurrency.

In addition to these basic risks, effectively investing in cryptocurrency requires highly specialized technical knowledge. An investor needs to be able to understand tokenomics, cryptography, the target market of the cryptocurrency, how smart contracts work, and a plethora of other factors.[3]

All these considerations taken together can be daunting even to a seasoned equity investor. However, all of us understand the growth potential of the crypto sector and want exposure to it. Fortunately, the market is beginning to cater to investors who want exposure to the crypto space through more traditional means.

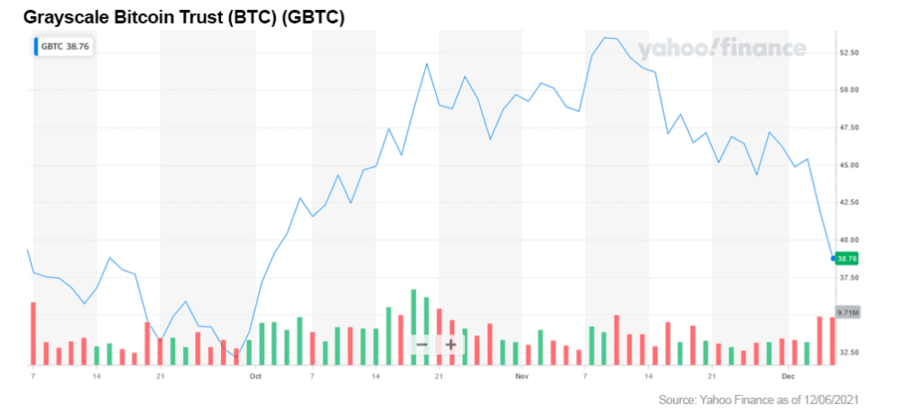

Exchange Traded Funds (ETFs) might not be sexy, but they are still one of the easiest ways to gain exposure to any asset — cryptocurrency included. These ETFs are even causing troubles for the most well-known crypto investment vehicle, the Grayscale Bitcoin Trust (OTC US: GBTC). For some time, this was the best way for investors to gain exposure to Bitcoin without having to open a cryptocurrency wallet.

However, returns for GBTC have not been as stellar as some had hoped. The fund is currently trending just 5% higher than the S&P 500. Additionally, it is facing significant pressure from more affordable ETFs that are able to take advantage of attractive fee structures and better ways of tracking BTC. The end result is that GBTC is now trading at a -15% discount compared to the value of its underlying assets.[4]

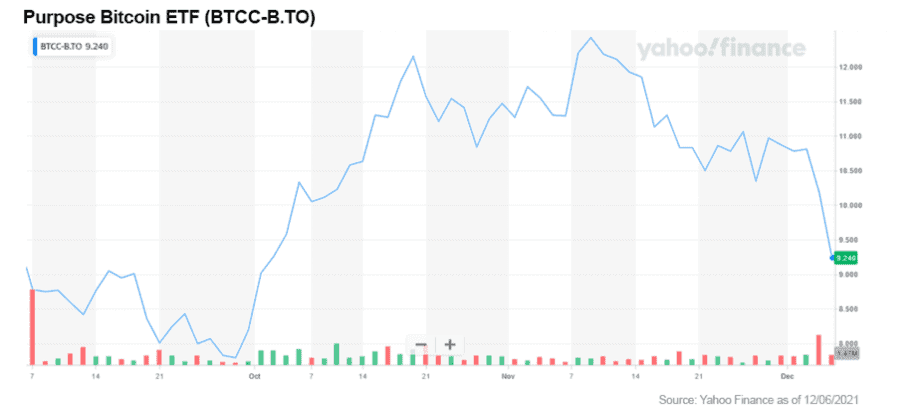

There are a few cryptocurrency ETFs available at the moment, however, the trend began with Canadian company Purpose back in February 2021.[5] The Purpose Bitcoin ETF (TSX: BTCC) has heavily outperformed the S&P 500, but there are other better choices available.

There are also newer ETFs on the block such as ProShares Trust — ProShares Bitcoin Strategy ETF (NYSE: BITO). However, these are a little younger and it’s tougher to say how they will perform over the long term. For me, the Purpose Bitcoin ETF (TSX: BTCC), or its Ethereum (ETH) based cousin, are still the safest bets for new equity investors looking for exposure to the crypto market.

Interestingly, in late November, Purpose also announced that it was creating a Bitcoin and Ethereum fund that pays a monthly yield.[6] The funds use a covered-call strategy to ensure that investors are able to gain a trickle of income — even if the price is trending negative.

This would enable investors to take advantage of upswings with the potential to significantly outperform traditional dividend yield investment vehicles.

Aside from ETFs, there are also three other key equity growth areas in the cryptocurrency space that I see right now...

In the cryptocurrency space, everyone requires one tool: an onramp. This onramp is typically called a stablecoin. These special coins are tied to a currency, for example the US dollar (USD), and provide a low-volatility way for investors to get fiat currency in and out of the cryptocurrency ecosystem.

The way they work is simple. Whenever an investor buys a stablecoin, they “lock” an equal amount of USD into that stablecoin’s ecosystem. If they want to convert it back to USD, they simply need to redeem their stablecoin, and they will receive their money back. So far, so simple.

The most popular stablecoin today is Tether (USDT). However, Tether’s days may soon be numbered. The stablecoin currency has a market cap of around $74,128,810,187. As Tether is supposed to be backed 1:1 by USD, this would make it the 42nd largest bank in the US, just below City National Bank.[7]

The problem is that it is unclear whether Tether actually has the ability to cover all these assets. If enough people were to try to redeem their Tether simultaneously, it could lead to a currency crisis as Tether attempts to hoover up assets in order to cover its withdrawals. This would have a knock-on effect on the currency markets.[8]

The source of this fear is the complete lack of transparency surrounding Tether’s holdings. It might have enough money to be a bank, but it certainly isn’t regulated like one. In fact, Tether is decidedly unregulated. The majority of Tether’s holdings are currently in offshore banks, where regulators can’t confirm or deny their statements about how much money is actually backing their token.

Somewhat worryingly, a report by Bloomberg revealed that the company’s accounts include billions of dollars in short-term loans to large Chinese companies, other crypto companies, and other high-risk investments.[9] If even some of these loans were to default, it could lead to Tether becoming worth less than one US dollar, which could have disastrous effects on the cryptocurrency and currency markets alike.

This fear has led to regulators placing stablecoins under increasing scrutiny. The most comprehensive legislation to date has come from the European Union in the form of two pieces of legislation: ‘Regulation on Markets in Crypto Assets' (MiCA) and the ‘Digital Operational Resilience Act' (DORA).[10] These regulations will require stablecoins to be regulated as financial service providers, and due to the Brussels Effect, are likely to be adopted globally.[11]

This will be a huge problem for Tether, which is unlikely to be able to comply, but it could be hugely beneficial for other stablecoin companies. There are few companies better placed to do this than Circle Internet Financial, the company behind USD Coin.

I have talked about Circle before here, and I still strongly feel that this stock is set to be a ‘strong performer.’ Circle is in the process of going public via the Special Purpose Acquisition Vehicle (SPAC) route via Concord Acquisition Corp. (NYSE: CND). The purpose of this deal is to enable Circle to become a fully regulated financial services provider and provide true transparency to its operations.

This would position Circle to displace Tether as the key onramp / offramp to the cryptocurrency space. This means that any potential investment into Concord Acquisition Corp. would be positioned to benefit from capital flowing into and out of the cryptocurrency sector without needing to own a single cryptocurrency.

Additionally, Circle has launched a $50 million venture capital fund, with a planned expansion into the Singapore market. This fund is designed to support Circle’s attempts to drive innovation in the digital finance space.

During the gold rush of the 19th century, the smartest money wasn’t out there prospecting — it was setting up shops to sell the tools and supplies people needed when they headed out west in hopes of hitting the jackpot. The same is true of the cryptocurrency world.

An obvious way to do this is to invest in the companies that are actually mining cryptocurrency. Crypto miners process transactions for many cryptocurrencies, notably Bitcoin, and are rewarded with cryptocurrency for doing so. By investing in these companies, investors gain access to not only the “tools” to produce more cryptocurrency, but also the value in the cryptocurrency that they are holding.

One of the most promising examples of a publicly trading mining company is HIVE Blockchain Technologies Ltd. (NASDAQ: HIVE / TSX-V: HIVE). HIVE was the first publicly traded crypto mining company, and it avoids environmental concerns by using 100% renewable energy in order to mine Bitcoin and Ethereum.

The company uses a HODL strategy that will be familiar to any crypto investor. (HODL is slang in the cryptocurrency community for holding a cryptocurrency rather than selling it.) In just November, the company announced that it has produced 218 BTC (approx. $12.2 million) and 2,334 ETH (approx. $10.8 million).[12]

The company’s most recent financials also show a company that is making a profit, and despite significant investments in its operations, still has around $4.7 million in liquid cash as of the six-month period ended September 30 2021.[13] This figure should now be even healthier following the closure of a bought-deal private placement financing to the tune of $115 million.[14]

There is one major risk factor for HIVE, and that is Ethereum’s transition to a Proof of Stake protocol. HIVE’s business relies heavily upon Ethereum, with around 48% of the tokens it generates coming from ETH. This means that there is a risk that a certain percentage of HIVE’s hardware could become obsolete.

There is one major and positive caveat here. It will be possible for HIVE to stake its already mined Ethereum in order to continue to generate profits. Additionally, it will be able to use its Ethereum mining hardware to target other coins that still use Proof of Work.

That being said, there is one more aspect of the cryptocurrency sector that all investors should be keeping an eye on. In my opinion, it’s the future of cryptocurrency: Decentralized Finance (DeFi).

Decentralized Finance (DeFi) uses the power of the blockchain to create faster, cheaper, and more accessible money without the need for 3rd party intervention.

DeFi is set to be the next big evolution in the world's financial systems.

There are many DeFi projects, however, many require you to buy their actual token to participate. The most promising projects are rarely listed on major cryptocurrency exchanges but are instead on decentralized exchanges (DEXs). These are difficult to navigate and hard to gain exposure to for traditional investors.

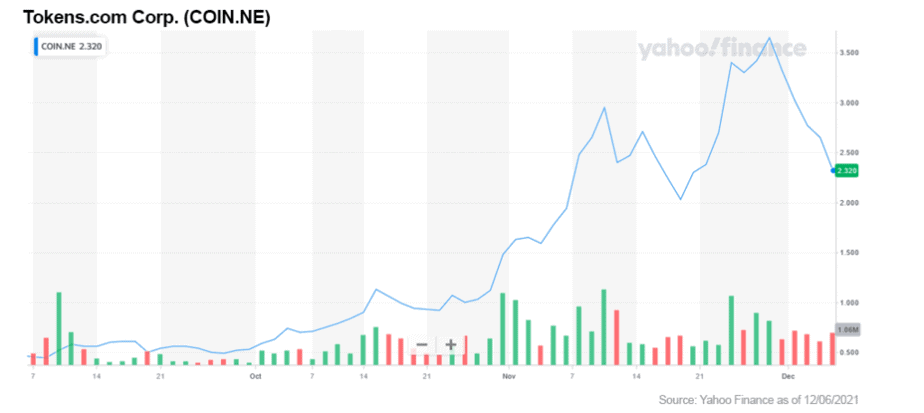

There are a few publicly traded stock options that investors can look at in the DeFi space. One that caught my eye as a risk capital option is Tokens.com Corp., trading in the US (OTCQB: SMURF) and in Canada (NEO: COIN). This company has positioned itself as benefiting from both DeFi and the metaverse. This is important as a true metaverse, built outside of Meta Platforms, Inc.’s (NASDAQ: FB) (formerly Facebook) closed garden, will likely require DeFi instruments in order to function properly.

The metaverse is being billed as the next evolution of the online world. It will enable humans to interact in virtual spaces through avatars. People can hold meetings, attend gigs, play games, and do just about anything else you can imagine. A key component of the metaverse is the ability to take digital objects from one “world” and transplant them to another.

Token.com Corp’s purpose is to provide better access to DeFi assets, specifically metaverse assets, through the public markets. The company invests in DeFi tokens and NFTs (non-fungible tokens), and then attempts to bring shareholder value by staking them. This process enables them to build a recurrent revenue stream.

To help combine DeFi and the metaverse, the company has majority ownership of a private company, Metaverse Group, which focuses upon buying digital “real estate” that is predicted to become valuable as the metaverse grows. This includes non-fungible token assets (NFTs) and space on virtual worlds. (For example, Roblox (NYSE: RBLX). This will then enable them to connect leading brands with already developed metaverse assets.

In addition, the company’s finances appear to be healthy. In its Q3 highlights, the company confirmed a net income of $4.1 million ($0.05 a share). The company earned staking rewards of around $719,051 during the 3 months ended September 30th.[15]

The Metaverse Group, a Tokens.com affiliated company, also recently closed the largest metaverse land acquisition in history.[16] In addition, on November 16, 2021, the company completed a private placement for a sizable CAD$16 million.[17]

There are some risk factors with Tokens.com Corp. — specifically its reliance on underlying crypto assets which are famously volatile. However, I believe that the combination of its newly acquired Metaverse Group asset and cryptocurrency is a big enough selling point to overcome these trends in the long term.

The key takeaway here is that there are plenty of great ways for investors to gain exposure to cryptocurrency without ever using a crypto exchange — decentralized or otherwise. These are all still high-risk, high-volatility investments, so investors should focus upon using their risk tolerance capital — not money destined for safer harbors.

In my view, cryptocurrency is still in its early days. There is room for explosive growth, particularly in the DeFi space, and even well-established cryptocurrencies like Bitcoin and Ethereum have plenty of space to grow.

Serious investors can benefit from gaining exposure to the space today, and for many of us, these ETF suggestions and recommended stocks are a much more convenient or early entry path to do so rather than seeking direct ownership.

That being said, the crypto space is high-risk, so always remember to do your own research and decide if these opportunities are right for you!

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] An attack vector is a route that a hacker can use to compromise your device

[2] https://www.cnbc.com/2021/11/19/over-10-billion-lost-to-defi-scams-and-thefts-in-2021.html

[3] Tokenomics is the study of the supply and demand characteristics of cryptocurrencies, for example hard caps, mining/distribution methodologies, or the practice of burning (destroying) fixed amounts of cryptocurrency to reduce supply

[4] https://www.ft.com/content/9fc7b034-7659-439f-a991-169662815883

[5]https://www.globenewswire.com/en/news-release/2021/02/18/2177751/0/en/Purpose-Investments-Launches-World-s-First-Bitcoin-ETF-Invested-Directly-in-the-Digital-Asset.html

[6] https://www.cbc.ca/news/business/bitcoin-ether-etf-purpose-1.6266783

[7] https://www.mx.com/moneysummit/biggest-banks-by-asset-size-united-states/

[8]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[9]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[10]https://www.consilium.europa.eu/en/press/press-releases/2021/11/24/digital-finance-package-council-reaches-agreement-on-mica-and-dora/

[11] The European Union is one of the world’s largest market, so organizations that wish to trade in that market will often adopt European standards, resulting in Brussels having an outsized effect on global regulations.

[12] https://finance.yahoo.com/news/retransmission-hive-presents-record-november-110000453.html

[13] https://www.hiveblockchain.com/medias/uploads/2021_09-30_HIVE_FS_FINAL.pdf

[14] https://finance.yahoo.com/news/hive-blockchain-announces-closing-115-214000903.html

[15] https://ca.finance.yahoo.com/news/tokens-com-announces-q3-2021-113000942.html

[16] https://ca.finance.yahoo.com/news/tokens-com-subsidiary-closes-largest-133800811.html

[17] https://ca.finance.yahoo.com/news/tokens-com-announces-closing-16-144200259.html