The words I am about to write are tantamount to a cardinal sin for a pro-crypto writer & investor. They will most likely clash with everything you have read about cryptocurrency so far. It’s possible it may even make some of you want to angrily email me explaining how wrong I am. Here we go…

Bitcoin (BTC) is not a safe-haven asset. Despite what Bank of America (NYSE: BAC) says, Bitcoin does not act like an inflation hedge.[1] As much as the cryptocurrency community wishes it were, Bitcoin is not digital gold. It always has been, and will remain so for the foreseeable future, a high-risk asset with more correlation to tech stocks than most commodities.

Now that I’ve thoroughly ruined my credentials as a bona fide pro-crypto investor, please allow me to explain why I believe this, what I think the future for Bitcoin actually is, and why that future is brilliant news for cryptocurrency investors.

The big problem with Bitcoin lies in the gulf between the vision of its founder Satoshi, and the reality of how the cryptocurrency has been used. Bitcoin’s reputation as “digital gold” is derived from the way that the token is created and distributed rather than from any real connection to the shiny yellow stuff.

The maximum amount of Bitcoin that can ever exist is 21 million BTC tokens. These tokens are slowly extracted by a network of computers competing to solve calculations in order to mint or “mine” BTC. As time goes on, the difficulty of finding new BTC increases, and thus the scarcity of liquid BTC will also decrease.

This scarcity is part of what drives Bitcoin’s value. The theory is that it makes Bitcoin an anti-inflationary asset, thereby giving it intrinsic value so long as investors use it as a store of value for their hard-earned cash. This should give BTC the same characteristics as an anti-inflationary commodity, like gold, and could potentially make it a safe haven in hard times.

It is likely these beliefs that led to the following line in Bank of America’s memo regarding the potential for a recession in April 2022:

"Inflation shock worsening, rates shock just beginning, recession shock coming," Bank of America chief investment strategist Michael Hartnett wrote in a note to clients, adding that in this context, cash, volatility, commodities and cryptocurrencies could outperform bonds and stocks. [2]

This memo is important because Hartnett is grouping cryptocurrencies generally, not just Bitcoin, with anti-inflationary commodities and cash. If you agree with the thesis that Bitcoin is digital gold, then it’s easy to see why Hartnett would make that assertion, however, let’s see what the data says.

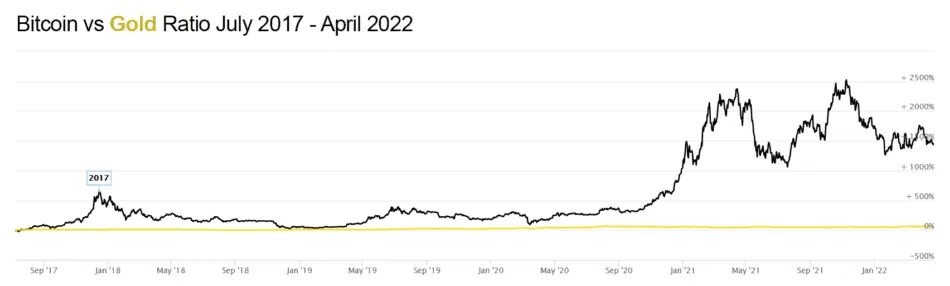

Since we’re talking about the threat of looming high inflation, let’s begin by comparing Bitcoin to the “gold standard” in anti-inflationary assets, the yellow metal itself — gold.

For me, this chart demonstrates two things. The first is that gold remains relatively flat throughout this period. The second is that Bitcoin price rises don’t seem to have any real correlation with gold prices. This also seems to hold true when we zoom out.

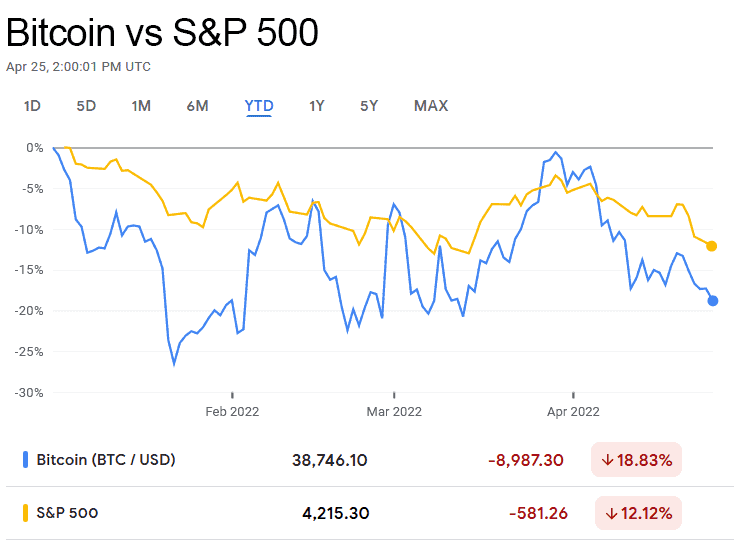

So if Bitcoin isn’t correlated with gold, what is it correlated too? Well let’s start by looking at what Bitcoin actually is — it is a new technology that is seeing significant interest from funds that focus on risk capital.[3] This would theoretically place Bitcoin in the same sort of realm as tech stocks, so let’s try using the S&P 500.

Now we’re getting somewhere. The correlation isn’t perfect, but Bitcoin appears to have far more in common with the S&P 500 than it does with gold. This means that investors are indeed treating Bitcoin as something closer to a speculative tech investment, rather than a commodity like gold or silver.

It isn’t just me coming to this conclusion. A Bank of America analyst, Alkesh Shah, noted this back in February, stating that Bitcoin was acting more like a risk asset than it was as an inflation hedge. [4] Other analysts have also noted that Bitcoin’s correlation to the S&P 500 hit a 17-month high in March 2022.[5] In short, the data shows that Bitcoin is closer to a tech stock than it is to gold.

Before we discuss the implication of this, let’s take a quick look at why investors are reacting this way.

At first glance, Bitcoin’s technological underpinnings make this outcome surprising, but you need to remember one thing — gold is old. Humans have coveted this shiny, malleable, metal for over 5,000 years.[6]

Since then it has been used in jewelry, as a primary medium of exchange, and in modern times, as the best of the anti-inflationary assets.

Bitcoin does not have that storied history. It is an emerging asset-class, riddled with contradictions and uncertainty. Its community is divided between blockchain evangelists with a noble belief in a decentralized libertarian future where BTC is used in lieu of fiat currency and people who just want to make a quick buck.

The political establishment remains at best ambivalent — and at worst outright hostile to Bitcoin. Finally, the technology remains deeply controversial with environmentalists due to its high energy use, although this situation is improving. [7]

I’m not trying to paint Bitcoin negatively here, although it may seem like it. I am trying to explain why the market reacts to Bitcoin in the way that it does. As much as crypto enthusiasts may wish it otherwise, for the time being most investors still view Bitcoin as a speculative high-risk asset.

Now that we know what is happening and have at least some grasp on why it is happening, we can decide what to do about it. In general, we should approach Bitcoin and other cryptocurrencies the same way that we would approach stocks or ETFs. “Blue-Chip” cryptos like Bitcoin and to a lesser extent Ethereum, I believe, will broadly follow the S&P 500.

It also means that we shouldn’t expect Bitcoin to perform strongly in a climate that doesn’t favor the stock markets. Tech stocks typically struggle during times of economic uncertainty since they are reliant on fundraising. As investors shy away from risky assets, their sources of revenue can dry up which can lead to a potential collapse. This same risk aversion will impact Bitcoin during any possible recession, and we can expect to see the price decrease markedly.

In practical terms, it means that we are likely going to see a period of marked instability in the price of stocks and crypto over the next year or so.

As my colleague Carl Delfeld highlighted in his excellent piece How to Protect Your Stock Portfolio From Increasing Inflation & Geopolitical Conflict, there is a very real risk that we are entering a period of inflation, even stagflation. This means that investors who are worried about their pocketbook should be avoiding weighting their portfolios too heavily in favor of cryptocurrency. If you’re thinking about offloading tech stocks, then it’s probably time to offload your Bitcoin as well.

This could also provide an opportunity for risk-tolerant investors. Buying while others are selling and fearful is an excellent way to grab valuable assets at a potential discount. If the overall markets in general are down, then investors may have an opportunity to buy Bitcoin on the cheap while waiting for the general capital markets to rebound.

What is true for Bitcoin tends to be true for other cryptocurrencies. The crypto market will generally track Bitcoin’s trend upwards or downwards, so by extension, you can use the S&P 500 to understand the broad direction of the overall cryptocurrency markets at the moment as well.

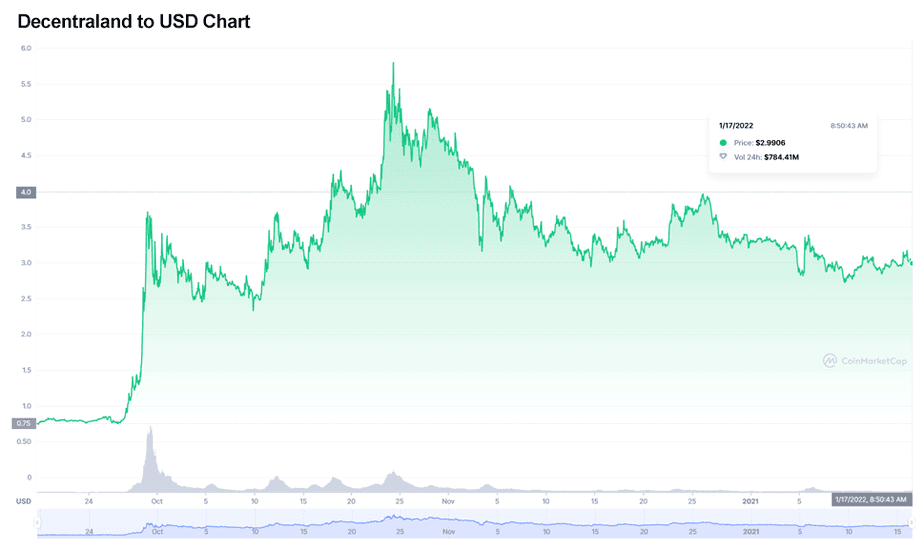

However, each individual project will have its own drivers that could increase risks or potential rewards. Investing in small niche projects can net much higher gains than simply investing in Bitcoin. For example, we’ve previously talked about Decentraland (MANA), which saw +4,000% growth in 2021, vastly outstripping Bitcoin’s 59.8%. (Read more on that here: KEY TRENDS FOR CRYPTO: Why the Metaverse, Polygon (MATIC), and Institutional Investors Could Make 2022 a Breakout Year for Cryptocurrency.)

With that said, there are some nuances that I want to emphasize. While Bitcoin is correlated to tech stocks and the S&P 500 Index, that doesn’t mean that it is the same as a tech stock. Cryptocurrency has its very own specific set of risk factors that should play into your investment strategy.

The first, and most worrisome, is the legal landscape. In the wake of Russian sanctions, there have been a number of voices in the political establishment, most notably Elizabeth Warren, calling for greater restrictions on cryptocurrency.

Setting aside the questionable logic upon which Warren’s argument stands, governments have good reasons to want to legislate for cryptocurrency.

Even when used for benign purposes, cryptocurrency creates an environment that is difficult for governments to control.

This is an anathema to these organizations, and many governments are working on Central Bank Digital Currencies, which they will undoubtedly want to push in favor of decentralized solutions. Even the whisper of Bitcoin-negative legislation could send the price tumbling down compared to the S&P.

Another thing to consider is the Decentralized Finance (DeFi) angle. DeFi can be understood as the cryptocurrency-powered mirror of the traditional financial system. Users can buy and sell cryptocurrency through decentralized exchanges, take out loans, or even insurance contracts.

This all operates in isolation of the rest of the global financial system through stablecoins, with the potential to completely disrupt the global banking system as we know it. (This likely explains why global governments still haven’t figured out a reasonable regulatory structure, but that’s for another time.)

This ecosystem is crucial to the success of cryptocurrency as a whole, but it is particularly important to Ethereum (ETH), which operates as the backbone of the whole system through the ERC20 smart contract standard. New projects within this ecosystem represent high-risk, high-reward investment options for investors with the industry knowledge and risk tolerance to back it up.

So now that I’ve (hopefully) justified my assertion that Bitcoin is a terrible hedge against inflation, I’d like to answer where I think it will go from here. In my view, there are too many technical, legal, and practical obstacles towards Bitcoin becoming legal tender. In the one country where it’s been tried, El Salvador, the rollout has been an unmitigated disaster.

However, I think that this is actually good news for investors. Of course, news about adoption will cause brief spikes in the price of BTC. However, I think that is because many observers miss the point: Bitcoin doesn’t need to be integrated into the real-world financial system to be useful. Indeed, doing so might even undermine its value.

Instead, we should view Bitcoin as an entry point into a wider cryptocurrency sphere. In this specific crypto context, it could be considered to be akin to gold — a (relatively) safe asset by cryptocurrency standards that investors can turn to when crypto markets become too unstable.

In other words, Bitcoin will continue to be an excellent store of value for investors interested in exposure to the wider cryptocurrency space. I expect to see more capital continue to pour into the token, as investors attempt to gain general exposure to the cryptocurrency space. It is even possible that Bitcoin will eventually decouple from the stock market, but for that to happen, the cryptocurrency space it represents would need to mature significantly.

This all brings us to the big question: Is now the right moment to invest in Bitcoin? For me, the answer is that the only better moment to invest in Bitcoin or other cryptocurrencies was earlier, but now works too.

I think that Bitcoin is likely to weather the storms ahead, and that there will be some great opportunities to purchase at a discount. However, at the end of the day, only you can decide whether a Bitcoin investment is the right choice for you. Take your time, do your research, and decide what entry point is right for you in an ever-changing cryptocurrency marketplace.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] There is some disagreement here, I’ll get to that later!

[2] https://www.reuters.com/world/us/global-markets-flows-urgent-2022-04-08/

[3] https://www.forbes.com/sites/danrunkevicius/2021/01/14/myth-busted-wall-street-is-not-investing-in-bitcoin/?sh=389b69205510

[4] https://www.coindesk.com/business/2022/02/09/bofa-says-bitcoin-trades-more-as-risk-asset-less-as-inflation-hedge/

[5] https://finance.yahoo.com/news/bitcoins-correlation-p-500-hits-083740983.html

[6] https://www.metaltek.com/blog/the-golden-age-the-history-of-gold/

[7] https://www.nasdaq.com/articles/a-comparison-of-bitcoins-environmental-impact-with-that-of-gold-and-banking-2021-05-04

This is not your typical hysterical cryptocurrency price piece. I will not be obsessing over whether Bitcoin (BTC) will go to zero (it technically could, but probably won’t) or hit $100K (it probably will eventually, but it might not be this year).

Instead, I’d like to take a step back and look at what I believe are the key trends for crypto in 2022 and how investors can use these to identify the best opportunities in the cryptocurrency space today.

The Non-fungible Token (NFT) craze of 2021 was worth $22 billion.[1] This is not because it introduced the art world to cryptocurrency, but rather because the first wave of NFTs represented an early experiment in monetizing digital assets.

Whereas one Bitcoin is pretty much the same as any other, each NFT is designed to be non-fungible, and therefore unique. It is possible to trade it for another thing, but you can’t trade it for the same thing. In physical terms, NFTs are like baseball cards with ID numbers; you can trade them for another card, but each card has its own unique properties and value. For example, the holy grail of sports cards, Honus Wagner, is worth significantly more than a more common card.[2]

Why is this important? Because the company formerly known as Facebook, Meta Platforms, Inc. (NASDAQ: FB), has fired the starting gun on the Metaverse.

This concept takes the idea of blending our digital and physical realities to the next level by combining online marketplaces, digital scarcity, and cutting-edge virtual reality/mixed reality technologies.

This promises to create a whole new way for people to interact in the digital world, whether that’s in the way we work or the way we spend our leisure time. It also opens up countless new revenue opportunities for businesses, who will find it easier to monetize digital assets.

However, many consumers are understandably a little concerned about allowing Facebook/Meta to access even more of their lives. As a result, there is a growing movement of companies such as Roblox (NYSE: RBLX) looking to build alternative metaverses. The big challenge they will need to overcome is interoperability, and that is where NFTs and cryptocurrency come into their own.

Hear me out…

NFTs will enable the two key features of a decentralized metaverse to function: interoperability and scarcity. Each NFT token can be appended to a specific digital asset and can then be traded for anything else or even ported into different platforms. This provides a way for creators to directly monetize their content, and an aftermarket for users to trade unique digital content amongst themselves.

NFTs are already being deployed in novel concepts. For example, the world’s first “NFT restaurant,” the seafood inspired New York-based Flyfish Club, has raised $14 million using NFTs. As a members-only dining experience, customers would require an NFT to prove their membership before going to the restaurant.[3]

In the digital realm, crypto projects that focus on this concept already exist. One of my favorites is Decentraland (MANA), which saw +4,000% growth in 2021. MANA represents an early attempt to build a decentralized metaverse and has around 300,000 monthly active users.[4]

Decentraland is based on the Ethereum blockchain and relies upon two kinds of tokens in order to function: LAND (not to be confused with the blockchain project Landshare), an NFT that defines ownership of land parcels representing digital real estate, and MANA, a cryptocurrency that allows users to purchase LAND, goods, and services in the Decentraland marketplace.

Rather than being governed like a normal company, Decentraland is governed by a decentralized autonomous organization (DAO). These organizations are designed to mimic a corporate governance structure, but instead of decisions being taken by the board or a CEO, they are taken by community members who hold tokens in the project.

In the case of Decentraland, this structure allows holders of MANA to vote on the future direction of the project and control things like upgrades, new products or LAND distributions.

Investors who are looking to get involved in Decentraland can either buy MANA directly on an exchange or invest in more traditional instruments that have strong exposure to MANA. The two best examples are Tokens.com Corp (OTCQB: SMURF / NEO: COIN), which I talk about in more detail here, or the Grayscale Decentraland Trust, which provides exposure to Decentraland’s MANA and all the assets underpinning it.

Despite positive efforts by the Ethereum team, gas transaction fees remain a significant challenge. It can cost a lot of money to make simple transactions, and when network load is high, it is often financially prohibitive to make small transactions.

This problem is not unique to any one platform. All the top ten smart contract platforms have significant challenges with fees and transaction times.

The big problem occurs when a transaction takes so long, it doesn’t get entered into any blocks. In this case, a fee is still charged, but the transaction doesn’t go through. If this can’t be solved, it could be an existential threat to crypto adoption.

One of the best solutions proposed for this are so-called zero-knowledge rollups (zk-rollups). A zero-knowledge rollup is a layer-2 scalability solution that allows blockchains to process more transactions at a cheaper rate than traditional layer-1 blockchains like Ethereum (ETH) or Bitcoin (BTC) by offloading most of the transactions away from the blockchain, and then bundling them into a single transaction.

To understand how this works, let’s take a look at a theoretical example. Let’s say that I want to buy a token — let’s call it Awesomecatscoin on Uniswap (UNI) — that doesn’t have a USD Coin (USDC)-to-Awesomecatscoin pairing. In order to purchase it, the decentralized exchange would need to do the following:

Each of these transactions requires a gas fee, which could significantly increase the cost of running what should be a simple trade, and could even make the trade unprofitable. In the worst case scenario, my transaction might fail because of a sudden spike in gas price. This is because each transaction currently needs to be processed on the primary (or layer-1) blockchain.

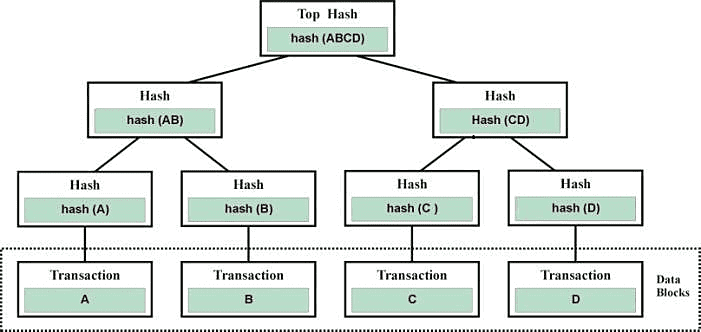

The solution to these problems is “rollups.” This is a broad term that covers many kinds of solutions, but the crux of it is that they use clever implementations of solutions like merkle trees in order to process most of the data off-chain and compute the final result onto the blockchain.

Understanding exactly how merkle trees work isn’t hugely important, but in essence they form a data structure that makes it easier to process large volumes of data on a blockchain. The top hash groups a number of transactions together (data blocks), and these will themselves be grouped under other hashes.

This makes it possible for users to verify large numbers of transactions by simply querying the top hash and means that they don’t need to process every transaction in the merkle tree to confirm that one is correct.

All blockchain technologies use merkle trees in one form or another, but zk-rollups store the “root” (or top hash) of the tree in a smart contract. The rest of the tree is processed off-chain rather than using the blockchain itself.

When transactions within a particular tree are complete, the smart contract confirms a non-interactive zero-knowledge proof (zk-SNARK)[6] to make sure that it is correct, and then processes this single confirmation on the blockchain. This can turn what may have been dozens of on-chain transactions into a single transaction.

For the sake of brevity, I have greatly simplified this process. If you’re interested in the specific processes, you can find more in the references at the end of this article.[7]

The concern is that almost all previous layer-2 solutions created new security, trust, or assumption challenges that would not be present if you were just using the layer-1 solution. A zk-rollup is designed to provide the same security as directly using its parent blockchains, while massively increasing scalability and without sharing any user data.

There are quite a few zk-rollup solutions in the works, but for the purpose of this discussion let’s focus upon Ethereum-based solutions. For me, there are two solutions that stand out: Loopring (LRC) and Polygon (MATIC).

Polygon (MATIC): Building Interoperable Blockchains

Of the two solutions, Polygon is the most well-known and stands as the 14th largest coin by market cap at the time of writing. The purpose of Polygon is to simultaneously allow processing Ethereum transactions off-chain, while also allowing developers to launch interoperable blockchains.

This is huge. Rather than simply bolting a solution on top of Ethereum, developers can actually create their own blockchains with specific modules that are more tailored to their needs. Polygon is composed of four layers: Ethereum layer, security layer, Polygon networks layer, and execution layer. Each of these layers performs a specific function that allows Polygon-developed blockchains to operate.

Polygon Has Experienced Runaway +8,888% Growth Over the Past Year

Investing in Polygon (MATIC) essentially means that you are investing in a tool that will enable developers to more easily create and maintain specialized blockchains, while still using Ethereum as the basic infrastructure. This helps to maintain decentralization and makes it easier to implement blockchains in more businesses in an interconnected landscape.

If that isn’t enough, Polygon has experienced an insane +8,888% growth rate over the last year.[8] While past performance is no guarantee of future results, that shows that there is considerable momentum behind MATIC.

You can buy MATIC on most exchanges. For more details, click here.

Loopring (LRC): Lowering the Barrier to Crypto Trading

Loopring (LRC) is a similar solution, but more focused on making it easier to create decentralized exchanges on top of Ethereum’s blockchain. Rather than solving transactions on the Ethereum blockchain directly, Loopring instead processes transactions off-chain, batches them together, and sends a single transaction to the Ethereum chain.

This is a big improvement in user experience and opens the door to making decentralized exchanges more user-friendly. Despite recent dips, the token has seen +251% growth over the past year.[9] This might seem small compared to MATIC’s explosive growth, but I believe it also makes LRC a crypto with significant room for upward mobility.

As with Polygon (MATIC), Loopring (LRC) can be purchased on most major cryptocurrency exchanges such as Kraken, Coinbase, or BinanceUS. You’ll find more details by visiting our page on exchanges here.

The final key trend, and this is a big one, is that institutional investors are likely to finally begin throwing their full weight around the crypto market come 2022. This will probably begin with so-called “blue-chip” cryptocurrencies like Ethereum and Bitcoin. This trend already began in 2021, with Venture Capital investing more than $30 billion in cryptocurrency over the course of 2021.[10] I expect this trend to accelerate in 2022.

The key driver of this will be stability. Governments are increasingly beginning to form real frameworks for how they want to actually want to handle cryptocurrency. They took the first steps in 2021 with both the European Union[11] and United States[12] building new frameworks describing how they want to handle stablecoins, the main on-ramp into the cryptocurrency space.

This combined with the fact that Bitcoin has managed to weather multiple bear markets has built confidence in cryptocurrency as an asset class. We are now at the point where there are real hopes that the SEC might approve the Spot Bitcoin ETFs proposed by NYDIG, Valkryie, Grayscale and Bitwise, although the organization has once again delayed its decision on the matter until March.[13]

These moves are all positive but leave an important open question: How can we “normal” investors benefit from the machinations of institutional capital?

Well, I’m glad you asked. While some companies are jumping in head first, a number are concerned about the risks of cryptocurrency and are adopting a “wait and see” approach in order to gain more clarity on the subject.[14]

This gives the rest of us an opportunity to strike first by jumping in now and buying blue-chip cryptocurrencies, in particular Bitcoin (BTC), before the institutional whales decide it's worth taking the risk. With the crypto markets down since January, it could be an opportunity to get Bitcoin at a steep discount.

This advice might seem simple on the surface but there is a reason I am bringing it up. The most important blue-chip crypto (Bitcoin) has a hard-capped, limited supply. This supply has become increasingly illiquid with over 76% of all Bitcoin now being held in long-term wallets.[15] The most liquid of all cryptocurrencies, those currently held on exchanges, are now down to just 6.3% of all circulating supply.

In short, when institutional capital finally comes pouring in, we could be looking at a supply squeeze. There will be a lot of people looking to buy Bitcoin, but it's possible that not so many will be willing to sell. This will provide investors who got in before the big institutions an opportunity to take profit while the market is at a high point.

For crypto investors, 2022 is sure to be another rollercoaster ride, but there are some very positive signs. A culmination of improved layer-2 technologies, the evolution of the Metaverse, and improved institution sentiment could help to drive overall adoption, and therefore the market more generally.

That being said, there are still risks ahead. The rise of central bank backed coins, such as China’s digital Yuan, could cause governments to take a more hostile stance to some forms of cryptocurrency. Additionally, it is likely that we will see more high-profile crypto failures in 2022, which could damage market confidence if they come at the wrong moment.

Despite these risks, I am still positive about the opportunities in the cryptocurrency market for 2022, and I look forward to sharing insights with you over the course of the year. As always, remember to do your own research, and find out if these opportunities are right for you!

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.artnews.com/art-news/market/2021-nft-sales-report-1234613782/

[2]https://www.bespokepost.com/the-post/the-mysterious-story-behind-the-worlds-most-valuable-baseball-card

[3] https://fortune.com/2022/01/13/nft-restaurant-new-york/

[4] https://nwn.blogs.com/nwn/2021/12/decentraland-blockchain-metaverse-user-revenue-stats.html

[5] Current Trends and Future Implementation Possibilities of the Merkel Tree - Scientific Figure on ResearchGate. Available from: https://www.researchgate.net/figure/An-example-of-Merkle-Tree_fig1_327601654 [accessed 14 Jan, 2022]

[6] https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof

[7] https://medium.com/fcats-blockchain-incubator/how-zk-rollups-work-8ac4d7155b0e

[8] https://www.coingecko.com/en/coins/polygon

[9] https://www.coingecko.com/en/coins/loopring

[10]https://markets.businessinsider.com/news/currencies/venture-capital-crypto-investment-record-30-billion-pitchbook-data-2021-12

[11] https://www.ceps.eu/ceps-publications/regulating-crypto-and-cyberware-in-the-eu/

[12]https://www.coindesk.com/policy/2021/11/01/biden-administration-to-congress-put-stablecoins-under-federal-supervision-or-we-will/

[13]https://www.coindesk.com/policy/2022/01/04/sec-delays-decision-on-nydigs-spot-bitcoin-etf-proposal/

[14]https://www.institutionalinvestor.com/article/b1vkvjjpnf0c2c/Here-s-How-Institutional-Investors-Bets-on-Crypto-Are-Performing

[15] https://cointelegraph.com/news/wait-and-see-approach-3-4-of-bitcoin-supply-now-illiquid

Do you feel like penny stocks and their potential of high returns have lost their allure? You’re not alone. Many investors, drawn in by tales of +1,000% gains, are beginning to overlook high-risk / high-return penny stocks in favor of the hottest new investment: cryptocurrency.

The problem is that many investors don’t know where to start. Buying cryptocurrency is complicated, and the technology backing it is often opaque, adding an additional risk factor that many investors may not be comfortable with. That may be about to change with the rollout of crypto ETFs and stocks operating within the crypto sector.

Longtime readers may be a little surprised that I’m even bothering to talk about crypto stocks. After all, I keep most of my cryptocurrency in wallets that I directly control. Why not just explain the best way to do that?

Well, many of you may own your own physical gold coins or bullion, a hedge or a hard asset. The advantage of this is that you own it and have it on hand should anything truly terrible happen. The disadvantage is that you are forced to store, protect, and care for it yourself. This means you need to take precautions to protect these hard assets from alternative risk factors, such as theft.

The same is true of cryptocurrency, but the risk factors are significantly higher. Your Bitcoin (BTC) or Ethereum (ETH) is not a physical asset, but a digital one, which means you need to take significant effort to secure an attack vector you may not fully understand.[1] To put this in context, around a whopping $10.5 billion worldwide has been lost due to Decentralized Finance (DeFi) fraud and theft in 2021.[2]

For individual investors who lack in-depth knowledge of best practices for cybersecurity (that would be most of us), this can create a level of risk that you can’t control, which puts many investors off investing directly in cryptocurrency.

In addition to these basic risks, effectively investing in cryptocurrency requires highly specialized technical knowledge. An investor needs to be able to understand tokenomics, cryptography, the target market of the cryptocurrency, how smart contracts work, and a plethora of other factors.[3]

All these considerations taken together can be daunting even to a seasoned equity investor. However, all of us understand the growth potential of the crypto sector and want exposure to it. Fortunately, the market is beginning to cater to investors who want exposure to the crypto space through more traditional means.

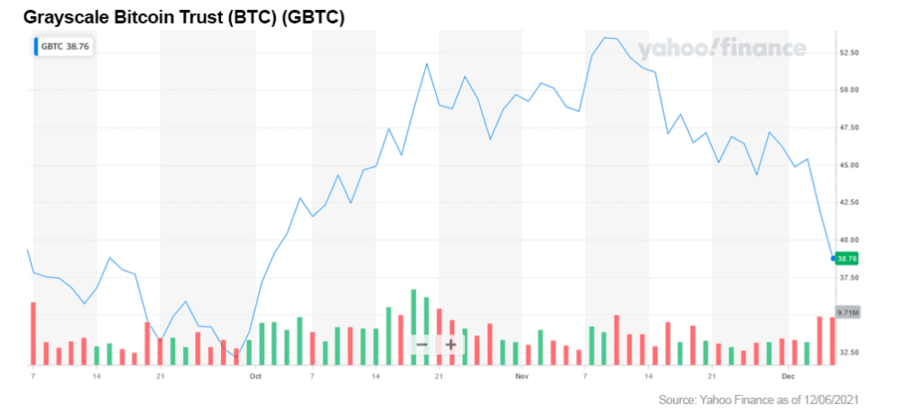

Exchange Traded Funds (ETFs) might not be sexy, but they are still one of the easiest ways to gain exposure to any asset — cryptocurrency included. These ETFs are even causing troubles for the most well-known crypto investment vehicle, the Grayscale Bitcoin Trust (OTC US: GBTC). For some time, this was the best way for investors to gain exposure to Bitcoin without having to open a cryptocurrency wallet.

However, returns for GBTC have not been as stellar as some had hoped. The fund is currently trending just 5% higher than the S&P 500. Additionally, it is facing significant pressure from more affordable ETFs that are able to take advantage of attractive fee structures and better ways of tracking BTC. The end result is that GBTC is now trading at a -15% discount compared to the value of its underlying assets.[4]

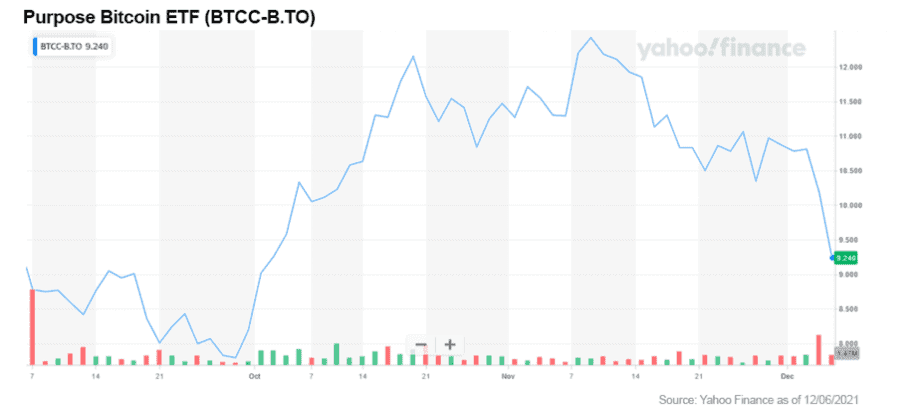

There are a few cryptocurrency ETFs available at the moment, however, the trend began with Canadian company Purpose back in February 2021.[5] The Purpose Bitcoin ETF (TSX: BTCC) has heavily outperformed the S&P 500, but there are other better choices available.

There are also newer ETFs on the block such as ProShares Trust — ProShares Bitcoin Strategy ETF (NYSE: BITO). However, these are a little younger and it’s tougher to say how they will perform over the long term. For me, the Purpose Bitcoin ETF (TSX: BTCC), or its Ethereum (ETH) based cousin, are still the safest bets for new equity investors looking for exposure to the crypto market.

Interestingly, in late November, Purpose also announced that it was creating a Bitcoin and Ethereum fund that pays a monthly yield.[6] The funds use a covered-call strategy to ensure that investors are able to gain a trickle of income — even if the price is trending negative.

This would enable investors to take advantage of upswings with the potential to significantly outperform traditional dividend yield investment vehicles.

Aside from ETFs, there are also three other key equity growth areas in the cryptocurrency space that I see right now...

In the cryptocurrency space, everyone requires one tool: an onramp. This onramp is typically called a stablecoin. These special coins are tied to a currency, for example the US dollar (USD), and provide a low-volatility way for investors to get fiat currency in and out of the cryptocurrency ecosystem.

The way they work is simple. Whenever an investor buys a stablecoin, they “lock” an equal amount of USD into that stablecoin’s ecosystem. If they want to convert it back to USD, they simply need to redeem their stablecoin, and they will receive their money back. So far, so simple.

The most popular stablecoin today is Tether (USDT). However, Tether’s days may soon be numbered. The stablecoin currency has a market cap of around $74,128,810,187. As Tether is supposed to be backed 1:1 by USD, this would make it the 42nd largest bank in the US, just below City National Bank.[7]

The problem is that it is unclear whether Tether actually has the ability to cover all these assets. If enough people were to try to redeem their Tether simultaneously, it could lead to a currency crisis as Tether attempts to hoover up assets in order to cover its withdrawals. This would have a knock-on effect on the currency markets.[8]

The source of this fear is the complete lack of transparency surrounding Tether’s holdings. It might have enough money to be a bank, but it certainly isn’t regulated like one. In fact, Tether is decidedly unregulated. The majority of Tether’s holdings are currently in offshore banks, where regulators can’t confirm or deny their statements about how much money is actually backing their token.

Somewhat worryingly, a report by Bloomberg revealed that the company’s accounts include billions of dollars in short-term loans to large Chinese companies, other crypto companies, and other high-risk investments.[9] If even some of these loans were to default, it could lead to Tether becoming worth less than one US dollar, which could have disastrous effects on the cryptocurrency and currency markets alike.

This fear has led to regulators placing stablecoins under increasing scrutiny. The most comprehensive legislation to date has come from the European Union in the form of two pieces of legislation: ‘Regulation on Markets in Crypto Assets' (MiCA) and the ‘Digital Operational Resilience Act' (DORA).[10] These regulations will require stablecoins to be regulated as financial service providers, and due to the Brussels Effect, are likely to be adopted globally.[11]

This will be a huge problem for Tether, which is unlikely to be able to comply, but it could be hugely beneficial for other stablecoin companies. There are few companies better placed to do this than Circle Internet Financial, the company behind USD Coin.

I have talked about Circle before here, and I still strongly feel that this stock is set to be a ‘strong performer.’ Circle is in the process of going public via the Special Purpose Acquisition Vehicle (SPAC) route via Concord Acquisition Corp. (NYSE: CND). The purpose of this deal is to enable Circle to become a fully regulated financial services provider and provide true transparency to its operations.

This would position Circle to displace Tether as the key onramp / offramp to the cryptocurrency space. This means that any potential investment into Concord Acquisition Corp. would be positioned to benefit from capital flowing into and out of the cryptocurrency sector without needing to own a single cryptocurrency.

Additionally, Circle has launched a $50 million venture capital fund, with a planned expansion into the Singapore market. This fund is designed to support Circle’s attempts to drive innovation in the digital finance space.

During the gold rush of the 19th century, the smartest money wasn’t out there prospecting — it was setting up shops to sell the tools and supplies people needed when they headed out west in hopes of hitting the jackpot. The same is true of the cryptocurrency world.

An obvious way to do this is to invest in the companies that are actually mining cryptocurrency. Crypto miners process transactions for many cryptocurrencies, notably Bitcoin, and are rewarded with cryptocurrency for doing so. By investing in these companies, investors gain access to not only the “tools” to produce more cryptocurrency, but also the value in the cryptocurrency that they are holding.

One of the most promising examples of a publicly trading mining company is HIVE Blockchain Technologies Ltd. (NASDAQ: HIVE / TSX-V: HIVE). HIVE was the first publicly traded crypto mining company, and it avoids environmental concerns by using 100% renewable energy in order to mine Bitcoin and Ethereum.

The company uses a HODL strategy that will be familiar to any crypto investor. (HODL is slang in the cryptocurrency community for holding a cryptocurrency rather than selling it.) In just November, the company announced that it has produced 218 BTC (approx. $12.2 million) and 2,334 ETH (approx. $10.8 million).[12]

The company’s most recent financials also show a company that is making a profit, and despite significant investments in its operations, still has around $4.7 million in liquid cash as of the six-month period ended September 30 2021.[13] This figure should now be even healthier following the closure of a bought-deal private placement financing to the tune of $115 million.[14]

There is one major risk factor for HIVE, and that is Ethereum’s transition to a Proof of Stake protocol. HIVE’s business relies heavily upon Ethereum, with around 48% of the tokens it generates coming from ETH. This means that there is a risk that a certain percentage of HIVE’s hardware could become obsolete.

There is one major and positive caveat here. It will be possible for HIVE to stake its already mined Ethereum in order to continue to generate profits. Additionally, it will be able to use its Ethereum mining hardware to target other coins that still use Proof of Work.

That being said, there is one more aspect of the cryptocurrency sector that all investors should be keeping an eye on. In my opinion, it’s the future of cryptocurrency: Decentralized Finance (DeFi).

Decentralized Finance (DeFi) uses the power of the blockchain to create faster, cheaper, and more accessible money without the need for 3rd party intervention.

DeFi is set to be the next big evolution in the world's financial systems.

There are many DeFi projects, however, many require you to buy their actual token to participate. The most promising projects are rarely listed on major cryptocurrency exchanges but are instead on decentralized exchanges (DEXs). These are difficult to navigate and hard to gain exposure to for traditional investors.

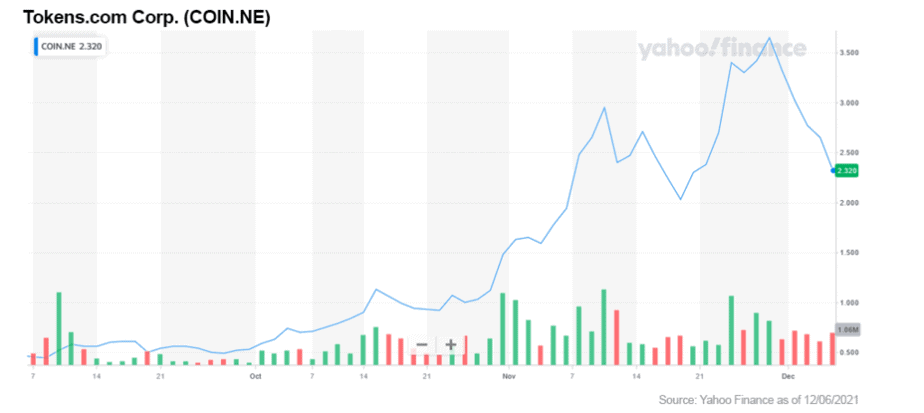

There are a few publicly traded stock options that investors can look at in the DeFi space. One that caught my eye as a risk capital option is Tokens.com Corp., trading in the US (OTCQB: SMURF) and in Canada (NEO: COIN). This company has positioned itself as benefiting from both DeFi and the metaverse. This is important as a true metaverse, built outside of Meta Platforms, Inc.’s (NASDAQ: FB) (formerly Facebook) closed garden, will likely require DeFi instruments in order to function properly.

The metaverse is being billed as the next evolution of the online world. It will enable humans to interact in virtual spaces through avatars. People can hold meetings, attend gigs, play games, and do just about anything else you can imagine. A key component of the metaverse is the ability to take digital objects from one “world” and transplant them to another.

Token.com Corp’s purpose is to provide better access to DeFi assets, specifically metaverse assets, through the public markets. The company invests in DeFi tokens and NFTs (non-fungible tokens), and then attempts to bring shareholder value by staking them. This process enables them to build a recurrent revenue stream.

To help combine DeFi and the metaverse, the company has majority ownership of a private company, Metaverse Group, which focuses upon buying digital “real estate” that is predicted to become valuable as the metaverse grows. This includes non-fungible token assets (NFTs) and space on virtual worlds. (For example, Roblox (NYSE: RBLX). This will then enable them to connect leading brands with already developed metaverse assets.

In addition, the company’s finances appear to be healthy. In its Q3 highlights, the company confirmed a net income of $4.1 million ($0.05 a share). The company earned staking rewards of around $719,051 during the 3 months ended September 30th.[15]

The Metaverse Group, a Tokens.com affiliated company, also recently closed the largest metaverse land acquisition in history.[16] In addition, on November 16, 2021, the company completed a private placement for a sizable CAD$16 million.[17]

There are some risk factors with Tokens.com Corp. — specifically its reliance on underlying crypto assets which are famously volatile. However, I believe that the combination of its newly acquired Metaverse Group asset and cryptocurrency is a big enough selling point to overcome these trends in the long term.

The key takeaway here is that there are plenty of great ways for investors to gain exposure to cryptocurrency without ever using a crypto exchange — decentralized or otherwise. These are all still high-risk, high-volatility investments, so investors should focus upon using their risk tolerance capital — not money destined for safer harbors.

In my view, cryptocurrency is still in its early days. There is room for explosive growth, particularly in the DeFi space, and even well-established cryptocurrencies like Bitcoin and Ethereum have plenty of space to grow.

Serious investors can benefit from gaining exposure to the space today, and for many of us, these ETF suggestions and recommended stocks are a much more convenient or early entry path to do so rather than seeking direct ownership.

That being said, the crypto space is high-risk, so always remember to do your own research and decide if these opportunities are right for you!

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets. He also holds shares in Concord Acquisition Corp. (NYSE: CND).

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] An attack vector is a route that a hacker can use to compromise your device

[2] https://www.cnbc.com/2021/11/19/over-10-billion-lost-to-defi-scams-and-thefts-in-2021.html

[3] Tokenomics is the study of the supply and demand characteristics of cryptocurrencies, for example hard caps, mining/distribution methodologies, or the practice of burning (destroying) fixed amounts of cryptocurrency to reduce supply

[4] https://www.ft.com/content/9fc7b034-7659-439f-a991-169662815883

[5]https://www.globenewswire.com/en/news-release/2021/02/18/2177751/0/en/Purpose-Investments-Launches-World-s-First-Bitcoin-ETF-Invested-Directly-in-the-Digital-Asset.html

[6] https://www.cbc.ca/news/business/bitcoin-ether-etf-purpose-1.6266783

[7] https://www.mx.com/moneysummit/biggest-banks-by-asset-size-united-states/

[8]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[9]https://www.bloomberg.com/news/features/2021-10-07/crypto-mystery-where-s-the-69-billion-backing-the-stablecoin-tether

[10]https://www.consilium.europa.eu/en/press/press-releases/2021/11/24/digital-finance-package-council-reaches-agreement-on-mica-and-dora/

[11] The European Union is one of the world’s largest market, so organizations that wish to trade in that market will often adopt European standards, resulting in Brussels having an outsized effect on global regulations.

[12] https://finance.yahoo.com/news/retransmission-hive-presents-record-november-110000453.html

[13] https://www.hiveblockchain.com/medias/uploads/2021_09-30_HIVE_FS_FINAL.pdf

[14] https://finance.yahoo.com/news/hive-blockchain-announces-closing-115-214000903.html

[15] https://ca.finance.yahoo.com/news/tokens-com-announces-q3-2021-113000942.html

[16] https://ca.finance.yahoo.com/news/tokens-com-subsidiary-closes-largest-133800811.html

[17] https://ca.finance.yahoo.com/news/tokens-com-announces-closing-16-144200259.html