The next great leap forward is here, and it’s artificial intelligence (AI), with Open AI’s ChatGPT leading the charge. ChatGPT has already proven itself able to pass the bar, provide accurate diagnoses to patients, and even write entire applications, which made me wonder: Could ChatGPT help me make better investment decisions?

Why am I asking this obvious, but important question? Well, AI has gained traction with hedge funds and the banking industry who use it to analyze vast amounts of data to make better trading decisions and optimize their portfolios.[1]

If publicly available artificial intelligence can replicate this, smaller retail investors could possess the same edge that the whales of finance have enjoyed for many years, without requiring the ability or technical background necessary to use and understand these specialized in-house banking tools.

Heck, this is a big part of why JP Morgan has reportedly begun work on making their own ChatGPT-like tool, IndexAI — though there are scant details about who will actually have access to JP Morgan’s newly developed tool or when it will be released.[2]

So in the meantime, I’ve decided to take a look at whether ChatGPT could do the job.

Let’s dive in, starting with a brief breakdown of what ChatGPT actually is…

ChatGPT and other tools like it are Large Language Models (LLMs), which is a type of artificial intelligence model designed to generate human-like text. LLMs can be used for everything from writing assistance to creating code. These models are all trained on extremely in-depth amounts of data, which enables the AI tool or App to understand the statistical patterns of language and create convincing replies.

The most famous of these, OpenAI’s ChatGPT, has captured the public imagination because it is able to sound very human. However, it’s important to remember that these models don’t actually understand data in the same way that a human does — it simply uses its built -in algorithm to predict what a convincing response would be based on the question asked of it ‘by a human.’

To give you an idea about how this works, ChatGPT was created in three phases:

This kind of approach has been used for some time. For example a more rudimentary precursor to LLMs, Statistical Machine Translation (SMTs), has been used in machine translation since as early as 1990 and improved upon by Google in 2007 with the release of Google Translate.[3] However, OpenAI has been able to take relatively niche tools and convert them into something with mass appeal with ChatGPT.

Why? Because the tool is so versatile compared to previous iterations of LLMs, and ChatGPT has given OpenAI the perfect advertisement for what AI can do to help ordinary people potentially revolutionize their lives.

This brings us neatly to our next ultimate question: How can ChatGPT help you as an investor? Well there are a few ways that it can enhance your investing decision-making process. We’ll go through three uses, with examples, and walk you through how you can use ChatGPT to help you make possibly better investment decisions.

Before we jump into what ChatGPT can do, I’d like to explain a couple of limitations of the tool. The first thing to keep in mind is that ChatGPT is not a specialized financial AI, nor meant to replace your financial advisor right now. It does a good job despite this, but it occasionally makes errors, and if you don’t use a critical human eye, its confident tone might catch you out.

The second limitation is the September 2021 cutoff date. This means that ChatGPT does not have access to any information after that date and will not be able to interpret the market conditions surrounding a stock today — just the raw data that you give it up to this specific date mentioned..

Finally, it’s important to note that there are two versions of ChatGPT available today. There is the free 3.5 model, which is faster but a little bit more basic than the paid 4.0 version. ChatGPT 4.0 is generally considered to be more sophisticated, but you will need to pay $20 a month for the privilege.

In each of the following examples, I will explain which model I have chosen to use and why, as well as provide a link to an actual conversation, so you can check it out for yourself.

Warning: ChatGPT is not a dedicated financial analyst tool, and its results should always be verified with further research on your part or to be discussed with your financial advisor. ChatGPT should not be taken as a replacement for a licensed financial advisor.

One of the simplest ways that ChatGPT can help investors is in information aggregation. Let’s say that you have just received a lengthy financial report and quarterly report from a company you like, for example, let’s say that you wanted to understand the implication of Amazon.com’s (NASDAQ: AMZN) quarterly earnings report and what it might mean for the long-term health of the company.[4]

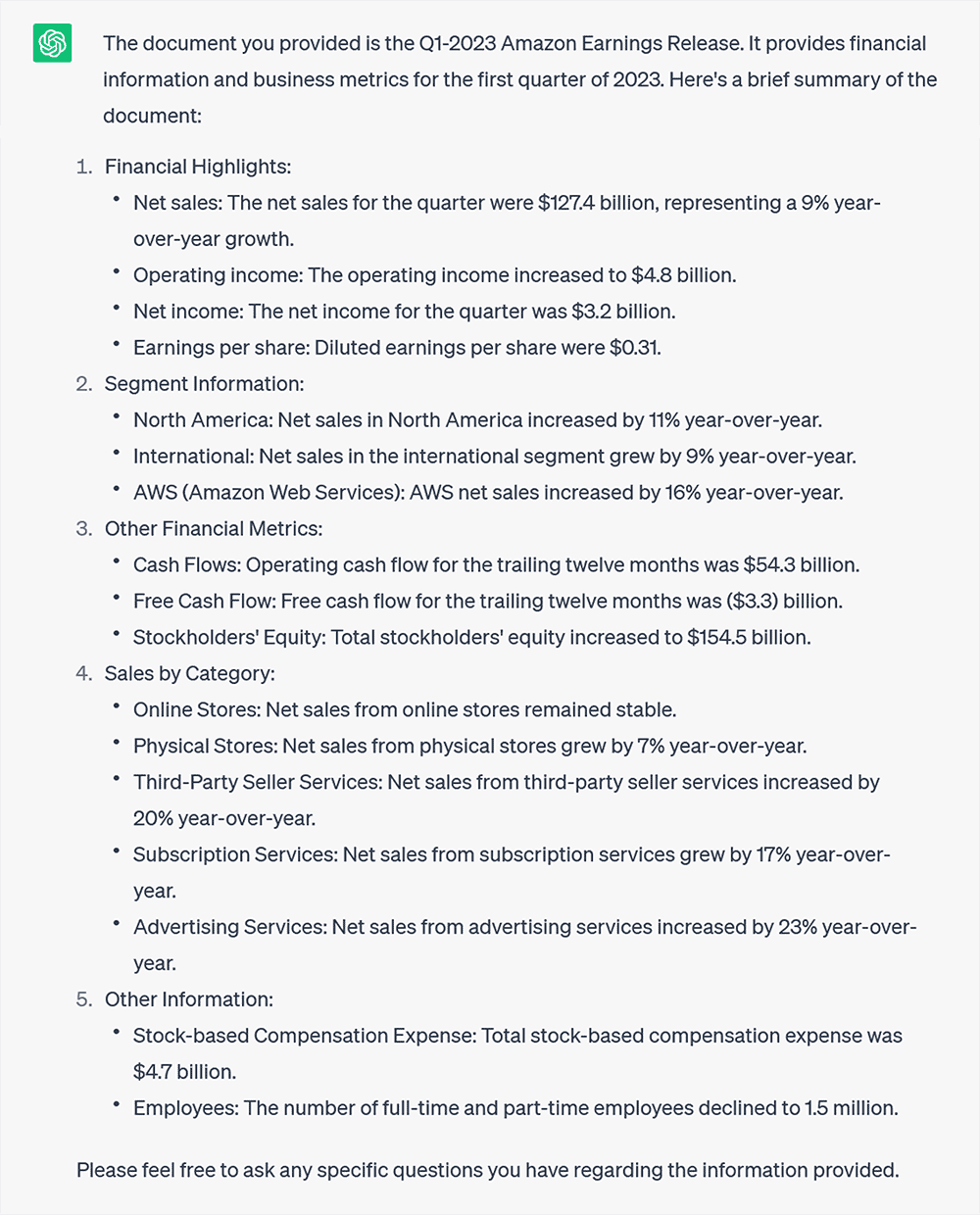

Now this is a big file — too big to give to ChatGPT in a single conversation due to the character limit. To get around this, I used a Google Chrome extension (found here) to upload it directly to ChatGPT 3.5. Once the file was uploaded, it provided me with the following summary:

ChatGPT then returned the following:

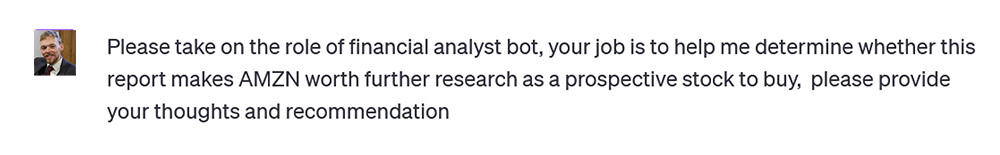

Now this in itself is useful. We’ve boiled down a fairly long, complicated document into a series of bullet points. But what if we wanted to save ourselves some trouble and ask ChatGPT for its recommendation based on that information? Well, to do that, I gave it the following prompt:

I specifically worded it this way so that ChatGPT takes on the “role” of a financial assistant, which makes it more likely to output useful information. Its response follows:

Now this is a good start. It explains the basics of the report in context but also highlights some potential areas for further consideration. In general, with my background knowledge of AMZN, this looks good and makes me want to do some further research.

You can find the chat here.[5]

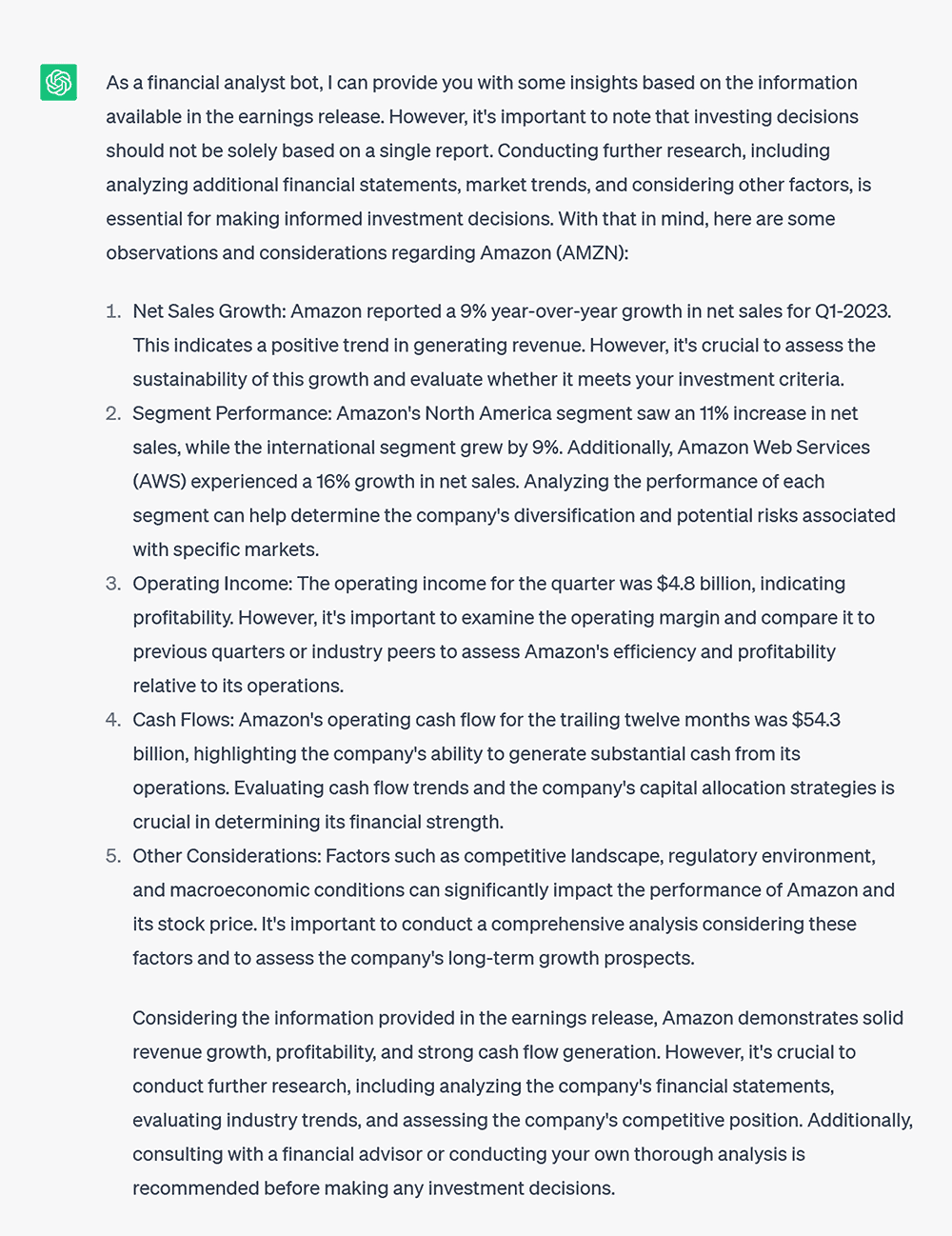

We’ve decided that we’d like to know more about AMZN, so the next step is to get some recent financial data. You’ll probably have your own way of doing this. In this case, I grabbed a CSV file with historical data for the past six months for AMZN from Yahoo Finance, and then used the extension I installed earlier to upload it to ChatGPT 3.5. (In my experience, ChatGPT 3.5 tends to be a little more direct when performing calculations.)

Once again, it gave me a solid summary:

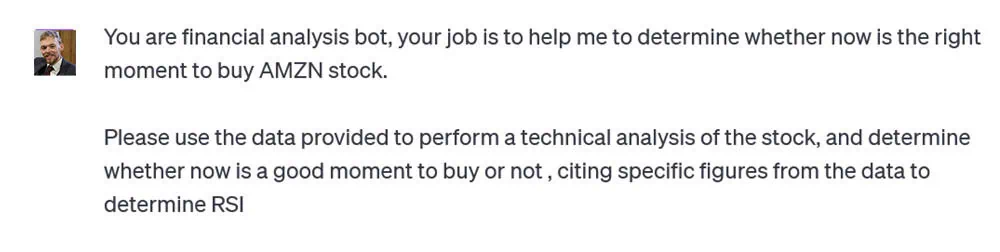

I then entered the following prompt:

The results were surprisingly accurate given that ChatGPT was not specifically trained in financial analysis. It correctly calculated Amazon’s Relative Strength Index (RSI) and provided an explanation of how to do so yourself in the future.

ChatGPT’s assessment that Amazon may be overbought is likely correct. If I wasn’t interested in buying AMZN stock for other reasons, I would probably take a wait and see approach before jumping in, and keep an eye on the stock’s RSI for the next few months.

You can find the whole chat here.

Now let’s look at something a little different. Let’s imagine that you want to invest in a more specialized industry, for example rare earth elements. Well let’s take a look at a company highlighted in Carl Delfield’s Rare Earth Elements article from early May on Financial News Now: Lynas Rare Earth Limited (ASX: LYC / OTC US: LYSCF).

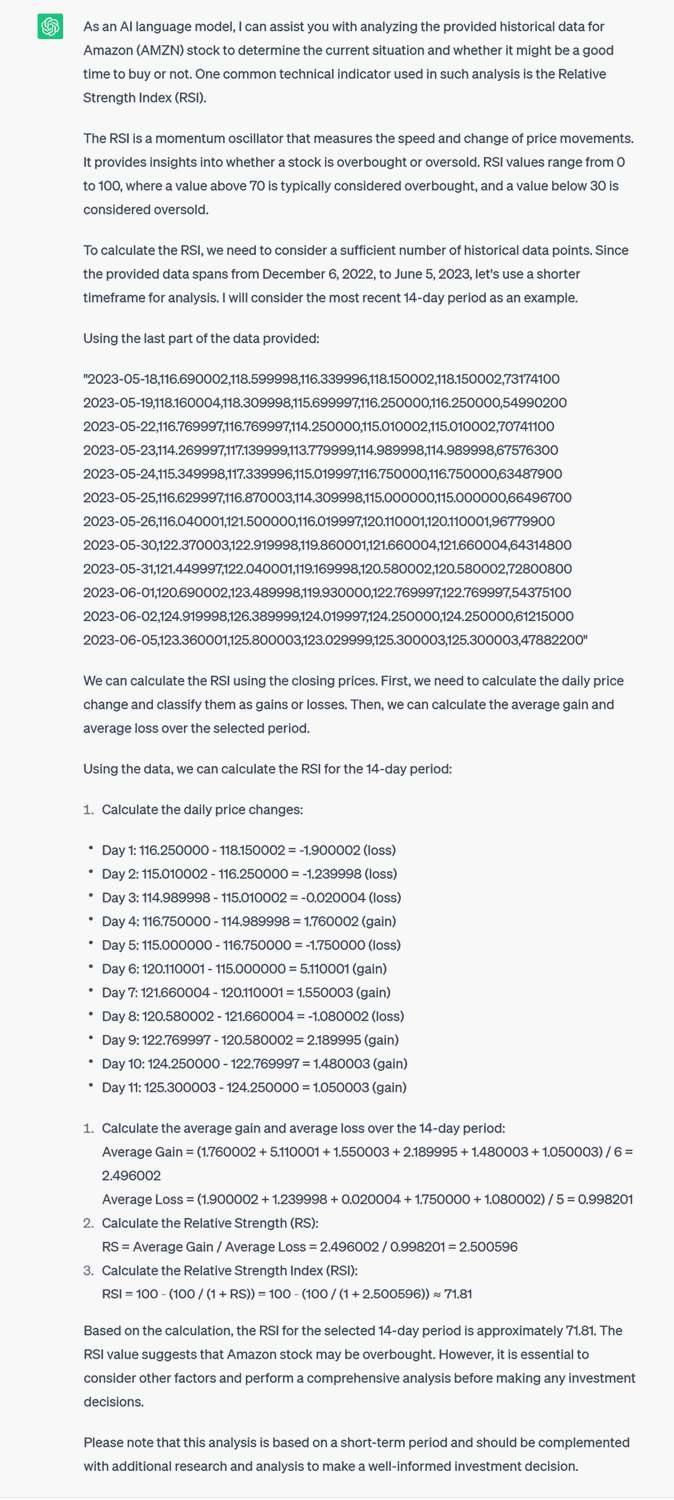

Specifically, you understand that the value of LYC, and other similar companies, lies in the deposits they have claim to. So you decide to look at the table deposit and are confronted with this:

Now for a moment, let’s assume that you don’t have a background in geology (I don’t!), that the term “Rare Earth Oxides” means nothing to you, and that the large collection of elemental symbols that follow make about as much sense as Egyptian hieroglyphics. This is where ChatGPT can come to the rescue.

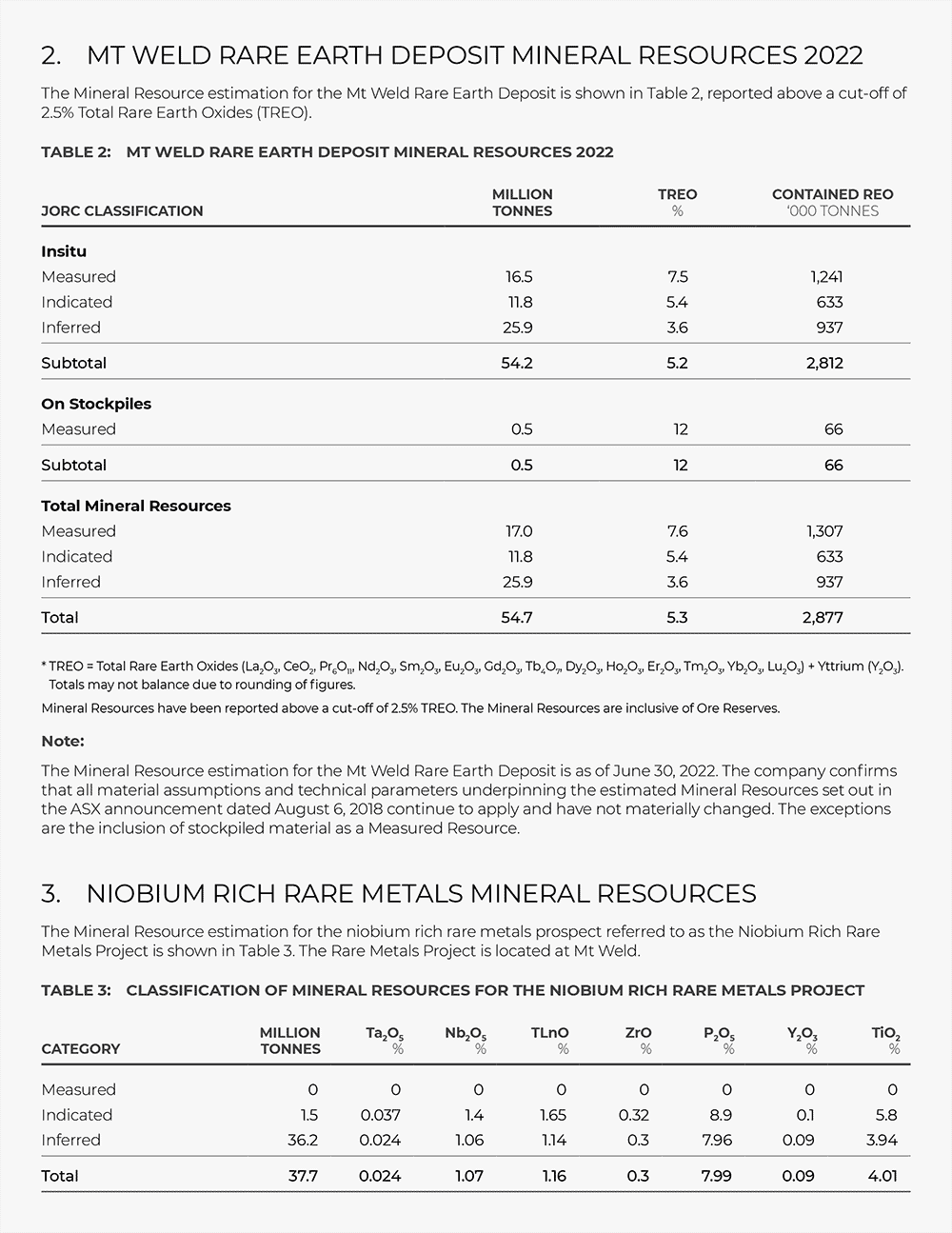

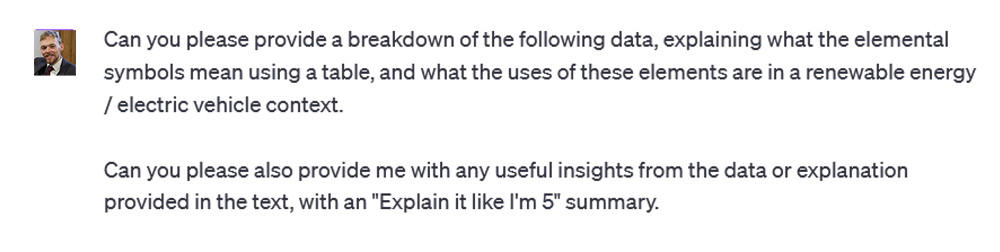

I used ChatGPT 4.0, as it is typically better at providing succinct explanations, and pasted the following prompt:

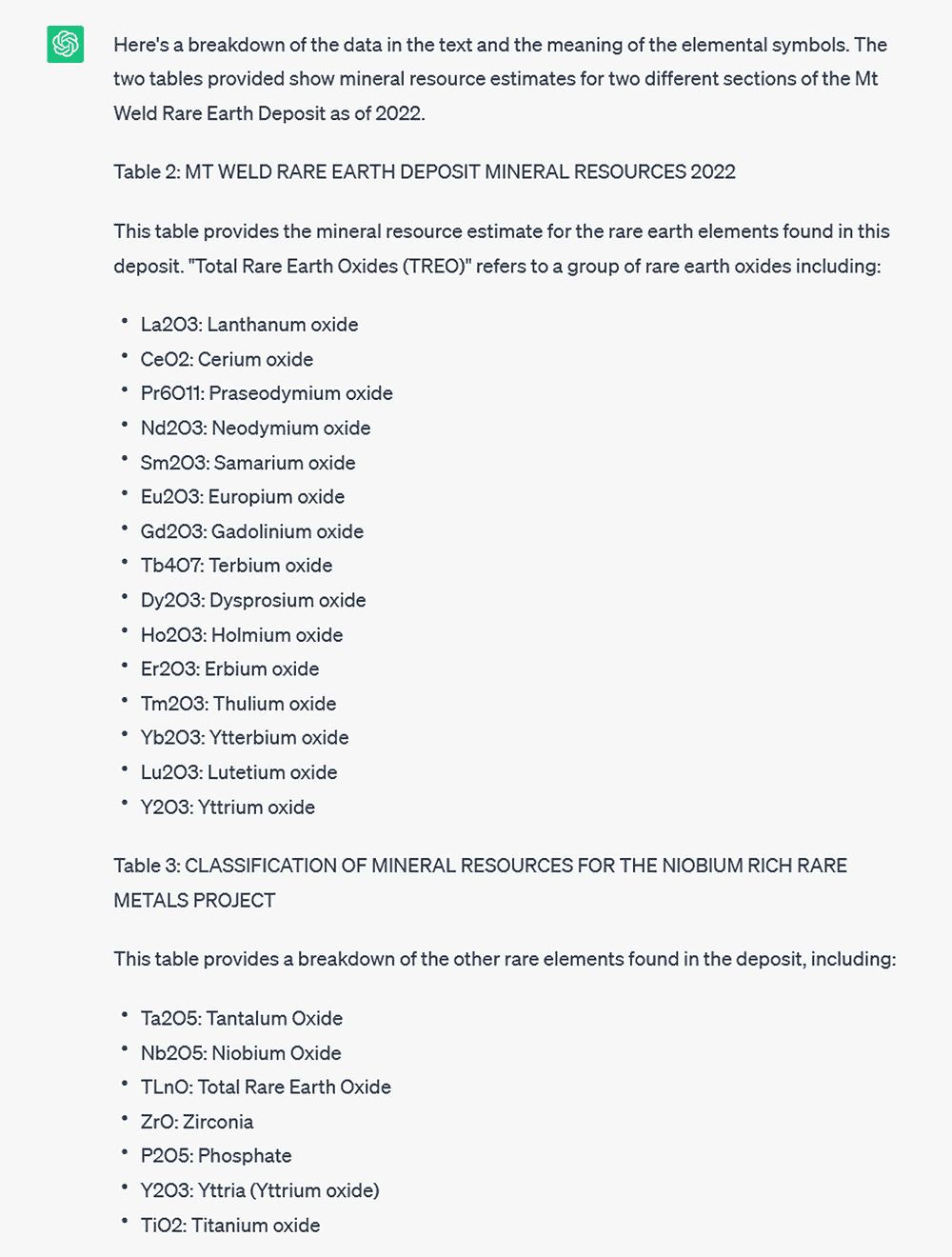

ChatGPT processes this for a moment, and then gives us a breakdown of all the mineral elements cited:

And then explains what these elements are used for:

Before finally giving me the “explain it like I’m five” explanation:

Now, what it’s not done is give me any insight into what the figures mean, so I’ll ask it to do so:

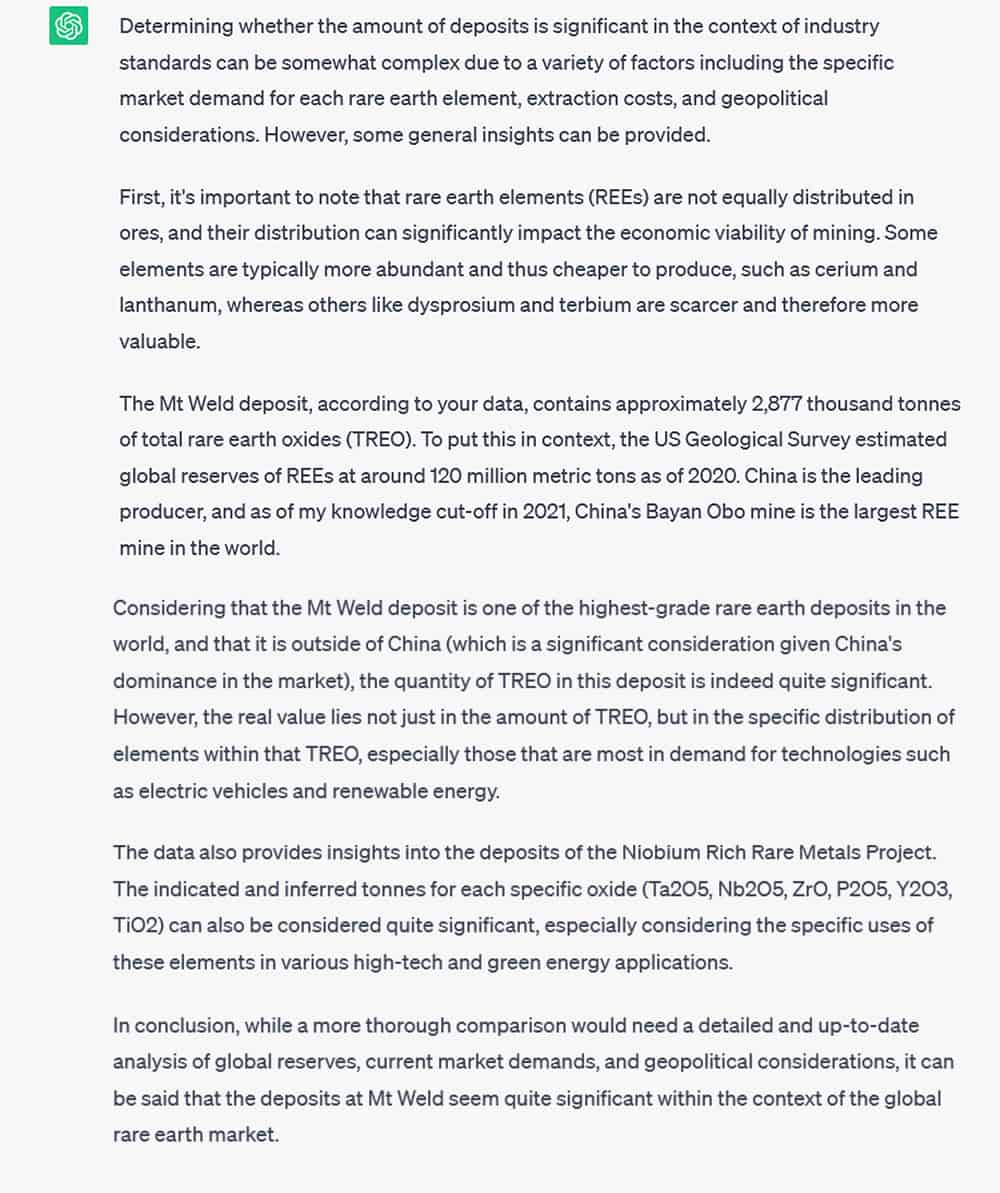

And the answer it gives me is surprisingly insightful:

This is actually very useful and puts a relatively small amount of data in context without us needing to have any in-depth experience about the rare earth elements industry. However, one phrase jumps out at me: “Considering that Mt Weld is one of the highest-grade rare earth deposits in the world…”

Now, we (hypothetically) don’t know much about REEs, but we do know that statements like this require some scrutiny, so let’s ask ChatGPT how it came to that conclusion:

Alright, that’s convincing, and gives us some pretty useful context, but let’s do a bit more due diligence and check whether Google agrees — and it does. I’ve found three separate sources that corroborate what ChatGPT is saying.[6] [7] [8]

The example I’ve given above is fairly niche, and you should always exercise critical thinking when using ChatGPT. And, if you’re a newcomer, ChatGPT can help to turn days of research into a matter of an hour or two and give you a solid basis for whether the company you’re looking at is really onto something or not.

Once again, you can find the chat here.

As you can see from these tests, ChatGPT is a powerful tool to aid your decision-making, but it can’t replace your own critical thinking. When I use it, and I do use it regularly, I think of it as having an assistant with a wealth of knowledge that I can tap into… Ultimately streamlining my research and analysis process.

I think that ChatGPT 4.0 in particular is useful as a learning tool, especially for new investors or newcomers to a particular industry. It is good at taking relatively complicated information and making it understandable.

Important Tip: When dealing with ChatGPT, it is important to carefully craft your prompt. Asking for help making a decision tends to be more effective than asking it for an outright recommendation and using simple direct language is most effective.

With that said, there are some very real limitations, which I’ve already hinted at. You may have noticed that the process is very manual, as there is currently no way to easily integrate ChatGPT into your spreadsheets specifically for financial analysis, and the data needs to be pasted into the app. This also means you can’t interpret large datasets, as there is an input limit of around 4,000 characters.[9]

Additionally, I’ve noticed that using ChatGPT has a tendency to give lower quality responses as the length of a conversation grows. Also, the increased complexity of the conversation makes it harder for the algorithm to identify what information should come next and impairs accuracy. In general, it is most useful if you keep prompts precise and to the point, as you would when requesting information from a human.

So this probably has you thinking about how you can get a piece of the AI action. Sadly, OpenAI (Chat-GTP) isn’t a publicly traded company, so unless you’ve got some pretty good connections, you won’t be able to invest in them anytime soon.

But… there are other options that are worth considering, and as a bonus, I’ll be including ChatGPT’s take on some of these stocks alongside my own analysis.

In each case, I’ve provided ChatGPT with historical data from Yahoo Finance, and asked it to use that as the basis for its analysis.

If you want a more in-depth dive into AI stocks, please check out this piece by my colleague MF Williams.

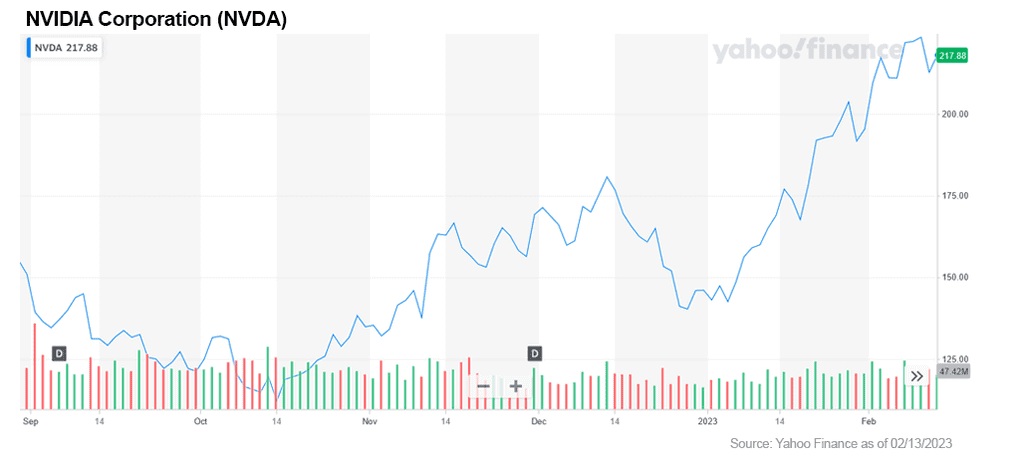

This isn’t exactly a unique take, but for my money, NVIDIA Corporation (NASDAQ: NVDA) remains one of the safest bets for artificial intelligence today. The company’s strong take on AI briefly helped it achieve a valuation of $1 trillion.[10]

The secret? NVIDIA’s latest chips are uniquely well suited to powering artificial intelligence neural networks and were the secret sauce that helped to make ChatGPT’s Large Language Models (LLMs) itself possible.[11]

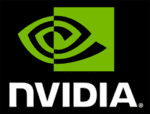

However, the chipmaker is riding at a high, so let’s see what ChatGPT says about whether now is a good moment to jump in or not:

On its own, this analysis isn’t very helpful, and it is important to note that the data used is just historical trading data pulled from Yahoo Finance. However I believe that the AI boom is far from over, so NVIDIA stock will have some staying power. It is a relatively safe option with limited growth potential.

One note against NVIDIA though. Many analysts believe that the company is overvalued and ahead of the curve.[12] So there is some risk of a sudden price drop in the future, although I believe that NVIDIA remains a solid buy for anyone with a long investment horizon and would be surprised if the chipmaker saw any long-term decline.

Meta Platforms, Inc. (NASDAQ: META) is an interesting one. The company suffered some serious setbacks after a fairly disastrous launch of its Metaverse, but the stock has been slowly but surely climbing back to recovery over the past few months.

More recently, Meta has pivoted to focus on artificial intelligence — with its new AI approach reportedly cutting memory consumption by 56% and GPU use by 84%.[13]

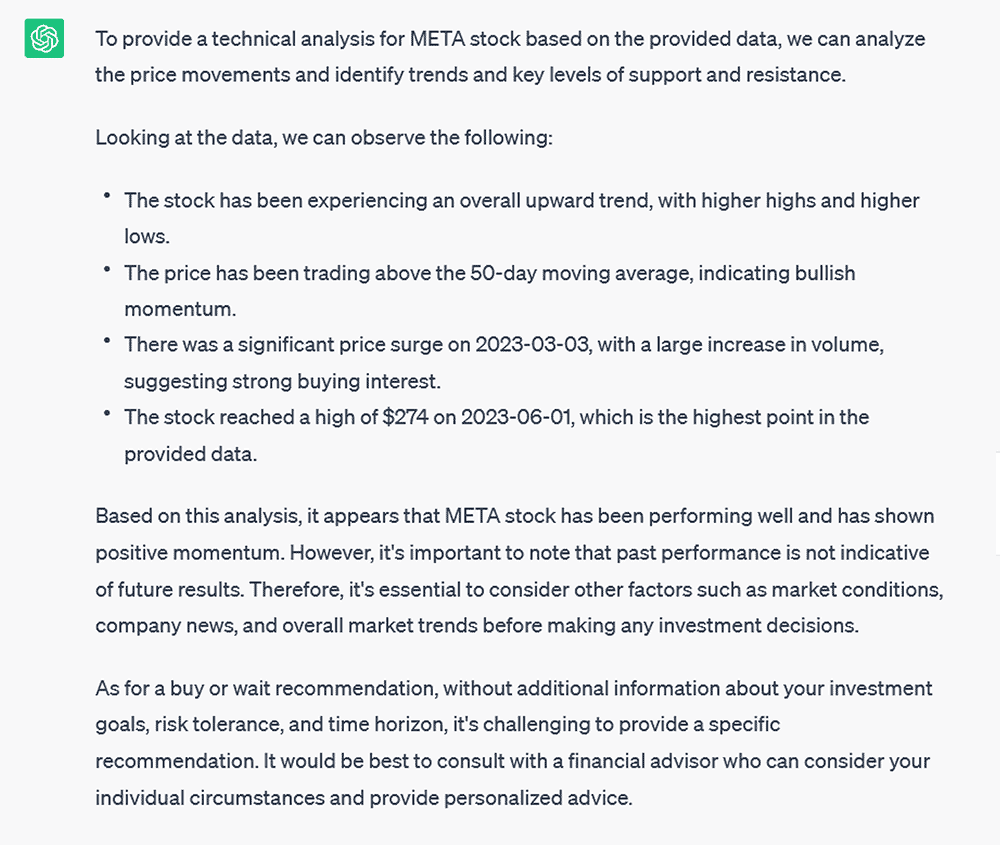

Before we dive into my analysis, let’s see what ChatGPT has to say. Once again, we’re using historical data pulled from Yahoo Finance to make this determination:

Alright, so less useful than before, but we can see that there is strong buying interest in META. By my own calculations we have an RSI of 82, which puts us into overbought territory, so a retraction is likely. This, coupled with the recent release of META’s latest headset, makes me think that waiting for a dip before jumping in would be a wise move unless you have a particularly long investment horizon.

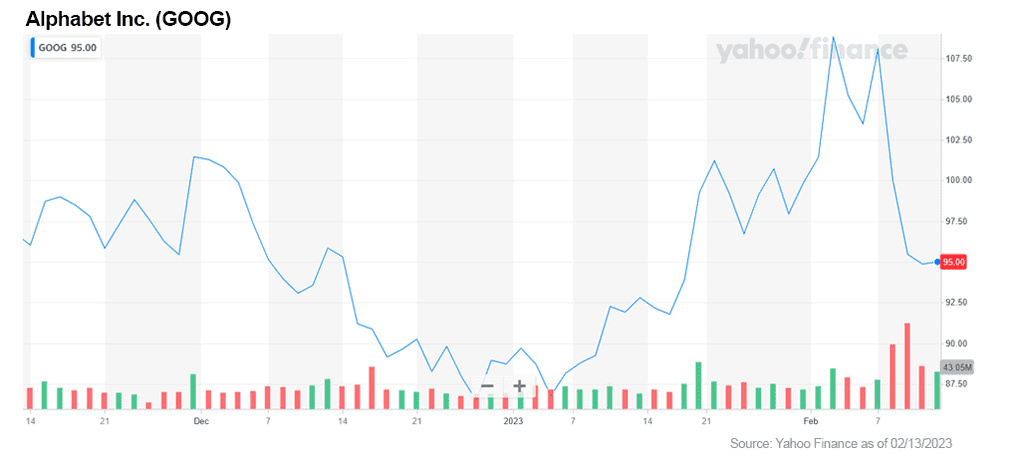

Another tech giant, but with good reason. Alphabet Inc. (NASDAQ: GOOG) started off slowly, experiencing a major stumble when Bard was first released. However, they now appear to be finally finding their footing.[14]

The company, seemingly spooked by OpenAI’s agreement with Microsoft, has rushed to further develop its AI capabilities, recently merging its two AI groups Google Brain and MindAI.[15]

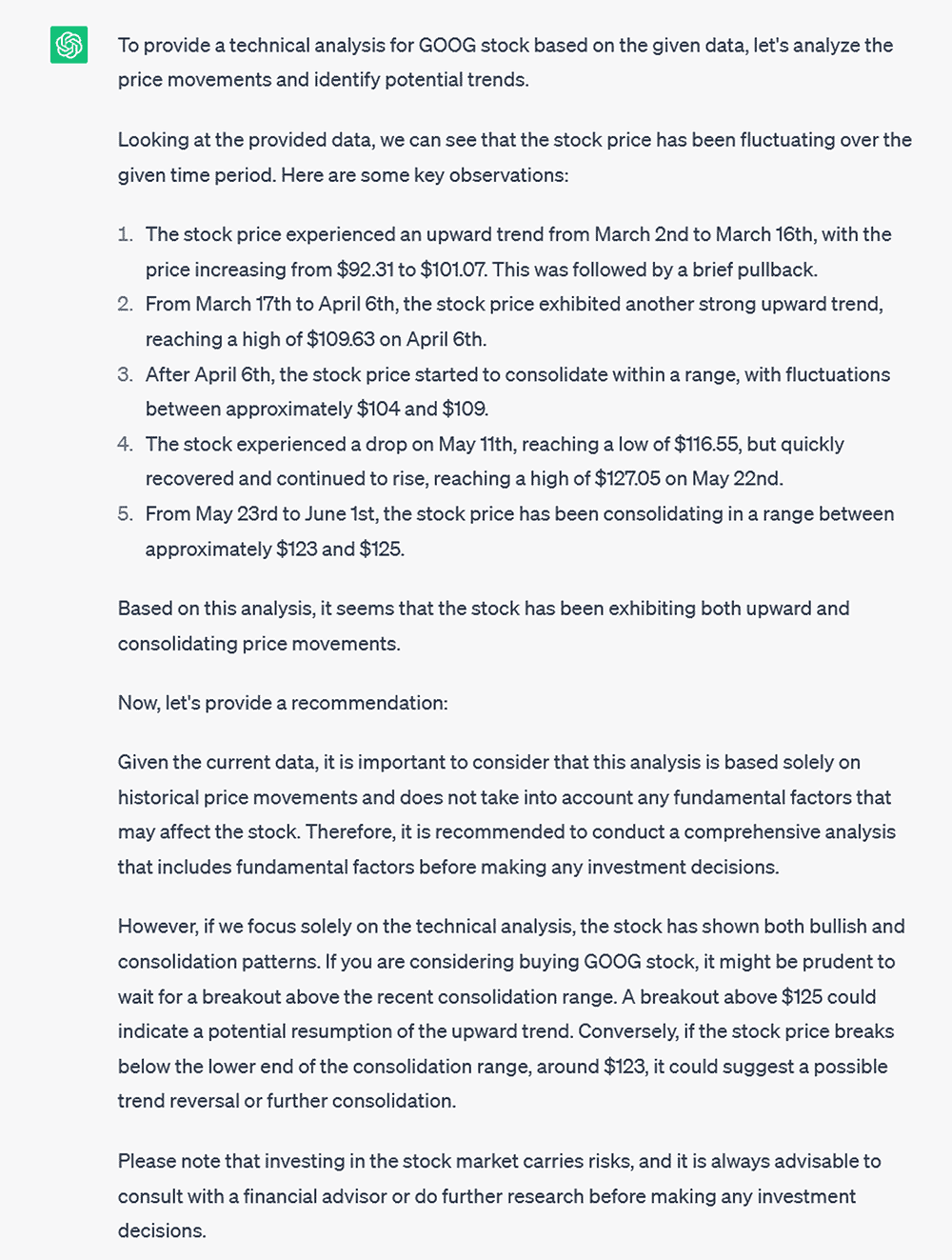

With that background, let’s see what ChatGPT has to say, and again, we’ll be pulling our data from Yahoo Finance for consistency:

A fairly noncommittal answer, but that’s fine. There’s still useful info here. Given that GOOG remains in the middle of the pack for tech stocks and that its RSI is trending down to around 67, I’d say that now is a good moment to jump in, or at least set a buy order a little below where the stock price currently stands.

We have covered a lot here, but I believe we can draw an important lesson about AI. Although ChatGPT is still relatively new and unspecialized, it has the capacity to make it significantly easier for retail investors to break down new opportunities, and more importantly, to understand the specifics about what they’re investing in without specialized knowledge.

This is where the true power of AI tools lies — in democratizing access to tools that were previously only available to seasoned financial professionals working in the brokerage sector. There are significant opportunities for investors, both in terms of actual investing and in the way that these tools will continue to grow and specialize, hopefully making it easier for all of us to build a secure financial future for our families.

If you decide to use these tools, and I believe you should at the very least play with it… just remember that there will never be any supplement for your own or your financial advisor’s critical thinking skills. And no matter what ChatGPT tells you, a bit of your own research will go a long way in maximizing your investment returns. However, this is a very nice tool to include within your portfolio building arsenal.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.bnymellon.com/us/en/insights/all-insights/artificial-intelligence-sweeps-hedge-funds.html

[2] https://www.cnbc.com/2023/05/25/jpmorgan-develops-ai-investment-advisor.html

[3]https://www.freecodecamp.org/news/a-history-of-machine-translation-from-the-cold-war-to-deep-learning-f1d335ce8b5/

[4] https://ir.aboutamazon.com/news-release/news-release-details/2023/Amazon.com-Announces-First-Quarter-Results/

[5] https://chat.openai.com/share/bec3e9b1-be49-4b5b-a87e-0af720b49129

[6] https://www.nsenergybusiness.com/projects/mt-weld-rare-earths-mine/

[7] https://www.nsenergybusiness.com/projects/mt-weld-rare-earths-mine/

[8] https://en.wikipedia.org/wiki/Mount_Weld_mine

[9] https://www.androidauthority.com/chatgpt-character-limit-3292997/

[10] https://www.thetimes.co.uk/article/nvidia-joins-1trn-club-as-investors-buy-into-story-of-ai-nrkhzhrg7

[11] https://medium.com/@ArunPrakashAsokan/nvidias-ai-revolution-story-behind-how-it-became-a-trillion-dollar-company-620e7235fdc

[12] https://finance.yahoo.com/news/cathie-wood-calls-nvidia-stock-overpriced-after-missing-2023-rally-134528552.html

[13] https://finance.yahoo.com/quote/META/history?p=META

[14] https://www.reuters.com/technology/google-ai-chatbot-bard-offers-inaccurate-information-company-ad-2023-02-08/

[15] https://www.cnbc.com/2023/04/20/alphabet-merges-ai-focused-groups-deepmind-and-google-research.html

I don’t know about you, but I have been absolutely floored by the amount, variety and quality of artificial intelligence apps that have been made public over the past few months.

Everything from video editing, image editing, text generators, video script generators, and social media post generators are now publicly available and changing the way we are thinking about traditional business tasks.

But hands down, the star of the show is OpenAI’s ChatGPT app that was first released in November 2022.

The application has literally slammed the tech giants with a sharp right hook to the jaw and stormed center stage.

Tech giant Google has declared a “code red emergency” and CEO Sundar Pichai called for immediate action and redirected some teams to focus on building out AI products ASAP.[1]

Chatter on the internet is bringing up the impossible thought that ChatGPT could one day replace Google’s search engine!

AI has become THE disruptive technology that looks to potentially knock tech giants on their ass if they don’t move quickly.

Nimble investors need to be looking for the next opportunity in the fast-moving market space of AI now. There really is not a minute to waste in starting your research.

Read on and I’ll explain more about ChatGPT, AI and my favorite companies that are leading the charge in the new and exciting frontier of artificial intelligence.

ChatGPT is an AI chatbot tool that has been fed an enormous amount of text data. The application can tap into this vast wealth of stored knowledge to provide answers on just about any question or written task.

The application was created by San Francisco-based tech lab OpenAI (Private). The company was founded in 2015 by current CEO Sam Altman as well as Tesla’s (NASDAQ: TSLA) Elon Musk and other big-name investors such as Peter Thiel and LinkedIn co-founder Reid Hoffman. Musk left OpenAI in 2018 to focus on Tesla.

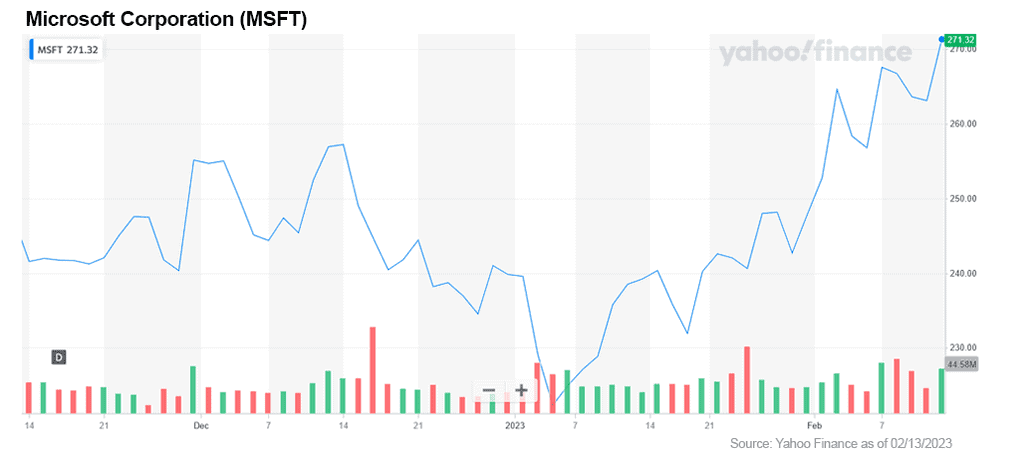

Microsoft (NASDAQ: MSFT) was an early investor in the company putting up a whopping $3 billion beginning in 2019.[2] That investment by Microsoft is already reaping huge returns for the company as they now have a massive advantage in the lucrative search engine market.

Microsoft’s search engine Bing is now integrated with ChatGPT. Users can search for anything and instead of getting thrown a list of a thousand websites that might have the answer to their query, they are now presented with the written answer directly on their screen.

No more clicking on a hundred links hoping that one will have the answer you are looking for.

This search tool is a potential Google killer and a direct threat to their core $149 BILLION search business!

Let me get geeky for a minute and get into the basic mechanics of ChatGPT (Chat Generative Pre-trained Transformer) software.

ChatGPT is a generative AI software application that uses a machine-learning technique called ‘reinforcement learning from human feedback’ (RLHF) to emulate human-written conversations based on a large range of user prompts.

This kind of software app is better known as an AI chatbot.

The ChatGPT app learns human language by reading hundreds of thousands of pages of text scraped from across the internet including online encyclopedias, books, academic journals and blogs.

The application then digests and catalogs this data which it then uses to respond to a seemingly limitless number of topics.

More than a million people engaged with ChatGPT within the first week of its public launch on November 30, 2022.[3]

Users were literally left in awe of the chatbot’s natural human language responses. Many users reported the feeling of having an actual conversation with a real human being.

I would recommend you take a few minutes to watch CNBC's report on "Why OpenAI's ChatGPT Is Such A Big Deal" below. It's a great summary of what exactly ChatGPT is and what it could mean for business and society in the future.

Forget the days of Microsoft’s infamous bouncing paper clip, Clippy, that drove everyone crazy by popping up at all the wrong times and interrupted workflow.

ChatGPT produces super high-quality humanistic responses in real-time and only at your request.

The secret to ChatGPT’s explosive popularity is that the application is continuously learning and evolving as more data is fed into the system. This allows ChatGPT to become increasingly accurate and versatile over time and to continue to deliver high-quality results for a wider range of inquiries.

OpenAI is now working on a more powerful version of their ChatGPT app called GPT-4 which is set to launch sometime this year.[4]

When you have time, try out the ChatGPT app. I think you will agree we are now entering a whole new world where science fiction meets reality.

My Followers Already Knew About AI Years Ago!

My followers know that I am a big proponent of investing in technology and especially technology that is still in its infancy.

I first brought AI stocks to the attention of my readers back in February of 2019 in this article: The Future Is Here: Investing In Artificial Intelligence Stocks. If you haven’t read it, it is still a good and relevant read on the hot technology that is being unveiled now.

This could very well be the year that early investors in artificial intelligence (AI) will begin to see the fruits of their patience and realize enormous gains.

Subscribe to Financial News Now and be sure to follow FNN on social media to ensure you are seeing my latest articles!

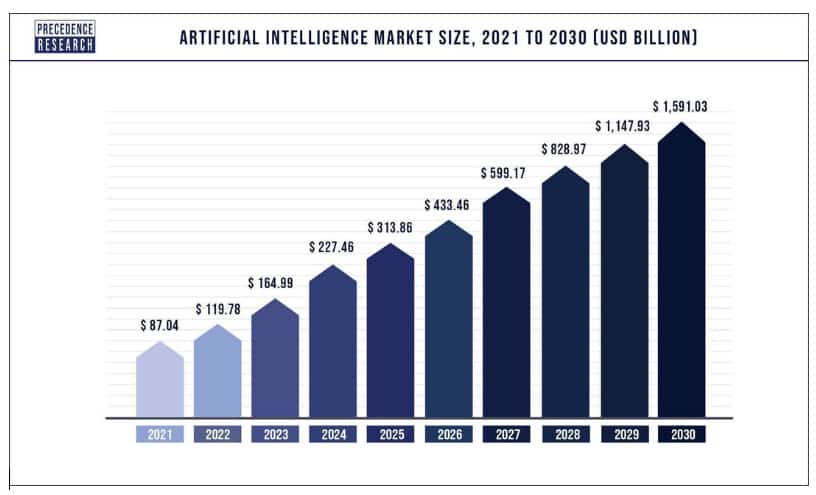

The global artificial intelligence (AI) market size was estimated at $119.78 billion in 2022, and it is expected to hit almost $1.6 trillion by 2030 with a registered CAGR of 38.1% from 2022 to 2030.[5]

Grandview Research is calling for global revenue forecasts in 2030 to hit over $1.8 trillion![6]

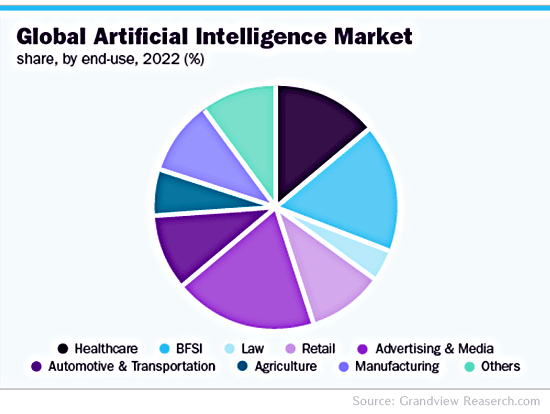

Artificial intelligence (AI) and ChatGPT are rapidly transforming many industries and are expected to have a significant impact on the global economy in the coming years.

Here are a few examples where the technology is disrupting traditional methods of doing business:

We have only touched the tip of the iceberg here. As the game-changing technology continues to evolve and more data is fed into the ChatGPT system, it will have a growing impact on a wider range of industries and use cases.

Companies that are early adopters of the technology could realize higher productivity, increased market share and competitive strength. As a result, investors could see increased company profits and better returns on their investments.

AI and ChatGPT are red-hot investment opportunities, and any intelligent investor should consider adding a few shares to their portfolios.

5 Reasons Why You Should Consider AI and ChatGPT Investment Opportunities

While most companies specializing in AI remain in the venture capital stage, there are plenty of public AI companies for those interested in positioning themselves in the space.

Here are just some of the companies that are leading the AI revolution. This should be a good starting point for your personal research as an intelligent investor.

1. NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA has been a long-time favorite of mine. If you had followed my recommendation back when I called this company back on February 3, 2019 when the stock was at $37.04.

The company continues to outperform with a continued solid future ahead in my opinion.

The company is a leader in GPU-accelerated computing and AI, and has been at the forefront of developing AI technologies and solutions. Internet and tech companies buy its processors for cloud computing. NVIDIA's AI chips also are helping to guide some self-driving cars in early trials.

The company has experienced headwinds over the past year with the implosion of the crypto markets. The GPUs produced by NVIDIA were the go-to board for mining crypto currency. With the crash of those markets, crypto miners have stopped buying new GPU boards and flooded the market with used boards that gamers can pick up at a fraction of the cost of new ones.

As inventories of used GPUs cycle through the markets, NVIDIA should start to see sales pick up again by 2nd quarter this year by my estimation.

Nvidia stock is up over 4% over the past six months, closing Monday, February 13, 2023 at $217.88. If you had followed my recommendation when I first called out this company back on February 3, 2019 when the stock was trading at $37.04, you would be up an impressive +488% to date.

2. Alphabet Inc. / Google (NASDAQ: GOOG)

Google is one of the largest and most influential technology companies in the world with a strong presence in AI and machine learning. The company has invested heavily in both, developing cutting-edge products and services.

While the company has been thrown back on its heels by ChatGPT, they are certainly not out of the race. Google is set to launch its answer to ChatGPT in the first half of 2023.

Known as Bard AI, the chatbot has been under development for the past two years and entered the testing phase in early February 2023 (coincidentally shortly after a ‘code red’ was announced by the company).

Ultimately, the company plans on incorporating the AI technology into its Google Search tool like Microsoft’s Bing is already doing.

Bard is built on Google’s Language Model for Dialogue Applications (or LaMDA). Google CEO Sundar Pichai has described Bard as an “experimental conversational AI service” that “seeks to combine the breadth of the world’s knowledge with the power, intelligence and creativity of our large language models.”

Bard is very similar to ChatGPT. Users can input a question, request or prompt, and Bard will provide a human-like response. One advantage that Bard has is that it will be using data that is current. ChatGPT on the other hand currently uses data only up to 2021.

Like ChatGPT, Bard is also subject to providing incorrect answers.

It was recently reported that when the chatbot was asked about new discoveries from the James Webb Space Telescope, Google’s Bard “made a factual error in its very first demo.” It didn’t take long for astronomers and science writers to point out the error.

Investors also took note and hammered the stock for a loss of 9% or a $100 billion market value loss in one day. However, if you bought Alphabet (Google) back when I recommended it back on February 3, 2019, you could have banked close to a double based on today's closing stock price.

All negatives aside, Alphabet (Google) is an enormous company with very deep pockets when it comes to pouring money into R&D. Their slower rollout of their very own chatbot and coming second to market could be perceived as a negative, but I believe they will overcome these hurdles in the coming months.

Investors should consider picking up a few shares to round out their AI portfolios.

3. Amazon.com, Inc. (NASDAQ: AMZN)

Amazon has integrated AI into many of its products and services, from its virtual assistant Alexa to its logistics and delivery systems. The company's dominance in the e-commerce and cloud computing markets has put it at the forefront of AI innovation.

The company now offers a chatbot service that customers can harness for their own purposes via their Amazon Web Services (AWS) platform.

The company could continue to see solid gains in share price as their cloud computing services continue to grow. Again, this is a company that should be included in any AI focused portfolio.

4. Microsoft Corporation (NASDAQ: MSFT)

As mentioned above, Microsoft has made significant investments in AI, including acquiring leading AI companies and developing its own AI platform. The company has also made AI a key part of its product strategy, integrating it into its products and services.

With the release and success of ChatGPT, Microsoft is now poised to challenge its competitors like Google, Amazon and Apple. It has not had this kind of technological advantage for more than two decades.

Microsoft is in talks to invest another $10 billion in OpenAI as it seeks to push its technology advantage even further.

The deal — which would mainly provide OpenAI with even larger amounts of computing power — has not been finalized and the funding amount could change.[7]

If this investment deal gets finalized, this could help push Microsoft into the number one position over Google search.

A small purchase of Microsoft shares could be a very wise move by intelligent investors.

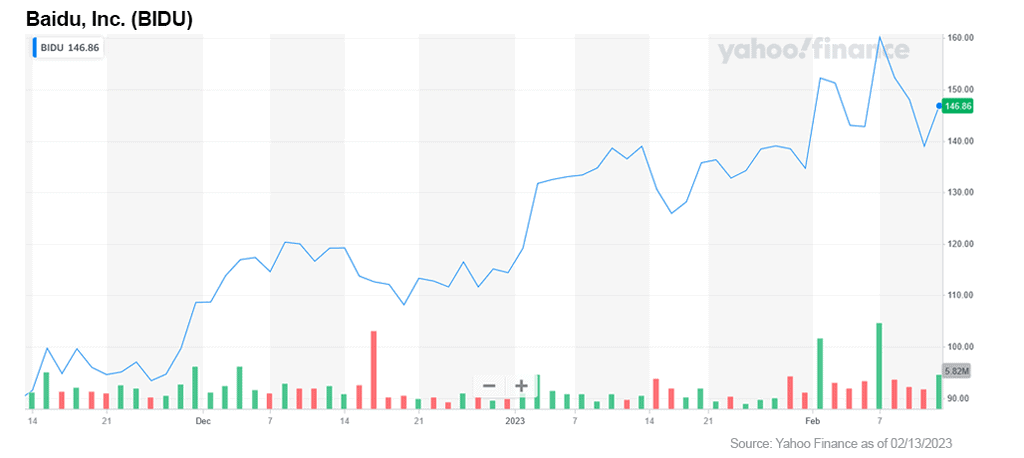

5. Baidu Inc. (NASDAQ: BIDU)

Baidu is one of China's leading technology companies, with a strong presence in the AI market. The company has invested heavily in AI research and development, and its AI platform provides a wide range of services, including natural language processing and image recognition.

The company recently announced it will be releasing its own AI chatbot called ERNIE sometime this year.

With little details, we will have to see how well it performs when compared to ChatGPT.

My guess is the company will come out with something that is at least comparable to ChatGPT. That combined with their huge Chinese audience could help drive their search business bottom line.

Certainly one to consider adding to your watchlist.

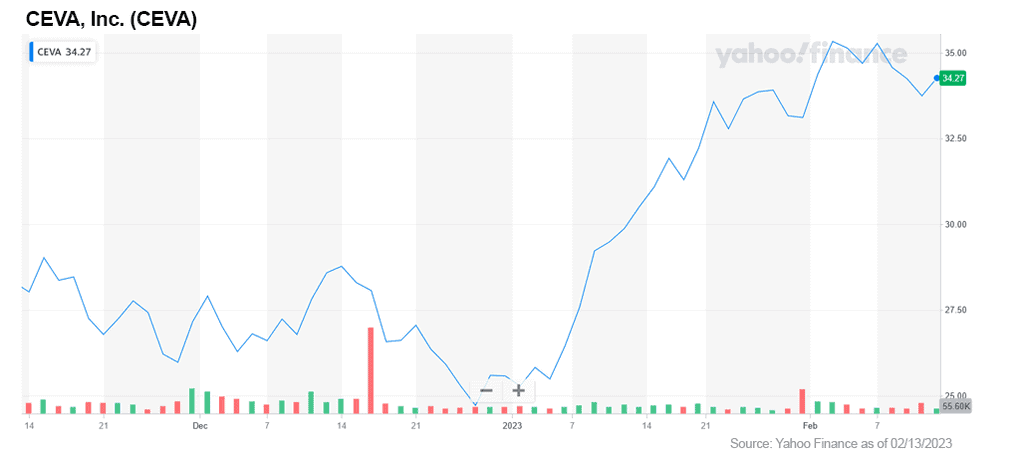

6. CEVA, Inc. (NASDAQ: CEVA)

CEVA provides chips for the AI space and is an intellectual property (IP) vendor known for licensing its digital signal processors (DSPs) to larger chipmakers. The company licenses DSPs for several applications like imaging and computer vision, connectivity, audio, voice, speech, AI and deep learning.

Within the AI and deep-learning space, CEVA is focusing on fast-growing markets like automotive, augmented reality, and smart homes, among others. The company also licenses its deep neural network frameworks to chipmakers for enabling AI applications in their devices.

The company share price has started to recover from their lows in October 2022, down about 4% over the last six months. A good entry point, in my opinion.

While the company might not be in the spotlight of AI advances, they are unquestionably a major player for the hardware that is driving this revolution.

Certainly a company to be considered when adding shares for your AI portfolio.

ChatGPT is a powerful and versatile AI technology that has the potential to have a significant impact on many industries. Companies that are leveraging this technology are likely to have a competitive advantage and benefit from the hyper-growth of the AI market over the next few years.

Intelligent investors should not miss this potential once in a lifetime investment opportunity. Start your research today with the companies I listed above. You will thank me later.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://businessinsider.mx/google-management-issues-code-red-over-chatgpt-report-2022-12/?r=US&IR=T

[2] https://www.nytimes.com/2023/01/12/technology/microsoft-openai-chatgpt.html

[3] https://investingnews.com/invest-in-openai-chatgpt/

[4] https://www.searchenginejournal.com/openai-gpt-4/476759/

[5] https://www.precedenceresearch.com/artificial-intelligence-market

[6] https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-market

[7] https://www.forbes.com/sites/qai/2023/02/10/can-i-invest-in-openai-putting-artificial-intelligence-in-your-portfolio/?sh=83708b47e127