The Ethereum Merge has finally happened.[1] Ethereum (ETH) has abandoned Proof of Work and moved towards a Proof of Stake consensus system.

This event has been one of the most anticipated moments in the crypto market in 2022, and its impact will reverberate throughout the market for the foreseeable future.

Understanding the future implications of the success, or failure, of Ethereum’s grand experiment will help savvy investors better take advantage of cryptocurrency.

Are you ready to explore the future of crypto? Then let’s dive in.

The Merge is the term given to the moment where the Ethereum blockchain will move away from Proof of Work (PoW) consensus methods to Proof of Stake (PoS) consensus methods.[2] In a technical sense, it joins the original execution layer of Ethereum with its new Proof of Stake consensus layer, the Beacon Chain.

In layman’s terms: The Merge will change the way Ethereum operates without compromising the history of the blockchain.

AN IMPORTANT NOTE FOR ETH HOLDERS: You don’t need to do anything with your cryptocurrency post-merge. There is no old-ETH or new-ETH — anyone telling you this is trying to scam you.

The reason this moment is so important is because Ethereum is the second largest cryptocurrency and forms the backbone of the decentralized apps (dApps) ecosystem which is worth $24 billion.[3] The Merge was a hugely complicated endeavor — akin to putting an entirely new engine in a car.

Any application that is built using Ethereum’s blockchain needs to process transactions using ETH. Prior to the Merge, this was done using a process called Proof of Work (PoW), also known as mining, that requires vast networks of computers and huge amounts of energy to solve complicated transactions. (Previously covered here.)

This was useful because it offered a decentralized way to secure the Ethereum blockchain and process transactions, but PoW came with a number of major drawbacks.

The most noticeable drawback for the non-crypto public was environmental. Mining requires an enormous amount of computing power, which translates into a massive demand for energy from miners. In a time when energy prices, particularly in Europe, are spiking, this was becoming increasingly problematic, both from an environmental and a cost aspect.

For the blockchain itself, mining pools posed a major scalability challenge.

There are thousands of dApps all using the same blockchain. Under Proof of Work, any sudden spike in network demand would lead to spiraling transaction fees and long wait-times.

This has severely hampered the growth of the dApps ecosystem and has been the main inspiration behind Cardano (ADA) and other so-called “Ethereum Killers.”

Instead of requiring miners to process transactions, Ethereum will now instead use validators. These can either be individuals with 32 ETH (around US$50,000), or “pools” of individuals staking fractions of their ETH. Like miners, they will be rewarded for doing so, with more opportunities for profit for individuals with larger stakes.

The first big benefit of this is energy. Running a Proof of Stake pool is more akin to running an app on your computer than a crypto mining farm. It is estimated that the consumption of the Ethereum blockchain dropped by 99.95% post-merge.[4] Prior to this, Ethereum used around 72 terawatts of energy a year, with a carbon footprint around the same size as that of Switzerland.[5] This major drop will help to dampen some of the environmental concerns that have historically surrounded crypto projects, such as NFTs.

One thing the Merge won’t do is solve scalability and gas price challenges. It puts the infrastructure in place to do so. This means that future updates will be able to focus on the scalability challenges that cause high gas fees.

Interestingly, this may not be entirely bad news. The main reason the Merge didn’t reduce gas fees was because the Ethereum foundation has dropped the idea of introducing Sharding. This solution would have made it possible to run multiple smaller versions of the Ethereum blockchain simultaneously, enabling faster and cheaper transactions running in parallel. Instead, they have decided to focus on supporting community-led 2nd-layer, or roll-up, solutions. (We’ve covered those here).

These community-led solutions have proven effective at reducing the strain on the Ethereum blockchain proper, and the decision to support them has some interesting long-term implications for investors.

On that note, I think it’s time we jumped into the big question…

Let’s start with the obvious. I don’t believe we’re going to see any major spike in the price of Ethereum due to the Merge. It seems like it has already been priced in, and any adjustments in Ethereum’s price seem to be following broader crypto market trends.

Instead, investors should be looking at the long-term implication for what this means for Ethereum as a technology, and how it will impact the ecosystem of dApps that rely upon it.

Interestingly, the Merge does seem to have had a positive impact on the NFT space. Both the price, and volume, for many key NFTs have surged post-merge. OpenSea, a major NFT marketplace, saw sales jump by 70%, and the average price increased by 74%.

Aside from these short-term changes, it is helpful for investors to look at the long-term implication for what this means for Ethereum as a technology, and how it will impact the ecosystem of dApps that rely upon it.

The immediate benefit is that Proof of Stake offers all ETH holders the ability to earn passive income by staking their crypto. For most investors the best way to do this will be through a staking pool, however, it is important to note that you will be unable to withdraw your Ethereum until the 1.5 update, which does not currently have a projected date. You can find details on how to stake here.

For investors who want the best of both worlds, there is another option: liquid staking pools. These solutions allow investors to stake their ETH tokens, while issuing them with an ERC20 derivative token that represents it. These tokens can be traded on any exchange that supports them. This is a little like trading a contract for a physical asset, like oil, rather than trading a physical barrel. The most popular liquid staking solution is Lido, which provides all stakers with sETH (Synthetic Ether), which they can trade.[6]

Most investors will probably want to use a solution like Lido, as there are limited downsides to doing so, however most crypto exchanges also offer some form of Ethereum staking

While there are obvious benefits for individual investors, staking could have another impact on Ethereum as a whole.

The biggest change for Ethereum will be in terms of supply. Pre-merge, there were around 13,000 ETH minted per day in order to reward miners. With the need for a large mining infrastructure removed, it is possible to reward stakers with far less Ethereum, reducing the amount minted daily to approximately 1,600 ETH a day.[7]

Whenever a transaction is conducted on the Ethereum blockchain, a portion of ETH is destroyed or burned. With average gas prices of 16 gwei, at least 1,600 ETH will be burned daily. This will lead to significant deflationary pressure on Ethereum as a whole.

When combined with the fact that 11% of ETH is currently staked and rising, this could lead to a reduction in the amount of liquid Ethereum.[8] This in turn could cause the price of ETH to increase as investors look to take advantage of opportunities offered by the Merge.

For more risk-tolerant investors, now is the moment to take a look at the third-party scalability solutions being developed for Ethereum. In particular, you should keep an eye on 2nd-layer solutions. These solutions “bundle” transactions and process them off-chain, before validating their outcome on-chain in a single transaction.

This has the ability to make extremely complicated dApps, like video games, more viable, and mass use of layer-2 solutions would significantly reduce overall strain on the Ethereum blockchain, limiting the need for capacity increase.[9]

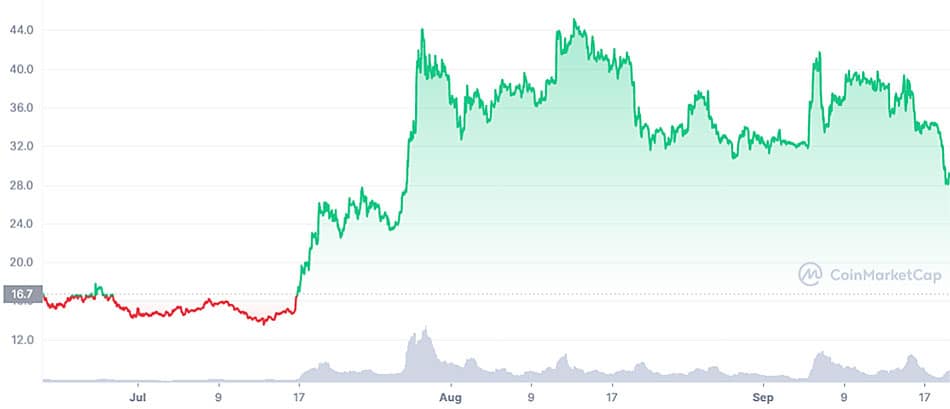

We’ve discussed zero-knowledge-roll-ups before, and I am still a big fan of Polygon (MATIC). It remains one of the most mature layer-2 solutions in the crypto market today and has a high adoption rate. This makes it relatively safe, at least by cryptocurrency standards, and a good bet for investors who are hoping that the dApps space will continue to grow as the crypto markets recover.

The Merge will also generate another major side effect: a large group of disgruntled miners. These are people who have invested thousands of dollars into equipment specifically designed to mine Ethereum and other cryptocurrencies.

Big miners, like an old favorite of mine HIVE Blockchain Technologies Ltd. (NASDAQ: HIVE / TSX-V: HIVE), are looking at diversifying their operations to other Proof of Work coins.[10] Many miners have moved to Ethereum Classic (ETC), and the token has largely seen its gains maintained. I don’t think we’ll see a significant upward movement in ETC’s price based on Ethereum mining in the near-future, and that those gains are already priced in.

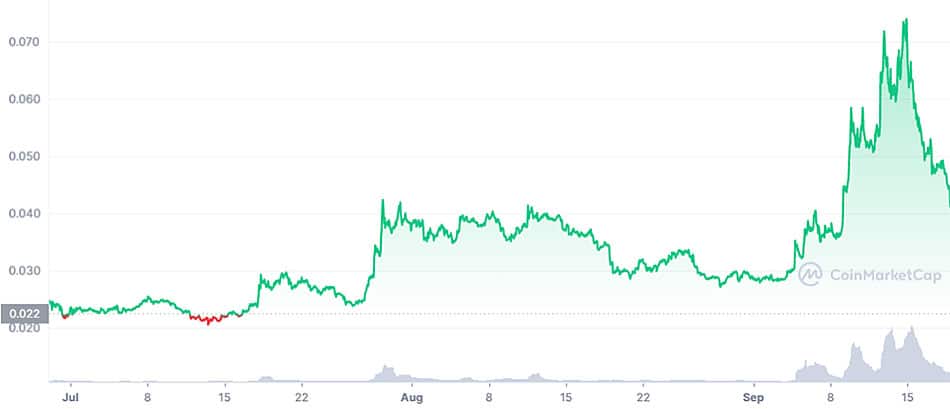

Another popular alternative with miners is Raven Coin (RVN). Its rise came a little closer to the Merge, and as a sub $0.10 token it is prone to sharp price shifts. However, there has been a marked increase in volume over the course of September.

There is a chance that Ravencoin will maintain the support of miners. It’s a fork of Bitcoin, and was designed in 2017 specifically to support the launch of new tokens. It’s a bit of an odd one because it did not conduct an initial coin offering (ICO), and the developers have not opted to take any payment.[11]

The project was set up to provide a more fully decentralized alternative to token issuance that doesn’t rely on smart contracts. Instead, Ravencoin is designed to facilitate the transfer of physical assets, like gold.

It’s a little early to tell whether Ravencoin will be successful, however, I do think the recent burst of media attention might give the project more traction than it has had in the past. I think it’s worth a small portion of your “fun money,” but I wouldn’t bet the house on it just yet.

If Ethereum’s shift to PoS is successful in the long term, then it may cause significant challenges for various Ethereum killers like Cardano (ADA). Specifically, this is because many of these projects have framed themselves in opposition to Ethereum’s perceived sluggishness and the inefficiency of their PoW protocols.

As things stand, Ethereum has a total market dominance of around 20% and gaining. The next biggest smart contracts platform is Binance Coin (BNB) which has 5%. Other platforms are currently barely making a dent, and even promising projects like ADA are sitting at below 1% market share.

Many of these tokens had positioned themselves as Ethereum Killers, and supporters had hoped that Ethereum’s slow progress might have worked to their advantage. Unfortunately, with the Merge successfully going through, we are likely to see Ethereum eating into the market share of smaller platforms.

I’m not selling my ADA today, but the moment when I do might be just on the horizon.

Aside from these specific insights, it is likely that the outcome of the Ethereum PoS experiment will have a significant impact on the overall trajectory of the cryptocurrency space as a whole. If Ethereum is able to successfully navigate the next 12 months, and make good on promises to roll out performance improving updates, then I think that the price will continue to grow.

If this thesis holds true, then we should also see a new renaissance in the dApps space, as lower costs make it possible to build more interesting tools. This could be the catalyst to make jaded investors like Mark Cuban find the space interesting again.[12]

With that said, I don’t think that Proof of Work is going away any time soon. It is unlikely that Bitcoin will ever make that transition, so we may see a proliferation of niche PoW-based coins like RVN. This could represent a good hedging opportunity for investors who want a piece of something a little different from what Ethereum is attempting to do.

One thing is for sure, the Merge has created many new opportunities for investors. Take your time to do some digging of your own, and decide if any of these opportunities are right for you.

Saul Bowden, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLOSURE: Saul Bowden holds Ethereum, Bitcoin, and other crypto assets.

DISCLAIMER: Investing in any securities or cryptocurrencies is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.coindesk.com/tech/2022/09/15/the-ethereum-merge-is-done-did-it-work/

[2] https://ethereum.org/en/history/#frontier

[3] https://defillama.com/chain/Ethereum?currency=USD

[4] https://blog.ethereum.org/2021/05/18/country-power-no-more

[5]https://www.theguardian.com/technology/2022/aug/29/cryptocurrency-ethereum-plans-to-cut-carbon-emissions-by-99-per-cent-with-upgrade

[6] https://lido.fi/

[7] https://ethereum.org/en/upgrades/merge/issuance/

[8] https://cointelegraph.com/news/64-of-staked-eth-controlled-by-five-entities-nansen

[9] https://ethereum.org/en/layer-2/

[10]https://cointelegraph.com/news/hive-blockchain-explores-new-mineable-coins-ahead-of-ethereum-merge

[11] https://www.gemini.com/cryptopedia/what-is-ravencoin-mining-rvn-crypto

[12] https://www.thestreet.com/investing/cryptocurrency/billionaire-mark-cuban-says-crypto-is-missing-something