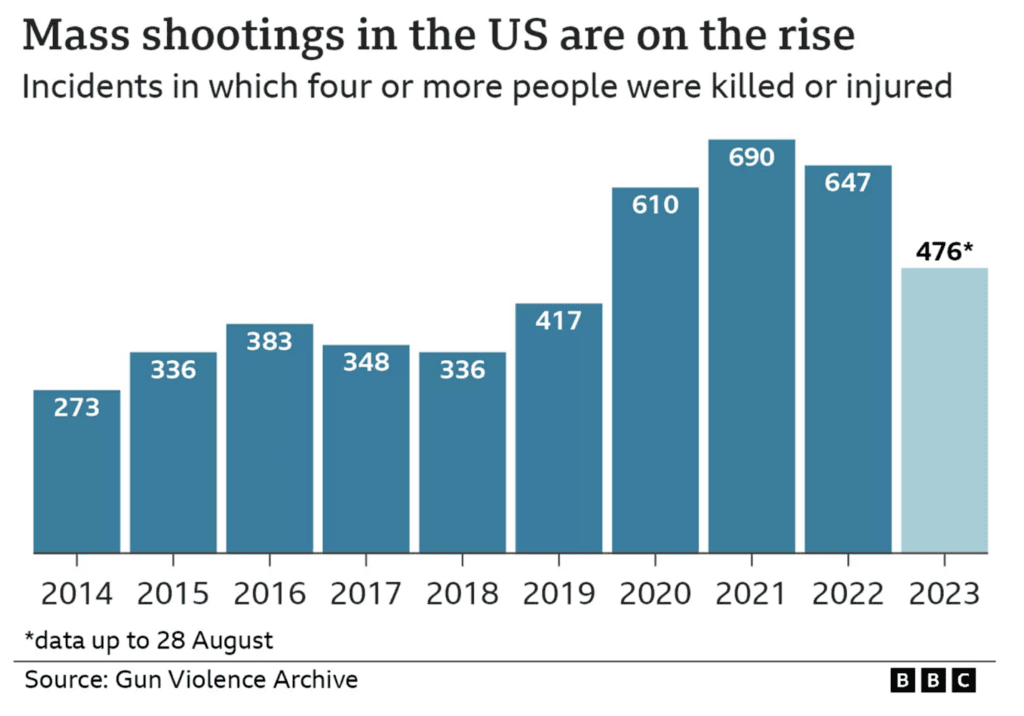

Mass shootings continue to ravage the American landscape. 2023 could now become the most lethal year on record with more than 25,000 people killed in gun violence (so far) with four months still to go.[1]

In an effort to halt the flow of lethal weapons in public spaces, owners of these venues are increasingly turning to cutting-edge weapons detection companies to screen their patrons at the entrances of schools, concerts, hospitals, expos and other public areas where large numbers of people gather.

I began covering weapons detection companies back in 2018 when the technology was relatively in its infancy. At that time, many of these technologies were still in their R&D phase with very few fully working models available for public use.

Today, this has changed in a big way.

The systems are increasingly ubiquitous in world-famous venues, screening hundreds of thousands of patrons each year for deadly lethal weapons. This increase in usage can be attributed to one main factor: the massive leap in the software technology that now fuses artificial intelligence (AI) and machine learning to the data coming from the various physical screening stations used.

This is my fifth article on the subject. It has been over a year and a half since I last dove into the weapons detection technology space. I thought it was time for an update in order to discuss the Top 3 weapons detection companies I have found to date.

My other articles can be found here:

The playing field has narrowed considerably over the past five years with my Top 3 contenders taking the clear lead in product advancements and demonstrating increased use of their respective critical technologies in many world-renown public venues.

These companies aren't just revolutionizing security; they're now redefining it.

My research included direct conversations with two of the companies, Liberty Defense Holdings, Ltd. (OTCQB: LDDFF / TSX-V: SCAN / FRA: LD2A) and Xtract One Technologies Inc. (OTCQX: XTRAF / TSX: XTRA / FRA: 0PL), formerly Patriot One Technologies (OTCQX: PTOTF / TSX: PAT / FRA: 0PL).

Unfortunately the third company, Evolv Technologies Holdings, Inc. (NASDAQ: EVLV), did not respond to my multiple email and phone requests for an interview.

In addition to these interviews, I conducted independent research using publicly available information from each of the respective company websites, company press releases and information drawn from other public sources.

This article delves into the strengths, weaknesses, and long-term investment potential of each of these three prominent players in this field.

I am providing exclusive insight into this specific security technology revolution for consideration as an investment in not one, but potentially two publicly trading weapons detection companies that right now seem to be reshaping the security landscape.

Weapons detection technology has come a long way since I first started covering this space over five years ago.

The goal of the technology has always been to identify and detect lethal weapons on a person as they pass through a screening process at their first point of entry. In addition, the flow of patrons passing through these screeners should be rapid and not cause congestion — nor inconvenience patrons due to false positives. The real-time data received from these weapons detection systems must be accurate.

While the physical screening equipment has largely remained unchanged using various scanning walk-through methods, it is the software (and more specifically the fusion of artificial intelligence and machine learning into the data systems) that has paved the way for a new breed of weapons detection systems that are at the forefront of creating safer public environments.

Remember, we are talking about protecting schools, airports, shopping centers, places of worship, night-clubs, hospitals, stadiums, transportation hubs, private and government buildings… anywhere people are exposed to a potential threat.

In a world where security is becoming paramount, innovation is taking center stage, ushering in a new era of security powered by cutting-edge AI technology.

Imagine a future where threats are identified before they manifest. This future is not only possible but investable thanks to these Top 3 visionary companies: Liberty Defense, Xtract One Technologies, and Evolv Technologies.

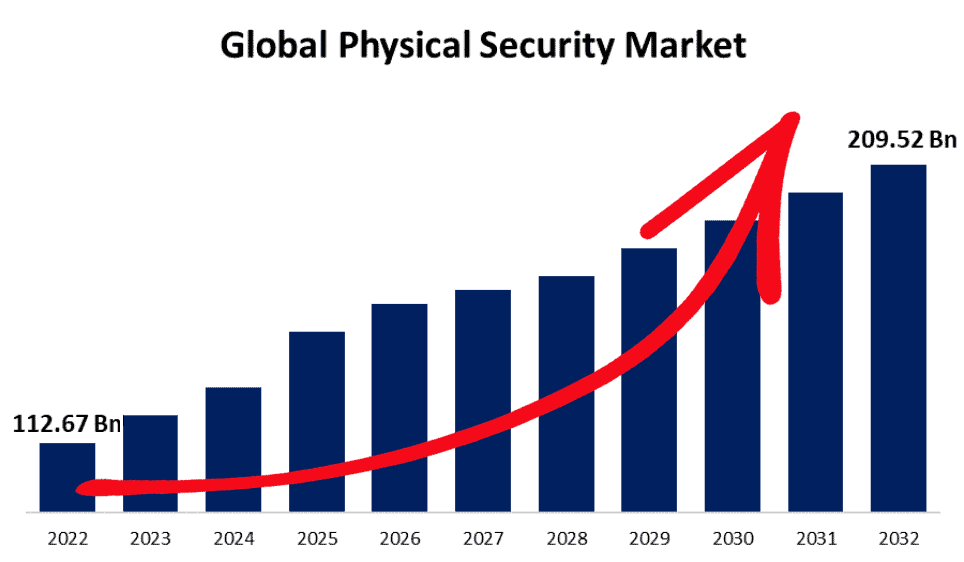

The global physical security market size has been valued from USD$112.67–$119.75 Billion in 2022. This market is expected to grow globally to over US$209 Billion by 2032. That is almost double compared to what the market is today and a compound annual growth rate (CAGR) of about 8% from 2023 to 2030.[3], [4]

Why Invest in Weapons Detection Technology?

In evaluating the long-term investment potential of these companies, several factors come into play:

And while innovation of this caliber carries an upfront price, shrewd investors know that pioneering technology often lays the foundation for substantial long-term returns. Think of Apple’s iPhone and the massive profits it brought to the company, and the investors with the foresight to bet on this and take a stake.

The investment potential here could be staggering.

Let’s take a look at these three cutting-edge enterprises and see how they compare.

I had the pleasure of talking with Jay Adelaar, Senior Vice President of Capital Markets at Liberty Defense, and discussing where the company is at with their technology and what next steps are required to bring their product to market.

The company’s HEXWAVE technology is based on millimeter wave-based scanners. The data coming from HEXWAVE is analyzed by sophisticated AI and machine learning software to identify potential weapons or potential threats.

The founding Liberty Defense development team members previously worked for L3Harris Technologies, Inc. (NYSE: LHX) This team was responsible for developing security equipment for L3Harris that were eventually sold for over $5 billion.

The team has applied their collective expertise in millimeter wave detection technology to the Liberty Defense HEXWAVE technology and the results are positioned to be impressive.

Jay explained to me that the company has put seven years and $50 million in R&D into advancing the technology, and its commercial weapons detection system is finally ready for commercial sales.

And it seems that investment appears to be paying off…

The company’s key advantage over its competitors is the fact that their HEXWAVE technology could have the ability to detect non-metallic weapons. Think of 3D printed weapons, ceramic knives and plastic IEDs.[5]

No other weapons detection company that I’ve come across can detect these items at this time. If these claims are true, this would become a game-changer within the weapons detection technology landscape.

Jay pointed out that the technology is not an everyday metal detector. Instead the novel technology is actually looking for shapes and objects on the body.

Those shapes are then processed by proprietary AI software to determine if it is something inoffensive (such as keys) or whether it is a potential lethal weapon that should be stopped on-site.

This could become an enormous advantage over the competing technologies if this claim holds true, in my opinion.

Jay told me that beta testing has already been completed at Baltimore Orioles Major League Baseball games; the Swaminarayan Akshardham, which is the largest Hindu temple on the east coast and second largest in the world; Toronto Pearson Airport; and at an 85,000-person stadium in Wisconsin, among other locations.

Jay mentioned that the company is at the point where the technology has been cleared by the FCC for use in indoor and outdoor settings and is ready for commercial sales.

As I listened, I could imagine a world where I would not have to take off my shoes at the airport any longer. The scan is done and pass through happens quickly.

As for third party testing, nothing yet has been done other than receiving FCC approval last year. Jay mentioned, “We will be doing testing with the TSA next month and plan to test with Safeskies and NCS4 for commercial applications at a later date.” He further stated “There is no formal testing required for deployment.”

This is not a development or engineering story anymore but has moved into a sales and revenue story, according to Jay.

Already impressive clients and partners are lining up to purchase security units.

An incredibly impressive list considering Liberty recently started commercial sales.

One of my concerns with Liberty Defense (OTCQB: LDDFF / TSX-V: SCAN / FRA: LD2A) is the fact that the company is by many factors… cash poor. The company has put everything into R&D, and commercial sales have only just begun.

It cannot offer any leasing or subscription self-finance-based offer for their security devices at this time, which might discourage some potential customers who are unable to shoulder all the upfront costs for their future units.[6]

At the moment, the company is using factoring, or a 3rd party finance company, in order to finance the production of units for guaranteed initial purchase orders (IPO’s). This obviously cuts into the company’s profit margin and will certainly affect the bottom line.

Additionally, as Jay pointed out, the junior capital markets are challenging right now. Liberty Defense will need to raise additional capital in order to manufacture the needed weapons detection screening units and put forth a solid sales and distribution plan moving forward.

Overall, Liberty Defense is a justified punt within the junior technology sector. It has years of work and expanse building out their technology in what could become the only screening device that could detect non-metallic weapons. Third-party testing is sorely needed though to verify these claims to the market.

This junior company could be on the cusp of exploding revenues if it can only navigate past the biggest hump of raising additional capital to support Liberty One’s commercial sales and marketing plan moving forward. It would seem the company has built out its technology but requires additional capital to fully realize its efforts from an adoption or sales perspective.

— Jay Adelaar, SVP of Capital Markets at Liberty Defense

Liberty Defense should certainly be on your watch list at a minimum. Don’t get me wrong, there are certain risks:

However, the potential for gains here could be enormous if the company gets it together and raises the capital needed in order to advance into a hyper-sales growth plan.

Xtract One (OTCQX: XTRAF / TSX: XTRA / FRA: 0PL), formerly known as Patriot One Technologies (OTCQX: PTOTF / TSX: PTOF / FRA: 0PL), was first covered in November 2018.

The company has come a long way during the last five years. Most importantly, a necessary change in management was made a couple of years ago.

The new and current CEO/ Director, Peter Evans, has completely revamped the company, conducting a cleaning of house, if you will.

It would seem under his leadership, the company is much more focused on its target markets and on the path to becoming a leading global security screening company.

From my point of view, Peter has turned the company around 180 degrees.

I had the immense pleasure of talking with Peter a few weeks ago. I was very impressed by his energy and his excitement directed towards the company’s future. This guy is in it for the win, and I have to believe he will succeed in his endeavor.

Peter has been laser focused on getting his security technology improved and part of that was the acquisition of Xtract AI, a boutique AI software development company based in Vancouver, BC. This led to the company rebranding — and a name change from Patriot One to Xtract One — while adding in the artificial intelligence tech into not only the business itself, but also the name.

Peter immediately saw the potential in the quality of AI development the acquired company was doing and incorporated that into the Xtract One screening product offering. That is now reflected in a product Xtract calls the ‘Smart Gateway.’

Peter told me that the company is constantly working on innovations for its products and actively working with customers to get them what they need to improve onsite security in a timely manner.

And this is paying off in dividends for Xtract One.

Businesses, it seems, have been lining up for the new screening units, and Xtract One saw a doubling of sales in their 3rd QTR year-over-year.

Some current clients include Kia Automotive, Hyundai, casinos and schools. These are very large brands and sectors that have signed up.

Probably one of the biggest feathers in the company hat is a contract with Madison Square Garden (MSG) in New York City.

Peter said, “Madison Square Garden tested us 24 different times at events like the Tribeca Film Festival, the Tony Awards, Billy Joel concerts and UFC concerts and they came to the conclusion after testing all the technologies that rigorously that we were the one they wanted to bank their future on.”

That partnership has opened up an incredible number of opportunities for the company. Radio City Music Hall, Tribeca Film Festival, NBA and NHL teams among others can now be counted as clients.

As for deployment at MSG, Peter went on, “...MSG will start deploying in September in preparation for the NHL and NBA start of seasons, which are the beginning of October. Radio City Music Hall will be deploying in preparation for the start of the holiday season. ...the Beacon Theatre will go in right after that so between August and October all the MSG properties will be fully deployed.”

This has also given Xtract One national exposure as a leader in the security screening space.

Xtract One was recently approved by the TSA (Transportation Security Administration) to be included in their security screening product catalog. A large accomplishment indeed.

It was also selected by the US Department of Veteran Affairs to secure all entrances at their Richmond VA Medical Center.

Xtract One was also chosen for a strategic partnership with the Oakview Group, a pre-eminent venue management organization in North America that operates more than 350 arenas.

One huge advantage that this junior company has is it is managing its tight cash-position and plans to stay that way. Peter stated that he believes the company has enough cash on-hand to see it through to break-even and eventually reaching a cash-flow positive scenario.

The CEO said Xtract is not interested in raising additional funds whether it be debt, through factoring their customer invoices, or any additional equity financings.

Peter explained to me that the company is holding the course with its current revenue model, winning contracts, increasing subscription revenues, and building the business on achieving a cash-flow positive position moving forward.

The company, it would be estimated, is on track to get to a breakeven point in the near future.

This gives the company the advantage of offering customers subscription-based software-as-a-service (SaaS) services and equipment.

And it allows more customers to have access to Xtract One screening units as the upfront costs are deferred over time, whereby increasing customer engagement rates. I love subscription-based business models over the long term which offer greater convenience, cost savings, and scalability — not to mention recurring profits over time.

One of my concerns about the company is its scanners only detect metallic objects at this time. That will have to change if it is going to remain a viable weapons detection company. 3D-printed weapons are becoming more prevalent, and that threat will eventually need to be addressed.

I do have faith Peter is already working on ‘weapon shape identity’ utilizing AI (artificial intelligence) technology, which is currently being utilized on the company’s detection systems.

Xtract One has turned into a solid junior company with, I believe, a proven leader at the helm committed to innovations in security technology. A must for any savvy investor’s watchlist at a minimum.

As I mentioned earlier, it is unfortunate Evolv Technologies (NASDAQ: EVLV) would not answer my repeated requests for an interview for this article. I reached out to the people at Evolv several times via email and phone with zero response.

That said, I have had to amass my research on the company through its website, press releases and other publicly available information sources.

The company has the largest market cap of these three leading weapons detection companies that I have highlighted here.

Evolv Technologies: US$971.968M

Xtract One Technologies: US$99.78M

Liberty Defense: US$16.523M

Evolv has seen very solid sales growth over the past year and its share price reflects that.

The company holds claim to some big name clients such as SoFi Stadium (Los Angeles Chargers), Acrisure Stadium (Pittsburgh Steelers), Target Field (Minnesota Twins), Amalie Arena (Tampa Bay Lightning), and AO Arena (home to three sports teams in Manchester, England and where a suicide bomber killed 22 people and injured 500 more at an Ariana Grande concert in 2017).

One of my biggest concerns though is that the company’s screening units only detect metallic objects, and by some accounts it is not very effective in that.

The technology has actually never been tested and reviewed by an independent third party.

In March 2022, Evolv claimed it had a “fully independent” third-party review. But through a records request done by IPVM, an authority on physical security technology, the research company found some very disturbing findings. In fact, the company was said to be lying.[7] [8] [9]

Inside the report by IPVM and also later reported by the BBC, IPVM examined over 1,000 pages of documents showing how the National Center for Spectator Sports Safety and Security (NCS⁴), a reputable national authority on public safety, failed the public in multiple ways. The NCS should be shamed for their involvement with this study.

Specifically, these documents show:[10]

At least one school district says the company was not forthcoming about how poorly the system detects knives.

Utica City Schools in upstate New York spent $3.7 million on an Evolv system. That system has since been put into storage after it failed to detect a knife that was used in a stabbing at the school.[11]

Acting superintendent of Utica City Schools Brian Nolan said the system also missed a state trooper’s service weapon — twice — when he went through the sensor with the gun on his hip.

Some school administrators are reporting that the scanners have caused “chaos” — failing to detect common handguns at commonly-used sensitivity settings, mistaking everyday school items for deadly weapons, and failing to deliver on the company’s promise of frictionless school security.[13]

Vice recently reported on a similar situation in South Carolina where the Evolv weapons detection system did not detect a Glock pistol.[12]

“It's good at finding weapons of mass destruction, or AK-47s, or AR-15s or machetes,” Nolan said. “But as for the knife, the much-trusted weapon of high school student choice, not so much.”

Evolv also often fails to detect pepper spray cans, Nolan added, another common weapon brought to school by high school students.

On the flipside, Evolv is very good at sounding false positives for non-weapons such as water bottles, umbrellas, binders and laptops. One workaround for this problem was that students were told to carry their laptops in their arms while they passed through the screener.

— Donald Maye, a security researcher at IPVM

Evolv has responded to these allegations on their website.

Powerful accusations to be sure. This is a story that is still developing.

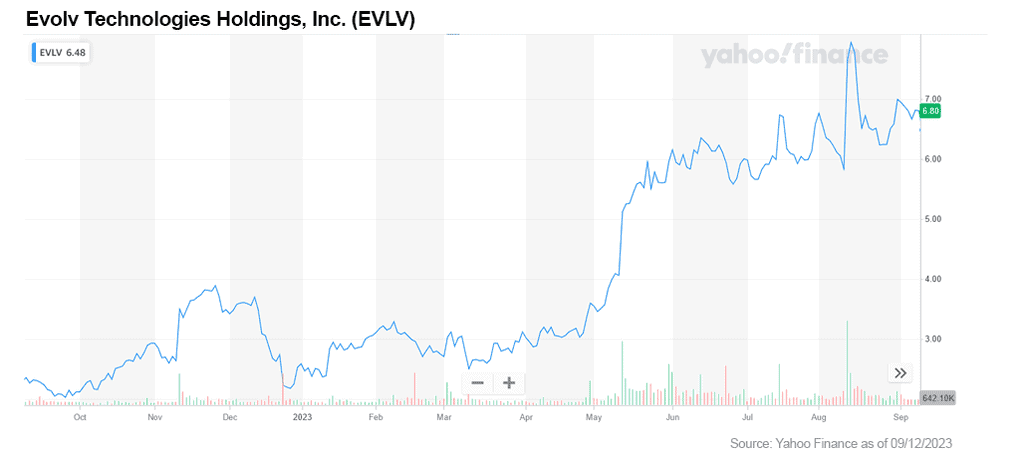

Interestingly, the market did appear to react after the December 6, 2022 release of the IPVM report with the share price dropping -41% over ten days.

Since then the market has shrugged off the allegations sending the share price rocketing up over +200% since the beginning of the year.

Buyer beware, in my opinion.

Given the fact that Evolv has still not conducted any other 3rd party testing leaves its system’s effectiveness unknown.

Until that happens, I cannot honestly give any type of investor recommendation for Evolv Technologies

Some within my network would question an immediate short position on the stock. I find it very strange that investors, including the overall market, are not rattled by these claims.

The convergence of AI and security has birthed a promising sector within the technology landscape. Liberty Defense, Xtract One Technologies, and Evolv Technologies each offer unique approaches to weapons detection.

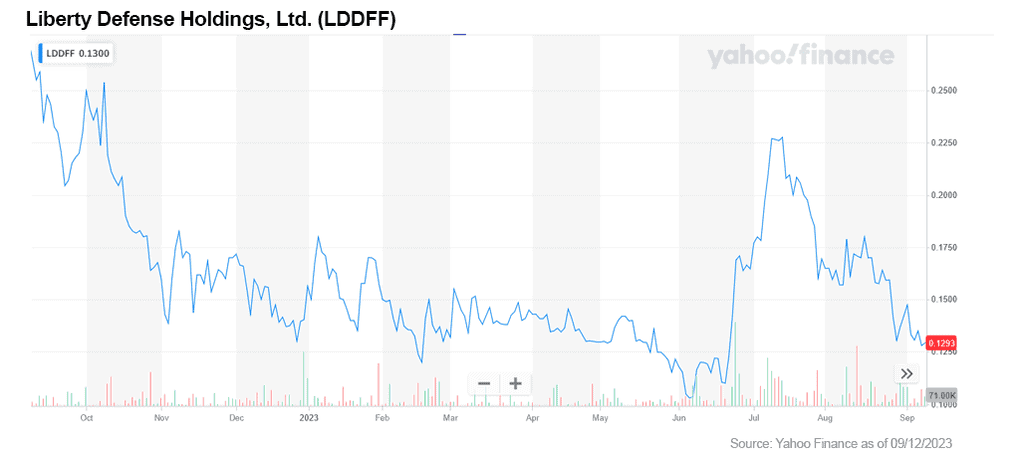

Liberty Defense (OTCQB: LDDFF / TSX-V: SCAN / FRA: LD2A) stands out as a technological leader due to the fact that the company’s technology could potentially detect non-metallic weapons — a growing threat in today’s security environment.

Liberty Defense also may have the most upside as they have the lowest market cap of the three companies reviewed. The company’s biggest obstacle to being a powerhouse in the field will be its ability to raise enough capital and increase its commercial sales.

A bit riskier of an investment but it has the potential to pay dividends in the near future.

Liberty Defense Quick Stats (as of 9/12/2023):

Current Share Price: US$0.13

Market Cap: US$16.523M

Shares Outstanding: 127.1M

Float: 122.92M

EBITDA: -9.83M

The company has seen its share price fall by over -53% in the last year.

Quarterly Revenue Growth (y-o-y): N/A

Xtract One (OTCQX: XTRAF / TSX: XTRA / FRA: 0PL) is a solid sales leader with one of the best leadership teams in the space leading the charge to success.

This is a solid company that is currently in a position to become cash positive within the near future, and with its proven weapons detection technology making progress has some of the biggest venues in the world as their clients.

A solid investment opportunity as the company continues to grow its commercial client list, and a very reasonable market-cap related to potential upside.

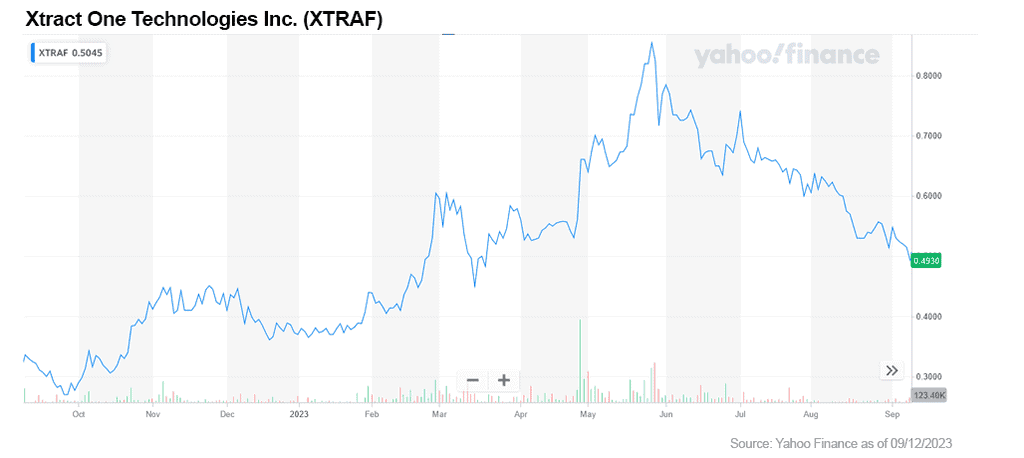

Xtract One Quick Stats (as of 9/12/2023):

Current Share Price: US$0.5045

Market Cap: US$97.23M

Shares Outstanding: 197.78M

Float: 165.33M

EBITDA: -17.35M

The company has seen its share price rise by over +70.19% in the last year.

Quarterly Revenue Growth (y-o-y): -6.70%

Evolv Technologies (NASDAQ: EVLV) has some serious allegations that the company will need to address in the short term.

This company has managed to break all barriers and sales continue to increase. This reminds me of a company with a highly skilled & effective pharmaceutical sales approach, trained and ready to promote a new drug that will help anyone listening (sound familiar?).

The overall effectiveness of the company’s technology is a big question mark at this point. This could be a matter of time before this negative press comes to haunt the company share price, in my opinion.

A solid investment opportunity as the company continues to grow its commercial client list, and a very reasonable market cap related to potential upside.

Evolv Technologies Quick Stats (as of 9/12/2023):

Current Share Price: US$6.48

Market Cap: US$1.02B

Shares Outstanding: 150M

Float: 78.91M

EBITDA: -91.89M

The company has seen its share price rise by +208% in the last year.

Quarterly Revenue Growth (y-o-y): 118.60%

My Final Assessment

So to sum up my careful evaluation of all three companies, I would invest my budget accordingly:

For the astute investor attuned to technology's pulse, these companies offer a chance to ride the wave of innovation and reap huge rewards. But with a word of caution. Please do your own due diligence.

The time is now, the future is calling — will you answer?

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://abcnews.go.com/US/116-people-died-gun-violence-day-us-year/story?id=97382759

[2] https://www.bbc.com/news/world-us-canada-41488081

[3] https://www.globenewswire.com/en/news-release/2023/05/22/2673088/0/en/Global-Physical-Security-Market-Size-To-Worth-USD-209-52-Billion-By-2032-CAGR-of-6-4-Spherical-Insights-Consulting.html

[4] https://www.grandviewresearch.com/industry-analysis/security-market

[5] https://libertydefense.com/product/hexwave/

[6] http://libertydefense.com/news/liberty-defense-launches-hexwave-product-for-commercial-applications/

[7] https://www.lpm.org/news/2023-05-04/jcps-is-poised-to-spend-17-million-on-ai-weapons-detection-is-it-worth-it

[8] https://ipvm.com/reports/ncs4-sponsorships

[9] https://www.bbc.com/news/technology-63476769

[10] https://ipvm.com/reports/ncs4-sponsorships

[11] https://www.atlantanewsfirst.com/2023/06/05/flaws-found-weapons-detection-system-metro-atlanta-schools/

[12] https://www.vice.com/en/article/5d3dw5/the-least-safe-day-rollout-of-gun-detecting-ai-scanners-in-schools-has-been-a-cluster-emails-show

[13] https://www.vice.com/en/article/5d3dw5/the-least-safe-day-rollout-of-gun-detecting-ai-scanners-in-schools-has-been-a-cluster-emails-show