You might want to take a seat before reading this article. What I am about to share with you will send shivers down your spine.

World economies, and even western civilization itself, are hanging by a thread, and if things do not change fast, we will be in a world of hurt. You thought 8+% inflation was horrible? That number will look very good a year from now if world governments do not get a handle on this vitally important commodity.

What is that commodity?

Chemical fertilizers.

And nobody is talking about this impending tragedy that is slowly unfolding across the globe as I write this article.

It is something that most people don’t even realize is going to be a driving factor behind skyrocketing world inflation numbers.

After doing extensive research on the sector, I believe that food inflation is about to get way worse than anything we have experienced in generations.

Intelligent investors are highly aware of the looming situation and hedging their portfolios with companies that could profit from the fertilizer supply crisis.

In this article I want to share with you the various reasons that have contributed to the fertilizer supply crisis and 7 companies that could help your stock portfolio weather the upcoming storm.

Let’s get started…

I want to stay on topic here and do not want to go too deep into plant chemistry and the myriad of inorganic fertilizers that are used in global food production.

Suffice to say that chemical fertilizers are the backbone of the world’s food supply.

Without them, billions would literally starve.

Several studies have shown that up to 60% of crop yield can be directly attributed to commercial fertilizer inputs.[1]

That is more than half of global food production!

Three-quarters of countries in the world depend on imported fertilizer for 50% or more of their fertilizer use.[2]

Chemical fertilizers and their importance to our existence as a species cannot be overstated. It is a critical commodity equal to the level of water and air we consume. Without quality fertilizer, many billions would perish.

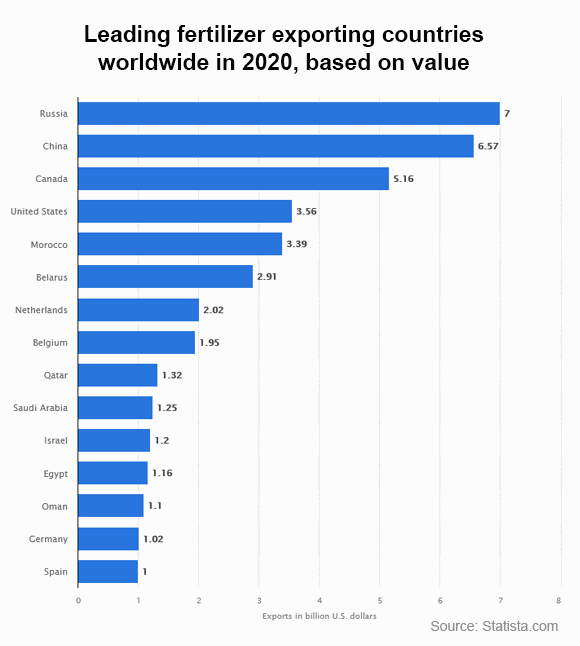

There are literally a handful of countries that produce and export chemical fertilizers, as you can see in the chart below.

Of the top 6, I want you to focus your attention on three of those: Russia, China and Belarus.

Those three countries control a vast majority of the global fertilizer exports. They also are not allies of the Western world…

And the chart below shows the top importers of fertilizers.

The supply and demand of fertilizers has deep geopolitical implications. He who controls the fertilizers, ultimately could control the worldwide food supply.

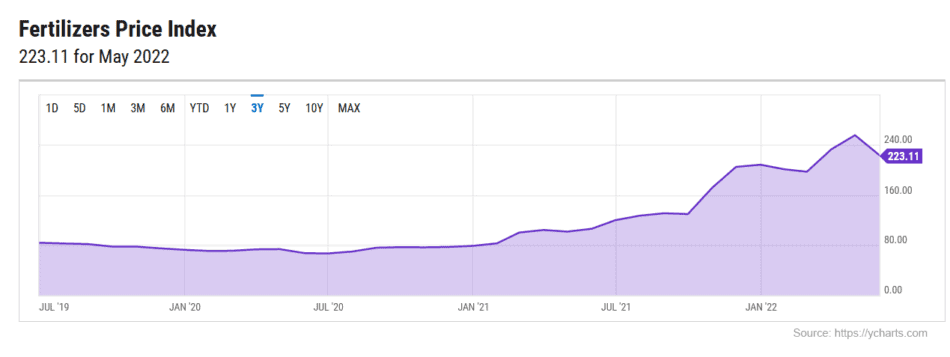

The chart below shows the current spot price for fertilizers. I took a 3-year snapshot so you can see that fertilizer prices have been more or less stable for many years. When Russia began its saber rattling and amassed troops along the Ukrainian border, prices began to rise significantly.

Over the past year, fertilizer prices have shot up +186%!

Soaring prices are driven by a confluence of factors including surging input costs, supply disruptions caused by sanctions (Belarus and Russia), export restrictions (Russia and China) and robust demand.

I will get into these factors in the next section, but what you should know is that any disruption to fertilizer availability directly affects food supply chains around the world sending food prices soaring ever higher.

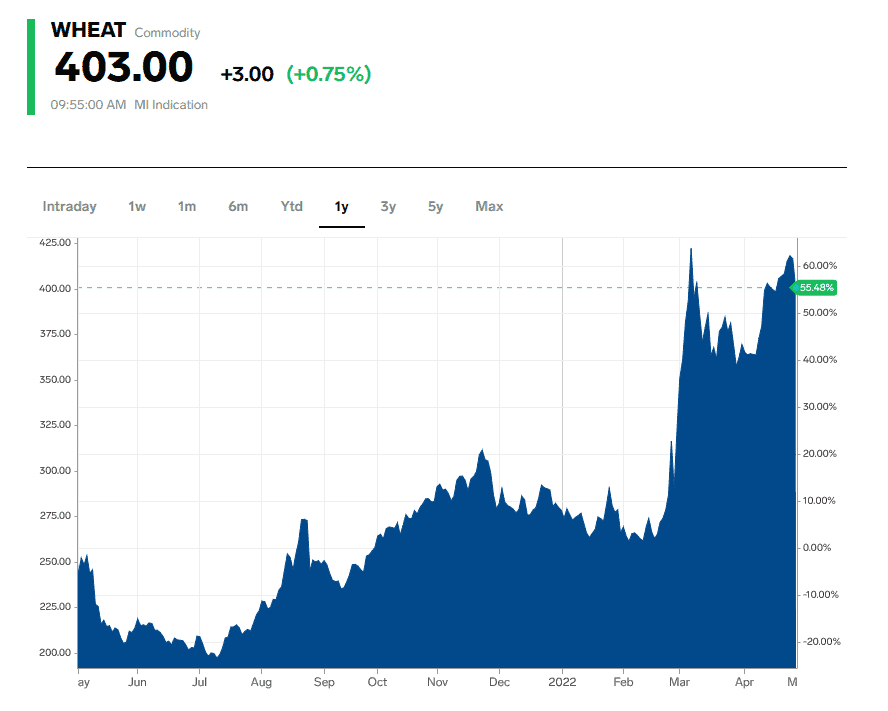

Just take a look at the recent wheat spot price, up over +88% in the past year!

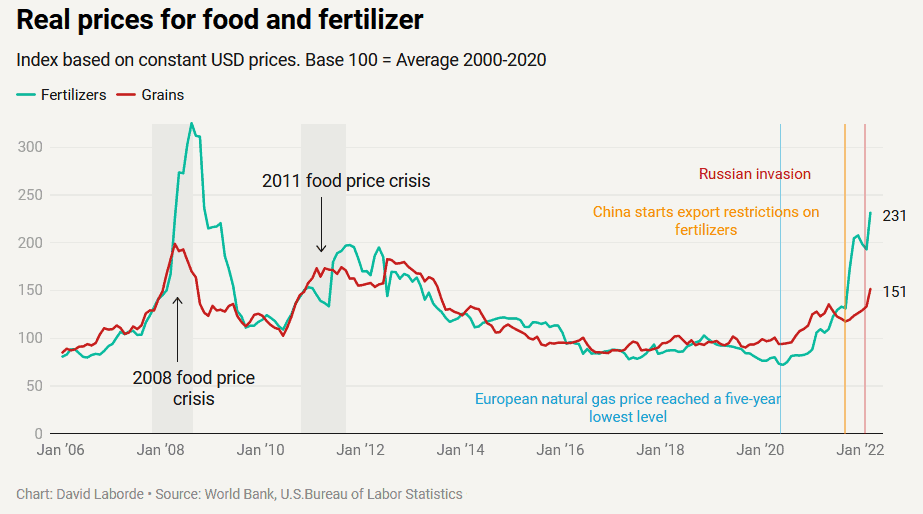

This chart clearly illustrates the correlation between fertilizer prices and food prices almost in lockstep.

Remember the three top producers of fertilizers I mentioned above?

These three key points have directly resulted in almost half of the world’s fertilizer production being taken off the world marketplace.

Add to this the surging costs of manufacturing one of the main sources of nitrogen-based fertilizers. Ammonia gas, derived from natural gas, is used to make ammonium nitrate fertilizer. Ammonia gas is now seeing record high prices in the order of more than +300% due to skyrocketing natural gas prices!

Demand for fertilizers continues to be strong as the US and Brazil have set aside record acreage to fertilizer-intensive soybeans. China is also consuming large amounts of grain crops as it works on rebuilding its hog herd population following the massive cull to control the African swine fever outbreak.

All said, the combined market forces at play will continue to drive fertilizer prices ever higher. Those higher prices will be passed on to consumers at the grocery store, greatly increasing inflationary pressures across the globe.

Fertilizer companies are riding surging demand not seen in years. Supplies are running short due to various market forces including sanctions and hoarding. Customers are looking for reliable sources to fill the supply gap giving US and Canadian firms an obvious advantage.

Fertilizer stock prices will continue to follow this demand surge and could be an excellent hedge against inflation. Currently there is no indication that commodity prices will slow down anytime soon.

In my research I have found the following 7 companies that I feel are well-positioned to live up to the challenge and increase production of critical inorganic fertilizer compounds.

As always, I encourage my readers to use my articles as a starting point in their own research and do their own due diligence before making any investment decisions.

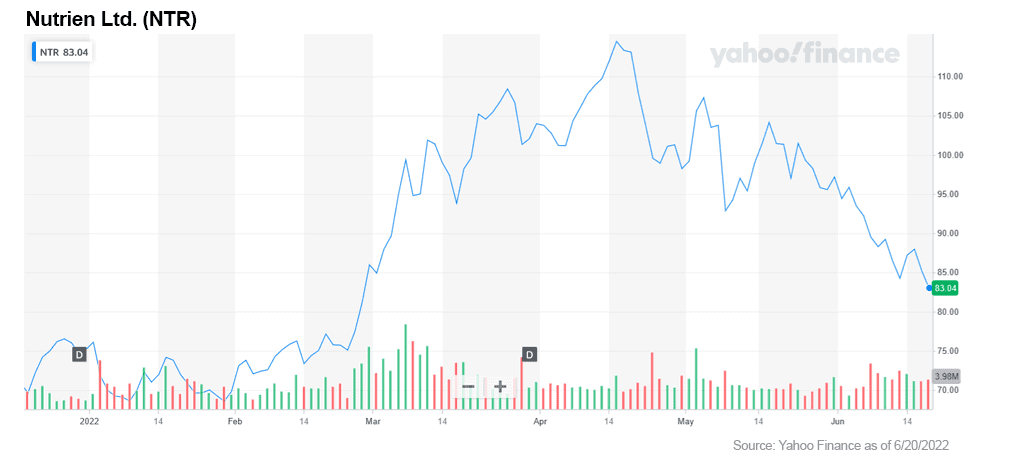

1. Nutrien Ltd. (NYSE: NTR)

Based in Canada, Nutrien Ltd. is a leading global supplier of fertilizers. The company is considering ramping up its potash production to 15 million tons this year amid a global shortfall. This is a one million-ton increase in production from its previous target.

The company could make 18 million tons of the commonly used fertilizer if it increased capacity in increments over a one to three-year period, according to Mark Thompson, Nutrien’s chief strategy officer.[3]

This increase in production will substantially boost revenues in the coming quarters.

4th quarter earnings were up almost +80% year-over-year. Net earnings were up +282% from a year ago.

A solid company in the fertilizer space in my opinion.

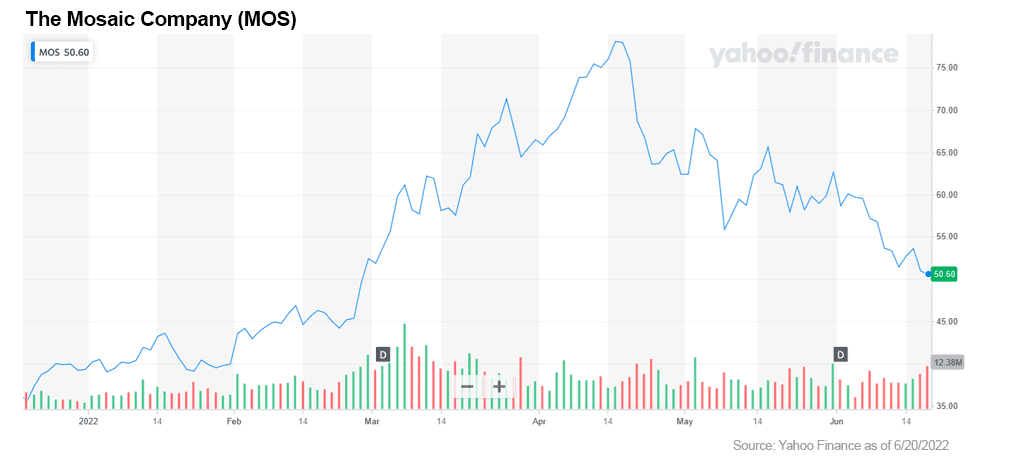

2. The Mosaic Company (NYSE: MOS)

Another beneficiary of the Russia and Belarus sanctions. Mosaic produces both potash and phosphate fertilizers globally.

The company is riding the commodity price surge and the windfall of having Russia, a leading exporter of fertilizer components, knocked off the playing field.

Year-over-year growth was up over +52%. Moving forward the continued demand for potash should create more upside and continue to solidify its financial performance.

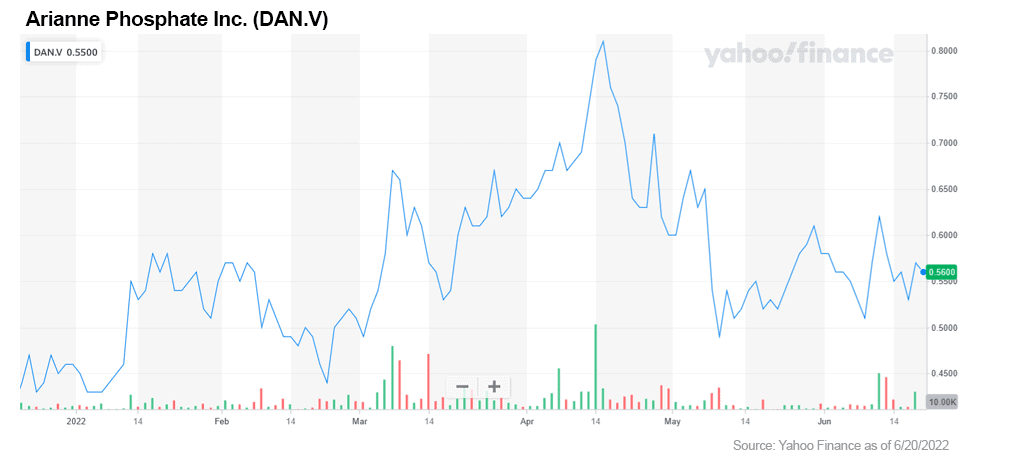

3. Arianne Phosphate Inc. (TSX-V: DAN, OTC US: DRRSF)

Arianne is based in Quebec, Canada, and is a startup junior mining operation.

The company has been working to develop a property rich in phosphate rock reserves for almost a decade. The company claims the reserve is the largest in Canada and is estimated at 590 tons.

Up to now, the project has focused on building out infrastructure in order to get the material out of the ground and to a nearby port for export and processing.

This is a long-shot play in the space. If they can pull this off and start operations, investors will see double- or even triple-digit gains very rapidly.

From my experience these things can go either way, so caution is advised. It’s worth checking out their website for more information: https://www.arianne-inc.com/

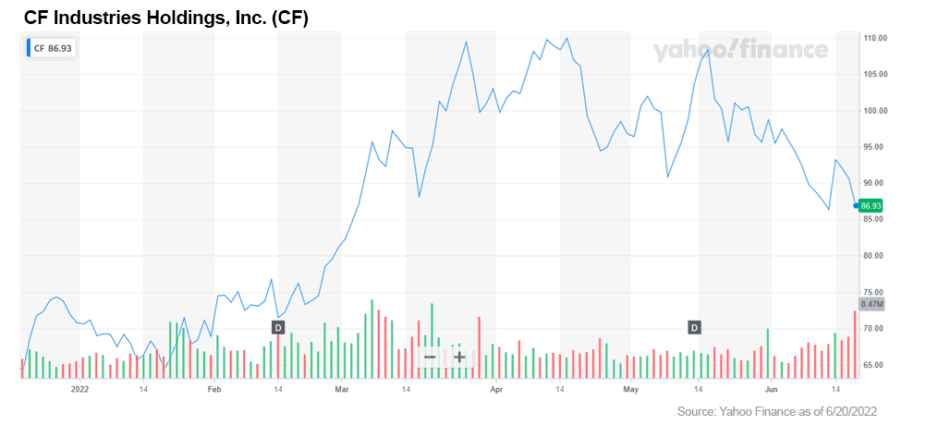

4. CF Industries Holdings, Inc. (NYSE: CF)

Based in the US, CF produces nitrogen-based fertilizers, primarily using natural gas as a base component. This fact does cut into their overall profit margin as its product is directly tied to the price of natural gas.

Russia and Ukraine both produce nitrogen-based fertilizers. With those two competitors removed from the market, CF stands to gain handsomely during this agricultural crisis.

CF plans to expand fertilizer shipments to both US coasts to offset any declines in exports from Russia. These increased shipments should boost CF’s revenues and profit margins in the near-term.

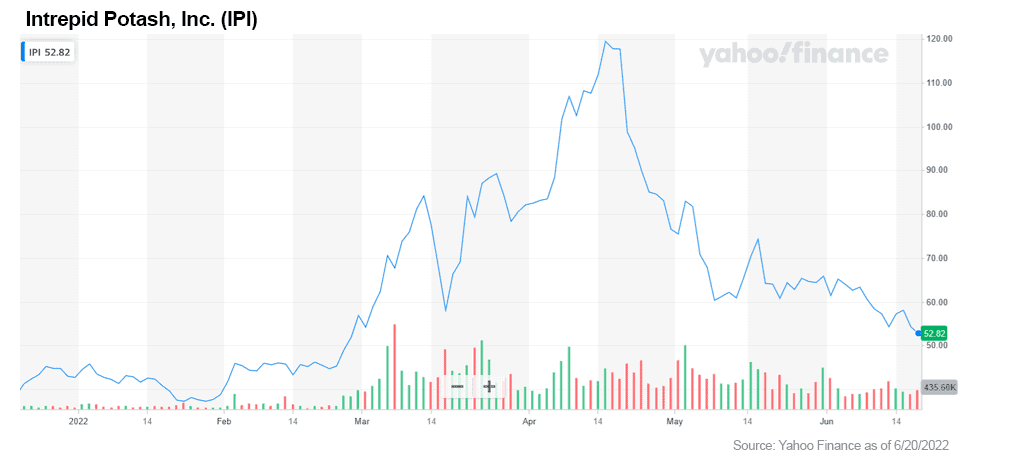

5. Intrepid Potash, Inc. (NYSE: IPI)

Based in Denver, Colorado, this fertilizer manufacturer is one of the largest producers of potassium chloride, specializing in the potassium-rich salt known as potash which is mined from ancient seabeds.

Intrepid is a direct winner of the Belarusian and Russia sanctions on potash exports.

The company topped 1st quarter earnings and revenue estimates fueled by explosive gains in fertilizer commodity prices. The company carries zero debt on its balance sheet and recently announced a $35M share buyback plan.

A solid play in this space in my opinion.

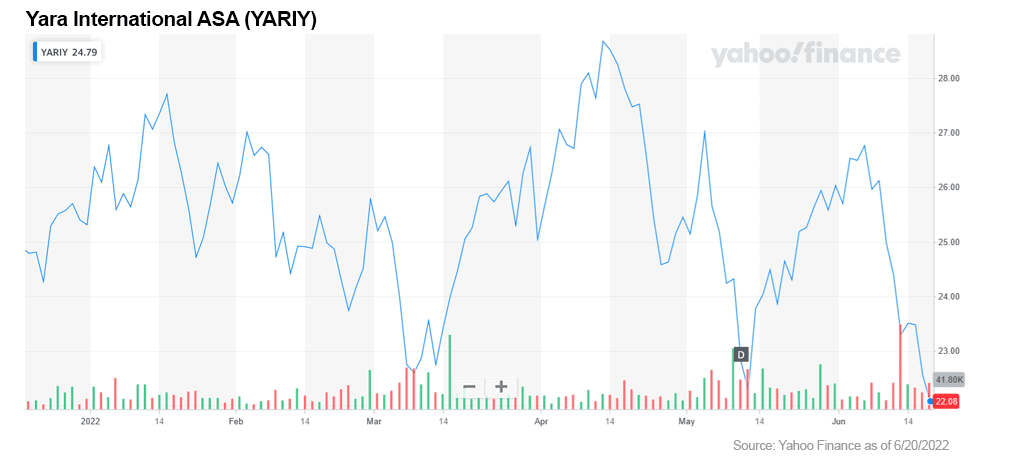

6. Yara International ASA (OTC US: YARIY)

Based in Oslo, Norway, the company produces and distributes nitrogen-based fertilizers.

In January, Yara partnered with Linde Engineering to construct and deliver a 24MV green hydrogen demonstration plant at the company’s ammonia production facility in Norway.

The project aims to supply the first green ammonia products to the market by mid-2023. Producing nitrogen fertilizers that do not rely on fossil fuels is a game changer.

These green fertilizers will have an 80–90% lower carbon footprint than fertilizers produced with natural gas.

The company expects this product to be in high demand as we continue to move in a carbon-free global economy.

Yara’s 4th QTR revenue and other income increased 72% year-over-year to $5.03.

The company boasted a 75.6% growth year-over-year.

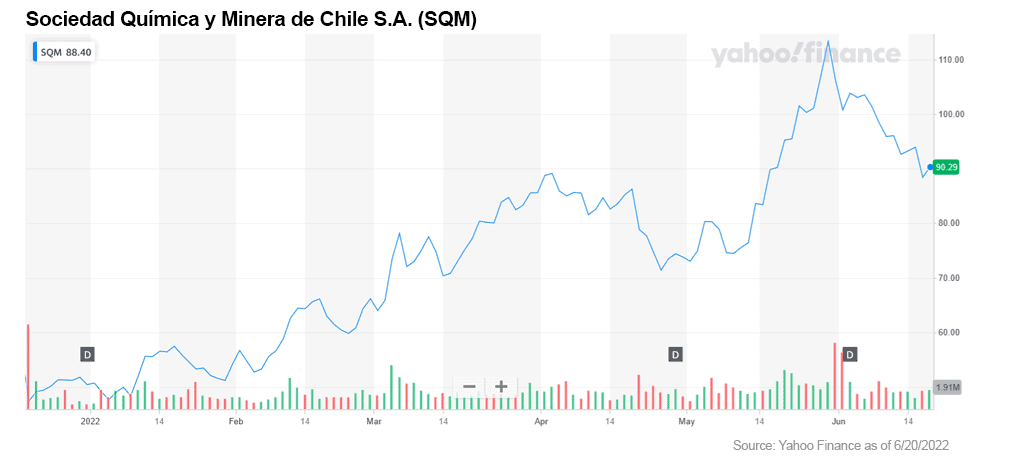

7. Sociedad Química y Minera de Chile S.A. (NYSE: SQM)

I have written about Sociedad Quimica y Minera de Chile in a previous article on lithium. They are a solid player in the lithium production space. They claim to produce up to 20% of the world’s lithium output.

To my surprise they are also involved in the production of chemical fertilizers: iodine, lithium, potassium chloride and potassium sulfate, industrial chemicals, and other commodity fertilizers.

SQM is one of the top producers of potassium nitrate. They hold an astounding 46% market share of this critical fertilizer component.

Revenues for the company in 2021 were up over 57% with net profits up over 300% year-over-year.

This company is one of my favorites in the space given their holdings in both lithium and chemical fertilizer production. A double play!

World economies are intertwined to the point that a single act can send ripples throughout the worldwide markets and put economies into a tailspin. The Ukraine invasion by Russia is a perfect example.

Fertilizers are a world market commodity subject to global supply & demand, resulting in market fluctuations.

We are now directly feeling the effects of rising commodity prices (specifically grains, fertilizers and oil/gas) due to tightened supply caused by a conflict located half a world away.

Intelligent investors know that they cannot sit idly by while their portfolios wither under the heat of high inflation. Investors should act swiftly and with purpose to protect their hard-won gains they have accumulated.

The fertilizer supply crisis is the time and place to move rapidly. Fertilizer prices will continue to go up, driving food prices and inflation to record highs. By investing in those companies that will benefit from this surge in prices, your portfolio will be shielded and could ride the wave as well.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.topcropmanager.com/the-role-of-fertilizer-in-growing-the-worlds-food-10387/

[2] https://www.axios.com/2022/05/06/fertilizer-prices-food-securtiy

[3] https://www.bloomberg.com/news/articles/2022-05-12/nutrien-weighs-increasing-potash-output-amid-fertilizer-crunch

It has been awhile since we have seen any good news coming out of the markets.

This week has started with equities markets testing new lows. Stocks across the board have seen their valuations slashed 20% or more over the past couple months. It is enough to make even seasoned traders feel a bit of despair.

But with all things bad, there is always a silver lining, and this market correction is no different.

Value companies are at rock bottom prices not seen in years. According to Warren Buffett, the undisputed world’s most successful investor, this is a generational opportunity to pick up shares of these companies at what could be bargain prices.

History always repeats itself and with this bit of knowledge… intelligent traders know that all market downturns are followed by an eventual market upturn.

In this article I take a look at past market corrections and how those have always turned into massive opportunities for investors.

Read on to learn more about where we lie historically and where we could be heading when the hovering dark clouds begin to clear.

Bulls vs. bears. These are the eternal market forces that are bound together in a delicate dance between market gains and market crashes. It is literally at the foundation of our market system.

When conducting my research for this article, I was somewhat surprised how many market crashes the US has endured over its relatively short history. I found I had to remind myself that everything in life is cyclical.

By my calculations, there were 28 market crashes over the past 245 years.

That adds up to a market crash happening every 8.75 years on average!

Below I put together a spreadsheet of all the US market crashes I was able to identify.

First on the list is not a US market crash, but I thought it was interesting to include — The Tulip Bulb Bubble!?!

As you can see, market crashes are not all that uncommon and really are a large part of the US economic cycle.

This is a known fact, and intelligent traders should always be prepared for the down cycles. The goal is to be able to weather the lows and capitalize on the highs. (I’ll get into some strategies to achieve this goal further down in the article.)

For now, let’s continue to take a look at each of these crashes over the last 150 years.

The chart below is a great illustration of each market crash and the time it took for the market to recover.

Looking at the chart, what stands out for me is the 1918 influenza pandemic that hit the US economy and resulted in a 15-year market slump. We will see if our current COVID pandemic mirrors history.

The ‘Roaring 20s’ followed and led to the Great Depression which lasted over 20 years.

I also see market crashes becoming less frequent than they were prior to 1910 with longer periods of market gains.

The point of this chart is that historically, market crashes have always turned positive, and seasoned long-term investors have seen the value of their investments come back and continue to grow, given enough time and patience.

Over the long term, it really doesn’t matter if the market crashes. Markets have historically always recovered, more recently in a relatively short period of time. The eternal struggle between bull and bear markets is always happening and investors should not fret.

Today’s market slump is no different than others that have happened over the past 150 years. It amounts to a blip in the long upward trend of increased market value.

Check out the S&P 500 index chart from 1950 through 2021 below. Each market crash is highlighted with its respective cause.

Again, you can see they are evenly spread out with a frequency that is fairly predictable. Each is followed by another upward trend.

The takeaway again is that after each downdraft, there is a corresponding updraft in market value that follows. Again, long-term investors will see gains by being patient and holding the course.

For sure watching your portfolio valuation skid 10%, 15% or even 20% in the short-term can be disconcerting, but there is relief in knowing that over the long-term, markets do recover over time.

According to Dow Jones Market Data going back to 1896, on average the Dow will gain in the weeks and months following a market correction.[1]

And of the past 20 corrections, the Dow has been positive 12 months later 75% of the time.[2]

Now let’s turn our attention to one of the greatest investors of all time, Warren Buffett.

He is known as the ‘Oracle of Omaha’ for a reason, and investors around the world study his investment strategies religiously.

Buffett bought his first stock at age 11 in the spring of 1942 when the US was suffering heavy losses in World War II.

That was 80 years ago…

Today his famous fund, Berkshire Hathaway, has weathered many downturns in the markets since its inception in 1965. It also boasts significant gains over this period when compared to the S&P 500 index.

The 2021 Berkshire Hathaway shareholder report was recently released and reported a +29.6% return for 2021![3]

From the 2021 shareholders report, the fund realized a Compounded Annual Gain (1965–2021) of 20.1% vs. the S&P gain of 10.5% during the same period.[4]

The Overall Gain (1964–2021) of the fund has been a whopping 3,641,613% vs. the 30,209% gain seen by the S&P 500.[5]

Needless to say, Buffett has a strategy that obviously works over the long haul.

And even Buffett will admit that every year has not been all roses.

On a year-by-year basis, Buffet's fund has had many "off" years, even for this investing guru.

But while there were some down years, overall his investment decisions have proven to be very sound and earned investors in his fund a handsome return over the long-term.

Buffett is a strong believer in the strength and resilience of the American economy.

He has reiterated this belief over and over through the years.

In his 2018 Berkshire annual shareholder meeting he said:

"All you had to do was figure that America was going to do well over time, that we would overcome the current difficulties.”

And again in 2020:

"I was convinced of this in World War II. I was convinced of it during the Cuban Missile Crisis, 9/11, the financial crisis — that nothing can basically stop America," he said, adding, "We faced tougher problems, and the American miracle, the American magic, has always prevailed, and it will do so again."

"Never bet against America," he went on to say.

So how does Buffett do it?

What are his recommendations for his followers during times of heavy negative volatility pushing into bear market territory?

I found an interview Buffett made back in 2014 when the Russians were invading Crimea and the markets went south.

That market period had many similarities to today. His recommendations basically boiled down to three main points.

That he said was the best way to build wealth.

Some other pearls of wisdom from the ‘Oracle of Omaha’ from that interview:

"If stocks are cheaper, I'll be more likely to be buying them," he said, celebrating the fact that a stock he was actively buying had dropped in price. Buffett went on to say that he wouldn't cash out even if the conflict escalated into another cold war or World War III.[6]

"Well, if you tell me all of that is going to happen, I will still be buying the stock," he said. "You're going to invest your money in something over time. The one thing you could be quite sure of is if we went into some very major war, the value of money would go down.

"I mean, that's happened in virtually every war that I'm aware of," Buffett continued. "So the last thing you'd want to do is hold money during a war."

Buffett stressed that the US stock market rose during WWII and has only increased over time.

"American businesses are going to be worth more money," Buffett said. "Dollars are going to be worth less, so that money won't buy you quite as much.

"But you're going to be a lot better off owning productive assets over the next 50 years," he added.[7]

In the Berkshire shareholder report in 2018, Buffett recounts his first stock purchase over 80 years ago.

It was 1942; the US was suffering heavy losses in WWII. He purchased three shares of Cities Service for $115.

He went on to point out that had he invested that money in a no-fee S&P 500 Index fund and reinvested all the dividends, that investment of $115 would be worth over $600k in 2019 — a +5,288-fold gain.

If he had put that same investment ($115) in gold, the value would have only been $4,200 during that same period of time.

Takeaway: Buy stocks, not gold, during times of war and economic crisis.

My recommendation: Buy the future, such as 5G, esports & fintech.

For the intelligent investor, times like these are moments to rejoice. It is a great opportunity to purchase equities at value prices and increase one’s holdings.

Here are Buffett’s ‘Four Investment Pillars’ to consider when looking for companies to consider adding to your portfolio.

And if all of this is too much work or goes way over your head, do not fret. You can still profit from equities without doing anything.

Buffett recommends to just put your money in an index fund and forget about it.

He eloquently points out that an investment of $10,000 in 1942 into an index fund, reinvesting all dividends, would be worth over $51 MILLION dollars today!

Check this clip of Buffett telling his followers this bit of advice:

As I have illustrated, good things come for patient investors willing to invest long-term and not allow market cycles to interrupt their overall investment strategy.

The ups and downs of the markets are a normal phenomenon and should be viewed as possibly an opportunity, not some great travesty.

The historical data clearly shows that the American economy is strong and resilient over time. The capital markets do fall, recover and move on to ever greater valuations over time.

Warren Buffett is the perfect example of an intelligent investor and should be a mentor for all of us to follow.

He has over 80 years of investment experience to share. His recommendations for investors should be heeded faithfully. He has been through more market crashes than most investors in history and has always come out on top.

His Berkshire Hathaway fund continues to serve up handsome profits for its investors and this is the result of his slow and steady hand at the helm.

The takeaway from this article is this: Market crashes and negative volatility come and go. Stay the course, remain patient and you will be rewarded over time.

At the end of the day, while it might take some Warren Buffet style homework, it is really about finding true value and discovering the future overachieving stocks to invest in.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.marketwatch.com/story/the-next-shoe-to-drop-the-125-year-old-dow-industrials-on-brink-of-correction-heres-what-history-says-happens-next-in-the-u-s-stock-market-11645651055?siteid=yhoof2

[2] Ibid.

[3] 2021 10-K and Annual Report

[4] Ibid.

[5] Ibid.

[6] https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-russia-ukraine-stocks-gold-bitcoin-dollars-2022-2

[7] Ibid.

Time to take a deep breath and exhale slowly.

We are heading into unknown economic waters…

The US economy has come under inflation stress not seen since 2008/2009, but economic indicators are showing positive signs the economy is in decent shape.

Needless to say, capital markets are currently in shambles, and investors are taking a beating across the board — right from junior stocks through to blue-chip holdings.

As an investor myself, these are times to be adaptive in this highly dynamic stock market landscape. New strategies are needed to not only help protect assets, but to also provide some gains to offset rising inflation.

In this article I will go over current market forces that are unwinding in different directions on a daily basis and illustrate how the elite investor is looking to capitalize and protect assets in these uncertain times.

Read on to learn more…

The US economy is flashing red and green at the same time, and it has economists scratching their heads as to what direction we will be heading in over the next 12 months.

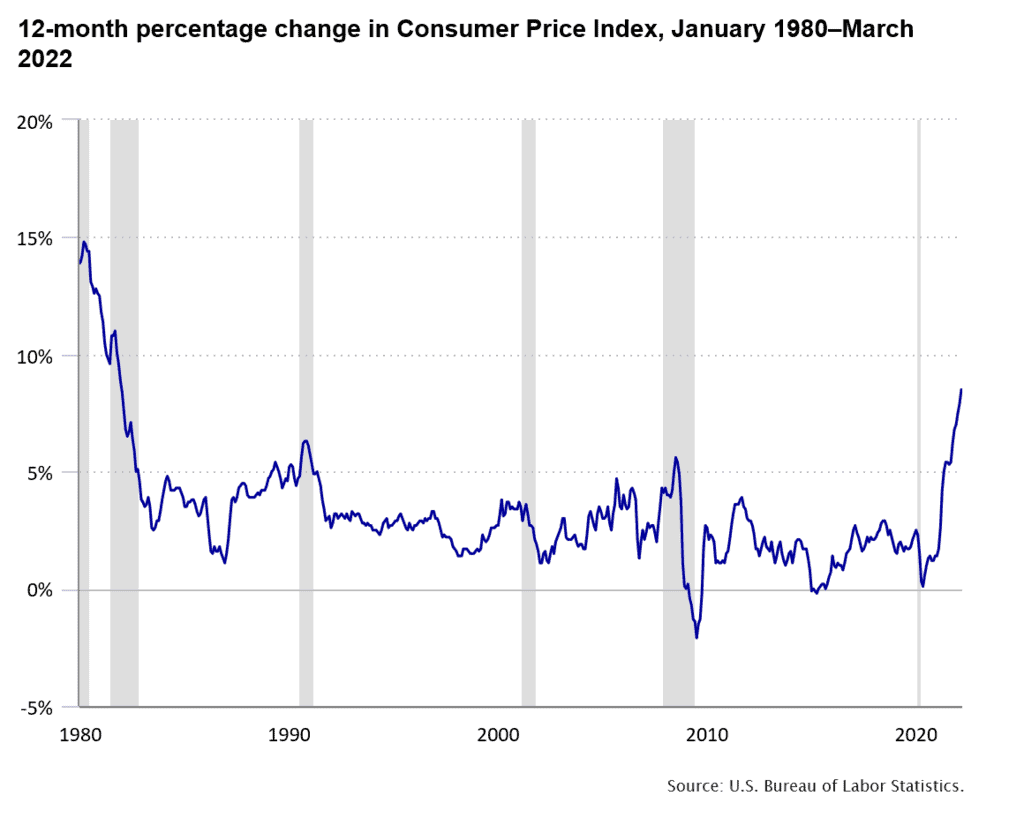

On one hand, you have a red flag as the inflation rate spiked up to 8.5% in March 2022, a near 40-year high.[1]

This can be directly attributed to two things.

First is the quantitative easing that has been going on since March 2020 when the Federal Reserve wisely stepped in to save the economy from the COVID pandemic. Billions of free money was thrown into the monetary system with seemingly little impact on inflation. For the most part, there has been close to zero inflation for most of the past two years.

Inflation started to raise its head back in October 2021, and we have seen a steady increase from that point forward.

The second reason for rising inflation is the severe supply shock the world is experiencing as a direct result of the Ukraine-Russia conflict. That conflict, now in its third month, is negatively affecting the supply of many essential commodities including oil, wheat, cooking oils, palladium and nickel to name a few, sending their prices skyrocketing.

Those skyrocketing prices in turn get passed down the line to consumers in the form of higher food and energy costs.

Energy costs (fuel oil, gasoline, electricity and natural gas) made up 32% of consumer price increases over the past year.

Check out this 6-month chart for the wheat spot price. This will give you an idea of the huge increases in basic food prices, which is already translating to higher prices at grocery stores.

Below you can see the Consumer Price Index (CPI) chart to get an idea of where inflation is at since its last peak in the early 1980s.

On the other hand, the US economy looks healthy and is showing green trending signals.

In the past 12 months, employers added nearly 6.5 million jobs. Weekly jobless claims fell 5,000 to 180,000. Unemployment is now at a ridiculous low rate of 3.6%.[3]

For the first quarter this year, consumer spending was recently reported as rising a healthy 2.7% after inflation. This is the highest it has been in three quarters.

Business investment also surged 7.3%, the biggest increase in over a year.[4]

These stats show the economy is currently in good health despite such high inflationary numbers. I’m not so sure considering the war in Ukraine rages on, supply chain bottlenecks still persist, and consumer demand remains high. All these factors will likely weigh on the Consumer Price Index (CPI), or weighted average of a selection of consumer goods and services, for the coming months ahead.

The rising inflation rate is obviously alarming to many investors, and the Federal Reserve has kicked into high gear, working to mitigate further rising inflation and attempting to cool things down.

Their only tool to fight inflation is increasing interest rates. This is a double-edged sword because while that may bring the inflation rate down, rising rates could also have the negative effect of slowing the economy down too much, resulting in a possible recession.

I am hoping the FED finds that fine line balance in increasing rates to bring down inflation, but at the same time keep the capital markets moving forward. This is easier said than done.

US Federal Reserve Board Chairman Jerome Powell’s recent language was strongly worded and echoes this sentiment:

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices and broader price pressures.”

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship.”

“On the other hand,” he said, "Russia’s war in Ukraine is not only adding to inflation by raising the prices of crucial commodities like oil and wheat, it is increasing the uncertainty in the economic outlook.”

Mr. Powell maintained that the US economy remained strong and that this was a good time to prevent the “entrenchment” of runaway inflation.[5]

The Federal Reserve has announced a series of rate hikes over the coming year with whispers of pulling back on the quantitative easing that has been going on since the beginning of the COVID pandemic.

Obviously, markets are jittery. Where will we be in the coming 12 months?

Walking a tight rope would be putting the current situation mildly.

One thing is for sure, the war in Ukraine has to come to a peaceful solution sooner rather than later or we are all going to be feeling the pain in a big way.

As Mr. Powell pointed out, the Ukraine-Russia conflict is only making matters worse.

Aside from supply chain shocks due to rising commodity prices, Europe is in a high-risk position of losing their critical access to Russian oil and gas. As they send arms to Ukraine to confront the Russian invaders, they risk enraging Putin who will look for ways to retaliate.

If the Russians decide to cut off oil and gas supplies to the West, Europe would be devastated economically with reverberations that will be felt globally.

Is Russia, and specifically Putin, going to do that? I do not believe so. The Russian economy is extremely dependent on that oil and gas income, and they know they cannot live without it.

But I was wrong about the Ukraine invasion. I thought it was all a bluff to get concessions from Europe and the US.

At this point, I would have to say anything is possible with Putin. He has not acted rationally in a long time…

Add to the mix the recent resurgence of COVID in China with citywide lockdowns currently going on in several parts of the country. This could again adversely affect the supply chain channels in many industries, specifically in semiconductors and consumer electronic goods coming from Chinese factories.

Investor sentiment right now is low, to say the least. Many investors are feeling pessimistic about the near-term future of the overall capital markets.

The NASDAQ Composite has fallen -18.7% from its high back on November 2021. A number of economists believe the risk of a recession is rising and could land in the next year or so.

While the specter of a recession sounds like a bad thing, such economic events are part of the natural ebb and flow of any developed economy whether within the US Capital Markets or internationally.

Investors should view recessions as an opportune time to buy shares of high-quality, well-run companies. I recently wrote an article about what prior stock market crashes can teach us.

In that article, my research strongly showed that historically market crashes have always turned positive. Seasoned elite investors have seen the value of their investments come back and continue to grow, given enough time and patience.

Whenever I am in a slump and feeling like everything is grey, I turn to the Oracle of Omaha, the OG of elite investors…

In a letter to Berkshire Hathaway investors back in 1986, I found this pearl of wisdom from Warren Buffet that helped me feel a bit of calm, even during this latest storm:[6]

“What we do know, however, is that occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community.

“The timing of these epidemics will be unpredictable.

“And the market aberrations produced by them will be equally unpredictable, both as to duration and degree.

“Therefore, we never try to anticipate the arrival or departure of either disease.

“Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Repeat after me: Be fearful when others are greedy and greedy when others are fearful.

Certain equities offer a reliable haven during inflationary times and historically produce returns that exceed inflation.

There are a number of sectors that tend to be more protected from inflation and recessions. Below are some of the sectors that I believe are good choices for safe haven status. I have also included a few companies in each sector that will help jump start your research.

These potential recession-resistant stocks can help put your portfolio in a defensive posture if a bear market does indeed come into play.

Basic Materials: Lithium Mining

Lithium is critical in battery technology and renewable energy storage. It is a key component in moving our economy away from fossil fuels.

Lithium mining will continue to be a strong investment choice moving into the next couple of years as the green energy revolution continues to gain traction.

Technology and Semiconductors:

Technology will continue its long-term growth well into the next couple of years and beyond. Our world will continue to see technology advance and this underlying need for semiconductors have an increasing role in playing a part in our daily lives moving forward.

Science fiction is happening now and investing in any of these three companies will most likely provide investors with a positive performance on their investments.

Infrastructure: 5G Broadband

No matter what happens to the economy, 5G broadband will continue to be rolled out by worldwide governments with help from large communications companies.

In fact, the US government has already allocated $65 billion in broadband spending.

Companies such as AT&T and Verizon use subcontractors to manage the work of installing new towers, transmitters and cabling.

These cell tower installation companies stand to gain big during the next 5 years. The 5G revolution will gain further traction as consumers begin to see the potential of this exciting advance in technology that will change all of our lives in fundamental ways.

FNN contributor Blake Desaulniers wrote an excellent report on 5G and the incredible opportunities for early investors. This is a must read.

Healthcare:

Healthcare is another industry that is protected from inflationary or recessionary pressures. People will always need healthcare, and the aging population of baby boomers will only increase the growth potential for the healthcare industry.

Below are two companies that stood out in my research that look well-positioned to weather any economic storm.

Consumer Cyclical: Home Improvement

If and when the sh*t hits the economic fan, I believe these two companies are safe bets for investors. I went ahead and put in two consumer cyclical stocks as I see the DIY crowd utilizing the home improvement stores during times of economic stress.

If the water boiler goes out, do you call a repairman and spend an extra $550 for installation, or do you go on YouTube, learn how to do it and install the new boiler yourself? I’m going to lean towards do it yourself…

Consumer Defensive:

No matter what happens in the next 12 months, consumers will still need to go out and buy essentials.

This sector will be virtually untouched by any economic headwinds that may lie ahead and could even see a bump as consumers take a pass on going out to eat at restaurants and spend more time at home.

If there is anything that we have learned over the course of many years in the markets, it is one thing: the markets always recover.

But we have to also be aware that certain sectors will be harder hit than others in any downturn. The elite investor knows that defensive positioning is critical in preserving asset gains.

The threat of inflation or a subsequent idea of a recession should be seen as an opportunity to fine-tune your holdings and pick up solid companies at value prices.

Warren Buffett has learned and practiced this one thing and look where he is today. I believe he is an excellent mentor to follow.

Repeat after me: Be fearful when others are greedy and greedy when others are fearful.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm

[2] https://www.bls.gov/opub/ted/2022/consumer-prices-up-8-5-percent-for-year-ended-march-2022.htm

[3] https://www.npr.org/2022/04/13/1092291748/economy-recession-inflation-federal-reserve-interest-rates

[4] https://www.marketwatch.com/story/did-the-u-s-economy-really-shrink-in-early-2022-is-a-recession-near-no-and-heres-why-11651155255

[5] https://www.nytimes.com/2022/03/17/business/federal-reserve-inflation-recession.html

[6] https://www.berkshirehathaway.com/letters/1986.html

Here we go again. More negative market volatility and everyone is running in circles, pulling out their hair, screaming like Chicken Little that “The sky is falling!”

If you are new to trading stocks, these past weeks might seem very dark and worrisome. But those of you who have been in the markets for a decade or more know this is a regular market cycle that happens, and it will eventually figure itself out given enough time.

Patience is key to investing in the capital markets.

In my opinion, this is not a time to freak out. Rather, choose to be calm and disciplined while restraining yourself from not making any rash trading decisions.

As the famous slogan of the British during WWII told its citizens when bombs were raining down on London, "Keep Calm and Carry On."

The same applies today. We all need to step back, take a deep breath and know that right now this is NOT the end of the world.

In this article, I will provide a short history of past market crashes and discuss how the Oracle of Omaha, Warren Buffett, has not only weathered these downturns but has managed to come out on top of every market crash during his entire investment history dating back to 1942.

Bulls vs. bears. These are the eternal market forces that are bound together in a delicate dance between market gains and market crashes. It is literally at the foundation of our market system.

When conducting my research for this article, I was somewhat surprised how many market crashes the US has endured over its relatively short history. I found I had to remind myself that everything in life is cyclical.

By my calculations, there were 28 market crashes over the past 245 years.

That adds up to a market crash happening every 8.75 years on average!

Below I put together a spreadsheet of all the US market crashes I was able to identify.

First on the list is not a US market crash, but I thought it was interesting to include — The Tulip Bulb Bubble!?!

As you can see, market crashes are not all that uncommon and really are a large part of the US economic cycle.

This is a known fact, and intelligent traders should always be prepared for the down cycles. The goal is to be able to weather the lows and capitalize on the highs. (I’ll get into some strategies to achieve this goal further down in the article.)

For now, let’s continue to take a look at each of these crashes over the last 150 years.

The chart below is a great illustration of each market crash and the time it took for the market to recover.

Looking at the chart, what stands out for me is the 1918 influenza pandemic that hit the US economy and resulted in a 15-year market slump. We will see if our current COVID pandemic mirrors history.

The ‘Roaring 20s’ followed and led to the Great Depression which lasted over 20 years.

I also see market crashes becoming less frequent than they were prior to 1910 with longer periods of market gains.

The point of this chart is that historically, market crashes have always turned positive, and seasoned long-term investors have seen the value of their investments come back and continue to grow, given enough time and patience.

The Lesson: Stay the course!

Over the long term, it really doesn’t matter if the market crashes. Markets have historically always recovered, more recently in a relatively short period of time. The eternal struggle between bull and bear markets is always happening and investors should not fret.

Today’s market slump is no different than others that have happened over the past 150 years. It amounts to a blip in the long upward trend of increased market value.

Check out the S&P 500 index chart from 1950 through 2021 below. Each market crash is highlighted with its respective cause.

Again, you can see they are evenly spread out with a frequency that is fairly predictable. Each is followed by another upward trend.

The takeaway again is that after each downdraft, there is a corresponding updraft in market value that follows. Again, long-term investors will see gains by being patient and holding the course.

For sure watching your portfolio valuation skid 10%, 15% or even 20% in the short-term can be disconcerting, but there is relief in knowing that over the long-term, markets do recover over time.

According to Dow Jones Market Data going back to 1896, on average the Dow will gain in the weeks and months following a market correction.[1]

And of the past 20 corrections, the Dow has been positive 12 months later 75% of the time.[2]

Now let’s turn our attention to one of the greatest investors of all time, Warren Buffett.

He is known as the ‘Oracle of Omaha’ for a reason, and investors around the world study his investment strategies religiously.

Buffett bought his first stock at age 11 in the spring of 1942 when the US was suffering heavy losses in World War II.

That was 80 years ago…

Today his famous fund, Berkshire Hathaway, has weathered many downturns in the markets since its inception in 1965. It also boasts significant gains over this period when compared to the S&P 500 index.

The 2021 Berkshire Hathaway shareholder report was recently released and reported a +29.6% return for 2021![3]

From the 2021 shareholders report, the fund realized a Compounded Annual Gain (1965–2021) of 20.1% vs. the S&P gain of 10.5% during the same period.[4]

The Overall Gain (1964–2021) of the fund has been a whopping 3,641,613% vs. the 30,209% gain seen by the S&P 500.[5]

Needless to say, Buffett has a strategy that obviously works over the long haul.

And even Buffett will admit that every year has not been all roses.

On a year-by-year basis, Buffet's fund has had many "off" years, even for this investing guru.

But while there were some down years, overall his investment decisions have proven to be very sound and earned investors in his fund a handsome return over the long-term.

Buffett is a strong believer in the strength and resilience of the American economy.

He has reiterated this belief over and over through the years.

In his 2018 Berkshire annual shareholder meeting he said:

"All you had to do was figure that America was going to do well over time, that we would overcome the current difficulties.”

And again in 2020:

"I was convinced of this in World War II. I was convinced of it during the Cuban Missile Crisis, 9/11, the financial crisis — that nothing can basically stop America," he said, adding, "We faced tougher problems, and the American miracle, the American magic, has always prevailed, and it will do so again."

"Never bet against America," he went on to say.

So how does Buffett do it?

What are his recommendations for his followers during times of heavy negative volatility pushing into bear market territory?

I found an interview Buffett made back in 2014 when the Russians were invading Crimea and the markets went south.

That market period had many similarities to today. His recommendations basically boiled down to three main points.

That he said was the best way to build wealth.

Some other pearls of wisdom from the ‘Oracle of Omaha’ from that interview:

"If stocks are cheaper, I'll be more likely to be buying them," he said, celebrating the fact that a stock he was actively buying had dropped in price. Buffett went on to say that he wouldn't cash out even if the conflict escalated into another cold war or World War III.[6]

"Well, if you tell me all of that is going to happen, I will still be buying the stock," he said. "You're going to invest your money in something over time. The one thing you could be quite sure of is if we went into some very major war, the value of money would go down.

"I mean, that's happened in virtually every war that I'm aware of," Buffett continued. "So the last thing you'd want to do is hold money during a war."

Buffett stressed that the US stock market rose during WWII and has only increased over time.

"American businesses are going to be worth more money," Buffett said. "Dollars are going to be worth less, so that money won't buy you quite as much.

"But you're going to be a lot better off owning productive assets over the next 50 years," he added.[7]

In the Berkshire shareholder report in 2018, Buffett recounts his first stock purchase over 80 years ago.

It was 1942; the US was suffering heavy losses in WWII. He purchased three shares of Cities Service for $115.

He went on to point out that had he invested that money in a no-fee S&P 500 Index fund and reinvested all the dividends, that investment of $115 would be worth over $600k in 2019 — a +5,288-fold gain.

If he had put that same investment ($115) in gold, the value would have only been $4,200 during that same period of time.

Takeaway: Buy stocks, not gold, during times of war and economic crisis.

My recommendation: Buy the future, such as 5G, esports & fintech.

For the intelligent investor, times like these are moments to rejoice. It is a great opportunity to purchase equities at value prices and increase one’s holdings.

Here are Buffett’s ‘Four Investment Pillars’ to consider when looking for companies to consider adding to your portfolio.

And if all of this is too much work or goes way over your head, do not fret. You can still profit from equities without doing anything.

Buffett recommends to just put your money in an index fund and forget about it.

He eloquently points out that an investment of $10,000 in 1942 into an index fund, reinvesting all dividends, would be worth over $51 MILLION dollars today!

Check this clip of Buffett telling his followers this bit of advice:

As I have illustrated, good things come for patient investors willing to invest long-term and not allow market cycles to interrupt their overall investment strategy.

The ups and downs of the markets are a normal phenomenon and should be viewed as possibly an opportunity, not some great travesty.

The historical data clearly shows that the American economy is strong and resilient over time. The capital markets do fall, recover and move on to ever greater valuations over time.

Warren Buffett is the perfect example of an intelligent investor and should be a mentor for all of us to follow.

He has over 80 years of investment experience to share. His recommendations for investors should be heeded faithfully. He has been through more market crashes than most investors in history and has always come out on top.

His Berkshire Hathaway fund continues to serve up handsome profits for its investors and this is the result of his slow and steady hand at the helm.

The takeaway from this article is this: Market crashes and negative volatility come and go. Stay the course, remain patient and you will be rewarded over time.

In other words, Keep Calm and Carry On.

MF Williams, Contributor

for Investors News Service

P.S. To discover more opportunities in the hottest sectors in North America, sign up now to the Financial News Now newsletter to get the latest updates and investment ideas directly in your inbox!

DISCLAIMER: Investing in any securities is highly speculative. Please be sure to always do your own due diligence before making any investment decisions. Read our full disclaimer here.

[1] https://www.marketwatch.com/story/the-next-shoe-to-drop-the-125-year-old-dow-industrials-on-brink-of-correction-heres-what-history-says-happens-next-in-the-u-s-stock-market-11645651055?siteid=yhoof2

[2] Ibid.

[3] 2021 10-K and Annual Report

[4] Ibid.

[5] Ibid.

[6] https://markets.businessinsider.com/news/stocks/warren-buffett-berkshire-hathaway-russia-ukraine-stocks-gold-bitcoin-dollars-2022-2

[7] Ibid.